ボルバンバンド + RSI + ADX + ATR 反転取引戦略

作成日:

2024-02-21 14:13:47

最終変更日:

2024-02-21 14:13:47

コピー:

0

クリック数:

1017

1

フォロー

1629

フォロワー

概要

この戦略は,複数の技術指標を融合し,ボルバン帯の指標が価格逆転信号を発したときに,RSI,ADX,ATRの指標と組み合わせて市場の構造を判断し,高い確率の逆転取引機会を探します.

戦略原則

20周期のボルバーバンドを使用し,価格が上下軌道に達する時に反転K線を構成する買入シグナルを待つ.

RSIは,市場が揺れ圏内にあるかどうかを判断する指標で,RSIは60以上は看板範囲で,40未満は看板範囲である.

ADXは20を下回ると,市場が揺れ動いていると判断し,20以上は市場が動いていると判断する.

ATRの止損設定と止損追跡

EMAの均線フィルター信号と組み合わせた.

戦略的優位分析

複数の指標が融合し,高確率の取引シグナルを形成する.

設定可能なパラメータ,異なる市場環境に適応する.

リスク管理の厳格なルール

戦略的リスク分析

パラメータを正しく設定しない場合,取引が頻発する可能性があります.

逆転が失敗する可能性は依然として存在します.

ストップ・ロスト・トラッキングは特定の市場では有効でない可能性があります.

戦略最適化の方向性

より多くの指標の組み合わせをテストし,より適切なパラメータ配置を探します.

突破の失敗の後,逆転の機会を早期に認識する.

テストした結果, 損失を減らし, 損失を減らし, 損失を減らし,

要約する

この戦略は,ボルバン帯を基本取引信号として使うと同時に,複数の補助指標が高確率のフィルタリングシステムを形成し,止損規則も比較的完備である.パラメータ調整と指標最適化によって戦略のパフォーマンスをさらに強化することができる.全体的に見ると,この戦略は,信頼性の高い反転取引システムを形成している.

ストラテジーソースコード

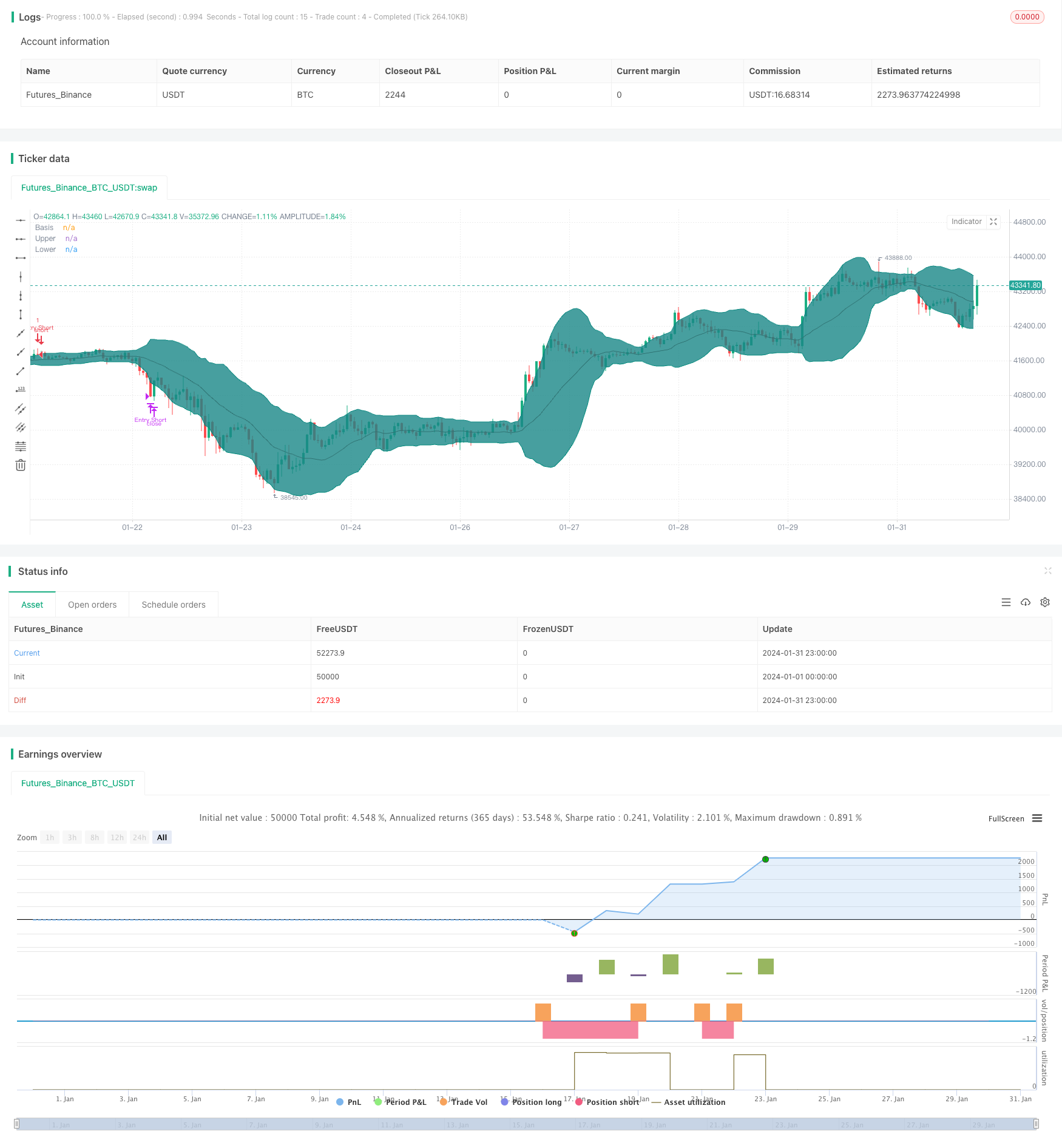

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(shorttitle="BB + EMA + RSI + ADX + ATR Reversal", title="Bollinger Bands Reversal", overlay=true)

// Inputs

ema1Input = input(title = "EMA1 Input", defval = 200, minval = 10, maxval = 400, step = 10, group = "Indicators")

ema2Input = input(title = "EMA2 Input", defval = 100, minval = 10, maxval = 400, step = 10, group = "Indicators")

length = input(title = "BB Length", defval = 20, minval=1, group = "Bollinger Band Indicator")

bbsrc = input(title = "BB Source", defval = close, group = "Bollinger Band Indicator")

mult = input(title = "BB Standard Deviation", type = input.float, defval = 2.0, minval=0.001, maxval=50, group = "Bollinger Band Indicator")

offset = input(title = "BB Offset", defval = 0, minval = -500, maxval = 500, group = "Bollinger Band Indicator")

rsilen = input(title = "RSI Length", defval = 14, minval=1, group = "RSI Indicator")

rsisrc = input(title = "RSI Source", defval = close, group = "RSI Indicator")

rsiMaxEntry = input(title = "RSI Maximum Value", defval = 60, minval = 50, maxval = 100, group = "RSI Indicator")

rsiMinEntry = input(title = "RSI Minimum Value", defval = 40, minval = 0, maxval = 50, group = "RSI Indicator")

rsiMaxExit = input(title = "RSI Max Exit Value", defval = 70, minval = 50, maxval = 100, group = "RSI Indicator")

rsiMinExit = input(title = "RSI Min Exit Value", defval = 30, minval = 0, maxval = 50, group = "RSI Indicator")

atrLength = input(title = "ATR Length", defval = 14, minval = 1, group = "ATR Indicator")

useStructure = input(title = "Use Trailing Stop?", type = input.bool, defval = true, group = "ATR Indicator")

atrlookback = input(title = "ATR Lookback Period", defval = 7, minval = 1, group = "ATR Indicator")

atrMultiplier = input(title = "ATR Multiplier", type = input.float, defval = 1.0, minval = 0.1, group = "ATR Indicator")

sigMaxValue = input(title = "ADX Max Value", type = input.float, defval = 20.0, minval = 0, maxval = 100, step = 0.1, group = "ADX Indicator")

adxlen = input(title = "ADX Smoothing", defval = 14, group = "ADX Indicator")

dilen = input(title = "DI Length", defval = 14, group = "ADX Indicator")

// Date input

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12, group = "Backtest Date Range")

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31, group = "Backtest Date Range")

fromYear = input(defval = 2000, title = "From Year", minval = 1970, group = "Backtest Date Range")

thruMonth = input(defval = 1, title = "Thru Month", minval = 1, maxval = 12, group = "Backtest Date Range")

thruDay = input(defval = 1, title = "Thru Day", minval = 1, maxval = 31, group = "Backtest Date Range")

thruYear = input(defval = 2099, title = "Thru Year", minval = 1970, group = "Backtest Date Range")

inDataRange = true

// Built in Bollinger Band

basis = sma(bbsrc, length)

dev = mult * stdev(bbsrc, length)

upper = basis + dev

lower = basis - dev

// Built in RSI

up = rma(max(change(rsisrc), 0), rsilen)

down = rma(-min(change(rsisrc), 0), rsilen)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// Built in ADX

dirmov(len) =>

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = rma(tr, len)

plus = fixnan(100 * rma(plusDM, len) / truerange)

minus = fixnan(100 * rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

// Custom variables

ema1 = ema(close, ema1Input)

ema2 = ema(close, ema2Input)

atr = atr(atrLength)

// Entry and exit signals

CrossLongEntry = (close <= lower or close[1] <= lower[1]) and close > open and close[1] < open[1] and close > ema1 and close > ema2 and strategy.position_size == 0 and inDataRange and rsi > rsiMinEntry and rsi < rsiMaxEntry and sig < sigMaxValue

CrossShortEntry = (close >= upper or close[1] >= upper[1]) and close < open and close[1] > open[1] and close < ema1 and close < ema2 and strategy.position_size == 0 and inDataRange and rsi > rsiMinEntry and rsi < rsiMaxEntry and sig < sigMaxValue

CrossLongExit = (close >= upper or close[1] >= upper[1]) and close < open and close[1] > open[1] and strategy.position_size > 0 and inDataRange or rsi < rsiMinExit or rsi > rsiMaxExit

CrossShortExit = (close <= lower or close[1] <= lower[1]) and close > open and close[1] < open[1] and strategy.position_size < 0 and inDataRange or rsi < rsiMinExit or rsi > rsiMaxExit

// Determining the stop loss based on ATR

StopLossLong = (useStructure ? lowest(low, atrlookback) : close) - atr * atrMultiplier

StopLossShort = (useStructure ? highest(high, atrlookback) : close) + atr * atrMultiplier

// Custom variables used to store the stoploss value

var StopLong = 0.0

var StopShort = 0.0

// Telling my script to store the stoploss value in the corresponding variables

if CrossLongEntry

StopLong := StopLossLong

if CrossShortEntry

StopShort := StopLossShort

// Strategy

strategy.entry("Entry Long", strategy.long, when = CrossLongEntry, comment = "Entry Long")

strategy.close("Entry Long", when = CrossLongExit or close < StopLong, comment = "Long Exit")

strategy.entry("Entry Short", strategy.short, when = CrossShortEntry, comment = "Entry Short")

strategy.close("Entry Short", when = CrossShortExit or close > StopShort, comment = "Short Exit")

// Plots the Bollinger Band

plot(basis, "Basis", color=#872323, offset = offset)

p1 = plot(upper, "Upper", color=color.teal, offset = offset)

p2 = plot(lower, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=#198787, transp=95)

// Use this if you want to see the stoploss visualised, be aware though plotting these can be confusing

// plot(StopLong)

// plot(StopShort)