概述

此策略的主要思想是结合123反转形态和智能资金流量指数(SMI)指标,实现稳定的趋势追踪交易。当两个信号同时发出买入或者卖出信号时,该策略才会建立对应的多头或者空头仓位。

策略原理

该策略由两部分组成:

123反转策略:该策略基于股票的收盘价和9日Stoch指标实现反转交易。具体来说,当连续两天的收盘价关系发生反转(即前一天的收盘价高于前两天,后一天的收盘价低于前一天),并且Stoch的快线高于慢线时,做空;当连续两天的收盘价关系发生反转(即前一天收盘价低于前两天,后一天收盘价高于前一天),并且Stoch的快线低于慢线时,做多。

SMI策略:该策略基于智能资金流量指数实现趋势追踪。SMI指标可以反映机构资金和散户资金的博弈,SMI上升预示着机构资金正在吸纳,反之则预示机构资金正在抛售。当SMI指标上升时做多,下降时做空。

当123反转形态和SMI指数同时发出买入信号时,该策略才会采取多头仓位;当两者同时发出卖出信号时,该策略才会采取空头仓位。

策略优势

该策略结合反转形态和趋势追踪指标,可以有效识别市场反转点并跟踪趋势,实现稳定的盈利。具体优势如下:

123反转形态具有较高的胜率和盈利率,可以有效识别短期反转机会。

SMI指标可以反映机构资金流向,跟踪机构资金可以获得较稳定的盈利。

结合使用反转形态和趋势追踪指标,可以提高信号的质量,减少不必要的交易,有效控制风险。

策略风险

该策略也存在一定的风险,主要集中在以下几个方面:

123反转形态存在一定的假信号风险,不能完全避免亏损的交易。可以适当优化参数,提高信号质量。

SMI指标存在一定的滞后,不能完全实时反映资金流向。可以结合其他指标进行验证,提高准确性。

双重信号带来过于保守的问题,可能错过较强势的单边趋势行情。可以适当放宽信号条件,降低过滤标准。

优化方向

该策略还可以从以下几个方面进行进一步优化:

优化参数,寻找最优参数组合,提高策略盈利能力。

增加止损机制,可以有效控制单笔损失。

结合其他指标或形态,进一步验证信号质量,提高信号准确率。

针对不同品种分别优化参数,提高策略适应性。

总结

该策略整体思路清晰,有效结合反转形态和趋势跟踪指标,可以稳定识别短期反转机会并跟踪中长期趋势。通过参数优化和机制设计的改进,可以进一步增强策略的盈利能力和风险控制能力。

Overview

The main idea of this strategy is to combine the 123 reversal pattern and the Smart Money Index (SMI) indicator to achieve stable trend tracking trading. The strategy will only establish corresponding long or short positions when both signals issue buy or sell signals at the same time.

Strategy Principle

The strategy consists of two parts:

123 reversal strategy: This strategy implements reversal trading based on the closing price of the stock and the 9-day Stoch indicator. Specifically, go short when the closing price relationship reverses for two consecutive days (i.e. the previous closing price is higher than the one before the previous day, and the next closing price is lower than the previous day), and Stoch fast line is above slow line; go long when the closing price relationship reverses for two consecutive days (i.e. the previous closing price is lower than the one before the previous day, and the next closing price is higher than the previous day), and Stoch fast line is below slow line.

SMI strategy: This strategy implements trend tracking based on the Smart Money Index. The SMI indicator can reflect the game between institutional funds and retail funds. The rise of SMI indicates that institutional funds are absorbing funds, while the fall indicates that institutional funds are selling out. Go long when SMI rises and go short when SMI falls.

The strategy will only take a long position when both the 123 reversal pattern and the SMI indicator issue a buy signal at the same time. It will only take a short position when both issue a sell signal at the same time.

Strategy Advantages

The strategy combines reversal patterns and trend tracking indicators to effectively identify market reversal points and track trends for steady profits. The specific advantages are as follows:

The 123 reversal pattern has a relatively high win rate and profit rate, which can effectively identify short-term reversal opportunities.

The SMI indicator can reflect the direction of institutional funds. Tracking institutional funds can obtain more steady profits.

The combined use of reversal patterns and trend tracking indicators can improve the quality of signals, reduce unnecessary trading, and effectively control risks.

Strategy Risks

The strategy also has some risks, mainly concentrated in the following areas:

The 123 reversal pattern has a certain risk of false signals and cannot completely avoid losing trades. Parameters can be optimized appropriately to improve signal quality.

The SMI indicator has a certain lag and cannot completely reflect the direction of funds in real time. Other indicators can be combined for verification to improve accuracy.

Double signals can lead to over-conservative problems, possibly missing stronger one-sided trending opportunities. Signal conditions can be appropriately relaxed to reduce filtering criteria.

Optimization Directions

The strategy can also be further optimized in the following aspects:

Optimize parameters to find the optimal parameter combination and improve the profitability of the strategy.

Add stop loss mechanisms to effectively control single loss.

Combine other indicators or patterns to further verify signal quality and improve signal accuracy.

Optimize parameters separately for different varieties to improve the adaptability of the strategy.

Summary

The overall idea of the strategy is clear, effectively combining reversal patterns and trend tracking indicators to steadily identify short-term reversal opportunities and track medium-to-long term trends. By improving parameters optimization and mechanism design, the profitability and risk control capabilities of the strategy can be further enhanced.

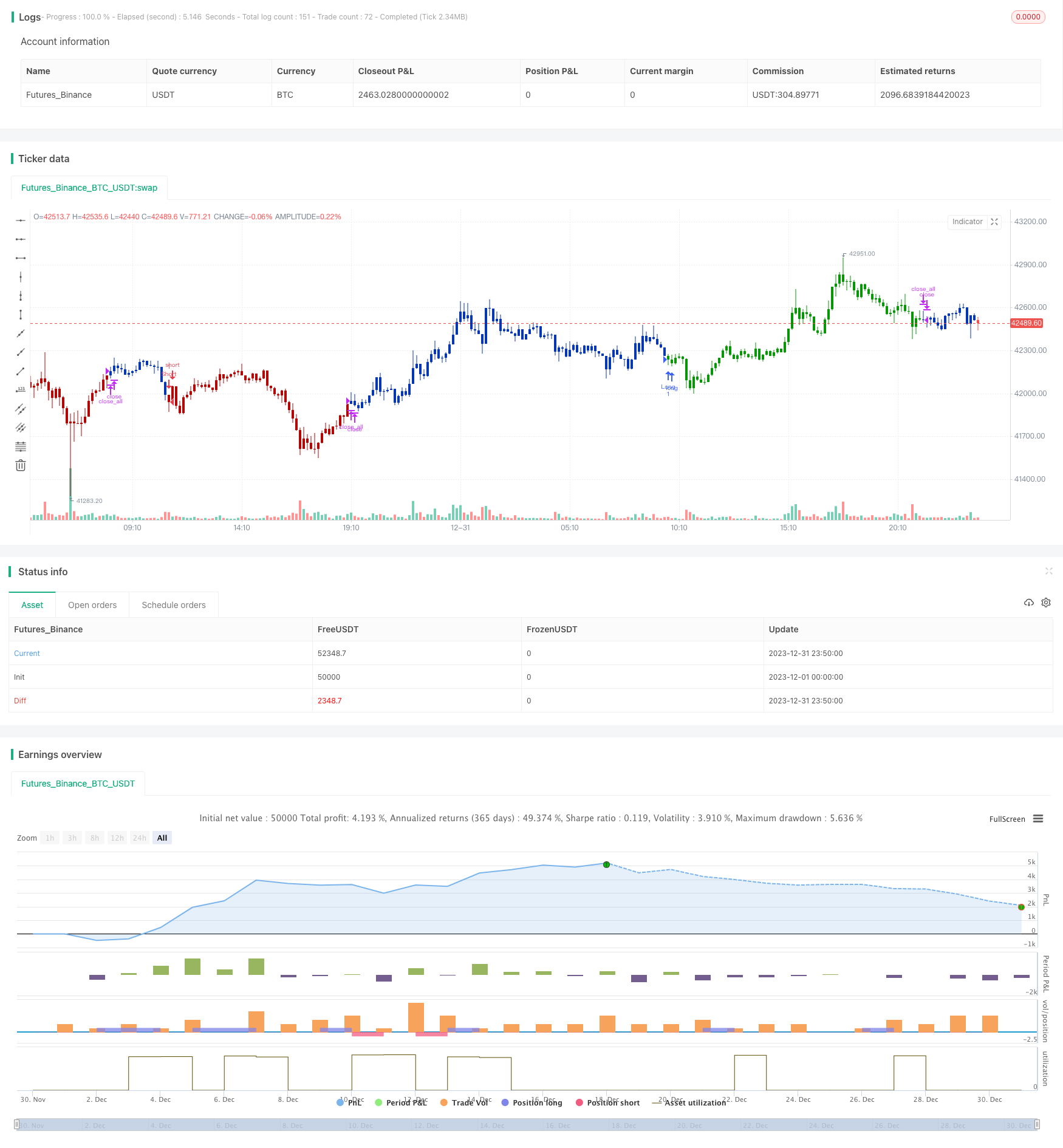

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 10/07/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Smart money index (SMI) or smart money flow index is a technical analysis indicator demonstrating investors sentiment.

// The index was invented and popularized by money manager Don Hays.[1] The indicator is based on intra-day price patterns.

// The main idea is that the majority of traders (emotional, news-driven) overreact at the beginning of the trading day

// because of the overnight news and economic data. There is also a lot of buying on market orders and short covering at the opening.

// Smart, experienced investors start trading closer to the end of the day having the opportunity to evaluate market performance.

// Therefore, the basic strategy is to bet against the morning price trend and bet with the evening price trend. The SMI may be calculated

// for many markets and market indices (S&P 500, DJIA, etc.)

//

// The SMI sends no clear signal whether the market is bullish or bearish. There are also no fixed absolute or relative readings signaling

// about the trend. Traders need to look at the SMI dynamics relative to that of the market. If, for example, SMI rises sharply when the

// market falls, this fact would mean that smart money is buying, and the market is to revert to an uptrend soon. The opposite situation

// is also true. A rapidly falling SMI during a bullish market means that smart money is selling and that market is to revert to a downtrend

// soon. The SMI is, therefore, a trend-based indicator.

// Some analysts use the smart money index to claim that precious metals such as gold will continually maintain value in the future.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

SMI(Length, tf) =>

pos = 0.0

nRes = 0.0

xcloseH1 = security(syminfo.tickerid, tf, close[1])

xopenH1 = security(syminfo.tickerid, tf, open[1])

nRes := nz(nRes[1], 1) - (open - close) + (xopenH1 - xcloseH1)

xSmaRes = sma(nRes, Length)

pos:= iff(xSmaRes > nRes, 1,

iff(xSmaRes < nRes, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Smart Money Index (SMI)", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Smart Money Index (SMI) ----")

LengthSMI = input(18, minval=1)

res = input(title="Resolution", type=input.resolution, defval="D")

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posSMI = SMI(LengthSMI, res)

pos = iff(posReversal123 == 1 and posSMI == 1 , 1,

iff(posReversal123 == -1 and posSMI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )