Strategi Penjejakan Semula Purata Bergerak

Gambaran keseluruhan

Strategi ini menggunakan peraturan rata-rata bergerak untuk mencari peluang rebound selepas penurunan saham dalam jangka pendek. Apabila rata-rata bergerak cepat berada di bawah rata-rata bergerak perlahan, ia menunjukkan bahawa saham berada dalam trend menurun. Apabila harga jatuh di bawah rata-rata bergerak cepat, ruang untuk jatuh lagi adalah terhad.

Prinsip Strategi

Tetapkan purata bergerak pantas EMA (seperti garis 8 hari) dan purata bergerak perlahan SMA (seperti garis 20 hari).

Apabila SMA berada di atas EMA, petunjuk berada dalam trend naik; apabila SMA berada di bawah EMA, petunjuk berada dalam trend menurun.

Apabila harga menembusi EMA tertentu (seperti 2-10%), saham memasuki kawasan yang lebih rendah, dan kemungkinan besar akan bangkit.

Apabila harga kembali melangkaui EMA, ia adalah isyarat untuk membeli.

Garis berhenti terletak berhampiran EMA, garis berhenti terletak berhampiran rata-rata bergerak perlahan tengah SMA (seperti garis 50 hari), atau berhenti pada satu perkadaran.

Apabila harga kembali jatuh di bawah EMA, kerugian akan dihentikan.

Kelebihan Strategik

Kaedah ini digunakan untuk mengukur nilai rata-rata bergerak dan agak dipercayai.

Penggunaan rata-rata bergerak pantas dan keadaan keterlaluan penurunan dapat meningkatkan kebarangkalian untuk menentukan rebound keterlaluan penurunan.

Anda boleh mengkonfigurasi keadaan hentian dan hentian untuk mengawal risiko.

Rasio pegangan yang boleh dilaraskan secara fleksibel, sesuai dengan pilihan risiko yang berbeza.

Risiko Strategik

Walau bagaimanapun, walaupun terdapat kebarangkalian untuk kegagalan rebound, terdapat juga kebarangkalian untuk kegagalan rebound walaupun terdapat kebarangkalian untuk kegagalan rebound.

Rata-rata bergerak itu sendiri mempunyai ketegangan yang kuat dan mudah tertumpah ke dalam rebound tempatan.

Titik kemusnahan adalah berhampiran dengan purata bergerak pantas, dan mudah dilanda apabila turun naik.

Sebahagian parameter memerlukan konfigurasi manual, parameter yang berbeza mempunyai kesan yang lebih besar terhadap hasilnya.

Kesan lebih berkaitan dengan pilihan saham.

Arah pengoptimuman strategi

Meningkatkan indikator penilaian trend dan mengelakkan operasi berlawanan arah.

Menambah penapis untuk penunjuk seperti jumlah transaksi untuk meningkatkan peluang kejayaan.

Titik hentian boleh mempertimbangkan pengesanan dinamik, mengurangkan kemungkinan hentian terjejas.

Kaedah ini boleh digunakan untuk mengkaji kombinasi parameter yang optimum dan mengurangkan ketergantungan parameter.

Ia boleh digabungkan dengan syarat-syarat pilihan saham untuk meningkatkan keberkesanan pilihan saham.

ringkaskan

Strategi ini adalah strategi yang jelas, mudah difahami, dan merupakan salah satu contoh strategi perdagangan berbalik rata-rata bergerak. Kelebihannya adalah bahawa ia agak stabil, boleh mengawal risiko, dan sesuai untuk pemula. Tetapi ada juga kemungkinan bahawa anda tidak dapat menilai titik balik dengan betul.

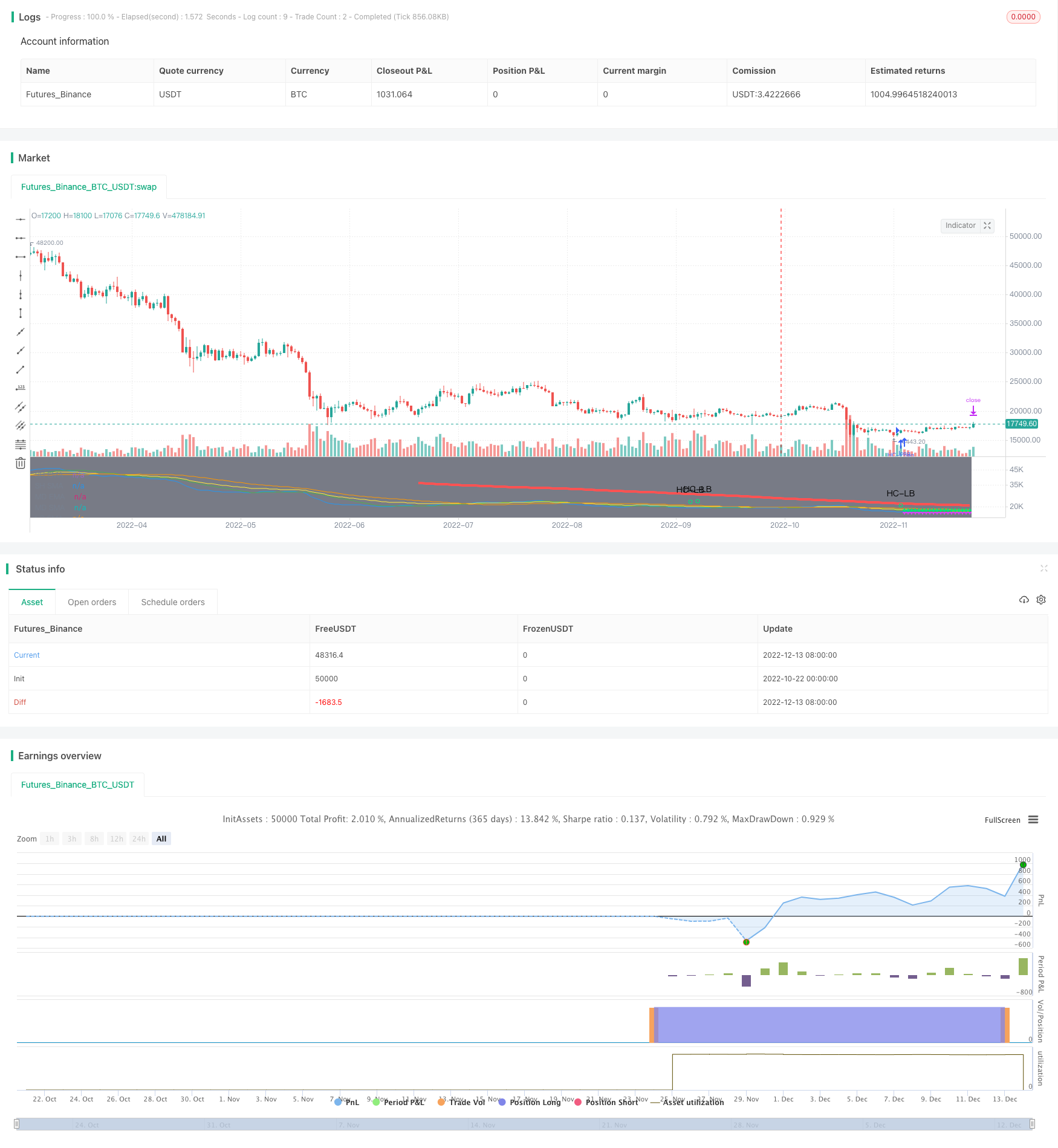

/*backtest

start: 2022-10-22 00:00:00

end: 2022-12-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MakeMoneyCoESTB2020

//*********************Notes for continued work***************

//************************************************************

//I. Intro

//This strategy is designed to allow you to catch the bounce or "SNAP Back" of a equity that has been in a downward trend.

//Once the moving averages are in the order of 200SMA > 50 SMA > 34EMA > 20SMA > 8EMA, the strategy is setup.

//Next you wait for a trigger of the closing price crossing over the 8EMA, while there is a desired gap size between the 8EMA and the 20SMA (2-10% of stock value preferred).

//Exit position based on target profit reached (conservative sell half at 34EMA and engage a trailing stop loss for remainder or set static limit) or price crosses 8EMA or stop loss%

//*)This code also allows you to determine your desired backtesting date compliments of alanaster

//This code is the product of many hours of hard work on the part of the greater tradingview community. The credit goes to everyone in the community who has put code out there for the greater good.

//The idea for the coding came from video I watched on YouTube presented by TradeStation called Snap Back - thank you guys for the inspiration.

//UPDATE: I have coded the other side of the strategy to allow you to take advantage of the same set-up in an uptrend for Short plays. You can turn the up or downsides on, off, or both.

//Happy Hunting!

//II. Table Of Contents

// 1. Define Strategy Variables

// 2. Perform Calculations

// 3. Display Chart Information

// 4. Determine Entry Conditions

// 5. Determine Exit Conditions

// 1. Define Strategy Variables*************************************************************************************************************************************************************************

//Title

// strategy("SNAP BACK 2.0 Strategy", shorttitle="SNAP Back 2.0", default_qty_type=strategy.percent_of_equity, default_qty_value=5, initial_capital=20000,slippage=2, currency=currency.USD, overlay=true)

//Define calculations price source

price = input(title="Price Source", defval=close)

//Define Trade Agression Level

aggro=input(title="Aggressive = 0, Conservative = 1", defval=0, options=[0, 1])

//Define Gap percentage allowed between 8EMA and 20SMA

GAP=input(title="Gap% between 8EMA & 20SMA", defval=2, minval=0, maxval=25, step=1)/100

//Does user want to run the Strategy for Trending Up or Trending Down

RunTrend=input(title="Run Strategy Trending Up, Down, or Both", defval="Up", options=["Up", "Down", "Both"])

//Initialize 8/34EMA 20/50/200/200SMA

SH_EMA_length= input(title="SH EMA Length", defval=8) //short EMA length

MD_EMA_length= input(title="MD EMA Length", defval=34) //medium EMA length

SH_SMA_length= input(title="SH SMA Length", defval=20) //short SMA length

MD_SMA_length= input(title="LG SMA Length", defval=50) //medium SMA length

LG_SMA_length= input(title="SH SMA Length", defval=200) //long SMA length

SH_EMA=ema(price, SH_EMA_length) //short EMA

MD_EMA=ema(price, MD_EMA_length) //medium EMA

SH_SMA=sma(price, SH_SMA_length) //short SMA

MD_SMA=sma(price, MD_SMA_length) //medium SMA

LG_SMA=sma(price, LG_SMA_length) //long SMA

// 2. Perform Calculations*************************************************************************************************************************************************************************

// ************************************ INPUT BACKTEST RANGE ******************************************=== coutesy of alanaster

fromMonth = input(defval = 4, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2020, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

// === INPUT SHOW PLOT ===

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

bgcolor(color = showDate and window() ? color.gray : na, transp = 90)

// 3. Display Chart Information*************************************************************************************************************************************************************************

//plot EMAs

plot(SH_EMA, title = "SH EMA", color = color.blue)

plot(MD_EMA, title = "MD EMA", color = color.yellow)

//plot SMAs

plot(SH_SMA, title = "SH SMA", color = color.green)

plot(MD_SMA, title = "MD SMA", color = color.orange)

plot(LG_SMA, title = "LG SMA", color = color.red, linewidth = 4, transp = 70)

// 4. Determine Entry Conditions*************************************************************************************************************************************************************************

//Determine if SNAP Back (SB) setup is present:

SB_RB_Up= false //SB_RB_Up = Snap Back RainBow for an Uptrend Swing

SB_RB_Up:= iff(LG_SMA>MD_SMA and MD_SMA>MD_EMA and MD_EMA>SH_SMA and SH_SMA>SH_EMA, true, false) //is the 200SMA > 50 SMA > 34EMA > 20SMA > 8EMA

// plotshape(SB_RB, title= "SB_RB", color=color.black, style=shape.cross, text="Rainbow") //for testing only

SB_RB_DWN= false //SB_RB_DWN = Snap Back RainBow for a Downtrend Swing

SB_RB_DWN:= iff(LG_SMA<MD_SMA and MD_SMA<MD_EMA and MD_EMA<SH_SMA and SH_SMA<SH_EMA, true, false) //is the 200SMA < 50 SMA < 34EMA < 20SMA < 8EMA

SB_Gap=false

SB_Gap:= iff(abs(SH_SMA-SH_EMA)>(price*GAP), true, false) //is there a greater than "GAP"% of the price gap between the 8EMA and 20SMA

SB_SetUp_Up=false

SB_SetUp_Up:= iff(SB_RB_Up and SB_Gap, true, false)//Uptrend Setup both conditions must be true

//plotshape(SB_SetUp, title= "SB_SetUp", color=color.white, style=shape.diamond, text="Set Up") //for testing

SB_SetUp_DWN=false

SB_SetUp_DWN:= iff(SB_RB_DWN and SB_Gap, true, false)//Downtrend Setup both conditions must be true

//Determine trigger (TGR) for entry

SB_TGR_Up=false

SB_TGR_Up:= iff(iff(aggro==0, crossover(price, SH_EMA), true) and iff(aggro==1, crossover(price[aggro],SH_EMA) and price>open[aggro], true), true, false) //if the price crosses over the 8EMA that is our entry signal, aggro determines how aggressively we enter the position (wait for a confirmaiton bar or not)

SB_TGR_DWN=false

SB_TGR_DWN:= iff(iff(aggro==0, crossunder(price, SH_EMA), true) and iff(aggro==1, crossunder(price[aggro],SH_EMA) and price<open[aggro], true), true, false) //if the price crosses under the 8EMA that is our entry signal, aggro determines how aggressively we enter the position (wait for a confirmaiton bar or not)

//Determine when to run the strategy based on user input for uptrend or downtrend

RunTrendUp=false //Varibile for running the Strategy in an UpTrend

RunTrendUp:= iff(RunTrend == "Up" or RunTrend == "Both", true, false)

RunTrendDWN=false //Varibile for running the Strategy in a DownTrend

RunTrendDWN:= iff(RunTrend == "Down" or RunTrend == "Both", true, false)

//Determine full buy conditions

MAbuy=false//long entry variable

MAbuy := iff(SB_SetUp_Up and SB_TGR_Up and RunTrendUp, true, false) //when both the setup, the trigger, and RunTrend are true return true

plotshape(MAbuy, title= "HC-LB", color=color.lime, style=shape.circle, text="HC-LB")

strategy.entry("HC-Long", strategy.long, comment="HC-Long", when = MAbuy and window())

MAsell=false//short entry variable

MAsell := iff(SB_SetUp_DWN and SB_TGR_DWN and RunTrendDWN, true, false) //when both the setup, the trigger, and RunTrend are true return true

plotshape(MAsell, title= "HC-SB", color=color.purple, style=shape.circle, text="HC-SB")

strategy.entry("HC-Short", strategy.short, comment="HC-Short", when = MAsell and window())

// 5. Submit Profit and Loss Exit Calculations Orders*************************************************************************************************************************************************************************

//Stop Criteria

StpCri=input(title="Stop Criteria: SL or SH_EMA", defval="SL", options=["SL", "SH_EMA"])

//Profit Criteria

ProCri=input(title="Profit Criteria: TGT% or MD_EMA", defval="TGT%", options=["TGT%", "MD_EMA"])

// User Options to Change Inputs (%)

TrailPerc = input(title="Trail Loss %", type=input.float, minval=0, step=1, defval=6) /100

stopPer = input(4, title='Stop Loss %', type=input.float) / 100

takePer = input(6, title='Take Profit %', type=input.float) / 100

//Percent of SH_EMA to use for StopLoss

SH_EMA_percent = input(96, title="% of SH_EMA for Stop")/100

//Percent of MD_EMA to use for Take Profit

MD_EMA_percent = input(100, title="% of MD_EMA for Profit")/100

//calculate Trail stop price for MD_EMA TGT% condition

longStopPrice=0.0//long side entry stop variable

longStopPrice := if (strategy.position_size > 0)

stopValue = close * (1 - TrailPerc)

max(stopValue, longStopPrice[1])

else

0

shortStopPrice=0.0//short side entry stop variable

shortStopPrice := if (strategy.position_size < 0)

shortStopValue = close * (1 + TrailPerc)

min(shortStopValue, shortStopPrice[1])

else

999999

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

//exit position conditions and orders

if strategy.position_size > 0 //long side exit conditions

if StpCri=="SL" and ProCri=="TGT%"

strategy.exit(id="Close Long", when = window(), stop=longStop, limit=longTake)// sell when either the TGT or the SL is hit

if StpCri=="SL" and ProCri=="MD_EMA"

strategy.exit(id="Close Long (50%)", when = window(), stop=longStop, limit=MD_EMA_percent*MD_EMA, qty_percent=50)// sell 50% when MD_EMA hit or SL then transition to a trailing stop loss

strategy.exit(id="Close Long Trailing Stop", when = window(), stop=longStopPrice, qty_percent=100)

if StpCri=="SH_EMA" and ProCri=="MD_EMA"

strategy.exit(id="Close Long (50%)", when = window(), stop=SH_EMA*SH_EMA_percent, limit=MD_EMA_percent*MD_EMA, qty_percent=50)// sell 50% when MD_EMA hit or SH_EMA hit then transition to a trailing stop loss

strategy.exit(id="Close Long Trailing Stop", when = window(), stop=longStopPrice, qty_percent=100)

if StpCri=="SH_EMA" and ProCri=="TGT%"

strategy.exit(id="Close Long", when = window(), stop=SH_EMA*SH_EMA_percent, limit=longTake)// sell when either the TGT or the SH_EMA is hit

if strategy.position_size < 0 //short side exit conditions

if StpCri=="SL" and ProCri=="TGT%"

strategy.exit(id="Close Short", when = window(), stop=shortStop, limit=shortTake)// sell when either the TGT or the SL is hit

if StpCri=="SL" and ProCri=="MD_EMA"

strategy.exit(id="Close Short (50%)", when = window(), stop=shortStop, limit=(2-MD_EMA_percent)*MD_EMA, qty_percent=50)// sell 50% when MD_EMA hit or SL then transition to a trailing stop loss

strategy.exit(id="Close Short Trailing Stop", when = window(), stop=shortStopPrice, qty_percent=100)

if StpCri=="SH_EMA" and ProCri=="MD_EMA"

strategy.exit(id="Close Short (50%)", when = window(), stop=SH_EMA*(2-SH_EMA_percent), limit=(2-MD_EMA_percent)*MD_EMA, qty_percent=50)// sell 50% when MD_EMA hit or SH_EMA hit then transition to a trailing stop loss

strategy.exit(id="Close Short Trailing Stop", when = window(), stop=shortStopPrice, qty_percent=100)

if StpCri=="SH_EMA" and ProCri=="TGT%"

strategy.exit(id="Close Short", when = window(), stop=SH_EMA*(2-SH_EMA_percent), limit=shortTake)// sell when either the TGT or the SH_EMA is hit

// Plot stop trailing loss values for confirmation

plot(series=(strategy.position_size > 0 and (ProCri == "MD_EMA")) ? longStopPrice : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Long Trail Stop") //plot the trailing stop on the chart for an uptrend

plot(series=(strategy.position_size < 0 and (ProCri == "MD_EMA")) ? shortStopPrice : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the trailing stop on the chart for a downtrend

//plot fixed stop loss value

plot(series=(strategy.position_size > 0 and (StpCri == "SL")) ? longStop : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Long Trail Stop") //plot the stop on the chart for an uptrend

plot(series=(strategy.position_size < 0 and (StpCri == "SL")) ? shortStop : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the stop on the chart for a downtrend

//plot highlight of SH_EMA% used for stop exit condition

plot(series=(strategy.position_size > 0 and (StpCri == "SH_EMA")) ? SH_EMA*SH_EMA_percent : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the SH_EMA based stop on the chart for a uptrend

plot(series=(strategy.position_size < 0 and (StpCri == "SH_EMA")) ? SH_EMA*(2-SH_EMA_percent) : na, color=color.fuchsia, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the SH_EMA based stop on the chart for a downtrend

//plot the TGT profit points

plot(series=(strategy.position_size > 0 and (ProCri == "TGT%")) ? longTake : na, color=color.lime, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the TGT% for long position

plot(series=(strategy.position_size > 0 and (ProCri == "MD_EMA")) ? MD_EMA_percent*MD_EMA : na, color=color.lime, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the MD_EMA % TGT for long position

plot(series=(strategy.position_size < 0 and (ProCri == "TGT%")) ? shortTake : na, color=color.lime, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the TGT% for short position

plot(series=(strategy.position_size < 0 and (ProCri == "MD_EMA")) ? (2-MD_EMA_percent)*MD_EMA : na, color=color.lime, style=plot.style_cross, linewidth=2, title="Short Trail Stop") //plot the MD_EMA % TGT for short position