Chiến lược tối ưu hóa lọc xu hướng kép

Tổng quan

Chiến lược này sử dụng bộ lọc hai đường trung bình và cơ chế xác nhận nhiều hướng đẩy để thiết kế một hệ thống theo dõi ổn định hơn. Nó bao gồm ba phần chính:

Hệ thống theo dõi xu hướng tối ưu hóa dựa trên bộ theo dõi biến động hai đỉnh được cải tiến, xác định định hướng xu hướng lớn.

Hệ thống lọc xu hướng phụ dựa trên kết hợp đường trung bình đa chu kỳ, lọc thêm một phần tiếng ồn.

Chỉ số Alpha cung cấp xác nhận cuối cùng để đảm bảo độ tin cậy của tín hiệu giao dịch.

Bằng cách bảo vệ ba lần như trên, chiến lược có thể đánh giá chính xác hơn các xu hướng lớn và có khả năng lọc mạnh mẽ tiếng ồn thị trường ngắn hạn.

Nguyên tắc

Theo dõi xu hướng chính

Sử dụng hệ thống theo dõi biến động hai đỉnh cải tiến TOTT và Close Series lọc xu hướng kép để tính toán hướng xu hướng chính. TOTT tự nó có khả năng lọc rất mạnh đối với tiếng ồn.

Bộ lọc xu hướng phụ

Ngoài hệ thống phán đoán xu hướng chính, chiến lược cũng thiết lập hệ thống lọc xu hướng phụ nhiều chu kỳ dựa trên kết hợp đường EMA. Nhiều cấp xác nhận Gold Cross và Dead Cross dựa trên mối quan hệ đường trung bình của EMA, làm tăng thêm độ tin cậy của phán đoán về hướng xu hướng chính, lọc nhiều tiếng ồn hơn.

Alpha xác nhận.

Khi vào vị trí yên bình, chiến lược cũng sẽ kiểm tra giá trị chỉ số Alpha để đảm bảo độ tin cậy của tín hiệu giao dịch cuối cùng. Alpha có thể phản ánh sức mạnh mua và bán của thị trường và là một chỉ số xác nhận tốt.

Ưu điểm

- Thiết kế bảo vệ đa dạng, đánh giá chính xác các xu hướng lớn

- Khả năng lọc tiếng ồn mạnh mẽ

- Tín hiệu giao dịch ổn định và đáng tin cậy

- Không gian tối ưu hóa tham số lớn

Rủi ro

- Tần số tạo tín hiệu có thể thấp

- Sử dụng đường trung bình trong hệ thống theo dõi, có thể bị phá vỡ khi thị trường thay đổi mạnh

Để giảm nguy cơ trên, bạn có thể điều chỉnh các tham số để tối ưu hóa độ nhạy của hệ thống theo dõi hoặc kết hợp nhiều chỉ số đảo ngược như bộ lọc cuối cùng.

Hướng tối ưu hóa

- Điều chỉnh các tham số của hệ thống theo dõi biến động của hai đỉnh để tìm các tham số tốt hơn

- Cố gắng tối ưu hóa các tham số của các loại đường trung bình khác nhau

- Tối ưu hóa chu kỳ đường trung bình của kết hợp đường EMA

- Cập nhật bộ lọc Alpha

- Tăng hệ thống chống thiệt hại

Tóm tắt

Chiến lược này được thiết kế toàn diện, có biện pháp phù hợp, bảo vệ nhiều và lọc tiếng ồn mạnh mẽ đã giành được hiệu suất ổn định. Với sự tối ưu hóa tham số và cải tiến cơ chế liên tục, hiệu suất của chiến lược có thể được nâng cao hơn nữa.

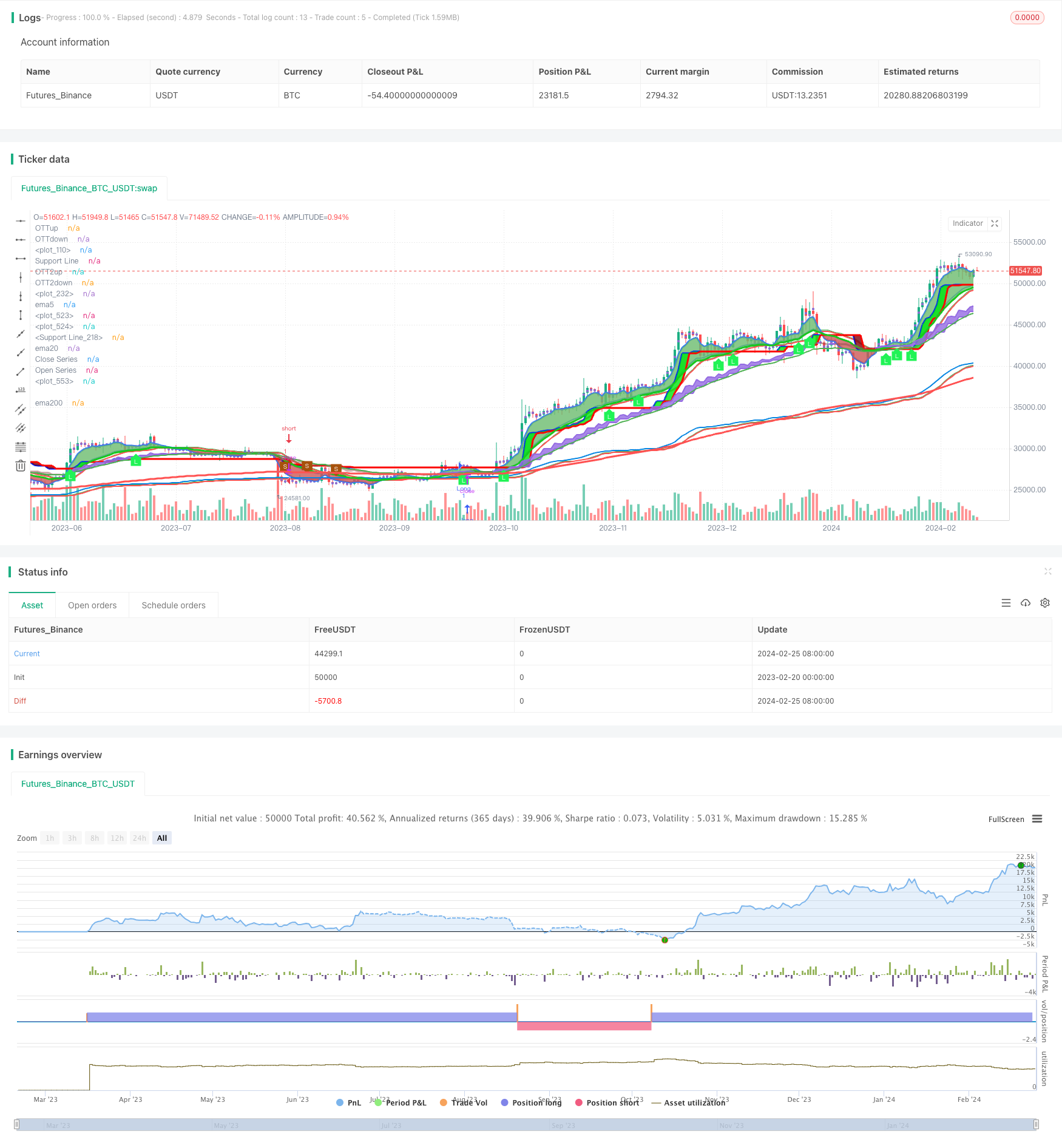

/*backtest

start: 2023-02-20 00:00:00

end: 2024-02-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

strategy('TOTT-OCC R5.1 wixca-buy-sell', 'TOTT', overlay=true)

src = input(close, title='Source')

length = input.int(18, 'OTT Period', minval=1)

percent = input.float(1, 'Optimization Constant', step=0.1, minval=0)

coeff1 = input.float(0.001, 'Twin OTT Coefficient', step=0.001, minval=0)

showsupport = input(title='Show Support Line?', defval=true)

showsignalsk1 = input(title='Show Signals?', defval=true)

mav = input.string(title='Moving Average Type', defval='EMA', options=['SMA', 'EMA', 'WMA', 'TMA', 'VAR', 'WWMA', 'ZLEMA', 'TSF'])

highlighting = input(title='Highlighter On/Off ?', defval=true)

Var_Func(src, length) =>

valpha = 2 / (length + 1)

vud1 = src > src[1] ? src - src[1] : 0

vdd1 = src < src[1] ? src[1] - src : 0

vUD = math.sum(vud1, 9)

vDD = math.sum(vdd1, 9)

vCMO = nz((vUD - vDD) / (vUD + vDD))

VAR = 0.0

VAR := nz(valpha * math.abs(vCMO) * src) + (1 - valpha * math.abs(vCMO)) * nz(VAR[1])

VAR

VAR = Var_Func(src, length)

Wwma_Func(src, length) =>

wwalpha = 1 / length

WWMA = 0.0

WWMA := wwalpha * src + (1 - wwalpha) * nz(WWMA[1])

WWMA

WWMA = Wwma_Func(src, length)

Zlema_Func(src, length) =>

zxLag = length / 2 == math.round(length / 2) ? length / 2 : (length - 1) / 2

zxEMAData = src + src - src[zxLag]

ZLEMA = ta.ema(zxEMAData, length)

ZLEMA

ZLEMA = Zlema_Func(src, length)

Tsf_Func(src, length) =>

lrc = ta.linreg(src, length, 0)

lrc1 = ta.linreg(src, length, 1)

lrs = lrc - lrc1

TSF = ta.linreg(src, length, 0) + lrs

TSF

TSF = Tsf_Func(src, length)

getMA(src, length) =>

ma = 0.0

if mav == 'SMA'

ma := ta.sma(src, length)

ma

if mav == 'EMA'

ma := ta.ema(src, length)

ma

if mav == 'WMA'

ma := ta.wma(src, length)

ma

if mav == 'TMA'

ma := ta.sma(ta.sma(src, math.ceil(length / 2)), math.floor(length / 2) + 1)

ma

if mav == 'VAR'

ma := VAR

ma

if mav == 'WWMA'

ma := WWMA

ma

if mav == 'ZLEMA'

ma := ZLEMA

ma

if mav == 'TSF'

ma := TSF

ma

ma

MAvg = getMA(src, length)

fark = MAvg * percent * 0.01

longStop = MAvg - fark

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = MAvg + fark

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

MT = dir == 1 ? longStop : shortStop

OTT = MAvg > MT ? MT * (200 + percent) / 200 : MT * (200 - percent) / 200

OTTup = OTT * (1 + coeff1)

OTTdn = OTT * (1 - coeff1)

PPLOT = plot(showsupport ? MAvg : na, color=color.new(#0585E1, 0), linewidth=2, title='Support Line')

pALLup = plot(nz(OTTup[2]), color=color.new(color.green, 0), linewidth=2, title='OTTup')

pALLdn = plot(nz(OTTdn[2]), color=color.new(color.red, 0), linewidth=2, title='OTTdown')

buySignalk1 = ta.crossover(MAvg, OTTup[2])

sellSignalk1 = ta.crossunder(MAvg, OTTdn[2])

K11 = ta.barssince(buySignalk1)

K22 = ta.barssince(sellSignalk1)

O11 = ta.barssince(buySignalk1[1])

O22 = ta.barssince(sellSignalk1[1])

//plotshape(buySignalk1 and showsignalsk1 and O11 > K22 ? math.min(low, OTTdn) : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

//plotshape(sellSignalk1 and showsignalsk1 and O22 > K11 ? math.max(high, OTTup) : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, display=display.none)

//longFillColor = highlighting ? O22 > K11 ? color.green : na : na

//shortFillColor = highlighting ? O11 > K22 ? color.red : na : na

//fill(mPlot, PPLOT, title='UpTrend Highligter', color=longFillColor, transp=90)

//fill(mPlot, PPLOT, title='DownTrend Highligter', color=shortFillColor, transp=90)

fill(pALLup, pALLdn, title='Flat Zone Highligter', color=color.new(#e0e2e9, 12))

//plotshape(ta.crossover (AlphaTrend,OTTup), style=shape.labelup, location=location.belowbar, color=color.new(color.blue, 0), size=size.tiny, title='AT>OTT', text='AL1', textcolor=color.white)

//plotshape(ta.crossunder(AlphaTrend,OTTdn), style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny, title='OTT<AT', text='SAT1', textcolor=color.white)

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//© vixca

//@version=5

//indicator('L&S', overlay=true) //pyramiding=1, initial_capital=1000,default_qty_type = strategy.cash, calc_on_order_fills=false,default_qty_value = 1000, commission_type=strategy.commission.percent, commission_value=0.2,calc_on_every_tick=true)

//strategy('Twin Optimized Trend Tracker', 'TOTT', overlay=true)

src2 = input(close, title='Source')

length2 = input.int(69, 'OTT Period', minval=1)

percent2 = input.float(1, 'Optimization Constant', step=0.1, minval=0)

coeff2 = input.float(0.001, 'Twin OTT Coefficient', step=0.001, minval=0)

showsupport2 = input(title='Show Support Line?', defval=true)

showsignalsk2 = input(title='Show Signals?', defval=true)

mav2 = input.string(title='Moving Average Type', defval='VAR2', options=['SMA', 'EMA', 'WMA', 'TMA', 'VAR2', 'WWMA', 'ZLEMA2', 'TSF2'])

highlighting2 = input(title='Highlighter On/Off ?', defval=true)

Var_Func2(src2, length2) =>

valpha = 2 / (length2 + 1)

vud1 = src2 > src2[1] ? src2 - src2[1] : 0

vdd1 = src2 < src2[1] ? src2[1] - src2 : 0

vUD = math.sum(vud1, 9)

vDD = math.sum(vdd1, 9)

vCMO = nz((vUD - vDD) / (vUD + vDD))

VAR2 = 0.0

VAR2 := nz(valpha * math.abs(vCMO) * src2) + (1 - valpha * math.abs(vCMO)) * nz(VAR2[1])

VAR2

VAR2 = Var_Func2(src2, length2)

Wwma_Func2(src2, length) =>

wwalpha = 1 / length2

WWMA2 = 0.0

WWMA2 := wwalpha * src2 + (1 - wwalpha) * nz(WWMA2[1])

WWMA2

WWMA2 = Wwma_Func2(src2, length2)

Zlema_Func2(src2, length) =>

zxLag = length2 / 2 == math.round(length2 / 2) ? length2 / 2 : (length2 - 1) / 2

zxEMAData = src2 + src2 - src2[zxLag]

ZLEMA2 = ta.ema(zxEMAData, length2)

ZLEMA2

ZLEMA2 = Zlema_Func2(src2, length2)

Tsf_Func2(src2, length2) =>

lrc = ta.linreg(src2, length2, 0)

lrc1 = ta.linreg(src2, length2, 1)

lrs = lrc - lrc1

TSF2 = ta.linreg(src2, length2, 0) + lrs

TSF2

TSF2 = Tsf_Func2(src2, length2)

getMA2(src2, length2) =>

ma = 0.0

if mav2 == 'SMA'

ma := ta.sma(src2, length2)

ma

if mav2 == 'EMA'

ma := ta.ema(src2, length2)

ma

if mav2 == 'WMA'

ma := ta.wma(src2, length2)

ma

if mav2 == 'TMA'

ma := ta.sma(ta.sma(src2, math.ceil(length2 / 2)), math.floor(length2 / 2) + 1)

ma

if mav2 == 'VAR2'

ma := VAR2

ma

if mav2 == 'WWMA2'

ma := WWMA2

ma

if mav2 == 'ZLEMA2'

ma := ZLEMA2

ma

if mav2 == 'TSF2'

ma := TSF2

ma

ma

mav2g = getMA2(src2, length2)

fark2 = mav2g * percent2 * 0.01

longStop2 = mav2g - fark2

longStop2Prev = nz(longStop2[1], longStop2)

longStop2 := mav2g > longStop2Prev ? math.max(longStop2, longStop2Prev) : longStop2

shortStop2 = mav2g + fark2

shortStop2Prev = nz(shortStop2[1], shortStop2)

shortStop2 := mav2g < shortStop2Prev ? math.min(shortStop2, shortStop2Prev) : shortStop2

dir2 = 1

dir2 := nz(dir2[1], dir2)

dir2 := dir2 == -1 and mav2g > shortStop2Prev ? 1 : dir2 == 1 and mav2g < longStop2Prev ? -1 : dir2

MT2 = dir2 == 1 ? longStop2 : shortStop2

OTT2 = mav2g > MT2 ? MT2 * (200 + percent2) / 200 : MT * (200 - percent) / 200

OTT2up = OTT2 * (1 + coeff2)

OTT2dn = OTT2 * (1 - coeff2)

PPLOT2 = plot(showsupport2 ? mav2g : na, color=color.new(#0585E1, 0), linewidth=2, title='Support Line')

pALLup2 = plot(nz(OTT2up[2]), color=color.new(color.green, 0), linewidth=2, title='OTT2up')

pALLdn2 = plot(nz(OTT2dn[2]), color=color.new(color.red, 0), linewidth=2, title='OTT2down')

buySignalk2 = ta.crossover(mav2g, OTT2up[2])

sellSignalk2 = ta.crossunder(mav2g, OTT2dn[2])

K111 = ta.barssince(buySignalk2)

K222 = ta.barssince(sellSignalk2)

O111 = ta.barssince(buySignalk2[1])

O222 = ta.barssince(sellSignalk2[1])

//plotshape(buySignalk2 and showsignalsk2 and O111 > K222 ? math.min(low, OTT2dn) : na, title='Buy2', text='Buy2', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

//plotshape(sellSignalk2 and showsignalsk2 and O222 > K111 ? math.max(high, OTT2up) : na, title='Sell2', text='Sell2', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

mPlot2 = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, display=display.none)

longFillColor2 = highlighting2 ? O222 > K111 ? color.green : na : na

shortFillColor2 = highlighting2 ? O111 > K222 ? color.red : na : na

//fill(mPlot2, PPLOT2, title='UpTrend Highligter', color=longFillColor2, transp=90)

//fill(mPlot2, PPLOT2, title='DownTrend Highligter', color=shortFillColor2, transp=90)

fill(pALLup2, pALLdn2, title='Flat Zone Highligter', color=color.new(#9d7fce, 33))

//ema kesişimi yapmak için ekledim

//wma34 = ta.wma(close, 34)

//ema1 = ta.ema(close, 900)

src4 = input(title='Source', defval=close)

//length3 = input(34, 'wma')

//lenght4 = input(1000, "ema")

//plot(ta.wma(src4, length3), color=color.new(#dbbce0, 0), linewidth=3, title='wma34')

//plot(ta.ema(src4, lenght4), color=color.new(#080c05, 0), linewidth=3, title='ema1')

//plotshape(ta.crossover (close[3],ta.ema(close, 900))and (close > ta.ema(close,900)), style=shape.labelup, location=location.belowbar, color=color.new(#21f356, 0), size=size.tiny, title='Longtrend', text='LT', textcolor=color.white)

//plotshape(ta.crossunder (close[3],ta.ema(close, 900)) and (close < ta.ema(close,900)), style=shape.labeldown, location=location.abovebar, color=color.new(#a7510b, 0), size=size.tiny, title='Shorttrend', text='ST', textcolor=color.white)

//long_signal = ta.crossover (close,OTT2up) and (close [3] > OTT2up) // and ta.crossover (AlphaTrend,OTTup) //and ta.crossover(ta.ema(close, 5), ta.ema(close, 21))

//short_signal = ta.crossunder (close,OTTdn) and (close[3] < OTTdn) // and ta.crossunder (AlphaTrend,OTTdn) //and ta.crossunder(ta.ema(close,5), ta.ema(close, 21))

//long_signal1 = ta.crossover(mav2g,OTT2up[2])

//short_signal1 = ta.crossunder(mav2g, OTT2dn[2])

//plotshape(long_signal, style=shape.labelup, location=location.belowbar, color=color.new(color.blue, 0), size=size.tiny, title='wixcaAL', text='wixAL', textcolor=color.white)

//plotshape(short_signal, style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny, title='wixcaSAT', text='wixSAT', textcolor=color.white)

//strategy.entry('Long', strategy.long, when=long_signal)

//strategy.entry('Short', strategy.short, when=short_signal)

//plotshape(buySignalk1 and showsignalsk1 and O11 > K22 ? math.min(low, OTTdn) : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

//@version=5

//indicator("EMA5 Strategy with Sequential Labels", overlay=true)

// EMA hesaplama

//emaLength = 21

//ema21 = ta.ema(close, emaLength)

// Mum kapanışı EMA5'in altında ise short aç

//shortCondition = close < ema21

// Mum kapanışı EMA5'in üstündeyse long aç

//longCondition = close > ema21

// Sinyal sayacı

//var int signalCount = 0

// Ticaret sinyallerini plot et ve ardışık numaralandırma

//plotshape(series=shortCondition, title="Short Signal", color=color.red, style=shape.triangledown, location=location.abovebar) //text = string(signalCount + 1))

//plotshape(series=longCondition, title="Long Signal", color=color.green, style=shape.triangleup, location=location.belowbar)//, text = str.tostring(signalCount + 2))

// Sinyal sayacını güncelle

//if (shortCondition or longCondition)

// signalCount := signalCount + 2

//

//@version=5

//

//strategy(title='Open Close Cross Strategy R5.1 revised by JustUncleL', shorttitle='OCC Strategy R5.1', overlay=true, pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=10, calc_on_every_tick=false)

//

// Revision: 5

// Original Author: @JayRogers

// Revision Author: JustUncleL revisions 3, 4, 5

//

// *** USE AT YOUR OWN RISK ***

// - There are drawing/painting issues in pinescript when working across resolutions/timeframes that I simply

// cannot fix here.. I will not be putting any further effort into developing this until such a time when

// workarounds become available.

// NOTE: Re-painting has been observed infrequently with default settings and seems OK up to Alternate

// multiplier of 5.

// Non-repainting mode is available by setting "Delay Open/Close MA" to 1 or more, but the reported

// performance will drop dramatically.

//

// R5.1 Changes by JustUncleL

// - Upgraded to Version 3 Pinescript.

// - Added option to select Trade type (Long, Short, Both or None)

// - Added bar colouring work around patch.

// - Small code changes to improve efficiency.

// - NOTE: To enable non-Repainting mode set "Delay Open/Close MA" to 1 or more.

// 9-Aug-2017

// - Correction on SuperSmooth MA calculation.

//

// R5 Changes by JustUncleL

// - Corrected cross over calculations, sometimes gave false signals.

// - Corrected Alternate Time calculation to allow for Daily,Weekly and Monthly charts.

// - Open Public release.

// R4 Changes By JustUncleL

// - Change the way the Alternate resolution in selected, use a Multiplier of the base Time Frame instead,

// this makes it easy to switch between base time frames.

// - Added TMA and SSMA moving average options. But DEMA is still giving the best results.

// - Using "calc_on_every_tick=false" ensures results between backtesting and real time are similar.

// - Added Option to Disable the coloring of the bars.

// - Updated default settings.

//

// R3 Changes by JustUncleL:

// - Returned a simplified version of the open/close channel, it shows strength of current trend.

// - Added Target Profit Option.

// - Added option to reduce the number of historical bars, overcomes the too many trades limit error.

// - Simplified the strategy code.

// - Removed Trailing Stop option, not required and in my opion does not work well in Trading View,

// it also gives false and unrealistic performance results in backtesting.

//

// R2 Changes:

// - Simplified and cleaned up plotting, now just shows a Moving Average derived from the average of open/close.

// - Tried very hard to alleviate painting issues caused by referencing alternate resolution..

//

// Description:

// - Strategy based around Open-Close Crossovers.

// Setup:

// - I have generally found that setting the strategy resolution to 3-4x that of the chart you are viewing

// tends to yield the best results, regardless of which MA option you may choose (if any) BUT can cause

// a lot of false positives - be aware of this

// - Don't aim for perfection. Just aim to get a reasonably snug fit with the O-C band, with good runs of

// green and red.

// - Option to either use basic open and close series data, or pick your poison with a wide array of MA types.

// - Optional trailing stop for damage mitigation if desired (can be toggled on/off)

// - Positions get taken automagically following a crossover - which is why it's better to set the resolution

// of the script greater than that of your chart, so that the trades get taken sooner rather than later.

// - If you make use of the stops, be sure to take your time tweaking the values. Cutting it too fine

// will cost you profits but keep you safer, while letting them loose could lead to more drawdown than you

// can handle.

// - To enable non-Repainting mode set "Delay Open/Close MA" to 1 or more.

//

// === INPUTS ===

useRes = input(defval=true, title='Use Alternate Resolution?')

intRes = input(defval=3, title='Multiplier for Alernate Resolution')

stratRes = timeframe.ismonthly ? str.tostring(timeframe.multiplier * intRes, '###M') : timeframe.isweekly ? str.tostring(timeframe.multiplier * intRes, '###W') : timeframe.isdaily ? str.tostring(timeframe.multiplier * intRes, '###D') : timeframe.isintraday ? str.tostring(timeframe.multiplier * intRes, '####') : '60'

basisType = input.string(defval='SMMA', title='MA Type: ', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'WMA', 'VWMA', 'SMMA', 'HullMA', 'LSMA', 'ALMA', 'SSMA', 'TMA'])

basisLen = input.int(defval=8, title='MA Period', minval=1)

offsetSigma = input.int(defval=6, title='Offset for LSMA / Sigma for ALMA', minval=0)

offsetALMA = input.float(defval=0.85, title='Offset for ALMA', minval=0, step=0.01)

scolor = input(false, title='Show coloured Bars to indicate Trend?')

delayOffset = input.int(defval=0, title='Delay Open/Close MA (Forces Non-Repainting)', minval=0, step=1)

tradeType = input.string('BOTH', title='What trades should be taken : ', options=['LONG', 'SHORT', 'BOTH', 'NONE'])

// === /INPUTS ===

// Constants colours that include fully non-transparent option.

green100 = #008000FF

lime100 = #00FF00FF

red100 = #FF0000FF

blue100 = #0000FFFF

aqua100 = #00FFFFFF

darkred100 = #8B0000FF

gray100 = #808080FF

// === BASE FUNCTIONS ===

// Returns MA input selection variant, default to SMA if blank or typo.

variant(type, src, len, offSig, offALMA) =>

v1 = ta.sma(src, len) // Simple

v2 = ta.ema(src, len) // Exponential

v3 = 2 * v2 - ta.ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ta.ema(v2, len)) + ta.ema(ta.ema(v2, len), len) // Triple Exponential

v5 = ta.wma(src, len) // Weighted

v6 = ta.vwma(src, len) // Volume Weighted

v7 = 0.0

sma_1 = ta.sma(src, len) // Smoothed

v7 := na(v7[1]) ? sma_1 : (v7[1] * (len - 1) + src) / len

v8 = ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len))) // Hull

v9 = ta.linreg(src, len, offSig) // Least Squares

v10 = ta.alma(src, len, offALMA, offSig) // Arnaud Legoux

v11 = ta.sma(v1, len) // Triangular (extreme smooth)

// SuperSmoother filter

// © 2013 John F. Ehlers

a1 = math.exp(-1.414 * 3.14159 / len)

b1 = 2 * a1 * math.cos(1.414 * 3.14159 / len)

c2 = b1

c3 = -a1 * a1

c1 = 1 - c2 - c3

v12 = 0.0

v12 := c1 * (src + nz(src[1])) / 2 + c2 * nz(v12[1]) + c3 * nz(v12[2])

type == 'EMA' ? v2 : type == 'DEMA' ? v3 : type == 'TEMA' ? v4 : type == 'WMA' ? v5 : type == 'VWMA' ? v6 : type == 'SMMA' ? v7 : type == 'HullMA' ? v8 : type == 'LSMA' ? v9 : type == 'ALMA' ? v10 : type == 'TMA' ? v11 : type == 'SSMA' ? v12 : v1

// security wrapper for repeat calls

reso(exp, use, res) =>

security_1 = request.security(syminfo.tickerid, res, exp, gaps=barmerge.gaps_off, lookahead=barmerge.lookahead_on)

use ? security_1 : exp

// === /BASE FUNCTIONS ===

// === SERIES SETUP ===

closeSeries = variant(basisType, close[delayOffset], basisLen, offsetSigma, offsetALMA)

openSeries = variant(basisType, open[delayOffset], basisLen, offsetSigma, offsetALMA)

// === /SERIES ===

// === PLOTTING ===

// Get Alternate resolution Series if selected.

closeSeriesAlt = reso(closeSeries, useRes, stratRes)

openSeriesAlt = reso(openSeries, useRes, stratRes)

//

trendColour = closeSeriesAlt > openSeriesAlt ? color.rgb(148, 106, 226) : color.rgb(146, 80, 80, 62)

bcolour = closeSeries > openSeriesAlt ? lime100 : red100

barcolor(scolor ? bcolour : na, title='Bar Colours')

closeP = plot(closeSeriesAlt, title='Close Series', color=trendColour, linewidth=2, style=plot.style_line, transp=20)

openP = plot(openSeriesAlt, title='Open Series', color=trendColour, linewidth=2, style=plot.style_line, transp=20)

fill(closeP, openP, color=trendColour, transp=80)

// === /PLOTTING ===

// === ALERT conditions

xlong = ta.crossover(closeSeriesAlt, openSeriesAlt)

xshort = ta.crossunder(closeSeriesAlt, openSeriesAlt)

longCond = xlong // alternative: longCond[1]? false : (xlong or xlong[1]) and close>closeSeriesAlt and close>=open

shortCond = xshort // alternative: shortCond[1]? false : (xshort or xshort[1]) and close<closeSeriesAlt and close<=open

// === /ALERT conditions.

// === STRATEGY ===

// stop loss

slPoints = input.int(defval=0, title='Initial Stop Loss Points (zero to disable)', minval=0)

tpPoints = input.int(defval=0, title='Initial Target Profit Points (zero for disable)', minval=0)

// Include bar limiting algorithm

ebar = input.int(defval=10000, title='Number of Bars for Back Testing', minval=0)

dummy = input(false, title='- SET to ZERO for Daily or Longer Timeframes')

//

// Calculate how many mars since last bar

tdays = (timenow - time) / 60000.0 // number of minutes since last bar

tdays := timeframe.ismonthly ? tdays / 1440.0 / 5.0 / 4.3 / timeframe.multiplier : timeframe.isweekly ? tdays / 1440.0 / 5.0 / timeframe.multiplier : timeframe.isdaily ? tdays / 1440.0 / timeframe.multiplier : tdays / timeframe.multiplier // number of bars since last bar

//

//set up exit parameters

TP = tpPoints > 0 ? tpPoints : na

SL = slPoints > 0 ? slPoints : na

// Make sure we are within the bar range, Set up entries and exit conditions

//if (ebar == 0 or tdays <= ebar) and tradeType != 'NONE'

// strategy.entry('long', strategy.long, when=longCond == true and tradeType != 'SHORT')

// strategy.entry('short', strategy.short, when=shortCond == true and tradeType != 'LONG')

// strategy.close('long', when=shortCond == true and tradeType == 'LONG')

// strategy.close('short', when=longCond == true and tradeType == 'SHORT')

// strategy.exit('XL', from_entry='long', profit=TP, loss=SL)

// strategy.exit('XS', from_entry='short', profit=TP, loss=SL)

// === /STRATEGY ===

// eof

line1=ta.ema (close, 5)

line2=ta.ema(close, 20)

line3=ta.ema(close, 13)

trendColour1= line1 >= line2 ? color.rgb(108, 187, 110) : color.rgb(204, 87, 87)

p1 = plot(line1, title="ema5", color=#3179f5, linewidth=3)

p2 = plot(line2, title="ema20", color=#18c71d, linewidth=3)

fill(p1, p2, title = "5-20 Background", color = trendColour1, transp=80)

//length6 = input(50, 'sma1')

//plot(ta.sma(src4, length6), color=color.new(color.lime, 0), linewidth=3, title='sma50')

//length7 = input(200, 'sma2')

//plot(ta.sma(src4, length7), color=color.new(color.olive, 0), linewidth=3, title='sma200')

//length8 = input(900, 'ema3')

//plot(ta.ema(src4, length8), color=color.new(color.teal, 0), linewidth=3, title='ema900')

//longCondition =long

//if longCondition

// strategy.entry("Long", strategy.long)

//shortCondition = short

//if shortCondition

// strategy.entry("Short", strategy.short)

//if (ebar == 0 or tdays <= ebar) and tradeType != 'NONE'

// strategy.entry('long', strategy.long, when=longCond == true and tradeType != 'SHORT')

// strategy.entry('short', strategy.short, when=shortCond == true and tradeType != 'LONG')

//strategy.close('long', when=shortCond == true and tradeType == 'LONG')

//strategy.close('short', when=longCond == true and tradeType == 'SHORT')

//strategy.exit('XL', from_entry='long', profit=TP, loss=SL)

//strategy.exit('XS', from_entry='short', profit=TP, loss=SL)

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// author © KivancOzbilgic

// developer © KivancOzbilgic

//@version=5

//indicator('AlphaTrend', shorttitle='AT', overlay=true, format=format.price, precision=2, timeframe='')

coeff = input.float(1, 'Multiplier', step=0.1)

AP = input(14, 'Common Period')

ATR = ta.sma(ta.tr, AP)

src5 = input(close)

showsignalsk = input(title='Show Signals?', defval=true)

novolumedata = input(title='Change calculation (no volume data)?', defval=false)

upT = low - ATR * coeff

downT = high + ATR * coeff

AlphaTrend = 0.0

AlphaTrend := (novolumedata ? ta.rsi(src5, AP) >= 50 : ta.mfi(hlc3, AP) >= 50) ? upT < nz(AlphaTrend[1]) ? nz(AlphaTrend[1]) : upT : downT > nz(AlphaTrend[1]) ? nz(AlphaTrend[1]) : downT

color1 = AlphaTrend > AlphaTrend[2] ? #00E60F : AlphaTrend < AlphaTrend[2] ? #80000B : AlphaTrend[1] > AlphaTrend[3] ? #00E60F : #80000B

k1 = plot(AlphaTrend, color=color.new(#0022FC, 0), linewidth=3)

k2 = plot(AlphaTrend[2], color=color.new(#FC0400, 0), linewidth=3)

fill(k1, k2, color=color1)

buySignalk = ta.crossover(AlphaTrend, AlphaTrend[2])

sellSignalk = ta.crossunder(AlphaTrend, AlphaTrend[2])

K1 = ta.barssince(buySignalk)

K2 = ta.barssince(sellSignalk)

O1 = ta.barssince(buySignalk[1])

O2 = ta.barssince(sellSignalk[1])

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © vixca

//@version=5

//indicator('EMA Strategy', overlay=true)

// EMA values

ema5 = ta.ema(close, 5)

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema200 = ta.ema(close, 200)

ema900 = ta.ema(close, 900)

// Plot EMA lines

//plot(ema5, color=color.new(color.blue, 0), linewidth=2)

//plot(ema20, color=color.new(color.orange, 0), linewidth=2)

plot(ema50, color=color.new(color.green, 0), linewidth=2)

plot(ema200, title="ema200", color=color.new(color.red, 0), linewidth=3)

plot(ema900, title="ema900", color=color.new(color.purple, 0), linewidth=4)

// Long condition

//longCondition = ema5 > ema20 and ema50 > ema200 and close > ema900

// Short condition

//shortCondition = ema5 < ema20 and ema50 < ema200 and close < ema900

// Plot signals

//plotshape(longCondition, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.large)

//plotshape(shortCondition, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.large)

//plotshape(long, style=shape.labelup, location=location.belowbar, color=color.new(#21f356, 0), size=size.tiny, title='Longtrend', text='Lt', textcolor=color.white)

//plotshape(short, style=shape.labeldown, location=location.abovebar, color=color.new(#a7510b, 0), size=size.tiny, title='Shorttrend', text='St', textcolor=color.white)

// Güçlü al ve güçlü sat koşulları

//strongBuy = longCondition and long

//strongSell = shortCondition and short

// Güçlü al ve güçlü sat sinyalleri 3 mum sonrada doğru mu?

//strongBuy = longCondition and long and close[3] > close[0]

//strongSell = shortCondition and short and close[3] < close[0]

// Güçlü al ve güçlü sat sinyallerini çiz

//plotshape(strongBuy, style=shape.circle, location=location.belowbar, color=color.new(color.blue, 0), size=size.large, title='Strong Buy', text='B', textcolor=color.white)

//plotshape(strongSell, style=shape.xcross, location=location.abovebar, color=color.new(color.black, 0), size=size.large, title='Strong Sell', text='S', textcolor=color.white)

//plotshape(strongBuy, style=shape.labelup, location=location.belowbar, color=color.new(#21f356, 0), size=size.tiny, title='Strong Buy', text='B', textcolor=color.white)

//plotshape(strongSell, style=shape.labeldown, location=location.abovebar, color=color.new(#a7510b, 0), size=size.tiny, title='Strong Sell', text='S', textcolor=color.white)

long = ema5 > ema20 and close > OTT2up and close[1] > OTT2up[1] and close > OTTup and close[1] > OTTup[1] and close > AlphaTrend and close[1] > AlphaTrend[1] and low > OTTup and low[1] > OTTup[1] and close > openSeriesAlt and close[1] > openSeriesAlt[1]// and and low[1] > OTT2up and low[2] > ema50[2] and low[2] > OTT2up//and AlphaTrend > OTT2up and close > ema50

short = ema5 < ema20 and close < OTT2dn and close[1] < OTT2dn[1] and close < OTTdn and close[1] < OTTdn[1] and close < AlphaTrend and close[1] < AlphaTrend[1] and high < OTTdn and high[1] < OTTdn[1] and close < closeSeriesAlt and close[1] < closeSeriesAlt[1]//] and high [1] < OTT2dn and high [2] < ema50[2] and high [2] < OTT2dn//and AlphaTrend < OTTdn and close < ema50

//close > ema50 and close[1] > ema50[1] and close[2] > ema50[2]

// longShortCond şartını çiz

//plotshape(long, style=shape.labelup, location=location.belowbar, color=color.new(#21f356, 0), size=size.tiny, title='Long Condition', text='L', textcolor=color.white)

//plotshape(short, style=shape.labeldown, location=location.abovebar, color=color.new(#a7510b, 0), size=size.tiny, title='Short Condition', text='S', textcolor=color.white)

// Pozisyon açma ve kapatma sinyallerini belirleyin

buy = long and not long[1]

sell = short and not short[1]

close_long = short and not short[1]

close_short = long and not long[1]

// Sinyalleri grafiğe işaretleyin

plotshape(buy,style=shape.labelup, location=location.belowbar, color=color.new(#21f356, 0), size=size.tiny, title='Long Condition', text='L', textcolor=color.white)

plotshape(sell, style=shape.labeldown, location=location.abovebar, color=color.new(#a7510b, 0), size=size.tiny, title='Short Condition', text='S', textcolor=color.white)

//plotshape(close_long, style=shape.xcross, location=location.abovebar, color=color.green, text="Close Long")

//plotshape(close_short, style=shape.xcross, location=location.belowbar, color=color.red, text="Close Short")

// Sinyalleri stratejiye uygulayın

strategy.entry("Long", strategy.long, when=buy)

strategy.entry("Short", strategy.short, when=sell)

strategy.close("Long", when=close_long)

strategy.close("Short", when=close_short)