Purata Pergerakan dan Strategi Indeks Kekuatan Relatif

Gambaran keseluruhan

Strategi Indeks Jangkaus Rata-rata Bergerak (Moving Average Relative Strength Index Strategy) adalah strategi perdagangan kuantitatif yang menggunakan purata bergerak dan indeks kekuatan relatif sebagai isyarat perdagangan. Strategi ini menghasilkan isyarat perdagangan dengan membandingkan nilai purata bergerak harga dan indeks kekuatan relatif untuk menangkap peluang dalam trend pasaran.

Prinsip Strategi

Strategi ini berdasarkan kepada dua indikator:

- Purata bergerak sederhana ((SMA): mencerminkan trend purata harga.

- RSI (Relative Strength Index): Mencerminkan kelemahan harga.

Strategi ini berbunyi:

Apabila garisan penunjuk RSI di bawah purata bergerak adalah kawasan jual beli, ia dianggap sebagai saham yang diremehkan, menghasilkan isyarat beli; apabila garisan penunjuk RSI di atas purata bergerak adalah kawasan jual beli, ia dianggap sebagai saham yang diremehkan, menghasilkan isyarat jual beli.

Iaitu, purata bergerak mencerminkan nilai saksama saham hingga tahap tertentu, dan RSI mewakili keadaan kuat dan lemah saham sekarang. RSI lebih tinggi atau lebih rendah daripada purata bergerak bermaksud peluang untuk berbalik.

Secara khusus, strategi ini menghasilkan isyarat perdagangan melalui langkah-langkah berikut:

- Mengira nilai RSI saham, dan purata bergerak mudah

- Perbandingan RSI dengan purata bergerak

- Apabila RSI melintasi purata bergerak, ia menghasilkan isyarat jual

- Apabila RSI melintasi purata bergerak di bawah, ia menghasilkan isyarat beli.

- Tetapkan titik hentian dan bergerak hentian untuk mengawal risiko

Kelebihan Strategik

Strategi ini menggabungkan penilaian trend pada purata bergerak dan penilaian overbought dan oversold pada RSI, dan menggunakan kelebihan indikator yang berbeza untuk menilai titik perubahan pasaran.

Kelebihan utama:

- Rata-rata Bergerak Berkesan Untuk Menunjukkan Trend Harga

- Indeks RSI boleh mencerminkan kegemilangan

- Gabungan Dua Indikator Untuk Menentukan Titik Peralihan Pasar Dengan Lebih Tepat

- Anda boleh menetapkan titik berhenti untuk mengawal risiko

Risiko Strategik

Strategi ini mempunyai beberapa risiko:

- Kebarangkalian untuk menghasilkan isyarat yang salah yang boleh menyebabkan kerugian yang tidak perlu

- Apabila keadaan bergolak, penangguhan boleh ditembusi dan menyebabkan kerugian yang lebih besar.

- Penetapan parameter yang tidak betul juga boleh menjejaskan prestasi polisi

Untuk mengawal risiko, anda boleh mengoptimumkannya dengan:

- Menyesuaikan parameter purata bergerak dan RSI untuk menjadikan isyarat penunjuk lebih dipercayai

- Melepaskan titik hentian yang sesuai untuk mengelakkan hentian yang terlalu kerap dicetuskan

- Penghentian yang lebih fleksibel menggunakan penghentian bergerak seperti DYNAMIC

Arah pengoptimuman strategi

Strategi ini boleh dioptimumkan dengan cara berikut:

- Uji kombinasi parameter dari pelbagai kitaran untuk mencari parameter terbaik

- Menambah penapisan untuk penunjuk lain, seperti penunjuk kuantiti, untuk meningkatkan kebolehpercayaan isyarat

- Mengoptimumkan strategi penangguhan kerugian untuk menjadikannya lebih dinamik dan munasabah

- Menubuhkan mekanisme pengoptimuman parameter adaptasi dengan menggabungkan teknologi seperti pembelajaran mendalam

- Tambah modul pengurusan kedudukan untuk menyesuaikan kedudukan secara dinamik mengikut keadaan pasaran

Strategi ini boleh terus meningkatkan kestabilan dan keuntungan melalui optimasi parameter, optimasi penunjuk, dan pengendalian risiko.

ringkaskan

Strategi purata bergerak dan indikator yang agak kuat menggunakan penilaian trend harga dan penilaian overbought dan oversold, dapat menentukan titik perubahan pasaran dengan berkesan dan menangkap peluang untuk berbalik. Strategi ini mudah digunakan, boleh dikawal risiko, dan merupakan strategi perdagangan kuantitatif yang praktikal. Dengan pengoptimuman berterusan, anda boleh mendapatkan kesan yang lebih baik.

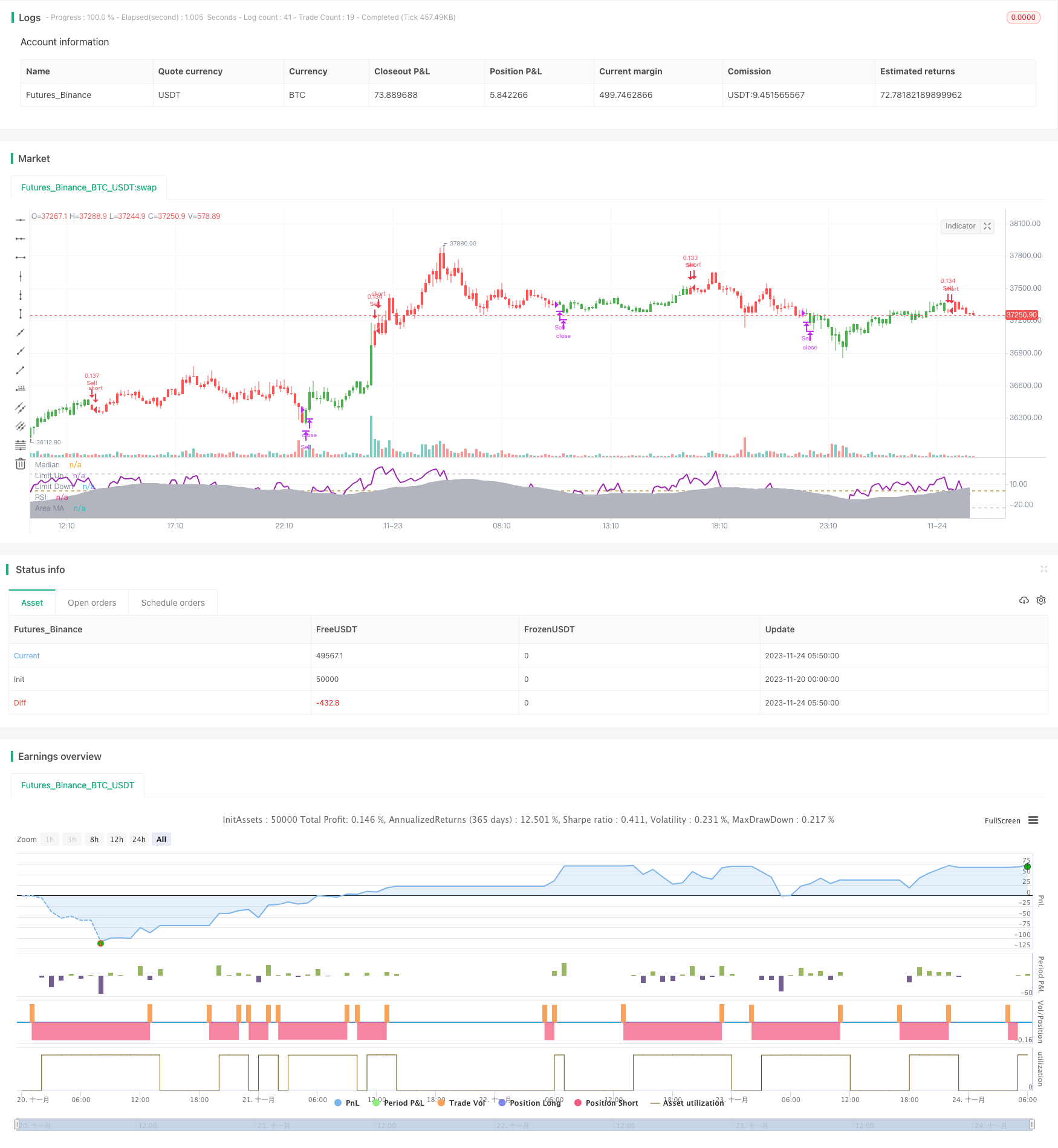

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-24 06:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "RSI versus SMA", shorttitle = "RSI vs SMA", overlay = false, pyramiding = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, currency = currency.GBP)

// Revision: 1

// Author: @JayRogers

//

// *** USE AT YOUR OWN RISK ***

// - Nothing is perfect, and all decisions by you are on your own head. And stuff.

//

// Description:

// - It's RSI versus a Simple Moving Average.. Not sure it really needs much more description.

// - Should not repaint - Automatically offsets by 1 bar if anything other than "open" selected as RSI source.

// === INPUTS ===

// rsi

rsiSource = input(defval = open, title = "RSI Source")

rsiLength = input(defval = 8, title = "RSI Length", minval = 1)

// sma

maLength = input(defval = 34, title = "MA Period", minval = 1)

// invert trade direction

tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// risk management

useStop = input(defval = false, title = "Use Initial Stop Loss?")

slPoints = input(defval = 25, title = "Initial Stop Loss Points", minval = 1)

useTS = input(defval = true, title = "Use Trailing Stop?")

tslPoints = input(defval = 120, title = "Trail Points", minval = 1)

useTSO = input(defval = false, title = "Use Offset For Trailing Stop?")

tslOffset = input(defval = 20, title = "Trail Offset Points", minval = 1)

// === /INPUTS ===

// === BASE FUNCTIONS ===

// delay for direction change actions

switchDelay(exp, len) =>

average = len >= 2 ? sum(exp, len) / len : exp[1]

up = exp > average

down = exp < average

state = up ? true : down ? false : up[1]

// === /BASE FUNCTIONS ===

// === SERIES and VAR ===

// rsi

shunt = rsiSource == open ? 0 : 1

rsiUp = rma(max(change(rsiSource[shunt]), 0), rsiLength)

rsiDown = rma(-min(change(rsiSource[shunt]), 0), rsiLength)

rsi = (rsiDown == 0 ? 100 : rsiUp == 0 ? 0 : 100 - (100 / (1 + rsiUp / rsiDown))) - 50 // shifted 50 points to make 0 median

// sma of rsi

rsiMa = sma(rsi, maLength)

// self explanatory..

tradeDirection = tradeInvert ? 0 <= rsiMa ? true : false : 0 >= rsiMa ? true : false

// === /SERIES ===

// === PLOTTING ===

barcolor(color = tradeDirection ? green : red, title = "Bar Colours")

// hlines

medianLine = hline(0, title = 'Median', color = #996600, linewidth = 1)

limitUp = hline(25, title = 'Limit Up', color = silver, linewidth = 1)

limitDown = hline(-25, title = 'Limit Down', color = silver, linewidth = 1)

// rsi and ma

rsiLine = plot(rsi, title = 'RSI', color = purple, linewidth = 2, style = line, transp = 50)

areaLine = plot(rsiMa, title = 'Area MA', color = silver, linewidth = 1, style = area, transp = 70)

// === /PLOTTING ===

goLong() => not tradeDirection[1] and tradeDirection

killLong() => tradeDirection[1] and not tradeDirection

strategy.entry(id = "Buy", long = true, when = goLong())

strategy.close(id = "Buy", when = killLong())

goShort() => tradeDirection[1] and not tradeDirection

killShort() => not tradeDirection[1] and tradeDirection

strategy.entry(id = "Sell", long = false, when = goShort())

strategy.close(id = "Sell", when = killShort())

if (useStop)

strategy.exit("XSL", from_entry = "Buy", loss = slPoints)

strategy.exit("XSS", from_entry = "Sell", loss = slPoints)

// if we're using the trailing stop

if (useTS and useTSO) // with offset

strategy.exit("XSL", from_entry = "Buy", trail_points = tslPoints, trail_offset = tslOffset)

strategy.exit("XSS", from_entry = "Sell", trail_points = tslPoints, trail_offset = tslOffset)

if (useTS and not useTSO) // without offset

strategy.exit("XSL", from_entry = "Buy", trail_points = tslPoints)

strategy.exit("XSS", from_entry = "Sell", trail_points = tslPoints)