マルチタイムフレーム MACD ヒートマップ戦略

概要

この戦略の核心となる考え方は,市場トレンドの変化のタイミングを判断するために,異なる時間周期の複数のMACD指標の組み合わせの信号を利用して,低リスクのトレンド追跡取引を実現することである.

戦略原則

戦略は,5つの異なる時間周期のMACD指標を用い,60分,120分,240分,480分と日線を含む,MACD指標の複数の時間フレームの組み合わせを形成する.

5つの時間周期のMACD指標がすべて正 (((または負) であり,上部K線がMACDがすべて正 (((または負) ではないとき,多頭 (((または空頭) 信号として判断し,多頭 (((または空頭) を行う.

止損は固定ポイントで止まります.

停止の方法は,部分的および全体的なポジションをそれぞれ閉鎖する2つのレベルの移動停止である.

MACD指数に1つ以上の空白が発生した場合,信号として反転し,現在のポジションを平らにする.

TsLは,ストップダストの追跡にも使われています.

ストップをブレイクエブンに移動する機能を使用し,特定の利益に達すると,ストップを開場価格の近くに移動して利益をロックします.

パインコネクターの文法を使用して,動的に取引信号のポップアップを作成します.

戦略的優位性

多時間枠MACDの組み合わせにより,信号の精度が向上し,大きなトレンドをキャプチャし,部分的なノイズをフィルターできます.

移動ストップを2段階設定すると,大トレンドで複数の部分利益を得ることができます.

固定ストップポイントが設定され,単一損失を制御できます.

MACD指標が一致しない場合,一時的にストップして,ストップを破ることを避ける.

TsLのストップトラッキング機能は,ストップをリアルタイムで価格変化を追跡させる.

ストップ・ロスはBE機能に移動し,損失が収益化された後に利益の一部をロックすることができます.

ダイナミックな取引信号,MT4/5に接続して自動取引を行う.

リスクと解決

MACDシグナルに偽突破が発生し,不必要な損失を引き起こす可能性があります.MACDパラメータを適切に調整して,偽シグナルを過度にフィルターすることができます.

固定ストップポイントは大きすぎたり小さすぎたりするかもしれない.異なるストップポイントサイズをテストして最適なパラメータを見つけることができる.

2つのストップポイントがあまりにも近く,またはあまりにも遠く,最適の撤収と利益率を達成することはできません.異なるストップポイントをテストして最適なパラメータを見つけることができます.

BE機能は早すぎたり遅すぎたりして発動する.異なるBE発動点をテストして最適なパラメータを見つけることができる.

追跡止損距離が大きすぎたり小さすぎたりするかもしれない.異なる追跡止損距離をテストして最適なパラメータを見つけることができる.

戦略の最適化

複数の時間枠のMACD組み合わせをテストして,キャプチャされた市場トレンドの最適な組み合わせを見つけることができます.

取引状況の背景を判断する指標を導入し,不適切な取引状況でポジションを開くのを防ぐことができます.

様々な品種のパラメータ設定の違いを研究し,自己適応の止損防止システムを設計することができる.

機械学習技術と組み合わせて,止損停止パラメータの動的最適化が可能である.

資金管理モジュールが導入され,ポジションのサイズが動的に調整され,リスクを制御できます.

要約する

全体として,この戦略は,多時間枠MACD指標判断トレンドを使用し,ダブルストップ,トラッキングストップ,BE機能を設定して利益をロックし,ストップコントロールリスクを固定します.これは比較的安定したトレンド追跡戦略です.パラメータ最適化と機能拡張により,戦略の安定性と収益率をさらに強化できます.

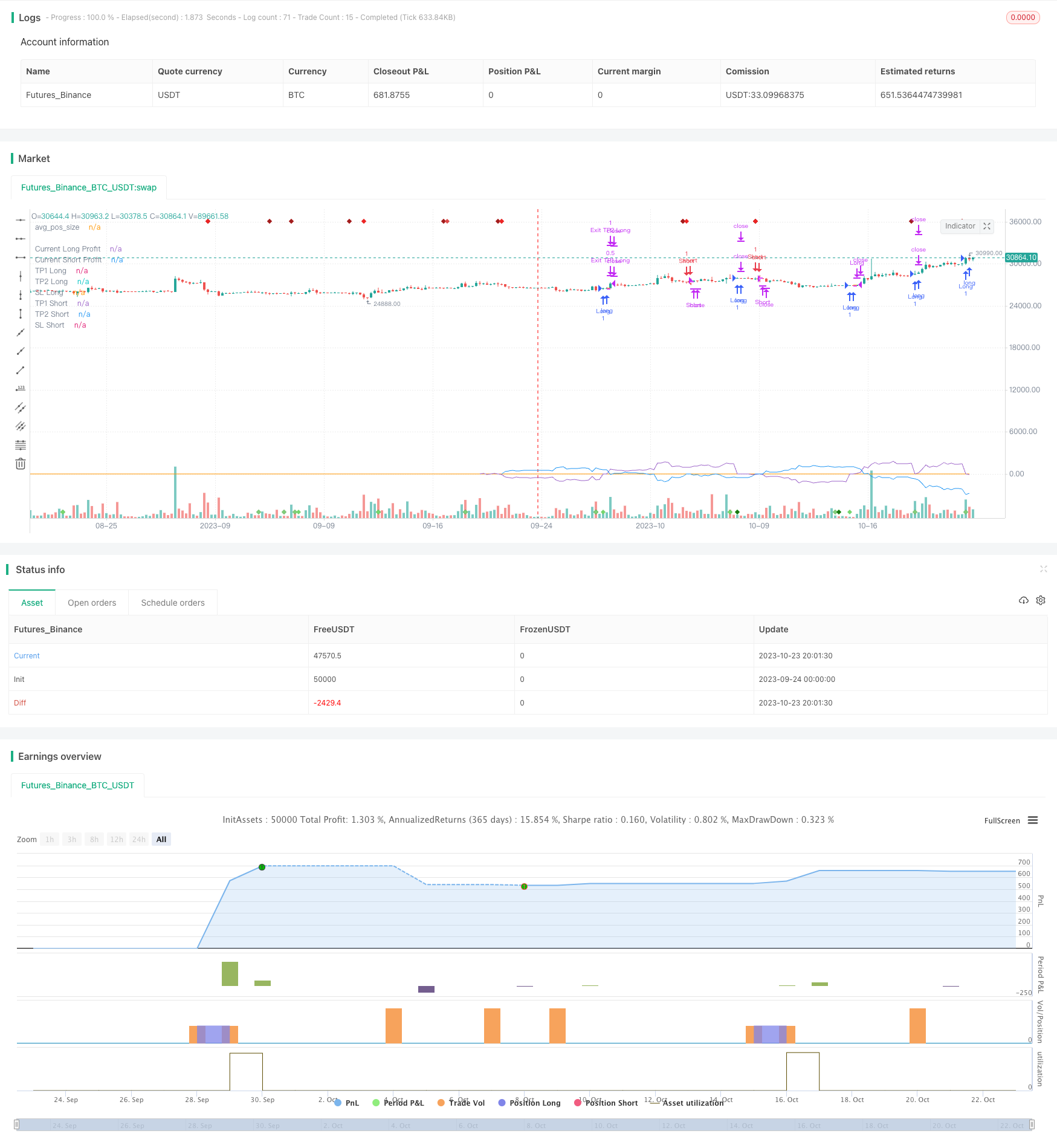

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 6h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//@strategy_alert_message {{strategy.order.alert_message}}

SCRIPT_NAME = "Heatmap MACD Strategy - Pineconnector"

strategy(SCRIPT_NAME,

overlay= true,

process_orders_on_close = true,

calc_on_every_tick = true,

pyramiding = 1,

initial_capital = 100000,

default_qty_type = strategy.fixed,

default_qty_value = 1,

commission_type = strategy.commission.percent,

commission_value = 0.075,

slippage = 1

)

pineconnector_licence_ID = input.string(title = "Licence ID", defval = "123456789", group = "Pineconnector", tooltip = "Insert your Pineconnector Licence ID here")

pos_size = input.float(3, minval = 0, maxval = 100, title = "Position Size", group = "Position Size", tooltip = "Required to specify the position size here for Pineconnector to work properly")

res1 = input.timeframe('60', title='First Timeframe', group = "Timeframes")

res2 = input.timeframe('120', title='Second Timeframe', group = "Timeframes")

res3 = input.timeframe('240', title='Third Timeframe', group = "Timeframes")

res4 = input.timeframe('240', title='Fourth Timeframe', group = "Timeframes")

res5 = input.timeframe('480', title='Fifth Timeframe', group = "Timeframes")

macd_src = input.source(close, title="Source", group = "MACD")

fast_len = input.int(9, minval=1, title="Fast Length", group = "MACD")

slow_len = input.int(26, minval=1, title="Slow Length", group = "MACD")

sig_len = input.int(9, minval=1, title="Signal Length", group = "MACD")

// # ========================================================================= #

// # | Close on Opposite |

// # ========================================================================= #

use_close_opposite = input.bool(false, title = "Close on Opposite Signal?", group = "Close on Opposite", tooltip = "Close the position if 1 or more MACDs become bearish (for longs) or bullish (for shorts)")

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

use_sl = input.bool(true, title = "Use Stop Loss?", group = "Stop Loss")

sl_mode = "pips"//input.string("%", title = "Mode", options = ["%", "pips"], group = "Stop Loss")

sl_value = input.float(40, minval = 0, title = "Value", group = "Stop Loss", inline = "stoploss")// * 0.01

// # ========================================================================= #

// # | Trailing Stop Loss |

// # ========================================================================= #

use_tsl = input.bool(false, title = "Use Trailing Stop Loss?", group = "Trailing Stop Loss")

tsl_input_pips = input.float(10, minval = 0, title = "Trailing Stop Loss (pips)", group = "Trailing Stop Loss")

// # ========================================================================= #

// # | Take Profit |

// # ========================================================================= #

use_tp1 = input.bool(true, title = "Use Take Profit 1?", group = "Take Profit 1")

tp1_value = input.float(30, minval = 0, title = "Value (pips)", group = "Take Profit 1")// * 0.01

tp1_qty = input.float(50, minval = 0, title = "Quantity (%)", group = "Take Profit 1")// * 0.01

use_tp2 = input.bool(true, title = "Use Take Profit 2?", group = "Take Profit 2")

tp2_value = input.float(50, minval = 0, title = "Value (pips)", group = "Take Profit 2")// * 0.01

// # ========================================================================= #

// # | Stop Loss to Breakeven |

// # ========================================================================= #

use_sl_be = input.bool(false, title = "Use Stop Loss to Breakeven Mode?", group = "Break Even")

sl_be_value = input.float(30, step = 0.1, minval = 0, title = "Value (pips)", group = "Break Even", inline = "breakeven")

sl_be_offset = input.int(1, step = 1, minval = 0, title = "Offset (pips)", group = "Break Even", tooltip = "Set the SL at BE price +/- offset value")

[_, _, MTF1_hist] = request.security(syminfo.tickerid, res1, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF2_hist] = request.security(syminfo.tickerid, res2, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF3_hist] = request.security(syminfo.tickerid, res3, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF4_hist] = request.security(syminfo.tickerid, res4, ta.macd(macd_src, fast_len, slow_len, sig_len))

[_, _, MTF5_hist] = request.security(syminfo.tickerid, res5, ta.macd(macd_src, fast_len, slow_len, sig_len))

bull_hist1 = MTF1_hist > 0 and MTF1_hist[1] < 0

bull_hist2 = MTF2_hist > 0 and MTF2_hist[1] < 0

bull_hist3 = MTF3_hist > 0 and MTF3_hist[1] < 0

bull_hist4 = MTF4_hist > 0 and MTF4_hist[1] < 0

bull_hist5 = MTF5_hist > 0 and MTF5_hist[1] < 0

bear_hist1 = MTF1_hist < 0 and MTF1_hist[1] > 0

bear_hist2 = MTF2_hist < 0 and MTF2_hist[1] > 0

bear_hist3 = MTF3_hist < 0 and MTF3_hist[1] > 0

bear_hist4 = MTF4_hist < 0 and MTF4_hist[1] > 0

bear_hist5 = MTF5_hist < 0 and MTF5_hist[1] > 0

plotshape(bull_hist1, title = "Bullish MACD 1", location = location.bottom, style = shape.diamond, size = size.normal, color = #33e823)

plotshape(bull_hist2, title = "Bullish MACD 2", location = location.bottom, style = shape.diamond, size = size.normal, color = #1a7512)

plotshape(bull_hist3, title = "Bullish MACD 3", location = location.bottom, style = shape.diamond, size = size.normal, color = #479c40)

plotshape(bull_hist4, title = "Bullish MACD 4", location = location.bottom, style = shape.diamond, size = size.normal, color = #81cc7a)

plotshape(bull_hist5, title = "Bullish MACD 5", location = location.bottom, style = shape.diamond, size = size.normal, color = #76d66d)

plotshape(bear_hist1, title = "Bearish MACD 1", location = location.top, style = shape.diamond, size = size.normal, color = #d66d6d)

plotshape(bear_hist2, title = "Bearish MACD 2", location = location.top, style = shape.diamond, size = size.normal, color = #de4949)

plotshape(bear_hist3, title = "Bearish MACD 3", location = location.top, style = shape.diamond, size = size.normal, color = #cc2525)

plotshape(bear_hist4, title = "Bearish MACD 4", location = location.top, style = shape.diamond, size = size.normal, color = #a11d1d)

plotshape(bear_hist5, title = "Bearish MACD 5", location = location.top, style = shape.diamond, size = size.normal, color = #ed2424)

bull_count = (MTF1_hist > 0 ? 1 : 0) + (MTF2_hist > 0 ? 1 : 0) + (MTF3_hist > 0 ? 1 : 0) + (MTF4_hist > 0 ? 1 : 0) + (MTF5_hist > 0 ? 1 : 0)

bear_count = (MTF1_hist < 0 ? 1 : 0) + (MTF2_hist < 0 ? 1 : 0) + (MTF3_hist < 0 ? 1 : 0) + (MTF4_hist < 0 ? 1 : 0) + (MTF5_hist < 0 ? 1 : 0)

bull = bull_count == 5 and bull_count[1] < 5 and barstate.isconfirmed

bear = bear_count == 5 and bear_count[1] < 5 and barstate.isconfirmed

signal_candle = bull or bear

entryLongPrice = ta.valuewhen(bull and strategy.position_size[1] <= 0, close, 0)

entryShortPrice = ta.valuewhen(bear and strategy.position_size[1] >= 0, close, 0)

plot(strategy.position_size, title = "avg_pos_size")

get_pip_size() =>

float _pipsize = 1.

if syminfo.type == "forex"

_pipsize := (syminfo.mintick * (str.contains(syminfo.ticker, "JPY") ? 100 : 10))

else if str.contains(syminfo.ticker, "XAU") or str.contains(syminfo.ticker, "XAG")

_pipsize := 0.1

_pipsize

// # ========================================================================= #

// # | Stop Loss |

// # ========================================================================= #

var float final_SL_Long = 0.

var float final_SL_Short = 0.

if signal_candle and use_sl

final_SL_Long := entryLongPrice - (sl_value * get_pip_size())

final_SL_Short := entryShortPrice + (sl_value * get_pip_size())

// # ========================================================================= #

// # | Trailing Stop Loss |

// # ========================================================================= #

var MaxReached = 0.0

if signal_candle[1]

MaxReached := strategy.position_size > 0 ? high : low

MaxReached := strategy.position_size > 0

? math.max(nz(MaxReached, high), high)

: strategy.position_size < 0 ? math.min(nz(MaxReached, low), low) : na

if use_tsl and use_sl

if strategy.position_size > 0

stopValue = MaxReached - (tsl_input_pips * get_pip_size())

final_SL_Long := math.max(stopValue, final_SL_Long[1])

else if strategy.position_size < 0

stopValue = MaxReached + (tsl_input_pips * get_pip_size())

final_SL_Short := math.min(stopValue, final_SL_Short[1])

// # ========================================================================= #

// # | Take Profit 1 |

// # ========================================================================= #

var float final_TP1_Long = 0.

var float final_TP1_Short = 0.

final_TP1_Long := entryLongPrice + (tp1_value * get_pip_size())

final_TP1_Short := entryShortPrice - (tp1_value * get_pip_size())

plot(use_tp1 and strategy.position_size > 0 ? final_TP1_Long : na, title = "TP1 Long", color = color.aqua, linewidth=2, style=plot.style_linebr)

plot(use_tp1 and strategy.position_size < 0 ? final_TP1_Short : na, title = "TP1 Short", color = color.blue, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Take Profit 2 |

// # ========================================================================= #

var float final_TP2_Long = 0.

var float final_TP2_Short = 0.

final_TP2_Long := entryLongPrice + (tp2_value * get_pip_size())

final_TP2_Short := entryShortPrice - (tp2_value * get_pip_size())

plot(use_tp2 and strategy.position_size > 0 and tp1_qty != 100 ? final_TP2_Long : na, title = "TP2 Long", color = color.orange, linewidth=2, style=plot.style_linebr)

plot(use_tp2 and strategy.position_size < 0 and tp1_qty != 100 ? final_TP2_Short : na, title = "TP2 Short", color = color.white, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Stop Loss to Breakeven |

// # ========================================================================= #

var bool SL_BE_REACHED = false

// Calculate open profit or loss for the open positions.

tradeOpenPL() =>

sumProfit = 0.0

for tradeNo = 0 to strategy.opentrades - 1

sumProfit += strategy.opentrades.profit(tradeNo)

result = sumProfit

//get_pip_size() =>

// syminfo.type == "forex" ? syminfo.pointvalue * 100 : 1

current_profit = tradeOpenPL()// * get_pip_size()

current_long_profit = (close - entryLongPrice) / (syminfo.mintick * 10)

current_short_profit = (entryShortPrice - close) / (syminfo.mintick * 10)

plot(current_short_profit, title = "Current Short Profit")

plot(current_long_profit, title = "Current Long Profit")

if use_sl_be

if strategy.position_size[1] > 0

if not SL_BE_REACHED

if current_long_profit >= sl_be_value

final_SL_Long := entryLongPrice + (sl_be_offset * get_pip_size())

SL_BE_REACHED := true

else if strategy.position_size[1] < 0

if not SL_BE_REACHED

if current_short_profit >= sl_be_value

final_SL_Short := entryShortPrice - (sl_be_offset * get_pip_size())

SL_BE_REACHED := true

plot(use_sl and strategy.position_size > 0 ? final_SL_Long : na, title = "SL Long", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

plot(use_sl and strategy.position_size < 0 ? final_SL_Short : na, title = "SL Short", color = color.fuchsia, linewidth=2, style=plot.style_linebr)

// # ========================================================================= #

// # | Strategy Calls |

// # ========================================================================= #

string entry_long_limit_alert_message = ""

string entry_long_TP1_alert_message = ""

string entry_long_TP2_alert_message = ""

tp1_qty_perc = tp1_qty / 100

if use_tp1 and use_tp2

entry_long_TP1_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_long_TP2_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size - (pos_size * tp1_qty_perc)) + ",tp=" + str.tostring(final_TP2_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if use_tp1 and not use_tp2

entry_long_TP1_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if not use_tp1 and use_tp2

entry_long_TP2_alert_message := pineconnector_licence_ID + ",buy," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP2_Long)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Long) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_long_limit_alert_message := entry_long_TP1_alert_message + "\n" + entry_long_TP2_alert_message

//entry_long_limit_alert_message = pineconnector_licence_ID + ",buystop," + syminfo.ticker + ",price=" + str.tostring(buy_price) + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP_Long) + ",sl=" + str.tostring(final_SL_Long)

//entry_short_market_alert_message = pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + (use_tp1 ? ",tp=" + str.tostring(final_TP1_Short) : "")

// + (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "")

//entry_short_limit_alert_message = pineconnector_licence_ID + ",sellstop," + syminfo.ticker + ",price=" + str.tostring(sell_price) + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP_Short) + ",sl=" + str.tostring(final_SL_Short)

string entry_short_limit_alert_message = ""

string entry_short_TP1_alert_message = ""

string entry_short_TP2_alert_message = ""

if use_tp1 and use_tp2

entry_short_TP1_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_short_TP2_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size - (pos_size * tp1_qty_perc)) + ",tp=" + str.tostring(final_TP2_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if use_tp1 and not use_tp2

entry_short_TP1_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size * tp1_qty_perc) + ",tp=" + str.tostring(final_TP1_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

else if not use_tp1 and use_tp2

entry_short_TP2_alert_message := pineconnector_licence_ID + ",sell," + syminfo.ticker + ",risk=" + str.tostring(pos_size) + ",tp=" + str.tostring(final_TP2_Short)

+ (use_sl ? ",sl=" + str.tostring(final_SL_Short) : "") + (use_sl_be ? ",beoffset=" + str.tostring(sl_be_offset) + ",betrigger=" + str.tostring(sl_be_value) : "")

+ (use_tsl ? ",trailtrig=" + str.tostring(tsl_input_pips) + ",traildist=" + str.tostring(tsl_input_pips) + ",trailstep=1" : "")

entry_short_limit_alert_message := entry_short_TP1_alert_message + "\n" + entry_short_TP2_alert_message

long_update_sl_alert_message = pineconnector_licence_ID + ",newsltplong," + syminfo.ticker + ",sl=" + str.tostring(final_SL_Long)

short_update_sl_alert_message = pineconnector_licence_ID + ",newsltpshort," + syminfo.ticker + ",sl=" + str.tostring(final_SL_Short)

cancel_long = pineconnector_licence_ID + ",cancellong," + syminfo.ticker// + "x"

cancel_short = pineconnector_licence_ID + ",cancellong," + syminfo.ticker// + "x"

close_long = pineconnector_licence_ID + ",closelong," + syminfo.ticker

close_short = pineconnector_licence_ID + ",closeshort," + syminfo.ticker

if bull and strategy.position_size <= 0

alert(close_short, alert.freq_once_per_bar_close)

strategy.entry("Long", strategy.long)

alert(entry_long_TP1_alert_message, alert.freq_once_per_bar_close)

alert(entry_long_TP2_alert_message, alert.freq_once_per_bar_close)

else if bear and strategy.position_size >= 0

alert(close_long, alert.freq_once_per_bar_close)

strategy.entry("Short", strategy.short)

alert(entry_short_TP1_alert_message, alert.freq_once_per_bar_close)

alert(entry_short_TP2_alert_message, alert.freq_once_per_bar_close)

if strategy.position_size[1] > 0

if low <= final_SL_Long and use_sl

strategy.close("Long", alert_message = close_long)

else

strategy.exit("Exit TP1 Long", "Long", limit = final_TP1_Long, comment_profit = "Exit TP1 Long", qty_percent = tp1_qty)

strategy.exit("Exit TP2 Long", "Long", limit = final_TP2_Long, comment_profit = "Exit TP2 Long", alert_message = close_long)

if bull_count[1] == 5 and bull_count < 5 and barstate.isconfirmed and use_close_opposite

strategy.close("Long", comment = "1 or more MACDs became bearish", alert_message = close_long)

else if strategy.position_size[1] < 0

if high >= final_SL_Short and use_sl

//strategy.exit("Exit SL Short", "Short", stop = final_SL_Short, comment_loss = "Exit SL Short")

strategy.close("Short", alert_message = close_short)

else

strategy.exit("Exit TP1 Short", "Short", limit = final_TP1_Short, comment_profit = "Exit TP1 Short", qty_percent = tp1_qty)

strategy.exit("Exit TP2 Short", "Short", limit = final_TP2_Short, comment_profit = "Exit TP2 Short")

if bear_count[1] == 5 and bear_count < 5 and barstate.isconfirmed and use_close_opposite

strategy.close("Short", comment = "1 or more MACDs became bullish", alert_message = close_short)

// # ========================================================================= #

// # | Logs |

// # ========================================================================= #

// if bull and strategy.position_size <= 0

// log.info(entry_long_limit_alert_message)

// else if bear and strategy.position_size >= 0

// log.info(entry_short_limit_alert_message)

// # ========================================================================= #

// # | Reset Variables |

// # ========================================================================= #

if (strategy.position_size > 0 and strategy.position_size[1] <= 0)

or (strategy.position_size < 0 and strategy.position_size[1] >= 0)

//is_TP1_REACHED := false

SL_BE_REACHED := false