Strategi Terobosan Ayunan Purata Pergerakan VWAP Berganda

Gambaran keseluruhan

Strategi penembusan pergerakan rata-rata VWAP berganda menggunakan analisis tren pasaran melalui pergerakan rata-rata VWAP berganda untuk mencari peluang penembusan dalam pasaran yang bergolak. Ia menggabungkan indikator ADX untuk menentukan sama ada pasaran bergolak atau tidak, dan menggunakan dua perbezaan piawaian VWAP yang berbeza untuk mencari masuk tunggal di bawah pintu pecah.

Prinsip Strategi

Strategi ini terdiri daripada beberapa bahagian:

Tetapan VWAP: mengira garis purata VWAP dan bandwidthnya. Bandwidth VWAP dalaman melalui

stDevMultiplierKawalan, lalai 1; bandwidth VWAP luaran melaluistDevMultiplierPengendalian, pengesahan 2.Tetapan ADX: mengira nilai ADX untuk menentukan sama ada pasaran bergoyang. Apabila ADX berada di bawah nilai terendah, ia akan dianggap sebagai pasaran bergoyang. Parameter ADX boleh dikonfigurasi.

Tetapan masuk: Dalam pasaran yang bergolak, masuk apabila harga menembusi bandwidth VWAP luaran. Anda boleh mengkonfigurasi harga hentian dan harga hentian.

Sekatan kemasukan: EMA boleh disaring mengikut garis rata-rata atau tempoh masa, untuk mengelakkan kemasukan pada waktu yang tidak sesuai.

Cara untuk mendapatkan keuntungan: Menjejaki Hentikan atau Hentikan harga yang terputus-putus. Anda boleh memilih untuk menembusi harga keluar VWAP.

Strategi ini menilai pergerakan bergolak dengan indikator ADX, mencari peluang masuk apabila harga menembusi bandwidth VWAP. Dua band VWAP menyediakan penapisan yang lebih banyak untuk memastikan kekuatan masuk.

Analisis kelebihan

Dua pita VWAP menyediakan penapis masuk tambahan untuk memastikan masa masuk yang kuat.

Indeks ADX menilai pasaran yang bergolak dan mengelakkan kesilapan semasa trend berlaku.

Mengesan kerugian untuk mengunci keuntungan dan mengelakkan penjarahan.

Ia mempunyai banyak parameter yang boleh dikonfigurasikan dan sangat mudah disesuaikan.

Idea yang jelas dan mudah difahami, mudah disalin dan diubah suai.

Risiko dan penyelesaian

Tetapan parameter yang tidak betul boleh menyebabkan masuk ke lapangan atau kedudukan yang terlalu ketat. Kombinasi parameter yang dioptimumkan memastikan kestabilan strategi.

Tracking stop loss mudah terlalu radikal atau konservatif. Dalam kombinasi dengan indikator kadar turun naik secara dinamik menyesuaikan kedudukan stop loss.

Prestasi sensitif kepada tempoh dagangan. Ia boleh dioptimumkan melalui penapis masa untuk memastikan kemasukan yang cekap.

Indeks VWAP sensitif terhadap harga yang luar biasa. Dalam kombinasi dengan indikator lain, harga dibenarkan.

Arah pengoptimuman

Secara dinamik menyesuaikan amplitudo hentian. Anda boleh menyesuaikan kedudukan hentian dalam masa nyata berdasarkan indikator seperti kadar turun naik.

Multiple timeframe Memastikan masa kemasukan. Tambah trend dan penunjuk institusi dengan jangka masa yang lebih tinggi untuk mengelakkan kemasukan yang bertentangan.

Pertimbangan pengurusan kedudukan. Persentase kedudukan disesuaikan mengikut kadar turun naik dan pergerakan dana akaun.

Menguji prestasi kitaran VWAP yang berbeza. Tetapan kitaran VWAP menentukan kitaran pegangan strategi yang boleh dioptimumkan.

ringkaskan

Strategi penembusan gemilang VWAP berganda memberikan penyaringan masuk tambahan dengan menggunakan jalur VWAP berganda. Strategi ini jelas dan lebih mudah dilaksanakan. Strategi ini dapat meningkatkan kestabilan strategi dengan cara seperti penyesuaian parameter, pengoptimuman stop loss, dan pengurusan kedudukan.

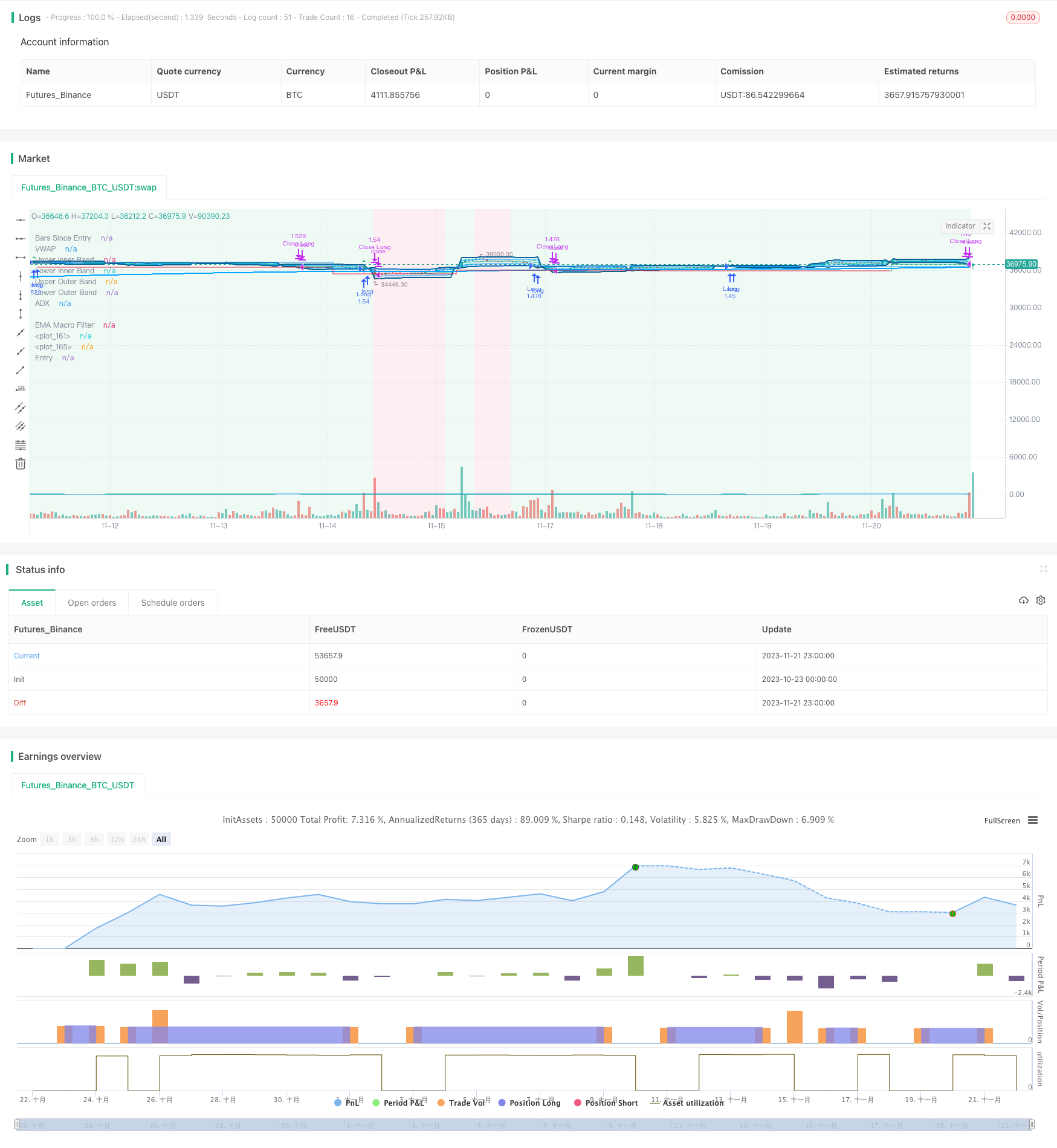

/*backtest

start: 2023-10-23 00:00:00

end: 2023-11-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © jordanfray

//@version=5

strategy(title="Double VWAP Strategy", overlay=true, scale=scale.none, max_bars_back=500, default_qty_type=strategy.percent_of_equity, default_qty_value=100,initial_capital=100000, commission_type=strategy.commission.percent, commission_value=0.05, backtest_fill_limits_assumption=2)

// Indenting Classs

indent_1 = " "

indent_2 = " "

indent_3 = " "

indent_4 = " "

// Group Titles

group_one_title = "VWAP Settings"

group_two_title = "ADX Settings"

group_three_title = "Entry Settings"

group_four_title = "Limit Entries"

// Input Tips

adx_thresholdToolTip = "The minumn ADX value to allow opening a postion"

adxCancelToolTip= "You can optionally set a different lower value for ADX that will allow entries even if below the trigger threshold."

ocean_blue = color.new(#0C6090,0)

sky_blue = color.new(#00A5FF,0)

green = color.new(#2DBD85,0)

red = color.new(#E02A4A,0)

light_blue = color.new(#00A5FF,90)

light_green = color.new(#2DBD85,90)

light_red = color.new(#E02A4A,90)

light_yellow = color.new(#FFF900,90)

white = color.new(#ffffff,0)

transparent = color.new(#000000,100)

// Strategy Settings - VWAP

var cumVol = 0.

cumVol += nz(volume)

if barstate.islast and cumVol == 0

runtime.error("No volume is provided by the data vendor.")

computeVWAP(src, isNewPeriod, stDevMultiplier) =>

var float sum_src_vol = na

var float sum_vol = na

var float sum_src_src_vol = na

sum_src_vol := isNewPeriod ? src * volume : src * volume + sum_src_vol[1]

sum_vol := isNewPeriod ? volume : volume + sum_vol[1]

sum_src_src_vol := isNewPeriod ? volume * math.pow(src, 2) : volume * math.pow(src, 2) + sum_src_src_vol[1]

_vwap = sum_src_vol / sum_vol

variance = sum_src_src_vol / sum_vol - math.pow(_vwap, 2)

variance := variance < 0 ? 0 : variance

standard_deviation = math.sqrt(variance)

lower_band_value = _vwap - standard_deviation * stDevMultiplier

upper_band_value = _vwap + standard_deviation * stDevMultiplier

[_vwap, lower_band_value, upper_band_value]

var anchor = input.string(defval="Session", title="Anchor Period", options=["Session", "Week", "Month", "Quarter", "Year"], group=group_one_title)

src = input(defval = close, title = "Inner VWAP Source", group=group_one_title)

multiplier_inner = input(defval=1.0, title="Inner Bands Multiplier", group=group_one_title)

multiplier_outer = input(defval=2.0, title="Outer Bands Multiplier", group=group_one_title)

show_bands = true

timeChange(period) =>

ta.change(time(period))

isNewPeriod = switch anchor

"Session" => timeChange("D")

"Week" => timeChange("W")

"Month" => timeChange("M")

"Quarter" => timeChange("3M")

"Year" => timeChange("12M")

=> false

float vwap_val = na

float upper_inner_band_value = na

float lower_inner_band_value = na

float upper_outer_band_value = na

float lower_outer_band_value = na

[inner_vwap, inner_bottom, inner_top] = computeVWAP(src, isNewPeriod, multiplier_inner)

[outer_vwap, outer_bottom, outer_top] = computeVWAP(src, isNewPeriod, multiplier_outer)

vwap_val := inner_vwap

upper_inner_band_value := show_bands ? inner_top : na

lower_inner_band_value := show_bands ? inner_bottom : na

upper_outer_band_value := show_bands ? outer_top : na

lower_outer_band_value := show_bands ? outer_bottom : na

plot(vwap_val, title="VWAP", color=green)

upper_inner_band = plot(upper_inner_band_value, title="Upper Inner Band", color=sky_blue)

lower_inner_band = plot(lower_inner_band_value, title="Lower Inner Band", color=sky_blue)

upper_outer_band = plot(upper_outer_band_value, title="Upper Outer Band", linewidth=2, color=ocean_blue)

lower_outer_band = plot(lower_outer_band_value, title="Lower Outer Band", linewidth=2, color=ocean_blue)

fill(upper_outer_band, lower_outer_band, title="VWAP Bands Fill", color= show_bands ? light_blue : na)

// ADX Settings

adx_len = input.int(defval=14, title="ADX Smoothing", group=group_two_title)

di_len = input.int(defval=14, title="DI Length", group=group_two_title)

adx_threshold = input.int(defval=40, title="ADX Threshold", group=group_two_title, tooltip=adx_thresholdToolTip)

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plus_dm = na(up) ? na : (up > down and up > 0 ? up : 0)

minus_dm = na(down) ? na : (down > up and down > 0 ? down : 0)

true_range = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plus_dm, len) / true_range)

minus = fixnan(100 * ta.rma(minus_dm, len) / true_range)

[plus, minus]

adx(di_len, adx_len) =>

[plus, minus] = dirmov(di_len)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adx_len)

adx_val = adx(di_len, adx_len)

plot(adx_val, title="ADX")

// Entry Settings

stop_loss_val = input.float(defval=2.0, title="Stop Loss (%)", step=0.1, group=group_three_title)/100

take_profit_val = input.float(defval=6.0, title="Take Profit (%)", step=0.1, group=group_three_title)/100

long_entry_limit_lookback = input.int(defval=1, title="Long Entry Limit Lookback", minval=1, step=1, group=group_three_title)

short_entry_limit_lookback = input.int(defval=1, title="Short Entry Limit Lookback", minval=1, step=1, group=group_three_title)

limit_order_long_price = ta.lowest(close, long_entry_limit_lookback)

limit_order_short_price = ta.highest(close, short_entry_limit_lookback)

start_trailing_after = input.float(defval=3, title="Start Trailing After (%)", step=0.1, group=group_three_title)/100

trail_behind = input.float(defval=2, title="Trail Behind (%)", step=0.1, group=group_three_title)/100

close_early_if_crosses_outter_band = input.bool(defval=false, title="Close early if price crosses outer VWAP band")

// Limit Entries

enableEmaFilter = input.bool(defval=true, title="Use EMA Filter", group=group_four_title)

emaFilterTimeframe = input.timeframe(defval="", title=indent_4+"Timeframe", group=group_four_title)

emaFilterLength = input.int(defval=300, minval=1, step=10, title=indent_4+"Length", group=group_four_title)

emaFilterSource = input.source(defval=hl2, title=indent_4+"Source", group=group_four_title)

ema_filter = ta.ema(emaFilterSource, emaFilterLength)

ema_filter_smoothed = request.security(syminfo.tickerid, emaFilterTimeframe, ema_filter[barstate.isrealtime ? 1 : 0], gaps=barmerge.gaps_on)

plot(enableEmaFilter ? ema_filter_smoothed: na, title="EMA Macro Filter", linewidth=2, color=sky_blue, editable=true)

useTimeFilter = input.bool(defval=false, title="Use Time Session Filter", group=group_four_title)

withinTime = true

long_start_trailing_val = strategy.position_avg_price + (strategy.position_avg_price * start_trailing_after)

short_start_trailing_val = strategy.position_avg_price - (strategy.position_avg_price * start_trailing_after)

long_trail_behind_val = close - (strategy.position_avg_price * (trail_behind/100))

short_trail_behind_val = close + (strategy.position_avg_price * (trail_behind/100))

currently_in_a_long_postion = strategy.position_size > 0

currently_in_a_short_postion = strategy.position_size < 0

long_profit_target = strategy.position_avg_price * (1 + take_profit_val)

long_stop_loss = strategy.position_avg_price * (1.0 - stop_loss_val)

short_profit_target = strategy.position_avg_price * (1 - take_profit_val)

short_stop_loss = strategy.position_avg_price * (1 + stop_loss_val)

bars_since_entry = currently_in_a_long_postion or currently_in_a_short_postion ? bar_index - strategy.opentrades.entry_bar_index(strategy.opentrades - 1) + 1 : 5

plot(bars_since_entry, editable=false, title="Bars Since Entry", color=green)

long_run_up = ta.highest(high, bars_since_entry)

long_trailing_stop = currently_in_a_long_postion and bars_since_entry > 0 and long_run_up > long_start_trailing_val ? long_run_up - (long_run_up * trail_behind) : long_stop_loss

//long_run_up_line = plot(long_run_up, style=plot.style_stepline, editable=false, color=currently_in_a_long_postion ? green : transparent)

long_trailing_stop_line = plot(long_trailing_stop, style=plot.style_stepline, editable=false, color=currently_in_a_long_postion ? long_trailing_stop > strategy.position_avg_price ? green : red : transparent)

short_run_up = ta.lowest(low, bars_since_entry)

short_trailing_stop = currently_in_a_short_postion and bars_since_entry > 0 and short_run_up < short_start_trailing_val ? short_run_up + (short_run_up * trail_behind) : short_stop_loss

//short_run_up_line = plot(short_run_up, style=plot.style_stepline, editable=false, color=currently_in_a_short_postion ? green : transparent)

short_trailing_stop_line = plot(short_trailing_stop, style=plot.style_stepline, editable=false, color=currently_in_a_short_postion ? short_trailing_stop < strategy.position_avg_price ? green : red : transparent)

// Conditions

adx_is_below_threshold = adx_val < adx_threshold

price_crossed_down_VWAP_lower_outer_band = ta.crossunder(low, lower_outer_band_value)

price_closed_above_VWAP_lower_outer_band = close > lower_outer_band_value

price_crossed_up_VWAP_upper_outer_band = ta.crossover(high,upper_outer_band_value)

price_closed_below_VWAP_upper_outer_band = close < upper_outer_band_value

price_above_ema_filter = close > ema_filter_smoothed

price_below_ema_filter = close < ema_filter_smoothed

//Trade Restirctions

no_trades_allowed = not withinTime or not adx_is_below_threshold

// Enter trades when...

long_conditions_met = enableEmaFilter ? price_above_ema_filter and not currently_in_a_long_postion and withinTime and adx_is_below_threshold and price_crossed_down_VWAP_lower_outer_band and price_closed_above_VWAP_lower_outer_band : not currently_in_a_long_postion and withinTime and adx_is_below_threshold and price_crossed_down_VWAP_lower_outer_band and price_closed_above_VWAP_lower_outer_band

short_conditions_met = enableEmaFilter ? price_below_ema_filter and not currently_in_a_short_postion and withinTime and adx_is_below_threshold and price_crossed_up_VWAP_upper_outer_band and price_closed_below_VWAP_upper_outer_band : not currently_in_a_short_postion and withinTime and adx_is_below_threshold and price_crossed_up_VWAP_upper_outer_band and price_closed_below_VWAP_upper_outer_band

plotshape(long_conditions_met ? close : na, title="Long Entry Symbol", color=green, style=shape.triangleup, location=location.abovebar)

plotshape(short_conditions_met ? close : na, title="Short Entry Symbol", color=red, style=shape.triangledown, location=location.belowbar)

// Take Profit When...

price_closed_below_short_trailing_stop = ta.cross(close, short_trailing_stop)

price_hit_short_entry_profit_target = low > short_profit_target

price_closed_above_long_entry_trailing_stop = ta.cross(close, long_trailing_stop)

price_hit_long_entry_profit_target = high > long_profit_target

long_position_take_profit = close_early_if_crosses_outter_band ? price_crossed_up_VWAP_upper_outer_band or price_closed_above_long_entry_trailing_stop or price_hit_long_entry_profit_target : price_closed_above_long_entry_trailing_stop or price_hit_long_entry_profit_target

short_position_take_profit = close_early_if_crosses_outter_band ? price_crossed_down_VWAP_lower_outer_band or price_closed_below_short_trailing_stop or price_hit_short_entry_profit_target : price_closed_below_short_trailing_stop or price_hit_short_entry_profit_target

// Cancel limir order if...

cancel_long_condition = false

cancel_short_condition = false

// Long Entry

strategy.entry(id="Long", direction=strategy.long, limit=limit_order_long_price, when=long_conditions_met)

strategy.cancel(id="Cancel Long", when=cancel_long_condition)

strategy.exit(id="Close Long", from_entry="Long", stop=long_trailing_stop, limit=long_profit_target, when=long_position_take_profit)

// Short Entry

strategy.entry(id="Short", direction=strategy.short, limit=limit_order_short_price, when=short_conditions_met)

strategy.cancel(id="Cancel Short", when=cancel_short_condition)

strategy.exit(id="Close Short", from_entry="Short", stop=short_trailing_stop, limit=short_profit_target, when=short_position_take_profit)

entry = plot(strategy.position_avg_price, editable=false, title="Entry", style=plot.style_stepline, color=currently_in_a_long_postion or currently_in_a_short_postion ? color.blue : transparent, linewidth=1)

fill(entry,long_trailing_stop_line, editable=false, color=currently_in_a_long_postion ? long_trailing_stop > strategy.position_avg_price ? light_green : light_red : transparent)

fill(entry,short_trailing_stop_line, editable=false, color=currently_in_a_short_postion ? short_trailing_stop < strategy.position_avg_price ? light_green : light_red : transparent)

bgcolor(title="No Trades Allowed", color=no_trades_allowed ? light_red : light_green)