Estrategia de trading bidireccional ADX

Descripción general

La estrategia de ADX bidireccional es una estrategia cuantitativa para realizar operaciones bidireccionales utilizando el índice de dirección promedio (ADX). La estrategia determina el umbral para determinar si se produce una señal de negociación, y se obtiene ganancias mediante el cálculo de la diferencia entre el indicador ADX y los indicadores DIPlus y DIMinus.

Principio de estrategia

- Calcula el rango de fluctuación real

- Calcula el movimiento direccional de múltiples cabezas (Directional Movement Plus) y el movimiento direccional de la cabeza vacía (Directional Movement Minus)

- Calcula el rango de fluctuaciones reales suavizadas

- Calcula el movimiento direccional más suave y el movimiento direccional sin cabeza suave

- Cálculo de los indicadores DIPlus, DIMinus y ADX

- Calcular la diferencia entre DIPlus y ADX, DIMinus y ADX

- Configuración de un límite de la diferencia entre las transacciones de más y de menos

- Cuando la diferencia es mayor que la depreciación, se produce una señal de negociación

- Generar órdenes de compra y venta

El núcleo de la estrategia es el uso de indicadores de índices dinámicos como el ADX para determinar la dirección y la intensidad de la tendencia, en combinación con la regla de determinación del valor diferencial para establecer el umbral y el comercio automático.

Análisis de las ventajas

- El uso de ADX para determinar la dirección de las tendencias permite capturar con precisión las tendencias del mercado

- Aplicación de la ley de determinación de diferencias para filtrar las señales falsas

- El comercio bidireccional permite aprovechar al máximo las oportunidades de venta libre y venta libre

- Las transacciones son totalmente automáticas y no requieren intervención humana.

- La lógica de la estrategia es clara, fácil de entender y modificar

Análisis de riesgos

- El ADX está rezagado y puede haber perdido el punto de inflexión de la tendencia

- Los riesgos de las transacciones bidireccionales aumentan y las pérdidas podrían ampliarse

- La configuración incorrecta de los parámetros puede conducir a un exceso de comercio

- Los datos de retrospectiva no representan el mercado real, los riesgos en el mercado real siguen existiendo

La solución:

- Señales de confirmación de transacciones en combinación con otros indicadores

- Optimización de parámetros para controlar la frecuencia de las operaciones

- Estricto tamaño de posición para administrar las posiciones de negociación

Dirección de optimización

- Optimización de los parámetros ADX para mejorar su sensibilidad

- Añadir otros indicadores para filtrar señales

- Parámetros de optimización de algoritmos de aprendizaje automático

- El uso de estrategias de alto nivel para controlar el riesgo de pérdidas

- Combinando las predicciones de modelos para obtener señales de negociación más precisas

Resumir

La estrategia binaria de ADX trading overall es una estrategia de cuantificación muy práctica. Utiliza los indicadores de ADX para juzgar la tendencia y capturar oportunidades de negociación bidireccionales. Al mismo tiempo, aplica la determinación de la diferencia para garantizar la efectividad de la señal. La lógica de la estrategia es clara, simple y fácil de modificar y optimizar, es una estrategia de negociación de seguimiento de tendencias bidireccionales.

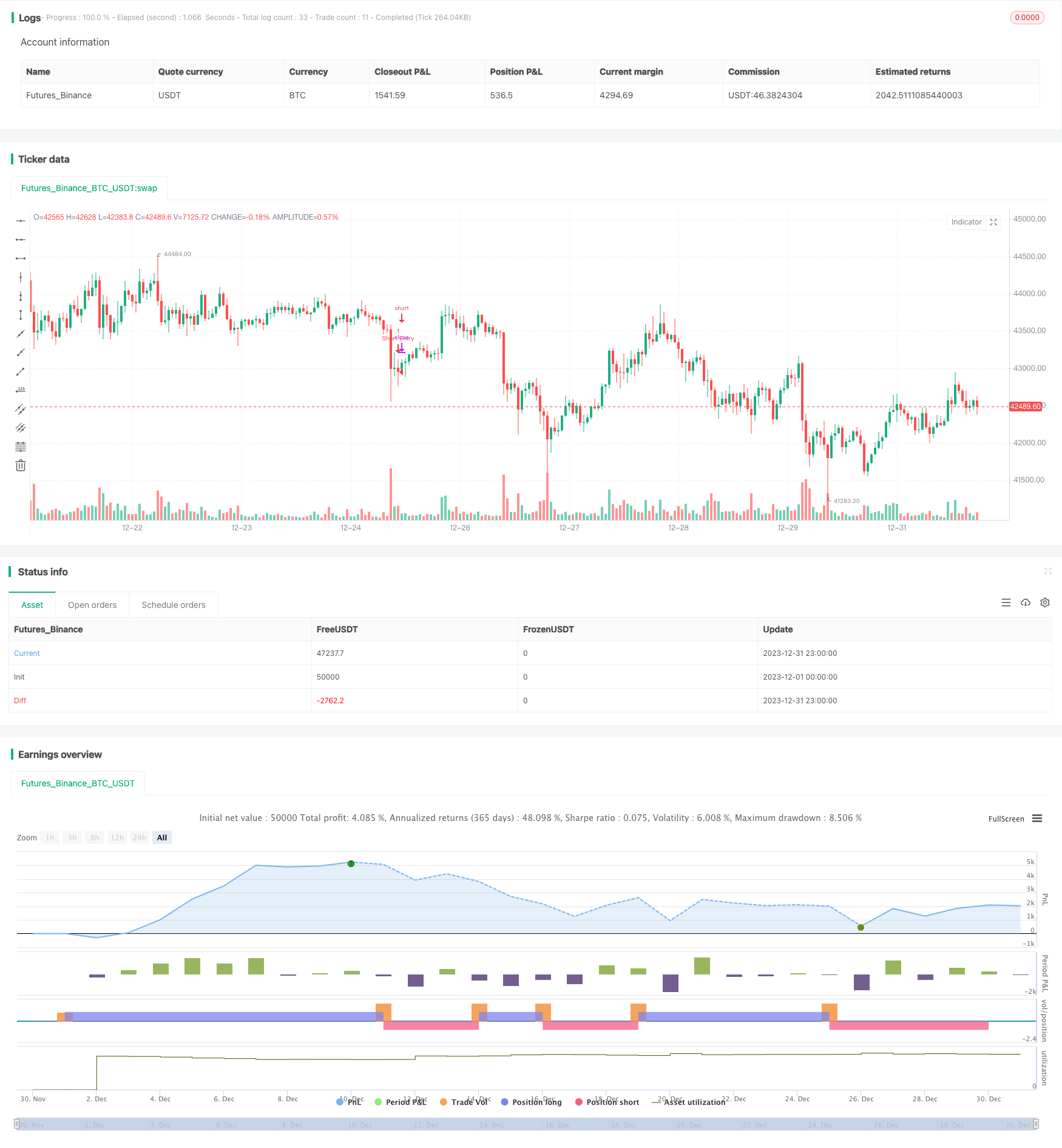

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MAURYA_ALGO_TRADER

//@version=5

strategy("Monthly Performance", overlay=true)

len = input(14)

th = input(20)

TrueRange = math.max(math.max(high - low, math.abs(high - nz(close[1]))), math.abs(low - nz(close[1])))

DirectionalMovementPlus = high - nz(high[1]) > nz(low[1]) - low ? math.max(high - nz(high[1]), 0) : 0

DirectionalMovementMinus = nz(low[1]) - low > high - nz(high[1]) ? math.max(nz(low[1]) - low, 0) : 0

SmoothedTrueRange = 0.0

SmoothedTrueRange := nz(SmoothedTrueRange[1]) - nz(SmoothedTrueRange[1]) / len + TrueRange

SmoothedDirectionalMovementPlus = 0.0

SmoothedDirectionalMovementPlus := nz(SmoothedDirectionalMovementPlus[1]) - nz(SmoothedDirectionalMovementPlus[1]) / len + DirectionalMovementPlus

SmoothedDirectionalMovementMinus = 0.0

SmoothedDirectionalMovementMinus := nz(SmoothedDirectionalMovementMinus[1]) - nz(SmoothedDirectionalMovementMinus[1]) / len + DirectionalMovementMinus

DIPlus = SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100

DIMinus = SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100

DX = math.abs(DIPlus - DIMinus) / (DIPlus + DIMinus) * 100

ADX = ta.sma(DX, len)

// plot(DIPlus, color=color.new(color.green, 0), title='DI+')

// plot(DIMinus, color=color.new(color.red, 0), title='DI-')

// plot(ADX, color=color.new(color.white, 0), title='ADX')

// hline(th, color=color.black)

//diff_1 = math.abs(DIPlus - DIMinus)

diff_2 = math.abs(DIPlus-ADX)

diff_3 = math.abs(DIMinus - ADX)

long_diff = input(10, "Long Difference")

short_diff = input(10, "Short Difference")

buy_condition = diff_2 >=long_diff and diff_3 >=long_diff and (ADX < DIPlus and ADX > DIMinus)

sell_condition = diff_2 >=short_diff and diff_3 >=short_diff and (ADX > DIPlus and ADX < DIMinus)

if buy_condition

strategy.entry("Long Entry", strategy.long, comment = "Long")

if sell_condition

strategy.entry("Short Entry", strategy.short, comment = "Short")

// Copy below code to end of the desired strategy script

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

// monthly pnl performance by Dr. Maurya @MAURYA_ALGO_TRADER //

///////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

show_performance = input.bool(true, 'Show Monthly Monthly Performance ?', group='Monthly Performance')

dash_loc_mp = input("Bottom Right","Location" ,options=["Top Right","Bottom Right","Top Left","Bottom Left", "Middle Right","Bottom Center"] ,group='Monthly Performance', inline = "performance")

text_size_mp = input('Small',"Size" ,options=["Tiny","Small","Normal","Large"] ,group='Monthly Performance', inline = "performance")

bg_c = input.color( color.rgb(7, 226, 242, 38), "Background Color", group='Monthly Performance')

text_head_color = input.color( color.rgb(0,0,0), "Month/Year Heading Color", group='Monthly Performance')

tab_month_c = input.color( color.white, "Month PnL Data Color", group='Monthly Performance')

tab_year_c = input.color( color.rgb(0,0,0), "Year PnL Data Color", group='Monthly Performance')

border_c = input.color( color.white, "Table Border Color", group='Monthly Performance')

var table_position_mp = dash_loc_mp == 'Top Left' ? position.top_left :

dash_loc_mp == 'Bottom Left' ? position.bottom_left :

dash_loc_mp == 'Middle Right' ? position.middle_right :

dash_loc_mp == 'Bottom Center' ? position.bottom_center :

dash_loc_mp == 'Top Right' ? position.top_right : position.bottom_right

var table_text_size_mp = text_size_mp == 'Tiny' ? size.tiny :

text_size_mp == 'Small' ? size.small :

text_size_mp == 'Normal' ? size.normal : size.large

/////////////////

strategy.initial_capital = 50000

/////////////////////////////////////////////

// var bool new_month = na

new_month = ta.change(month) //> 0 ? true : false

newest_month = new_month and strategy.closedtrades >= 1

// profit

only_profit = strategy.netprofit

initial_balance = strategy.initial_capital

// month number

var int month_number = na

month_number := (ta.valuewhen(newest_month, month(time), 0)) //and month(time) > 1 ? (ta.valuewhen(newest_month, month(time), 0) - 1) : 12 //1 to 12

//month_year

var int month_time = na

month_time := ta.valuewhen(newest_month, time, 0) - 2419200000

var int m_counter = 0

if newest_month

m_counter += 1

// current month values

var bool new_year = na

new_year := ta.change(year)

curr_m_pnl = only_profit - nz(ta.valuewhen(newest_month, only_profit, 0), 0)

curr_m_number = newest_month ? ta.valuewhen(newest_month, month(time), 0) : month(time)

curr_y_pnl = (only_profit - nz(ta.valuewhen(new_year, only_profit, 0),0))

var float [] net_profit_array = array.new_float()

var int [] month_array = array.new_int()

var int [] month_time_array = array.new_int()

if newest_month

array.push(net_profit_array, only_profit)

array.push(month_array, month_number)

array.push(month_time_array, month_time)

var float [] y_pnl_array = array.new_float()

var int [] y_number_array = array.new_int()

var int [] y_time_array = array.new_int()

newest_year = ta.change(year) and strategy.closedtrades >= 1

get_yearly_pnl = nz(ta.valuewhen(newest_year, strategy.netprofit, 0) - nz(ta.valuewhen(newest_year, strategy.netprofit, 1), 0), 0)

get_m_year = ta.valuewhen(newest_year, year(time), 1)

get_y_time = ta.valuewhen(newest_year, time, 0)

if newest_year

array.push(y_pnl_array, get_yearly_pnl)

array.push(y_number_array, get_m_year)

array.push(y_time_array, get_y_time)

var float monthly_profit = na

var int column_month_number = na

var int row_month_time = na

var testTable = table.new(position = table_position_mp, columns = 14, rows = 40, bgcolor = bg_c, border_color = border_c, border_width = 1)

if barstate.islastconfirmedhistory and show_performance

table.cell(table_id = testTable, column = 0, row = 0, text = "YEAR", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 1, row = 0, text = "JAN", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 2, row = 0, text = "FEB", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 3, row = 0, text = "MAR", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 4, row = 0, text = "APR", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 5, row = 0, text = "MAY", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 6, row = 0, text = "JUN", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 7, row = 0, text = "JUL", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 8, row = 0, text = "AUG", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 9, row = 0, text = "SEP", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 10, row = 0, text = "OCT", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 11, row = 0, text = "NOV", text_color = text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 12, row = 0, text = "DEC", text_color =text_head_color, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 13, row = 0, text = "YEAR P/L", text_color = text_head_color, text_size=table_text_size_mp)

for i = 0 to (array.size(y_number_array) == 0 ? na : array.size(y_number_array) - 1)

row_y = year(array.get(y_time_array, i)) - year(array.get(y_time_array, 0)) + 1

table.cell(table_id = testTable, column = 13, row = row_y, text = str.tostring(array.get(y_pnl_array , i), "##.##") + '\n' + '(' + str.tostring(array.get(y_pnl_array , i)*100/initial_balance, "##.##") + ' %)', bgcolor = array.get(y_pnl_array , i) > 0 ? color.green : array.get(y_pnl_array , i) < 0 ? color.red : color.gray, text_color = tab_year_c, text_size=table_text_size_mp)

curr_row_y = array.size(month_time_array) == 0 ? 1 : (year(array.get(month_time_array, array.size(month_time_array) - 1))) - (year(array.get(month_time_array, 0))) + 1

table.cell(table_id = testTable, column = 13, row = curr_row_y, text = str.tostring(curr_y_pnl, "##.##") + '\n' + '(' + str.tostring(curr_y_pnl*100/initial_balance, "##.##") + ' %)', bgcolor = curr_y_pnl > 0 ? color.green : curr_y_pnl < 0 ? color.red : color.gray, text_color = tab_year_c, text_size=table_text_size_mp)

for i = 0 to (array.size(net_profit_array) == 0 ? na : array.size(net_profit_array) - 1)

monthly_profit := i > 0 ? ( array.get(net_profit_array, i) - array.get(net_profit_array, i - 1) ) : array.get(net_profit_array, i)

column_month_number := month(array.get(month_time_array, i))

row_month_time :=((year(array.get(month_time_array, i))) - year(array.get(month_time_array, 0)) ) + 1

table.cell(table_id = testTable, column = column_month_number, row = row_month_time, text = str.tostring(monthly_profit, "##.##") + '\n' + '(' + str.tostring(monthly_profit*100/initial_balance, "##.##") + ' %)', bgcolor = monthly_profit > 0 ? color.green : monthly_profit < 0 ? color.red : color.gray, text_color = tab_month_c, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 0, row =row_month_time, text = str.tostring(year(array.get(month_time_array, i)), "##.##"), text_color = text_head_color, text_size=table_text_size_mp)

curr_row_m = array.size(month_time_array) == 0 ? 1 : (year(array.get(month_time_array, array.size(month_time_array) - 1))) - (year(array.get(month_time_array, 0))) + 1

table.cell(table_id = testTable, column = curr_m_number, row = curr_row_m, text = str.tostring(curr_m_pnl, "##.##") + '\n' + '(' + str.tostring(curr_m_pnl*100/initial_balance, "##.##") + ' %)', bgcolor = curr_m_pnl > 0 ? color.green : curr_m_pnl < 0 ? color.red : color.gray, text_color = tab_month_c, text_size=table_text_size_mp)

table.cell(table_id = testTable, column = 0, row =curr_row_m, text = str.tostring(year(time), "##.##"), text_color = text_head_color, text_size=table_text_size_mp)

//============================================================================================================================================================================