EMAベースの取引戦略

作成日:

2023-11-24 15:46:48

最終変更日:

2023-11-24 15:46:48

コピー:

2

クリック数:

1388

1

フォロー

1664

フォロワー

概要

この戦略は4つの異なる周期のEMA平均線を使用し,その配列順序に応じて取引信号を形成し,交通灯のような赤黄緑の3色指示灯,そのため交通灯取引戦略と名付けられた.それは,トレンドと逆転の両方の角度から市場を総合的に判断し,取引決定の正確性を向上させることを目的としている.

戦略原則

フィルターとして,快線 ((8周期),中線 ((14周期),慢線 ((16周期) の3つのEMA平均線を設定し,さらに1つの長い周期 ((100周期) のEMA平均線を追加します.

快中慢3平均線の並列順序とフィルターとの交差を判断し,多量と空間のタイミングを決定する:

速線で中線を穿越したり中線で遅線を穿越したりすると,多信号と判断する.

中線下を通過すると平多信号と判断

速線下を通る中線や中線下を通る遅線は空白信号と判断する

中線で快線を突破すると,平空信号と判断する.

- 快中慢3均線の順序でトレンドの方向と強さを判断し,均線とフィルターの交差判断の反転点を組み合わせ,トレンド追跡と反転キャプチャの有機的な組み合わせを実現する.

優位分析

この戦略は,トレンド追跡と反転取引の利点を統合し,市場機会をうまく把握します. 主な利点は以下の通りです.

- 複数のEMA平均線を使用し,判断力向上,偽信号の減少

- 取引機会を逃さないために,空白条件を多めに設定する.

- 立体を使って長短周期平均線,判断力全面

- カスタマイズ可能なストップ・ストップ・損失条件,リスク制御が設定される

参数最適化により,この戦略はより多くの品種に適応し,テストでより高い収益性と安定性を示した.

リスク分析

この戦略の主なリスクは,

- 複数のEMAの平均線順序が混乱すると判断が難しくなり,取引が遅れる.

- 市場における異常波動を効果的にフィルターできない偽信号で,大波で損失を招く場合

- パラメータを不適切なタイミングで設定し,ストップ・ロスの条件が過度に緩やかまたは厳格になり,損益または過度の損失を招く

戦略の安定性をさらに高め,パラメータの最適化,ストップ・ローンの設定,慎重な操作などの方法でリスクを制御することをお勧めします.

最適化の方向

この戦略の主な最適化方向は

- EMA平均線の周期パラメータを調整して,より多くの品種に対応

- MACD,ブリン帯などの他の指標のフィルターを追加して判断の正確性を向上させる

- リスクとリターンのバランスを最適化するストップ・ストラスト比率

- ATR ストップのような自律的なストップメカニズムを追加し,下行リスクをさらに制御します.

多面的なパラメータ調整とリスク管理手段の導入により,戦略の安定性と収益性を継続的に向上させることができます.

要約する

この交通灯取引戦略は,トレンド追跡と反転判断を統合し,4組のEMAを使用し,取引信号を均線に形成し,パラメータを最適化してより多くの品種に適応し,反測で強い収益性を示す.さらなるリスク管理と多元化指標の導入により,安定した効率的な定量取引戦略になる見込みである.

ストラテジーソースコード

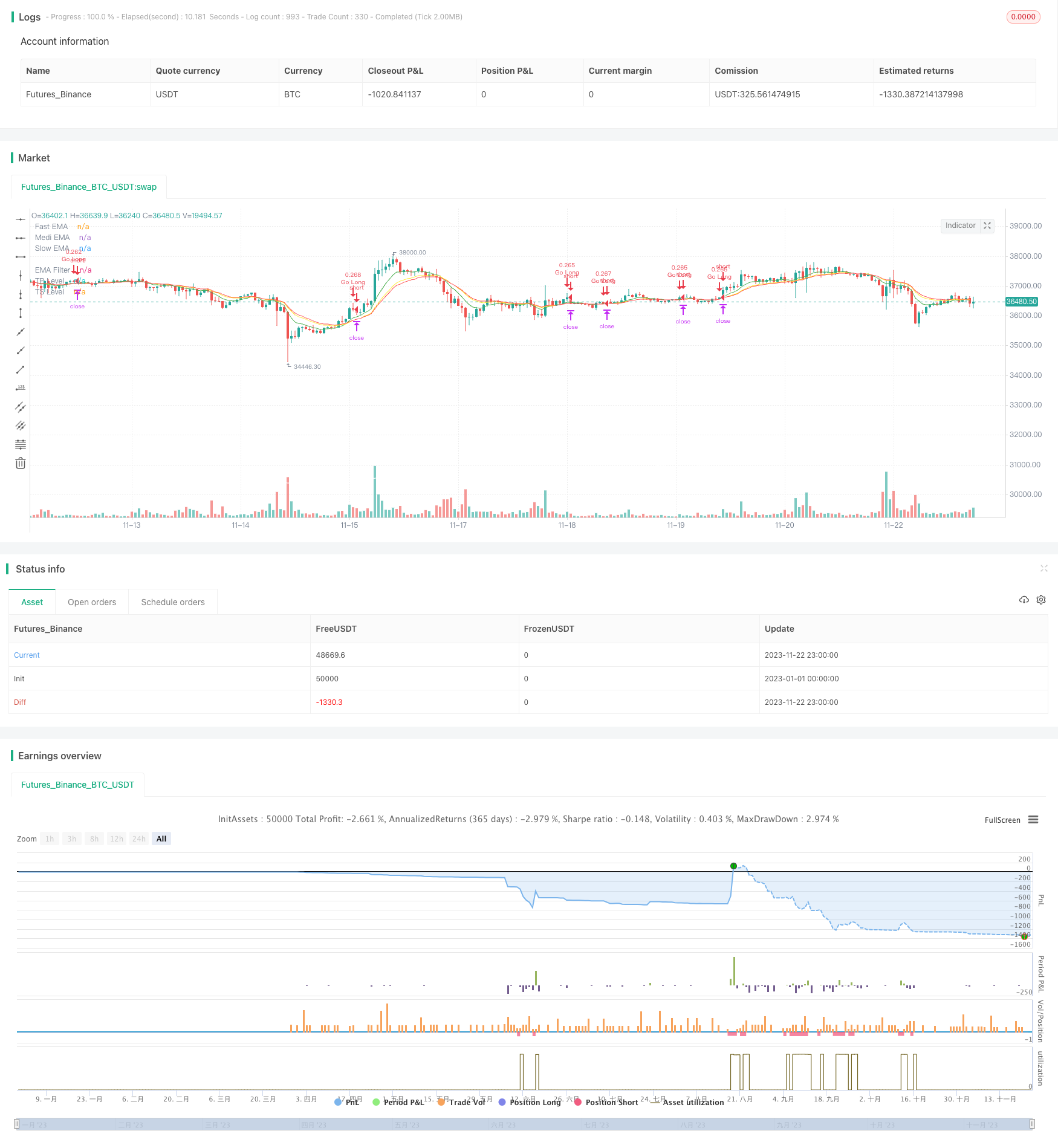

/*backtest

start: 2023-01-01 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maxits

// 4HS Crypto Market Strategy

// This strategy uses 4 ema to get Long or Short Signals

// Length are: 8, 14, 16, 100

// We take long positions when the order of the emas is the following:

// green > yellow > red (As the color of Traffic Lights) and they are above white ema (Used as a filter for long positions)

// We take short positions when the order of the emas is the following:

// green < yellow < red (As the color of inverse Traffic Lights) and they are below white ema (Used as a filter for short positions)

//@version=4

strategy(title="Trafic Lights Strategy",

shorttitle="TLS",

overlay=true,

initial_capital=1000,

default_qty_value=20,

default_qty_type=strategy.percent_of_equity,

commission_value=0.1,

pyramiding=0

)

// User Inputs

// i_time = input(defval = timestamp("28 May 2017 13:30 +0000"), title = "Start Time", type = input.time) //Starting time for Backtesting

sep1 = input(title="============ System Conditions ============", type=input.bool, defval=false)

enable_Long = input(true, title="Enable Long Positions") // Enable long Positions

enable_Short = input(true, title="Enable Short Positions") // Enable short Positions

sep2 = input(title="============ Indicator Parameters ============", type=input.bool, defval=false)

f_length = input(title="Fast EMA Length", type=input.integer, defval=8, minval=1)

m_length = input(title="Medium EMA Length", type=input.integer, defval=14, minval=1)

s_length = input(title="Slow EMA Length", type=input.integer, defval=16, minval=1)

filter_L = input(title="EMA Filter", type=input.integer, defval=100, minval=1)

filterRes = input(title="Filter Resolution", type=input.resolution, defval="D") // ema Filter Time Frame

sep3 = input(title="============LONG Profit-Loss Parameters============", type=input.bool, defval=false)

e_Long_TP = input(true, title="Enable a Profit Level?")

e_Long_SL = input(false, title="Enable a S.Loss Level?")

e_Long_TS = input(true, title="Enable a Trailing Stop?")

long_TP_Input = input(40.0, title='Take Profit %', type=input.float, minval=0)/100

long_SL_Input = input(1.0, title='Stop Loss %', type=input.float, minval=0)/100

atrLongMultip = input(2.0, title='ATR Multiplier', type=input.float, minval=0.1) // Parameters to calculate Trailing Stop Loss

atrLongLength = input(14, title='ATR Length', type=input.integer, minval=1)

sep4 = input(title="============SHORT Profit-Loss Parameters============", type=input.bool, defval=false)

e_Short_TP = input(true, title="Enable a Profit Level?")

e_Short_SL = input(false, title="Enable a S.Loss Level?")

e_Short_TS = input(true, title="Enable a Trailing Stop?")

short_TP_Input = input(30.0, title='Take Profit %', type=input.float, minval=0)/100

short_SL_Input = input(1.0, title='Stop Loss %', type=input.float, minval=0)/100

atrShortMultip = input(2.0, title='ATR Multiplier', type=input.float, minval=0.1)

atrShortLength = input(14, title='ATR Length', type=input.integer, minval=1)

// Indicators

fema = ema(close, f_length)

mema = ema(close, m_length)

sema = ema(close, s_length)

filter = security(syminfo.tickerid, filterRes, ema(close, filter_L))

plot(fema, title="Fast EMA", color=color.new(color.green, 0))

plot(mema, title="Medi EMA", color=color.new(color.yellow, 0))

plot(sema, title="Slow EMA", color=color.new(color.red, 0))

plot(filter, title="EMA Filter", color=color.new(color.white, 0))

// Entry Conditions

longTrade = strategy.position_size > 0

shortTrade = strategy.position_size < 0

notInTrade = strategy.position_size == 0

inTrade = strategy.position_size != 0

priceEntry = strategy.position_avg_price

goLong = fema > mema and mema > sema and fema > filter and enable_Long and (crossover (fema, mema) or crossover (mema, sema) or crossover (sema, filter))

goShort = fema < mema and mema < sema and fema < filter and enable_Short and (crossunder (fema, mema) or crossunder (mema, sema) or crossunder (sema, filter))

close_L = crossunder(fema, mema)

close_S = crossover (fema, mema)

// Profit and Loss conditions

// Long

long_TP = priceEntry * (1 + long_TP_Input) // Long Position Take Profit Calculation

long_SL = priceEntry * (1 - long_SL_Input) // Long Position Stop Loss Calculation

atrLong = atr(atrLongLength) // Long Position ATR Calculation

long_TS = low - atrLong * atrLongMultip

long_T_stop = 0.0 // Code for calculating Long Positions Trailing Stop Loss/

long_T_stop := if (longTrade)

longStop = long_TS

max(long_T_stop[1], longStop)

else

0

//Short

short_TP = priceEntry * (1 - short_TP_Input) // Long Position Take Profit Calculation

short_SL = priceEntry * (1 + short_SL_Input) // Short Position Stop Loss Calculation

atrShort = atr(atrShortLength) // Short Position ATR Calculation

short_TS = high + atrShort * atrShortMultip

short_T_stop = 0.0 // Code for calculating Short Positions Trailing Stop Loss/

short_T_stop := if shortTrade

shortStop = short_TS

min(short_T_stop[1], shortStop)

else

9999999

// Strategy Long Entry

if goLong and notInTrade

strategy.entry("Go Long", long=strategy.long, comment="Go Long", alert_message="Open Long Position")

if longTrade and close_L

strategy.close("Go Long", when=close_L, comment="Close Long", alert_message="Close Long Position")

if e_Long_TP // Algorithm for Enabled Long Position Profit Loss Parameters

if (e_Long_TS and not e_Long_SL)

strategy.exit("Long TP & TS", "Go Long", limit = long_TP, stop = long_T_stop)

else

if (e_Long_SL and not e_Long_TS)

strategy.exit("Long TP & TS", "Go Long",limit = long_TP, stop = long_SL)

else

strategy.exit("Long TP & TS", "Go Long",limit = long_TP)

else

if not e_Long_TP

if (e_Long_TS and not e_Long_SL)

strategy.exit("Long TP & TS", "Go Long", stop = long_T_stop)

else

if (e_Long_SL and not e_Long_TS)

strategy.exit("Long TP & TS", "Go Long",stop = long_SL)

// Strategy Short Entry

if goShort and notInTrade

strategy.entry("Go Short", long=strategy.short, comment="Go Short", alert_message="Open Short Position")

if shortTrade and close_S

strategy.close("Go Short", comment="Close Short", alert_message="Close Short Position")

if e_Short_TP // Algorithm for Enabled Short Position Profit Loss Parameters

if (e_Short_TS and not e_Short_SL)

strategy.exit("Short TP & TS", "Go Short", limit = short_TP, stop = short_T_stop)

else

if (e_Short_SL and not e_Short_TS)

strategy.exit("Short TP & SL", "Go Short",limit = short_TP, stop = short_SL)

else

strategy.exit("Short TP & TS", "Go Short",limit = short_TP)

else

if not e_Short_TP

if (e_Short_TS and not e_Short_SL)

strategy.exit("Short TS", "Go Short", stop = short_T_stop)

else

if (e_Short_SL and not e_Short_TS)

strategy.exit("Short SL", "Go Short",stop = short_SL)

// Long Position Profit and Loss Plotting

plot(longTrade and e_Long_TP and long_TP ? long_TP : na, title="TP Level", color=color.green, style=plot.style_linebr, linewidth=2)

plot(longTrade and e_Long_SL and long_SL and not e_Long_TS ? long_SL : na, title="SL Level", color=color.red, style=plot.style_linebr, linewidth=2)

plot(longTrade and e_Long_TS and long_T_stop and not e_Long_SL ? long_T_stop : na, title="TS Level", color=color.red, style=plot.style_linebr, linewidth=2)

// Short Position Profit and Loss Plotting

plot(shortTrade and e_Short_TP and short_TP ? short_TP : na, title="TP Level", color=color.green, style=plot.style_linebr, linewidth=2)

plot(shortTrade and e_Short_SL and short_SL and not e_Short_TS ? short_SL : na, title="SL Level", color=color.red, style=plot.style_linebr, linewidth=2)

plot(shortTrade and e_Short_TS and short_T_stop and not e_Short_SL ? short_T_stop : na, title="TS Level", color=color.red, style=plot.style_linebr, linewidth=2)