Strategi perdagangan dua arah osilator jalur ganda RSI panjang dan pendek

Ringkasan

Strategi perdagangan dua arah menggunakan indikator RSI untuk melakukan perdagangan dua arah. Strategi ini menggunakan prinsip overbought dan oversold dari indikator RSI, menggabungkan pengaturan dua arah dan sinyal perdagangan linier, untuk mencapai posisi terbuka dan posisi kosong dua arah yang efisien.

Prinsip Strategi

Strategi ini didasarkan pada prinsip overbought dan oversold RSI. Strategi ini pertama-tama menghitung nilai RSI vrsi, serta uptrend sn dan downtrend ln dalam dua orbit. Ini menghasilkan sinyal plus ketika RSI turun di bawah trajectory ln dan sinyal minus ketika RSI naik di atas trajectory sn.

Strategi ini juga mendeteksi perubahan naik turunnya K-line, yang selanjutnya menghasilkan sinyal longLocic ketika K-line melompati dari bawah ke atas, dan shortLogic ketika K-line melompati dari atas ke bawah. Selain itu, strategi ini menyediakan saklar parameter yang dapat digunakan untuk melakukan hanya lebih, hanya kosong, atau membalikkan sinyal.

Setelah menghasilkan beberapa sinyal penarikan, strategi akan menghitung jumlah sinyal dan mengontrol jumlah posisi yang dibuka. Dengan parameter, Anda dapat mengatur aturan penarikan yang berbeda. Kondisi penarikan meliputi stop loss, stop loss, dan stop loss bergerak.

Secara keseluruhan, strategi ini menggabungkan berbagai teknik seperti RSI, crossover rata-rata, statistical leverage, dan stop loss untuk memungkinkan perdagangan otomatis dalam jangka panjang dan jangka pendek.

Keunggulan Strategis

- Dengan menggunakan prinsip overbought dan oversold dari indikator RSI, Anda dapat membuat lebih banyak posisi shorting di posisi yang masuk akal.

- Pengaturan jalur ganda untuk menghindari sinyal yang salah. Jalur atas untuk mencegah posisi multihead dari posisi yang terlalu cepat, dan jalur bawah untuk mencegah posisi kosong dari posisi yang terlalu cepat.

- Sinyal perdagangan rata-rata memfilter untuk mematahkan sinyal palsu.

- Jumlah sinyal statistik dan jumlah deposit, pengendalian risiko.

- Persentase Stop Loss yang dapat disesuaikan, risiko keuntungan yang dapat dikontrol.

- Stop loss bergerak untuk melacak stop loss dan mengunci keuntungan lebih lanjut.

- Hanya melakukan lebih banyak, hanya melakukan kosong atau membalik sinyal, untuk menyesuaikan dengan lingkungan pasar yang berbeda.

- Sistem perdagangan otomatis, mengurangi biaya operasi manual.

Risiko Strategis

- RSI memiliki risiko reversal failure. RSI masuk ke zona overbought/oversold tidak selalu reversal.

- Stop loss yang ditetapkan memiliki risiko tersandung. Pengaturan stop loss yang tidak tepat dapat menyebabkan stop loss atau stop loss prematur.

- Bergantung pada indikator teknis, ada risiko pengoptimalan parameter. Setting parameter indikator yang tidak tepat dapat mempengaruhi efektivitas strategi.

- Ada beberapa kondisi yang dapat memicu terjadinya penurunan jumlah pasien.

- Sistem perdagangan otomatis memiliki risiko kesalahan yang tidak biasa.

Untuk menghadapi risiko di atas, pengaturan parameter dapat dioptimalkan, strategi stop loss dapat disesuaikan, penyaringan likuiditas dapat ditingkatkan, logika pembuatan sinyal dapat dioptimalkan, dan pemantauan kesalahan yang tidak biasa dapat ditingkatkan.

Arah optimasi strategi

- Uji parameter RSI untuk mengoptimalkan parameter RSI pada periode yang berbeda.

- Ujilah berbagai setelan Stop Loss Percentage.

- Meningkatkan volume transaksi atau penyaringan tingkat keuntungan untuk menghindari kekurangan likuiditas.

- Optimalkan logik generasi sinyal, dan memperbaiki metode perpotongan rata-rata.

- Menambahkan beberapa periode pengujian ulang untuk memverifikasi stabilitas.

- Pertimbangkan untuk menambahkan indikator lain untuk mengoptimalkan efek sinyal.

- Bergabung dengan strategi manajemen posisi.

- Menambahkan pengawasan terhadap kesalahan yang tidak biasa.

- Mengoptimalkan algoritma pelacakan stop loss otomatis.

- Pertimbangkan strategi untuk meningkatkan pembelajaran mesin.

Meringkaskan

Strategi perdagangan dua arah RSI melalui penggunaan komprehensif indikator RSI, statistik membuka posisi dan prinsip stop loss, dan banyak teknik lainnya, memungkinkan perdagangan dua arah otomatis. Strategi ini sangat dapat disesuaikan, pengguna dapat menyesuaikan parameter sesuai dengan kebutuhan dan menyesuaikan diri dengan lingkungan pasar yang berbeda.

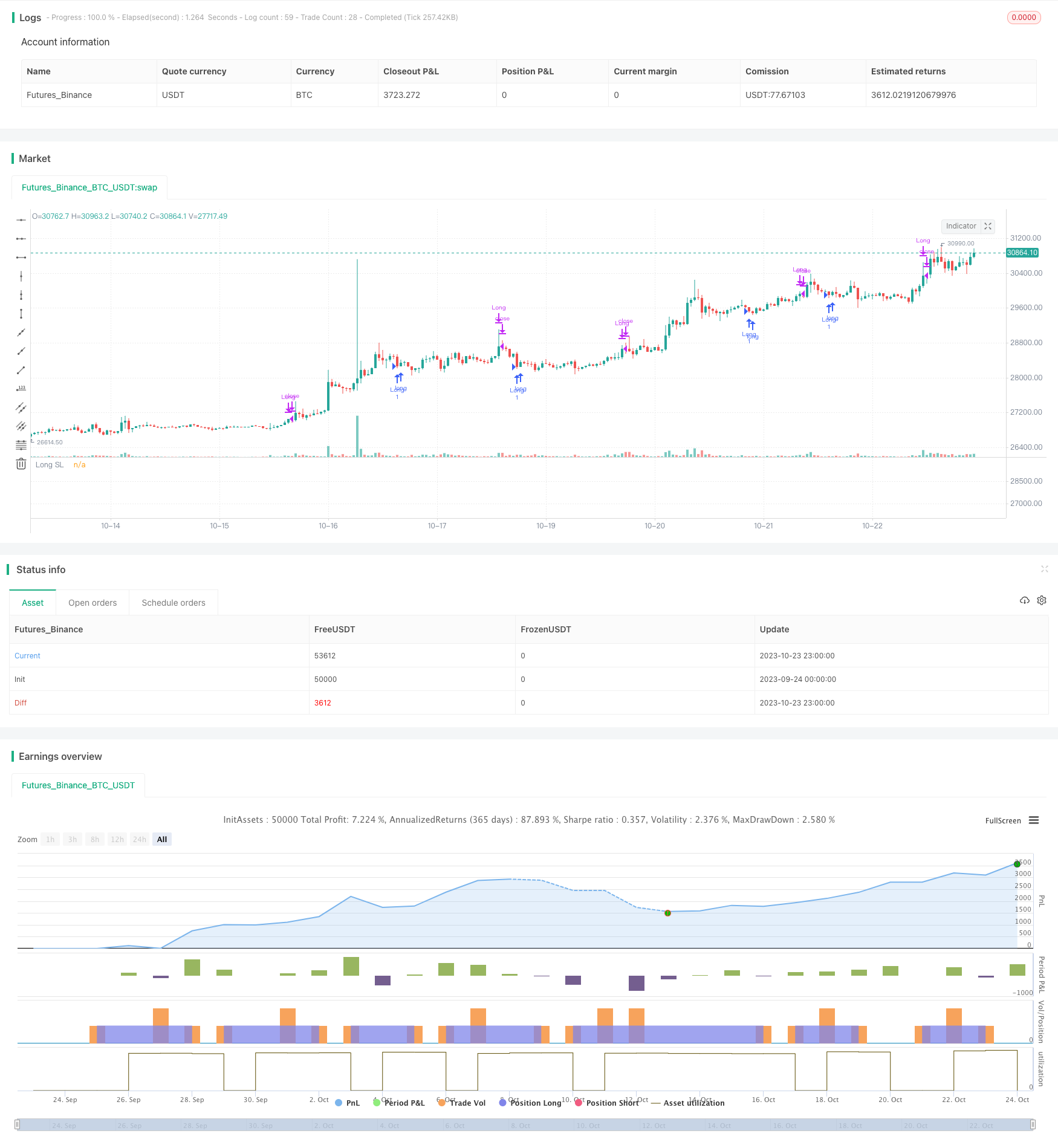

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

// Learn more about Autoview and how you can automate strategies like this one here: https://autoview.with.pink/

// strategy("Autoview Build-a-bot - 5m chart", "Strategy", overlay=true, pyramiding=2000, default_qty_value=10000)

// study("Autoview Build-a-bot", "Alerts")

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made *//

testStartYear = input(1, "Backtest Start Year")

testStartMonth = input(11, "Backtest Start Month")

testStartDay = input(10, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(77777777, "Backtest Stop Year")

testStopMonth = input(11, "Backtest Stop Month")

testStopDay = input(15, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

RSIlength = input(1,title="RSI Period Length")

price = close

vrsi = (rsi(price, RSIlength))

src = close

len = input(2, minval=1, title="Length")

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsin = input(12)

sn = 100 - rsin

ln = 0 + rsin

// Put your long and short rules here

longLocic = crossunder(rsi, ln)

shortLogic = crossover(rsi, sn)

//////////////////////////

//* Strategy Component *//

//////////////////////////

isLong = input(true, "Longs Only")

isShort = input(false, "Shorts Only")

isFlip = input(false, "Flip the Opens")

long = longLocic

short = shortLogic

if isFlip

long := shortLogic

short := longLocic

else

long := longLocic

short := shortLogic

if isLong

long := long

short := na

if isShort

long := na

short := short

////////////////////////////////

//======[ Signal Count ]======//

////////////////////////////////

sectionLongs = 0

sectionLongs := nz(sectionLongs[1])

sectionShorts = 0

sectionShorts := nz(sectionShorts[1])

if long

sectionLongs := sectionLongs + 1

sectionShorts := 0

if short

sectionLongs := 0

sectionShorts := sectionShorts + 1

//////////////////////////////

//======[ Pyramiding ]======//

//////////////////////////////

pyrl = input(2, "Pyramiding less than") // If your count is less than this number

pyre = input(1, "Pyramiding equal to") // If your count is equal to this number

pyrg = input(1000000, "Pyramiding greater than") // If your count is greater than this number

longCondition = long and sectionLongs <= pyrl or long and sectionLongs >= pyrg or long and sectionLongs == pyre ? 1 : 0 and vrsi < 20

shortCondition = short and sectionShorts <= pyrl or short and sectionShorts >= pyrg or short and sectionShorts == pyre ? 1 : 0

////////////////////////////////

//======[ Entry Prices ]======//

////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

////////////////////////////////////

//======[ Open Order Count ]======//

////////////////////////////////////

sectionLongConditions = 0

sectionLongConditions := nz(sectionLongConditions[1])

sectionShortConditions = 0

sectionShortConditions := nz(sectionShortConditions[1])

if longCondition

sectionLongConditions := sectionLongConditions + 1

sectionShortConditions := 0

if shortCondition

sectionLongConditions := 0

sectionShortConditions := sectionShortConditions + 1

///////////////////////////////////////////////

//======[ Position Check (long/short) ]======//

///////////////////////////////////////////////

last_longCondition = na

last_shortCondition = na

last_longCondition := longCondition ? time : nz(last_longCondition[1])

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1])

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

/////////////////////////////////////

//======[ Position Averages ]======//

/////////////////////////////////////

totalLongs = 0.0

totalLongs := nz(totalLongs[1])

totalShorts = 0.0

totalShorts := nz(totalShorts[1])

averageLongs = 0.0

averageLongs := nz(averageLongs[1])

averageShorts = 0.0

averageShorts := nz(averageShorts[1])

if longCondition

totalLongs := totalLongs + last_open_longCondition

totalShorts := 0.0

if shortCondition

totalLongs := 0.0

totalShorts := totalShorts + last_open_shortCondition

averageLongs := totalLongs / sectionLongConditions

averageShorts := totalShorts / sectionShortConditions

/////////////////////////////////

//======[ Trailing Stop ]======//

/////////////////////////////////

isTS = input(false, "Trailing Stop")

tsi = input(100, "Activate Trailing Stop Price (%). Divided by 100 (1 = 0.01%)") / 100

ts = input(100, "Trailing Stop (%). Divided by 100 (1 = 0.01%)") / 100

last_high = na

last_low = na

last_high_short = na

last_low_short = na

last_high := not in_longCondition ? na : in_longCondition and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_high_short := not in_shortCondition ? na : in_shortCondition and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_shortCondition ? na : in_shortCondition and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

last_low_short := not in_longCondition ? na : in_longCondition and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

long_ts = isTS and not na(last_high) and low <= last_high - last_high / 100 * ts and longCondition == 0 and last_high >= averageLongs + averageLongs / 100 * tsi

short_ts = isTS and not na(last_low) and high >= last_low + last_low / 100 * ts and shortCondition == 0 and last_low <= averageShorts - averageShorts/ 100 * tsi

///////////////////////////////

//======[ Take Profit ]======//

///////////////////////////////

isTP = input(true, "Take Profit")

tp = input(125, "Take Profit (%). Divided by 100 (1 = 0.01%)") / 100

long_tp = isTP and close > averageLongs + averageLongs / 100 * tp and not longCondition

short_tp = isTP and close < averageShorts - averageShorts / 100 * tp and not shortCondition

/////////////////////////////

//======[ Stop Loss ]======//

/////////////////////////////

isSL = input(true, "Stop Loss")

sl = input(140, "Stop Loss (%). Divided by 100 (1 = 0.01%)") / 100

long_sl = isSL and close < averageLongs - averageLongs / 100 * sl and longCondition == 0

short_sl = isSL and close > averageShorts + averageShorts / 100 * sl and shortCondition == 0

/////////////////////////////////

//======[ Close Signals ]======//

/////////////////////////////////

longClose = long_tp or long_sl or long_ts ? 1 : 0

shortClose = short_tp or short_sl or short_ts ? 1: 0

///////////////////////////////

//======[ Plot Colors ]======//

///////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? purple : long_sl ? maroon : long_ts ? blue : longCloseCol[1]

shortCloseCol := short_tp ? purple : short_sl ? maroon : short_ts ? blue : shortCloseCol[1]

tpColor = isTP and in_longCondition ? purple : isTP and in_shortCondition ? purple : white

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : white

//////////////////////////////////

//======[ Strategy Plots ]======//

//////////////////////////////////

plot(isTS and in_longCondition ? averageLongs + averageLongs / 100 * tsi : na, "Long Trailing Activate", blue, style=3, linewidth=2)

plot(isTS and in_longCondition and last_high >= averageLongs + averageLongs / 100 * tsi ? last_high - last_high / 100 * ts : na, "Long Trailing", fuchsia, style=2, linewidth=3)

plot(isTS and in_shortCondition ? averageShorts - averageShorts/ 100 * tsi : na, "Short Trailing Activate", blue, style=3, linewidth=2)

plot(isTS and in_shortCondition and last_low <= averageShorts - averageShorts/ 100 * tsi ? last_low + last_low / 100 * ts : na, "Short Trailing", fuchsia, style=2, linewidth=3)

plot(isTP and in_longCondition and last_high < averageLongs + averageLongs / 100 * tp ? averageLongs + averageLongs / 100 * tp : na, "Long TP", tpColor, style=3, linewidth=2)

plot(isTP and in_shortCondition and last_low > averageShorts - averageShorts / 100 * tp ? averageShorts - averageShorts / 100 * tp : na, "Short TP", tpColor, style=3, linewidth=2)

plot(isSL and in_longCondition and last_low_short > averageLongs - averageLongs / 100 * sl ? averageLongs - averageLongs / 100 * sl : na, "Long SL", slColor, style=3, linewidth=2)

plot(isSL and in_shortCondition and last_high_short < averageShorts + averageShorts / 100 * sl ? averageShorts + averageShorts / 100 * sl : na, "Short SL", slColor, style=3, linewidth=2)

///////////////////////////////

//======[ Alert Plots ]======//

///////////////////////////////

// plot(longCondition, "Long", green)

// plot(shortCondition, "Short", red)

// plot(longClose, "Long Close", longCloseCol)

// plot(shortClose, "Short Close", shortCloseCol)

///////////////////////////////////

//======[ Reset Variables ]======//

///////////////////////////////////

if longClose or not in_longCondition

averageLongs := 0

totalLongs := 0.0

sectionLongs := 0

sectionLongConditions := 0

if shortClose or not in_shortCondition

averageShorts := 0

totalShorts := 0.0

sectionShorts := 0

sectionShortConditions := 0

////////////////////////////////////////////

//======[ Strategy Entry and Exits ]======//

////////////////////////////////////////////

if testPeriod()

strategy.entry("Long", 1, when=longCondition)

strategy.entry("Short", 0, when=shortCondition)

strategy.close("Long", when=longClose)

strategy.close("Short", when=shortClose)