Stratégie de suivi des tendances révolutionnaires avec combinaison d'indicateurs

Aperçu

Cette stratégie est connue sous le nom de stratégie de suivi de la tendance de rupture de la combinaison d’indicateurs de la couronne. Cette stratégie utilise de multiples indicateurs pour identifier la direction de la tendance du marché et effectuer des opérations de suivi de la tendance.

- Utilisation de l’indicateur de tendance des vagues pour déterminer les principales tendances du marché

- Le RSI combiné à l’indicateur des flux de trésorerie filtre certains faux signaux

- Les indicateurs de l’EMA permettent de déterminer la direction à prendre

- L’entrée est suivie par une méthode de suivi innovante pour s’assurer qu’elle suit la tendance.

Principe de stratégie

La stratégie consiste à déterminer la direction et la force des grandes tendances et à mettre en place des transactions bidirectionnelles à plusieurs niveaux. Les principes de fonctionnement sont les suivants:

Les signaux d’entrée multiples:

- Le prix est supérieur à l’EMA de 200 jours, ce qui indique qu’il se trouve sur un marché à capitaux multiples.

- Les prix reviennent à un support autour de l’EMA du 50e jour

- L’indicateur de la vague s’est retourné à la hausse et un signal d’achat est apparu.

- Le RSI et les IFM sont tous deux surbouchés.

- Les trois lignes K consécutives ont dépassé l’EMA de 50 jours, indiquant une hausse

Signal d’entrée à vide: Contrairement aux signaux d’entrée multiples

Comment arrêter la perte de vitesse: Deux options sont proposées: prix minimum/prix maximum de stop-loss et prix ATR de stop-loss

Analyse des forces stratégiques

Cette stratégie présente les avantages suivants:

- L’analyse des tendances sur plusieurs indicateurs permet d’éviter les fausses percées

- L’EMA est un outil de suivi des tendances

- La méthode de suivi des pertes pour réaliser des profits durables

- Il est possible d’effectuer plusieurs prises de position simultanément, en suivant la direction du marché

Analyse stratégique des risques

Cette stratégie comporte aussi des risques:

- Probabilité que l’indicateur émet un mauvais signal

- Le point de rupture est trop petit, ce qui augmente le risque de rupture

- Les frais de transaction sont une perte cachée

Pour atténuer ces risques, il est possible d’optimiser les choses de la manière suivante:

- Ajustez les paramètres de l’indicateur et filtrez les signaux d’erreur

- Laissez les points de rupture appropriés.

- Optimiser les paramètres de l’indicateur et réduire le nombre de transactions

Orientation de l’optimisation de la stratégie

Au niveau du code, les principales directions d’optimisation de cette stratégie sont les suivantes:

- Ajustez les paramètres des indicateurs de la vague, du RSI et des MFI pour sélectionner la meilleure combinaison de paramètres

- Tester l’efficacité des performances de différents paramètres de cycle EMA

- Ajustez le facteur de risque pour les gains et les pertes de l’arrêt-arrêt afin d’obtenir une configuration optimale

L’ajustement et le test des paramètres permettent de réduire les retraits et les risques tout en maximisant les gains.

Résumer

Cette stratégie utilise une combinaison d’indicateurs pour déterminer la direction de la tendance générale, utilise l’indicateur EMA comme signal d’opération spécifique et utilise le suivi des arrêts de perte pour localiser les bénéfices. Grâce à l’optimisation des paramètres, il est possible d’obtenir de meilleurs rendements stables. Cependant, il convient également de tenir compte de certains risques systémiques et de rester constamment attentif à l’effet des indicateurs et aux changements de l’environnement du marché.

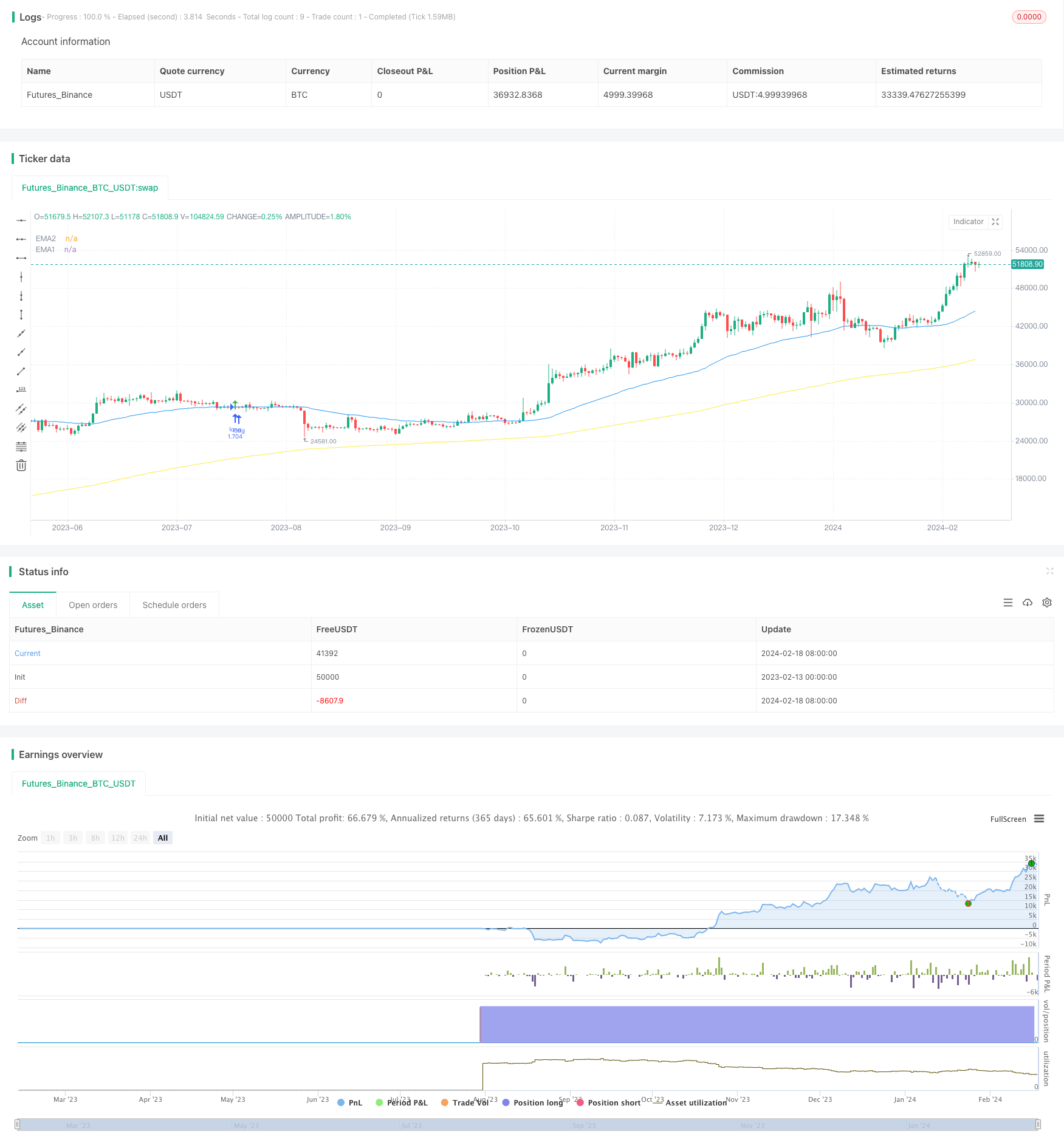

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Lowest Low/ Highest High & ATR Stop Loss/ Take Profit

//Optimized for the 30 minutes chart

strategy(title="TradePro's Trading Idea Cipher B+ Divergence EMA Pullback Strategy", shorttitle="WT MFI RSI EMA PB STRAT", overlay = true, pyramiding = 0, max_bars_back=5000, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=5000, currency=currency.USD)

// { Time Range

FromMonth=input(defval=1,title="FromMonth",minval=1,maxval=12)

FromDay=input(defval=1,title="FromDay",minval=1,maxval=31)

FromYear=input(defval=2020,title="FromYear",minval=2016)

ToMonth=input(defval=1,title="ToMonth",minval=1,maxval=12)

ToDay=input(defval=1,title="ToDay",minval=1,maxval=31)

ToYear=input(defval=9999,title="ToYear",minval=2017)

start=timestamp(FromYear,FromMonth,FromDay,00,00)

finish=timestamp(ToYear,ToMonth,ToDay,23,59)

window()=>true

// See if this bar's time happened on/after start date

afterStartDate = time >= start and time<=finish?true:false

zeroline = 0

// } Time Range

// { Wavetrend, RSI, MFI

// WaveTrend

cl = input(12, "Channel Length")

al = input(12, "Average Length")

overbought = input(53, title = 'WT Overbought Level 1', type = input.integer)

oversold = input(-53, title = 'WT Oversold Level 1', type = input.integer)

ap = hlc3

esa = ema(ap, cl)

d = ema(abs(ap - esa), cl)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, al)

wt1 = tci

wt2 = sma(wt1,4)

wtOs = wt2 <= oversold

wtOb = wt2 >= overbought

wtX = cross(wt1, wt2)

wtUp = wt2 - wt1 <= 0

wtDown = wt2 - wt1 >= 0

buySignal = wtX and wtOs and wtUp

sellSignal = wtX and wtOb and wtDown

// RSI & MFI

rsiMFIPosY = input(2, title = 'MFI Area Y Pos', type = input.float)

rsiMFIperiod = input(80,title = 'MFI Period', type = input.integer)

rsiMFIMultiplier = input(200, title = 'MFI Area multiplier', type = input.float)

f_rsimfi(_period, _multiplier, _tf) => security(syminfo.tickerid, _tf, sma(((close - open) / (high - low)) * _multiplier, _period) - rsiMFIPosY)

rsiMFI = f_rsimfi(rsiMFIperiod, rsiMFIMultiplier, timeframe.period)

// } Wavetrend, RSI, MFI

// { EMA

emasrc = close

res = input(title="EMA Timeframe", type=input.resolution, defval="30")

len1 = input(title="EMA1 Length", type=input.integer, defval=200)

col1 = color.yellow

len2 = input(title="EMA2 Length", type=input.integer, defval=50)

col2 = color.blue

// Calculate EMA

ema1 = ema(emasrc, len1)

emaSmooth1 = security(syminfo.tickerid, res, ema1, barmerge.gaps_off, barmerge.lookahead_off)

ema2 = ema(emasrc, len2)

emaSmooth2 = security(syminfo.tickerid, res, ema2, barmerge.gaps_off, barmerge.lookahead_off)

// Draw EMA

plot(emaSmooth1, title="EMA1", linewidth=1, color=col1)

plot(emaSmooth2, title="EMA2", linewidth=1, color=col2)

// } EMA

// { Long Entry

enablelong = input(true, title="Enable long?")

//Long Signal

upcondition = close > emaSmooth1

wavetrendlong = wt1 and wt2 < zeroline

mfilong = rsiMFI > 0

emapblong1 = (close > emaSmooth2) and (close[1] < emaSmooth2[1])

emapblong2 = ((close[2] > emaSmooth2[2]) and (close[3] > emaSmooth2[3]) and (close[4] > emaSmooth2[4])) or ((close[5] > emaSmooth2[5]) and (close[6] > emaSmooth2[6]) and (close[7] > emaSmooth2[7])) or ((close[8] > emaSmooth2[8]) and (close[9] > emaSmooth2[9]) and (close[10] > emaSmooth2[10]))

longcondition = upcondition and wavetrendlong and buySignal and mfilong and emapblong1 and emapblong2

//strategy buy long

if (longcondition) and (afterStartDate) and strategy.opentrades < 1 and (enablelong == true)

strategy.entry("long", strategy.long)

plotshape(longcondition, style=shape.arrowup,

location=location.abovebar, color=color.green)

// } Long Entry

// { Short Entry

enableshort = input(true, title="Enable short?")

//Short Signal

downcondition = close < emaSmooth1

wavetrendshort = wt1 and wt2 > zeroline

mfishort = rsiMFI < 0

emapbshort1 = (close < emaSmooth2) and (close[1] > emaSmooth2[1])

emapbshort2 = ((close[2] < emaSmooth2[2]) and (close[3] < emaSmooth2[3]) and (close[4] < emaSmooth2[4])) or ((close[5] < emaSmooth2[5]) and (close[6] < emaSmooth2[6]) and (close[7] < emaSmooth2[7])) or ((close[8] < emaSmooth2[8]) and (close[9] < emaSmooth2[9]) and (close[10] < emaSmooth2[10]))

shortcondition = downcondition and wavetrendshort and sellSignal and mfishort and emapbshort1 and emapbshort2

//strategy buy short

if (shortcondition) and (afterStartDate) and strategy.opentrades < 1 and (enableshort == true)

strategy.entry("short", strategy.short)

plotshape(shortcondition, style=shape.arrowdown,

location=location.belowbar, color=color.red)

// } Short Entry

// { Exit Conditions

bought = strategy.position_size[1] < strategy.position_size

sold = strategy.position_size[1] > strategy.position_size

barsbought = barssince(bought)

barssold = barssince(sold)

slbuffer = input(title="SL Buffer", type=input.float, step=0.1, defval=0)

// } Exit Conditions

// { Lowest Low/ Highes High Exit Condition

enablelowhigh = input(false, title="Enable lowest low/ highest high exit?")

//Lowest Low LONG

profitfactorlong = input(title="ProfitfactorLong", type=input.float, step=0.1, defval=2)

loLen = input(title="Lowest Low Lookback", type=input.integer,

defval=50, minval=2)

stop_level_long = lowest(low, loLen)[1]

if enablelowhigh == true and strategy.position_size>0

profit_level_long = strategy.position_avg_price + ((strategy.position_avg_price - stop_level_long[barsbought])*profitfactorlong) + slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_long[barsbought] - slbuffer, limit=profit_level_long)

//Lowest Low SHORT

profitfactorshort = input(title="ProfitfactorShort", type=input.float, step=0.1, defval=2)

highLen = input(title="highest high lookback", type=input.integer,

defval=50, minval=2)

stop_level_short = highest(high, highLen)[1]

if enablelowhigh == true and strategy.position_size<0

profit_level_short = strategy.position_avg_price - ((stop_level_short[barssold] - strategy.position_avg_price)*profitfactorshort) - slbuffer

strategy.exit(id="TP/ SL", stop=stop_level_short[barssold] + slbuffer, limit=profit_level_short)

// } Lowest Low/ Highes High Exit Condition

// { ATR Take Profit/ Stop Loss

enableatr = input(true, title="Enable ATR exit?")

atrprofitfactorlong = input(title="ATR Profitfactor Long", type=input.float, step=0.1, defval=6)

atrstopfactorlong = input(title="ATR Stopfactor Long", type=input.float, step=0.1, defval=5)

atrprofitfactorshort = input(title="ATR Profitfactor Short", type=input.float, step=0.1, defval=3)

atrstopfactorshort = input(title="ATR Stopfactor Short", type=input.float, step=0.1, defval=5)

//ATR

lengthATR = input(title="ATR Length", defval=11, minval=1)

atr = atr(lengthATR)

//LONG EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barsbought1 = barssince(bought)

profit_level = strategy.position_avg_price + (atr*atrprofitfactorlong)

stop_level = strategy.position_avg_price - (atr*atrstopfactorlong)

strategy.exit("Take Profit/ Stop Loss", "long", stop=stop_level[barsbought1], limit=profit_level[barsbought1])

//SHORT EXIT

if (afterStartDate) and ((enableatr == true) and (strategy.opentrades > 0))

barssold1 = barssince(sold)

profit_level = strategy.position_avg_price - (atr*atrprofitfactorshort)

stop_level = strategy.position_avg_price + (atr*atrstopfactorshort)

strategy.exit("Take Profit/ Stop Loss", "short", stop=stop_level[barssold1], limit=profit_level[barssold1])

// } ATR Take Profit/ Stop Loss