Estrategia cuantitativa de seguimiento de tendencias basada en SAR

Descripción general

La estrategia de brecha especulativa es una estrategia de comercio cuantitativa de seguimiento de tendencias que utiliza la curva de suavizado SAR como su principal señal de negociación, complementada con varios filtros, como EMA, movimiento de expansión y osciladores de volatilidad, para identificar los puntos de reversión de la tendencia mediante la configuración de los parámetros SAR y lograr un seguimiento de tendencias de bajo riesgo. Es una estrategia muy adecuada para inversiones de línea media y larga.

Principio de estrategia

La estrategia utiliza el SAR de la parálisis como su principal indicador de señales de negociación. El SAR es capaz de determinar con eficacia el punto de reversión de la tendencia de los precios, y cuando el símbolo SAR cambia, significa que la tendencia se ha invertido. Esta estrategia generalmente emite una señal de compra o venta cuando el SAR se invierte.

Además, la estrategia también ofrece la opción de romper el SAR. Es decir, se produce una señal cuando el precio ha roto el último valor del SAR antes de que el SAR no se haya invertido completamente. Esto puede seguir adelante con la sensibilidad de la estrategia.

Para filtrar las falsas señales, la estrategia también introduce EMA, el volumen de expansión y el oscilador de volatilidad, tres filtros auxiliares, que se pueden usar solos o en combinación para confirmar la fiabilidad de las tendencias de precios y las señales de negociación.

Finalmente, la estrategia ofrece tres tipos de stop loss: stop loss fijo, stop loss fijo y stop loss de la proporción de riesgo de retorno. Esto hace que la estrategia sea flexible para adaptarse a diferentes tipos de variedades de operaciones.

Análisis de las ventajas

El SAR es capaz de determinar con precisión la reversión de la tendencia de los precios y de capturar las nuevas tendencias de los precios en el momento adecuado para el seguimiento de tendencias medianas y largas.

La configuración de múltiples filtros reduce la probabilidad de falsos ataques y mejora la fiabilidad de la señal.

La configuración es sencilla y flexible, y los parámetros se pueden personalizar para adaptarse a diferentes tipos de transacciones.

Ofrece una variedad de métodos de stop loss para buscar el equilibrio entre el riesgo y el retorno.

Se puede conectar directamente a un robot de negociación para automatizar las transacciones.

Análisis de riesgos

En un mercado fuera de tendencia, puede haber más señales falsas y transacciones no válidas.

La configuración incorrecta de los parámetros SAR también puede afectar la precisión de la evaluación de la señal.

Como estrategia de seguimiento de tendencias, los mercados con grandes movimientos pueden alcanzar fácilmente la línea de pérdidas.

Para los riesgos anteriores, se puede ajustar adecuadamente el parámetro SAR o el parámetro del filtro para reducir la probabilidad de una negociación ineficaz. También se puede relajar adecuadamente el límite de pérdida para soportar una mayor volatilidad en el mercado.

Dirección de optimización

Optimización de los parámetros de SAR. Se puede optimizar el paso y el incremento de los parámetros de SAR a través de datos de retroceso histórico para obtener estrategias de negociación más estables y eficientes.

Introducir indicadores de juicio de tendencias. Añadir indicadores de juicio auxiliares como MACD, DMI a la estrategia, para mejorar la capacidad de juicio de tendencias.

Optimización de la tasa de riesgo-recibo. Ajuste los parámetros del porcentaje de stop-loss fijo y la tasa de riesgo-recibo para asumir adecuadamente un mayor riesgo para obtener mayores beneficios.

Añadir variedades de divisas. Actualmente, la estrategia solo admite el comercio de monedas digitales, y se puede ampliar para admitir variedades de divisas, mercancías y mercados de valores.

Resumir

La brecha especulativa es una estrategia de cuantificación de tipo de tendencia de seguimiento muy práctica. Es sensible a la respuesta, la señal de juicio es confiable, y se puede obtener un beneficio estable a largo plazo a través de la gestión de la parada de pérdidas. La optimización de los parámetros y reglas adecuadas puede mejorar aún más la eficiencia de la estrategia.

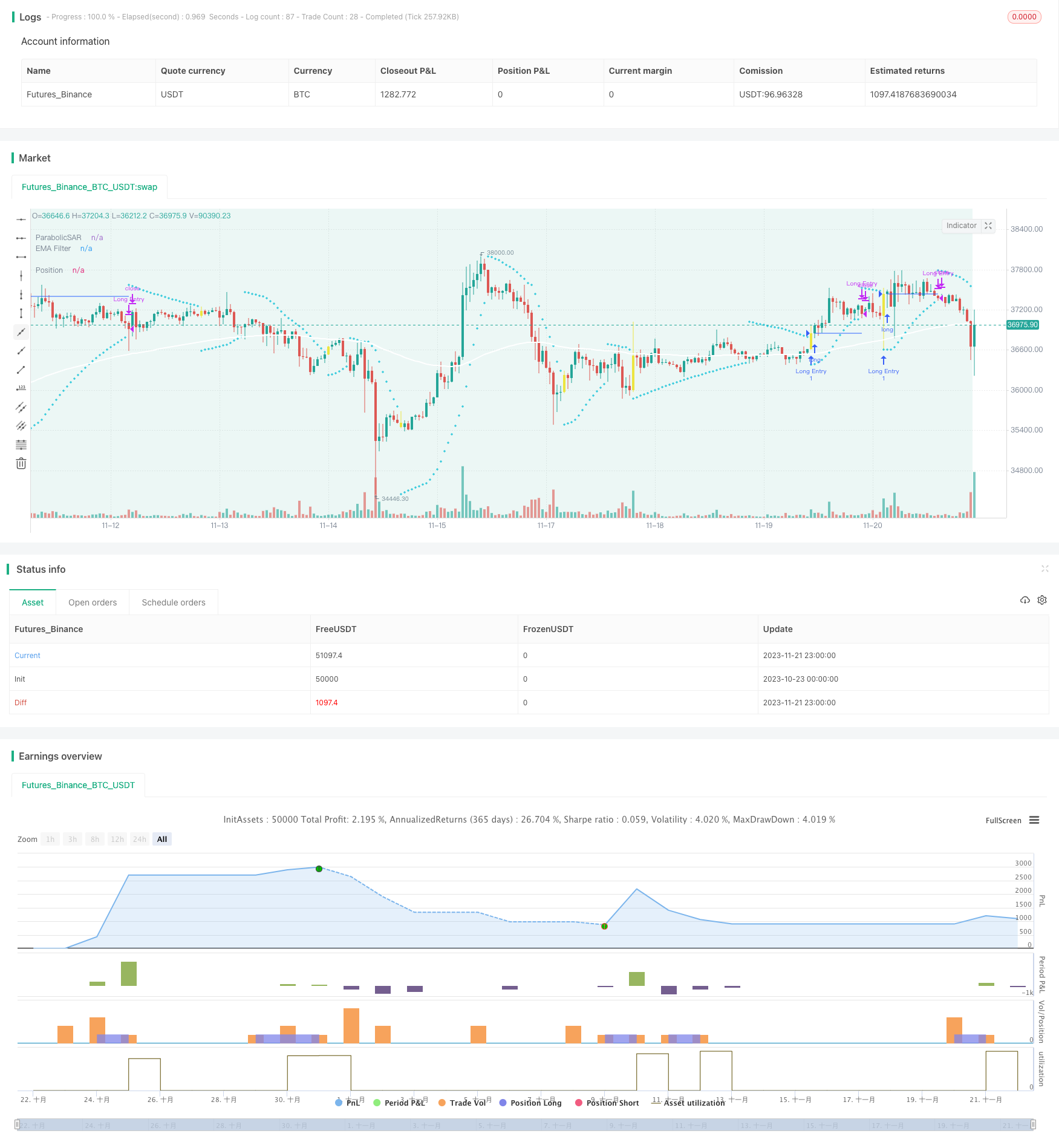

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//VERSION =================================================================================================================

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// This strategy is intended to study.

// It can also be used to signal a bot to open a deal by providing the Bot ID, email token and trading pair in the strategy settings screen.

// As currently written, this strategy uses a SAR PARABOLIC to send signal, and EMA, Squeeze Momentum, Volatility Oscilator as filter.

// There are two enter point, when SAR Flips, or Breakout Point - the last SAR Value before it Flips.

// There are tree options for exit: SAR Flips, Fixed Stop Loss ande Fixed Take Profit in % and Risk Reward tha can be set, 0.5/1, 1/1, 1/2 etc.

//Autor M4TR1X_BR

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

//STRATEGY ================================================================================================================

strategy(title = 'BT-SAR Ema, Squeeze, Voltatility',

shorttitle = 'SAR ESV',

overlay = true)

//▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// INPUTS =================================================================================================================

// TIME INPUTS

usefromDate = input.bool(defval = true, title = 'Start date', inline = '0', group = "Time Filters")

initialDate = input(defval = timestamp('01 Jan 2022 00:00 UTC'), title = '', inline = "0",group = 'Time Filters',tooltip="This start date is in the time zone of the exchange ")

usetoDate = input.bool(defval = true, title = 'End date', inline = '1', group = "Time Filters")

finalDate = input(defval = timestamp('31 Dec 2029 23:59 UTC'), title = '', inline = "1",group = 'Time Filters',tooltip="This end date is in the time zone of the exchange")

// TIME LOGIC

inTradeWindow = true

// SAR PARABOLIC INPUTS ==================================================================================================

string sargroup= "SAR PARABOLIC ========================================="

start = input.float(defval=0.02,title='Start',inline='',group = sargroup)

increment = input.float(defval=0.02,title='Increment',inline='',group = sargroup)

maximum = input.float(defval=0.2,title='Maximo',inline='',group = sargroup)

// SAR PARABOLIC LOGIC

out = ta.sar(start, increment, maximum)

// SAR FLIP OR BREAKOUT OPTIONS

string bkgroup ='SAR TRADE SIGNAL ====================================== '

sarTradeSignal =input.string(defval='SAR Flip',title='SAR Trade Signal', options= ['SAR Flip','SAR Breakout'],group=bkgroup, tooltip='SAR Flip: Once the parabolic SAR flips it will send a signal, SAR Breakout: Will wait the price cross last Sar Value before it flips.')

nBars = input.int(defval=4,title='Bars',group=bkgroup, tooltip ='Define the number of bars for a entry when the price cross breakout point')

float sarBreakoutPoint= ta.valuewhen((close[1] < out[1]) and (close > out),out[1],0) //Get Sar Breakout Point

bool check = (close[1] < out[1]) and (close > out) //Verify when sar flips

bool BreakoutPrice = sarTradeSignal=='SAR Breakout'? (ta.barssince(check) < nBars) and ((open < sarBreakoutPoint) and (close > sarBreakoutPoint)): (ta.barssince(check) < nBars) and (close > out)

barcolor (check? color.yellow:na,title="Signal Bar color" )

// MOVING AVERAGES INPUTS ================================================================================================

string magroup = "Moving Average ========================================"

useEma = input.bool(defval = true, title = 'Moving Average Filter',inline='', group= magroup,tooltip='This will enable or disable Exponential Moving Average Filter on Strategy')

emaType=input.string (defval='Ema',title='Type',options=['Ema','Sma'],inline='', group= magroup)

emaSource = input.source(defval=close,title=" Source",inline="", group= magroup)

emaLength = input.int(defval=100,title="Length",minval=0,inline='', group= magroup)

// MOVING AVERAGE LOGIC

float ema = emaType=='Ema'? ta.ema(emaSource,emaLength): ta.sma(emaSource,emaLength)

// VOLATILITY OSCILLATOR =================================================================================================

string vogroup = "VOLATILITY OSCILLATOR ================================="

useVltFilter=input.bool(defval=true,title="Volatility Oscillator Filter",inline='',group= vogroup,tooltip='This will enable or disable Volatility Oscillator filter on Strategy')

vltFilterLength = input.int(defval=100,title="Volatility Oscillator",inline='',group=vogroup)

vltFilterSpike = close - open

vltFilterX = ta.stdev(vltFilterSpike,vltFilterLength)

vltFilterY = ta.stdev(vltFilterSpike,vltFilterLength) * -1

// SQUEEZE MOMENTUM INPUTS ==============================================================================================

string sqzgroup = "SQUEEZE MOMENTUM ====================================="

useSqzFilter=input.bool(defval=true,title="Squeeze Momentum Filter",inline='',group= sqzgroup, tooltip='This will enable or disable Squeeze Momentum filter on Strategy')

sqzFilterlength = input.int(defval=20, title='Bollinger Bands Length',inline='',group= sqzgroup)

sqzFiltermult = input.float(defval=2.0, title='Boliinger Bands Mult',inline='',group= sqzgroup)

keltnerLength = input.int(defval=20, title='Keltner Channel Length',inline='',group= sqzgroup)

keltnerMult = input.float(defval=1.5, title='Keltner Channel Mult',inline='',group= sqzgroup)

useTrueRange = input(true, title='Use TrueRange (KC)', inline='',group= sqzgroup)

// CALCULATE BOLLINGER BANDS

sqzFilterSrc = close

basis = ta.sma(sqzFilterSrc, sqzFilterlength)

dev = keltnerMult * ta.stdev(sqzFilterSrc, sqzFilterlength)

upperBB = basis + dev

lowerBB = basis - dev

// CALCULATE KELTNER CHANNEL

sma = ta.sma(sqzFilterSrc, keltnerLength)

range_1 = useTrueRange ? ta.tr : high - low

rangema = ta.sma(range_1, keltnerLength)

upperKC = sma + rangema * keltnerMult

lowerKC = sma - rangema * keltnerMult

// CHECK IF BOLLINGER BANDS IS IN OR OUT OF KELTNER CHANNEL

sqzOn = lowerBB > lowerKC and upperBB < upperKC

sqzOff = lowerBB < lowerKC and upperBB > upperKC

noSqz = sqzOn == false and sqzOff == false

// SQUEEZE MOMENTUM LOGIC

val = ta.linreg(sqzFilterSrc - math.avg(math.avg(ta.highest(high, keltnerLength), ta.lowest(low, keltnerLength)),ta.sma(close, keltnerLength)), keltnerLength, 0)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT STOP LOSS INPUTS =========================================================================================

string tkpgroup='Take Profit =================================================='

tpType = input.string(defval = 'SAR Flip', title='Take Profit and Stop Loss', options=['SAR Flip','Fixed % TP/SL', 'Risk Reward TP/SL'], group=tkpgroup )

longTakeProfitPerc = input.float(defval = 1.5, title = 'Fixed TP %', minval = 0.05, step = 0.5, group=tkpgroup, tooltip = 'The percentage increase to set the take profit price target.')/100

longLossPerc = input.float(defval=1.0, title="Fixed Long SL %", minval=0.1, step=0.5, group = tkpgroup, tooltip = 'The percentage increase to set the Long Stop Loss price target.') * 0.01

//shortLossPerc = input.float(defval=1.5, title="Fixed Short SL (%)", minval=0.1, step=0.5, group = tkpgroup, tooltip = 'The percentage increase to set the Short Stop Loss price target.') * 0.01

longTakeProfitRR = input.float(defval = 1, title = 'Risk Reward TP', minval = 0.25, step = 0.25, group=tkpgroup, tooltip = 'The Risk Reward parameter.')

var plotStopLossRR = input.bool(defval=false, title='Show RR Stop Loss', group=tkpgroup)

//enableStopLossRR = input.bool(defval = false, title = 'Enable Risk Reward TP',group=tkpgroup, tooltip = 'Enable Variable Stop Loss.')

string trpgroup='Traling Profit ==============================================='

enableTrailing = input.bool(defval = false, title = 'Enable Trailing',group=trpgroup, tooltip = 'Enable or disable the trailing for take profit.')

trailingTakeProfitDeviationPerc = input.float(defval = 0.1, title = 'Trailing Take Profit Deviation %', minval = 0.01, maxval = 100, step = 0.01, group=trpgroup, tooltip = 'The step to follow the price when the take profit limit is reached.') / 100

// BOT MESSAGES

string msgroup='Alert Message For Bot ========================================='

messageEntry = input.string("", title="Strategy Entry Message",group=msgroup)

messageExit =input.string("",title="Strategy Exit Message",group=msgroup)

messageClose = input.string("", title="Strategy Close Message",group=msgroup)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITIONS =============================================================================================================

//VERIFY IF THE BUY FILTERS ARE ON OR OFF

bool emaFilterBuy = useEma? (close > ema):(close >= ema) or (close <= ema)

bool volatilityFilterBuy = useVltFilter? (vltFilterSpike > vltFilterX) : (vltFilterSpike >= 0) or (vltFilterSpike <= 0)

bool sqzFilterBuy = useSqzFilter? (val > val[1]): (val >= val[1] or val <=val[1])

bool sarflip = (close > out)

//LONG / SHORT POSITIONS LOGIC

//Var 'check' will verify if the SAR flips and if the exit price occurs it will limit in bars number a new entry on the same signal.

bool limitEntryNumbers = (ta.barssince(check) < nBars)

bool openLongPosition = sarTradeSignal == 'SAR Flip'? (sarflip and emaFilterBuy and volatilityFilterBuy and sqzFilterBuy and limitEntryNumbers) :sarTradeSignal=='SAR Breakout'? (BreakoutPrice and emaFilterBuy and volatilityFilterBuy and sqzFilterBuy): na

bool openShortPosition = na

bool closeLongPosition= tpType=='SAR Flip'? (close < out):na

bool closeShortPosition=na

// CHEK OPEN POSITONS =====================================================================================================

// open signal when not already into a position

bool validOpenLongPosition = openLongPosition and strategy.opentrades.size(strategy.opentrades - 1) <= 0

bool longIsActive = validOpenLongPosition or strategy.opentrades.size(strategy.opentrades - 1) > 0

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT STOP LOSS CONFIG ==========================================================================================

// FIXED TAKE PROFIT IN %

float posSize = strategy.opentrades.entry_price(strategy.opentrades - 1) //Get the entry price

var float longTakeProfitPrice = na

longTakeProfitPrice := if (longIsActive)

if (openLongPosition and not (strategy.opentrades.size(strategy.opentrades - 1) > 0))

posSize * (1 + longTakeProfitPerc)

else

nz(longTakeProfitPrice[1], close * (1 + longTakeProfitPerc))

else

na

longTrailingTakeProfitStepTicks = longTakeProfitPrice * trailingTakeProfitDeviationPerc / syminfo.mintick

// FIXED STOP LOSS IN %

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

//shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// TAKE PROFIT BY RISK/REWARD

// Set stop loss

tta = not (strategy.opentrades.size(strategy.opentrades - 1) > 0)

float lastb = ta.valuewhen(check and tta,ta.lowest(low,5),0) - (10 * syminfo.mintick)

// TAKE PROFIT CALCULATION

float stopLossRisk = (posSize - lastb)

float takeProfitRR = posSize + (longTakeProfitRR * stopLossRisk)

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITION ORDERS =====================================================================================================

// LOGIC ===============================================================================================================

// getting into LONG position

if (openLongPosition) and (inTradeWindow)

strategy.entry(id = 'Long Entry', direction = strategy.long, alert_message=messageEntry)

//submit exit orders for trailing take profit price

if (longIsActive) and (inTradeWindow)

strategy.exit(id = 'Long Take Profit', from_entry = 'Long Entry', limit = enableTrailing ? na : tpType=='Fixed % TP/SL'? longTakeProfitPrice: tpType == 'Risk Reward TP/SL'? takeProfitRR:na, trail_price = enableTrailing ? longTakeProfitPrice : na, trail_offset = enableTrailing ? longTrailingTakeProfitStepTicks : na, stop = tpType =='Fixed % TP/SL' ? longStopPrice: tpType == 'Risk Reward TP/SL'? lastb:na) //, alert_message='{ "action": "close_at_market_price", "message_type": "bot", "bot_id": 9330698, "email_token": "392265bc-84eb-4a54-a99c-758383ff9449", "delay_seconds": 0,"pair":"USDT_{{ticker}}" }')

if (closeLongPosition)

strategy.close(id = 'Long Entry', alert_message='{ "action": "close_at_market_price", "message_type": "bot", "bot_id": 9330698, "email_token": "392265bc-84eb-4a54-a99c-758383ff9449", "delay_seconds": 0,"pair":"USDT_{{ticker}}" }')

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// PLOTS ===============================================================================================================

// TRADE WINDOW ========================================================================================================

bgcolor(color = inTradeWindow ? color.new(#089981,90):na, title = 'Time Window')

// SAR PARABOLIC

var sarColor = color.new(#00bcd4,0)

plot(out, "ParabolicSAR", color=sarColor, linewidth=1,style=plot.style_cross)

//BREAKOUT LINE

var plotBkPoint = input.bool(defval=false, title='Show Breakout Point', group=bkgroup)

plot(series = (sarTradeSignal=='SAR Breakout' and plotBkPoint == true)? sarBreakoutPoint:na, title = 'Breakout line', color =color.new(#ffeb3b,50) , linewidth = 1, style = plot.style_linebr, offset = 0)

// EMA/SMA

var emafilterColor = color.new(color.white, 0)

plot(series=useEma? ema:na, title = 'EMA Filter', color = emafilterColor, linewidth = 2, style = plot.style_line)

// ENTRY PRICE

var posColor = color.new(#2962ff, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr,offset=0)

// FIXED TAKE PROFIT

var takeProfitColor = color.new(#ba68c8, 0)

plot(series = tpType=='Fixed % TP/SL'? longTakeProfitPrice:na, title = 'Fixed TP', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 0)

// FIXED STOP LOSS

var stopLossColor = color.new(#ff0000, 0)

plot(series = tpType=='Fixed % TP/SL' ? longStopPrice:na, title = 'Fixed SL', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 0)

// RISK REWARD TAKE PROFIT

var takeProfitRRColor = color.new(#ba68c8, 0)

plot(series=tpType == 'Risk Reward TP/SL'? takeProfitRR:na,title='Risk Reward TP',color=takeProfitRRColor,linewidth=1,style=plot.style_linebr)

// STOP LOSS RISK REWARD

plot(series = (check and plotStopLossRR)? lastb:na, title = 'Last Bottom', color =color.new(#ff0000,0), linewidth = 2, style = plot.style_linebr, offset = 0)

// ======================================================================================================================