Strategi Pelacakan Risiko Rendah Piramida Titik Rendah

Strategi ini mengurangi risiko dengan mengidentifikasi titik rendah potensial dalam pergerakan harga dengan kombinasi berbagai indikator dan dengan cara membangun posisi secara bertahap melalui pelacakan piramida. Strategi ini juga menggabungkan fungsi seperti stop loss, stop stop, dan stop loss yang bergerak untuk mengontrol risiko secara efektif.

Tinjauan Strategi

Strategi ini pertama-tama menggunakan perbedaan antara RSI dan EMA RSI untuk mengidentifikasi titik rendah potensial dalam harga. Untuk memfilter sinyal palsu, strategi ini juga menggabungkan moving average dan indikator acak multi-frame untuk konfirmasi. Setelah sinyal rendah dikonfirmasi, beberapa pesanan akan dibangun secara bertahap di tempat yang sedikit lebih rendah dari titik tersebut, itulah ide dari piramida pelacakan. Strategi ini memungkinkan untuk membuat hingga 12 pesanan pelacakan, dan jumlah setiap pesanan akan meningkat secara berurutan, yang secara efektif dapat menyebarkan risiko.

Prinsip Strategi

Strategi ini terdiri dari tiga bagian, yaitu low point identification module, pyramid tracking module, dan risk control module.

Modul pengenalan titik rendahUntuk meningkatkan akurasi, juga diperkenalkan indikator moving average dan multi-frame time frame acak indikator untuk sinyal pemfilteran. Hanya ketika harga di bawah rata-rata bergerak dan acak indikator K-line di bawah 30, validitas sinyal titik rendah akan dikonfirmasi.

Modul Pelacakan PiramidaStrategi ini adalah inti dari strategi ini. Setelah sinyal titik rendah dikonfirmasi, strategi ini akan membuka pesanan pertama di posisi 0,1% lebih rendah dari titik rendah tersebut. Setelah itu, lebih banyak pesanan akan ditambahkan selama harga terus turun dan berada di bawah persentase tertentu dari harga masuk rata-rata. Jumlah pesanan baru akan meningkat secara berurutan, misalnya, jumlah pesanan ketiga adalah 3 kali lipat dari pesanan pertama.

Modul pengendalian risikoTerutama terdiri dari tiga aspek. Pertama adalah total stop loss, berdasarkan stop loss yang dihitung berdasarkan harga tertinggi dalam periode tertentu terakhir. Semua pesanan akan mengikuti stop loss ini secara bersamaan. Kedua adalah pengaturan stop loss yang independen untuk setiap pesanan, yang memungkinkan untuk berhenti sesuai dengan persentase tertentu dari harga masuk. Ketiga adalah total stop loss berdasarkan rasio ekuitas akun, yang merupakan alat kontrol risiko terkuat.

Keunggulan Strategis

- Menggunakan pelacakan piramida untuk mengurangi risiko pada pesanan individu, sekaligus menyebarluaskan risiko secara keseluruhan

- Kombinasi multi-indikator meningkatkan akurasi identifikasi titik rendah

- Total Stop Loss, Stop Stop, dan Stop Loss Mobile berfungsi untuk mengendalikan risiko secara efektif

- Mekanisme Stop Loss Ratio melindungi akun dari kerugian besar

- Mencari keseimbangan antara risiko dan keuntungan dengan menyesuaikan parameter

Risiko Strategis

- Akurasi low-point identifikasi masih terbatas, mungkin kehilangan titik masuk yang optimal atau masuk ke sinyal palsu

- Pemasaran tambahan dapat menimbulkan kerugian yang lebih besar

- Siklus operasi yang lebih lama diperlukan untuk menunjukkan keunggulan strategi

- Pengaturan parameter yang tidak tepat dapat menyebabkan kurangnya kontrol risiko

Untuk mengurangi risiko di atas, optimasi dapat dilakukan dalam beberapa hal berikut:

- Mengganti atau menambah indikator untuk meningkatkan akurasi identifikasi titik rendah

- Mengoptimalkan parameter seperti jumlah pesanan, interval, dan stop-loss, mengurangi risiko pesanan tunggal

- Pengurangan Stop Loss yang Tepat untuk Melindungi Keuntungan

- Uji varietas yang berbeda, pilih varietas yang mudah bergerak dan berfluktuasi

Arah optimasi strategi

Strategi ini masih memiliki ruang untuk dioptimalkan lebih jauh:

- Cobalah untuk mengidentifikasi kelemahan teknologi yang lebih canggih seperti pembelajaran mesin.

- Parameter seperti jumlah pesanan, stop loss, dan lain-lain yang disesuaikan dengan kondisi pasar

- Menambahkan strategi stop loss di dalam kotak untuk menghindari peningkatan kerugian

- Menambahkan mekanisme masuk kembali

- Parameter strategi untuk mengoptimalkan varietas saham dan mata uang digital

Meringkaskan

Strategi ini secara efektif mengurangi risiko satu pesanan melalui pemikiran pelacakan piramida, fungsi seperti stop loss, stop stop, dan stop loss bergerak juga memainkan peran pengendalian risiko yang baik. Namun, masih ada ruang untuk pengoptimalan di bidang identifikasi titik rendah, jika dapat memperkenalkan teknologi yang lebih canggih, menambahkan fungsi penyesuaian dinamis, dan kemudian bekerja sama dengan pengoptimalan parameter, rasio risiko keuntungan dari strategi ini akan ditingkatkan secara signifikan.

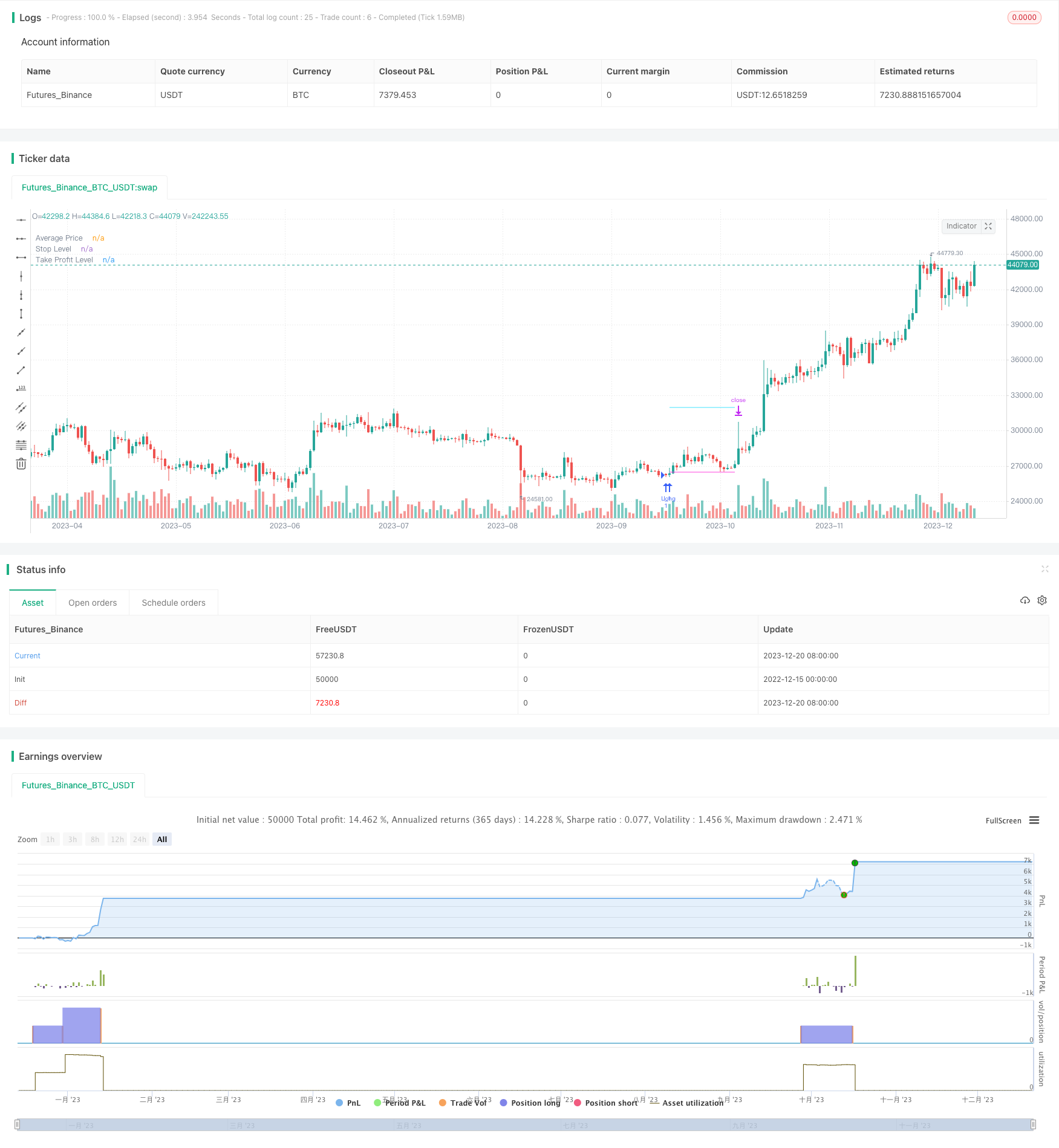

/*backtest

start: 2022-12-15 00:00:00

end: 2023-12-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © A3Sh

//@version=5

// Strategy that finds potential lows in the price action and spreads the risk by entering multiple positions at these lows.

// The low is detected based on the difference between MTF RSI and EMA based RSI, Moving Average and MTF Stochastic indicators.

// The size of each next position that is entered is multiplied by the sequential number of the position.

// Each separate position can exit when a specified take profit is triggered and re-open when detecting a new potential low.

// All positions are closed when the price action crosses over the dynamic blue stop level line.

// This strategy combines open-source code developed by fellow Tradingview community members:

// The Lowfinder code is developed by RafaelZioni

// https://www.tradingview.com/script/GzKq2RVl-Low-finder/

// Both the MTF RSI code and the MTF Stochastic code are adapted from the MTFindicators libary written by Peter_O

// https://www.tradingview.com/script/UUVWSpXR-MTFindicators/

// The Stop Level calculation is inspired by the syminfo-mintick tutorial on Kodify.net

// https://kodify.net/tradingview/info/syminfo-mintick/

strategy("LowFinder_PyraMider",

overlay=true, pyramiding=99,

precision=2,

initial_capital=10000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10,

commission_type=strategy.commission.percent,

commission_value=0.06,

slippage=1

)

// Backtest Window

start_time = input(defval=timestamp("01 April 2021 20:00"), group = "Backtest Window", title="Start Time")

end_time = input(defval=timestamp("01 Aug 2030 20:00"), group = "Backtest Window", title="End Time")

window() => true

// Inputs

portfolio_size = input.float (100, group = 'Risk - Portfolio', title = 'Portfolio %', step=1.0) / 100

leverage = input.int (1, group = 'Risk - Portfolio', title = 'Leverage', minval = 1)

q_mode = input.string ('multiply', group = 'Risk - Order Size', title = 'Order Size Mode', options = ['base', 'multiply'], tooltip = 'Base mode: the base quantiy for each sequential order. Multiply mode: each quantity is multiplied by order number')

q_mode_m = input.int (1, group = 'Risk - Order Size', title = 'Order Size Divider (Multiply Mode)', tooltip = 'Divide Multiply by this number to lower the sequential order sizes')

fixed_q = input.bool (false, group = 'Risk - Order Size', title = 'Fixed Order Size', inline = '01', tooltip = 'Use with caution! Overrides all Risk calculations')

amount_q = input.float (1, group = 'Risk - Order Size', title = '. . Base Currency:', inline = '01')

sl_on = input.bool (false, group = 'Risk - Stop Loss', title = 'StopLoss of', inline = '03')

stopLoss = input.float (1.5, group = 'Risk - Stop Loss', title = '', step=0.1, inline = '03') / 100

sl_mode = input.string ('equity', group = 'Risk - Stop Loss', title = '% of', options = ['avg_price', 'equity'], inline = '03')

stop_len = input.int (100, group = 'Risk - Stop Level', title = 'Stop Level Length', tooltip = 'Lookback most recent highest high')

stop_deviation = input.float (0.3, group = 'Risk - Stop Level', title = 'Deviatation % above Stop Level', step=0.1) / 100

cond2_toggle = input.bool (true , group = 'Risk - Take Profit', title = 'Take Profit/Trailing Stop', inline = '04')

tp_all = input.float (1.0, group = 'Risk - Take Profit', title = '..........%', step=0.1, inline = '04') / 100

tp_on = input.bool (true, group = 'Risk - Take Profit', title = 'Exit Crossover Take Profit and .....', inline = '02')

exit_mode = input.string ('stoplevel', group = 'Risk - Take Profit', title = '', options = ['close', 'stoplevel'], inline = '02')

takeProfit = input.float (10.0, group = 'Risk - Take Profit', title = 'Take Profit % per Order', tooltip = 'Each separate order exits when hit', step=0.1)

posCount = input.int (12, group = 'Pyramiding Settings', title = 'Max Number of Orders')

next_entry = input.float (0.2, group = 'Pyramiding Settings', title = 'Next Order % below Avg. Price', step=0.1)

oa_lookback = input.int (0, group = 'Pyramiding Settings', title = 'Next Order after X candles', tooltip = 'Prevents opening too much orders in a Row')

len_rsi = input.int (5, group = 'MTF LowFinder Settings', title = 'Lookback of RSI')

mtf_rsi = input.int (1, group = 'MTF LowFinder Settings', title = 'Higher TimeFrame Multiplier RSI', tooltip='Multiplies the current timeframe by specified value')

ma_length = input.int (26, group = 'MTF LowFinder Settings', title = 'MA Length / Sensitivity')

new_entry = input.float (0.1, group = 'MTF LowFinder Settings', title = 'First Order % below Low',step=0.1, tooltip = 'Open % lower then the found low')/100

ma_signal = input.int (100, group = 'Moving Average Filter', title = 'Moving Average Length')

periodK = input.int (14, group = 'MTF Stochastic Filter', title = 'K', minval=1)

periodD = input.int (3, group = 'MTF Stochastic Filter', title = 'D', minval=1)

smoothK = input.int (3, group = 'MTF Stochastic Filter', title = 'Smooth', minval=1)

lower = input.int (30, group = 'MTF Stochastic Filter', title = 'MTF Stoch Filter (above gets filtered)')

mtf_stoch = input.int (10, group = 'MTF Stochastic Filter', title = 'Higher TimeFrame Multiplier', tooltip='Multiplies the current timeframe by specified value')

avg_on = input.bool (true, group = 'Plots', title = 'Plot Average Price')

plot_ma = input.bool (false, group = 'Plots', title = 'Plot Moving Average')

plot_ts = input.bool (false, group = 'Plots', title = 'Plot Trailing Stop Level')

// variables //

var entry_price = 0.0 // The entry price of the first entry

var previous_entry = 0.0 // Stores the price of the previous entry

var iq = 0.0 // Inititial order quantity before risk calculation

var nq = 0.0 // Updated new quantity after the loop

var oq = 0.0 // Old quantity at the beginning or the loop

var q = 0.0 // Final calculated quantity used as base order size

var int order_after = 0

// Order size calaculations //

// Order size based on max amount of pyramiding orders or fixed by user input ///

// Order size calculation based on 'base' mode or ' multiply' mode //

if fixed_q

q := amount_q

else if q_mode == 'multiply'

iq := (math.abs(strategy.equity * portfolio_size / posCount) / open) * leverage

oq := iq

for i = 0 to posCount

nq := oq + (iq * ( i/ q_mode_m + 1))

oq := nq

q := (iq * posCount / oq) * iq

else

q := (math.abs(strategy.equity * portfolio_size / posCount) / open) * leverage

// Function to calcaulate final order size based on order size modes and round the result with 1 decimal //

quantity_mode(index,string q_mode) =>

q_mode == 'base' ? math.round(q,1) : q_mode == 'multiply' ? math.round(q * (index/q_mode_m + 1),1) : na

// LowFinder Calculations //

// MTF RSI by Peter_O //

rsi_mtf(float source, simple int mtf,simple int len) =>

change_mtf=source-source[mtf]

up_mtf = ta.rma(math.max(change_mtf, 0), len*mtf)

down_mtf = ta.rma(-math.min(change_mtf, 0), len*mtf)

rsi_mtf = down_mtf == 0 ? 100 : up_mtf == 0 ? 0 : 100 - (100 / (1 + up_mtf / down_mtf))

// Lowfinder by RafaelZioni //

vrsi = rsi_mtf(close,mtf_rsi,len_rsi)

pp=ta.ema(vrsi,ma_length)

dd=(vrsi-pp)*5

cc=(vrsi+dd+pp)/2

lows=ta.crossover(cc,0)

// MTF Stoch Calcualation // MTF Stoch adapted from Peter_O //

stoch_mtfK(source, mtf, len) =>

k = ta.sma(ta.stoch(source, high, low, periodK * mtf), smoothK * mtf)

stoch_mtfD(source, mtf, len) =>

k = ta.sma(ta.stoch(source, high, low, periodK * mtf), smoothK * mtf)

d = ta.sma(k, periodD * mtf)

mtfK = stoch_mtfK(close, mtf_stoch, periodK)

mtfD = stoch_mtfD(close, mtf_stoch, periodK)

// Open next position % below average position price //

below_avg = close < (strategy.position_avg_price * (1 - (next_entry / 100)))

// Moving Average Filter //

moving_average_signal = ta.sma(close, ma_signal)

plot (plot_ma ? moving_average_signal : na, title = 'Moving Average', color = color.rgb(154, 255, 72))

// Buy Signal //

buy_signal = lows and close < moving_average_signal and mtfK < lower

// First Entry % Below lows //

if buy_signal

entry_price := close * (1 - new_entry)

// Plot Average Price of Position//

plot (avg_on ? strategy.position_avg_price : na, title = 'Average Price', style = plot.style_linebr, color = color.new(color.white,0), linewidth = 1)

// Take profit per Open Order //

take_profit_price = close * takeProfit / 100 / syminfo.mintick

// Calculate different Stop Level conditions to exit All //

// Stop Level Caculation //

stop_long1_level = ta.highest (high, stop_len)[1] * (1 + stop_deviation)

stop_long2_level = ta.highest (high, stop_len)[2] * (1 + stop_deviation)

stop_long3_level = ta.highest (high, stop_len)[3] * (1 + stop_deviation)

stop_long4_level = ta.highest (high, stop_len)[1] * (1 - 0.008)

// Stop triggers //

stop_long1 = ta.crossover(close,stop_long1_level)

stop_long2 = ta.crossover(close,stop_long2_level)

stop_long4 = ta.crossunder(close,stop_long4_level)

// Exit Conditions, cond 1 only Stop Level, cond2 Trailing Stop option //

exit_condition_1 = close < strategy.position_avg_price ? stop_long1 : close > strategy.position_avg_price ? stop_long2 : na

exit_condition_2 = close < strategy.position_avg_price * (1 + tp_all) ? stop_long2 :

close > strategy.position_avg_price * (1 + tp_all) ? stop_long4 :

close < strategy.position_avg_price ? stop_long1 : na

// Switch between conditions //

exit_conditions = cond2_toggle ? exit_condition_2 : exit_condition_1

// Exit when take profit //

ex_m = exit_mode == 'close' ? close : stop_long2_level

tp_exit = ta.crossover(ex_m, strategy.position_avg_price * (1 + tp_all)) and close > strategy.position_avg_price * 1.002

// Plot stoplevel, take profit level //

plot_stop_level = strategy.position_size > 0 ? stop_long2_level : na

plot_trailing_stop = cond2_toggle and plot_ts and strategy.position_size > 0 and close > strategy.position_avg_price * (1 + tp_all) ? stop_long4_level : na

plot(plot_stop_level, title = 'Stop Level', style=plot.style_linebr, color = color.new(#41e3ff, 0), linewidth = 1)

plot(plot_trailing_stop, title = 'Trailing Stop', style=plot.style_linebr, color = color.new(#4cfca4, 0), linewidth = 1)

plot_tp_level = cond2_toggle and strategy.position_size > 0 ? strategy.position_avg_price * (1 + tp_all) : na

plot(plot_tp_level, title = 'Take Profit Level', style=plot.style_linebr, color = color.new(#ff41df, 0), linewidth = 1)

// Calculate Stop Loss based on equity and average price //

loss_equity = ((strategy.position_size * strategy.position_avg_price) - (strategy.equity * stopLoss)) / strategy.position_size

loss_avg_price = strategy.position_avg_price * (1 - stopLoss)

stop_loss = sl_mode == 'avg_price' ? loss_avg_price : loss_equity

plot(strategy.position_size > 0 and sl_on ? stop_loss : na, title = 'Stop Loss', color=color.new(color.red,0),style=plot.style_linebr, linewidth = 1)

// Enter first position //

if ta.crossunder(close,entry_price) and window() and strategy.position_size == 0

strategy.entry('L_1', strategy.long, qty = math.round(q,1), comment = '+' + str.tostring(math.round(q,1)))

previous_entry := close

// Enter next pyramiding positions //

if buy_signal and window() and strategy.position_size > 0 and below_avg

order_after := order_after + 1

for i = 1 to strategy.opentrades

entry_comment = '+' + str.tostring((quantity_mode(i,q_mode))) // Comment with variable //

if strategy.opentrades == i and i < posCount and order_after > oa_lookback

entry_price := close

entry_id = 'L_' + str.tostring(i + 1)

strategy.entry(id = entry_id, direction=strategy.long, limit=entry_price, qty= quantity_mode(i,q_mode), comment = entry_comment)

previous_entry := entry_price

order_after := 0

// Exit per Position //

if strategy.opentrades > 0 and window()

for i = 0 to strategy.opentrades

exit_comment = '-' + str.tostring(strategy.opentrades.size(i))

exit_from = 'L_' + str.tostring(i + 1)

exit_id = 'Exit_' + str.tostring(i + 1)

strategy.exit(id= exit_id, from_entry= exit_from, profit = take_profit_price, comment = exit_comment)

// Exit All //

if exit_conditions or (tp_exit and tp_on and cond2_toggle) and window()

strategy.close_all('Exti All')

entry_price := 0

if ta.crossunder(close,stop_loss) and sl_on and window()

strategy.close_all('StopLoss')

entry_price := 0