ボリンジャーバンド標準偏差ブレイクアウト戦略

作成日:

2023-11-21 17:14:04

最終変更日:

2023-11-21 17:14:04

コピー:

0

クリック数:

883

1

フォロー

1664

フォロワー

概要

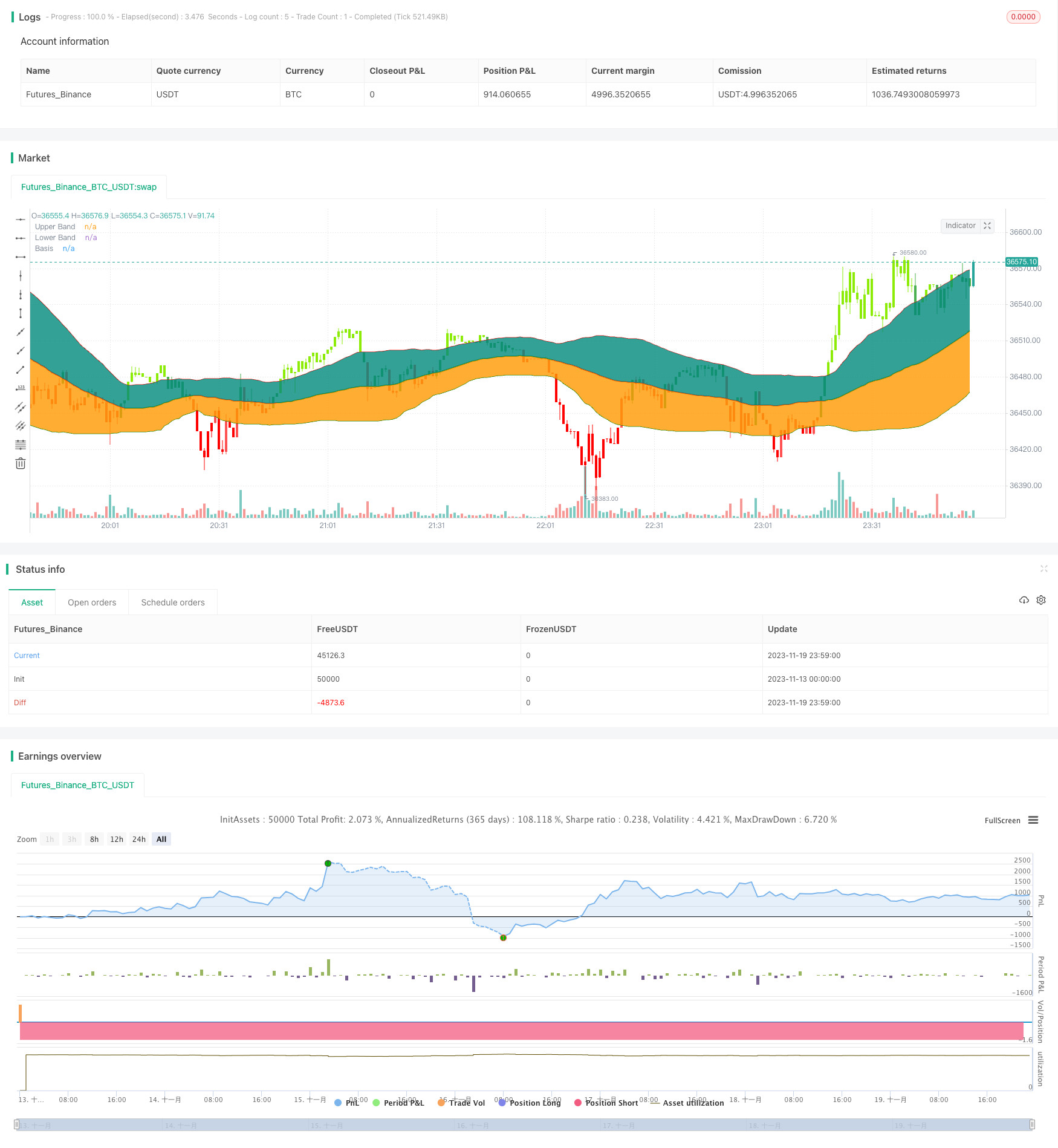

この戦略は,クラシックなボリンジャー波帯指標に基づいており,価格収束が上線を突破するときに多めにし,価格収束が下線を突破するときに空白にし,トレンドを追跡する突破策の1つである.

戦略原則

- 基準線は55日間のSMAである.

- 上線と下線は,それぞれ基準線上の各基準差である.

- 価格の収束が軌道上を突破すると,多信号が発生する.

- 価格収束が下線を突破すると空白信号が生じる.

- 標準差の2倍というより標準差の2倍というリスクが低くなります.

優位分析

- 固定値ではなく標準差値を使用することでリスクが軽減されます.

- 55日移動平均は中期トレンドをよく表しています.

- 売り上げは破綻し,売り上げは破綻した.

- 複数のタイムサイクル分析により,トレンドの方向を容易に決定できます.

リスク分析

- 利子が揺れ動いたり

- 費用の影響を考慮する必要があります.

- 突破信号は偽突破かもしれない.

- 損失の滑り込みがあるかもしれない.

ストップ・ロスを設定し,取引手数料を考慮し,または指標フィルターを追加することでリスクを減らすことができます.

最適化の方向

- ベーキングラインのパラメータを最適化し,最適な平均線を探します.

- 最適化基準の差が大きいので,最適なパラメータを見つけます.

- 添加量価格指標などの補助判断.

- ストップ・ローズメカニズムを追加

要約する

この戦略の全体的な論理は明確で,標準差の帯域幅によってリスクを調整し,閉盘突破は偽突破を避ける.しかしながら,震動損失を防ぐことに注意する必要がある.これは,止損,フィルターを増やすなどによって最適化することができる.

ストラテジーソースコード

/*backtest

start: 2023-11-13 00:00:00

end: 2023-11-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//┌───── •••• ─────┐//

// TradeChartist //

//└───── •••• ─────┘//

//Bollinger Bands is a classic indicator that uses a simple moving average of 20 periods along with upper and lower bands that are 2 standard deviations away from the basis line.

//These bands help visualize price volatility and trend based on where the price is in relation to the bands.

//This Bollinger Bands filter plots a long signal when price closes above the upper band and plots a short signal when price closes below the lower band.

//It doesn't take into account any other parameters such as Volume/RSI/fundamentals etc, so user must use discretion based on confirmations from another indicator or based on fundamentals.

//This filter's default is 55 SMA and 1 standard deviation, but can be changed based on asset type

//It is definitely worth reading the 22 rules of Bollinger Bands written by John Bollinger.

strategy(shorttitle="BB Breakout Strategy", title="Bollinger Bands Filter", overlay=true,

pyramiding=1, currency=currency.NONE ,

initial_capital = 10000, default_qty_type = strategy.percent_of_equity,

default_qty_value=100, calc_on_every_tick= true, process_orders_on_close=false)

src = input(close, title = "Source")

length = input(55, minval=1, title = "SMA length")// 20 for classis Bollinger Bands SMA line (basis)

mult = input(1., minval=0.236, maxval=2, title="Standard Deviation")//2 for Classic Bollinger Bands //Maxval = 2 as higher the deviation, higher the risk

basis = sma(src, length)

dev = mult * stdev(src,length)

CC = input(true, "Color Bars")

upper = basis + dev

lower = basis - dev

//Conditions for Long and Short - Extra filter condition can be used such as RSI or CCI etc.

short = src<lower// and rsi(close,14)<40

long = src>upper// and rsi(close,14)>60

L1 = barssince(long)

S1 = barssince(short)

longSignal = L1<S1 and not (L1<S1)[1]

shortSignal = S1<L1 and not (S1<L1)[1]

//Plots and Fills

////Long/Short shapes with text

// plotshape(S1<L1 and not (S1<L1)[1]?close:na, text = "sᴇʟʟ", textcolor=#ff0100, color=#ff0100, style=shape.triangledown, size=size.small, location=location.abovebar, transp=0, title = "SELL", editable = true)

// plotshape(L1<S1 and not (L1<S1)[1]?close:na, text = "ʙᴜʏ", textcolor = #008000, color=#008000, style=shape.triangleup, size=size.small, location=location.belowbar, transp=0, title = "BUY", editable = true)

// plotshape(shortSignal?close:na, color=#ff0100, style=shape.triangledown, size=size.small, location=location.abovebar, transp=0, title = "Short Signal", editable = true)

// plotshape(longSignal?close:na, color=#008000, style=shape.triangleup, size=size.small, location=location.belowbar, transp=0, title = "Long Signal", editable = true)

p1 = plot(upper, color=#ff0000, display=display.all, transp=75, title = "Upper Band")

p2 = plot(lower, color=#008000, display=display.all, transp=75, title = "Lower Band")

p = plot(basis, color=L1<S1?#008000:S1<L1?#ff0000:na, linewidth=2, editable=false, title="Basis")

fill(p,p1, color=color.teal, transp=85, title = "Top Fill") //fill for basis-upper

fill(p,p2, color=color.orange, transp=85, title = "Bottom Fill")//fill for basis-lower

//Barcolor

bcol = src>upper?color.new(#8ceb07,0):

src<lower?color.new(#ff0000,0):

src>basis?color.green:

src<basis?color.red:na

barcolor(CC?bcol:na, editable=false, title = "Color Bars")

// //Alerts ---- // Use 'Once per bar close'

// alertcondition(condition=longSignal, title="Long - BB Filter", message='BB Filter Long @ {{close}}') // Use 'Once per bar close'

// alertcondition(condition=shortSignal, title="Short - BB Filter", message='BB Filter Short @ {{close}}') // Use 'Once per bar close'

Notestart1 = input(true, "╔═══ Time Range to BackTest ═══╗")

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input(defval=2018, title="From Year", minval=2015)

ToMonth = input(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input(defval=9999, title="To Year", minval=2010)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => // create function "within window of time"

time >= start and time <= finish ? true : false

if(window())

strategy.entry("Long", long=true, when = longSignal)

// strategy.close("Long", when = (short and S3==0), comment = "Close Long")

if(window())

strategy.entry("Short", long=false, when = shortSignal)

// strategy.close("Short", when = (long and L3==0), comment = "Close Short")