ローポイントピラミッド低リスク追跡戦略

この戦略は,さまざまな指標を組み合わせて,価格の動きの潜在的低点を識別し,ピラミッドを追跡して段階的にポジションを構築することでリスクを軽減します.この戦略は,停止,停止,移動停止などの機能を組み合わせて,リスクを効果的に制御できます.

戦略概要

この戦略は,まず,RSIとEMAのRSIの差値を使用して価格の潜在的低点を識別する. 偽の信号をフィルターするために,この戦略は,移動平均と多時間枠のランダム指標を組み合わせて確認する. 低点信号が確認されたら,その点より少し低い位置に徐々に複数の注文が作られる,これがトラッキングピラミッドの考え方である.

戦略原則

この戦略は,低点識別モジュール,ピラミッド追跡モジュール,リスク管理モジュールという 3つの部分から構成されています.

低点識別モジュールRSI指数とそのEMAの差値の間の差を用い,価格の潜在的低点を識別する. 精度を高めるために,移動平均指数と多時間枠ランダム指数で信号フィルタリングも導入されている. 価格が移動平均よりも低く,ランダム指数K線も30を下回っている場合にのみ,低点信号の有効性が確認される.

ピラミッド追跡モジュールこの戦略の核心である。低点の信号が確認されると,戦略は,その低点より0.1%下にある位置で最初の注文を開きます。その後,価格が下がり続け,平均入場価格より一定比率を下回る限り,追加注文を継続します。新しい注文の数は,次々に増加します,例えば,第3の注文の数は,最初の注文の3倍です。このピラミッドトラッキング方式は,平均リスクです。この戦略は,最大で12の追跡注文を開くことを許します。

リスク管理モジュール主に3つの側面が含まれる。第一は,全体的なストップで,最近の一定周期における最高価格の計算に基づくストップ・レベルである。すべてのオーダーが,このストップ・レベルに従って同時にストップする。第二は,各オーダーの個別のストップ・セットで,入場価格の一定比率に従ってストップを許される。第三は,口座権益比率に基づく全体的なストップであり,これは最も強力なリスク管理手段である。

戦略的優位性

- ピラミッドトラッキングを利用して,個々の注文のリスクを低減し,全体的なリスクを分散させる

- 多指標の組み合わせにより低点識別の正確性向上

- 整体停止,停止,移動停止機能によりリスクが効果的に管理される

- 配当率の停止メカニズムは,重大な損失から口座を保護します.

- パラメータを調整することで,リスクと利益のバランスポイントを見つけることができます.

戦略リスク

- 低点識別の正確には限界があり,最適な入口点を逃すか,偽信号に入れる可能性がある.

- 追加オーダーで不利益が発生し,損失が増加する可能性がある

- 戦略の優位性を示すために,より長い実行周期が必要

- パラメータの不適切な設定は,リスクの制御不足につながる

上記のリスクを低減するために,以下の点で最適化することができます.

- 低点識別の正確性を向上させる指標の変更または追加

- オーダー数,間隔,上昇停止などのパラメータを最適化して,単一のオーダーのリスクを減らす

- 利益を守るため 適切なストップ・ローンを削減する

- 異なる品種をテストし 流動性のある品種と 変動性のある品種を選びます

戦略最適化の方向性

この戦略をさらに改善する余地がある:

- マシン・ラーニングなどのより高度な技術導入を試みる

- 市場の状況に合わせて,注文数,ストップ・ロスの幅などのパラメータ

- 損失拡大を防ぐために,箱体内のストップ・ストラトジーを追加する

- 再入学制度の強化

- 株式と仮想通貨の品種を最適化する戦略パラメータ

要約する

この戦略は,ピラミッド追跡の思考によって,単一の注文のリスクを効果的に軽減し,全体的な停止,停止,移動停止などの機能も,優れたリスク制御の役割を果たしている.しかし,低点識別などの面で最適化の余地が残っており,より高度な技術を導入し,ダイナミック調度機能を追加し,パラメータ最適化と連携させることができれば,この戦略の利益リスク比は大幅に向上する.

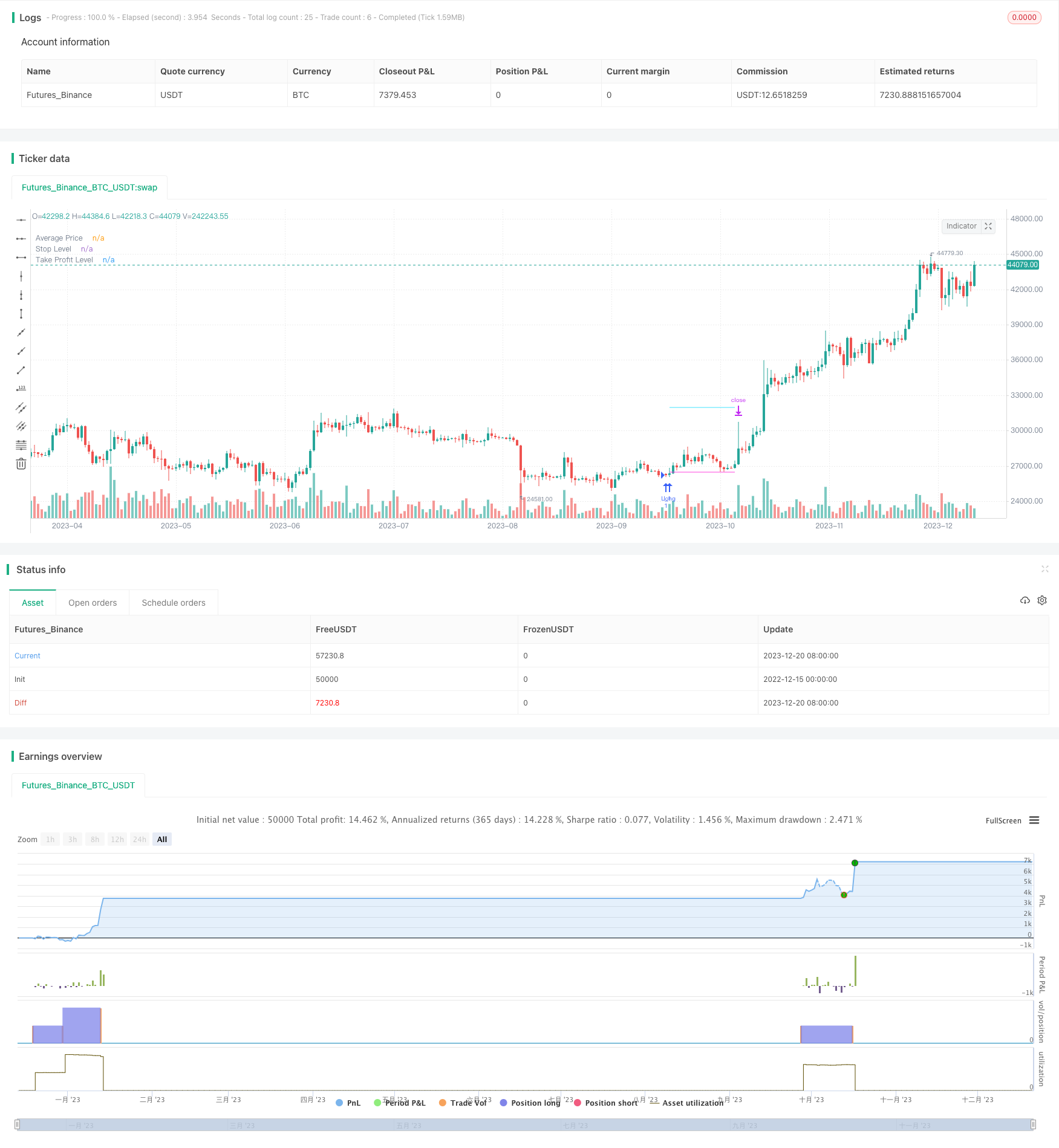

/*backtest

start: 2022-12-15 00:00:00

end: 2023-12-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © A3Sh

//@version=5

// Strategy that finds potential lows in the price action and spreads the risk by entering multiple positions at these lows.

// The low is detected based on the difference between MTF RSI and EMA based RSI, Moving Average and MTF Stochastic indicators.

// The size of each next position that is entered is multiplied by the sequential number of the position.

// Each separate position can exit when a specified take profit is triggered and re-open when detecting a new potential low.

// All positions are closed when the price action crosses over the dynamic blue stop level line.

// This strategy combines open-source code developed by fellow Tradingview community members:

// The Lowfinder code is developed by RafaelZioni

// https://www.tradingview.com/script/GzKq2RVl-Low-finder/

// Both the MTF RSI code and the MTF Stochastic code are adapted from the MTFindicators libary written by Peter_O

// https://www.tradingview.com/script/UUVWSpXR-MTFindicators/

// The Stop Level calculation is inspired by the syminfo-mintick tutorial on Kodify.net

// https://kodify.net/tradingview/info/syminfo-mintick/

strategy("LowFinder_PyraMider",

overlay=true, pyramiding=99,

precision=2,

initial_capital=10000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10,

commission_type=strategy.commission.percent,

commission_value=0.06,

slippage=1

)

// Backtest Window

start_time = input(defval=timestamp("01 April 2021 20:00"), group = "Backtest Window", title="Start Time")

end_time = input(defval=timestamp("01 Aug 2030 20:00"), group = "Backtest Window", title="End Time")

window() => true

// Inputs

portfolio_size = input.float (100, group = 'Risk - Portfolio', title = 'Portfolio %', step=1.0) / 100

leverage = input.int (1, group = 'Risk - Portfolio', title = 'Leverage', minval = 1)

q_mode = input.string ('multiply', group = 'Risk - Order Size', title = 'Order Size Mode', options = ['base', 'multiply'], tooltip = 'Base mode: the base quantiy for each sequential order. Multiply mode: each quantity is multiplied by order number')

q_mode_m = input.int (1, group = 'Risk - Order Size', title = 'Order Size Divider (Multiply Mode)', tooltip = 'Divide Multiply by this number to lower the sequential order sizes')

fixed_q = input.bool (false, group = 'Risk - Order Size', title = 'Fixed Order Size', inline = '01', tooltip = 'Use with caution! Overrides all Risk calculations')

amount_q = input.float (1, group = 'Risk - Order Size', title = '. . Base Currency:', inline = '01')

sl_on = input.bool (false, group = 'Risk - Stop Loss', title = 'StopLoss of', inline = '03')

stopLoss = input.float (1.5, group = 'Risk - Stop Loss', title = '', step=0.1, inline = '03') / 100

sl_mode = input.string ('equity', group = 'Risk - Stop Loss', title = '% of', options = ['avg_price', 'equity'], inline = '03')

stop_len = input.int (100, group = 'Risk - Stop Level', title = 'Stop Level Length', tooltip = 'Lookback most recent highest high')

stop_deviation = input.float (0.3, group = 'Risk - Stop Level', title = 'Deviatation % above Stop Level', step=0.1) / 100

cond2_toggle = input.bool (true , group = 'Risk - Take Profit', title = 'Take Profit/Trailing Stop', inline = '04')

tp_all = input.float (1.0, group = 'Risk - Take Profit', title = '..........%', step=0.1, inline = '04') / 100

tp_on = input.bool (true, group = 'Risk - Take Profit', title = 'Exit Crossover Take Profit and .....', inline = '02')

exit_mode = input.string ('stoplevel', group = 'Risk - Take Profit', title = '', options = ['close', 'stoplevel'], inline = '02')

takeProfit = input.float (10.0, group = 'Risk - Take Profit', title = 'Take Profit % per Order', tooltip = 'Each separate order exits when hit', step=0.1)

posCount = input.int (12, group = 'Pyramiding Settings', title = 'Max Number of Orders')

next_entry = input.float (0.2, group = 'Pyramiding Settings', title = 'Next Order % below Avg. Price', step=0.1)

oa_lookback = input.int (0, group = 'Pyramiding Settings', title = 'Next Order after X candles', tooltip = 'Prevents opening too much orders in a Row')

len_rsi = input.int (5, group = 'MTF LowFinder Settings', title = 'Lookback of RSI')

mtf_rsi = input.int (1, group = 'MTF LowFinder Settings', title = 'Higher TimeFrame Multiplier RSI', tooltip='Multiplies the current timeframe by specified value')

ma_length = input.int (26, group = 'MTF LowFinder Settings', title = 'MA Length / Sensitivity')

new_entry = input.float (0.1, group = 'MTF LowFinder Settings', title = 'First Order % below Low',step=0.1, tooltip = 'Open % lower then the found low')/100

ma_signal = input.int (100, group = 'Moving Average Filter', title = 'Moving Average Length')

periodK = input.int (14, group = 'MTF Stochastic Filter', title = 'K', minval=1)

periodD = input.int (3, group = 'MTF Stochastic Filter', title = 'D', minval=1)

smoothK = input.int (3, group = 'MTF Stochastic Filter', title = 'Smooth', minval=1)

lower = input.int (30, group = 'MTF Stochastic Filter', title = 'MTF Stoch Filter (above gets filtered)')

mtf_stoch = input.int (10, group = 'MTF Stochastic Filter', title = 'Higher TimeFrame Multiplier', tooltip='Multiplies the current timeframe by specified value')

avg_on = input.bool (true, group = 'Plots', title = 'Plot Average Price')

plot_ma = input.bool (false, group = 'Plots', title = 'Plot Moving Average')

plot_ts = input.bool (false, group = 'Plots', title = 'Plot Trailing Stop Level')

// variables //

var entry_price = 0.0 // The entry price of the first entry

var previous_entry = 0.0 // Stores the price of the previous entry

var iq = 0.0 // Inititial order quantity before risk calculation

var nq = 0.0 // Updated new quantity after the loop

var oq = 0.0 // Old quantity at the beginning or the loop

var q = 0.0 // Final calculated quantity used as base order size

var int order_after = 0

// Order size calaculations //

// Order size based on max amount of pyramiding orders or fixed by user input ///

// Order size calculation based on 'base' mode or ' multiply' mode //

if fixed_q

q := amount_q

else if q_mode == 'multiply'

iq := (math.abs(strategy.equity * portfolio_size / posCount) / open) * leverage

oq := iq

for i = 0 to posCount

nq := oq + (iq * ( i/ q_mode_m + 1))

oq := nq

q := (iq * posCount / oq) * iq

else

q := (math.abs(strategy.equity * portfolio_size / posCount) / open) * leverage

// Function to calcaulate final order size based on order size modes and round the result with 1 decimal //

quantity_mode(index,string q_mode) =>

q_mode == 'base' ? math.round(q,1) : q_mode == 'multiply' ? math.round(q * (index/q_mode_m + 1),1) : na

// LowFinder Calculations //

// MTF RSI by Peter_O //

rsi_mtf(float source, simple int mtf,simple int len) =>

change_mtf=source-source[mtf]

up_mtf = ta.rma(math.max(change_mtf, 0), len*mtf)

down_mtf = ta.rma(-math.min(change_mtf, 0), len*mtf)

rsi_mtf = down_mtf == 0 ? 100 : up_mtf == 0 ? 0 : 100 - (100 / (1 + up_mtf / down_mtf))

// Lowfinder by RafaelZioni //

vrsi = rsi_mtf(close,mtf_rsi,len_rsi)

pp=ta.ema(vrsi,ma_length)

dd=(vrsi-pp)*5

cc=(vrsi+dd+pp)/2

lows=ta.crossover(cc,0)

// MTF Stoch Calcualation // MTF Stoch adapted from Peter_O //

stoch_mtfK(source, mtf, len) =>

k = ta.sma(ta.stoch(source, high, low, periodK * mtf), smoothK * mtf)

stoch_mtfD(source, mtf, len) =>

k = ta.sma(ta.stoch(source, high, low, periodK * mtf), smoothK * mtf)

d = ta.sma(k, periodD * mtf)

mtfK = stoch_mtfK(close, mtf_stoch, periodK)

mtfD = stoch_mtfD(close, mtf_stoch, periodK)

// Open next position % below average position price //

below_avg = close < (strategy.position_avg_price * (1 - (next_entry / 100)))

// Moving Average Filter //

moving_average_signal = ta.sma(close, ma_signal)

plot (plot_ma ? moving_average_signal : na, title = 'Moving Average', color = color.rgb(154, 255, 72))

// Buy Signal //

buy_signal = lows and close < moving_average_signal and mtfK < lower

// First Entry % Below lows //

if buy_signal

entry_price := close * (1 - new_entry)

// Plot Average Price of Position//

plot (avg_on ? strategy.position_avg_price : na, title = 'Average Price', style = plot.style_linebr, color = color.new(color.white,0), linewidth = 1)

// Take profit per Open Order //

take_profit_price = close * takeProfit / 100 / syminfo.mintick

// Calculate different Stop Level conditions to exit All //

// Stop Level Caculation //

stop_long1_level = ta.highest (high, stop_len)[1] * (1 + stop_deviation)

stop_long2_level = ta.highest (high, stop_len)[2] * (1 + stop_deviation)

stop_long3_level = ta.highest (high, stop_len)[3] * (1 + stop_deviation)

stop_long4_level = ta.highest (high, stop_len)[1] * (1 - 0.008)

// Stop triggers //

stop_long1 = ta.crossover(close,stop_long1_level)

stop_long2 = ta.crossover(close,stop_long2_level)

stop_long4 = ta.crossunder(close,stop_long4_level)

// Exit Conditions, cond 1 only Stop Level, cond2 Trailing Stop option //

exit_condition_1 = close < strategy.position_avg_price ? stop_long1 : close > strategy.position_avg_price ? stop_long2 : na

exit_condition_2 = close < strategy.position_avg_price * (1 + tp_all) ? stop_long2 :

close > strategy.position_avg_price * (1 + tp_all) ? stop_long4 :

close < strategy.position_avg_price ? stop_long1 : na

// Switch between conditions //

exit_conditions = cond2_toggle ? exit_condition_2 : exit_condition_1

// Exit when take profit //

ex_m = exit_mode == 'close' ? close : stop_long2_level

tp_exit = ta.crossover(ex_m, strategy.position_avg_price * (1 + tp_all)) and close > strategy.position_avg_price * 1.002

// Plot stoplevel, take profit level //

plot_stop_level = strategy.position_size > 0 ? stop_long2_level : na

plot_trailing_stop = cond2_toggle and plot_ts and strategy.position_size > 0 and close > strategy.position_avg_price * (1 + tp_all) ? stop_long4_level : na

plot(plot_stop_level, title = 'Stop Level', style=plot.style_linebr, color = color.new(#41e3ff, 0), linewidth = 1)

plot(plot_trailing_stop, title = 'Trailing Stop', style=plot.style_linebr, color = color.new(#4cfca4, 0), linewidth = 1)

plot_tp_level = cond2_toggle and strategy.position_size > 0 ? strategy.position_avg_price * (1 + tp_all) : na

plot(plot_tp_level, title = 'Take Profit Level', style=plot.style_linebr, color = color.new(#ff41df, 0), linewidth = 1)

// Calculate Stop Loss based on equity and average price //

loss_equity = ((strategy.position_size * strategy.position_avg_price) - (strategy.equity * stopLoss)) / strategy.position_size

loss_avg_price = strategy.position_avg_price * (1 - stopLoss)

stop_loss = sl_mode == 'avg_price' ? loss_avg_price : loss_equity

plot(strategy.position_size > 0 and sl_on ? stop_loss : na, title = 'Stop Loss', color=color.new(color.red,0),style=plot.style_linebr, linewidth = 1)

// Enter first position //

if ta.crossunder(close,entry_price) and window() and strategy.position_size == 0

strategy.entry('L_1', strategy.long, qty = math.round(q,1), comment = '+' + str.tostring(math.round(q,1)))

previous_entry := close

// Enter next pyramiding positions //

if buy_signal and window() and strategy.position_size > 0 and below_avg

order_after := order_after + 1

for i = 1 to strategy.opentrades

entry_comment = '+' + str.tostring((quantity_mode(i,q_mode))) // Comment with variable //

if strategy.opentrades == i and i < posCount and order_after > oa_lookback

entry_price := close

entry_id = 'L_' + str.tostring(i + 1)

strategy.entry(id = entry_id, direction=strategy.long, limit=entry_price, qty= quantity_mode(i,q_mode), comment = entry_comment)

previous_entry := entry_price

order_after := 0

// Exit per Position //

if strategy.opentrades > 0 and window()

for i = 0 to strategy.opentrades

exit_comment = '-' + str.tostring(strategy.opentrades.size(i))

exit_from = 'L_' + str.tostring(i + 1)

exit_id = 'Exit_' + str.tostring(i + 1)

strategy.exit(id= exit_id, from_entry= exit_from, profit = take_profit_price, comment = exit_comment)

// Exit All //

if exit_conditions or (tp_exit and tp_on and cond2_toggle) and window()

strategy.close_all('Exti All')

entry_price := 0

if ta.crossunder(close,stop_loss) and sl_on and window()

strategy.close_all('StopLoss')

entry_price := 0