Strategi Perdagangan Kuantitatif Purata Berganda Bergerak

Tarikh penciptaan:

2024-02-01 15:13:13

Akhirnya diubah suai:

2024-02-01 15:13:13

Salin:

1

Bilangan klik:

690

1

fokus pada

1664

Pengikut

Gambaran keseluruhan

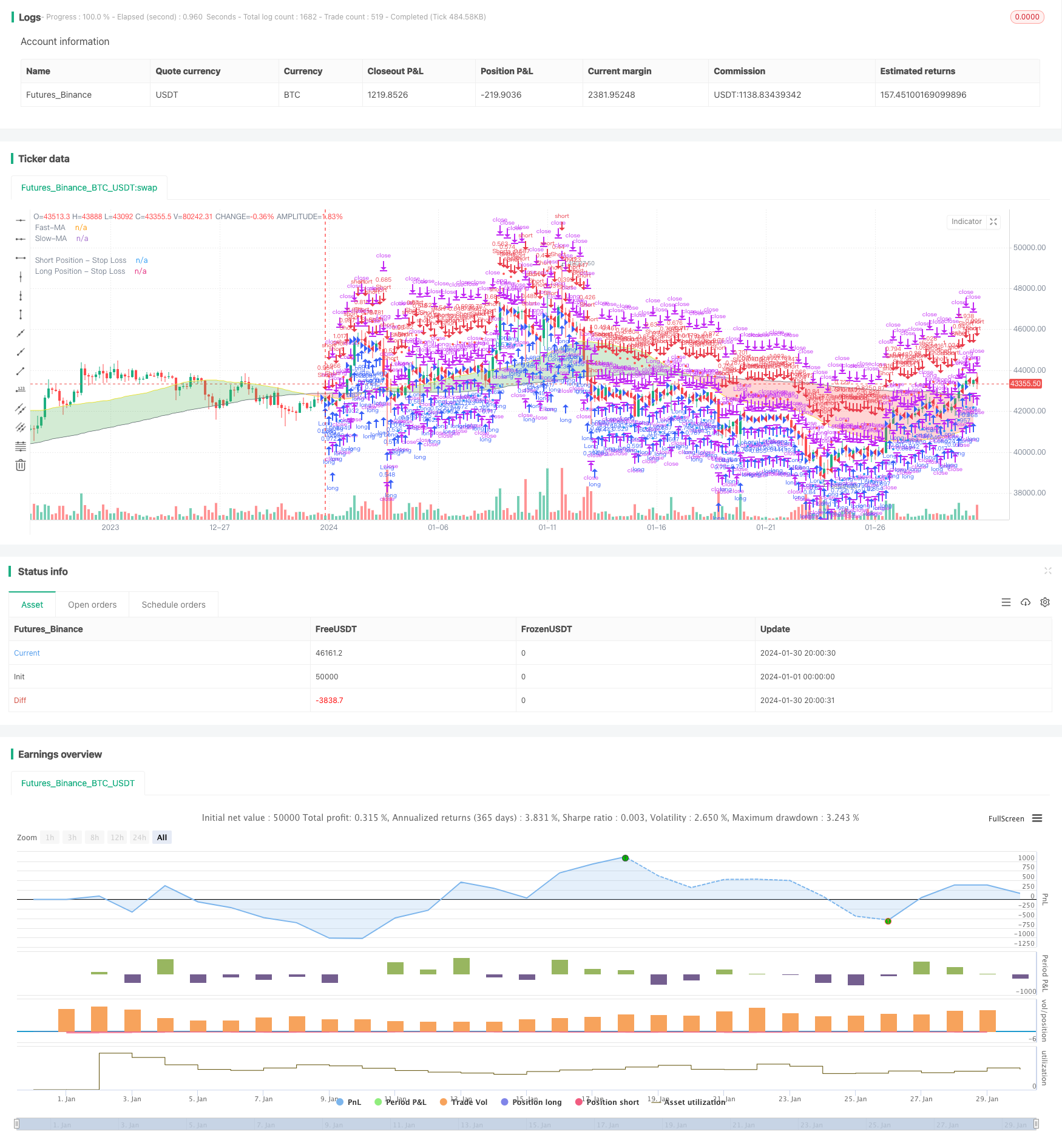

Strategi ini adalah jenis strategi trend-following. Strategi ini dibuat dengan mengira purata bergerak cepat dan purata bergerak perlahan, dan digabungkan dengan penunjuk garis paralisis untuk membuat keputusan jual beli.

Prinsip Strategi

- Hitung purata bergerak pantas dan purata bergerak perlahan. Parameter purata bergerak boleh disesuaikan.

- Bandingkan dua purata bergerak untuk menentukan arah trend pasaran. Apabila rata-rata bergerak cepat melintasi rata-rata bergerak perlahan, ia dianggap sebagai pasaran multihead; apabila rata-rata bergerak cepat melintasi rata-rata bergerak perlahan, ia dianggap sebagai pasaran kosong.

- Gabungan harga penutupan dengan hubungan purata bergerak sebagai pengesahan lanjut. Isyarat beli dihasilkan hanya apabila garis cepat melintasi garis perlahan dan harga penutupan lebih tinggi daripada garis cepat; isyarat jual dihasilkan hanya apabila garis cepat melintasi garis perlahan di bawah dan harga penutupan lebih rendah daripada garis cepat.

- Penapis penembusan palsu menggunakan penunjuk garisan paralisis. Hanya apabila garisan pantas menembusi garisan perlahan, dan harga penutupan lebih tinggi daripada garisan pantas, dan harga saham lebih tinggi daripada garisan paralisis, isyarat beli akhirnya dihasilkan; dan sebaliknya.

- Tetapkan garis hentian berdasarkan kerugian maksimum yang boleh ditanggung. Hentian harga khusus dikira dengan penunjuk ATR

Kelebihan Strategik

- Menggunakan purata bergerak untuk menentukan arah trend pasaran, mengelakkan perdagangan yang kerap di pasaran yang tidak jelas

- Keadaan penapisan berganda berkesan mengelakkan masalah penembusan palsu yang biasa

- Mengendalikan kerugian tunggal dengan berkesan dengan strategi Hentikan Kerugian

Risiko Strategik

- Strategi penunjuk arah mudah menghasilkan isyarat palsu

- Tidak mengambil kira risiko mata wang

- Mungkin ada yang terlewatkan pada permulaan.

Untuk mengatasi masalah di atas, anda boleh mengoptimumkan dari beberapa aspek berikut:

- Optimumkan parameter purata bergerak untuk lebih sesuai dengan jenis tertentu

- Penapisan isyarat boleh digabungkan dengan penunjuk atau model lain

- Pertimbangkan risiko mata wang untuk perlindungan masa nyata atau menukar akaun broker secara automatik

Arah pengoptimuman

- Mengoptimumkan parameter purata bergerak untuk menangkap trend

- Menambah portfolio model untuk meningkatkan ketepatan isyarat

- Semakan berkala untuk mengelakkan penipuan

- Mengoptimumkan strategi henti kerugian dan meningkatkan kestabilan strategi

ringkaskan

Strategi ini adalah strategi pengesanan trend yang khas dengan dua purata bergerak dan gabungan indikator. Ia menilai trend pasaran dengan membandingkan arah dua purata bergerak dengan lebih cepat dan lebih lambat; dan menggabungkan pelbagai penapis indikator untuk mengelakkan isyarat palsu dan menghasilkan isyarat perdagangan.

Kod sumber strategi

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sosacur01

//@version=5

strategy(title="2 MA | Trend Following", overlay=true, pyramiding=1, commission_type=strategy.commission.percent, commission_value=0.2, initial_capital=10000)

//==========================================

//BACKTEST RANGE

useDateFilter = input.bool(true, title="Filter Date Range of Backtest",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 jan 2000"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

backtestEndDate = input(timestamp("1 Jul 2100"),

title="End Date", group="Backtest Time Period",

tooltip="This end date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

inTradeWindow = true

if not inTradeWindow and inTradeWindow[1]

strategy.cancel_all()

strategy.close_all(comment="Date Range Exit")

//--------------------------------------

//LONG/SHORT POSITION ON/OFF INPUT

LongPositions = input.bool(title='On/Off Long Postion', defval=true, group="Long & Short Position")

ShortPositions = input.bool(title='On/Off Short Postion', defval=true, group="Long & Short Position")

//---------------------------------------

//SLOW MA INPUTS

averageType1 = input.string(defval="SMA", group="Slow MA Inputs", title="Slow MA Type", options=["SMA", "EMA", "WMA", "HMA", "RMA", "SWMA", "ALMA", "VWMA", "VWAP"])

averageLength1 = input.int(defval=160, group="Slow MA Inputs", title="Slow MA Length", minval=50)

averageSource1 = input(close, title="Slow MA Source", group="Slow MA Inputs")

//SLOW MA TYPE

MovAvgType1(averageType1, averageSource1, averageLength1) =>

switch str.upper(averageType1)

"SMA" => ta.sma(averageSource1, averageLength1)

"EMA" => ta.ema(averageSource1, averageLength1)

"WMA" => ta.wma(averageSource1, averageLength1)

"HMA" => ta.hma(averageSource1, averageLength1)

"RMA" => ta.rma(averageSource1, averageLength1)

"SWMA" => ta.swma(averageSource1)

"ALMA" => ta.alma(averageSource1, averageLength1, 0.85, 6)

"VWMA" => ta.vwma(averageSource1, averageLength1)

"VWAP" => ta.vwap(averageSource1)

=> runtime.error("Moving average type '" + averageType1 +

"' not found!"), na

//----------------------------------

//FAST MA INPUTS

averageType2 = input.string(defval="SMA", group="Fast MA Inputs", title="Fast MA Type", options=["SMA","EMA","WMA","HMA","RMA","SWMA","ALMA","VWMA","VWAP"])

averageLength2 = input.int(defval=40, group="Fast MA Inputs", title="Fast MA Length", maxval=40)

averageSource2 = input(close, title="Fast MA Source", group="Fast MA Inputs")

//FAST MA TYPE

MovAvgType2(averageType2, averageSource2, averageLength2) =>

switch str.upper(averageType2)

"SMA" => ta.sma(averageSource2, averageLength2)

"EMA" => ta.ema(averageSource2, averageLength2)

"WMA" => ta.wma(averageSource2, averageLength2)

"HMA" => ta.hma(averageSource2, averageLength2)

"RMA" => ta.rma(averageSource2, averageLength2)

"SWMA" => ta.swma(averageSource2)

"ALMA" => ta.alma(averageSource2, averageLength2, 0.85, 6)

"VWMA" => ta.vwma(averageSource2, averageLength2)

"VWAP" => ta.vwap(averageSource2)

=> runtime.error("Moving average type '" + averageType2 +

"' not found!"), na

//---------------------------------------------------

//MA VALUES

FASTMA = MovAvgType2(averageType2, averageSource2, averageLength2)

SLOWMA = MovAvgType1(averageType1, averageSource1, averageLength1)

//BUY/SELL TRIGGERS

bullish_trend = FASTMA > SLOWMA and close > FASTMA

bearish_trend = FASTMA < SLOWMA and close < FASTMA

//MAs PLOT

plot1 = plot(SLOWMA,color=color.gray, linewidth=1, title="Slow-MA")

plot2 = plot(FASTMA,color=color.yellow, linewidth=1, title="Fast-MA")

fill(plot1, plot2, color=SLOWMA>FASTMA ? color.new(color.red, 70) : color.new(color.green, 70), title="EMA Clouds")

//-----------------------------------------------------

//PARABOLIC SAR USER INPUT

usepsarFilter = input.bool(title='Use Parabolic Sar?', defval=true, group = "Parabolic SAR Inputs")

psar_display = input.bool(title="Display Parabolic Sar?", defval=false, group="Parabolic SAR Inputs")

start = input.float(title="Start", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

increment = input.float(title="Increment", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

maximum = input.float(title="Maximum", defval=0.2, group="Parabolic SAR Inputs", step=0.001)

//SAR VALUES

psar = request.security(syminfo.tickerid, "D", ta.sar(start, increment, maximum))

//BULLISH & BEARISH PSAR CONDITIONS

bullish_psar = (usepsarFilter ? low > psar : bullish_trend )

bearsish_psar = (usepsarFilter ? high < psar : bearish_trend)

//SAR PLOT

psar_plot = if low > psar

color.rgb(198, 234, 199, 13)

else

color.rgb(219, 134, 134, 48)

plot(psar_display ? psar : na, color=psar_plot, title="Par SAR")

//-------------------------------------

//ENTRIES AND EXITS

long_entry = if inTradeWindow and bullish_trend and bullish_psar and LongPositions

true

long_exit = if inTradeWindow and bearish_trend

true

short_entry = if inTradeWindow and bearish_trend and bearsish_psar and ShortPositions

true

short_exit = if inTradeWindow and bullish_trend

true

//--------------------------------------

//RISK MANAGEMENT - SL, MONEY AT RISK, POSITION SIZING

atrPeriod = input.int(14, "ATR Length", group="Risk Management Inputs")

sl_atr_multiplier = input.float(title="Long Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

sl_atr_multiplier_short = input.float(title="Short Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

i_pctStop = input.float(2, title="% of Equity at Risk", step=.5, group="Risk Management Inputs")/100

//ATR VALUE

_atr = ta.atr(atrPeriod)

//CALCULATE LAST ENTRY PRICE

lastEntryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

//STOP LOSS - LONG POSITIONS

var float sl = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - LONG POSITION

if (strategy.position_size[1] != strategy.position_size)

sl := lastEntryPrice - (_atr * sl_atr_multiplier)

//IN TRADE - LONG POSITIONS

inTrade = strategy.position_size > 0

//PLOT SL - LONG POSITIONS

plot(inTrade ? sl : na, color=color.blue, style=plot.style_circles, title="Long Position - Stop Loss")

//CALCULATE ORDER SIZE - LONG POSITIONS

positionSize = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier)

//============================================================================================

//STOP LOSS - SHORT POSITIONS

var float sl_short = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - SHORT POSITIONS

if (strategy.position_size[1] != strategy.position_size)

sl_short := lastEntryPrice + (_atr * sl_atr_multiplier_short)

//IN TRADE SHORT POSITIONS

inTrade_short = strategy.position_size < 0

//PLOT SL - SHORT POSITIONS

plot(inTrade_short ? sl_short : na, color=color.red, style=plot.style_circles, title="Short Position - Stop Loss")

//CALCULATE ORDER - SHORT POSITIONS

positionSize_short = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier_short)

//===============================================

//LONG STRATEGY

strategy.entry("Long", strategy.long, comment="Long", when = long_entry, qty=positionSize)

if (strategy.position_size > 0)

strategy.close("Long", when = (long_exit), comment="Close Long")

strategy.exit("Long", stop = sl, comment="Exit Long")

//SHORT STRATEGY

strategy.entry("Short", strategy.short, comment="Short", when = short_entry, qty=positionSize_short)

if (strategy.position_size < 0)

strategy.close("Short", when = (short_exit), comment="Close Short")

strategy.exit("Short", stop = sl_short, comment="Exit Short")

//ONE DIRECTION TRADING COMMAND (BELLOW ONLY ACTIVATE TO CORRECT BUGS)