RSI MTF Ob+Os

Auteur:Inventeur de la quantification, Date: 2022-05-09 15h35 et 09 minLes étiquettes:Indice de résistance

Bonjour les commerçants,

Cet indicateur utilise le même concept que mon précédent indicateur

Il s'agit d'un simple indicateur

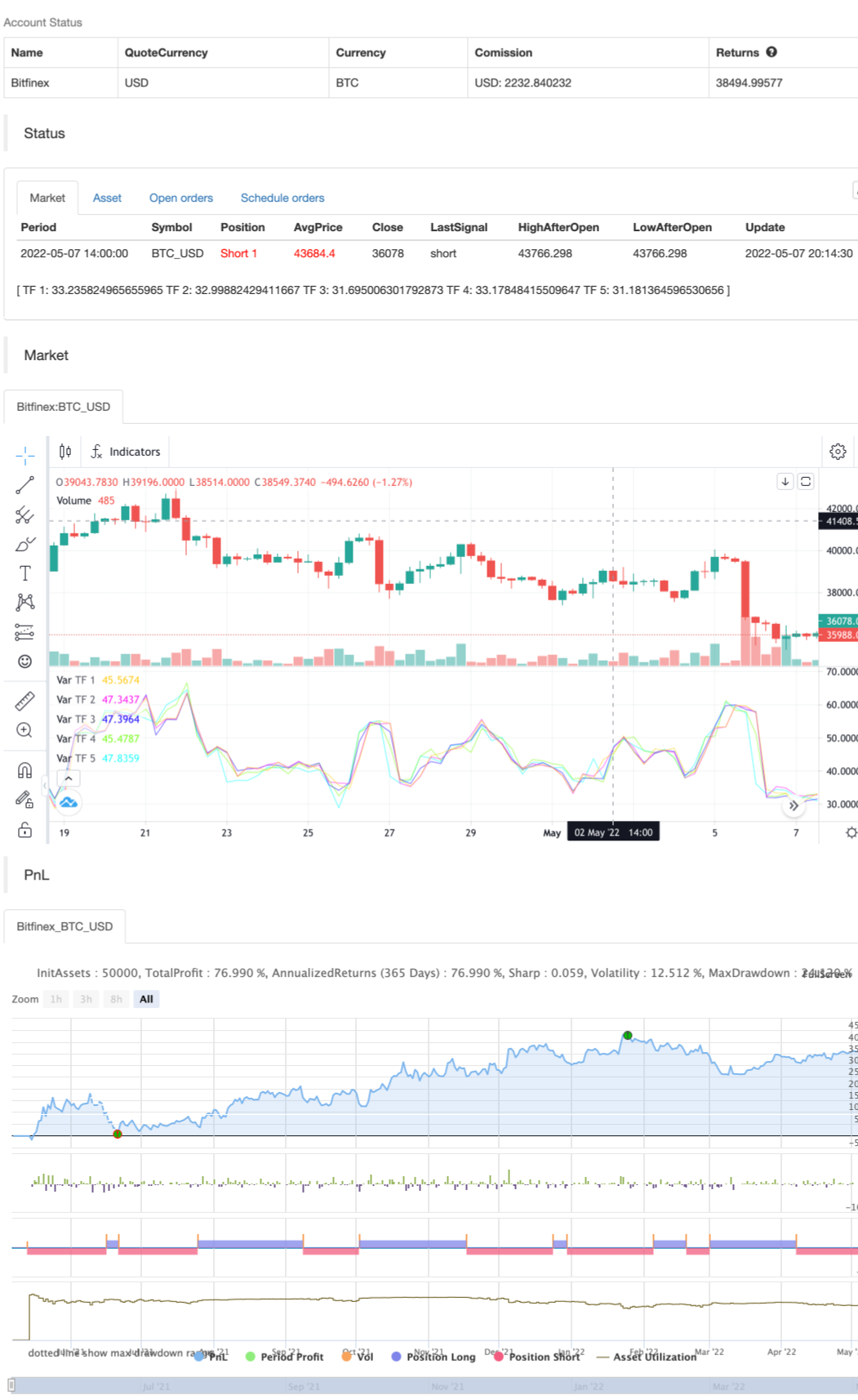

Il peut détecter les niveaux de surachat et de survente jusqu'à 5 délais, ce qui aide les traders à repérer plus facilement un point d'inversion potentiel.

Il existe des options pour sélectionner des délais allant de 1 à 5 pour détecter le surachat et le survente.

Aqua Background est en survente, à la recherche de Long. Orange Background est "Overbought", à la recherche de "Short".

Amusez-vous!

/*backtest

start: 2021-05-08 00:00:00

end: 2022-05-07 23:59:00

period: 6h

basePeriod: 15m

exchanges: [{"eid":"Bitfinex","currency":"BTC_USD"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © thakon33

// __ __ __ ____ ____

// / /_/ / ___ _/ /_____ ___ |_ /|_ /

// / __/ _ \/ _ `/ '_/ _ \/ _ \_/_ <_/_ <

// \__/_//_/\_,_/_/\_\\___/_//_/____/____/

//@version=5

indicator("RSI MTF Ob+Os")

//------------------------------------------------------------------------------

// Input

var g_rsi = "[ RSI SETTING ]"

rsiSrc = input (title="Source", defval=close, group=g_rsi)

rsiLength = input.int(title="Length", defval=14, minval=1, group=g_rsi)

rsiOverbought = input.int(title="Overbought", defval=65, minval=50, maxval=99, step=1, group=g_rsi)

rsiOversold = input.int(title="Oversold", defval=35, minval=1, maxval=50, step=1, group=g_rsi)

var g_tf = "[ SELECT TIMEFRAME ]"

rsiTf1 = input.timeframe(title="Timeframe 1", defval="15", group=g_tf, inline="tf1")

rsiTf2 = input.timeframe(title="Timeframe 2", defval="30", group=g_tf, inline="tf2")

rsiTf3 = input.timeframe(title="Timeframe 3", defval="60", group=g_tf, inline="tf3")

rsiTf4 = input.timeframe(title="Timeframe 4", defval="120", group=g_tf, inline="tf4")

rsiTf5 = input.timeframe(title="Timeframe 5", defval="240", group=g_tf, inline="tf5")

rsiTf1_E = input.bool(title="", defval=true, group=g_tf, inline="tf1")

rsiTf2_E = input.bool(title="", defval=true, group=g_tf, inline="tf2")

rsiTf3_E = input.bool(title="", defval=true, group=g_tf, inline="tf3")

rsiTf4_E = input.bool(title="", defval=true, group=g_tf, inline="tf4")

rsiTf5_E = input.bool(title="", defval=true, group=g_tf, inline="tf5")

//------------------------------------------------------------------------------

// Calculate RSI

Fsec(Sym, Tf, Exp) =>

request.security(Sym, Tf, Exp[barstate.isrealtime ? 1 : 0], barmerge.gaps_off, barmerge.lookahead_off) [barstate.isrealtime ? 0 : 1]

rsi1 = Fsec(syminfo.tickerid, rsiTf1, ta.rsi(rsiSrc, rsiLength))

rsi2 = Fsec(syminfo.tickerid, rsiTf2, ta.rsi(rsiSrc, rsiLength))

rsi3 = Fsec(syminfo.tickerid, rsiTf3, ta.rsi(rsiSrc, rsiLength))

rsi4 = Fsec(syminfo.tickerid, rsiTf4, ta.rsi(rsiSrc, rsiLength))

rsi5 = Fsec(syminfo.tickerid, rsiTf5, ta.rsi(rsiSrc, rsiLength))

//------------------------------------------------------------------------------

// RSI Overbought and Oversold detect

rsi1_Ob = not rsiTf1_E or rsi1 >= rsiOverbought

rsi2_Ob = not rsiTf2_E or rsi2 >= rsiOverbought

rsi3_Ob = not rsiTf3_E or rsi3 >= rsiOverbought

rsi4_Ob = not rsiTf4_E or rsi4 >= rsiOverbought

rsi5_Ob = not rsiTf5_E or rsi5 >= rsiOverbought

rsi1_Os = not rsiTf1_E or rsi1 <= rsiOversold

rsi2_Os = not rsiTf2_E or rsi2 <= rsiOversold

rsi3_Os = not rsiTf3_E or rsi3 <= rsiOversold

rsi4_Os = not rsiTf4_E or rsi4 <= rsiOversold

rsi5_Os = not rsiTf5_E or rsi5 <= rsiOversold

rsiOb = rsi1_Ob and rsi2_Ob and rsi3_Ob and rsi4_Ob and rsi5_Ob

rsiOs = rsi1_Os and rsi2_Os and rsi3_Os and rsi4_Os and rsi5_Os

//------------------------------------------------------------------------------

// Drawing on chart

plot (rsiTf1_E ? rsi1 : na, title="TF 1", color=color.rgb(255, 205, 22, 20), linewidth=1)

plot (rsiTf2_E ? rsi2 : na, title="TF 2", color=color.rgb(255, 22, 239, 20), linewidth=1)

plot (rsiTf3_E ? rsi3 : na, title="TF 3", color=color.rgb(38, 22, 255, 0), linewidth=1)

plot (rsiTf4_E ? rsi4 : na, title="TF 4", color=color.rgb(123, 253, 22, 20), linewidth=1)

plot (rsiTf5_E ? rsi5 : na, title="TF 5", color=color.rgb(0, 255, 255, 50), linewidth=1)

strategy.entry("BUY", strategy.long, when=rsiOb)

strategy.entry("SELL", strategy.short, when=rsiOs)

//==============================================================================

//==============================================================================

Relationnée

- Le MACD RSI Ichimoku est une tendance de dynamique à la suite d'une longue stratégie.

- RSI Stratégie de changement de direction

- Stratégie de négociation des bandes de Bollinger améliorées RSI

- Stratégie de pivot et de dynamique

- Stratégie de négociation complète des moyennes mobiles et du RSI

- Stratégie de redressement du mardi (filtre du week-end)

- La stratégie de croisement renforcée de l'EMA avec le RSI/MACD/ATR

- Stratégie de négociation à long terme combinée MACD et RSI

- RSI2 Stratégie Réversion intradienne Taux de victoire Test de retour

- Tendance multi-indicateurs à la suite de la stratégie

- Stratégie de négociation AlphaTradingBot

Plus de

- Stratégie de la gamme EHMA

- Moyenne mobile d'achat-vente

- Midas Mk. II - Le dernier Crypto Swing

- Le TMA-Legacy

- La stratégie de TV haut et bas

- Meilleure stratégie de tradingView

- Résultats de l'évaluation de la volatilité

- Chande Kroll Arrêtez

- CCI + EMA avec stratégie croisée RSI

- Stratégie de capture de tendance des bandes EMA + leledc + bandes Bollinger

- Stratégie MACD Willy

- RSI - Signaux d'achat et de vente

- La tendance de Heikin-Ashi

- HA Préjugés de marché

- L'oscillateur lisse du nuage Ichimoku

- Williams %R - Lissé

- QQE MOD + SSL hybride + Waddah Attar explosion

- Acheter ou vendre Strat

- Triple Supertrend avec EMA et ADX

- Tom DeMark Carte de chaleur séquentielle