Estrategia de seguimiento de bajo riesgo con pirámide de punto bajo

Esta estrategia reduce el riesgo mediante la combinación de diferentes indicadores para identificar los puntos bajos potenciales en el movimiento de los precios y mediante el seguimiento de la pirámide para construir una posición gradual. Al mismo tiempo, la estrategia combina funciones como stop loss, stop loss y stop loss móvil para controlar el riesgo de manera efectiva.

Descripción general de la estrategia

La estrategia utiliza primero la diferencia entre el RSI y el RSI de la EMA para identificar posibles bajos en el precio. Para filtrar falsas señales, la estrategia también combina promedios móviles y indicadores aleatorios de múltiples marcos temporales para confirmar. Una vez que se confirma la señal de un punto bajo, se crean gradualmente varios pedidos en el lugar un poco más bajo, lo que es la idea de la pirámide de seguimiento.

Principio de estrategia

La estrategia se compone principalmente de tres partes: un módulo de identificación de puntos bajos, un módulo de seguimiento de la pirámide y un módulo de control de riesgos.

Modulo de reconocimiento de puntos bajosSe utiliza el diferencial entre el indicador RSI y su EMA para identificar los puntos bajos potenciales de los precios. Para mejorar la precisión, también se introduce un indicador de media móvil y un indicador aleatorio de múltiples marcos de tiempo para filtrar la señal. La validez de la señal de punto bajo solo se confirma cuando el precio está por debajo de la media móvil y la línea K del indicador aleatorio está por debajo de 30.

Módulo de seguimiento de la pirámideEs el núcleo de esta estrategia. Una vez que se confirma la señal de un punto bajo, la estrategia abre la primera orden 0.1% por debajo de ese punto bajo. Después, se seguirán agregando más órdenes siempre que el precio siga bajando y esté por debajo de la proporción de precio de entrada promedio.

Módulo de control de riesgosSe trata principalmente de tres aspectos. El primero es el total de la parada de pérdidas, basado en el precio más alto calculado en el último período determinado. Todas las órdenes se detienen al mismo tiempo con este punto de parada. El segundo es la configuración de la parada de cada orden independiente, que permite detenerse en función de una cierta proporción del precio de entrada.

Ventajas estratégicas

- El uso de la pirámide de seguimiento para reducir el riesgo de los pedidos individuales, mientras que la dispersión del riesgo global

- Combinación de múltiples indicadores para mejorar la precisión de la identificación de puntos bajos

- El control de riesgos es eficaz con las funciones de parada total, parada y parada móvil

- El mecanismo de suspensión de la proporción de derechos y intereses protege las cuentas de pérdidas importantes

- Se puede encontrar el punto de equilibrio entre el riesgo y el beneficio ajustando los parámetros

Riesgo estratégico

- La precisión de reconocimiento de puntos bajos aún tiene ciertas limitaciones, ya que puede perderse el punto de entrada óptimo o entrar en una señal falsa.

- El aumento de los pedidos podría ser perjudicial y aumentar las pérdidas

- Se requiere un ciclo de operación más largo para mostrar las ventajas de la estrategia

- La configuración incorrecta de los parámetros puede conducir a un control de riesgo insuficiente

Para reducir los riesgos mencionados anteriormente, se puede optimizar en los siguientes aspectos:

- Reemplazar o agregar indicadores para mejorar la precisión de la identificación de puntos bajos

- Optimización de los parámetros como el número de pedidos, el intervalo y la escalabilidad para reducir el riesgo de pedidos individuales

- Reducir adecuadamente el stop loss y proteger las ganancias

- Prueba de variedades, selecciona variedades con buena fluidez y mayor volatilidad

Dirección de optimización de la estrategia

La estrategia aún tiene espacio para ser optimizada:

- Intentar introducir tecnologías más avanzadas como el aprendizaje automático para identificar puntos bajos

- Parámetros como el número de órdenes, el límite de pérdidas y otros que se ajustan a la dinámica del mercado

- Aumentar las estrategias de pérdidas dentro de la caja para evitar la expansión de las pérdidas

- Mecanismo de reingreso más amplio

- Parámetros estratégicos para optimizar las variedades de acciones y monedas digitales

Resumir

La estrategia de seguimiento de la pirámide reduce el riesgo de los pedidos individuales, y las funciones de stop loss, stop loss y stop loss móvil también juegan un buen papel en el control del riesgo. Sin embargo, la identificación de puntos bajos todavía tiene espacio para la optimización, si se puede introducir una tecnología más avanzada, agregar funciones de modelado dinámico y, luego, combinar la optimización de los parámetros, la proporción de riesgo de ganancias de la estrategia se mejorará considerablemente.

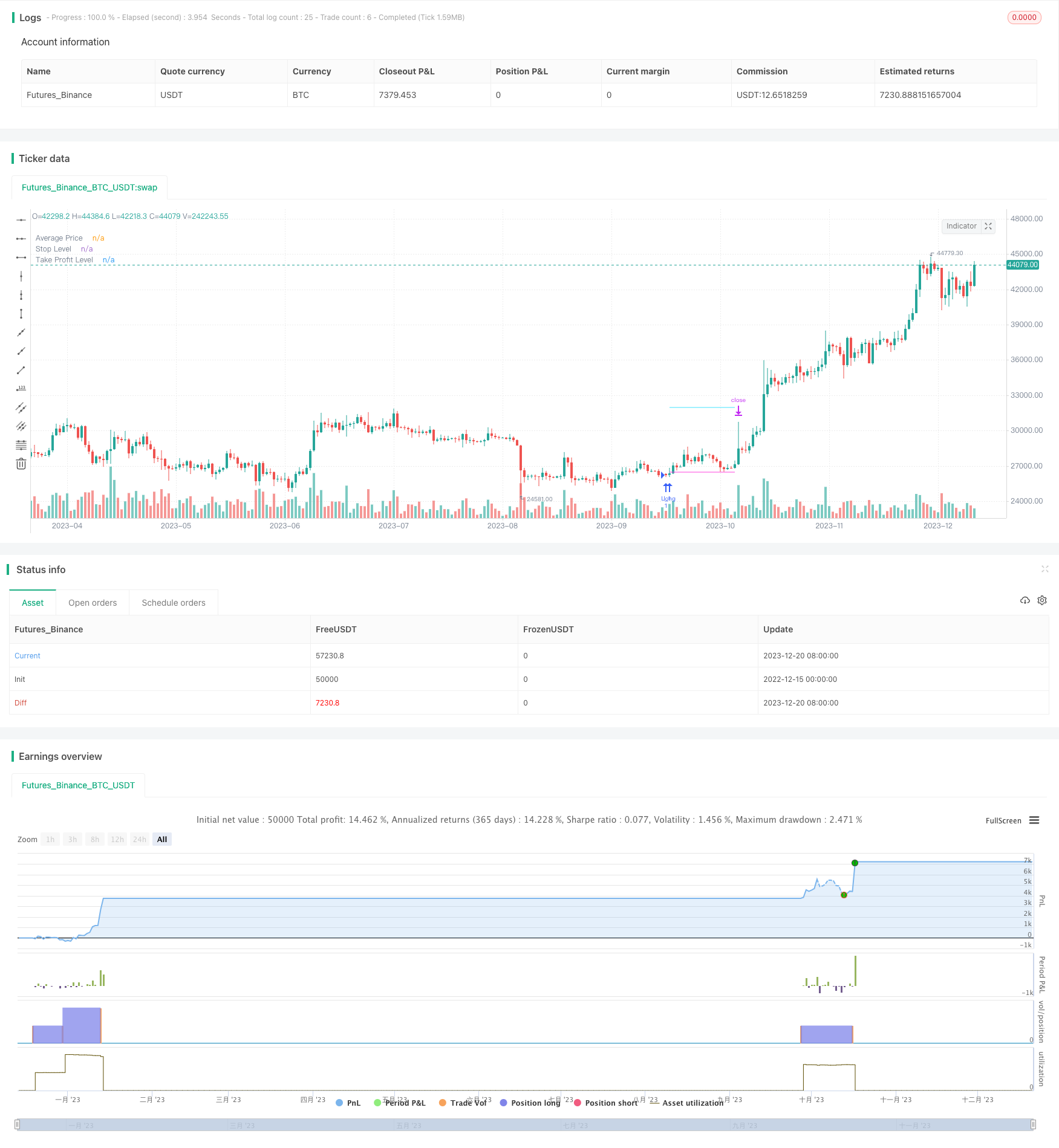

/*backtest

start: 2022-12-15 00:00:00

end: 2023-12-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © A3Sh

//@version=5

// Strategy that finds potential lows in the price action and spreads the risk by entering multiple positions at these lows.

// The low is detected based on the difference between MTF RSI and EMA based RSI, Moving Average and MTF Stochastic indicators.

// The size of each next position that is entered is multiplied by the sequential number of the position.

// Each separate position can exit when a specified take profit is triggered and re-open when detecting a new potential low.

// All positions are closed when the price action crosses over the dynamic blue stop level line.

// This strategy combines open-source code developed by fellow Tradingview community members:

// The Lowfinder code is developed by RafaelZioni

// https://www.tradingview.com/script/GzKq2RVl-Low-finder/

// Both the MTF RSI code and the MTF Stochastic code are adapted from the MTFindicators libary written by Peter_O

// https://www.tradingview.com/script/UUVWSpXR-MTFindicators/

// The Stop Level calculation is inspired by the syminfo-mintick tutorial on Kodify.net

// https://kodify.net/tradingview/info/syminfo-mintick/

strategy("LowFinder_PyraMider",

overlay=true, pyramiding=99,

precision=2,

initial_capital=10000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10,

commission_type=strategy.commission.percent,

commission_value=0.06,

slippage=1

)

// Backtest Window

start_time = input(defval=timestamp("01 April 2021 20:00"), group = "Backtest Window", title="Start Time")

end_time = input(defval=timestamp("01 Aug 2030 20:00"), group = "Backtest Window", title="End Time")

window() => true

// Inputs

portfolio_size = input.float (100, group = 'Risk - Portfolio', title = 'Portfolio %', step=1.0) / 100

leverage = input.int (1, group = 'Risk - Portfolio', title = 'Leverage', minval = 1)

q_mode = input.string ('multiply', group = 'Risk - Order Size', title = 'Order Size Mode', options = ['base', 'multiply'], tooltip = 'Base mode: the base quantiy for each sequential order. Multiply mode: each quantity is multiplied by order number')

q_mode_m = input.int (1, group = 'Risk - Order Size', title = 'Order Size Divider (Multiply Mode)', tooltip = 'Divide Multiply by this number to lower the sequential order sizes')

fixed_q = input.bool (false, group = 'Risk - Order Size', title = 'Fixed Order Size', inline = '01', tooltip = 'Use with caution! Overrides all Risk calculations')

amount_q = input.float (1, group = 'Risk - Order Size', title = '. . Base Currency:', inline = '01')

sl_on = input.bool (false, group = 'Risk - Stop Loss', title = 'StopLoss of', inline = '03')

stopLoss = input.float (1.5, group = 'Risk - Stop Loss', title = '', step=0.1, inline = '03') / 100

sl_mode = input.string ('equity', group = 'Risk - Stop Loss', title = '% of', options = ['avg_price', 'equity'], inline = '03')

stop_len = input.int (100, group = 'Risk - Stop Level', title = 'Stop Level Length', tooltip = 'Lookback most recent highest high')

stop_deviation = input.float (0.3, group = 'Risk - Stop Level', title = 'Deviatation % above Stop Level', step=0.1) / 100

cond2_toggle = input.bool (true , group = 'Risk - Take Profit', title = 'Take Profit/Trailing Stop', inline = '04')

tp_all = input.float (1.0, group = 'Risk - Take Profit', title = '..........%', step=0.1, inline = '04') / 100

tp_on = input.bool (true, group = 'Risk - Take Profit', title = 'Exit Crossover Take Profit and .....', inline = '02')

exit_mode = input.string ('stoplevel', group = 'Risk - Take Profit', title = '', options = ['close', 'stoplevel'], inline = '02')

takeProfit = input.float (10.0, group = 'Risk - Take Profit', title = 'Take Profit % per Order', tooltip = 'Each separate order exits when hit', step=0.1)

posCount = input.int (12, group = 'Pyramiding Settings', title = 'Max Number of Orders')

next_entry = input.float (0.2, group = 'Pyramiding Settings', title = 'Next Order % below Avg. Price', step=0.1)

oa_lookback = input.int (0, group = 'Pyramiding Settings', title = 'Next Order after X candles', tooltip = 'Prevents opening too much orders in a Row')

len_rsi = input.int (5, group = 'MTF LowFinder Settings', title = 'Lookback of RSI')

mtf_rsi = input.int (1, group = 'MTF LowFinder Settings', title = 'Higher TimeFrame Multiplier RSI', tooltip='Multiplies the current timeframe by specified value')

ma_length = input.int (26, group = 'MTF LowFinder Settings', title = 'MA Length / Sensitivity')

new_entry = input.float (0.1, group = 'MTF LowFinder Settings', title = 'First Order % below Low',step=0.1, tooltip = 'Open % lower then the found low')/100

ma_signal = input.int (100, group = 'Moving Average Filter', title = 'Moving Average Length')

periodK = input.int (14, group = 'MTF Stochastic Filter', title = 'K', minval=1)

periodD = input.int (3, group = 'MTF Stochastic Filter', title = 'D', minval=1)

smoothK = input.int (3, group = 'MTF Stochastic Filter', title = 'Smooth', minval=1)

lower = input.int (30, group = 'MTF Stochastic Filter', title = 'MTF Stoch Filter (above gets filtered)')

mtf_stoch = input.int (10, group = 'MTF Stochastic Filter', title = 'Higher TimeFrame Multiplier', tooltip='Multiplies the current timeframe by specified value')

avg_on = input.bool (true, group = 'Plots', title = 'Plot Average Price')

plot_ma = input.bool (false, group = 'Plots', title = 'Plot Moving Average')

plot_ts = input.bool (false, group = 'Plots', title = 'Plot Trailing Stop Level')

// variables //

var entry_price = 0.0 // The entry price of the first entry

var previous_entry = 0.0 // Stores the price of the previous entry

var iq = 0.0 // Inititial order quantity before risk calculation

var nq = 0.0 // Updated new quantity after the loop

var oq = 0.0 // Old quantity at the beginning or the loop

var q = 0.0 // Final calculated quantity used as base order size

var int order_after = 0

// Order size calaculations //

// Order size based on max amount of pyramiding orders or fixed by user input ///

// Order size calculation based on 'base' mode or ' multiply' mode //

if fixed_q

q := amount_q

else if q_mode == 'multiply'

iq := (math.abs(strategy.equity * portfolio_size / posCount) / open) * leverage

oq := iq

for i = 0 to posCount

nq := oq + (iq * ( i/ q_mode_m + 1))

oq := nq

q := (iq * posCount / oq) * iq

else

q := (math.abs(strategy.equity * portfolio_size / posCount) / open) * leverage

// Function to calcaulate final order size based on order size modes and round the result with 1 decimal //

quantity_mode(index,string q_mode) =>

q_mode == 'base' ? math.round(q,1) : q_mode == 'multiply' ? math.round(q * (index/q_mode_m + 1),1) : na

// LowFinder Calculations //

// MTF RSI by Peter_O //

rsi_mtf(float source, simple int mtf,simple int len) =>

change_mtf=source-source[mtf]

up_mtf = ta.rma(math.max(change_mtf, 0), len*mtf)

down_mtf = ta.rma(-math.min(change_mtf, 0), len*mtf)

rsi_mtf = down_mtf == 0 ? 100 : up_mtf == 0 ? 0 : 100 - (100 / (1 + up_mtf / down_mtf))

// Lowfinder by RafaelZioni //

vrsi = rsi_mtf(close,mtf_rsi,len_rsi)

pp=ta.ema(vrsi,ma_length)

dd=(vrsi-pp)*5

cc=(vrsi+dd+pp)/2

lows=ta.crossover(cc,0)

// MTF Stoch Calcualation // MTF Stoch adapted from Peter_O //

stoch_mtfK(source, mtf, len) =>

k = ta.sma(ta.stoch(source, high, low, periodK * mtf), smoothK * mtf)

stoch_mtfD(source, mtf, len) =>

k = ta.sma(ta.stoch(source, high, low, periodK * mtf), smoothK * mtf)

d = ta.sma(k, periodD * mtf)

mtfK = stoch_mtfK(close, mtf_stoch, periodK)

mtfD = stoch_mtfD(close, mtf_stoch, periodK)

// Open next position % below average position price //

below_avg = close < (strategy.position_avg_price * (1 - (next_entry / 100)))

// Moving Average Filter //

moving_average_signal = ta.sma(close, ma_signal)

plot (plot_ma ? moving_average_signal : na, title = 'Moving Average', color = color.rgb(154, 255, 72))

// Buy Signal //

buy_signal = lows and close < moving_average_signal and mtfK < lower

// First Entry % Below lows //

if buy_signal

entry_price := close * (1 - new_entry)

// Plot Average Price of Position//

plot (avg_on ? strategy.position_avg_price : na, title = 'Average Price', style = plot.style_linebr, color = color.new(color.white,0), linewidth = 1)

// Take profit per Open Order //

take_profit_price = close * takeProfit / 100 / syminfo.mintick

// Calculate different Stop Level conditions to exit All //

// Stop Level Caculation //

stop_long1_level = ta.highest (high, stop_len)[1] * (1 + stop_deviation)

stop_long2_level = ta.highest (high, stop_len)[2] * (1 + stop_deviation)

stop_long3_level = ta.highest (high, stop_len)[3] * (1 + stop_deviation)

stop_long4_level = ta.highest (high, stop_len)[1] * (1 - 0.008)

// Stop triggers //

stop_long1 = ta.crossover(close,stop_long1_level)

stop_long2 = ta.crossover(close,stop_long2_level)

stop_long4 = ta.crossunder(close,stop_long4_level)

// Exit Conditions, cond 1 only Stop Level, cond2 Trailing Stop option //

exit_condition_1 = close < strategy.position_avg_price ? stop_long1 : close > strategy.position_avg_price ? stop_long2 : na

exit_condition_2 = close < strategy.position_avg_price * (1 + tp_all) ? stop_long2 :

close > strategy.position_avg_price * (1 + tp_all) ? stop_long4 :

close < strategy.position_avg_price ? stop_long1 : na

// Switch between conditions //

exit_conditions = cond2_toggle ? exit_condition_2 : exit_condition_1

// Exit when take profit //

ex_m = exit_mode == 'close' ? close : stop_long2_level

tp_exit = ta.crossover(ex_m, strategy.position_avg_price * (1 + tp_all)) and close > strategy.position_avg_price * 1.002

// Plot stoplevel, take profit level //

plot_stop_level = strategy.position_size > 0 ? stop_long2_level : na

plot_trailing_stop = cond2_toggle and plot_ts and strategy.position_size > 0 and close > strategy.position_avg_price * (1 + tp_all) ? stop_long4_level : na

plot(plot_stop_level, title = 'Stop Level', style=plot.style_linebr, color = color.new(#41e3ff, 0), linewidth = 1)

plot(plot_trailing_stop, title = 'Trailing Stop', style=plot.style_linebr, color = color.new(#4cfca4, 0), linewidth = 1)

plot_tp_level = cond2_toggle and strategy.position_size > 0 ? strategy.position_avg_price * (1 + tp_all) : na

plot(plot_tp_level, title = 'Take Profit Level', style=plot.style_linebr, color = color.new(#ff41df, 0), linewidth = 1)

// Calculate Stop Loss based on equity and average price //

loss_equity = ((strategy.position_size * strategy.position_avg_price) - (strategy.equity * stopLoss)) / strategy.position_size

loss_avg_price = strategy.position_avg_price * (1 - stopLoss)

stop_loss = sl_mode == 'avg_price' ? loss_avg_price : loss_equity

plot(strategy.position_size > 0 and sl_on ? stop_loss : na, title = 'Stop Loss', color=color.new(color.red,0),style=plot.style_linebr, linewidth = 1)

// Enter first position //

if ta.crossunder(close,entry_price) and window() and strategy.position_size == 0

strategy.entry('L_1', strategy.long, qty = math.round(q,1), comment = '+' + str.tostring(math.round(q,1)))

previous_entry := close

// Enter next pyramiding positions //

if buy_signal and window() and strategy.position_size > 0 and below_avg

order_after := order_after + 1

for i = 1 to strategy.opentrades

entry_comment = '+' + str.tostring((quantity_mode(i,q_mode))) // Comment with variable //

if strategy.opentrades == i and i < posCount and order_after > oa_lookback

entry_price := close

entry_id = 'L_' + str.tostring(i + 1)

strategy.entry(id = entry_id, direction=strategy.long, limit=entry_price, qty= quantity_mode(i,q_mode), comment = entry_comment)

previous_entry := entry_price

order_after := 0

// Exit per Position //

if strategy.opentrades > 0 and window()

for i = 0 to strategy.opentrades

exit_comment = '-' + str.tostring(strategy.opentrades.size(i))

exit_from = 'L_' + str.tostring(i + 1)

exit_id = 'Exit_' + str.tostring(i + 1)

strategy.exit(id= exit_id, from_entry= exit_from, profit = take_profit_price, comment = exit_comment)

// Exit All //

if exit_conditions or (tp_exit and tp_on and cond2_toggle) and window()

strategy.close_all('Exti All')

entry_price := 0

if ta.crossunder(close,stop_loss) and sl_on and window()

strategy.close_all('StopLoss')

entry_price := 0