개요

이 전략은 주로 이동 평균의 법칙을 사용하여, 주식의 단기적 인 추락 이후의 반발 기회를 찾습니다. 빠른 이동 평균이 느린 이동 평균 아래에있을 때, 주식은 하향 추세에 있음을 나타냅니다. 빠른 이동 평균의 일정 정도를 넘어선 후에 다시 떨어지는 공간이 제한되어, 가격이 다시 올라갈 수 있다면 빠른 이동 평균을 뚫고 주식의 하향 추세가 끝났음을 나타냅니다. 반발이 발생합니다.

전략 원칙

빠른 이동 평균 EMA (예: 8 일 선) 과 느린 이동 평균 SMA (예: 20 일 선) 을 설정한다.

SMA가 EMA 위에 있을 때, 지표는 상승 추세에 있다. SMA가 EMA 아래에 있을 때, 지표는 하락 추세에 있다.

가격이 EMA의 일정 범위를 (예: 2-10%) 넘어서면, 주식이 초하락 영역에 들어서면, 반발 가능성이 높다.

가격 상승이 EMA를 넘어서면 구매 신호입니다.

스톱 라인은 EMA 근처에, 스톱 라인은 중간 느린 이동 평균 SMA (예: 50 일 라인) 근처에, 또는 일정 비율로 스톱 라인을 설정한다.

가격이 EMA를 다시 넘어갈 때, 청산 손실.

전략적 이점

이동 평균의 법칙을 이용해서 비교적 신뢰할 수 있습니다.

빠른 이동 평균과 오버박스 조건으로 오버박스의 반발을 결정하는 확률을 높일 수 있다.

Stop Loss 및 Stop Stop 조건을 구성하여 위험을 제어할 수 있습니다.

다양한 위험 선호에 맞는 유연한 포지션 비율을 설정할 수 있다.

전략적 위험

하지만, 이 경우에도 반발이 실패할 확률이 존재합니다.

이동 평균 자체는 지연성이 강하여 지역 반동에 빠질 수 있습니다.

파동이 큰 경우 쉽게 타격될 수 있는 빠른 이동 평균에 가까운 파동지점.

일부 파라미터는 수동으로 구성해야 하며, 다른 파라미터는 결과에 큰 영향을 미칩니다.

이 결과는 주식 선택에 큰 영향을 미칩니다.

전략 최적화 방향

트렌드를 판단하는 지표를 늘리고 역동적인 조작을 피한다.

거래량과 같은 지표 필터링을 추가하여 성공 확률을 높여줍니다.

스톱 피해는 동적 추적을 고려하여 스톱 피해가 확률을 줄일 수 있다.

최적의 변수 조합을 연구하여 변수 의존성을 줄일 수 있다.

주식 선택 조건과 결합하여 주식 선택 효과를 높일 수 있습니다.

요약하다

이 전략의 전체적인 아이디어는 명확하고 이해하기 쉽고, 이동 평균 반전 거래 전략의 전형적인 대표적이다. 장점은 상대적으로 안정적이며, 위험을 제어할 수 있으며, 초보자에게 적합하다. 그러나 또한 일정 확률에 반전점을 올바르게 판단할 수 없는 문제가 있다. 다른 지표, 동적 중지 손실, 매개 변수 최적화 등의 수단과 결합하여 개선할 수 있으며, 전략의 안정성을 향상시킬 수 있다.

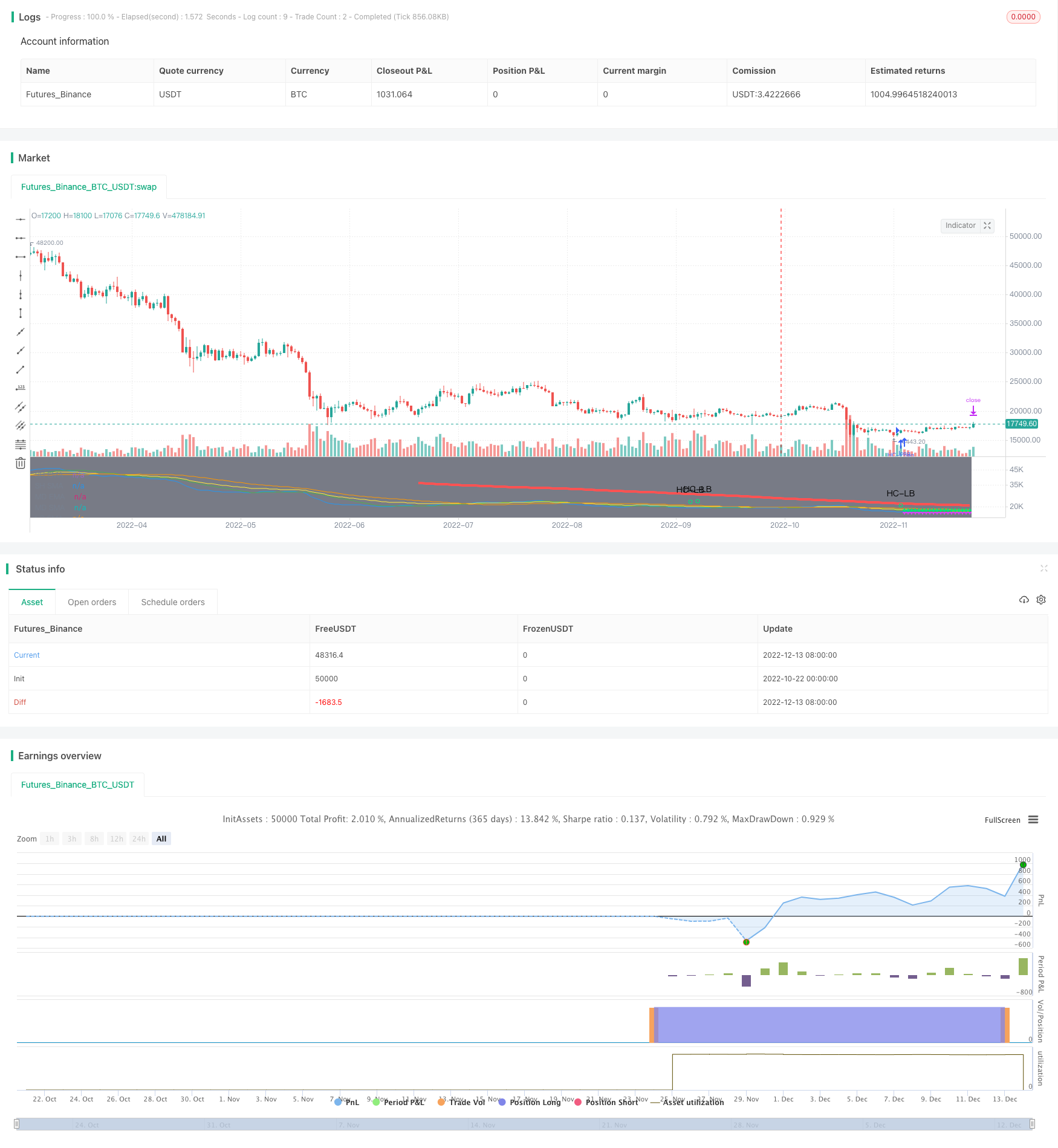

/*backtest

start: 2022-10-22 00:00:00

end: 2022-12-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MakeMoneyCoESTB2020

//*********************Notes for continued work***************

//************************************************************

//I. Intro

//This strategy is designed to allow you to catch the bounce or "SNAP Back" of a equity that has been in a downward trend.

//Once the moving averages are in the order of 200SMA > 50 SMA > 34EMA > 20SMA > 8EMA, the strategy is setup.

//Next you wait for a trigger of the closing price crossing over the 8EMA, while there is a desired gap size between the 8EMA and the 20SMA (2-10% of stock value preferred).

//Exit position based on target profit reached (conservative sell half at 34EMA and engage a trailing stop loss for remainder or set static limit) or price crosses 8EMA or stop loss%

//*)This code also allows you to determine your desired backtesting date compliments of alanaster

//This code is the product of many hours of hard work on the part of the greater tradingview community. The credit goes to everyone in the community who has put code out there for the greater good.

//The idea for the coding came from video I watched on YouTube presented by TradeStation called Snap Back - thank you guys for the inspiration.

//UPDATE: I have coded the other side of the strategy to allow you to take advantage of the same set-up in an uptrend for Short plays. You can turn the up or downsides on, off, or both.

//Happy Hunting!

//II. Table Of Contents

// 1. Define Strategy Variables

// 2. Perform Calculations

// 3. Display Chart Information

// 4. Determine Entry Conditions

// 5. Determine Exit Conditions

// 1. Define Strategy Variables*************************************************************************************************************************************************************************

//Title

// strategy("SNAP BACK 2.0 Strategy", shorttitle="SNAP Back 2.0", default_qty_type=strategy.percent_of_equity, default_qty_value=5, initial_capital=20000,slippage=2, currency=currency.USD, overlay=true)

//Define calculations price source

price = input(title="Price Source", defval=close)

//Define Trade Agression Level

aggro=input(title="Aggressive = 0, Conservative = 1", defval=0, options=[0, 1])

//Define Gap percentage allowed between 8EMA and 20SMA

GAP=input(title="Gap% between 8EMA & 20SMA", defval=2, minval=0, maxval=25, step=1)/100

//Does user want to run the Strategy for Trending Up or Trending Down

RunTrend=input(title="Run Strategy Trending Up, Down, or Both", defval="Up", options=["Up", "Down", "Both"])

//Initialize 8/34EMA 20/50/200/200SMA

SH_EMA_length= input(title="SH EMA Length", defval=8) //short EMA length

MD_EMA_length= input(title="MD EMA Length", defval=34) //medium EMA length

SH_SMA_length= input(title="SH SMA Length", defval=20) //short SMA length

MD_SMA_length= input(title="LG SMA Length", defval=50) //medium SMA length

LG_SMA_length= input(title="SH SMA Length", defval=200) //long SMA length

SH_EMA=ema(price, SH_EMA_length) //short EMA

MD_EMA=ema(price, MD_EMA_length) //medium EMA

SH_SMA=sma(price, SH_SMA_length) //short SMA

MD_SMA=sma(price, MD_SMA_length) //medium SMA

LG_SMA=sma(price, LG_SMA_length) //long SMA

// 2. Perform Calculations*************************************************************************************************************************************************************************

// ************************************ INPUT BACKTEST RANGE ******************************************=== coutesy of alanaster

fromMonth = input(defval = 4, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2020, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

// === INPUT SHOW PLOT ===

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

bgcolor(color = showDate and window() ? color.gray : na, transp = 90)

// 3. Display Chart Information*************************************************************************************************************************************************************************

//plot EMAs

plot(SH_EMA, title = "SH EMA", color = color.blue)

plot(MD_EMA, title = "MD EMA", color = color.yellow)

//plot SMAs

plot(SH_SMA, title = "SH SMA", color = color.green)

plot(MD_SMA, title = "MD SMA", color = color.orange)

plot(LG_SMA, title = "LG SMA", color = color.red, linewidth = 4, transp = 70)

// 4. Determine Entry Conditions*************************************************************************************************************************************************************************

//Determine if SNAP Back (SB) setup is present:

SB_RB_Up= false //SB_RB_Up = Snap Back RainBow for an Uptrend Swing

SB_RB_Up:= iff(LG_SMA>MD_SMA and MD_SMA>MD_EMA and MD_EMA>SH_SMA and SH_SMA>SH_EMA, true, false) //is the 200SMA > 50 SMA > 34EMA > 20SMA > 8EMA

// plotshape(SB_RB, title= "SB_RB", color=color.black, style=shape.cross, text="Rainbow") //for testing only

SB_RB_DWN= false //SB_RB_DWN = Snap Back RainBow for a Downtrend Swing

SB_RB_DWN:= iff(LG_SMA<MD_SMA and MD_SMA<MD_EMA and MD_EMA<SH_SMA and SH_SMA<SH_EMA, true, false) //is the 200SMA < 50 SMA < 34EMA < 20SMA < 8EMA

SB_Gap=false

SB_Gap:= iff(abs(SH_SMA-SH_EMA)>(price*GAP), true, false) //is there a greater than "GAP"% of the price gap between the 8EMA and 20SMA

SB_SetUp_Up=false

SB_SetUp_Up:= iff(SB_RB_Up and SB_Gap, true, false)//Uptrend Setup both conditions must be true

//plotshape(SB_SetUp, title= "SB_SetUp", color=color.white, style=shape.diamond, text="Set Up") //for testing

SB_SetUp_DWN=false

SB_SetUp_DWN:= iff(SB_RB_DWN and SB_Gap, true, false)//Downtrend Setup both conditions must be true

//Determine trigger (TGR) for entry

SB_TGR_Up=false

SB_TGR_Up:= iff(iff(aggro==0, crossover(price, SH_EMA), true) and iff(aggro==1, crossover(price[aggro],SH_EMA) and price>open[aggro], true), true, false) //if the price crosses over the 8EMA that is our entry signal, aggro determines how aggressively we enter the position (wait for a confirmaiton bar or not)

SB_TGR_DWN=false

SB_TGR_DWN:= iff(iff(aggro==0, crossunder(price, SH_EMA), true) and iff(aggro==1, crossunder(price[aggro],SH_EMA) and price<open[aggro], true), true, false) //if the price crosses under the 8EMA that is our entry signal, aggro determines how aggressively we enter the position (wait for a confirmaiton bar or not)

//Determine when to run the strategy based on user input for uptrend or downtrend

RunTrendUp=false //Varibile for running the Strategy in an UpTrend

RunTrendUp:= iff(RunTrend == "Up" or RunTrend == "Both", true, false)

RunTrendDWN=false //Varibile for running the Strategy in a DownTrend

RunTrendDWN:= iff(RunTrend == "Down" or RunTrend == "Both", true, false)

//Determine full buy conditions

MAbuy=false//long entry variable

MAbuy := iff(SB_SetUp_Up and SB_TGR_Up and RunTrendUp, true, false) //when both the setup, the trigger, and RunTrend are true return true

plotshape(MAbuy, title= "HC-LB", color=color.lime, style=shape.circle, text="HC-LB")

strategy.entry("HC-Long", strategy.long, comment="HC-Long", when = MAbuy and window())

MAsell=false//short entry variable

MAsell := iff(SB_SetUp_DWN and SB_TGR_DWN and RunTrendDWN, true, false) //when both the setup, the trigger, and RunTrend are true return true

plotshape(MAsell, title= "HC-SB", color=color.purple, style=shape.circle, text="HC-SB")

strategy.entry("HC-Short", strategy.short, comment="HC-Short", when = MAsell and window())

// 5. Submit Profit and Loss Exit Calculations Orders*************************************************************************************************************************************************************************

//Stop Criteria

StpCri=input(title="Stop Criteria: SL or SH_EMA", defval="SL", options=["SL", "SH_EMA"])

//Profit Criteria

ProCri=input(title="Profit Criteria: TGT% or MD_EMA", defval="TGT%", options=["TGT%", "MD_EMA"])

// User Options to Change Inputs (%)

TrailPerc = input(title="Trail Loss %", type=input.float, minval=0, step=1, defval=6) /100

stopPer = input(4, title='Stop Loss %', type=input.float) / 100

takePer = input(6, title='Take Profit %', type=input.float) / 100

//Percent of SH_EMA to use for StopLoss

SH_EMA_percent = input(96, title="% of SH_EMA for Stop")/100

//Percent of MD_EMA to use for Take Profit

MD_EMA_percent = input(100, title="% of MD_EMA for Profit")/100

//calculate Trail stop price for MD_EMA TGT% condition

longStopPrice=0.0//long side entry stop variable

longStopPrice := if (strategy.position_size > 0)

stopValue = close * (1 - TrailPerc)

max(stopValue, longStopPrice[1])

else

0

shortStopPrice=0.0//short side entry stop variable

shortStopPrice := if (strategy.position_size < 0)

shortStopValue = close * (1 + TrailPerc)

min(shortStopValue, shortStopPrice[1])

else

999999

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

//exit position conditions and orders

if strategy.position_size > 0 //long side exit conditions

if StpCri=="SL" and ProCri=="TGT%"

strategy.exit(id="Close Long", when = window(), stop=longStop, limit=longTake)// sell when either the TGT or the SL is hit

if StpCri=="SL" and ProCri=="MD_EMA"

strategy.exit(id="Close Long (50%)", when = window(), stop=longStop, limit=MD_EMA_percent*MD_EMA, qty_percent=50)// sell 50% when MD_EMA hit or SL then transition to a trailing stop loss

strategy.exit(id="Close Long Trailing Stop", when = window(), stop=longStopPrice, qty_percent=100)

if StpCri=="SH_EMA" and ProCri=="MD_EMA"

strategy.exit(id="Close Long (50%)", when = window(), stop=SH_EMA*SH_EMA_percent, limit=MD_EMA_percent*MD_EMA, qty_percent=50)// sell 50% when MD_EMA hit or SH_EMA hit then transition to a trailing stop loss

strategy.exit(id="Close Long Trailing Stop", when = window(), stop=longStopPrice, qty_percent=100)

if StpCri=="SH_EMA" and ProCri=="TGT%"

strategy.exit(id="Close Long", when = window(), stop=SH_EMA*SH_EMA_percent, limit=longTake)// sell when either the TGT or the SH_EMA is hit

if strategy.position_size < 0 //short side exit conditions

if StpCri=="SL" and ProCri=="TGT%"

strategy.exit(id="Close Short", when = window(), stop=shortStop, limit=shortTake)// sell when either the TGT or the SL is hit

if StpCri=="SL" and ProCri=="MD_EMA"

strategy.exit(id="Close Short (50%)", when = window(), stop=shortStop, limit=(2-MD_EMA_percent)*MD_EMA, qty_percent=50)// sell 50% when MD_EMA hit or SL then transition to a trailing stop loss

strategy.exit(id="Close Short Trailing Stop", when = window(), stop=shortStopPrice, qty_percent=100)

if StpCri=="SH_EMA" and ProCri=="MD_EMA"

strategy.exit(id="Close Short (50%)", when = window(), stop=SH_EMA*(2-SH_EMA_percent), limit=(2-MD_EMA_percent)*MD_EMA, qty_percent=50)// sell 50% when MD_EMA hit or SH_EMA hit then transition to a trailing stop loss

strategy.exit(id="Close Short Trailing Stop", when = window(), stop=shortStopPrice, qty_percent=100)

if StpCri=="SH_EMA" and ProCri=="TGT%"

strategy.exit(id="Close Short", when = window(), stop=SH_EMA*(2-SH_EMA_percent), limit=shortTake)// sell when either the TGT or the SH_EMA is hit

// Plot stop trailing loss values for confirmation

plot(series=(strategy.position_size > 0 and (ProCri == "MD_EMA")) ? longStopPrice : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Long Trail Stop") //plot the trailing stop on the chart for an uptrend

plot(series=(strategy.position_size < 0 and (ProCri == "MD_EMA")) ? shortStopPrice : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the trailing stop on the chart for a downtrend

//plot fixed stop loss value

plot(series=(strategy.position_size > 0 and (StpCri == "SL")) ? longStop : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Long Trail Stop") //plot the stop on the chart for an uptrend

plot(series=(strategy.position_size < 0 and (StpCri == "SL")) ? shortStop : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the stop on the chart for a downtrend

//plot highlight of SH_EMA% used for stop exit condition

plot(series=(strategy.position_size > 0 and (StpCri == "SH_EMA")) ? SH_EMA*SH_EMA_percent : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the SH_EMA based stop on the chart for a uptrend

plot(series=(strategy.position_size < 0 and (StpCri == "SH_EMA")) ? SH_EMA*(2-SH_EMA_percent) : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the SH_EMA based stop on the chart for a downtrend

//plot the TGT profit points

plot(series=(strategy.position_size > 0 and (ProCri == "TGT%")) ? longTake : na, color=color.lime, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the TGT% for long position

plot(series=(strategy.position_size > 0 and (ProCri == "MD_EMA")) ? MD_EMA_percent*MD_EMA : na, color=color.lime, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the MD_EMA % TGT for long position

plot(series=(strategy.position_size < 0 and (ProCri == "TGT%")) ? shortTake : na, color=color.lime, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the TGT% for short position

plot(series=(strategy.position_size < 0 and (ProCri == "MD_EMA")) ? (2-MD_EMA_percent)*MD_EMA : na, color=color.lime, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the MD_EMA % TGT for short position