概述

本策略通过计算快速移动平均线和慢速移动平均线,并结合抛物线指标进行买卖判断,属于趋势跟踪类型策略。当快速移动平均线上穿慢速移动平均线时做多;当快速移动平均线下穿慢速移动平均线时做空。同时结合抛物线指标过滤假突破。

策略原理

- 计算快速移动平均线和慢速移动平均线。移动平均线参数可以自定义。

- 比较两条移动平均线,判断市场趋势方向。当快速移动平均线上穿越慢速移动平均线时,判断为多头市场;当快速移动平均线下穿越慢速移动平均线时,判断为空头市场。

- 结合收盘价与移动平均线关系作为进一步确认。只有当快速线上穿慢速线,且收盘价高于快速线时,才产生买入信号;只有当快速线下穿慢速线,且收盘价低于快速线时,才产生卖出信号。

- 使用抛物线指标过滤假突破。只有快速线上穿慢速线,且收盘价高于快速线,且股价高于抛物线时,才最终产生买入信号;反之亦然。

- 根据最大承受损失设定止损线。结合ATR指标计算具体的止损价

策略优势

- 利用移动平均线判断市场趋势方向,避免在无明确方向的盘整市场频繁交易

- 双重过滤条件可有效避免常见的假突破问题

- 结合止损策略有效控制单笔亏损

策略风险

- 指标策略容易产生虚假信号

- 未考虑货币风险

- 可能错过初期不同方向的行情

针对以上问题,可以从以下几个方面进行优化 1. 优化移动平均线参数,使其更贴合具体品种 2. 可以结合其他指标或模型进行信号过滤 3. 考虑实时对冲或自动转换券商账户的货币风险

优化方向

- 优化移动平均线参数,更好捕捉趋势

- 增加模型组合,提高信号准确性

- 多时间周期验证,避免被套

- 优化止损策略,提高策略稳定性

总结

本策略属于典型的双移动平均线以及指标组合趋势跟踪策略。通过比较快慢两条移动平均线方向,判断市场趋势;并结合多种过滤指标避免假信号,从而产生交易信号。同时,策略具备止损功能以控制单笔亏损。优点是策略逻辑简单清晰,容易理解实现,可根据需要灵活优化。缺点是作为粗略趋势判断工具,信号准确性有待提高,可通过引入机器学习等高级模型进行优化。

策略源码

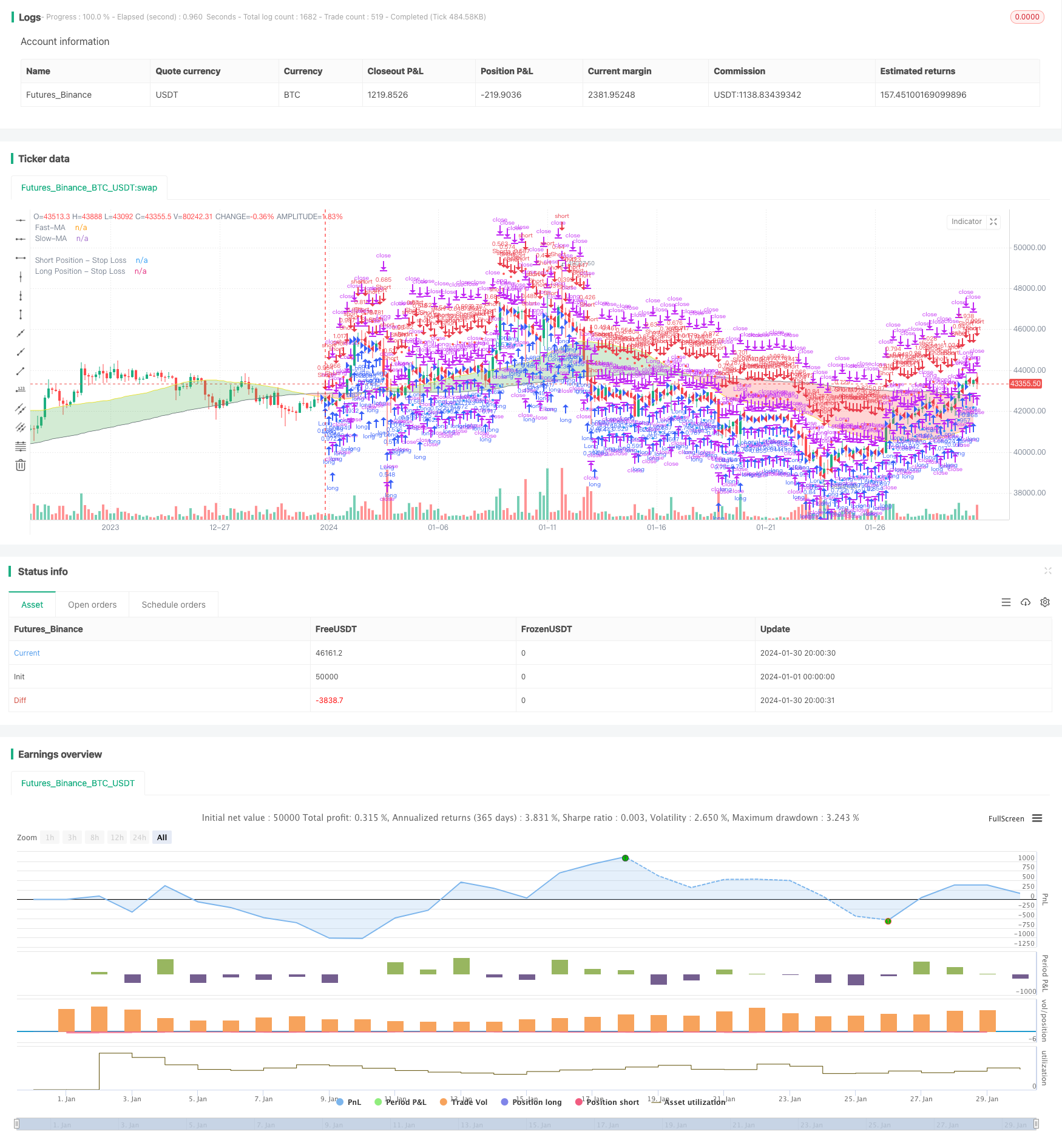

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sosacur01

//@version=5

strategy(title="2 MA | Trend Following", overlay=true, pyramiding=1, commission_type=strategy.commission.percent, commission_value=0.2, initial_capital=10000)

//==========================================

//BACKTEST RANGE

useDateFilter = input.bool(true, title="Filter Date Range of Backtest",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 jan 2000"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

backtestEndDate = input(timestamp("1 Jul 2100"),

title="End Date", group="Backtest Time Period",

tooltip="This end date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

inTradeWindow = true

if not inTradeWindow and inTradeWindow[1]

strategy.cancel_all()

strategy.close_all(comment="Date Range Exit")

//--------------------------------------

//LONG/SHORT POSITION ON/OFF INPUT

LongPositions = input.bool(title='On/Off Long Postion', defval=true, group="Long & Short Position")

ShortPositions = input.bool(title='On/Off Short Postion', defval=true, group="Long & Short Position")

//---------------------------------------

//SLOW MA INPUTS

averageType1 = input.string(defval="SMA", group="Slow MA Inputs", title="Slow MA Type", options=["SMA", "EMA", "WMA", "HMA", "RMA", "SWMA", "ALMA", "VWMA", "VWAP"])

averageLength1 = input.int(defval=160, group="Slow MA Inputs", title="Slow MA Length", minval=50)

averageSource1 = input(close, title="Slow MA Source", group="Slow MA Inputs")

//SLOW MA TYPE

MovAvgType1(averageType1, averageSource1, averageLength1) =>

switch str.upper(averageType1)

"SMA" => ta.sma(averageSource1, averageLength1)

"EMA" => ta.ema(averageSource1, averageLength1)

"WMA" => ta.wma(averageSource1, averageLength1)

"HMA" => ta.hma(averageSource1, averageLength1)

"RMA" => ta.rma(averageSource1, averageLength1)

"SWMA" => ta.swma(averageSource1)

"ALMA" => ta.alma(averageSource1, averageLength1, 0.85, 6)

"VWMA" => ta.vwma(averageSource1, averageLength1)

"VWAP" => ta.vwap(averageSource1)

=> runtime.error("Moving average type '" + averageType1 +

"' not found!"), na

//----------------------------------

//FAST MA INPUTS

averageType2 = input.string(defval="SMA", group="Fast MA Inputs", title="Fast MA Type", options=["SMA","EMA","WMA","HMA","RMA","SWMA","ALMA","VWMA","VWAP"])

averageLength2 = input.int(defval=40, group="Fast MA Inputs", title="Fast MA Length", maxval=40)

averageSource2 = input(close, title="Fast MA Source", group="Fast MA Inputs")

//FAST MA TYPE

MovAvgType2(averageType2, averageSource2, averageLength2) =>

switch str.upper(averageType2)

"SMA" => ta.sma(averageSource2, averageLength2)

"EMA" => ta.ema(averageSource2, averageLength2)

"WMA" => ta.wma(averageSource2, averageLength2)

"HMA" => ta.hma(averageSource2, averageLength2)

"RMA" => ta.rma(averageSource2, averageLength2)

"SWMA" => ta.swma(averageSource2)

"ALMA" => ta.alma(averageSource2, averageLength2, 0.85, 6)

"VWMA" => ta.vwma(averageSource2, averageLength2)

"VWAP" => ta.vwap(averageSource2)

=> runtime.error("Moving average type '" + averageType2 +

"' not found!"), na

//---------------------------------------------------

//MA VALUES

FASTMA = MovAvgType2(averageType2, averageSource2, averageLength2)

SLOWMA = MovAvgType1(averageType1, averageSource1, averageLength1)

//BUY/SELL TRIGGERS

bullish_trend = FASTMA > SLOWMA and close > FASTMA

bearish_trend = FASTMA < SLOWMA and close < FASTMA

//MAs PLOT

plot1 = plot(SLOWMA,color=color.gray, linewidth=1, title="Slow-MA")

plot2 = plot(FASTMA,color=color.yellow, linewidth=1, title="Fast-MA")

fill(plot1, plot2, color=SLOWMA>FASTMA ? color.new(color.red, 70) : color.new(color.green, 70), title="EMA Clouds")

//-----------------------------------------------------

//PARABOLIC SAR USER INPUT

usepsarFilter = input.bool(title='Use Parabolic Sar?', defval=true, group = "Parabolic SAR Inputs")

psar_display = input.bool(title="Display Parabolic Sar?", defval=false, group="Parabolic SAR Inputs")

start = input.float(title="Start", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

increment = input.float(title="Increment", defval=0.02, group="Parabolic SAR Inputs", step=0.001)

maximum = input.float(title="Maximum", defval=0.2, group="Parabolic SAR Inputs", step=0.001)

//SAR VALUES

psar = request.security(syminfo.tickerid, "D", ta.sar(start, increment, maximum))

//BULLISH & BEARISH PSAR CONDITIONS

bullish_psar = (usepsarFilter ? low > psar : bullish_trend )

bearsish_psar = (usepsarFilter ? high < psar : bearish_trend)

//SAR PLOT

psar_plot = if low > psar

color.rgb(198, 234, 199, 13)

else

color.rgb(219, 134, 134, 48)

plot(psar_display ? psar : na, color=psar_plot, title="Par SAR")

//-------------------------------------

//ENTRIES AND EXITS

long_entry = if inTradeWindow and bullish_trend and bullish_psar and LongPositions

true

long_exit = if inTradeWindow and bearish_trend

true

short_entry = if inTradeWindow and bearish_trend and bearsish_psar and ShortPositions

true

short_exit = if inTradeWindow and bullish_trend

true

//--------------------------------------

//RISK MANAGEMENT - SL, MONEY AT RISK, POSITION SIZING

atrPeriod = input.int(14, "ATR Length", group="Risk Management Inputs")

sl_atr_multiplier = input.float(title="Long Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

sl_atr_multiplier_short = input.float(title="Short Position - Stop Loss - ATR Multiplier", defval=2, group="Risk Management Inputs", step=0.5)

i_pctStop = input.float(2, title="% of Equity at Risk", step=.5, group="Risk Management Inputs")/100

//ATR VALUE

_atr = ta.atr(atrPeriod)

//CALCULATE LAST ENTRY PRICE

lastEntryPrice = strategy.opentrades.entry_price(strategy.opentrades - 1)

//STOP LOSS - LONG POSITIONS

var float sl = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - LONG POSITION

if (strategy.position_size[1] != strategy.position_size)

sl := lastEntryPrice - (_atr * sl_atr_multiplier)

//IN TRADE - LONG POSITIONS

inTrade = strategy.position_size > 0

//PLOT SL - LONG POSITIONS

plot(inTrade ? sl : na, color=color.blue, style=plot.style_circles, title="Long Position - Stop Loss")

//CALCULATE ORDER SIZE - LONG POSITIONS

positionSize = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier)

//============================================================================================

//STOP LOSS - SHORT POSITIONS

var float sl_short = na

//CALCULTE SL WITH ATR AT ENTRY PRICE - SHORT POSITIONS

if (strategy.position_size[1] != strategy.position_size)

sl_short := lastEntryPrice + (_atr * sl_atr_multiplier_short)

//IN TRADE SHORT POSITIONS

inTrade_short = strategy.position_size < 0

//PLOT SL - SHORT POSITIONS

plot(inTrade_short ? sl_short : na, color=color.red, style=plot.style_circles, title="Short Position - Stop Loss")

//CALCULATE ORDER - SHORT POSITIONS

positionSize_short = (strategy.equity * i_pctStop) / (_atr * sl_atr_multiplier_short)

//===============================================

//LONG STRATEGY

strategy.entry("Long", strategy.long, comment="Long", when = long_entry, qty=positionSize)

if (strategy.position_size > 0)

strategy.close("Long", when = (long_exit), comment="Close Long")

strategy.exit("Long", stop = sl, comment="Exit Long")

//SHORT STRATEGY

strategy.entry("Short", strategy.short, comment="Short", when = short_entry, qty=positionSize_short)

if (strategy.position_size < 0)

strategy.close("Short", when = (short_exit), comment="Close Short")

strategy.exit("Short", stop = sl_short, comment="Exit Short")

//ONE DIRECTION TRADING COMMAND (BELLOW ONLY ACTIVATE TO CORRECT BUGS)