Strategi Perdagangan Algoritmik Pelacakan Garis Ganda

Ringkasan

Strategi ini terutama menggunakan prinsip persilangan rata-rata, yang dikombinasikan dengan sinyal reversal indikator RSI, dan algoritma pelacakan dua baris yang disesuaikan untuk melakukan perdagangan persilangan rata-rata. Strategi ini melacak persilangan rata-rata dua periode yang berbeda, satu persilangan rata-rata cepat yang melacak tren jangka pendek, yang lain persilangan rata-rata lambat yang melacak tren jangka panjang.

Prinsip Strategi

Perhitungan rata-rata VWAP dari dua set parameter yang berbeda, yang mewakili tren jangka panjang dan tren jangka pendek

- Tren jangka panjang dalam perhitungan garis acuan dan garis acuan lambat

- Tren jangka pendek dalam penghitungan garis cepat dan garis dasar

Ambil rata-rata dari dua set garis langit-langit dan garis acuan sebagai rata-rata lambat dan rata-rata cepat

Perhitungan indikator Brin Belt untuk menilai konsolidasi dan terobosan

- Garis tengah adalah rata-rata rata-rata cepat dan lambat

- Brin naik dan turun untuk menilai terobosan

Perhitungan indikator TSV untuk menentukan energi volume transaksi

- TSV lebih besar dari 0 berarti kekuatan naik lebih besar dari kekuatan turun

- TSV lebih besar dari EMA yang menunjukkan peningkatan kekuatan

Perhitungan RSI untuk menilai overbought dan oversold

- RSI di bawah 30 adalah zona oversold, yang dapat dibeli

- RSI di atas 70 adalah zona overbought dan harus dijual

Syarat masuk:

- Jalur rata-rata cepat melalui jalur rata-rata lambat

- Harga penutupan untuk melintasi jalur Brin

- TSV lebih besar dari 0 dan lebih besar dari EMA

- RSI di bawah 30

Kondisi untuk bermain:

- Kecepatan rata-rata di bawah kecepatan rata-rata

- RSI lebih dari 70

Analisis Keunggulan

Dengan menggunakan sistem dua baris, tren jangka pendek dan panjang dapat ditangkap secara bersamaan.

Indeks RSI menghindari zona overbought dan zona oversold

Indeks TSV memastikan ada cukup volume transaksi untuk mendukung tren

Terobosan Penting dalam Pengukuran Brin Belt

Kombinasi berbagai indikator yang efektif untuk memfilter terobosan palsu

Analisis risiko

Sistem linear mudah menghasilkan sinyal yang salah dan membutuhkan penyaringan indikator tambahan

Parameter RSI perlu dioptimalkan, atau mungkin akan kehilangan titik jual beli

Indikator TSV juga sensitif terhadap parameter dan perlu diuji dengan cermat.

Penembusan Brin di Jalur Kereta Bisa Jadi Penembusan Palsu, Perlu Diverifikasi

Kombinasi multi-indikator, parameter yang sulit dioptimalkan, mudah dioptimalkan

Data pelatihan dan pengujian yang tidak memadai dapat menyebabkan kecocokan kurva

Arah optimasi

Uji lebih banyak parameter periodik untuk menemukan kombinasi optimal

Cobalah indikator lain seperti MACD, KD alternatif atau kombinasi RSI

Optimasi parameter untuk memanfaatkan analisis walk forward

Meningkatkan strategi stop loss untuk mengendalikan kerugian tunggal

Pertimbangkan untuk memasukkan penilaian sinyal bantu dalam model pembelajaran mesin

Jangan terlalu bergantung pada kombinasi parameter tunggal untuk menyesuaikan parameter untuk pasar yang berbeda

Meringkaskan

Strategi ini menangkap tren jangka pendek panjang melalui sistem dua garis sejajar, dan menggunakan berbagai indikator filter sinyal seperti RSI, TSV, dan Brin. Keuntungan dari strategi ini adalah dapat secara berurutan, menangkap gelombang kenaikan jangka panjang. Namun, ada juga risiko sinyal palsu tertentu, perlu mengoptimalkan parameter lebih lanjut dan mengendalikan stop loss untuk mengurangi risiko. Secara keseluruhan, strategi ini menggabungkan pelacakan tren dan indikator reversal, lebih efektif di pasar yang naik di garis panjang, tetapi perlu melakukan penyesuaian parameter untuk pasar yang berbeda.

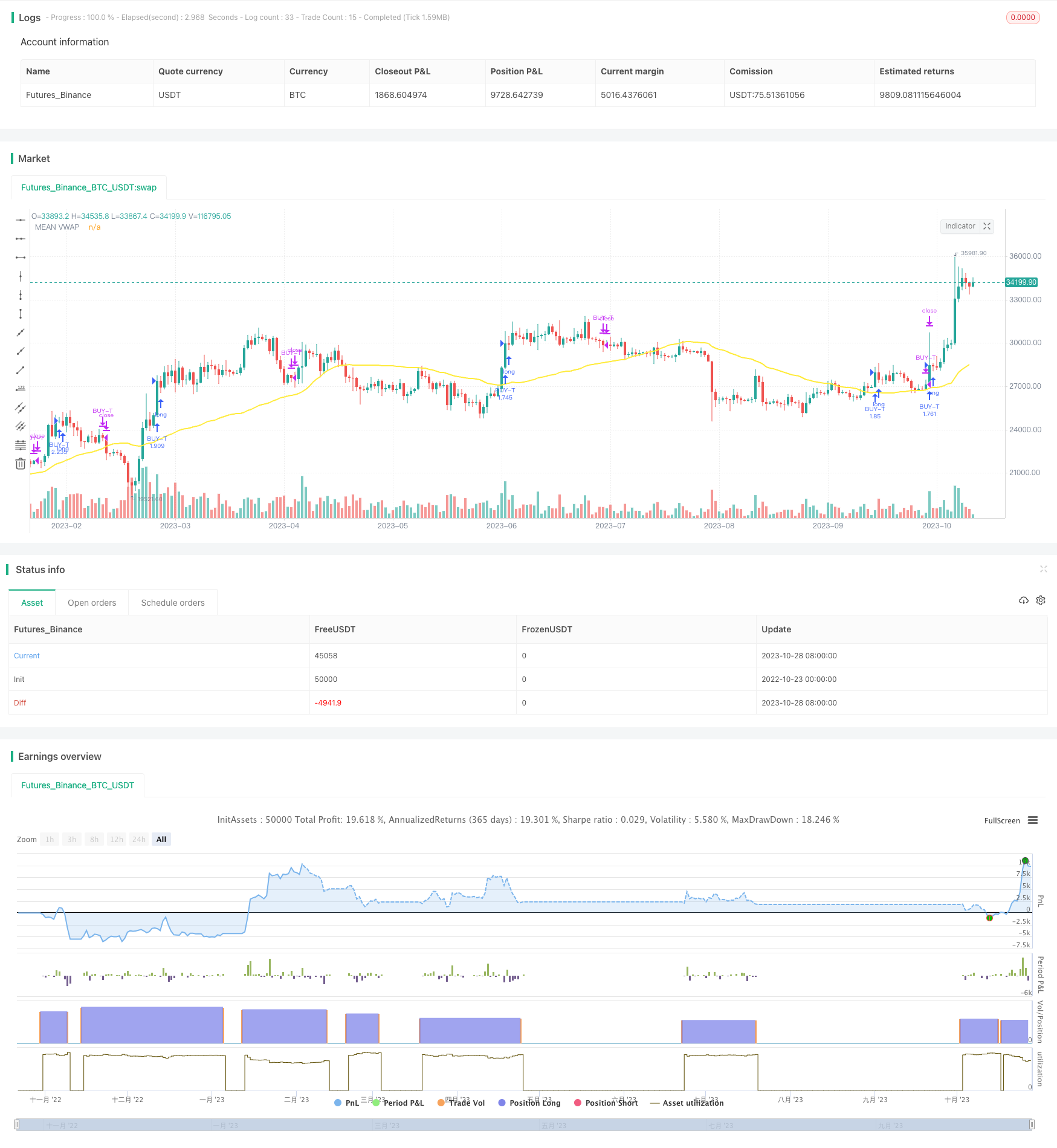

/*backtest

start: 2022-10-23 00:00:00

end: 2023-10-29 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// Credits

// "Vwap with period" code which used in this strategy to calculate the leadLine was written by "neolao" active on https://tr.tradingview.com/u/neolao/

// "TSV" code which used in this strategy was written by "liw0" active on https://www.tradingview.com/u/liw0. The code is corrected by "vitelot" December 2018.

// "Vidya" code which used in this strategy was written by "everget" active on https://tr.tradingview.com/u/everget/

strategy("HYE Combo Market [Strategy] (Vwap Mean Reversion + Trend Hunter)", overlay = true, initial_capital = 1000, default_qty_value = 100, default_qty_type = strategy.percent_of_equity, commission_value = 0.025)

//Strategy inputs

source = input(title = "Source", defval = close, group = "Mean Reversion Strategy Inputs")

smallcumulativePeriod = input(title = "Small VWAP", defval = 8, group = "Mean Reversion Strategy Inputs")

bigcumulativePeriod = input(title = "Big VWAP", defval = 10, group = "Mean Reversion Strategy Inputs")

meancumulativePeriod = input(title = "Mean VWAP", defval = 50, group = "Mean Reversion Strategy Inputs")

percentBelowToBuy = input(title = "Percent below to buy %", defval = 2, group = "Mean Reversion Strategy Inputs")

rsiPeriod = input(title = "Rsi Period", defval = 2, group = "Mean Reversion Strategy Inputs")

rsiEmaPeriod = input(title = "Rsi Ema Period", defval = 5, group = "Mean Reversion Strategy Inputs")

rsiLevelforBuy = input(title = "Maximum Rsi Level for Buy", defval = 30, group = "Mean Reversion Strategy Inputs")

slowtenkansenPeriod = input(9, minval=1, title="Slow Tenkan Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

slowkijunsenPeriod = input(13, minval=1, title="Slow Kijun Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

fasttenkansenPeriod = input(3, minval=1, title="Fast Tenkan Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

fastkijunsenPeriod = input(7, minval=1, title="Fast Kijun Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

BBlength = input(20, minval=1, title= "Bollinger Band Length", group = "Trend Hunter Strategy Inputs")

BBmult = input(2.0, minval=0.001, maxval=50, title="Bollinger Band StdDev", group = "Trend Hunter Strategy Inputs")

tsvlength = input(20, minval=1, title="TSV Length", group = "Trend Hunter Strategy Inputs")

tsvemaperiod = input(7, minval=1, title="TSV Ema Length", group = "Trend Hunter Strategy Inputs")

length = input(title="Vidya Length", type=input.integer, defval=20, group = "Trend Hunter Strategy Inputs")

src = input(title="Vidya Source", type=input.source, defval= hl2 , group = "Trend Hunter Strategy Inputs")

// Vidya Calculation

getCMO(src, length) =>

mom = change(src)

upSum = sum(max(mom, 0), length)

downSum = sum(-min(mom, 0), length)

out = (upSum - downSum) / (upSum + downSum)

out

cmo = abs(getCMO(src, length))

alpha = 2 / (length + 1)

vidya = 0.0

vidya := src * alpha * cmo + nz(vidya[1]) * (1 - alpha * cmo)

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group = "Strategy Date Range")

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group = "Strategy Date Range")

startYear = input(title="Start Year", type=input.integer,

defval=2000, minval=1800, maxval=2100, group = "Strategy Date Range")

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31, group = "Strategy Date Range")

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group = "Strategy Date Range")

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100, group = "Strategy Date Range")

inDateRange = true

// Mean Reversion Strategy Calculation

typicalPriceS = (high + low + close) / 3

typicalPriceVolumeS = typicalPriceS * volume

cumulativeTypicalPriceVolumeS = sum(typicalPriceVolumeS, smallcumulativePeriod)

cumulativeVolumeS = sum(volume, smallcumulativePeriod)

smallvwapValue = cumulativeTypicalPriceVolumeS / cumulativeVolumeS

typicalPriceB = (high + low + close) / 3

typicalPriceVolumeB = typicalPriceB * volume

cumulativeTypicalPriceVolumeB = sum(typicalPriceVolumeB, bigcumulativePeriod)

cumulativeVolumeB = sum(volume, bigcumulativePeriod)

bigvwapValue = cumulativeTypicalPriceVolumeB / cumulativeVolumeB

typicalPriceM = (high + low + close) / 3

typicalPriceVolumeM = typicalPriceM * volume

cumulativeTypicalPriceVolumeM = sum(typicalPriceVolumeM, meancumulativePeriod)

cumulativeVolumeM = sum(volume, meancumulativePeriod)

meanvwapValue = cumulativeTypicalPriceVolumeM / cumulativeVolumeM

rsiValue = rsi(source, rsiPeriod)

rsiEMA = ema(rsiValue, rsiEmaPeriod)

buyMA = ((100 - percentBelowToBuy) / 100) * bigvwapValue[0]

inTrade = strategy.position_size > 0

notInTrade = strategy.position_size <= 0

if(crossunder(smallvwapValue, buyMA) and rsiEMA < rsiLevelforBuy and close < meanvwapValue and inDateRange and notInTrade)

strategy.entry("BUY-M", strategy.long)

if(close > meanvwapValue or not inDateRange)

strategy.close("BUY-M")

// Trend Hunter Strategy Calculation

// Slow Tenkan Sen Calculation

typicalPriceTS = (high + low + close) / 3

typicalPriceVolumeTS = typicalPriceTS * volume

cumulativeTypicalPriceVolumeTS = sum(typicalPriceVolumeTS, slowtenkansenPeriod)

cumulativeVolumeTS = sum(volume, slowtenkansenPeriod)

slowtenkansenvwapValue = cumulativeTypicalPriceVolumeTS / cumulativeVolumeTS

// Slow Kijun Sen Calculation

typicalPriceKS = (high + low + close) / 3

typicalPriceVolumeKS = typicalPriceKS * volume

cumulativeTypicalPriceVolumeKS = sum(typicalPriceVolumeKS, slowkijunsenPeriod)

cumulativeVolumeKS = sum(volume, slowkijunsenPeriod)

slowkijunsenvwapValue = cumulativeTypicalPriceVolumeKS / cumulativeVolumeKS

// Fast Tenkan Sen Calculation

typicalPriceTF = (high + low + close) / 3

typicalPriceVolumeTF = typicalPriceTF * volume

cumulativeTypicalPriceVolumeTF = sum(typicalPriceVolumeTF, fasttenkansenPeriod)

cumulativeVolumeTF = sum(volume, fasttenkansenPeriod)

fasttenkansenvwapValue = cumulativeTypicalPriceVolumeTF / cumulativeVolumeTF

// Fast Kijun Sen Calculation

typicalPriceKF = (high + low + close) / 3

typicalPriceVolumeKF = typicalPriceKS * volume

cumulativeTypicalPriceVolumeKF = sum(typicalPriceVolumeKF, fastkijunsenPeriod)

cumulativeVolumeKF = sum(volume, fastkijunsenPeriod)

fastkijunsenvwapValue = cumulativeTypicalPriceVolumeKF / cumulativeVolumeKF

// Slow LeadLine Calculation

lowesttenkansen_s = lowest(slowtenkansenvwapValue, slowtenkansenPeriod)

highesttenkansen_s = highest(slowtenkansenvwapValue, slowtenkansenPeriod)

lowestkijunsen_s = lowest(slowkijunsenvwapValue, slowkijunsenPeriod)

highestkijunsen_s = highest(slowkijunsenvwapValue, slowkijunsenPeriod)

slowtenkansen = avg(lowesttenkansen_s, highesttenkansen_s)

slowkijunsen = avg(lowestkijunsen_s, highestkijunsen_s)

slowleadLine = avg(slowtenkansen, slowkijunsen)

// Fast LeadLine Calculation

lowesttenkansen_f = lowest(fasttenkansenvwapValue, fasttenkansenPeriod)

highesttenkansen_f = highest(fasttenkansenvwapValue, fasttenkansenPeriod)

lowestkijunsen_f = lowest(fastkijunsenvwapValue, fastkijunsenPeriod)

highestkijunsen_f = highest(fastkijunsenvwapValue, fastkijunsenPeriod)

fasttenkansen = avg(lowesttenkansen_f, highesttenkansen_f)

fastkijunsen = avg(lowestkijunsen_f, highestkijunsen_f)

fastleadLine = avg(fasttenkansen, fastkijunsen)

// BBleadLine Calculation

BBleadLine = avg(fastleadLine, slowleadLine)

// Bollinger Band Calculation

basis = sma(BBleadLine, BBlength)

dev = BBmult * stdev(BBleadLine, BBlength)

upper = basis + dev

lower = basis - dev

// TSV Calculation

tsv = sum(close>close[1]?volume*(close-close[1]):close<close[1]?volume*(close-close[1]):0,tsvlength)

tsvema = ema(tsv, tsvemaperiod)

// Rules for Entry & Exit

if(fastleadLine > fastleadLine[1] and slowleadLine > slowleadLine[1] and tsv > 0 and tsv > tsvema and close > upper and close > vidya and inDateRange and notInTrade)

strategy.entry("BUY-T", strategy.long)

if((fastleadLine < fastleadLine[1] and slowleadLine < slowleadLine[1]) or not inDateRange)

strategy.close("BUY-T")

// Plots

plot(meanvwapValue, title="MEAN VWAP", linewidth=2, color=color.yellow)

//plot(vidya, title="VIDYA", linewidth=2, color=color.green)

//colorsettingS = input(title="Solid Color Slow Leadline", defval=false, type=input.bool)

//plot(slowleadLine, title = "Slow LeadLine", color = colorsettingS ? color.aqua : slowleadLine > slowleadLine[1] ? color.green : color.red, linewidth=3)

//colorsettingF = input(title="Solid Color Fast Leadline", defval=false, type=input.bool)

//plot(fastleadLine, title = "Fast LeadLine", color = colorsettingF ? color.orange : fastleadLine > fastleadLine[1] ? color.green : color.red, linewidth=3)

//p1 = plot(upper, "Upper BB", color=#2962FF)

//p2 = plot(lower, "Lower BB", color=#2962FF)

//fill(p1, p2, title = "Background", color=color.blue)

//plot(smallvwapValue, color=#13C425, linewidth=2)

//plot(bigvwapValue, color=#CA1435, linewidth=2)