Stratégie de trading de suivi des chandeliers à grille bidirectionnelle

Aperçu

Cette stratégie est une stratégie de négociation de grille de suivi bidirectionnelle basée sur les variations en temps réel de la ligne K. Elle permet de réaliser des bénéfices stables dans les marchés haussiers et baissiers.

Principe de stratégie

Le nombre de grilles mises en place par l’utilisateur permet de calculer automatiquement la fourchette de prix et le prix de chaque grille.

Lorsque le prix dépasse le prix de la grille, il ouvre une position plus élevée en fonction d’un nombre fixe; lorsque le prix baisse en dessous du prix de la grille, il ouvre une position plus élevée et vide.

Ainsi, lorsque les prix fluctuent entre les grilles, il est possible de tirer profit en suivant les variations de prix.

Analyse des avantages

Le calcul automatique de la distance de la grille raisonnable, sans avoir besoin de déterminer manuellement la résistance de soutien.

Les échanges bilatéraux sont adaptés aux conditions changeantes du marché.

Le nombre de positions ouvertes est fixe, ce qui permet de contrôler les risques.

Le code est intuitif, facile à comprendre et à modifier.

Analyse des risques

La forte volatilité de la situation pourrait entraîner une augmentation des pertes.

Les frais de transaction cumulés peuvent également avoir une incidence sur les bénéfices finaux.

Il est nécessaire de déterminer raisonnablement le nombre de grilles, trop de grilles augmentent le nombre de transactions mais limitent les bénéfices à chaque fois.

Direction d’optimisation

Adhérer à une stratégie de stop-loss pour éviter l’expansion des pertes.

Ajout d’une fonction d’ajustement dynamique du nombre de grilles.

Envisagez d’ajouter de l’effet de levier pour augmenter le volume des transactions

Résumer

L’idée générale de cette stratégie est claire et concise, avec des gains stables grâce à des transactions de grille de suivi bidirectionnel, mais il existe également un certain risque de transaction. Avec une optimisation continue, de meilleurs résultats sont attendus.

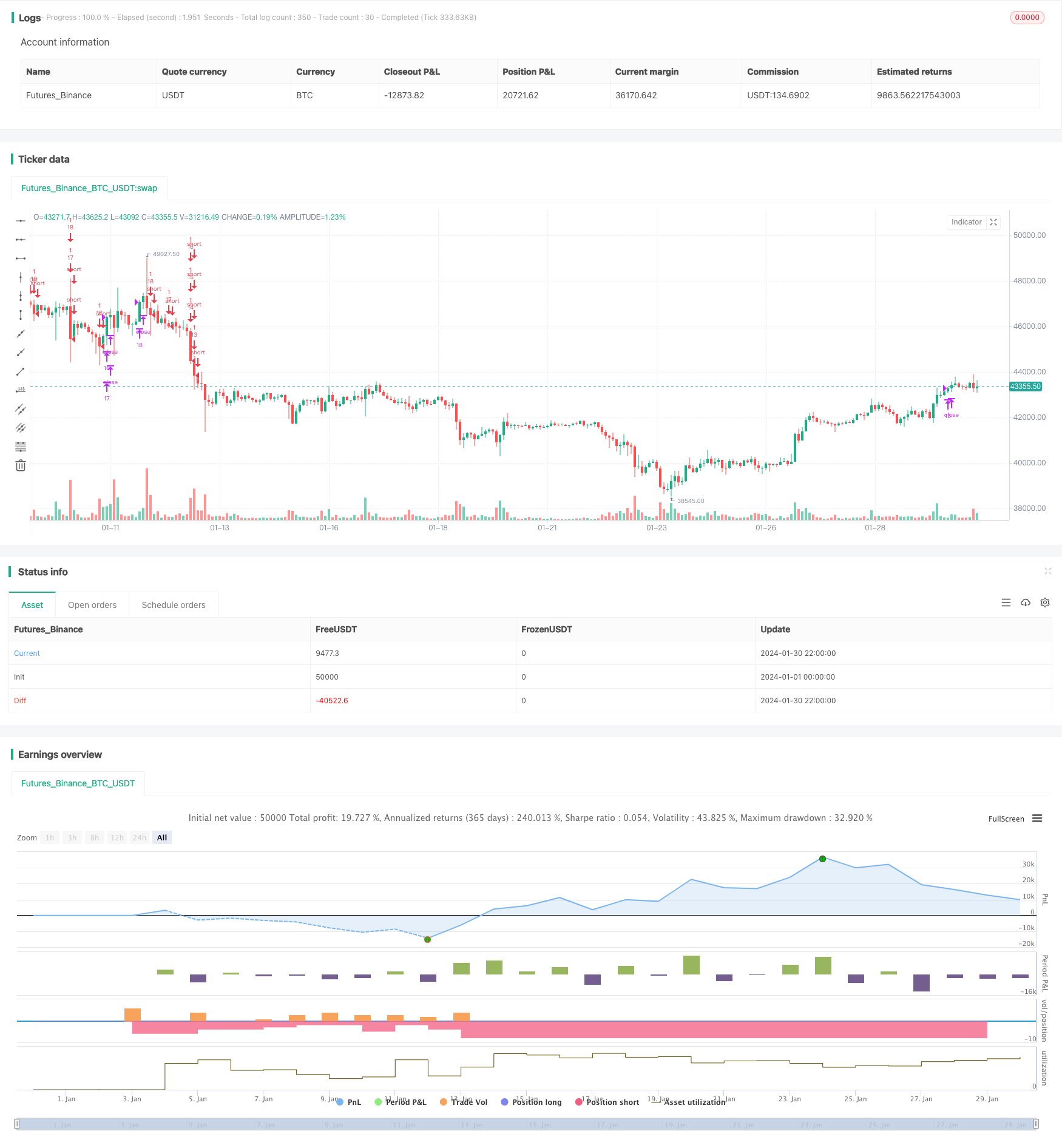

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//hk4jerry

strategy("Grid Bot Backtesting", overlay=false, pyramiding=3000, close_entries_rule="ANY", default_qty_type=strategy.cash, initial_capital=100.0, currency="USD", commission_type=strategy.commission.percent, commission_value=0.025)

i_autoBounds = input(group="Grid Bounds", title="Use Auto Bounds?", defval=true, type=input.bool) // calculate upper and lower bound of the grid automatically? This will theorhetically be less profitable, but will certainly require less attention

i_boundSrc = input(group="Grid Bounds", title="(Auto) Bound Source", defval="Hi & Low", options=["Hi & Low", "Average"]) // should bounds of the auto grid be calculated from recent High & Low, or from a Simple Moving Average

i_boundLookback = input(group="Grid Bounds", title="(Auto) Bound Lookback", defval=250, type=input.integer, maxval=500, minval=0) // when calculating auto grid bounds, how far back should we look for a High & Low, or what should the length be of our sma

i_boundDev = input(group="Grid Bounds", title="(Auto) Bound Deviation", defval=0.10, type=input.float, maxval=1, minval=-1) // if sourcing auto bounds from High & Low, this percentage will (positive) widen or (negative) narrow the bound limits. If sourcing from Average, this is the deviation (up and down) from the sma, and CANNOT be negative.

i_upperBound = input(group="Grid Bounds", title="(Manual) Upper Boundry(상단 가격)", defval=0.285, type=input.float) // for manual grid bounds only. The upperbound price of your grid

i_lowerBound = input(group="Grid Bounds", title="(Manual) Lower Boundry(하단 가격)", defval=0.225, type=input.float) // for manual grid bounds only. The lowerbound price of your grid.

i_gridQty = input(group="Grid Lines", title="Grid Line Quantity(그리드 수)", defval=30, maxval=999, minval=1, type=input.integer) // how many grid lines are in your grid

initial_balance = input(group="Trading option", title="Initial balance(투자금액)", defval=100, step=0.01)

start_time = input(group="Trading option",defval=timestamp('15 March 2023 06:00'), title='Start Time', type = input.time)

end_time = input(group="Trading option",defval=timestamp('31 Dec 2035 20:00'), title='End Time', type = input.time)

isAfterStartDate = true

tradingtime= (timenow - start_time)/(86400000*30)

yeartime=tradingtime/12

f_getGridBounds(_bs, _bl, _bd, _up) =>

if _bs == "Hi & Low"

_up ? highest(close, _bl) * (1 + _bd) : lowest(close, _bl) * (1 - _bd)

else

avg = sma(close, _bl)

_up ? avg * (1 + _bd) : avg * (1 - _bd)

f_buildGrid(_lb, _gw, _gq) =>

gridArr = array.new_float(0)

for i=0 to _gq-1

array.push(gridArr, _lb+(_gw*i))

gridArr

f_getNearGridLines(_gridArr, _price) =>

arr = array.new_int(3)

for i = 0 to array.size(_gridArr)-1

if array.get(_gridArr, i) > _price

array.set(arr, 0, i == array.size(_gridArr)-1 ? i : i+1)

array.set(arr, 1, i == 0 ? i : i-1)

break

arr

var upperBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true) : i_upperBound // upperbound of our grid

var lowerBound = i_autoBounds ? f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false) : i_lowerBound // lowerbound of our grid

var gridWidth = (upperBound - lowerBound)/(i_gridQty-1) // space between lines in our grid

var gridLineArr = f_buildGrid(lowerBound, gridWidth, i_gridQty) // an array of prices that correspond to our grid lines

var orderArr = array.new_bool(i_gridQty, false) // a boolean array that indicates if there is an open order corresponding to each grid line

var closeLineArr = f_getNearGridLines(gridLineArr, close) // for plotting purposes - an array of 2 indices that correspond to grid lines near price

var nearTopGridLine = array.get(closeLineArr, 0) // for plotting purposes - the index (in our grid line array) of the closest grid line above current price

var nearBotGridLine = array.get(closeLineArr, 1) // for plotting purposes - the index (in our grid line array) of the closest grid line below current price

if isAfterStartDate

for i = 0 to (array.size(gridLineArr) - 1)

if close < array.get(gridLineArr, i) and not array.get(orderArr, i) and i < (array.size(gridLineArr) - 1)

buyId = i

array.set(orderArr, buyId, true)

strategy.entry(id=tostring(buyId), long=true, qty=(initial_balance/(i_gridQty-1))/close, comment="#"+tostring(buyId))

if close > array.get(gridLineArr, i) and i != 0

if array.get(orderArr, i-1)

sellId = i-1

array.set(orderArr, sellId, false)

strategy.close(id=tostring(sellId), comment="#"+tostring(sellId))

if i_autoBounds

upperBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, true)

lowerBound := f_getGridBounds(i_boundSrc, i_boundLookback, i_boundDev, false)

gridWidth := (upperBound - lowerBound)/(i_gridQty-1)

gridLineArr := f_buildGrid(lowerBound, gridWidth, i_gridQty)

closeLineArr := f_getNearGridLines(gridLineArr, close)

nearTopGridLine := array.get(closeLineArr, 0)

nearBotGridLine := array.get(closeLineArr, 1)

var table table = table.new(position.top_right,6,8, frame_color = color.rgb(255, 255, 255),frame_width = 2,border_width = 2, border_color=color.rgb(255, 255, 255))

//제목

table.cell(table,0,0,"Upper limit price :", bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,1,"Lower limit price :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,2,"Grids quantity :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,0,3,"Investment :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,0,4,"USDT per grid :",text_color =color.white,bgcolor=color.new(color.black,0))

//수치

table.cell(table,1,0, tostring(upperBound, '###.#####')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,1, tostring(lowerBound, '###.#####')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,2, tostring(i_gridQty, '###'), bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,3, tostring(initial_balance,'###.##')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

table.cell(table,1,4, tostring(initial_balance/i_gridQty,'###.##')+ " USDT", bgcolor=color.new(#5a637e, 0),text_color =color.white)

//제목

table.cell(table,2,0,"Current position :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,2,1,"Position cost price :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,2,2,"Unrealized profit :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,2,3,"Unrealized profit % :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,2,4,"Fee :",text_color =color.white,bgcolor=color.new(color.black,0))

//수치

table.cell(table,3,0, tostring(strategy.position_size) + syminfo.basecurrency + "\n" + tostring(strategy.position_size*strategy.position_avg_price/1, '###.##') + "USDT" ,text_color =color.white,bgcolor=color.new(#5a637e, 0))

table.cell(table,3,1, text=strategy.position_size>0 ? tostring(strategy.position_avg_price,'###.####')+ " USDT" : "NOT TRADING",text_color =color.white,bgcolor=color.new(#5a637e, 0))

table.cell(table,3,2, tostring(strategy.openprofit, '###.##')+ " USDT",text_color =color.white,bgcolor=strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,3,3, tostring(strategy.openprofit/initial_balance*100, '###.##')+ "%",text_color =color.white,bgcolor=strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,3,4, "-" + tostring(strategy.position_avg_price*strategy.position_size*0.025/100,'###.##')+ " USDT",text_color =color.white,bgcolor=color.new(#5a637e, 0))

//제목

table.cell(table,4,0,"Grid profit :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,4,1,"Grid profit % :",text_color =color.white,bgcolor=color.new(color.black,0))

table.cell(table,4,2,"Net profit :", bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,4,3,"Net profit % :",bgcolor=color.new(color.black,0),text_color =color.white)

table.cell(table,4,4,"Balance USDT :",bgcolor=color.new(color.black,0),text_color =color.white)

//수치

table.cell(table,5,0, tostring(strategy.netprofit, '###.#####')+ "USDT", text_color =color.white,bgcolor=strategy.netprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,1, tostring((strategy.netprofit)/initial_balance*100/tradingtime, '####.##') + "%",text_color =color.white,bgcolor=strategy.netprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,2, tostring(strategy.netprofit+strategy.openprofit, '###.##') + " USDT",text_color =color.white,bgcolor=strategy.netprofit+strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,3, tostring((strategy.netprofit+strategy.openprofit)/initial_balance*100, '####.##') + "%",text_color =color.white,bgcolor=strategy.netprofit+strategy.openprofit > 0 ? color.teal : color.maroon)

table.cell(table,5,4, tostring(initial_balance+strategy.netprofit+strategy.openprofit, '###.##')+ " USDT", text_color =color.white,bgcolor=color.new(#3d4d7c, 0))

// plot(strategy.initial_capital+ strategy.netprofit+strategy.openprofit, "Current Balance",color=color.rgb(81, 137, 128))

// plot(initial_balance, "Investment",color=color.rgb(81, 137, 128))