Strategi penyeberangan rata-rata bergerak

Ringkasan

Strategi ini menggunakan berbagai indikator teknis seperti moving averages, oscillators, dan lain-lain, yang dikombinasikan dengan crossover rata-rata, untuk mengidentifikasi tren harga saham dan titik balik di bawah dan di atas, untuk melakukan operasi jual beli.

Prinsip

Strategi ini terdiri dari beberapa bagian utama:

Tentukan interval: Tentukan jumlah menit pada interval waktu dari peta K, seperti 1 menit, 5 menit, dan sebagainya.

Pilih Moving Average: Mengkonfigurasi parameter EMA, SMA, dan lain-lain yang biasa digunakan, seperti 10th line, 20th line, dll.

Pilih indikator getaran: Konfigurasi parameter indikator getaran seperti RSI, MACD, William.

Menghitung sinyal beli dan jual: Menghitung nilai rata-rata bergerak dan indikator osilasi dengan fungsi yang disesuaikan. Sinyal beli dihasilkan ketika rata-rata jangka pendek melintasi rata-rata jangka panjang; Sinyal jual dihasilkan ketika rata-rata jangka pendek melintasi rata-rata jangka panjang.

Sistem peringkat: Skor numerik dari sinyal beli dan jual dari masing-masing indikator, kemudian rata-rata, mendapatkan indeks peringkat keseluruhan. Indeks peringkat lebih besar dari 0 untuk sinyal beli, lebih kecil dari 0 untuk sinyal jual.

Sinyal perdagangan: menghasilkan sinyal perdagangan akhir berdasarkan indeks peringkat yang lebih besar atau lebih kecil dari 0, untuk melakukan operasi beli atau jual.

Strategi ini menggunakan berbagai indikator dalam kombinasi yang dapat secara efektif mengidentifikasi tren harga dan titik balik, meningkatkan keandalan sinyal. Persegi rata adalah sinyal teknis tren yang efektif, yang dikombinasikan dengan indikator getaran membantu menghindari terobosan palsu. Sistem peringkat juga membuat sinyal perdagangan lebih jelas.

Keunggulan

- Kombinasi crossover dan berbagai indikator getaran, sinyal perdagangan lebih dapat diandalkan dan menghindari sinyal palsu

- Sistem penilaian membuat sinyal jual beli lebih jelas

- Pemrograman modular menggunakan fungsi khusus, struktur kode yang jelas

- Menggunakan berbagai periode waktu untuk analisis kombinasi, meningkatkan akurasi

- Pengaturan parameter yang dioptimalkan, seperti panjang RSI, MACD periode rata-rata cepat dan lambat

- Fleksibilitas ditingkatkan dengan parameter yang dapat disesuaikan dengan indikator dan parameter garis rata-rata

Risiko yang ada

- Performa saham di bursa besar berbeda-beda

- Frekuensi transaksi mungkin lebih tinggi, meningkatkan biaya transaksi dan risiko slippage

- Parameter optimasi perlu diuji berulang kali untuk menyesuaikan dengan karakteristik saham yang berbeda

- Ada beberapa risiko penarikan dan kerugian

Risiko dapat dikurangi dengan melakukan hal-hal berikut:

- Pemilihan saham berdasarkan pergerakan pasar besar

- Adaptasi jangka waktu yang tepat untuk mengurangi frekuensi transaksi

- Pengaturan parameter yang dioptimalkan agar lebih sesuai dengan karakteristik saham

- Menggunakan strategi stop loss untuk mengendalikan kerugian

Arah optimasi

Strategi ini dapat dioptimalkan lebih lanjut dalam beberapa hal:

- Menambahkan lebih banyak indikator, seperti indikator volatilitas, sinyal penguatan

- Parameter pengoptimalan otomatis dengan metode pembelajaran mesin

- Menambahkan modul pilihan saham dan industri

- Kombinasi metode seleksi saham kuantitatif

- Adaptasi dan penghentian

- Pertimbangkan kondisi pasar dan hindari situasi yang tidak pasti

- Analisis hasil transaksi real-time, penyesuaian berat skor

Secara keseluruhan, strategi ini mengintegrasikan breakout rata-rata dan berbagai indikator untuk mengidentifikasi pergerakan harga secara efektif. Namun, perlu terus menguji optimasi, mengendalikan risiko. Di masa depan, dapat dilakukan perbaikan dari portofolio pilihan saham, optimasi parameter, dan stop loss.

Meringkaskan

Strategi ini menggunakan crossover rata-rata sebagai sinyal perdagangan utama, didukung oleh berbagai indikator getaran, dan menggunakan sistem penilaian untuk menghasilkan sinyal jual beli yang jelas. Dapat secara efektif mengidentifikasi tren harga dan titik balik, tetapi perlu mengendalikan frekuensi perdagangan, mengurangi biaya dan risiko perdagangan, dan juga perlu terus mengoptimalkan parameter.

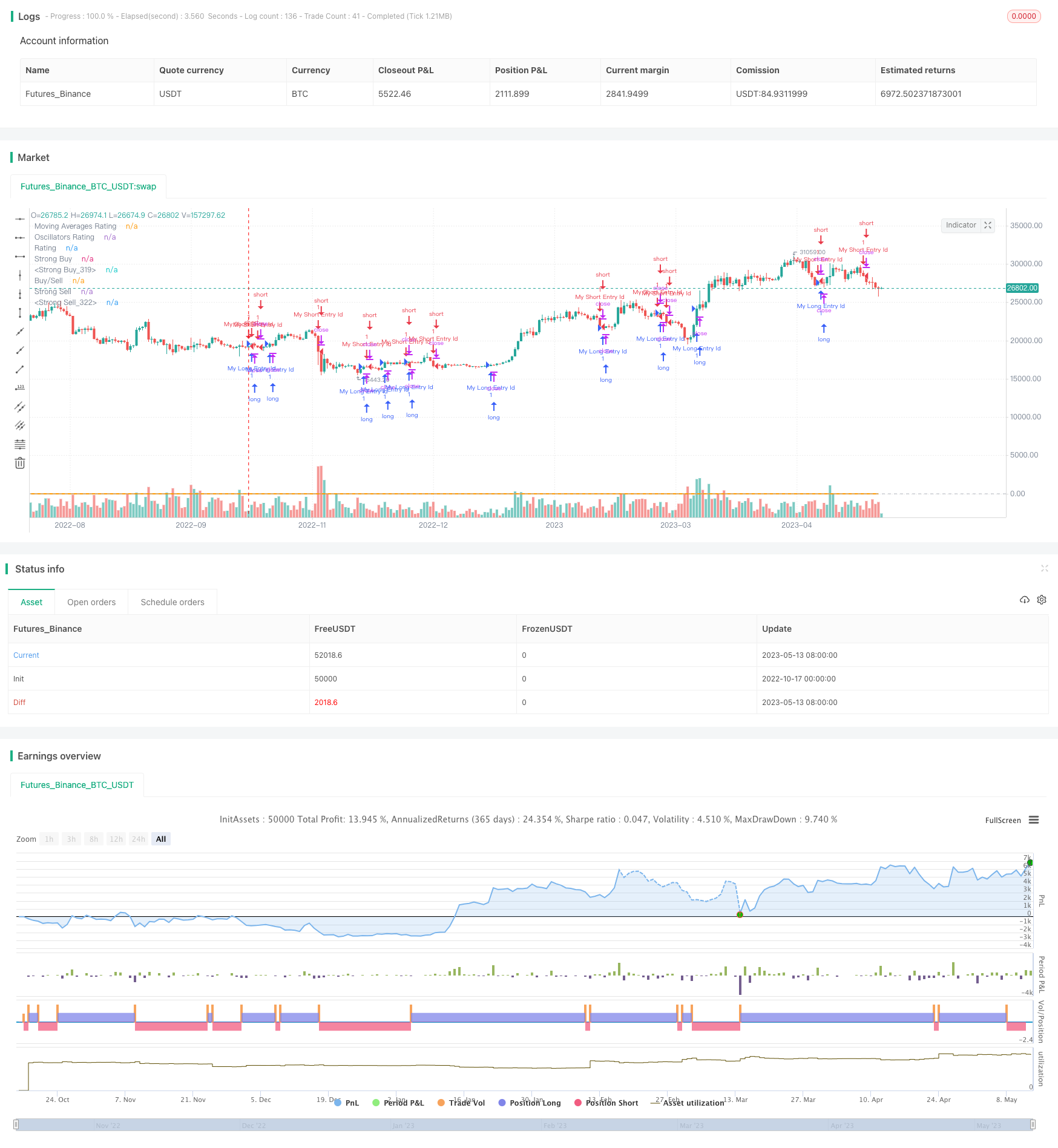

/*backtest

start: 2022-10-17 00:00:00

end: 2023-05-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("TV Signal", overlay=true, initial_capital = 500, currency = "USD")

// -------------------------------------- GLOBAL SELECTION --------------------------------------------- //

//res = input(defval="5" , title="resolution " , type=resolution)

res_num = input("240", title="Resolution (minutes)", options=["1", "5", "15", "60", "240"] )

res = res_num

src = close

// -----------------------------------MOVING AVERAGES SELECTION----------------------------------------- //

// EMAS input

ema10 = 10

ema20 = 20

ema30 = 30

ema50 = 50

ema100 = 100

ema200 = 200

// SMAS input

sma10 = 10

sma20 = 20

sma30 = 30

sma50 = 50

sma100 = 100

sma200 = 200

// Ichimoku - is not active in the calculation brought to you by TV TEAM for the lolz

// VWMA

vwma20 = 20

// Hull

hma9 = 9

// -----------------------------------OSCILLATORS SELECTION----------------------------------------- //

//RSI

rsi_len = input(14, minval=1, title="RSI Length")

//STOCH K

stoch_k = input(14, minval=1, title="STOCH K")

stoch_d = input(3, minval=1, title="STOCH D")

stoch_smooth = input(3, minval=1, title="STOCH Smooth")

//CCI

cci_len = input(20, minval=1, title="CCI Length")

//Momentum

momentum_len = input(10, minval=1, title="Momentum Length")

//MACD

macd_fast = input(12, title="MACD fast")

macd_slow = input(27, title="MACD slow")

//ADX

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

//BBP

bbp_len = input(13, title="BBP EMA Length")

//William Percentage Range

wpr_length = input(14, minval=1, title="William Perc Range Length")

//Ultimate Oscillator

uo_length7 = input(7, minval=1, title="UO Length 7"), uo_length14 = input(14, minval=1, title="UO Length 14"), uo_length28 = input(28, minval=1, title="UO Length 28")

// -------------------------------------- FUNCTIONS - Moving Averages -------------------------------------- //

// Simple Moving Averages Calculation Function - SELL indicator values < price // BUY – indicator values > price

calc_sma_index(len, src, res) =>

sma_val = request.security(syminfo.tickerid, res, sma(src, len))

sma_index = if( sma_val > close )

-1

else

1

sma_index

// Exponential Moving Averages Calculation Function - SELL indicator values < price // BUY – indicator values > price

calc_ema_index(len, src, res) =>

ema_val = request.security(syminfo.tickerid, res, sma(src, len))

ema_index = if( ema_val > close )

-1

else

1

ema_index

// Hull Moving Averages Calculation Function - SELL indicator values < price // BUY – indicator values > price

calc_hull_index(len, src, res) =>

hull_val = request.security(syminfo.tickerid, res, wma(2*wma(src, len/2)-wma(src, len), round(sqrt(len))))

hull_index = if( hull_val > close )

-1

else

1

hull_index

// VW Moving Averages Calculation Function - SELL indicator values < price // BUY – indicator values > price

calc_vwma_index(len, src, res) =>

vwma_val = request.security(syminfo.tickerid, res, vwma(src, len))

vwma_index = if( vwma_val > close )

-1

else

1

vwma_index

// -------------------------------------- FUNCTIONS - Oscillators -------------------------------------- //

// RSI indicator < lines that represent oversold conditions(70) and indicator values are rising = -1

// RSI indicator > lines that represent overbought conditions(30) and indicator values are falling = +1

calc_rsi_index(len, src, res) =>

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsi_res = request.security(syminfo.tickerid, res, rsi)

rsi_change = rsi_res - rsi_res[1]

rsi_index = 0

if( rsi_res > 70 and rsi_change < 0 )

rsi_index := -1

if( rsi_res < 30 and rsi_change > 0 )

rsi_index := 1

rsi_index

// STOCH indicator – main line < lower band (20) and main line crosses the signal line from bottom-up

// STOCH indicato – main line > upper band (80) and main line crosses the signal line from above-down

calc_stoch_index(len_k, len_d, smoothK, res) =>

stoch_k = sma(stoch(close, high, low, len_k), smoothK)

stoch_d = sma(stoch_k, len_d)

res_stoch_k = request.security(syminfo.tickerid, res, stoch_k)

res_stoch_d = request.security(syminfo.tickerid, res, stoch_d)

spread = (res_stoch_k/res_stoch_d -1)*100

stoch_index = 0

if( res_stoch_k > 80 and spread < 0 )

stoch_index := -1

if( res_stoch_k < 20 and spread > 0 )

stoch_index := 1

stoch_index

// CCI indicator – indicator < oversold level (-100) and reversed upwards

// CCI indicator – indicator > overbought level (100) and reversed downwards

calc_cci_index(len, src, res) =>

cci_ma = sma(src, len)

cci = (src - cci_ma) / (0.015 * dev(src, len))

cci_res = request.security(syminfo.tickerid, res, cci)

cci_change = cci_res - cci_res[1]

cci_index = 0

if( cci_res > 100 and cci_change > 0 )

cci_index := -1

if( cci_res < -100 and cci_change < 0 )

cci_index := 1

cci_index

//AWESOME OSCILLATOR – saucer and values are greater than 0 or zero line cross from bottom-up - BUY

//AWESOME OSCILLATOR – saucer and values are lower than 0 or zero line cross from above-down - SELL

calc_awesome_index(src, res) =>

ao = sma(hl2,5) - sma(hl2,34)

ao_res = request.security(syminfo.tickerid, res, ao)

ao_change = ao_res - ao_res[1]

ao_index = 0

if( ao_res > 0 and ao_change > 0 )

ao_index := 1

if( ao_res < 0 and ao_change < 0 )

ao_index := -1

ao_index

// Momentum indicator - indicator values are rising - BUY

// Momentum indicator - indicator values are falling - SELL

calc_momentum_index(len, src, res) =>

mom = src - src[len]

res_mom = request.security(syminfo.tickerid, res, mom)

mom_index = 0

if res_mom>= 0

mom_index := 1

if res_mom <= 0

mom_index := -1

mom_index

// MACD - main line values > signal line values - BUY

// MACD - main line values < signal line values - SELL

calc_macd_index(macd_fast, macd_slow, src, res) =>

macd = ema(src, macd_fast) - ema(src, macd_slow)

res_macd = request.security(syminfo.tickerid, res, macd)

macd_index = 0

if res_macd>= 0

macd_index := 1

if res_macd <= 0

macd_index := -1

macd_index

//STOCHRSI - main line < lower band (20) and main line crosses the signal line from bottom-up

//STOCHRSI - main line > upper band (80) and main line crosses the signal line from above-down

calc_stochrsi_index(len_rsi, len_stoch, smoothK, smoothD, src, res) =>

rsi = rsi(src, len_rsi)

stoch_k = sma(stoch(rsi, rsi, rsi, len_stoch), smoothK)

stoch_d = sma(stoch_k, smoothD)

res_stoch_k = request.security(syminfo.tickerid, res, stoch_k)

res_stoch_d = request.security(syminfo.tickerid, res, stoch_d)

spread = (res_stoch_k/res_stoch_d -1)*100

stochrsi_index = 0

if( res_stoch_k > 80 and spread < 0 )

stochrsi_index := -1

if( res_stoch_k < 20 and spread > 0 )

stochrsi_index := 1

stochrsi_index

//Williams % Range - line is above -20 and values are dropping - Overbough conditions - SELL

//Williams % Range - line is below -80 and values are rising - Oversold conditions - BUY

calc_wpr_index(len, src, res) =>

wpr_upper = highest(len)

wpr_lower = lowest(len)

wpr = 100 * (src - wpr_upper) / (wpr_upper - wpr_lower)

wpr_res = request.security(syminfo.tickerid, res, wpr)

wpr_change = wpr_res - wpr_res[1]

wpr_index = 0

if( wpr_res < -80 and wpr_change > 0 )

wpr_index := 1

if( wpr_res > -20 and wpr_change < 0 )

wpr_index := -1

wpr_index

//Ultimate Oscillator - line is above -20 and values are dropping - Overbough conditions - SELL

//Ultimate Oscillator - line is below -80 and values are rising - Oversold conditions - BUY

average(bp, tr_, length) => sum(bp, length) / sum(tr_, length)

calc_uo_index(len7, len14, len28, res) =>

high_ = max(high, close[1])

low_ = min(low, close[1])

bp = close - low_

tr_ = high_ - low_

avg7 = average(bp, tr_, len7)

avg14 = average(bp, tr_, len14)

avg28 = average(bp, tr_, len28)

uo = 100 * (4*avg7 + 2*avg14 + avg28)/7

uo_res = request.security(syminfo.tickerid, res, uo)

uo_index = 0

if uo_res >= 70

uo_index := 1

if uo_res <= 30

uo_index := -1

uo_index

//Average Directional Index - indicator > 20 and +DI line crossed -DI line from bottom-up

//Average Directional Index - indicator > 20 and +DI line crossed -DI line from above-down

dirmov(len) =>

up = change(high)

down = -change(low)

truerange = rma(tr, len)

plus = fixnan(100 * rma(up > down and up > 0 ? up : 0, len) / truerange)

minus = fixnan(100 * rma(down > up and down > 0 ? down : 0, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

adxHigh(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

plus

adxLow(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

minus

calc_adx_index(res) =>

sig = adx(dilen, adxlen) //ADX

sigHigh = adxHigh(dilen, adxlen) // DI+

sigLow = adxLow(dilen, adxlen) // DI-

res_sig = request.security(syminfo.tickerid, res, sig)

res_sigHigh = request.security(syminfo.tickerid, res, sigHigh)

res_sigLow = request.security(syminfo.tickerid, res, sigLow)

spread = (res_sigHigh/res_sigLow -1)*100

adx_index = 0

if res_sig >= 20 and spread > 0

adx_index := 1

if res_sig >= 20 and spread < 0

adx_index := -1

adx_index

//Bull Bear Power Index - bear power is below 0 and is weakening -> BUY

//Bull Bear Power Index - bull power is above 0 and is weakening -> SELL

calc_bbp_index(len, src, res ) =>

ema = ema(src, len)

bulls = high - ema

bears = low - ema

bulls_res = request.security(syminfo.tickerid, res, bulls)

bears_res = request.security(syminfo.tickerid, res, bears)

sum = bulls_res + bears_res

bbp_index = 0

if bears_res < 0 and bears_res > bears_res[1]

bbp_index := 1

if bulls_res > 0 and bulls_res < bulls_res[1]

bbp_index := -1

bbp_index

// --------------------------------MOVING AVERAGES CALCULATION------------------------------------- //

sma10_index = calc_sma_index(sma10, src, res)

sma20_index = calc_sma_index(sma20, src, res)

sma30_index = calc_sma_index(sma30, src, res)

sma50_index = calc_sma_index(sma50, src, res)

sma100_index = calc_sma_index(sma100, src, res)

sma200_index = calc_sma_index(sma200, src, res)

ema10_index = calc_ema_index(ema10, src, res)

ema20_index = calc_ema_index(ema20, src, res)

ema30_index = calc_ema_index(ema30, src, res)

ema50_index = calc_ema_index(ema50, src, res)

ema100_index = calc_ema_index(ema100, src, res)

ema200_index = calc_ema_index(ema200, src, res)

hull9_index = calc_ema_index(hma9, src, res)

vwma20_index = calc_ema_index(vwma20, src, res)

ichimoku_index = 0.0 //Ichimoku - is not active in the calculation brought to you by TV TEAM for the lolz

moving_averages_index = ( ema10_index + ema20_index + ema30_index + ema50_index + ema100_index + ema200_index +

sma10_index + sma20_index + sma30_index + sma50_index + sma100_index + sma200_index +

ichimoku_index + vwma20_index + hull9_index ) / 15

// -----------------------------------OSCILLATORS CALCULATION----------------------------------------- //

rsi_index = calc_rsi_index(rsi_len, src, res)

stoch_index = calc_stoch_index(stoch_k, stoch_d, stoch_smooth, res)

cci_index = calc_cci_index(cci_len, src, res)

ao_index = calc_awesome_index(src, res)

mom_index = calc_momentum_index(momentum_len, src, res)

macd_index = calc_macd_index(macd_fast, macd_slow, src, res)

stochrsi_index = calc_stochrsi_index(rsi_len, stoch_k, stoch_d, stoch_smooth, src, res)

wpr_index = calc_wpr_index(wpr_length, src, res)

uo_index = calc_uo_index(uo_length7, uo_length14, uo_length28, res)

adx_index = calc_adx_index(res)

bbp_index = calc_bbp_index(bbp_len , src, res)

oscillators_index = ( rsi_index + stoch_index + adx_index + cci_index + stochrsi_index + ao_index + mom_index + macd_index + wpr_index + uo_index + bbp_index ) / 11

rating_index = ( moving_averages_index + oscillators_index ) / 2

plot(moving_averages_index, color=green, linewidth = 1, title="Moving Averages Rating",transp = 70)

plot(oscillators_index , color=blue, linewidth = 1, title="Oscillators Rating",transp = 70)

plot(rating_index , color=orange, linewidth = 2, title="Rating")

strongbuy = hline(1, "Strong Buy" , color=silver )

buy = hline(0.5, "Strong Buy" , color=green )

normal = hline(0, "Buy/Sell" , color=silver )

sell = hline(-0.5,"Strong Sell", color=red )

strongsell = hline(-1, "Strong Sell", color=silver )

fill(strongbuy,buy, color=green, transp=90)

fill(buy,normal, color=#b2ffb2, transp=90)

fill(sell,normal, color=#F08080, transp=90)

fill(strongsell,sell, color=red, transp=90)

longCondition = rating_index > 0

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

shortCondition = rating_index < 0

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)