Strategi Perdagangan Kuantitatif DCA Tertimbang Elemen Progresif

Ringkasan

Strategi perdagangan kuantitatif DCA dengan elemen-elemen bertahap adalah strategi perdagangan kuantitatif yang menggabungkan sinyal pemicu indikator moving average dan mekanisme rata-rata biaya dolar bertahap. Strategi ini bertujuan untuk mendapatkan keuntungan yang lebih stabil di pasar yang lebih berorientasi pada tren dengan cara menilai tren dan membandingkannya dengan biaya.

Prinsip

Strategi ini terdiri dari tiga bagian utama:

- Penghakiman sinyal masuk

Gunakan persilangan rata-rata bergerak cepat dan rata-rata bergerak lambat sebagai sinyal untuk menilai masuk. Sesuai dengan pengaturan pengguna, Anda dapat memilih SMA, EMA, atau HMA sebagai rata-rata bergerak cepat.

- Peningkatan berat DCA

Setelah sinyal beli dipicu, strategi akan segera membuka posisi untuk membangun posisi dasar. Jika harga terus turun, strategi akan meningkatkan posisi aman berikutnya dengan cara bertahap. Setiap kali harga posisi aman baru diturunkan berdasarkan harga posisi aman sebelumnya.

Dengan cara ini, dengan cara menambah posisi secara bertahap, dapat mencapai tingkat penyeimbangan biaya, dan mendapatkan harga biaya yang lebih baik sambil memastikan bahwa risiko perdagangan dapat dikendalikan.

- Stop Stop Loss

Ketika harga naik melewati batas stop, strategi akan memilih stop; ketika harga turun melewati batas stop, strategi akan memilih stop.

Stop-loss line tetap sebagai basis 1 + rasio tetap dari nilai rata-rata transaksi posisi.

Stop loss line adalah pergerakan harga dari posisi aman terakhir. Berdasarkan posisi aman terakhir, sinyal stop loss dikonfirmasi di bawah harga transaksi dalam proporsi tertentu.

Keunggulan

- Strategi yang lebih stabil, dengan penilaian tren dan biaya rata-rata

Pengertian tren dapat menghindari pasar yang bergoyang tanpa arah, dengan biaya yang sama untuk mendapatkan biaya yang lebih baik dalam tren.

- Meningkatkan Risiko dengan Mengontrol

Setiap posisi ekuilibrium memiliki skala tertentu, dan posisi berikutnya memiliki persyaratan penarikan, yang dapat mengontrol risiko.

- Strategi pemantauan real-time atas penggunaan dana

Kode ini menambahkan label pemantauan real-time, yang memungkinkan pengguna untuk mengetahui batas atas strategi yang digunakan, dan menghindari penggunaan berlebihan yang menyebabkan posisi ditingkatkan.

- Stop loss fleksibilitas

Posisi dasar dan posisi aman masing-masing dapat menghentikan kerugian, mengakhiri keuntungan dan mengendalikan risiko.

Risiko dan optimasi

- Pertumbuhan harga yang sangat besar dapat menyebabkan beberapa kali kenaikan harga.

Pada saat harga bergejolak tajam, mungkin akan memicu beberapa kali penambahan posisi sehingga meningkatkan kerugian. Dapat dikurangi jumlah penambahan posisi dengan meningkatkan permintaan penarikan dari posisi keamanan berikutnya.

- Pilihan parameter garis rata-rata perlu dioptimalkan

Parameter garis rata-rata secara langsung mempengaruhi waktu masuk, dan berbagai varietas perlu diuji untuk menentukan parameter yang tepat.

- Rasio stop-loss harus diuji dan dioptimalkan.

Stop loss stop loss rasio terkait dengan tingkat pengembalian dan pengendalian penarikan, yang memerlukan pengaturan yang dioptimalkan melalui data retrospeksi.

- Kondisi penutupan yang wajib dapat diatur berdasarkan penarikan atau waktu

Untuk mengontrol risiko lebih lanjut, Anda dapat menguji penambahan kondisi posisi kosong wajib dengan pengembalian maksimum atau jangka waktu kepemilikan yang melebihi nilai terendah.

Meringkaskan

Strategi perdagangan kuantitatif DCA berimbang dengan elemen progresif menggabungkan keuntungan dari penilaian tren dengan biaya yang proporsional, dan dapat menghasilkan keuntungan yang stabil dalam situasi tren yang kuat. Dengan pengaturan parameter yang dioptimalkan, penyesuaian ukuran posisi dan persyaratan penarikan posisi, dapat dicapai perdagangan yang stabil dengan risiko yang dapat dikendalikan. Strategi ini dapat digunakan untuk hedge fund, dana CTA, dan desain beberapa strategi resistensi.

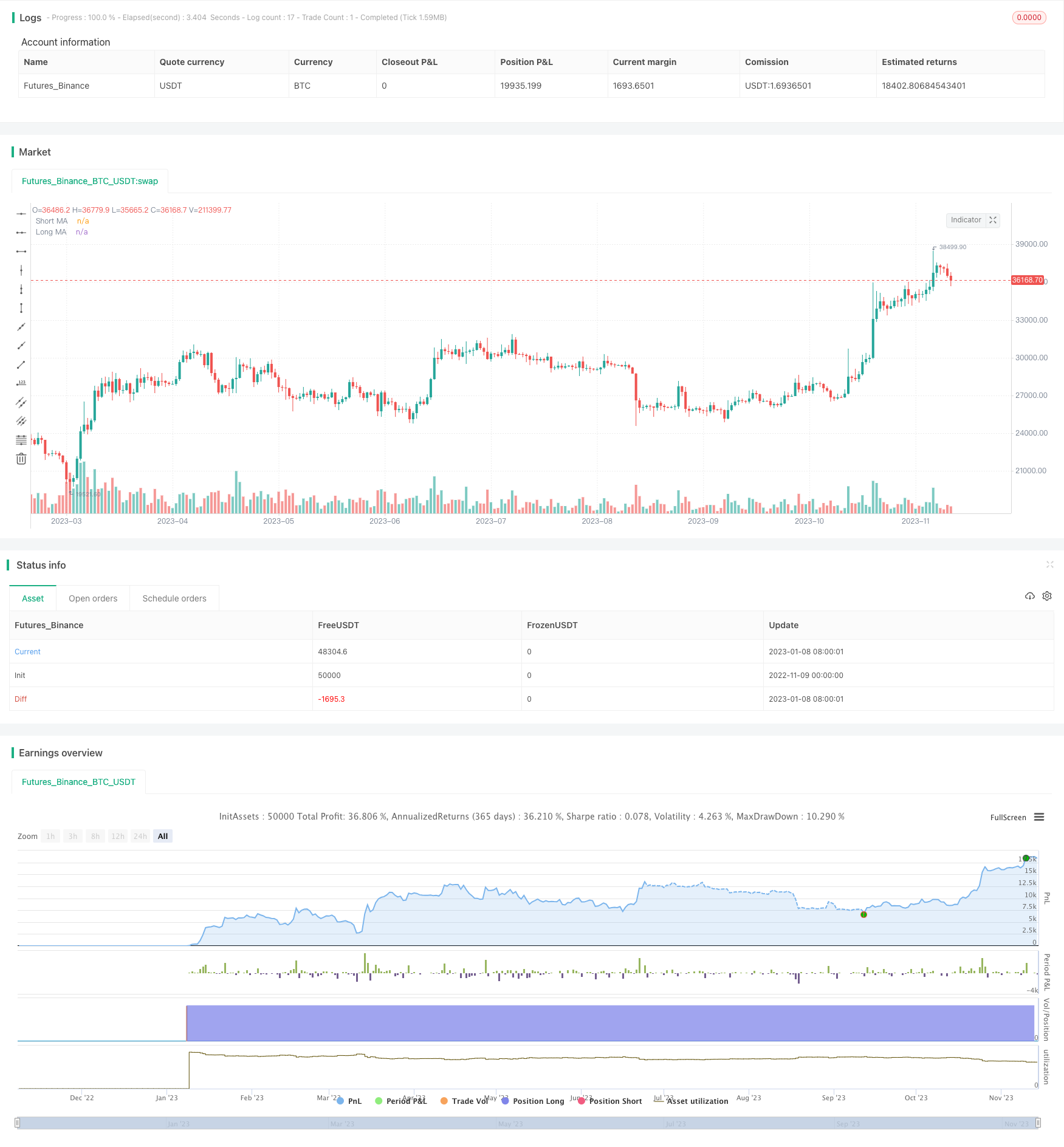

/*backtest

start: 2022-11-09 00:00:00

end: 2023-11-15 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MGTG

//@version=5

Strategy = input.string('Long', options=['Long'], group='Strategy', inline='1',

tooltip='Long bots profit when asset prices rise, Short bots profit when asset prices fall'

+ '\n\n' + 'Please note: to run a Short bot on a spot exchange account, you need to own the asset you want to trade. The bot will sell the asset at the current chart price and buy it back at a lower price - the profit made is actually trapped equity released from an asset you own that is declining in value.')

Profit_currency = input.string('Quote (USDT)', 'Profit currency', options=['Quote (USDT)', 'Quote (BTC)', 'Quote (BUSD)'], group='Strategy', inline='1')

Base_order_size = input.int(10, 'Base order Size', group='Strategy', inline='2',

tooltip='The Base Order is the first order the bot will create when starting a new deal.')

Safety_order_size = input.int(20, 'Safety order Size', group='Strategy', inline='2',

tooltip="Enter the amount of funds your Safety Orders will use to Average the cost of the asset being traded, this can help your bot to close deals faster with more profit. Safety Orders are also known as Dollar Cost Averaging and help when prices moves in the opposite direction to your bot's take profit target.")

Triger_Type = input.string('Over', 'Entry at Cross Over / Under', options=['Over', 'Under'], group='Deal start condition > Trading View custom signal', inline='1',

tooltip='Deal start condition decision')

Short_Moving_Average = input.string('SMA', 'Short Moving Average', group='Deal start condition > Trading View custom signal', inline='2',

options=["SMA", "EMA", "HMA"])

Short_Period = input.int(5, 'Period', group='Deal start condition > Trading View custom signal', inline='2')

Long_Moving_Average = input.string('HMA', 'Long Moving Average', group='Deal start condition > Trading View custom signal', inline='3',

options=["SMA", "EMA", "HMA"])

Long_Period = input.int(50, 'Period', group='Deal start condition > Trading View custom signal', inline='3')

Target_profit = input.float(1.5, 'Target profit (%)', step=0.05, group='Take profit / Stop Loss', inline='1') * 0.01

Stop_Loss = input.int(15, 'Stop Loss (%)', group='Take profit / Stop Loss', inline='1',

tooltip='This is the percentage that price needs to move in the opposite direction to your take profit target, at which point the bot will execute a Market Order on the exchange account to close the deal for a smaller loss than keeping the deal open.'

+ '\n' + 'Please note, the Stop Loss is calculated from the price the Safety Order at on the exchange account and not the Dollar Cost Average price.') * 0.01

Max_safety_trades_count = input.int(10, 'Max safety trades count', maxval=10, group='Safety orders', inline='1')

Price_deviation = input.float(0.4, 'Price deviation to open safety orders (% from initial order)', step=0.01, group='Safety orders', inline='2') * 0.01

Safety_order_volume_scale = input.float(1.8, 'Safety order volume scale', step=0.01, group='Safety orders', inline='3')

Safety_order_step_scale = input.float(1.19, 'Safety order step scale', step=0.01, group='Safety orders', inline='3')

// daily_volume = input.int(500, "Don't start deal(s) if the daily volume is less than", group='Advanced settings', inline='1')

// Minimum_price = input.int(500, "Minimum price to open deal", group='Advanced settings', inline='1')

// Maximum_price = input.int(500, "Maximum price to open deal", group='Advanced settings', inline='1')

// Close_deal_after_timeout = input.int(5, "Close deal after timeout (Hrs)", group='Advanced settings', inline='1')

initial_capital = 8913

strategy(

title='3Commas Visible DCA Strategy',

overlay=true,

initial_capital=initial_capital,

pyramiding=11,

process_orders_on_close=true,

commission_type=strategy.commission.percent,

commission_value=0.01,

max_bars_back=5000,

max_labels_count=50)

// Position

status_none = strategy.position_size == 0

status_long = strategy.position_size[1] == 0 and strategy.position_size > 0

status_long_offset = strategy.position_size[2] == 0 and strategy.position_size[1] > 0

status_short = strategy.position_size[1] == 0 and strategy.position_size < 0

status_increase = strategy.opentrades[1] < strategy.opentrades

Short_Moving_Average_Line =

Short_Moving_Average == 'SMA' ? ta.sma(close, Short_Period) :

Short_Moving_Average == 'EMA' ? ta.ema(close, Short_Period) :

Short_Moving_Average == 'HMA' ? ta.sma(close, Short_Period) : na

Long_Moving_Average_Line =

Long_Moving_Average == 'SMA' ? ta.sma(close, Long_Period) :

Long_Moving_Average == 'EMA' ? ta.ema(close, Long_Period) :

Long_Moving_Average == 'HMA' ? ta.sma(close, Long_Period) : na

Base_order_Condition = Triger_Type == "Over" ? ta.crossover(Short_Moving_Average_Line, Long_Moving_Average_Line) : ta.crossunder(Short_Moving_Average_Line, Long_Moving_Average_Line) // Buy when close crossing lower band

safety_order_deviation(index) => Price_deviation * math.pow(Safety_order_step_scale, index - 1)

pd = Price_deviation

ss = Safety_order_step_scale

step(i) =>

i == 1 ? pd :

i == 2 ? pd + pd * ss :

i == 3 ? pd + (pd + pd * ss) * ss :

i == 4 ? pd + (pd + (pd + pd * ss) * ss) * ss :

i == 5 ? pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss :

i == 6 ? pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss :

i == 7 ? pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss :

i == 8 ? pd + (pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss) * ss :

i == 9 ? pd + (pd + (pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss) * ss) * ss :

i == 10 ? pd + (pd + (pd + (pd + (pd + (pd + (pd + (pd + (pd + pd * ss) * ss) * ss) * ss) * ss) * ss) * ss) * ss) * ss : na

long_line(i) =>

close[1] - close[1] * (step(i))

Safe_order_line(i) =>

i == 0 ? ta.valuewhen(status_long, long_line(0), 0) :

i == 1 ? ta.valuewhen(status_long, long_line(1), 0) :

i == 2 ? ta.valuewhen(status_long, long_line(2), 0) :

i == 3 ? ta.valuewhen(status_long, long_line(3), 0) :

i == 4 ? ta.valuewhen(status_long, long_line(4), 0) :

i == 5 ? ta.valuewhen(status_long, long_line(5), 0) :

i == 6 ? ta.valuewhen(status_long, long_line(6), 0) :

i == 7 ? ta.valuewhen(status_long, long_line(7), 0) :

i == 8 ? ta.valuewhen(status_long, long_line(8), 0) :

i == 9 ? ta.valuewhen(status_long, long_line(9), 0) :

i == 10 ? ta.valuewhen(status_long, long_line(10), 0) : na

TP_line = strategy.position_avg_price * (1 + Target_profit)

SL_line = Safe_order_line(Max_safety_trades_count) * (1 - Stop_Loss)

safety_order_size(i) => Safety_order_size * math.pow(Safety_order_volume_scale, i - 1)

plot(Short_Moving_Average_Line, 'Short MA', color=color.new(color.white, 0), style=plot.style_line)

plot(Long_Moving_Average_Line, 'Long MA', color=color.new(color.green, 0), style=plot.style_line)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 1 ? Safe_order_line(1) : na, 'Safety order1', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 2 ? Safe_order_line(2) : na, 'Safety order2', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 3 ? Safe_order_line(3) : na, 'Safety order3', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 4 ? Safe_order_line(4) : na, 'Safety order4', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 5 ? Safe_order_line(5) : na, 'Safety order5', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 6 ? Safe_order_line(6) : na, 'Safety order6', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 7 ? Safe_order_line(7) : na, 'Safety order7', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 8 ? Safe_order_line(8) : na, 'Safety order8', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 9 ? Safe_order_line(9) : na, 'Safety order9', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 and Max_safety_trades_count >= 10 ? Safe_order_line(10) : na, 'Safety order10', color=color.new(#009688, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 ? TP_line : na, 'Take Profit', color=color.new(color.orange, 0), style=plot.style_linebr)

plot(strategy.position_size > 0 ? SL_line : na, 'Safety', color=color.new(color.aqua, 0), style=plot.style_linebr)

currency =

Profit_currency == 'Quote (USDT)' ? ' USDT' :

Profit_currency == 'Quote (BTC)' ? ' BTC' :

Profit_currency == 'Quote (BUSD)' ? ' BUSD' : na

if Base_order_Condition

strategy.entry('Base order', strategy.long, qty=Base_order_size/close, when=Base_order_Condition and strategy.opentrades == 0,

comment='BO' + ' - ' + str.tostring(Base_order_size) + str.tostring(currency))

for i = 1 to Max_safety_trades_count by 1

i_s = str.tostring(i)

strategy.entry('Safety order' + i_s, strategy.long, qty=safety_order_size(i)/close,

limit=Safe_order_line(i), when=(strategy.opentrades <= i) and strategy.position_size > 0,

comment='SO' + i_s + ' - ' + str.tostring(safety_order_size(i)) + str.tostring(currency))

for i = 1 to Max_safety_trades_count by 1

i_s = str.tostring(i)

// strategy.close('Base order', when=shortCondition)

// strategy.close('Safety order' + i_s, when=shortCondition)

// strategy.cancel('Safety order' + i_s, when=shortCondition)

strategy.cancel('SO' + i_s, when=ta.crossunder(low, SL_line) or ta.crossover(high, TP_line) or status_none)

strategy.exit('TP/SL','Base order', limit=TP_line, stop=SL_line, comment = Safe_order_line(100) > close ? 'SL' + i_s + ' - ' + str.tostring(Base_order_size) + str.tostring(currency) : 'TP' + i_s + ' - ' + str.tostring(Base_order_size) + str.tostring(currency))

strategy.exit('TP/SL','Safety order' + i_s, limit=TP_line, stop=SL_line, comment = Safe_order_line(100) > close ? 'SL' + i_s + ' - ' + str.tostring(safety_order_size(i)) + str.tostring(currency) : 'TP' + i_s + ' - ' + str.tostring(safety_order_size(i)) + str.tostring(currency))

// strategy.cancel('TP/SP' + i_s, when=Base_order_Condition)

// strategy.exit('Stop Loss','Base order', stop=SL_line)

// strategy.exit('Stop Loss','Safety order' + i_s, stop=SL_line)

//----------------label A----------------//

bot_usage(i) =>

i == 1 ? Base_order_size + safety_order_size(1) :

i == 2 ? Base_order_size + safety_order_size(1) + safety_order_size(2) :

i == 3 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) :

i == 4 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) :

i == 5 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) :

i == 6 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) :

i == 7 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) :

i == 8 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) + safety_order_size(8) :

i == 9 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) + safety_order_size(8) + safety_order_size(9) :

i == 10 ? Base_order_size + safety_order_size(1) + safety_order_size(2) + safety_order_size(3) + safety_order_size(4) + safety_order_size(5) + safety_order_size(6) + safety_order_size(7) + safety_order_size(8) + safety_order_size(9) + safety_order_size(10) : na

equity = strategy.equity

bot_use = bot_usage(Max_safety_trades_count)

bot_dev = float(step(Max_safety_trades_count)) * 100

bot_ava = (bot_use / equity) * 100

string label_A =

'Balance : ' + str.tostring(math.round(equity, 0), '###,###,###,###') + ' USDT' + '\n' +

'Max amount for bot usage : ' + str.tostring(math.round(bot_use, 0), '###,###,###,###') + ' USDT' + '\n' +

'Max safety order price deviation : ' + str.tostring(math.round(bot_dev, 0), '##.##') + ' %' + '\n' +

'% of available balance : ' + str.tostring(math.round(bot_ava, 0), '###,###,###,###') + ' %'

+ (bot_ava > 100 ? '\n \n' + '⚠ Warning! Bot will use amount greater than you have on exchange' : na)

if status_long

day_label =

label.new(

x=time[1],

y=high * 1.03,

text=label_A,

xloc=xloc.bar_time,

yloc=yloc.price,

color=bot_ava > 100 ? color.new(color.yellow, 0) : color.new(color.black, 50),

style=label.style_label_lower_right,

textcolor=bot_ava > 100 ? color.new(color.red, 0) : color.new(color.silver, 0),

size=size.normal,

textalign=text.align_left)