ダブルインバージョンモメンタムインデックス戦略

作成日:

2024-02-06 09:29:34

最終変更日:

2024-02-06 09:29:34

コピー:

0

クリック数:

593

1

フォロー

1664

フォロワー

概要

ダブル反転量指数戦略は,123反転戦略と相対運動量指数 (RMI) 戦略を組み合わせた戦略である.これは,二重信号を利用して取引決定の正確性を向上させることを目的としている.

戦略原則

この戦略は2つの部分から構成されています.

123 逆転戦略

- 昨日の閉盘価格が前日より低かったり,今日の閉盘価格が前日より高かったり,9日のSlow K線が50を下回ったとき,多めにします.

- 昨日の閉盘価格が前日より高く,今日の閉盘価格が前日より低く,そして9日のFast K線が50より高く,空白

相対運動量指数 (RMI) 戦略

- RMIは,RSIの基礎に動量因子の変数を加えたものです.その計算式は,RMI = (上動量SMA) / (下動量SMA) * 100です.

- RMIが超買線を下回ると,多額の取引を行い,RMIが超売線を下回ると,空白取引を行います.

この組み合わせ戦略は,123反転とRMI二重信号が同方向に発信された場合にのみ取引シグナルを生成する.これは,誤った取引の機会を効果的に減らすことができる.

戦略的優位分析

この戦略の利点は以下の通りです.

- 信号の正確性を向上させるための二重指標

- 逆転策を活用して 震災に適した戦略を練る

- RMIは強気なトレンドの転換点を認識する敏感な指標です.

戦略的リスク分析

この戦略にはいくつかのリスクがあります.

- 双重フィルタリングは取引の機会を逃す

- 逆回線信号は誤差を招く可能性があります.

- RMI パラメータの設定が不適切である場合

これらのリスクは,パラメータの組み合わせを調整し,指標の計算方法を最適化することで軽減することができます.

戦略最適化の方向性

この戦略は,以下の点で最適化できます.

- 異なるパラメータの組み合わせをテストし,最適なパラメータを見つけます.

- KDJ,MACDなどの反転指標の組み合わせを試す

- RMI公式の修正により,RMIはより敏感になります.

- 単一損失を抑えるための止損メカニズム

- 偽信号を避けるため,取引量に合わせて

要約する

二重反転量指数戦略は,二重信号フィルタリングとパラメータ最適化により,取引決定の正確性を効率的に向上させ,誤信号の確率を低減することができる.それは,振動的な状況に適用され,反転の機会を利用することができる.この戦略は,パラメータを調整し,指標計算方法を最適化することで,効果と laps リスクをさらに強化することができる.

ストラテジーソースコード

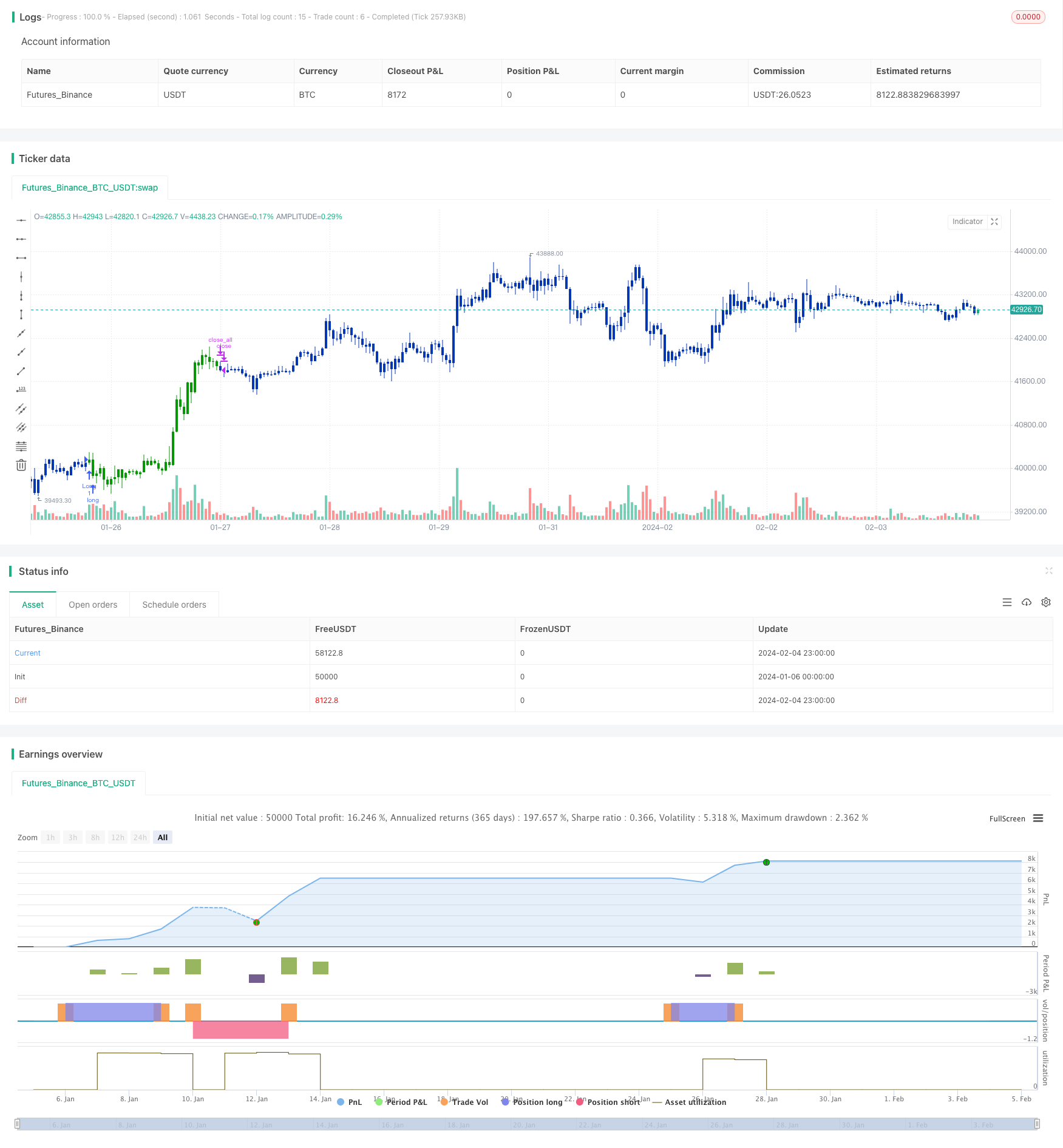

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 07/06/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Relative Momentum Index (RMI) was developed by Roger Altman. Impressed

// with the Relative Strength Index's sensitivity to the number of look-back

// periods, yet frustrated with it's inconsistent oscillation between defined

// overbought and oversold levels, Mr. Altman added a momentum component to the RSI.

// As mentioned, the RMI is a variation of the RSI indicator. Instead of counting

// up and down days from close to close as the RSI does, the RMI counts up and down

// days from the close relative to the close x-days ago where x is not necessarily

// 1 as required by the RSI). So as the name of the indicator reflects, "momentum" is

// substituted for "strength".

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

RMI(Length,BuyZone, SellZone) =>

pos = 0.0

xMU = 0.0

xMD = 0.0

xPrice = close

xMom = xPrice - xPrice[Length]

xMU := iff(xMom >= 0, nz(xMU[1], 1) - (nz(xMU[1],1) / Length) + xMom, nz(xMU[1], 1))

xMD := iff(xMom <= 0, nz(xMD[1], 1) - (nz(xMD[1],1) / Length) + abs(xMom), nz(xMD[1], 0))

RM = xMU / xMD

nRes = 100 * (RM / (1+RM))

pos:= iff(nRes < BuyZone, 1,

iff(nRes > SellZone, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Relative Momentum Index", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Relative Momentum Index ----")

LengthRMI = input(20, minval=1)

BuyZone = input(40, minval=1)

SellZone = input(70, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posRMI = RMI(LengthRMI,BuyZone, SellZone)

pos = iff(posReversal123 == 1 and posRMI == 1 , 1,

iff(posReversal123 == -1 and posRMI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )