Strategi Dagangan Algoritma Penjejakan Dwi Talian

Gambaran keseluruhan

Strategi ini menggunakan prinsip persimpangan rata-rata, menggabungkan isyarat pembalikan RSI, dan algoritma penjejakan dua baris yang disesuaikan untuk melakukan perdagangan persimpangan rata-rata. Strategi ini menjejaki persimpangan rata-rata dua kitaran yang berbeza, satu persimpangan rata-rata yang cepat mengikuti trend jangka pendek, dan satu lagi persimpangan rata-rata yang perlahan mengikuti trend jangka panjang. Apabila persimpangan rata-rata cepat melintasi atas persimpangan rata-rata perlahan, ia menunjukkan trend jangka pendek ke atas, dan boleh dibeli; apabila persimpangan rata-rata cepat melintasi bawah persimpangan rata-rata perlahan, ia menunjukkan berakhirnya trend jangka pendek, dan ia harus ditutup.

Prinsip Strategi

Mengira purata VWAP untuk dua set parameter yang berbeza yang mewakili trend jangka panjang dan trend jangka pendek

- Trend jangka panjang dalam pengiraan garis teras dan garis asas

- Trend jangka pendek dalam pengiraan garis teras cepat dan garis rujukan

Mengambil purata dua set garisan langit-langit dan garis asas sebagai rata-rata perlahan dan rata-rata cepat

Kaedah pengiraan Brinstrand untuk menilai penyesuaian dan penembusan

- Garis tengah adalah purata garis purata pantas dan perlahan

- Brin naik dan turun untuk menilai penembusan

Kaedah untuk mengira TSV

- TSV lebih besar daripada 0 menunjukkan kekuatan kenaikan lebih besar daripada kekuatan penurunan

- TSV lebih besar daripada EMA

Mengira RSI untuk menilai overbought dan oversold

- RSI di bawah 30 adalah selisih terlampau dan anda boleh membeli

- RSI di atas 70 adalah kawasan overbought dan patut dijual

Syarat penyertaan:

- Permukaan laju rata-rata pada laju rata-rata perlahan

- Harga penutupan untuk kereta api Brin

- TSV lebih besar daripada 0 dan lebih besar daripada EMA

- RSI kurang daripada 30

Syarat kejohanan:

- Garis purata pantas di bawah garis purata perlahan

- RSI melebihi 70

Analisis kelebihan

Menggunakan sistem dua hala, ia boleh menangkap trend jangka pendek dan panjang pada masa yang sama.

Indeks RSI mengelakkan membeli di kawasan yang lebih banyak dan menjual di kawasan yang lebih banyak

Indeks TSV memastikan terdapat jumlah transaksi yang mencukupi untuk menyokong trend

Pencapaian Utama di Burin

Kombinasi pelbagai penunjuk yang berkesan untuk menyaring penembusan palsu

Analisis risiko

Sistem linear mudah menghasilkan isyarat yang salah dan memerlukan penapisan penunjuk tambahan

Parameter RSI perlu dioptimumkan, jika tidak, ia mungkin terlepas titik jual beli

Indeks TSV juga sensitif terhadap parameter dan perlu diuji dengan teliti

Penembusan Brin di atas landasan mungkin palsu, perlu diperiksa

Kombinasi pelbagai parameter, parameter yang sukar untuk dioptimumkan, mudah untuk dioptimumkan berlebihan

Data latihan dan ujian yang tidak mencukupi boleh menyebabkan kecocokan kurva

Arah pengoptimuman

Uji lebih banyak parameter kitaran untuk mencari kombinasi parameter terbaik

Cuba indikator lain seperti MACD, alternatif KD atau gabungan RSI

Pengoptimuman parameter menggunakan analisis berjalan ke hadapan

Tambah strategi henti kerugian untuk mengawal kerugian tunggal

Pertimbangan untuk menggunakan model pembelajaran mesin untuk membantu penilaian isyarat

Jangan terlalu bergantung pada kombinasi parameter tunggal untuk menyesuaikan parameter untuk pasaran yang berbeza

ringkaskan

Strategi ini menangkap trend jangka pendek melalui sistem dua garis sejajar, dan menggunakan pelbagai petunjuk penapis isyarat, seperti RSI, TSV, dan Brin. Kelebihan strategi ini adalah bahawa ia boleh beransur-ansur, menangkap gelombang kenaikan jangka panjang. Tetapi ada juga risiko isyarat palsu, perlu mengoptimumkan parameter lebih lanjut dan mengawal stop loss untuk mengurangkan risiko.

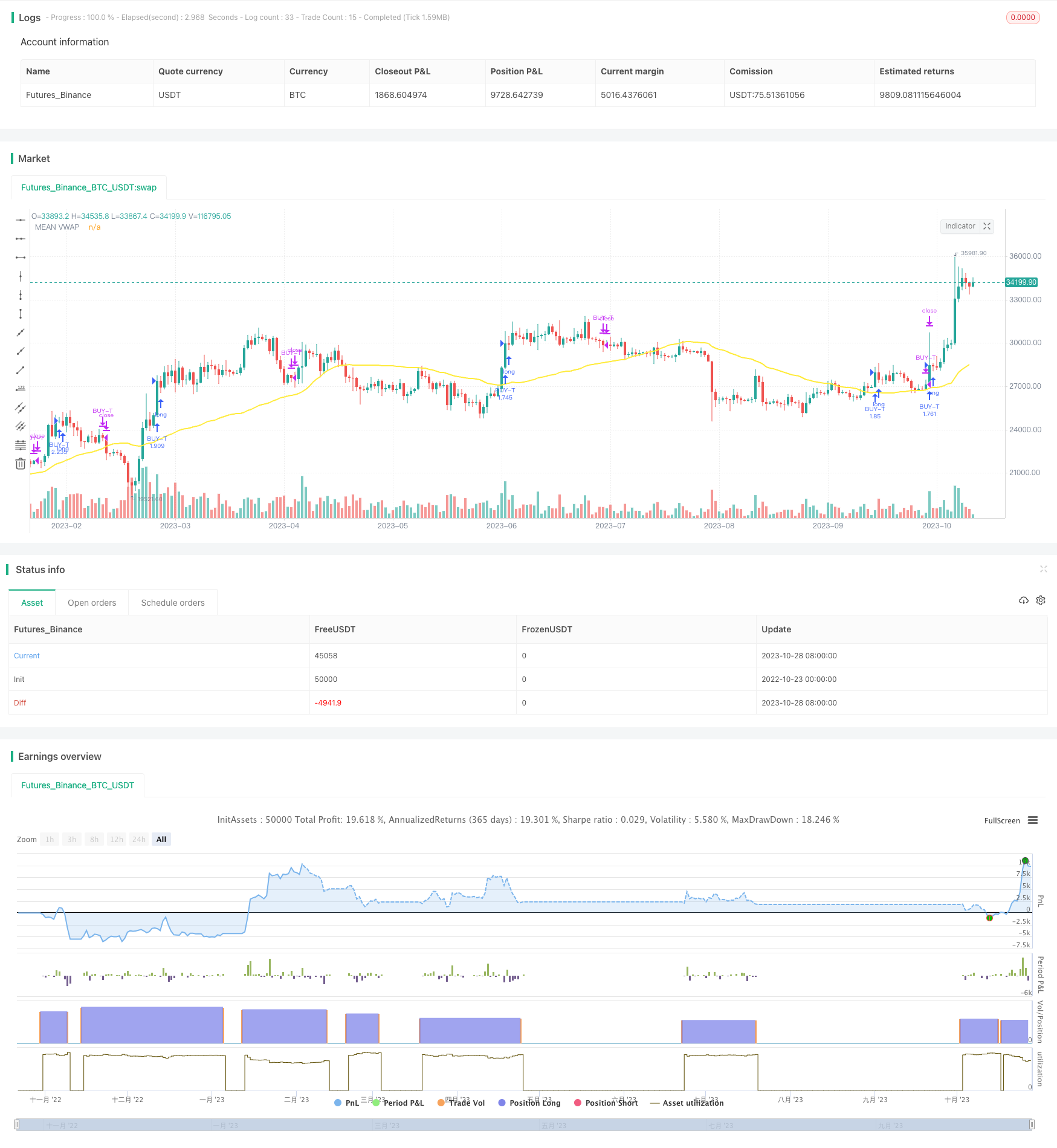

/*backtest

start: 2022-10-23 00:00:00

end: 2023-10-29 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// Credits

// "Vwap with period" code which used in this strategy to calculate the leadLine was written by "neolao" active on https://tr.tradingview.com/u/neolao/

// "TSV" code which used in this strategy was written by "liw0" active on https://www.tradingview.com/u/liw0. The code is corrected by "vitelot" December 2018.

// "Vidya" code which used in this strategy was written by "everget" active on https://tr.tradingview.com/u/everget/

strategy("HYE Combo Market [Strategy] (Vwap Mean Reversion + Trend Hunter)", overlay = true, initial_capital = 1000, default_qty_value = 100, default_qty_type = strategy.percent_of_equity, commission_value = 0.025)

//Strategy inputs

source = input(title = "Source", defval = close, group = "Mean Reversion Strategy Inputs")

smallcumulativePeriod = input(title = "Small VWAP", defval = 8, group = "Mean Reversion Strategy Inputs")

bigcumulativePeriod = input(title = "Big VWAP", defval = 10, group = "Mean Reversion Strategy Inputs")

meancumulativePeriod = input(title = "Mean VWAP", defval = 50, group = "Mean Reversion Strategy Inputs")

percentBelowToBuy = input(title = "Percent below to buy %", defval = 2, group = "Mean Reversion Strategy Inputs")

rsiPeriod = input(title = "Rsi Period", defval = 2, group = "Mean Reversion Strategy Inputs")

rsiEmaPeriod = input(title = "Rsi Ema Period", defval = 5, group = "Mean Reversion Strategy Inputs")

rsiLevelforBuy = input(title = "Maximum Rsi Level for Buy", defval = 30, group = "Mean Reversion Strategy Inputs")

slowtenkansenPeriod = input(9, minval=1, title="Slow Tenkan Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

slowkijunsenPeriod = input(13, minval=1, title="Slow Kijun Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

fasttenkansenPeriod = input(3, minval=1, title="Fast Tenkan Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

fastkijunsenPeriod = input(7, minval=1, title="Fast Kijun Sen VWAP Line Length", group = "Trend Hunter Strategy Inputs")

BBlength = input(20, minval=1, title= "Bollinger Band Length", group = "Trend Hunter Strategy Inputs")

BBmult = input(2.0, minval=0.001, maxval=50, title="Bollinger Band StdDev", group = "Trend Hunter Strategy Inputs")

tsvlength = input(20, minval=1, title="TSV Length", group = "Trend Hunter Strategy Inputs")

tsvemaperiod = input(7, minval=1, title="TSV Ema Length", group = "Trend Hunter Strategy Inputs")

length = input(title="Vidya Length", type=input.integer, defval=20, group = "Trend Hunter Strategy Inputs")

src = input(title="Vidya Source", type=input.source, defval= hl2 , group = "Trend Hunter Strategy Inputs")

// Vidya Calculation

getCMO(src, length) =>

mom = change(src)

upSum = sum(max(mom, 0), length)

downSum = sum(-min(mom, 0), length)

out = (upSum - downSum) / (upSum + downSum)

out

cmo = abs(getCMO(src, length))

alpha = 2 / (length + 1)

vidya = 0.0

vidya := src * alpha * cmo + nz(vidya[1]) * (1 - alpha * cmo)

// Make input options that configure backtest date range

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31, group = "Strategy Date Range")

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12, group = "Strategy Date Range")

startYear = input(title="Start Year", type=input.integer,

defval=2000, minval=1800, maxval=2100, group = "Strategy Date Range")

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31, group = "Strategy Date Range")

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12, group = "Strategy Date Range")

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100, group = "Strategy Date Range")

inDateRange = true

// Mean Reversion Strategy Calculation

typicalPriceS = (high + low + close) / 3

typicalPriceVolumeS = typicalPriceS * volume

cumulativeTypicalPriceVolumeS = sum(typicalPriceVolumeS, smallcumulativePeriod)

cumulativeVolumeS = sum(volume, smallcumulativePeriod)

smallvwapValue = cumulativeTypicalPriceVolumeS / cumulativeVolumeS

typicalPriceB = (high + low + close) / 3

typicalPriceVolumeB = typicalPriceB * volume

cumulativeTypicalPriceVolumeB = sum(typicalPriceVolumeB, bigcumulativePeriod)

cumulativeVolumeB = sum(volume, bigcumulativePeriod)

bigvwapValue = cumulativeTypicalPriceVolumeB / cumulativeVolumeB

typicalPriceM = (high + low + close) / 3

typicalPriceVolumeM = typicalPriceM * volume

cumulativeTypicalPriceVolumeM = sum(typicalPriceVolumeM, meancumulativePeriod)

cumulativeVolumeM = sum(volume, meancumulativePeriod)

meanvwapValue = cumulativeTypicalPriceVolumeM / cumulativeVolumeM

rsiValue = rsi(source, rsiPeriod)

rsiEMA = ema(rsiValue, rsiEmaPeriod)

buyMA = ((100 - percentBelowToBuy) / 100) * bigvwapValue[0]

inTrade = strategy.position_size > 0

notInTrade = strategy.position_size <= 0

if(crossunder(smallvwapValue, buyMA) and rsiEMA < rsiLevelforBuy and close < meanvwapValue and inDateRange and notInTrade)

strategy.entry("BUY-M", strategy.long)

if(close > meanvwapValue or not inDateRange)

strategy.close("BUY-M")

// Trend Hunter Strategy Calculation

// Slow Tenkan Sen Calculation

typicalPriceTS = (high + low + close) / 3

typicalPriceVolumeTS = typicalPriceTS * volume

cumulativeTypicalPriceVolumeTS = sum(typicalPriceVolumeTS, slowtenkansenPeriod)

cumulativeVolumeTS = sum(volume, slowtenkansenPeriod)

slowtenkansenvwapValue = cumulativeTypicalPriceVolumeTS / cumulativeVolumeTS

// Slow Kijun Sen Calculation

typicalPriceKS = (high + low + close) / 3

typicalPriceVolumeKS = typicalPriceKS * volume

cumulativeTypicalPriceVolumeKS = sum(typicalPriceVolumeKS, slowkijunsenPeriod)

cumulativeVolumeKS = sum(volume, slowkijunsenPeriod)

slowkijunsenvwapValue = cumulativeTypicalPriceVolumeKS / cumulativeVolumeKS

// Fast Tenkan Sen Calculation

typicalPriceTF = (high + low + close) / 3

typicalPriceVolumeTF = typicalPriceTF * volume

cumulativeTypicalPriceVolumeTF = sum(typicalPriceVolumeTF, fasttenkansenPeriod)

cumulativeVolumeTF = sum(volume, fasttenkansenPeriod)

fasttenkansenvwapValue = cumulativeTypicalPriceVolumeTF / cumulativeVolumeTF

// Fast Kijun Sen Calculation

typicalPriceKF = (high + low + close) / 3

typicalPriceVolumeKF = typicalPriceKS * volume

cumulativeTypicalPriceVolumeKF = sum(typicalPriceVolumeKF, fastkijunsenPeriod)

cumulativeVolumeKF = sum(volume, fastkijunsenPeriod)

fastkijunsenvwapValue = cumulativeTypicalPriceVolumeKF / cumulativeVolumeKF

// Slow LeadLine Calculation

lowesttenkansen_s = lowest(slowtenkansenvwapValue, slowtenkansenPeriod)

highesttenkansen_s = highest(slowtenkansenvwapValue, slowtenkansenPeriod)

lowestkijunsen_s = lowest(slowkijunsenvwapValue, slowkijunsenPeriod)

highestkijunsen_s = highest(slowkijunsenvwapValue, slowkijunsenPeriod)

slowtenkansen = avg(lowesttenkansen_s, highesttenkansen_s)

slowkijunsen = avg(lowestkijunsen_s, highestkijunsen_s)

slowleadLine = avg(slowtenkansen, slowkijunsen)

// Fast LeadLine Calculation

lowesttenkansen_f = lowest(fasttenkansenvwapValue, fasttenkansenPeriod)

highesttenkansen_f = highest(fasttenkansenvwapValue, fasttenkansenPeriod)

lowestkijunsen_f = lowest(fastkijunsenvwapValue, fastkijunsenPeriod)

highestkijunsen_f = highest(fastkijunsenvwapValue, fastkijunsenPeriod)

fasttenkansen = avg(lowesttenkansen_f, highesttenkansen_f)

fastkijunsen = avg(lowestkijunsen_f, highestkijunsen_f)

fastleadLine = avg(fasttenkansen, fastkijunsen)

// BBleadLine Calculation

BBleadLine = avg(fastleadLine, slowleadLine)

// Bollinger Band Calculation

basis = sma(BBleadLine, BBlength)

dev = BBmult * stdev(BBleadLine, BBlength)

upper = basis + dev

lower = basis - dev

// TSV Calculation

tsv = sum(close>close[1]?volume*(close-close[1]):close<close[1]?volume*(close-close[1]):0,tsvlength)

tsvema = ema(tsv, tsvemaperiod)

// Rules for Entry & Exit

if(fastleadLine > fastleadLine[1] and slowleadLine > slowleadLine[1] and tsv > 0 and tsv > tsvema and close > upper and close > vidya and inDateRange and notInTrade)

strategy.entry("BUY-T", strategy.long)

if((fastleadLine < fastleadLine[1] and slowleadLine < slowleadLine[1]) or not inDateRange)

strategy.close("BUY-T")

// Plots

plot(meanvwapValue, title="MEAN VWAP", linewidth=2, color=color.yellow)

//plot(vidya, title="VIDYA", linewidth=2, color=color.green)

//colorsettingS = input(title="Solid Color Slow Leadline", defval=false, type=input.bool)

//plot(slowleadLine, title = "Slow LeadLine", color = colorsettingS ? color.aqua : slowleadLine > slowleadLine[1] ? color.green : color.red, linewidth=3)

//colorsettingF = input(title="Solid Color Fast Leadline", defval=false, type=input.bool)

//plot(fastleadLine, title = "Fast LeadLine", color = colorsettingF ? color.orange : fastleadLine > fastleadLine[1] ? color.green : color.red, linewidth=3)

//p1 = plot(upper, "Upper BB", color=#2962FF)

//p2 = plot(lower, "Lower BB", color=#2962FF)

//fill(p1, p2, title = "Background", color=color.blue)

//plot(smallvwapValue, color=#13C425, linewidth=2)

//plot(bigvwapValue, color=#CA1435, linewidth=2)