Strategi mengikuti tren berdasarkan rotasi momentum multi-kerangka waktu

Ringkasan

Strategi ini menggunakan kombinasi rata-rata bergerak dari kerangka waktu, untuk mengidentifikasi rotasi tren pada grafik jam besar dan menengah, untuk memungkinkan perdagangan pelacakan tren berisiko rendah. Strategi ini memiliki fleksibilitas konfigurasi, untuk mencapai kesederhanaan, dan keuntungan efisiensi tinggi, yang cocok untuk pedagang yang memegang posisi mengejar tren panjang dan menengah.

Pengertian

Strategi menggunakan tiga moving averages 5, 20, dan 40 hari untuk menilai kombinasi tersusun dari tren dalam berbagai kerangka waktu. Berdasarkan prinsip konsistensi tren grafik jam besar dan menengah, menentukan periode polygonal.

Secara khusus, 5 hari di jalur cepat melewati jalur tengah 20 hari dianggap sebagai sinyal pendek, 20 hari di jalur tengah melewati jalur lambat 40 hari dianggap sebagai sinyal tengah. Bila 3 jalur cepat dan lambat berturut-turut ((5 hari> 20 hari> 40 hari), dinilai sebagai siklus multihead; Bila 3 jalur cepat dan lambat berturut-turut ((5 hari < 20 hari < 40 hari), dinilai sebagai siklus kosong.

Dengan cara ini, berdasarkan arah penilaian tren siklus besar, kemudian dikombinasikan dengan kekuatan siklus kecil untuk mendeteksi masuknya secara spesifik. Hanya dalam kondisi tren yang sama arah dan siklus kecil yang kuat, Anda dapat secara efektif menyaring terobosan dan terobosan, untuk mencapai operasi dengan tingkat kemenangan tinggi.

Selain itu, strategi ini juga menggunakan ATR Stop Loss untuk mengendalikan risiko tunggal dan meningkatkan tingkat profit.

Analisis Keunggulan

Fleksibilitas konfigurasi, pengguna dapat menyesuaikan parameter moving average sendiri untuk menyesuaikan dengan varietas dan preferensi perdagangan yang berbeda

Mudah untuk diimplementasikan dan mudah digunakan oleh pengguna pemula

Efisiensi dalam penggunaan dana, yang dapat dimanfaatkan secara maksimal

Risiko dapat dikontrol, mekanisme stop loss efektif untuk menghindari kerugian besar

Keahlian mengikuti tren yang kuat, keuntungan yang berkelanjutan setelah siklus besar menentukan arah

Tingkat kemenangan yang lebih tinggi, kualitas sinyal perdagangan yang baik, kurangnya kesalahan pertukaran jalur

Risiko dan perbaikan

Pengadilan periode besar bergantung pada alignment rata-rata bergerak, ada risiko kesalahan penghakiman yang tertinggal

Deteksi intensitas kecil dengan hanya satu K-line, mungkin dipicu lebih awal, dapat relaksasi sesuai

Stop loss dengan amplitudo tetap, dapat dioptimalkan menjadi stop loss dinamis

Pertimbangkan untuk menambahkan kondisi penyaringan tambahan, seperti energi volume transaksi dan sebagainya.

Anda dapat mencoba berbagai kombinasi parameter moving average, strategi optimasi

Meringkaskan

Strategi ini mengintegrasikan analisa multi-frame waktu dan manajemen stop loss, yang memungkinkan perdagangan pelacakan tren yang berisiko rendah. Dengan menyesuaikan parameter, dapat diterapkan pada varietas yang berbeda untuk memenuhi kebutuhan pengikut tren. Keputusan perdagangan lebih stabil dan sinyal lebih efisien dibandingkan dengan sistem kerangka waktu tunggal tradisional. Secara keseluruhan, strategi ini memiliki adaptasi pasar yang baik dan prospek pengembangan.

Overview

This strategy uses a combination of moving averages across timeframes to identify trend rotations on the hourly, daily and weekly charts. It allows low-risk trend following trading. The strategy is flexible, simple to implement, capital efficient and suitable for medium-long term trend traders.

Trading Logic

The strategy employs 5, 20 and 40-day moving averages to determine the alignment of trends across different timeframes. Based on the consistency between larger and smaller timeframes, it identifies bullish and bearish cycles.

Specifically, the crossing of 5-day fast MA above 20-day medium MA indicates an uptrend in the short term. The crossing of 20-day medium MA above 40-day slow MA signals an uptrend in the medium term. When the fast, medium and slow MAs are positively aligned (5-day > 20-day > 40-day), it is a bull cycle. When they are negatively aligned (5-day < 20-day < 40-day), it is a bear cycle.

By determining direction from the larger cycles and confirming strength on the smaller cycles, this strategy opens positions only when major trend and minor momentum align. This effectively avoids false breakouts and achieves high win rate.

The strategy also utilizes ATR trailing stops to control single trade risks and further improve profitability.

Advantages

Flexible configurations to suit different instruments and trading styles

Simple to implement even for beginner traders

High capital efficiency to maximize leverage

Effective risk control to avoid significant losses

Strong trend following ability for sustained profits

High win rate due to robust signals and fewer whipsaws

Risks and Improvements

MA crossovers may lag and cause late trend detection

Single candle strength detection could trigger premature entry, relax condition

Fixed ATR stop loss, optimize to dynamic stops

Consider adding supplementary filters like volume

Explore different MA parameters for optimization

Conclusion

This strategy integrates multiple timeframe analysis and risk management for low-risk trend following trading. By adjusting parameters, it can be adapted to different instruments to suit trend traders. Compared to single timeframe systems, it makes more robust trading decisions and generates higher efficiency signals. In conclusion, this strategy has good market adaptiveness and development potential.

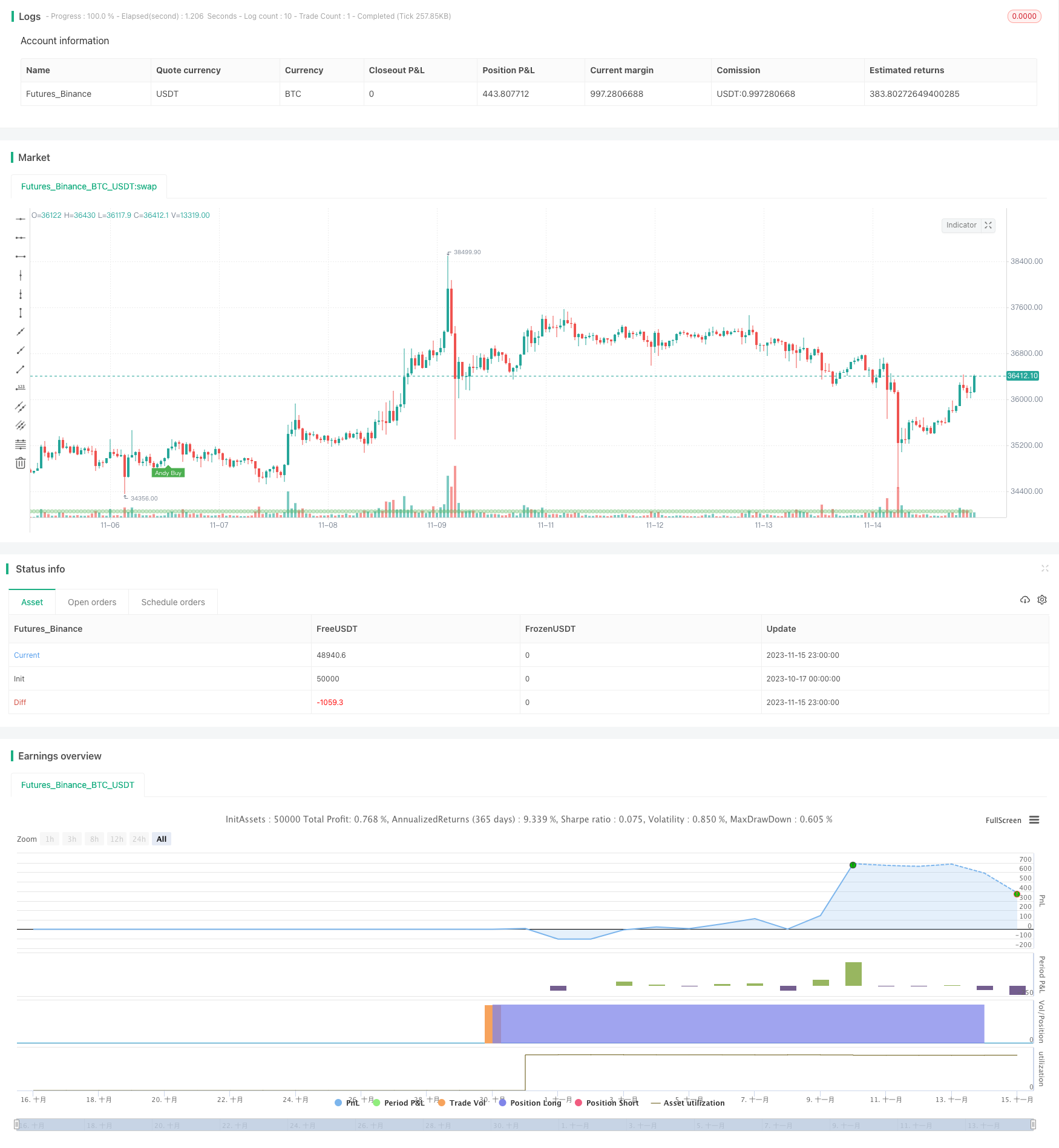

/*backtest

start: 2023-10-17 00:00:00

end: 2023-11-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kgynofomo

//@version=5

strategy(title="[Salavi] | Andy Advance Pro Strategy [BTC|M15]",overlay = true, pyramiding = 1,initial_capital = 10000, default_qty_type = strategy.cash,default_qty_value = 10000)

ema_short = ta.ema(close,5)

ema_middle = ta.ema(close,20)

ema_long = ta.ema(close,40)

cycle_1 = ema_short>ema_middle and ema_middle>ema_long

cycle_2 = ema_middle>ema_short and ema_short>ema_long

cycle_3 = ema_middle>ema_long and ema_long>ema_short

cycle_4 = ema_long>ema_middle and ema_middle>ema_short

cycle_5 = ema_long>ema_short and ema_short>ema_middle

cycle_6 = ema_short>ema_long and ema_long>ema_middle

bull_cycle = cycle_1 or cycle_2 or cycle_3

bear_cycle = cycle_4 or cycle_5 or cycle_6

// label.new("cycle_1")

// bgcolor(color=cycle_1?color.rgb(82, 255, 148, 60):na)

// bgcolor(color=cycle_2?color.rgb(82, 255, 148, 70):na)

// bgcolor(color=cycle_3?color.rgb(82, 255, 148, 80):na)

// bgcolor(color=cycle_4?color.rgb(255, 82, 82, 80):na)

// bgcolor(color=cycle_5?color.rgb(255, 82, 82, 70):na)

// bgcolor(color=cycle_6?color.rgb(255, 82, 82, 60):na)

// Inputs

a = input(2, title='Key Vaule. \'This changes the sensitivity\'')

c = input(7, title='ATR Period')

h = false

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema = ta.ema(src, 1)

above = ta.crossover(ema, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, ema)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

atr = ta.atr(14)

atr_length = input.int(25)

atr_rsi = ta.rsi(atr,atr_length)

atr_valid = atr_rsi>50

long_condition = buy and bull_cycle and atr_valid

short_condition = sell and bear_cycle and atr_valid

Exit_long_condition = short_condition

Exit_short_condition = long_condition

if long_condition

strategy.entry("Andy Buy",strategy.long, limit=close,comment="Andy Buy Here")

if Exit_long_condition

strategy.close("Andy Buy",comment="Andy Buy Out")

// strategy.entry("Andy fandan Short",strategy.short, limit=close,comment="Andy 翻單 short Here")

// strategy.close("Andy fandan Buy",comment="Andy short Out")

if short_condition

strategy.entry("Andy Short",strategy.short, limit=close,comment="Andy short Here")

// strategy.exit("STR","Long",stop=longstoploss)

if Exit_short_condition

strategy.close("Andy Short",comment="Andy short Out")

// strategy.entry("Andy fandan Buy",strategy.long, limit=close,comment="Andy 翻單 Buy Here")

// strategy.close("Andy fandan Short",comment="Andy Buy Out")

inLongTrade = strategy.position_size > 0

inLongTradecolor = #58D68D

notInTrade = strategy.position_size == 0

inShortTrade = strategy.position_size < 0

// bgcolor(color = inLongTrade?color.rgb(76, 175, 79, 70):inShortTrade?color.rgb(255, 82, 82, 70):na)

plotshape(close!=0,location = location.bottom,color = inLongTrade?color.rgb(76, 175, 79, 70):inShortTrade?color.rgb(255, 82, 82, 70):na)

plotshape(long_condition, title='Buy', text='Andy Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(short_condition, title='Sell', text='Andy Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

//atr > close *0.01* parameter

// MONTHLY TABLE PERFORMANCE - Developed by @QuantNomad

// *************************************************************************************************************************************************************************************************************************************************************************

show_performance = input.bool(true, 'Show Monthly Performance ?', group='Performance - credits: @QuantNomad')

prec = input(2, 'Return Precision', group='Performance - credits: @QuantNomad')

if show_performance

new_month = month(time) != month(time[1])

new_year = year(time) != year(time[1])

eq = strategy.equity

bar_pnl = eq / eq[1] - 1

cur_month_pnl = 0.0

cur_year_pnl = 0.0

// Current Monthly P&L

cur_month_pnl := new_month ? 0.0 :

(1 + cur_month_pnl[1]) * (1 + bar_pnl) - 1

// Current Yearly P&L

cur_year_pnl := new_year ? 0.0 :

(1 + cur_year_pnl[1]) * (1 + bar_pnl) - 1

// Arrays to store Yearly and Monthly P&Ls

var month_pnl = array.new_float(0)

var month_time = array.new_int(0)

var year_pnl = array.new_float(0)

var year_time = array.new_int(0)

last_computed = false

if (not na(cur_month_pnl[1]) and (new_month or barstate.islastconfirmedhistory))

if (last_computed[1])

array.pop(month_pnl)

array.pop(month_time)

array.push(month_pnl , cur_month_pnl[1])

array.push(month_time, time[1])

if (not na(cur_year_pnl[1]) and (new_year or barstate.islastconfirmedhistory))

if (last_computed[1])

array.pop(year_pnl)

array.pop(year_time)

array.push(year_pnl , cur_year_pnl[1])

array.push(year_time, time[1])

last_computed := barstate.islastconfirmedhistory ? true : nz(last_computed[1])

// Monthly P&L Table

var monthly_table = table(na)

if (barstate.islastconfirmedhistory)

monthly_table := table.new(position.bottom_center, columns = 14, rows = array.size(year_pnl) + 1, border_width = 1)

table.cell(monthly_table, 0, 0, "", bgcolor = #cccccc)

table.cell(monthly_table, 1, 0, "Jan", bgcolor = #cccccc)

table.cell(monthly_table, 2, 0, "Feb", bgcolor = #cccccc)

table.cell(monthly_table, 3, 0, "Mar", bgcolor = #cccccc)

table.cell(monthly_table, 4, 0, "Apr", bgcolor = #cccccc)

table.cell(monthly_table, 5, 0, "May", bgcolor = #cccccc)

table.cell(monthly_table, 6, 0, "Jun", bgcolor = #cccccc)

table.cell(monthly_table, 7, 0, "Jul", bgcolor = #cccccc)

table.cell(monthly_table, 8, 0, "Aug", bgcolor = #cccccc)

table.cell(monthly_table, 9, 0, "Sep", bgcolor = #cccccc)

table.cell(monthly_table, 10, 0, "Oct", bgcolor = #cccccc)

table.cell(monthly_table, 11, 0, "Nov", bgcolor = #cccccc)

table.cell(monthly_table, 12, 0, "Dec", bgcolor = #cccccc)

table.cell(monthly_table, 13, 0, "Year", bgcolor = #999999)

for yi = 0 to array.size(year_pnl) - 1

table.cell(monthly_table, 0, yi + 1, str.tostring(year(array.get(year_time, yi))), bgcolor = #cccccc)

y_color = array.get(year_pnl, yi) > 0 ? color.new(color.teal, transp = 40) : color.new(color.gray, transp = 40)

table.cell(monthly_table, 13, yi + 1, str.tostring(math.round(array.get(year_pnl, yi) * 100, prec)), bgcolor = y_color, text_color=color.new(color.white, 0))

for mi = 0 to array.size(month_time) - 1

m_row = year(array.get(month_time, mi)) - year(array.get(year_time, 0)) + 1

m_col = month(array.get(month_time, mi))

m_color = array.get(month_pnl, mi) > 0 ? color.new(color.teal, transp = 40) : color.new(color.gray, transp = 40)

table.cell(monthly_table, m_col, m_row, str.tostring(math.round(array.get(month_pnl, mi) * 100, prec)), bgcolor = m_color, text_color=color.new(color.white, 0))