ٹرینڈ بریک آؤٹ موونگ ایوریج فالونگ اسٹریٹجی

جائزہ

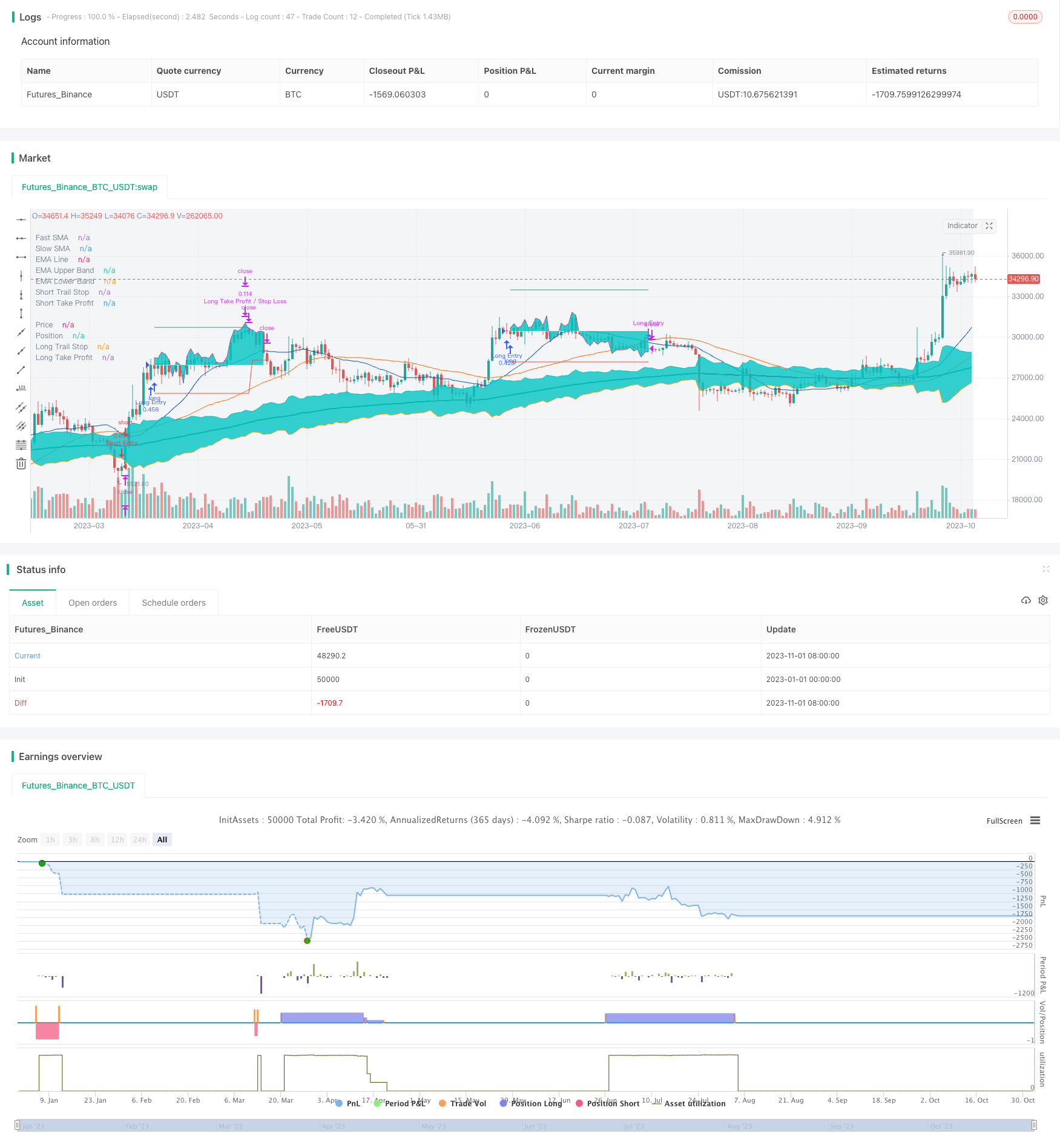

یہ حکمت عملی رجحان کی سمت کا تعین کرنے کے لئے سادہ طور پر حرکت پذیر مساوی لائنوں کے گولڈ فورک ڈیڈ فورکس کے ذریعہ ، رجحان کے ابتدائی مرحلے میں پوری پوزیشن کو زیادہ خالی کرنے کے لئے ، اور خطرے کے کنٹرول کے لئے اسٹاپ نقصان کا پیپر قائم کرنے کے لئے۔ داخلہ کے بعد مساوی لائنوں کا استعمال مسلسل رجحان کی پیروی کے لئے کیا جاتا ہے ، جب رجحان کا رخ موڑ جاتا ہے تو بروقت اسٹاپ نقصان ہوتا ہے۔ اس حکمت عملی میں ایک ترتیب دینے والا اسٹاپ ، اسٹاپ اور پوزیشن مینجمنٹ ماڈیول بھی ہے ، جو حکمت عملی کے پیرامیٹرز کو لچکدار انداز میں ایڈجسٹ کرسکتا ہے ، جو مختلف اقسام کے لئے موزوں ہے۔

حکمت عملی کا اصول

یہ حکمت عملی بنیادی طور پر رجحان کے آغاز اور اختتام کا تعین کرنے کے لئے ایک سادہ حرکت پذیر اوسط لائن کے گولڈ فورک اور ڈیڈ فورک کا استعمال کرتی ہے۔ حکمت عملی سب سے پہلے رجحان کی سمت کا تعین کرنے کے لئے فوری SMA ((مثال کے طور پر 21 ویں لائن) اور سست SMA ((مثال کے طور پر 49 ویں لائن) کے تعلقات پر مبنی ہے۔ جب فوری لائن نیچے سے سست لائن کو عبور کرتی ہے تو ، اس بات کا خیال ہے کہ قیمت اس وقت بڑھتی ہوئی رجحان میں داخل ہوگی اور اس وقت ایک پلس کھل جائے گی۔ جب فوری لائن اوپر سے نیچے سے سست لائن کو عبور کرتی ہے تو ، اس بات کا خیال ہے کہ قیمت نیچے کی طرف بڑھتی ہوئی رجحان میں داخل ہوگی اور اس وقت ایک خالی لائن کھل جائے گی۔

داخلہ کے بعد ، حکمت عملی قیمت اور SMA کے تعلقات کی اصل وقت میں نگرانی کرے گی۔ جب قیمت اوپر سے نیچے سے SMA کو توڑ دیتی ہے تو ، یہ سمجھا جاتا ہے کہ عروج کا رجحان ختم ہوچکا ہے ، اور اس سے زیادہ کو ختم کردیا جائے گا۔ جب قیمت نیچے سے SMA کو توڑتی ہے تو ، یہ سمجھا جاتا ہے کہ گرنے کا رجحان ختم ہوچکا ہے ، اور اس سے زیادہ کو ختم کردیا جائے گا۔

خطرے پر قابو پانے کے لئے ، حکمت عملی پوزیشن کھولنے کے وقت ایک ہی وقت میں اسٹاپ اور اسٹاپ بٹن پر دستخط کرے گی۔ اسٹاپ کا فاصلہ اے ٹی آر کی ترتیب کے مطابق ہے ، اور اسٹاپ کا فاصلہ فی صد کی ترتیب کے مطابق یا اے ٹی آر کی ترتیب کے مطابق منتخب کیا جاسکتا ہے۔ پوزیشن کھولنے کے بعد ، اسٹاپ بٹن قیمتوں کی اصل وقت میں پیروی کرے گا ، جس سے رجحان کی پیروی کا اثر حاصل ہوگا۔ اسٹاپ بٹن پہنچنے کے بعد ، کچھ پوزیشنوں سے باہر نکل جائے گا ، باقی پوزیشنوں کی پیروی جاری رہے گی ، جب تک کہ وہ مکمل طور پر باہر نہ آجائیں۔

اس حکمت عملی میں ایک پوزیشن مینجمنٹ ماڈیول بھی ہے جو ہر تجارت پر فنڈز کے استعمال کو محدود کرسکتا ہے ، اس طرح انفرادی تجارت کے خطرے کی نالی کو کنٹرول کیا جاسکتا ہے۔ اس کے علاوہ ، زیادہ سے زیادہ واپسی کی ترتیب حکمت عملی کے مجموعی خطرے کو کنٹرول کرسکتی ہے۔

اسٹریٹجک فوائد

- اوسط لائن کا استعمال کرتے ہوئے رجحان کی سمت کا تعین کرنے کے لئے، اصول سادہ اور آسان ہے

- لاگ ان کے بعد حقیقی وقت میں ٹریکنگ سٹاپ نقصان، زیادہ تر منافع کو لاک کر سکتے ہیں

- کنفیگریٹڈ سٹاپ، سٹاپنگ طریقوں، مختلف اقسام کے مطابق ایڈجسٹ کیا جا سکتا ہے

- انفرادی خطرے پر قابو پانے کے لئے ، مکمل پوزیشن کی تجارت نہیں

- زیادہ سے زیادہ واپسی کی ترتیب جو حکمت عملی کے مجموعی نقصان کو محدود کرتی ہے

خطرات اور حل

- ڈبل مساوی لائن کراسنگ میں کچھ پسماندگی ہے ، جس سے رجحانات کے آغاز کے لئے بہترین داخلے کے نقطہ نظر سے محروم ہوسکتا ہے

- بار بار پیرامیٹرز کو ایڈجسٹ کرنے کی ضرورت ہوتی ہے ، مختلف دورانیوں کے لئے اوسط لکیری امتزاج کی جانچ کرنا

- اوسط لائن کراسنگ میں غلطی کی شرح ہے ، اور داخلے کی درستگی 100٪ تک نہیں پہنچ سکتی ہے

- ٹریکنگ اسٹاپ نقصان کو توڑنے کے لئے آسان ہے ، تمام منافع کو لاک نہیں کیا جاسکتا ہے

- مناسب نرمی کی ضرورت ہے تاکہ قیمتوں میں واپسی کی اجازت دی جاسکے

- زیادہ سے زیادہ واپسی کی حد بہت زیادہ قدامت پسند ہوسکتی ہے ، جس سے فائدہ اٹھانے کا موقع ضائع ہوجاتا ہے۔

- زیادہ سے زیادہ واپسی کے تناسب کو مناسب طریقے سے نرمی دی جاسکتی ہے تاکہ حکمت عملی کو زیادہ سے زیادہ غلطی کی گنجائش دی جاسکے

اصلاح کی سمت

- مختلف پیرامیٹرز کے مجموعے کی کوشش کریں اور بہترین اوسط لکیری مدت کا انتخاب کریں

- رجحان کی طاقت کے اشارے شامل کرنے سے داخلے کی درستگی میں اضافہ ہوتا ہے

- اسٹاپ نقصان کی حکمت عملی کو بہتر بنائیں اور رجحانات میں کمی کو روکنے کی کوشش کریں

- مختلف روک تھام کی حکمت عملیوں کی جانچ کریں اور بہترین روک تھام کے مقامات کا انتخاب کریں

- پوزیشن مینجمنٹ پروگرام کو بہتر بنانا اور فنڈز کے استعمال کی کارکردگی کو بہتر بنانا

- زیادہ سے زیادہ واپسی کی ترتیب کو ایڈجسٹ کریں ، منافع اور خطرے کو متوازن کریں

خلاصہ کریں۔

یہ حکمت عملی مجموعی طور پر ایک ابتدائی حکمت عملی ہے جو ابتدائی افراد کے لئے بہت موزوں ہے۔ اس کے اصول آسان اور سمجھنے میں آسان ہیں۔ اس کے ساتھ ہی اس میں مناسب رسک کنٹرول کی صلاحیت بھی موجود ہے ، جس سے بڑے نقصانات کا امکان کم ہوسکتا ہے۔ پیرامیٹرز کی اصلاح کے ذریعہ اچھے نتائج حاصل کیے جاسکتے ہیں۔ لیکن اس کی بنیادی خامیوں نے یہ بھی طے کیا ہے کہ یہ اعلی صحت سے متعلق کارروائی نہیں کرسکتا ہے۔ یہ تجویز کی گئی ہے کہ اسے ابتدائی افراد کی مشق کی حکمت عملی کے طور پر استعمال کیا جاسکتا ہے ، لیکن یہ اعلی کارکردگی اور اعلی جیت کی کارروائی کے حصول کے لئے موزوں نہیں ہے۔ اگر آپ بہتر تجارتی نتائج حاصل کرنا چاہتے ہیں تو ، آپ کو زیادہ مضبوط پیش گوئی کرنے والی حکمت عملی تلاش کرنے کی ضرورت ہے۔

/*backtest

start: 2023-01-01 00:00:00

end: 2023-11-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2022 Iason Nikolas | jason5480

// Template Strategy script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @jason5480

// Revision: v0.0.1

// Date: 26-Feb-2022

//

// Description

// =============================================================================

// This script is designed to be used as a template for building new strategies.

// The framework provide you with a configurable implementation of the entry, exit,

// stop loss and take profit trailing logic. The user of this script has to copy

// it and replace the openLongPosition, openShortPosition, closeLongPosition and

// closeShortPosition variables in the STRATEGY module according to his needs!

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealer. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated trades using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// SETUP ============================================================================================================

strategy(title = 'Template Trailing Strategy',

shorttitle = 'TTS',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 100000)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// FILTERS ==========================================================================================================

// INPUT ============================================================================================================

usefromDate = input.bool(defval = true, title = 'From', inline = "From Date", group = "Filters")

fromDate = input(defval = timestamp('01 Jan 2021 00:00 UTC'), title = '', inline = "From Date", group = 'Filters')

usetoDate = input.bool(defval = false, title = 'To ', inline = "To Date", group = "Filters")

toDate = input(defval = timestamp('31 Dec 2121 23:59 UTC'), title = '', inline = "To Date", group = 'Filters')

longTradesEnabled = input.bool(defval = true, title = 'Long Trades', inline = 'Trades', group = 'Filters')

shortTradesEnabled = input.bool(defval = true, title = 'Short Trades', tooltip = 'Enable long/short trades.', inline = 'Trades', group = 'Filters')

emaFilterEnabled = input.bool(defval = true, title = 'EMA Filter', tooltip = 'Enable long/short trades based on EMA.', group = 'Filters')

emaResolution = input.timeframe(defval = 'D', title = 'EMA Res/Len/Src', inline = 'EMA Filter', group = 'Filters')

emaLength = input.int(defval = 200, title = '', inline = 'EMA Filter', group = 'Filters')

emaSrc = input.source(defval = close, title = '', tooltip = 'The timeframe, period and source for the EMA calculation.', inline = 'EMA Filter', group = 'Filters')

emaAtrBandEnabled = input.bool(defval = true, title = 'EMA ATR Band', tooltip = 'Enable ATR band for EMA filter.', group = 'Filters')

filterAtrLength = input.int(defval = 5, title = 'EMA ATR Len/Mul', minval = 1, inline = 'EMA ATR', group = 'Filters')

filterAtrMul = input.float(defval = 1.0, title = '', tooltip = 'ATR length and multiplier to be used for the ATR calculation that will be added on top of the EMA filter.', minval = 0.1, step = 0.1, inline = 'EMA ATR', group = 'Filters')

// LOGIC ============================================================================================================

isWithinPeriod() => true

emaLine = request.security(syminfo.tickerid, emaResolution, ta.ema(emaSrc, emaLength))

emaAtr = ta.atr(filterAtrLength)

emaUpperBand = emaLine + filterAtrMul * emaAtr

emaLowerBand = emaLine - filterAtrMul * emaAtr

bool emaLongApproval = emaFilterEnabled ? close > (emaAtrBandEnabled ? emaUpperBand : emaLine) and open > (emaAtrBandEnabled ? emaUpperBand : emaLine) : true

bool emaShortApproval = emaFilterEnabled ? close < (emaAtrBandEnabled ? emaLowerBand : emaLine) and open < (emaAtrBandEnabled ? emaLowerBand : emaLine) : true

bool longFiltersApproval = longTradesEnabled and emaLongApproval and isWithinPeriod()

bool shortFiltersApproval = shortTradesEnabled and emaShortApproval and isWithinPeriod()

// PLOT =============================================================================================================

bgcolor(color = isWithinPeriod() ? color.new(color.gray, 90) : na, title = 'Period')

showEma = input.bool(defval = true, title = 'Show EMA Line', inline = 'EMA Show', group = 'Plot')

showEmaBand = input.bool(defval = false, title = 'Show EMA Band', tooltip = 'Show the EMA Line/Band.', inline = 'EMA Show', group = 'Plot')

emaLineColor = emaLongApproval ? color.teal : emaShortApproval ? color.maroon : color.gray

plot(series = emaFilterEnabled and showEma ? emaLine : na, color = emaLineColor, style = plot.style_line, linewidth = 2, title = 'EMA Line')

emaUpperBandPlot = plot(series = emaUpperBand, color = na, style = plot.style_line, linewidth = 1, title = 'EMA Upper Band')

emaLowerBandPlot = plot(series = emaLowerBand, color = na, style = plot.style_line, linewidth = 1, title = 'EMA Lower Band')

emaBandFillColor = emaFilterEnabled and emaAtrBandEnabled and showEmaBand ? color.new(emaLineColor, 95) : na

fill(plot1 = emaUpperBandPlot, plot2 = emaLowerBandPlot, color = emaBandFillColor, title = 'EMA Band')

// INPUT ============================================================================================================

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// STRATEGY =========================================================================================================

// INPUT ============================================================================================================

fastMALen = input.int(defval = 21, title = 'Fast/Slow SMA Length', inline = 'MA Length', group = 'Strategy')

slowMALen = input.int(defval = 49, title = '', tooltip = 'How many candles back to calculte the fast/slow SMA.', inline = 'MA Length', group = 'Strategy')

// LOGIC ============================================================================================================

fastMA = ta.sma(close, fastMALen)

slowMA = ta.sma(close, slowMALen)

bool openLongPosition = longFiltersApproval and ta.crossover(fastMA, slowMA)

bool openShortPosition = shortFiltersApproval and ta.crossunder(fastMA, slowMA)

bool closeLongPosition = longTradesEnabled and ta.crossunder(fastMA, slowMA)

bool closeShortPosition = shortTradesEnabled and ta.crossover(fastMA, slowMA)

// PLOT =============================================================================================================

var fastColor = color.new(#0056BD, 0)

plot(series = fastMA, title = 'Fast SMA', color = fastColor, linewidth = 1, style = plot.style_line)

var slowColor = color.new(#FF6A00, 0)

plot(series = slowMA, title = 'Slow SMA', color = slowColor, linewidth = 1, style = plot.style_line)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// SHARED VARIABLES =================================================================================================

// INPUT ============================================================================================================

atrLength = input.int(defval = 14, title = 'ATR Length', minval = 1, tooltip = 'How many previous candles to use for the ATR calculation.', group = 'General')

// LOGIC ============================================================================================================

// the open signals when not already into a position

bool validOpenLongPosition = openLongPosition and not (strategy.position_size > 0)

bool validOpenShortPosition = openShortPosition and not (strategy.position_size < 0)

bool validCloseLongPosition = closeLongPosition and strategy.position_size > 0

bool validCloseShortPosition = closeShortPosition and strategy.position_size < 0

// count how far are the last valid open and regular close signals

int barsSinceValidOpenLong = nz(ta.barssince(validOpenLongPosition), 999999)

int barsSinceValidOpenShort = nz(ta.barssince(validOpenShortPosition), 999999)

int barsSinceCloseLong = nz(ta.barssince(closeLongPosition), 999999)

int barsSinceCloseShort = nz(ta.barssince(closeShortPosition), 999999)

// take profit has to communicate its execution with the stop loss logic when 'TP' mode is selected

var bool longTrailingTakeProfitExecuted = false

var bool shortTrailingTakeProfitExecuted = false

// close price when the valid open signal was triggered

float openPrice = ta.valuewhen(validOpenLongPosition or validOpenShortPosition, close, 0)

float openAtr = ta.valuewhen(validOpenLongPosition or validOpenShortPosition, ta.atr(atrLength), 0)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// ENTRY ============================================================================================================

// INPUT ============================================================================================================

enableEntryTrailing = input.bool(defval = false, title = 'Enable Trailing', tooltip = 'Enable or disable the trailing for entry position.', group = 'Entry')

devEntryMethod = input.string(defval = 'PERC', title = 'Deviation Method', options = ['PERC', 'ATR'], tooltip = 'The method to calculate the Deviation for the Trailing Entry.', group = 'Entry')

devEntryPerc = input.float(defval = 1.0, title = 'Deviation %', minval = 0.01, maxval = 100, step = 0.05, tooltip = 'The step to follow the price when the open position condition is met.', group = 'Entry') / 100

devEntryAtrMul = input.float(defval = 0.5, title = 'Deviation ATR Mul', minval = 0.01, step = 0.05, tooltip = 'Multiplier to be used on the initial entrys` ATR to calculate the step for following the price, when the entry target is reached.', group = 'Entry')

ctrLongEntrySrc = input.source(defval = high, title = 'Long/Short Entry Control', inline = 'Control', group = 'Entry')

ctrShortEntrySrc = input.source(defval = low, title = '', tooltip = 'The price source to check with the entry target to trigger the entry order for Long/Short position.', inline = 'Control', group = 'Entry')

// LOGIC ============================================================================================================

var bool enterLongPosition = false

int barsSinceEnterLong = nz(ta.barssince(enterLongPosition), 999999)

bool openLongIsActive = barsSinceCloseLong >= barsSinceValidOpenLong

bool enterLongIsPending = barsSinceEnterLong >= barsSinceValidOpenLong

bool tryEnterLongPosition = longFiltersApproval and openLongIsActive and enterLongIsPending

getLongEntryPrice(baseSrc) =>

switch devEntryMethod

'PERC' => baseSrc * (1 + devEntryPerc)

'ATR' => baseSrc + devEntryAtrMul * openAtr

=> na

float longEntryPrice = na

longEntryPrice := if validOpenLongPosition

getLongEntryPrice(close)

else if tryEnterLongPosition

math.min(getLongEntryPrice(low), nz(longEntryPrice[1], 999999))

else

na

enterLongPosition := enableEntryTrailing ? longFiltersApproval and ta.crossover(openLongPosition ? close : ctrLongEntrySrc, longEntryPrice) : openLongPosition

bool validEnterLongPosition = enterLongPosition and not (strategy.position_size > 0)

var bool enterShortPosition = false

int barsSinceEnterShort = nz(ta.barssince(enterShortPosition), 999999)

bool openShortIsActive = barsSinceCloseShort >= barsSinceValidOpenShort

bool enterShortIsPending = barsSinceEnterShort >= barsSinceValidOpenShort

bool tryEnterShortPosition = shortFiltersApproval and openShortIsActive and enterShortIsPending

getShortEntryPrice(baseSrc) =>

switch devEntryMethod

'PERC' => baseSrc * (1 - devEntryPerc)

'ATR' => baseSrc - devEntryAtrMul * openAtr

=> na

float shortEntryPrice = na

shortEntryPrice := if validOpenShortPosition

getShortEntryPrice(close)

else if tryEnterShortPosition

math.max(getShortEntryPrice(high), nz(shortEntryPrice[1]))

else

na

enterShortPosition := enableEntryTrailing ? shortFiltersApproval and ta.crossunder(openShortPosition ? close : ctrShortEntrySrc, shortEntryPrice) : openShortPosition

bool validEnterShortPosition = enterShortPosition and not (strategy.position_size < 0)

// PLOT =============================================================================================================

var buyColor = color.new(color.green, 0)

plot(series = enableEntryTrailing ? longEntryPrice : na, title = 'Long Buy Price', color = buyColor, linewidth = 1, style = plot.style_linebr)

plot(series = enableEntryTrailing ? shortEntryPrice : na, title = 'Short Sell Price', color = buyColor, linewidth = 1, style = plot.style_linebr)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// EXIT ============================================================================================================

// INPUT ============================================================================================================

enableExitTrailing = input.bool(defval = false, title = 'Enable Trailing', tooltip = 'Enable or disable the trailing for exit position.', group = 'Exit')

devExitMethod = input.string(defval = 'PERC', title = 'Deviation Method', options = ['PERC', 'ATR'], tooltip = 'The method to calculate the Deviation for the Trailing Exit.', group = 'Exit')

devExitPerc = input.float(defval = 3.0, title = 'Deviation %', minval = 0.01, maxval = 100, step = 0.05, tooltip = 'The step to follow the price when the close position condition is met.', group = 'Exit') / 100

devExitAtrMul = input.float(defval = 0.5, title = 'Deviation ATR Mul', minval = 0.01, step = 0.05, tooltip = 'Multiplier to be used on the initial entrys` ATR to calculate the step for following the price, when the exit target is reached.', group = 'Exit')

ctrLongExitSrc = input.source(defval = low, title = 'Long/Short Exit Control', inline = 'Control', group = 'Exit')

ctrShortExitSrc = input.source(defval = high, title = '', tooltip = 'The price source to check with the entry target to trigger the entry order for Long/Short position.', inline = 'Control', group = 'Exit')

// LOGIC ============================================================================================================

var bool exitLongPosition = false

int barsSinceExitLong = nz(ta.barssince(exitLongPosition), 999999)

bool closeLongIsActive = barsSinceValidOpenLong >= barsSinceCloseLong

bool exitLongIsPending = barsSinceExitLong >= barsSinceCloseLong

bool tryExitLongPosition = isWithinPeriod() and closeLongIsActive and exitLongIsPending

getLongExitPrice(baseSrc) =>

switch devExitMethod

'PERC' => baseSrc * (1 - devExitPerc)

'ATR' => baseSrc - devExitAtrMul * openAtr

=> na

float longExitPrice = na

longExitPrice := if validCloseLongPosition

getLongExitPrice(close)

else if tryExitLongPosition

math.max(getLongExitPrice(high), nz(longExitPrice[1], 999999))

else

na

exitLongPosition := enableExitTrailing ? isWithinPeriod() and ta.crossunder(closeLongPosition ? close : ctrLongExitSrc, longExitPrice) : closeLongPosition

bool longIsActive = enterLongPosition or strategy.position_size > 0 and not exitLongPosition

var bool exitShortPosition = false

int barsSinceExitShort = nz(ta.barssince(exitShortPosition), 999999)

bool closeShortIsActive = barsSinceValidOpenShort >= barsSinceCloseShort

bool exitShortIsPending = barsSinceExitShort >= barsSinceCloseShort

bool tryExitShortPosition = isWithinPeriod() and closeShortIsActive and exitShortIsPending

getShortExitPrice(baseSrc) =>

switch devExitMethod

'PERC' => baseSrc * (1 + devExitPerc)

'ATR' => baseSrc + devExitAtrMul * openAtr

=> na

float shortExitPrice = na

shortExitPrice := if validCloseShortPosition

getShortExitPrice(close)

else if tryExitShortPosition

math.min(getShortExitPrice(low), nz(shortExitPrice[1], 999999))

else

na

exitShortPosition := enableExitTrailing ? isWithinPeriod() and ta.crossunder(closeShortPosition ? close : ctrShortExitSrc, shortExitPrice) : closeShortPosition

bool shortIsActive = enterShortPosition or strategy.position_size < 0 and not exitShortPosition

// PLOT =============================================================================================================

var sellColor = color.new(color.red, 0)

plot(series = enableExitTrailing ? longExitPrice : na, title = 'Long Sell Price', color = sellColor, linewidth = 1, style = plot.style_linebr)

plot(series = enableExitTrailing ? shortExitPrice : na, title = 'Short Sell Price', color = sellColor, linewidth = 1, style = plot.style_linebr)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// STOP LOSS ========================================================================================================

// INPUT ============================================================================================================

stopLossMethod = input.string(defval = 'PERC', title = 'Stop Loss Method', options = ['PERC', 'ATR'], tooltip = 'The method to calculate the Stop Loss (percentagewise, based on initial ATR or based on ATR changing over time).', group = 'Stop Loss - Target')

longTrailingStopLossPerc = input.float(defval = 7.5, title = 'Long/Short Stop Loss %', minval = 0.05, maxval = 100, step = 0.05, inline = 'Trailing Stop Loss Perc', group = 'Stop Loss - Target') / 100

shortTrailingStopLossPerc = input.float(defval = 7.5, title = '', minval = 0.05, maxval = 100, step = 0.05, tooltip = 'The percentage of the price decrease/increase to set the Stop Loss price target for long/short positions.', inline = 'Trailing Stop Loss Perc', group = 'Stop Loss - Target') / 100

longStopLossAtrMul = input.float(defval = 3.0, title = 'ATR Long/Short Mul ', minval = 0.1, step = 0.1, inline = 'Trailing Stop Loss ATR Multiplier', group = 'Stop Loss - Target')

shortStopLossAtrMul = input.float(defval = 3.0, title = '', minval = 0.1, step = 0.1, tooltip = 'ATR multiplier to be used for the long/short Stop Loss.', inline = 'Trailing Stop Loss ATR Multiplier', group = 'Stop Loss - Target')

enableStopLossTrailing = input.string(defval = 'TP', title = 'Enable Trailing', options = ['TP', 'ON', 'OFF'], tooltip = 'Enable the trailing for Stop Loss when Take Profit order is executed (TP) or from the start of the entry order (ON) or not at all (OFF).', group = 'Stop Loss - Trailing')

breakEvenEnabled = input.bool(defval = false, title = 'Break Even', tooltip = 'When Take Profit price target is hit, move the Stop Loss to the entry price (or to a more strict price defined by the Stop Loss %/ATR Multiplier).', group = 'Stop Loss - Trailing')

// LOGIC ============================================================================================================

getLongStopLossPrice(baseSrc) =>

switch stopLossMethod

'PERC' => baseSrc * (1 - longTrailingStopLossPerc)

'ATR' => baseSrc - longStopLossAtrMul * openAtr

=> na

getLongStopLossPerc(baseSrc) =>

(baseSrc - getLongStopLossPrice(baseSrc)) / baseSrc

// trailing starts when the take profit price is reached if 'TP' mode is set or from the very begining if 'ON' mode is selected

bool enableLongTakeProfitTrailing = enableStopLossTrailing == 'ON' or enableStopLossTrailing == 'TP' and longTrailingTakeProfitExecuted

// calculate trailing stop loss price when enter long position and peserve its value until the position closes

float longTrailingStopLossPrice = na

longTrailingStopLossPrice := if longIsActive

if validEnterLongPosition

getLongStopLossPrice(openPrice)

else

stopPrice = getLongStopLossPrice(enableLongTakeProfitTrailing ? high : openPrice)

stopPrice := breakEvenEnabled and longTrailingTakeProfitExecuted ? math.max(stopPrice, openPrice) : stopPrice

math.max(stopPrice, nz(longTrailingStopLossPrice[1]))

else

na

getShortStopLossPrice(baseSrc) =>

switch stopLossMethod

'PERC' => baseSrc * (1 + shortTrailingStopLossPerc)

'ATR' => baseSrc + shortStopLossAtrMul * openAtr

=> na

getShortStopLossPerc(baseSrc) =>

(getShortStopLossPrice(baseSrc) - baseSrc) / baseSrc

// trailing starts when the take profit price is reached if 'TP' mode is set or from the very begining if 'ON' mode is selected

bool enableShortTakeProfitTrailing = enableStopLossTrailing == 'ON' or enableStopLossTrailing == 'TP' and shortTrailingTakeProfitExecuted

// calculate trailing stop loss price when enter short position and peserve its value until the position closes

float shortTrailingStopLossPrice = na

shortTrailingStopLossPrice := if shortIsActive

if validEnterShortPosition

getShortStopLossPrice(openPrice)

else

stopPrice = getShortStopLossPrice(enableShortTakeProfitTrailing ? low : openPrice)

stopPrice := breakEvenEnabled and shortTrailingTakeProfitExecuted ? math.min(stopPrice, openPrice) : stopPrice

math.min(stopPrice, nz(shortTrailingStopLossPrice[1], 999999.9))

else

na

// PLOT =============================================================================================================

var stopLossColor = color.new(#e25141, 0)

plot(series = longTrailingStopLossPrice, title = 'Long Trail Stop', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 1)

plot(series = shortTrailingStopLossPrice, title = 'Short Trail Stop', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 1)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// TAKE PROFIT ======================================================================================================

// INPUT ============================================================================================================

takeProfitMethod = input.string(defval = 'PERC', title = 'Take Profit Method', options = ['PERC', 'ATR', 'RR'], tooltip = 'The method to calculate the Take Profit price.', group = 'Take Profit - Target')

longTakeProfitPerc = input.float(defval = 10.0, title = 'Long/Short Take Profit %', minval = 0.05, step = 0.05, inline = 'Take Profit Perc', group = 'Take Profit - Target') / 100

shortTakeProfitPerc = input.float(defval = 10.0, title = '', minval = 0.05, step = 0.05, tooltip = 'The percentage of the price increase/decrease to set the take profit price target for long/short positions.', inline = 'Take Profit Perc', group = 'Take Profit - Target') / 100

longTakeProfitAtrMul = input.float(defval = 9.0, title = 'ATR Long/Short Mul ', minval = 0.1, step = 0.1, inline = 'Take Profit ATR Multiplier', group = 'Take Profit - Target')

shortTakeProfitAtrMul = input.float(defval = 9.0, title = '', minval = 0.1, step = 0.1, tooltip = 'ATR multiplier to be used for the long/short Take Profit.', inline = 'Take Profit ATR Multiplier', group = 'Take Profit - Target')

longRiskRewardRatio = input.float(defval = 1.5, title = 'Long/Short RR Ratio ', minval = 0.1, step = 0.1, inline = 'Risk Reward Ratio', group = 'Take Profit - Target')

shortRiskRewardRatio = input.float(defval = 1.5, title = '', minval = 0.1, step = 0.1, tooltip = 'The Risk/Reward Ratio to be used for the long/short Take Profit based on the Stop Loss Price.', inline = 'Risk Reward Ratio', group = 'Take Profit - Target')

enableTakeProfitTrailing = input.bool(defval = true, title = 'Enable Trailing', tooltip = 'Enable or disable the trailing for take profit.', group = 'Take Profit - Trailing')

devTakeProfitMethod = input.string(defval = 'PERC', title = 'Deviation Method', options = ['PERC', 'ATR'], tooltip = 'The method to calculate the Deviation for the Trailing Take Profit.', group = 'Take Profit - Trailing')

devTakeProfitPerc = input.float(defval = 1.0, title = 'Deviation %', minval = 0.01, maxval = 100, step = 0.05, tooltip = 'The percentage wise step to be used for following the price, when the take profit target is reached.', group = 'Take Profit - Trailing') / 100

devTakeProfitAtrMul = input.float(defval = 1.0, title = 'Deviation ATR Mul', minval = 0.01, step = 0.05, tooltip = 'Multiplier to be used on the initial entrys` ATR to calculate the step for following the price, when the take profit target is reached.', group = 'Take Profit - Trailing')

// LOGIC ============================================================================================================

getLongTakeProfitPrice(baseSrc) =>

switch takeProfitMethod

'PERC' => baseSrc * (1 + longTakeProfitPerc)

'ATR' => baseSrc + longTakeProfitAtrMul * openAtr

'RR' => baseSrc + longRiskRewardRatio * (baseSrc - getLongStopLossPrice(baseSrc))

=> na

getLongTakeProfitPerc(baseSrc) =>

(baseSrc - getLongTakeProfitPrice(baseSrc)) / baseSrc

// calculate take profit price when enter long position and peserve its value until the position closes

float longTakeProfitPrice = na

longTakeProfitPrice := if longIsActive and not longTrailingTakeProfitExecuted

if validEnterLongPosition

getLongTakeProfitPrice(openPrice)

else

nz(longTakeProfitPrice[1], getLongTakeProfitPrice(close))

else

na

longTrailingTakeProfitExecuted := strategy.position_size > 0 and (longTrailingTakeProfitExecuted[1] or strategy.position_size < strategy.position_size[1] or strategy.position_size[1] == 0 and high >= longTakeProfitPrice)

longTrailingTakeProfitStepTicks = switch devTakeProfitMethod

'PERC' => longTakeProfitPrice * devTakeProfitPerc / syminfo.mintick

'ATR' => devTakeProfitAtrMul * openAtr / syminfo.mintick

=> na

getShortTakeProfitPrice(baseSrc) =>

switch takeProfitMethod

'PERC' => baseSrc * (1 - shortTakeProfitPerc)

'ATR' => baseSrc - shortTakeProfitAtrMul * openAtr

'RR' => baseSrc - shortRiskRewardRatio * (getShortStopLossPrice(baseSrc) - baseSrc)

=> na

getShortTakeProfitPerc(baseSrc) =>

(getShortTakeProfitPrice(baseSrc) - baseSrc) / baseSrc

// calculate take profit price when enter short position and peserve its value until the position closes

float shortTakeProfitPrice = na

shortTakeProfitPrice := if shortIsActive and not shortTrailingTakeProfitExecuted

if validEnterShortPosition

getShortTakeProfitPrice(openPrice)

else

nz(shortTakeProfitPrice[1], getShortTakeProfitPrice(close))

else

na

shortTrailingTakeProfitExecuted := strategy.position_size < 0 and (shortTrailingTakeProfitExecuted[1] or strategy.position_size > strategy.position_size[1] or strategy.position_size[1] == 0 and low <= shortTakeProfitPrice)

shortTrailingTakeProfitStepTicks = switch devTakeProfitMethod

'PERC' => shortTakeProfitPrice * devTakeProfitPerc / syminfo.mintick

'ATR' => devTakeProfitAtrMul * openAtr / syminfo.mintick

=> na

// PLOT =============================================================================================================

var takeProfitColor = color.new(#419388, 0)

plot(series = longTakeProfitPrice, title = 'Long Take Profit', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 1)

plot(series = shortTakeProfitPrice, title = 'Short Take Profit', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 1)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// QUANTITY MANAGEMENT ==============================================================================================

// INPUT ============================================================================================================

takeProfitQuantityPerc = input.float(defval = 50, title = 'Take Profit Quantity %', minval = 0.0, maxval = 100, step = 1.0, tooltip = 'The percentage of the position that will be withdrawn when the take profit price target is reached.', group = 'Quantity/Risk Management')

riskPerc = input.float(defval = 2, title = 'Capital at Risk %', minval = 1, tooltip = 'The maximum percentage of the equity to risk in every trade when no leverage is used.', group = "Quantity/Risk Management") / 100

minTrade = input.int(defval = 10, title = 'Minimum Trade Price', minval = 1, tooltip = 'The minimum trade price in Quote currency that is allowed in the exchange for a valid new position.', group = "Quantity/Risk Management")

longLeverage = input.int(defval = 1, title = 'Leverage Long/Short ', minval = 1, inline = 'Leverage', group = "Quantity/Risk Management")

shortLeverage = input.int(defval = 1, title = '', minval = 1, tooltip = 'Leverage factor used to multiply the initial risk quantity of each trade (by borrowing the remaining amount). Thus, the profits and losses are multiplied respectivelly.', inline = 'Leverage', group = "Quantity/Risk Management")

// LOGIC ============================================================================================================

var int quoteDecimalDigits = math.max(math.ceil(-1 * math.log10(syminfo.mintick * syminfo.pointvalue)), 0)

floor(number, precision) =>

fact = math.pow(10, precision)

num = number * fact

math.floor(num) / fact

ceil(number, precision) =>

fact = math.pow(10, precision)

num = number * fact

math.ceil(num) / fact

clamp(number, lower, highest, precision) =>

ceil(math.max(floor(math.min(number, highest), precision), lower), precision)

getLongRiskQuoteQuantity() =>

clamp(strategy.equity * riskPerc * longLeverage / getLongStopLossPerc(close), minTrade, strategy.equity * longLeverage, quoteDecimalDigits)

getLongRiskQuoteQuantityPerc() =>

getLongRiskQuoteQuantity() / strategy.equity

getLongRiskBaseQuantity() =>

getLongRiskQuoteQuantity() / close

float longEntryBaseQuantity = na

longEntryBaseQuantity := if longIsActive

if validOpenLongPosition

getLongRiskBaseQuantity()

else

nz(longEntryBaseQuantity[1], getLongRiskBaseQuantity())

else

na

getShortRiskQuoteQuantity() =>

clamp(strategy.equity * riskPerc * shortLeverage / getShortStopLossPerc(close), minTrade, strategy.equity * shortLeverage, quoteDecimalDigits)

getShortRiskQuoteQuantityPerc() =>

getShortRiskQuoteQuantity() / strategy.equity

getShortRiskBaseQuantity() =>

getShortRiskQuoteQuantity() / close

float shortEntryBaseQuantity = na

shortEntryBaseQuantity := if shortIsActive

if validOpenShortPosition

getShortRiskBaseQuantity()

else

nz(shortEntryBaseQuantity[1], getShortRiskBaseQuantity())

else

na

// PLOT =============================================================================================================

label.new(x = validOpenLongPosition ? bar_index : na, y = na, text = 'Buy\n' + str.tostring(100 * getLongRiskQuoteQuantityPerc(), '#.##') + '%', yloc = yloc.belowbar, color = buyColor, style = label.style_label_up, textcolor = color.new(color.white, 0))

label.new(x = validOpenShortPosition ? bar_index : na, y = na, text = 'Sell\n' + str.tostring(100 * getShortRiskQuoteQuantityPerc(), '#.##') + '%', yloc = yloc.abovebar, color = sellColor, style = label.style_label_down, textcolor = color.new(color.white, 0))

label.new(x = validCloseShortPosition ? bar_index : na, y = na, text = 'Buy', yloc = yloc.belowbar, color = buyColor, style = label.style_label_up, textcolor = color.new(color.white, 0))

label.new(x = validCloseLongPosition ? bar_index : na, y = na, text = 'Sell', yloc = yloc.abovebar, color = sellColor, style = label.style_label_down, textcolor = color.new(color.white, 0))

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// ALERT MESSAGES ===================================================================================================

// INPUT ============================================================================================================

msgOpenLong = input.string(defval = 'Long: Started', title = 'Open Long/Short', inline = 'Open Message', group = 'Alert Messages')

msgOpenShort = input.string(defval = 'Short: Started', title = '', tooltip = 'Alert messages emited when open long/short position.', inline = 'Open Message', group = 'Alert Messages')

msgCloseLong = input.string(defval = 'Long: Closed at market price', title = 'Close Long/Short', inline = 'Close Message', group = 'Alert Messages')

msgCloseShort = input.string(defval = 'Short: Closed at market price', title = '', tooltip = 'Alert messages emited when close long/short position.', inline = 'Close Message', group = 'Alert Messages')

msgTPSLLong = input.string(defval = 'Long: Take Profit or Stop Loss executed', title = 'TP/SL Long/Short', inline = 'TP/SL Message', group = 'Alert Messages')

msgTPSLShort = input.string(defval = 'Short: Take Profit or Stop Loss executed', title = '', tooltip = 'Alert message emited when the first quantity target (take profit or stop loss) for long/short position is hit.', inline = 'TP/SL Message', group = 'Alert Messages')

msgSLLong = input.string(defval = 'Long: Stop Loss executed', title = 'SL Long/Short ', inline = 'SL Message', group = 'Alert Messages')

msgSLShort = input.string(defval = 'Short: Stop Loss executed', title = '', tooltip = 'Alert message emited when the second quantity stop loss target for long/short position is hit.', inline = 'SL Message', group = 'Alert Messages')

msgMaxDrawdown= input.string(defval = 'Death is the new beginning', title = 'Max Drawdown', tooltip = 'Alert message emited when the max drawdown limit is hit.', group = 'Alert Messages')

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITION ORDERS ==================================================================================================

// INPUT ============================================================================================================

maxDrawdown = input.int(defval = 25, title = 'Max Drawdown %', minval = 1, maxval = 100, tooltip = 'The maximum drawdown to stop trading.', group = "Quantity/Risk Management")

highlighting = input.bool(defval = false, title = 'Show Position Highlighter', tooltip = 'Highlight winning/lossing position.', group = 'Plot')

// LOGIC ============================================================================================================

// close on trend reversal

strategy.close(id = 'Long Entry', when = exitLongPosition, comment = 'Close Long', alert_message = msgCloseLong)

// close on trend reversal

strategy.close(id = 'Short Entry', when = exitShortPosition, comment = 'Close Short', alert_message = msgCloseShort)

// getting into LONG position

strategy.entry(id = 'Long Entry', direction = strategy.long, qty = longEntryBaseQuantity, when = enterLongPosition, alert_message = msgOpenLong)

// submit exit order for trailing take profit price also set the stop loss for the take profit percentage in case that stop loss it reached first

strategy.exit(id = 'Long Take Profit / Stop Loss', from_entry = 'Long Entry', qty_percent = takeProfitQuantityPerc, limit = enableTakeProfitTrailing ? na : longTakeProfitPrice, stop = longTrailingStopLossPrice, trail_price = enableTakeProfitTrailing ? longTakeProfitPrice : na, trail_offset = enableTakeProfitTrailing ? longTrailingTakeProfitStepTicks : na, when = longIsActive, alert_message = msgTPSLLong)

// submit exit order for trailing stop loss price for the remaining percent of the quantity not reserved by the take profit order

strategy.exit(id = 'Long Stop Loss', from_entry = 'Long Entry', stop = longTrailingStopLossPrice, when = longIsActive, alert_message = msgSLLong)

// getting into SHORT position

strategy.entry(id = 'Short Entry', direction = strategy.short, qty = shortEntryBaseQuantity, when = enterShortPosition, alert_message = msgOpenShort)

// submit exit order for trailing take profit price also set the stop loss for the take profit percentage in case that stop loss it reached first

strategy.exit(id = 'Short Take Profit / Stop Loss', from_entry = 'Short Entry', qty_percent = takeProfitQuantityPerc, limit = enableTakeProfitTrailing ? na : shortTakeProfitPrice, stop = shortTrailingStopLossPrice, trail_price = enableTakeProfitTrailing ? shortTakeProfitPrice : na, trail_offset = enableTakeProfitTrailing ? shortTrailingTakeProfitStepTicks : na, when = shortIsActive, alert_message = msgTPSLShort)

// submit exit order for trailing stop loss price for the remaining percent of the quantity not reserved by the take profit order

strategy.exit(id = 'Short Stop Loss', from_entry = 'Short Entry', stop = shortTrailingStopLossPrice, when = shortIsActive, alert_message = msgSLShort)

// limit the maximum drawdown

// strategy.risk.max_drawdown(value = maxDrawdown, type = strategy.percent_of_equity, alert_message = msgMaxDrawdown)

// PLOT =============================================================================================================

lowHighPrice = high > strategy.position_avg_price and low < strategy.position_avg_price ? longIsActive ? high : shortIsActive ? low : na

: high > strategy.position_avg_price ? high

: low < strategy.position_avg_price ? low

: na

pricePlot = plot(series = lowHighPrice, title = 'Price', color = na, linewidth = 1, style = plot.style_linebr)

var posColor = color.new(color.white, 0)

posPlot = plot(series = strategy.position_avg_price, title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr)

highlightColor = lowHighPrice > strategy.position_avg_price and longIsActive or lowHighPrice < strategy.position_avg_price and shortIsActive ? takeProfitColor

: lowHighPrice < strategy.position_avg_price and longIsActive or lowHighPrice > strategy.position_avg_price and shortIsActive ? stopLossColor

: na

fill(plot1 = posPlot, plot2 = pricePlot, color = highlighting ? color.new(highlightColor, 90) : na, title = 'Highlight trades')

// ==================================================================================================================