Strategi perdagangan kuantitatif teknis multi-indikator

Ringkasan

Strategi ini mengintegrasikan berbagai indikator teknis, termasuk sistem parallax shift, ekspor opini, rata-rata bergerak sederhana, rata-rata bergerak indeks, dan rata-rata bergerak, untuk mengidentifikasi potensi titik beli dan jual di grafik.

Prinsip Strategi

Indikator utama

- Sistem orientasi parabola: digunakan untuk menentukan titik-titik berhenti dan potensi titik masuk

- Strategi Ekspor Opini: Untuk Menentukan Arah Tren

- Rata-rata bergerak sederhana dengan keterlambatan nol: memberikan rata-rata bergerak rendah dengan keterlambatan

- Indeks Moving Average: Menelusuri Tren dan Fluktuasi Harga

- Garis rata yang halus: menghasilkan garis rata yang lebih halus

Sinyal perdagangan

- Ketika sistem parallax bergeser menunjukkan tren naik dan harga melebihi rata-rata pergerakan indeks 99th, melakukan over; ketika menunjukkan tren turun dan harga di bawah rata-rata pergerakan indeks 99th, melakukan short

- Sinyal-sinyal yang digabungkan dengan strategi ekspor opini publik untuk mengkonfirmasi lebih lanjut arah tren

- Garis rata yang halus bekerja dengan sinyal garis paralel, untuk menghindari penembusan palsu

Manajemen Risiko

- Tetapkan Stop Loss dan Stop Stop

- Pertimbangan untuk Memperbaiki Kondisi Pembelian, Fleksibilitas dalam Mengatur Posisi

Analisis Keunggulan

Keuntungan terbesar dari strategi ini adalah bahwa portofolio indikator yang komprehensif dapat secara efektif mengidentifikasi arah tren. Sistem garis paralel menentukan titik balik potensial; Strategi ekspor opini menilai tren utama; Moving Average memfilter sinyal palsu.

Selain itu, strategi ini menambahkan mekanisme stop-loss dan stop-lock untuk mengendalikan risiko. Garis rata yang halus juga digunakan untuk menghindari gangguan dari kebisingan jangka pendek.

Analisis risiko

Strategi ini mengalami kesulitan ketika indikator-indikator tersebut memberikan sinyal konflik. Selain itu, pengaturan parameter yang tidak tepat dapat berdampak buruk pada perdagangan.

Selain itu, perdagangan teknis sendiri memiliki risiko tertentu, tidak dapat sepenuhnya menghindari kerugian.

Arah optimasi

- Untuk menguji dan mengoptimalkan parameter indikator untuk menemukan kombinasi optimal

- Menambahkan algoritma pembelajaran mesin, menggunakan model pelatihan data besar, untuk meningkatkan akurasi sinyal

- Pertimbangan kondisi pasar, perubahan posisi secara dinamis, dan garis stop loss, yang dikombinasikan dengan indikator sentimen, dan informasi berita

- Optimalkan reset pembelian kondisi logika, membuat deteksi sinyal lebih fleksibel dan konsisten

Meringkaskan

Strategi ini mengintegrasikan berbagai indikator teknis, mengidentifikasi sinyal perdagangan melalui kombinasi indikator. Keuntungan adalah akurasi sinyal yang tinggi, stabilitas yang kuat. Pada saat yang sama, langkah-langkah pengendalian risiko ada. Secara keseluruhan, ini adalah program perdagangan yang layak dipertimbangkan.

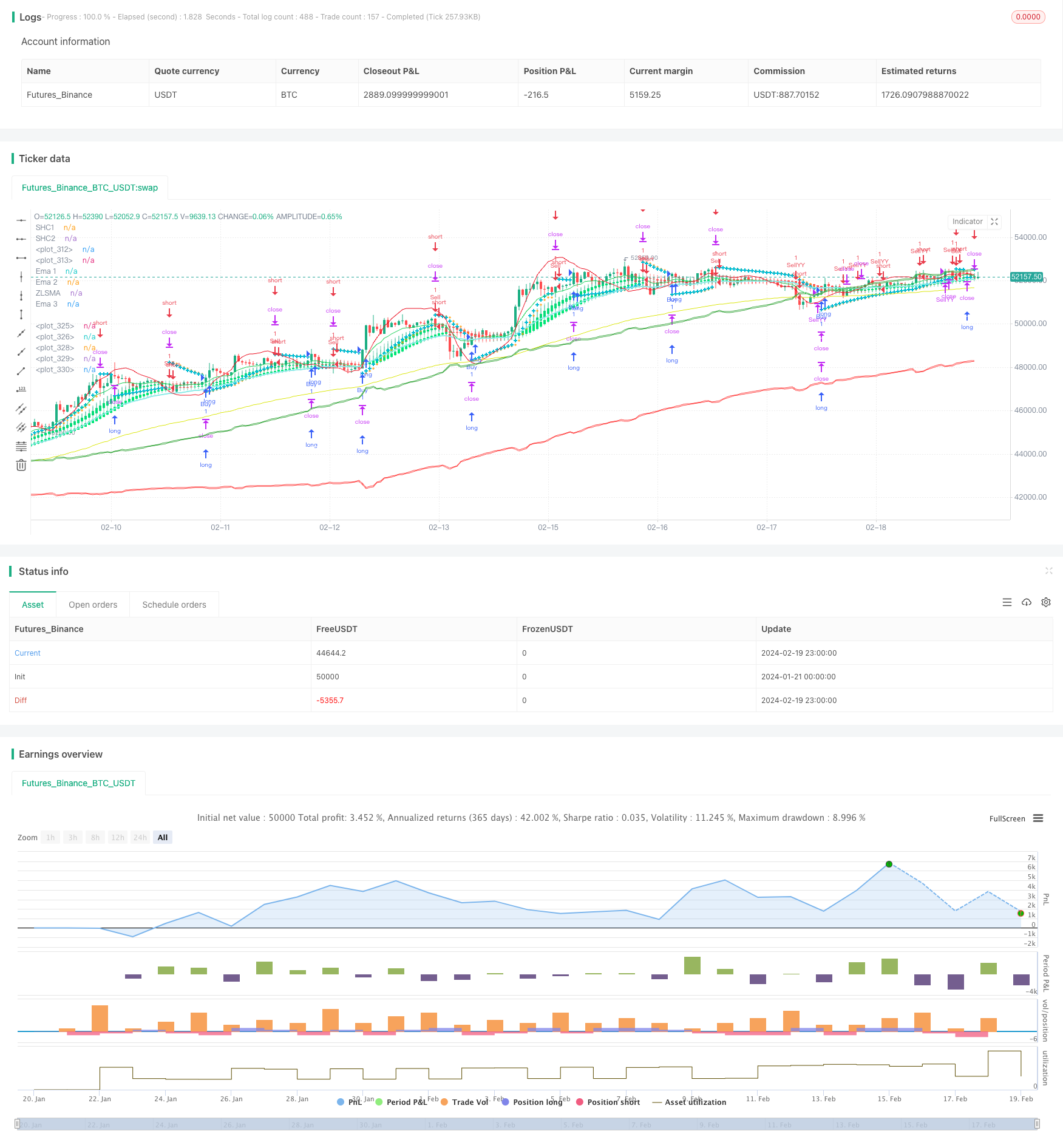

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("CE-ZLSMA-EMA-SAR-SHC", overlay=true)

// Parabolic SAR Strategy

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

var bool longSar = false

var bool shortSar = false

//input smoothed HAC 1

len=input.int(title="Length SHC1", defval = 10)

o=ta.ema(open,len)

c=ta.ema(close,len)

h=ta.ema(high,len)

l=ta.ema(low,len)

haclose = (o+h+l+c)/4

var haopen = 0.0

if na(haopen[1])

haopen := (o + c) / 2

else

haopen := (haopen[1] + haclose[1]) / 2

hahigh = math.max (h, math.max(haopen,haclose))

halow = math.min (l, math.min(haopen,haclose))

len2=input(10)

o2=ta.ema(haopen, len2)

c2=ta.ema(haclose, len2)

h2=ta.ema(hahigh, len2)

l2=ta.ema(halow, len2)

col=o2>c2 ? color.red : color.lime

bool shc1Green = o2 > c2

bool shc1Lime = o2 < c2

//input smoothed HAC 1

lenSHC2=input.int(title="Length SHC2 ", defval = 20)

oShc2=ta.ema(open,lenSHC2)

cShc2=ta.ema(close,lenSHC2)

hShc2=ta.ema(high,lenSHC2)

lShc2=ta.ema(low,lenSHC2)

hacloseShc2 = (oShc2+hShc2+lShc2+cShc2)/4

var haopenShc2 = 0.0

if na(haopenShc2[1])

haopenShc2 := (oShc2 + cShc2) / 2

else

haopenShc2 := (haopenShc2[1] + hacloseShc2[1]) / 2

hahighShc2 = math.max (hShc2, math.max(haopenShc2,hacloseShc2))

halowShc2 = math.min (lShc2, math.min(haopenShc2,hacloseShc2))

len2Shc2=input(10)

o2Shc2=ta.ema(haopenShc2, len2Shc2)

c2Shc2=ta.ema(hacloseShc2, len2Shc2)

h2Shc2=ta.ema(hahighShc2, len2Shc2)

l2Shc2=ta.ema(halowShc2, len2Shc2)

colShc2=o2Shc2>c2Shc2 ? color.red : color.lime

bool shc2Green = o2Shc2 > c2Shc2

bool shc2Lime = o2Shc2 < c2Shc2

//end smooth

bool shcGree = shc1Green and shc2Green

bool shcLime = shc1Lime and shc2Lime

//zlsma

lengthZlsma = input.int(title="Length", defval=32)

offset = input.int(title="Offset", defval=0)

src = input(close, title="Source")

lsma = ta.linreg(src, lengthZlsma, offset)

lsma2 = ta.linreg(lsma, lengthZlsma, offset)

eq= lsma-lsma2

zlsma = lsma+eq

// ema 10

len4 = input.int(10, minval=1, title="Length")

src4 = input.source(close, title="Source")

out4 = ta.ema(src4, len4)

//End of format

// ema 34

len5 = input.int(34, minval=1, title="Length")

src5 = input.source(close, title="Source")

out5 = ta.ema(src5, len5)

//end ema 34

// ema 99

len6 = input.int(99, minval=1, title="Length")

src6 = input.source(close, title="Source")

out6 = ta.ema(src6, len6)

// end ema 99

//kiem tra dieu kien gia dong cua lon hon ema99 thi moi me lenh long

bool onEma99 = close > out6

bool downEma99 = open < out6

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := math.max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := math.min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := math.min(AF + increment, maximum)

else

if low < EP

EP := low

AF := math.min(AF + increment, maximum)

if uptrend

SAR := math.min(SAR, low[1])

if bar_index > 1

SAR := math.min(SAR, low[2])

else

SAR := math.max(SAR, high[1])

if bar_index > 1

SAR := math.max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

if barstate.isconfirmed

if uptrend

// log.info("true")

strategy.entry("ParSE", strategy.short, stop=nextBarSAR, comment="ParSE")

strategy.cancel("ParLE")

shortSar := false

longSar := true

else

// log.info("false")

strategy.entry("ParLE", strategy.long, stop=nextBarSAR, comment="ParLE")

strategy.cancel("ParSE")

longSar := false

shortSar := true

// Chandelier Exit Strategy

length = input.int(title="ATR Period", defval=1)

mult = input.float(title="ATR Multiplier", step=0.1, defval=1.1)

showLabels = input.bool(title="Show Buy/Sell Labels ?", defval=true)

useClose = input.bool(title="Use Close Price for Extremums ?", defval=true)

highlightState = input.bool(title="Highlight State ?", defval=true)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var bool longOpened = false

var bool shortOpended = false

// Entry and exit logic

if (dir == 1)

if longSar

if not longOpened

strategy.close("Sell", disable_alert = true)

strategy.order("Buy", strategy.long)

longOpened := true

shortOpended := false

if (dir == -1)

if shortSar

if not shortOpended

strategy.close("Buy", disable_alert = true)

strategy.order("Sell", strategy.short)

shortOpended := true

longOpened := false

//strategy YY

// ~~~~~~~~~~~ INPUTS ~~~~~~~~~~~ //

lenYY = input.int(80, "Trend Length:", tooltip="How far back should we span this indicator?\nThis length effects all lengths of the indicator")

purchaseSrc = input.source(close, "Purchase Source (Long and Short):", tooltip="What source needs to exit the purchase zone for a purchase to happen?")

exitSrc = input.source(close, "Exit Source (Long and Short):", tooltip="What source needs to hit a exit condition to stop the trade (Take profit, Stop Loss or hitting the other sides Purchase Zone)?")

useTakeProfit = input.bool(true, "Use Take Profit", tooltip="Should we take profit IF we cross the basis line and then cross it AGAIN?")

useStopLoss = input.bool(true, "Use Stop Loss", tooltip="Stop loss will ensure you don't lose too much if its a bad call")

stopLossMult = input.float(0.1, "Stoploss Multiplier %:", tooltip="How far from the purchase lines should the stop loss be")

resetCondition = input.string("Entry", "Reset Purchase Availability After:", options=["Entry", "Stop Loss", "None"],

tooltip="If we reset after a condition is hit, this means we can purchase again when the purchase condition is met. \n" +

"Otherwise, we will only purchase after an opposite signal has appeared.\n" +

"Entry: means when the close enters the purchase zone (buy or sell).\n" +

"Stop Loss: means when the close hits the stop loss location (even when were out of a trade)\n" +

"This allows us to get more trades and also if our stop loss initally was hit but it WAS a good time to purchase, we don't lose that chance.")

// ~~~~~~~~~~~ VARIABLES ~~~~~~~~~~~ //

var bool longStart = na

var bool longAvailable = na

var bool longTakeProfitAvailable = na

var bool longStopLoss = na

var bool shortStart = na

var bool shortAvailable = na

var bool shortTakeProfitAvailable = na

var bool shortStopLoss = na

resetAfterStopLoss = resetCondition == "Stop Loss"

resetAfterEntry = resetCondition == "Entry"

// ~~~~~~~~~~~ CALCULATIONS ~~~~~~~~~~~ //

// Mid Line

midHigh = ta.vwma(ta.highest(high, lenYY), lenYY)

midLow = ta.vwma(ta.lowest(low, lenYY), lenYY)

mid = math.avg(midHigh, midLow)

midSmoothed = ta.ema(mid, lenYY)

//Volume Filtered

avgVol = ta.vwma(volume, lenYY)

volDiff = volume / avgVol

midVolSmoothed = ta.vwma(midSmoothed * volDiff, 3)

//RSI Filtered

midDifference = ta.sma(midHigh - midLow, lenYY)

midRSI = ta.rsi(midVolSmoothed, lenYY) * 0.01

midAdd = midRSI * midDifference

//Calculate Zones

purchaseZoneHigh = midSmoothed + midAdd

purchaseZoneLow = midSmoothed - midAdd

purchaseZoneBasis = math.avg(purchaseZoneHigh, purchaseZoneLow)

//Create Stop Loss Locations

stopLossHigh = purchaseZoneHigh * (1 + (stopLossMult * 0.01))

stopLossLow = purchaseZoneLow * (1 - (stopLossMult * 0.01))

// ~~~~~~~~~~~ PURCHASE CALCULATIONS ~~~~~~~~~~~ //

//Long

longEntry = ta.crossunder(purchaseSrc, purchaseZoneLow)

longStart := ta.crossover(purchaseSrc, purchaseZoneLow) and longAvailable

longAvailable := ta.crossunder(purchaseSrc, purchaseZoneHigh) or (resetAfterStopLoss and longStopLoss) or (resetAfterEntry and longEntry) ? true : longStart ? false : longAvailable[1]

longEnd = ta.crossover(exitSrc, purchaseZoneHigh)

longStopLoss := ta.crossunder(exitSrc, stopLossLow)

longTakeProfitAvailable := ta.crossover(exitSrc, purchaseZoneBasis) ? true : longEnd ? false : longTakeProfitAvailable[1]

longTakeProfit = ta.crossunder(exitSrc, purchaseZoneBasis) and longTakeProfitAvailable

//Short

shortEntry = ta.crossover(purchaseSrc, purchaseZoneHigh)

shortStart := ta.crossunder(purchaseSrc, purchaseZoneHigh) and shortAvailable

shortAvailable := ta.crossover(purchaseSrc, purchaseZoneLow) or (resetAfterStopLoss and shortStopLoss) or (resetAfterEntry and shortEntry)? true : shortStart ? false : shortAvailable[1]

shortEnd = ta.crossunder(exitSrc, purchaseZoneLow)

shortStopLoss := ta.crossover(exitSrc, stopLossHigh)

shortTakeProfitAvailable := ta.crossunder(exitSrc, purchaseZoneBasis) ? true : shortEnd ? false : shortTakeProfitAvailable[1]

shortTakeProfit = ta.crossover(exitSrc, purchaseZoneBasis) and shortTakeProfitAvailable

// ~~~~~~~~~~~ STRATEGY ~~~~~~~~~~~ //

var bool openLongYY = false

var bool openShortYY = false

if (longStart)

strategy.order("BuyYY", strategy.long)

strategy.close("SellYY", disable_alert = true)

openLongYY := true

openShortYY := false

else if (longEnd or (useStopLoss and longStopLoss) or (useTakeProfit and longTakeProfit))

strategy.close("BuyYY", disable_alert = true)

if (shortStart)

strategy.close("BuyYY", disable_alert = true)

strategy.order("SellYY", strategy.short)

openShortYY := true

openLongYY := false

else if (shortEnd or (useStopLoss and shortStopLoss) or (useTakeProfit and shortTakeProfit))

strategy.close("SellYY", disable_alert = true)

// ~~~~~~~~~~~ ALERTS ~~~~~~~~~~~ //

// if longStart or (longEnd or (useStopLoss and longStopLoss) or (useTakeProfit and longTakeProfit)) or shortStart or (shortEnd or (useStopLoss and shortStopLoss) or (useTakeProfit and shortTakeProfit))

// alert("{{strategy.order.action}} | {{ticker}} | {{close}}", alert.freq_once_per_bar)

// Plotting

plot(SAR, style=plot.style_cross, linewidth=1, color=color.orange)

plot(nextBarSAR, style=plot.style_cross, linewidth=3, color=color.aqua)

plot(zlsma, color=color.rgb(235, 15, 33), linewidth=1, title = "ZLSMA")

plot(out4, color=color.rgb(24, 209, 85), title="Ema 1")

plot(out5, color=color.rgb(139, 234, 231), linewidth = 2, title="Ema 2")

plot(out6, color=color.rgb(219, 230, 18), title="Ema 3")

plotcandle(o2, h2, l2, c2, title="SHC1", color=col)

plotcandle(o2Shc2, hShc2, l2Shc2, c2Shc2, title="SHC2", color=col)

// ~~~~~~~~~~~ PLOTS YY ~~~~~~~~~~~ //

shortLine = plot(purchaseZoneHigh, color=color.green)

shortStopLossLine = plot(stopLossHigh, color=color.green) //color=color.rgb(0, 97, 3)

fill(shortLine, shortStopLossLine, color = color.new(color.green, 90))

plot(purchaseZoneBasis, color=color.white)

longLine = plot(purchaseZoneLow, color=color.red)

longStopLossLine = plot(stopLossLow, color=color.red) //color=color.rgb(105, 0, 0)

fill(longLine, longStopLossLine, color=color.new(color.red, 90))