Strategi stop-profit dan stop-loss adaptif berdasarkan kerangka waktu ganda dan indikator momentum

Ringkasan

Strategi ini menggunakan kombinasi dari dua frame waktu dan indikator momentum, untuk mencapai adaptasi stop loss. Frame waktu utama memantau arah tren, frame waktu tambahan digunakan untuk sinyal konfirmasi. Ketika kedua arah sesuai, menghasilkan sinyal perdagangan.

Prinsip Strategi

Kerangka waktu utama menggunakan indikator regresi linier Sqqueeze Momentum (SQM) untuk menilai tren, dan kerangka waktu tambahan menggunakan indikator SQM EMA kombinasi untuk memfilter sinyal palsu.

Ketika master chart SQM menembus ke atas, ketika auxiliary chart SQM juga menembus ke atas, lakukan lebih banyak; ketika master chart SQM menembus ke bawah, ketika auxiliary chart SQM juga menembus ke bawah, lakukan kosong.

Setelah masuk ke pasar, Anda dapat mengatur stop loss dan stop loss awal berdasarkan parameter input. Ketika harga mencapai stop loss, Anda dapat memperbarui stop loss dan stop loss.

Keunggulan Strategis

Dua frame waktu memfilter sinyal palsu untuk memastikan keakuratan sinyal.

Indikator SQM menilai arah tren dan menghindari gangguan dari kebisingan pasar.

Adaptasi Stop Loss Mechanism, maksimal mengunci keuntungan, efektif mengendalikan risiko.

Analisis risiko

Parameter indikator SQM yang tidak tepat, mungkin akan melewatkan titik perubahan tren, dan menyebabkan kerugian.

Pemilihan frame waktu yang tidak tepat pada grafik pendukung tidak dapat memfilter kebisingan secara efektif dan menghasilkan kesalahan transaksi.

Stop loss terlalu besar, dan kerugian bisa sangat besar.

Arah optimasi

Parameter indikator SQM perlu disesuaikan dengan pasar yang berbeda untuk memastikan sensitivitasnya.

Kerangka waktu grafik tambahan juga memerlukan pengujian siklus yang berbeda untuk melihat siklus mana yang paling efektif untuk disaring.

Stop loss dapat diatur dalam kisaran fluktuasi, bukan nilai tetap, sehingga dapat disesuaikan dengan tingkat fluktuasi pasar.

Meringkaskan

Strategi ini sangat praktis secara keseluruhan, dua frame waktu bekerja sama dengan indikator momentum untuk menilai tren, dan menggunakan stop-loss adaptif untuk mencapai keuntungan yang stabil. Dengan mengoptimalkan parameter indikator SQM, siklus grafik tambahan dan pengaturan amplitudo stop-loss, efek strategi dapat dibuat lebih baik, layak untuk diterapkan dan dioptimalkan di lapangan.

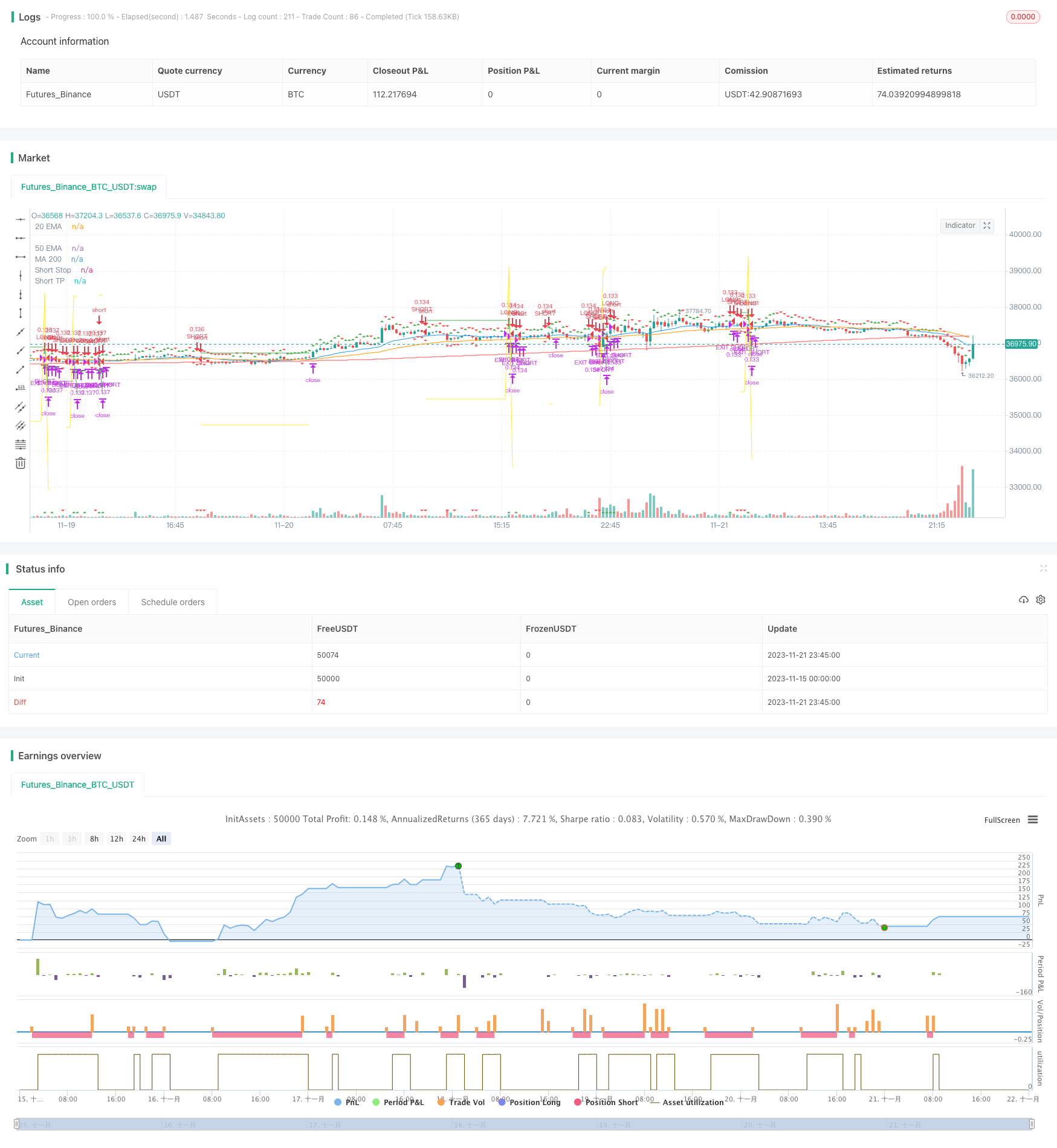

/*backtest

start: 2023-11-15 00:00:00

end: 2023-11-22 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("SQZ Multiframe Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

fast_ema_len = input(11, minval=5, title="Fast EMA")

slow_ema_len = input(34, minval=20, title="Slow EMA")

sqm_lengthKC = input(20, title="SQM KC Length")

kauf_period = input(20, title="Kauf Period")

kauf_mult = input(2,title="Kauf Mult factor")

min_profit_sl = input(5.0, minval=1, maxval=100, title="Min profit to start moving SL [%]")

longest_sl = input(10, minval=1, maxval=100, title="Maximum possible of SL [%]")

sl_step = input(0.5, minval=0.0, maxval=1.0, title="Take profit factor")

// ADMF

CMF_length = input(11, minval=1, title="CMF length") // EMA27 = SMMA/RMA14 ~ lunar month

show_plots = input(true, title="Show plots")

lower_resolution = timeframe.period=='1'?'5':timeframe.period=='5'?'15':timeframe.period=='15'?'30':timeframe.period=='30'?'60':timeframe.period=='60'?'240':timeframe.period=='240'?'D':timeframe.period=='D'?'W':'M'

higher_resolution = timeframe.period=='5'?'1':timeframe.period=='15'?'5':timeframe.period=='30'?'15':timeframe.period=='60'?'30':timeframe.period=='240'?'60':timeframe.period=='D'?'240':timeframe.period=='W'?'D':'W'

// Calculate Squeeze Momentum

sqm_val = linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0)

sqm_val_high = security(syminfo.tickerid, higher_resolution, linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0), lookahead=barmerge.lookahead_on)

sqm_val_low = security(syminfo.tickerid, lower_resolution, linreg(close - avg(avg(highest(high, sqm_lengthKC), lowest(low, sqm_lengthKC)),sma(close,sqm_lengthKC)), sqm_lengthKC,0), gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_on)

// Emas

high_close = security(syminfo.tickerid, higher_resolution, close, lookahead=barmerge.lookahead_on)

high_fast_ema = security(syminfo.tickerid, higher_resolution, ema(close, fast_ema_len), lookahead=barmerge.lookahead_on)

high_slow_ema = security(syminfo.tickerid, higher_resolution, ema(close, slow_ema_len), lookahead=barmerge.lookahead_on)

//low_fast_ema = security(syminfo.tickerid, lower_resolution, ema(close, fast_ema_len), lookahead=barmerge.lookahead_on)

//low_slow_ema = security(syminfo.tickerid, lower_resolution, ema(close, slow_ema_len), lookahead=barmerge.lookahead_on)

// CMF

ad = close==high and close==low or high==low ? 0 : ((2*close-low-high)/(high-low))*volume

money_flow = sum(ad, CMF_length) / sum(volume, CMF_length)

// Entry conditions

low_condition_long = (sqm_val_low > sqm_val_low[1])

low_condition_short = (sqm_val_low < sqm_val_low[1])

money_flow_min = (money_flow[4] > money_flow[3]) and (money_flow[3] > money_flow[2]) and (money_flow[2] < money_flow[1]) and (money_flow[1] < money_flow)

money_flow_max = (money_flow[4] < money_flow[3]) and (money_flow[3] < money_flow[2]) and (money_flow[2] > money_flow[1]) and (money_flow[1] > money_flow)

condition_long = ((sqm_val > sqm_val[1])) and (money_flow_min or money_flow_min[1] or money_flow_min[2] or money_flow_min[3]) and lowest(sqm_val, 5) < 0

condition_short = ((sqm_val < sqm_val[1])) and (money_flow_max or money_flow_max[1] or money_flow_max[2] or money_flow_max[3]) and highest(sqm_val, 5) > 0

high_condition_long = true//high_close > high_fast_ema and high_close > high_slow_ema //(high_fast_ema > high_slow_ema) //and (sqm_val_low > sqm_val_low[1])

high_condition_short = true//high_close < high_fast_ema and high_close < high_slow_ema//(high_fast_ema < high_slow_ema) //and (sqm_val_low < sqm_val_low[1])

enter_long = low_condition_long and condition_long and high_condition_long

enter_short = low_condition_short and condition_short and high_condition_short

// Stop conditions

var current_target_price = 0.0

var current_sl_price = 0.0 // Price limit to take profit

var current_target_per = 0.0

var current_profit_per = 0.0

set_targets(isLong, min_profit, current_target_per, current_profit_per) =>

target = 0.0

sl = 0.0

if isLong

target := close * (1.0 + current_target_per)

sl := close * (1.0 - (longest_sl/100.0)) // Longest SL

else

target := close * (1.0 - current_target_per)

sl := close * (1.0 + (longest_sl/100.0)) // Longest SL

[target, sl]

target_reached(isLong, min_profit, current_target_per, current_profit_per) =>

target = 0.0

sl = 0.0

profit_per = 0.0

target_per = 0.0

if current_profit_per == 0

profit_per := (min_profit*sl_step) / 100.0

else

profit_per := current_profit_per + ((min_profit*sl_step) / 100.0)

target_per := current_target_per + (min_profit / 100.0)

if isLong

target := strategy.position_avg_price * (1.0 + target_per)

sl := strategy.position_avg_price * (1.0 + profit_per)

else

target := strategy.position_avg_price * (1.0 - target_per)

sl := strategy.position_avg_price * (1.0 - profit_per)

[target, sl, profit_per, target_per]

hl_diff = sma(high - low, kauf_period)

stop_condition_long = 0.0

new_stop_condition_long = low - (hl_diff * kauf_mult)

if (strategy.position_size > 0)

if (close > current_target_price)

[target, sl, profit_per, target_per] = target_reached(true, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

current_profit_per := profit_per

current_target_per := target_per

stop_condition_long := max(stop_condition_long[1], current_sl_price)

else

stop_condition_long := new_stop_condition_long

stop_condition_short = 99999999.9

new_stop_condition_short = high + (hl_diff * kauf_mult)

if (strategy.position_size < 0)

if (close < current_target_price)

[target, sl, profit_per, target_per] = target_reached(false, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

current_profit_per := profit_per

current_target_per := target_per

stop_condition_short := min(stop_condition_short[1], current_sl_price)

else

stop_condition_short := new_stop_condition_short

// Submit entry orders

if (enter_long and (strategy.position_size <= 0))

if (strategy.position_size < 0)

strategy.close(id="SHORT")

current_target_per := (min_profit_sl / 100.0)

current_profit_per := 0.0

[target, sl] = set_targets(true, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

strategy.entry(id="LONG", long=true)

// if show_plots

// label.new(bar_index, high, text=tostring("LONG\nSL: ") + tostring(stop_condition_long), style=label.style_labeldown, color=color.green)

if (enter_short and (strategy.position_size >= 0))

if (strategy.position_size > 0)

strategy.close(id="LONG")

current_target_per := (min_profit_sl / 100.0)

current_profit_per := 0.0

[target, sl] = set_targets(false, min_profit_sl, current_target_per, current_profit_per)

current_target_price := target

current_sl_price := sl

strategy.entry(id="SHORT", long=false)

// if show_plots

// label.new(bar_index, high, text=tostring("SHORT\nSL: ") + tostring(stop_condition_short), style=label.style_labeldown, color=color.red)

if (strategy.position_size > 0)

strategy.exit(id="EXIT LONG", stop=stop_condition_long)

if (strategy.position_size < 0)

strategy.exit(id="EXIT SHORT", stop=stop_condition_short)

// Plot anchor trend

plotshape(low_condition_long, style=shape.triangleup,

location=location.abovebar, color=color.green)

plotshape(low_condition_short, style=shape.triangledown,

location=location.abovebar, color=color.red)

plotshape(condition_long, style=shape.triangleup,

location=location.belowbar, color=color.green)

plotshape(condition_short, style=shape.triangledown,

location=location.belowbar, color=color.red)

//plotshape((close < profit_target_short) ? profit_target_short : na, style=shape.triangledown,

// location=location.belowbar, color=color.yellow)

plotshape(enter_long, style=shape.triangleup,

location=location.bottom, color=color.green)

plotshape(enter_short, style=shape.triangledown,

location=location.bottom, color=color.red)

// Plot emas

plot(ema(close, 20), color=color.blue, title="20 EMA")

plot(ema(close, 50), color=color.orange, title="50 EMA")

plot(sma(close, 200), color=color.red, title="MA 200")

// Plot stop loss values for confirmation

plot(series=(strategy.position_size > 0) and show_plots ? stop_condition_long : na,

color=color.green, style=plot.style_linebr,

title="Long Stop")

plot(series=(strategy.position_size < 0) and show_plots ? stop_condition_short : na,

color=color.green, style=plot.style_linebr,

title="Short Stop")

plot(series=(strategy.position_size < 0) and show_plots ? current_target_price : na,

color=color.yellow, style=plot.style_linebr,

title="Short TP")

plot(series=(strategy.position_size > 0) and show_plots ? current_target_price : na,

color=color.yellow, style=plot.style_linebr,

title="Long TP")

//plot(series=(strategy.position_size < 0) ? profit_sl_short : na,

// color=color.gray, style=plot.style_linebr,

// title="Short Stop")