Strategi Pelacakan Momentum Adaptif Multi-faktor

Ringkasan

Strategi multi-faktor otomatis untuk melacak momentum mengintegrasikan berbagai indikator teknis untuk mengidentifikasi tren pasar dan titik-titik resistensi pendukung utama, untuk memungkinkan perdagangan otomatis pada aset yang sangat fluktuatif seperti cryptocurrency. Strategi ini menggunakan indikator RSI, MACD, dan Stochastic untuk menentukan waktu jual beli, dan untuk mengidentifikasi tren yang lebih akurat dengan persentase perubahan harga.

Prinsip Strategi

Inti dari strategi multi-faktor adaptif untuk melacak momentum adalah penggunaan terpadu dari berbagai indikator teknis. Strategi ini terutama digunakan untuk beberapa komponen berikut:

Indikator RSI menilai overbought dan oversold. Kombinasi parameter yang berbeda dapat mengidentifikasi sinyal RSI biasa atau sinyal RSI Corner yang lebih baik untuk menentukan apakah ada peluang untuk berbalik.

Indikator MACD membantu menentukan arah tren. Ketika MACD melintasi atau melintasi garis sinyal, sinyal beli dan jual dihasilkan.

Indikator Stochastic mengidentifikasi zona overbought dan oversold. K-line dan D-line sinyal kombinasi forks dan dead-forks menentukan apakah mereka terbalik.

Persentase perubahan harga untuk memeriksa apakah benar-benar terobosan. Perhitungan persentase perubahan harga tertinggi, terendah, dan harga penutupan dalam periode tertentu untuk menentukan apakah merupakan terobosan yang benar.

Indikator EMA menilai tingkat tinggi di tingkat besar. Di atas garis cepat, garis lambat adalah sinyal bullish, di bawah garis turun adalah sinyal bearish.

Strategi ini memilih untuk melakukan lebih banyak shorting sesuai dengan kondisi pasar yang kosong, dan setelah memasuki posisi, mengatur stop loss stop, untuk mengontrol risiko secara efektif. Ketika sinyal pembalikan muncul, pilih posisi kosong. Seluruh proses pengambilan keputusan sepenuhnya menggabungkan beberapa faktor judgment, sehingga dapat membuat keputusan yang lebih akurat.

Analisis Keunggulan

Strategi ini memiliki beberapa keuntungan:

Multi-faktor drive memiliki keuntungan penilaian. Berbanding dengan satu indikator, kombinasi multi-indikator dapat saling diverifikasi, membuat hasil lebih akurat dan dapat diandalkan, sehingga menghemat biaya transaksi yang tidak perlu.

Syarat ketat untuk menghindari kesalahan transaksi. Strategi menetapkan persyaratan ketat untuk kondisi jual beli, membutuhkan beberapa indikator untuk melepaskan sinyal sekaligus, sehingga dapat menyaring banyak kebisingan dan menghindari kesalahan transaksi.

Adaptasi superparameter mengurangi intervensi manusia. Kemampuan strategi untuk secara dinamis menghitung parameter indikator, menghindari subjektivitas pilihan superparameter buatan, sehingga membuat parameter kebijakan lebih ilmiah.

Stop Loss Stop Loss Mechanism Mengontrol Risiko. Strategi ini akan menghitung dan memetakan posisi stop loss stop loss secara real time setelah membuka posisi, sehingga dapat secara efektif mengontrol kerugian tunggal dan mencegah terjadinya eksposur posisi.

Analisis risiko

Strategi ini juga memiliki beberapa risiko yang perlu diwaspadai:

Probabilitas kesalahan sinyal yang dilepaskan oleh indikator. Meskipun verifikasi multi-indikator dapat mengurangi tingkat kesalahan sinyal secara signifikan, kemungkinan masih ada. Hal ini dapat menyebabkan kerugian yang tidak perlu.

Risiko terobosan stop loss. Dalam situasi ekstrem, harga mungkin terjun ke jurang, menyebabkan stop loss asli terobosan dengan mudah, menyebabkan kerugian yang lebih besar.

Parameter yang dioptimalkan terlalu banyak. Parameter dinamis, meskipun menghindari subjektivitas yang ditimbulkan oleh pilihan buatan, dapat menyebabkan optimalisasi parameter yang berlebihan dan kehilangan kemampuan generalisasi.

Solusi yang sesuai:

- Peningkatan tingkat keparahan kondisi penyaringan sinyal, mengurangi tingkat kesalahan sinyal.

- Menggunakan metode batch-building untuk menghindari kerugian yang terlalu besar.

- Meningkatkan jumlah sampel yang diuji, dan secara ketat menilai stabilitas parameter.

Arah optimasi strategi

Ada beberapa dimensi yang dapat dioptimalkan untuk strategi pelacakan momentum adaptif multi-faktor:

Meningkatkan jumlah faktor penilaian. Meningkatkan jumlah faktor penilaian dengan menggabungkan lebih banyak jenis penilaian sinyal indikator yang berbeda, seperti penilaian tambahan seperti volatilitas, volume perdagangan, dan sebagainya.

Algoritma untuk mengoptimalkan mekanisme stop loss. Algoritma stop loss yang lebih canggih seperti tracking stop loss, shock stop loss, dan lain-lain dapat diperkenalkan untuk mengurangi kemungkinan terobosan stop loss.

Memperkenalkan model pembelajaran mesin. Menggunakan model seperti RNN, LSTM untuk memodelkan data historis untuk membantu menentukan keputusan pembelian dan penjualan.

Strategi Integrasi. Mengadopsi beberapa substrategi dan mengintegrasikannya menggunakan metode pembelajaran terpadu dapat menghasilkan kinerja yang lebih stabil secara keseluruhan.

Meringkaskan

Strategi pelacakan momentum multi-faktor mengintegrasikan penggunaan beberapa indikator teknis untuk mengidentifikasi waktu jual beli. Strategi ini lebih akurat dibandingkan dengan indikator tunggal, sementara parameter yang ada di dalamnya menyesuaikan diri dan mekanisme pengendalian risiko. Langkah selanjutnya adalah dengan memperkenalkan lebih banyak faktor penilaian tambahan, algoritma penghentian yang canggih, dan pembelajaran mesin.

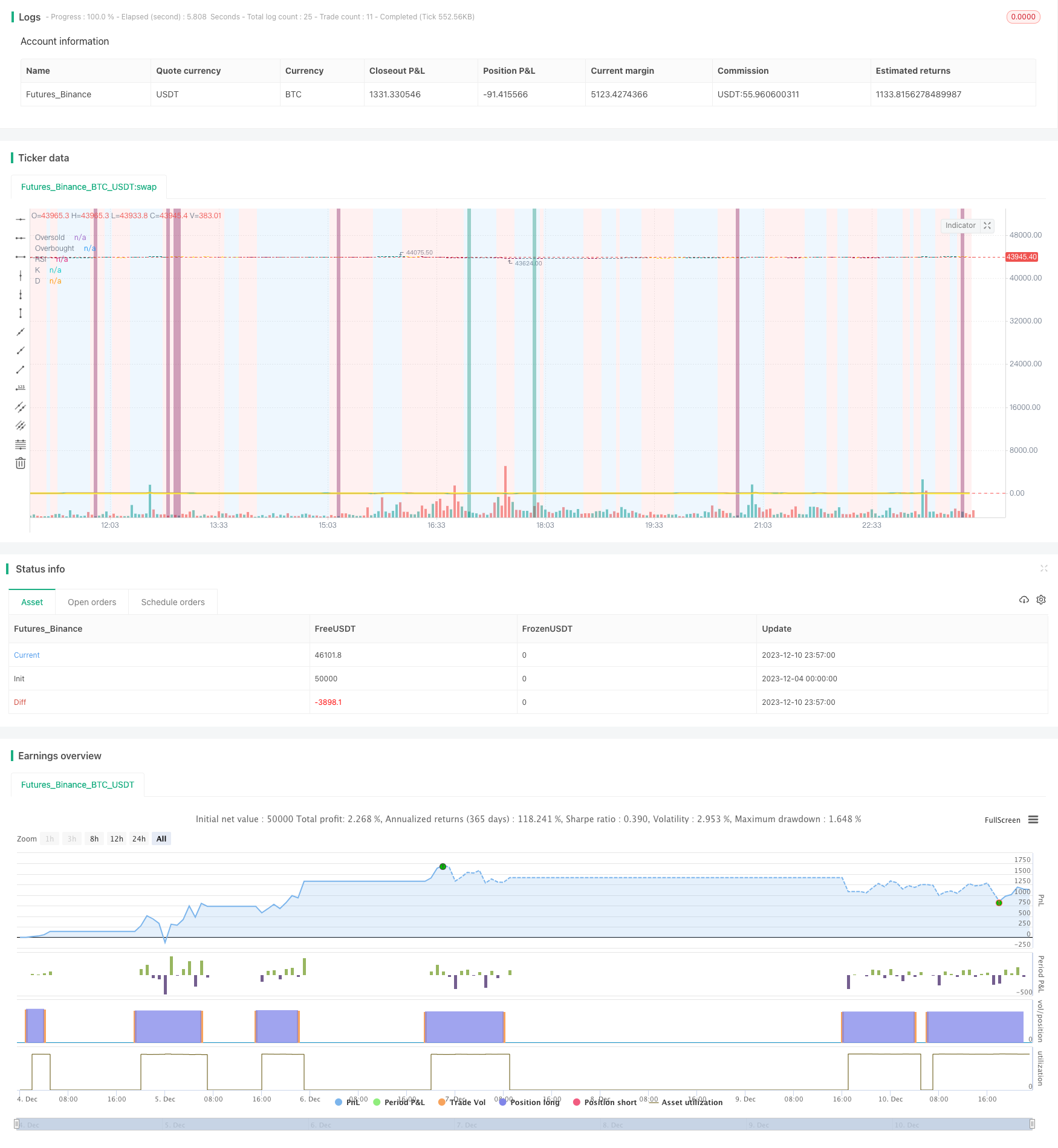

/*backtest

start: 2023-12-04 00:00:00

end: 2023-12-11 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

// ██████╗██████╗ ███████╗ █████╗ ████████╗███████╗██████╗ ██████╗ ██╗ ██╗

//██╔════╝██╔══██╗██╔════╝██╔══██╗╚══██╔══╝██╔════╝██╔══██╗ ██╔══██╗╚██╗ ██╔╝

//██║ ██████╔╝█████╗ ███████║ ██║ █████╗ ██║ ██║ ██████╔╝ ╚████╔╝

//██║ ██╔══██╗██╔══╝ ██╔══██║ ██║ ██╔══╝ ██║ ██║ ██╔══██╗ ╚██╔╝

//╚██████╗██║ ██║███████╗██║ ██║ ██║ ███████╗██████╔╝ ██████╔╝ ██║

// ╚═════╝╚═╝ ╚═╝╚══════╝╚═╝ ╚═╝ ╚═╝ ╚══════╝╚═════╝ ╚═════╝ ╚═╝

//███████╗ ██████╗ ██╗ ██╗ ██╗████████╗██╗ ██████╗ ███╗ ██╗███████╗ ██╗ █████╗ ███████╗ █████╗

//██╔════╝██╔═══██╗██║ ██║ ██║╚══██╔══╝██║██╔═══██╗████╗ ██║██╔════╝███║██╔══██╗╚════██║██╔══██╗

//███████╗██║ ██║██║ ██║ ██║ ██║ ██║██║ ██║██╔██╗ ██║███████╗╚██║╚██████║ ██╔╝╚█████╔╝

//╚════██║██║ ██║██║ ██║ ██║ ██║ ██║██║ ██║██║╚██╗██║╚════██║ ██║ ╚═══██║ ██╔╝ ██╔══██╗

//███████║╚██████╔╝███████╗╚██████╔╝ ██║ ██║╚██████╔╝██║ ╚████║███████║ ██║ █████╔╝ ██║ ╚█████╔╝

//╚══════╝ ╚═════╝ ╚══════╝ ╚═════╝ ╚═╝ ╚═╝ ╚═════╝ ╚═╝ ╚═══╝╚══════╝ ╚═╝ ╚════╝ ╚═╝ ╚════╝

strategy(shorttitle='Ain1 No Label',title='All in One Strategy no RSI Label', overlay=true, scale=scale.left, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type=strategy.commission.percent, commission_value=0.18, calc_on_every_tick=true)

kcolor = color.new(#0094FF, 60)

dcolor = color.new(#FF6A00, 60)

// ----------------- Strategy Inputs -------------------------------------------------------------

//Backtest dates with auto finish date of today

start = input(defval = timestamp("01 April 2021 00:00 -0500"), title = "Start Time", type = input.time)

finish = input(defval = timestamp("31 December 2021 00:00 -0600"), title = "End Time", type = input.time)

window() => true // create function "within window of time"

// Strategy Selection - Long, Short, or Both

stratinfo = input(true, "Long/Short for Mixed Market, Long for Bull, Short for Bear")

strat = input(title="Trade Types", defval="Long/Short", options=["Long Only", "Long/Short", "Short Only"])

strat_val = strat == "Long Only" ? 1 : strat == "Long/Short" ? 0 : -1

// Risk Management Inputs

sl= input(10.0, "Stop Loss %", minval = 0, maxval = 100, step = 0.01)

stoploss = sl/100

tp = input(20.0, "Target Profit %", minval = 0, maxval = 100, step = 0.01)

TargetProfit = tp/100

useXRSI = input(false, "Use RSI crossing back, select only one strategy")

useCRSI = input(false, "Use Tweaked Connors RSI, select only one")

RSIInfo = input(true, "These are the RSI Strategy Inputs, RSI Length applies to MACD, set OB and OS to 45 for using Stoch and EMA strategies.")

length = input(14, "RSI Length", minval=1)

overbought= input(62, "Overbought")

oversold= input(35, "Oversold")

cl1 = input(3, "Connor's MA Length 1", minval=1, step=1)

cl2 = input(20, "Connor's MA Lenght 2", minval=1, step=1)

cl3 = input(50, "Connor's MA Lenght 3", minval=1, step=1)

// MACD and EMA Inputs

useMACD = input(false, "Use MACD Only, select only one strategy")

useEMA = input(false, "Use EMA Only, select only one strategy (EMA uses Stochastic inputs too)")

MACDInfo=input(true, "These are the MACD strategy variables")

fastLength = input(5, minval=1, title="EMA Fast Length")

slowLength = input(10, minval=1, title="EMA Slow Length")

ob_min = input(52, "Overbought Lookback Minimum Value", minval=0, maxval=200)

ob_lb = input(25, "Overbought Lookback Bars", minval=0, maxval=100)

os_min = input(50, "Oversold Lookback Minimum Value", minval=0, maxval=200)

os_lb = input(35, "Oversold Lookback Bars", minval=0, maxval=100)

source = input(title="Source", type=input.source, defval=close)

RSI = rsi(source, length)

// Price Movement Inputs

PriceInfo = input(true, "Price Change Percentage Cross Check Inputs for all Strategies, added logic to avoid early sell")

lkbk = input(5,"Max Lookback Period")

// EMA and SMA Background Inputs

useStoch = input(false, "Use Stochastic Strategy, choose only one")

StochInfo = input(true, "Stochastic Strategy Inputs")

smoothK = input(3, "K", minval=1)

smoothD = input(3, "D", minval=1)

k_mode = input("SMA", "K Mode", options=["SMA", "EMA", "WMA"])

high_source = input(high,"High Source")

low_source= input(low,"Low Source")

HTF = input("","Curernt or Higher time frame only", type=input.resolution)

// Selections to show or hide the overlays

showZones = input(true, title="Show Bullish/Bearish Zones")

showStoch = input(true, title="Show Stochastic Overlays")

showRSIBS = input(true, title="Show RSI Buy Sell Zones")

showMACD = input(true, title="Show MACD")

color_bars=input(true, "Color Bars")

// ------------------ Dynamic RSI Calculation ----------------------------------------

AvgHigh(src,cnt,val) =>

total = 0.0

count = 0

for i = 0 to cnt

if src[i] > val

count := count + 1

total := total + src[i]

round(total / count)

RSI_high = AvgHigh(RSI, ob_lb, ob_min)

AvgLow(src,cnt,val) =>

total = 0.0

count = 0

for i = 0 to cnt

if src[i] < val

count := count + 1

total := total + src[i]

round(total / count)

RSI_low = AvgLow(RSI, os_lb, os_min)

// ------------------ Price Percentage Change Calculation -----------------------------------------

perc_change(lkbk) =>

overall_change = ((close[0] - open[lkbk]) / open[lkbk]) * 100

highest_high = 0.0

lowest_low = 0.0

for i = lkbk to 0

highest_high := i == lkbk ? high : high[i] > high[(i + 1)] ? high[i] : highest_high[1]

lowest_low := i == lkbk ? low : low[i] < low[(i + 1)] ? low[i] : lowest_low[1]

start_to_high = ((highest_high - open[lkbk]) / open[lkbk]) * 100

start_to_low = ((lowest_low - open[lkbk]) / open[lkbk]) * 100

previous_to_high = ((highest_high - open[1])/open[1])*100

previous_to_low = ((lowest_low-open[1])/open[1])*100

previous_bar = ((close[1]-open[1])/open[1])*100

[overall_change, start_to_high, start_to_low, previous_to_high, previous_to_low, previous_bar]

// Call the function

[overall, to_high, to_low, last_high, last_low, last_bar] = perc_change(lkbk)

// Plot the function

//plot(overall*50, color=color.white, title='Overall Percentage Change', linewidth=3)

//plot(to_high*50, color=color.green,title='Percentage Change from Start to High', linewidth=2)

//plot(to_low*50, color=color.red, title='Percentage Change from Start to Low', linewidth=2)

//plot(last_high*100, color=color.teal, title="Previous to High", linewidth=2)

//plot(last_low*100, color=color.maroon, title="Previous to Close", linewidth=2)

//plot(last_bar*100, color=color.orange, title="Previous Bar", linewidth=2)

//hline(0, title='Center Line', color=color.orange, linewidth=2)

true_dip = overall < 0 and to_high > 0 and to_low < 0 and last_high > 0 and last_low < 0 and last_bar < 0

true_peak = overall > 0 and to_high > 0 and to_low > 0 and last_high > 0 and last_low < 0 and last_bar > 0

alertcondition(true_dip, title='True Dip', message='Dip')

alertcondition(true_peak, title='True Peak', message='Peak')

// ------------------ Background Colors based on EMA Indicators -----------------------------------

// Uses standard lengths of 9 and 21, if you want control delete the constant definition and uncomment the inputs

haClose(gap) => (open[gap] + high[gap] + low[gap] + close[gap]) / 4

rsi_ema = rsi(haClose(0), length)

v2 = ema(rsi_ema, length)

v3 = 2 * v2 - ema(v2, length)

emaA = ema(rsi_ema, fastLength)

emaFast = 2 * emaA - ema(emaA, fastLength)

emaB = ema(rsi_ema, slowLength)

emaSlow = 2 * emaB - ema(emaB, slowLength)

//plot(rsi_ema, color=color.white, title='RSI EMA', linewidth=3)

//plot(v2, color=color.green,title='v2', linewidth=2)

//plot(v3, color=color.red, title='v3', linewidth=2)

//plot(emaFast, color=color.teal, title="EMA Fast", linewidth=2)

//plot(emaSlow, color=color.maroon, title="EMA Slow", linewidth=2)

EMABuy = crossunder(emaFast, v2) and window()

EMASell = crossover(emaFast, emaSlow) and window()

alertcondition(EMABuy, title='EMA Buy', message='EMA Buy Condition')

alertcondition(EMASell, title='EMA Sell', message='EMA Sell Condition')

// bullish signal rule:

bullishRule =emaFast > emaSlow

// bearish signal rule:

bearishRule =emaFast < emaSlow

// current trading State

ruleState = 0

ruleState := bullishRule ? 1 : bearishRule ? -1 : nz(ruleState[1])

ruleColor = ruleState==1 ? color.new(color.blue, 90) : ruleState == -1 ? color.new(color.red, 90) : ruleState == 0 ? color.new(color.gray, 90) : na

bgcolor(showZones ? ruleColor : na, title="Bullish/Bearish Zones")

// ------------------ Stochastic Indicator Overlay -----------------------------------------------

// Calculation

// Use highest highs and lowest lows

h_high = highest(high_source ,lkbk)

l_low = lowest(low_source ,lkbk)

stoch = stoch(RSI, RSI_high, RSI_low, length)

k =

k_mode=="EMA" ? ema(stoch, smoothK) :

k_mode=="WMA" ? wma(stoch, smoothK) :

sma(stoch, smoothK)

d = sma(k, smoothD)

k_c = change(k)

d_c = change(d)

kd = k - d

// Plot

signalColor = k>oversold and d<overbought and k>d and k_c>0 and d_c>0 ? kcolor :

k<overbought and d>oversold and k<d and k_c<0 and d_c<0 ? dcolor : na

kp = plot(showStoch ? k : na, "K", color=kcolor)

dp = plot(showStoch ? d : na, "D", color=dcolor)

fill(kp, dp, color = signalColor, title="K-D")

signalUp = showStoch ? not na(signalColor) and kd>0 : na

signalDown = showStoch ? not na(signalColor) and kd<0 : na

//plot(signalUp ? kd : na, "Signal Up", color=kcolor, transp=90, style=plot.style_columns)

//plot(signalDown ? (kd+100) : na , "Signal Down", color=dcolor, transp=90, style=plot.style_columns, histbase=100)

//StochBuy = crossover(k, d) and kd>0 and to_low<0 and window()

//StochSell = crossunder(k,d) and kd<0 and to_high>0 and window()

StochBuy = crossover(k, d) and window()

StochSell = crossunder(k, d) and window()

alertcondition(StochBuy, title='Stoch Buy', message='K Crossing D')

alertcondition(StochSell, title='Stoch Sell', message='D Crossing K')

// -------------- Add Price Movement -------------------------

// Calculations

h1 = vwma(high, length)

l1 = vwma(low, length)

hp = h_high[1]

lp = l_low[1]

// Plot

var plot_color=#353535

var sig = 0

if (h1 >hp)

sig:=1

plot_color:=color.lime

else if (l1 <lp)

sig:=-1

plot_color:=color.maroon

//plot(1,title = "Price Movement Bars", style=plot.style_columns,color=plot_color)

//plot(sig,title="Signal 1 or -1",display=display.none)

// --------------------------------------- RSI Plot ----------------------------------------------

// Plot Oversold and Overbought Lines

over = hline(oversold, title="Oversold", color=color.green)

under = hline(overbought, title="Overbought", color=color.red)

fillcolor = color.new(#9915FF, 90)

fill(over, under, fillcolor, title="Band Background")

// Show RSI and EMA crosses with arrows and RSI Color (tweaked Connors RSI)

// Improves strategy setting ease by showing where EMA 5 crosses EMA 10 from above to confirm overbought conditions or trend reversals

// This shows where you should enter shorts or exit longs

// Tweaked Connors RSI Calculation

connor_ob = overbought

connor_os = oversold

ma1 = sma(close,cl1)

ma2 = sma(close, cl2)

ma3 = sma(close, cl3)

// Buy Sell Zones using tweaked Connors RSI (RSI values of 80 and 20 for Crypto as well as ma3, ma20, and ma50 are the tweaks)

RSI_SELL = ma1 > ma2 and open > ma3 and RSI >= connor_ob and true_peak and window()

RSI_BUY = ma2 < ma3 and ma3 > close and RSI <= connor_os and true_dip and window()

alertcondition(RSI_BUY, title='Connors Buy', message='Connors RSI Buy')

alertcondition(RSI_SELL, title='Connors Sell', message='Connors RSI Sell')

// Color Definition

col = useCRSI ? (close > ma2 and close < ma3 and RSI <= connor_os ? color.lime : close < ma2 and close > ma3 and RSI <= connor_ob ? color.red : color.yellow ) : color.yellow

// Plot colored RSI Line

plot(RSI, title="RSI", linewidth=3, color=col)

//------------------- MACD Strategy -------------------------------------------------

[macdLine, signalLine, _] = macd(close, fastLength, slowLength, length)

bartrendcolor = macdLine > signalLine and k > 50 and RSI > 50 ? color.teal : macdLine < signalLine and k < 50 and RSI < 50 ? color.maroon : macdLine < signalLine ? color.yellow : color.gray

barcolor(color = color_bars ? bartrendcolor : na)

MACDBuy = macdLine>signalLine and RSI<RSI_low and overall<0 and window()

MACDSell = macdLine<signalLine and RSI>RSI_high and overall>0 and window()

//plotshape(showMACD ? MACDBuy: na, title = "MACD Buy", style = shape.arrowup, text = "MACD Buy", color=color.green, textcolor=color.green, size=size.small)

//plotshape(showMACD ? MACDSell: na, title = "MACD Sell", style = shape.arrowdown, text = "MACD Sell", color=color.red, textcolor=color.red, size=size.small)

MACColor = MACDBuy ? color.new(color.teal, 50) : MACDSell ? color.new(color.maroon, 50) : na

bgcolor(showMACD ? MACColor : na, title ="MACD Signals")

// -------------------------------- Entry and Exit Logic ------------------------------------

// Entry Logic

XRSI_OB = crossunder(RSI, overbought) and overall<0 and window()

RSI_OB = RSI>overbought and true_peak and window()

XRSI_OS = crossover(RSI, oversold) and overall>0 and window()

RSI_OS = RSI<oversold and true_dip and window()

alertcondition(XRSI_OB, title='Reverse RSI Sell', message='RSI Crossing back under OB')

alertcondition(XRSI_OS, title='Reverse RSI Buy', message='RSI Crossing back over OS')

alertcondition(RSI_OS, title='RSI Buy', message='RSI Crossover OS')

alertcondition(RSI_SELL, title='RSI Sell', message='RSI Crossunder OB')

// Strategy Entry and Exit with built in Risk Management

GoLong = strategy.position_size==0 and strat_val > -1 and rsi_ema > RSI and k < d ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : useStoch ? StochBuy : RSI_OS) : false

GoShort = strategy.position_size==0 and strat_val < 1 and rsi_ema < RSI and d < k ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : useStoch ? StochSell : RSI_OB) : false

if (GoLong)

strategy.entry("LONG", strategy.long)

if (GoShort)

strategy.entry("SHORT", strategy.short)

longStopPrice = strategy.position_avg_price * (1 - stoploss)

longTakePrice = strategy.position_avg_price * (1 + TargetProfit)

shortStopPrice = strategy.position_avg_price * (1 + stoploss)

shortTakePrice = strategy.position_avg_price * (1 - TargetProfit)

//plot(series=(strategy.position_size > 0) ? longTakePrice : na, color=color.green, style=plot.style_circles, linewidth=3, title="Long Take Profit")

//plot(series=(strategy.position_size < 0) ? shortTakePrice : na, color=color.green, style=plot.style_circles, linewidth=3, title="Short Take Profit")

//plot(series=(strategy.position_size > 0) ? longStopPrice : na, color=color.red, style=plot.style_cross, linewidth=2, title="Long Stop Loss")

//plot(series=(strategy.position_size < 0) ? shortStopPrice : na, color=color.red, style=plot.style_cross, linewidth=2, title="Short Stop Loss")

if (strategy.position_size > 0)

strategy.exit(id="Exit Long", from_entry = "LONG", stop = longStopPrice, limit = longTakePrice)

if (strategy.position_size < 0)

strategy.exit(id="Exit Short", from_entry = "SHORT", stop = shortStopPrice, limit = shortTakePrice)

CloseLong = strat_val > -1 and strategy.position_size > 0 and rsi_ema > RSI and d > k ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

if(CloseLong)

strategy.close("LONG")

CloseShort = strat_val < 1 and strategy.position_size < 0 and rsi_ema < RSI and k > d ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

if(CloseShort)

strategy.close("SHORT")