ダウ理論に基づくRSI/MFIモメンタム指標戦略

作成日:

2023-12-12 17:54:58

最終変更日:

2023-12-12 17:54:58

コピー:

0

クリック数:

792

1

フォロー

1628

フォロワー

概要

この戦略は,相対的に強弱な指標 ((RSI) または資金流動指標 ((MFI) を用いて,市場をブルまたはベアと判断し,ダウ氏理論のブル・ベア係数と組み合わせて,調整された確率分布を計算する.異なる市場タイプに応じて,異なる入場と出場ロジックを使用する.

戦略原則

- RSIまたはMFIを計算して,市場が現在どのような状態にあるかを判断します.

- ダウシュ理論の牛熊係数を計算し,現在の価格と取引量との関連性を反映する

- RSI/MFIの確率分布を調整し,正確な多空分布を決定する

- 現在セッションIDと確率に基づいて入学かどうかを判断する

- 利益の撤回や市場の整合時にストップ・損失

優位分析

- 市場を正確に判断する道氏理論

- 盲目入学を避けるために 整合要素を考慮する

- 利回り高 撤回低

リスク分析

- パラメータが正しくない場合,誤判が多発する.

- 十分な歴史データが必要です

- ストップダストロジックは単純で,特殊な状況に最適化できません.

最適化の方向

- 市場セッションの判断は,他の指標と組み合わせて考えられます.

- 波動率,歴史データなどのより厳格なストップ・ロジックを追加

- 機械学習などで より良いパラメータを特定できます

要約する

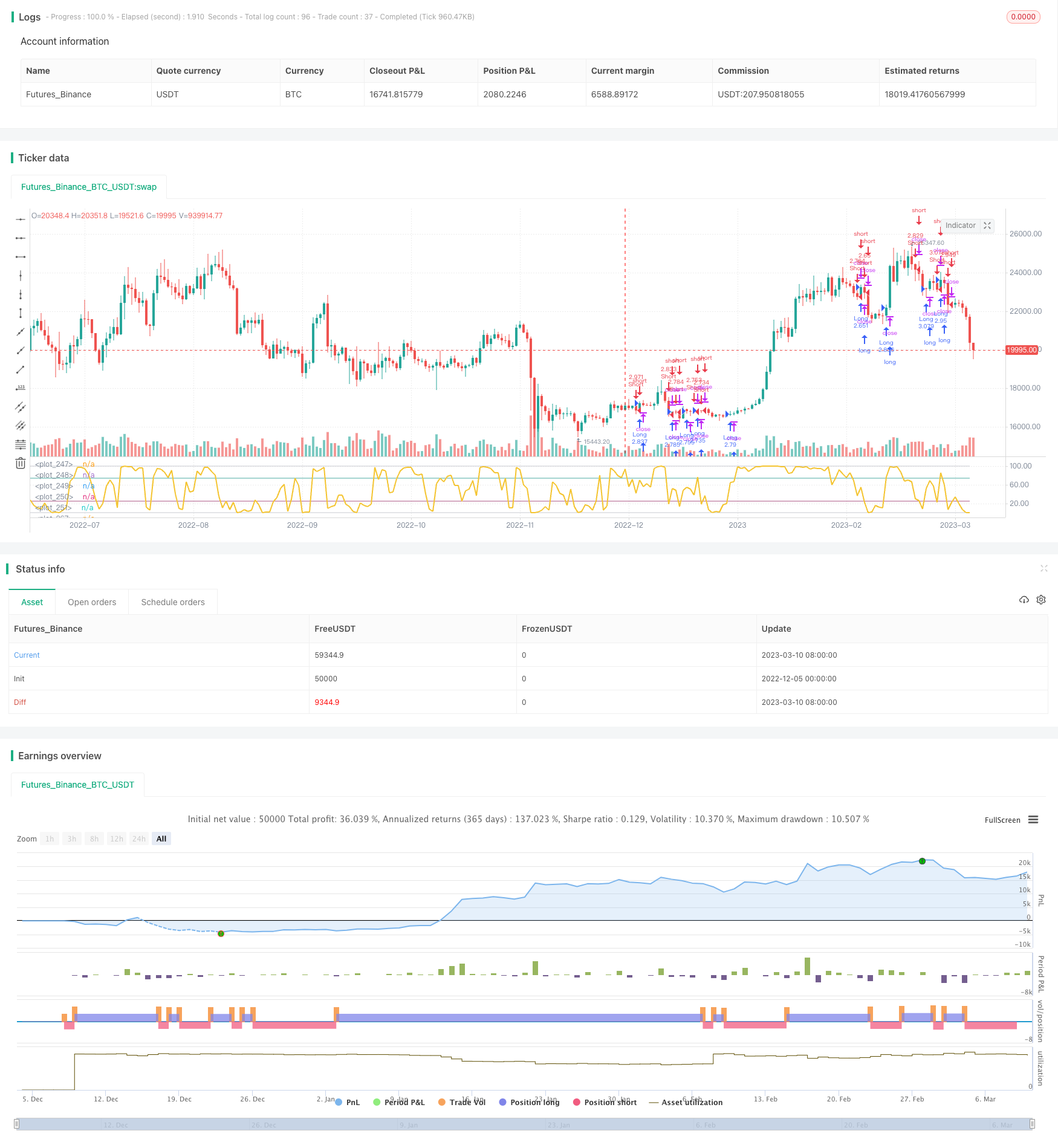

この戦略は,全体的に反測結果が良好で,一定の実戦価値がある。しかし,さらにテストと調整が必要であり,特に止損論理が必要である。補助的な判断指標として使用すると効果がより良く,盲目追従はできない。

ストラテジーソースコード

/*backtest

start: 2022-12-05 00:00:00

end: 2023-03-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//MIT License

//Copyright (c) 2019 user-Noldo

//Permission is hereby granted, free of charge, to any person obtaining a copy

//of this software and associated documentation files (the "Software"), to deal

//in the Software without restriction, including without limitation the rights

//to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

//copies of the Software, and to permit persons to whom the Software is

//furnished to do so, subject to the following conditions:

//The above copyright notice and this permission notice shall be included in all

//copies or substantial portions of the Software.

//THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR

//IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

//FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE

//AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

//LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

//OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE

//SOFTWARE.

strategy("Dow Factor RSI/MFI and Dependent Variable Odd Generator Strategy",shorttitle = "Dow_Factor RSI/MFI & DVOG Strategy", overlay = false, default_qty_type=strategy.percent_of_equity,commission_type=strategy.commission.percent, commission_value=0.125, default_qty_value=100 )

src = close

lights = input(title="Barcolor I / 0 ? ", options=["ON", "OFF"], defval="OFF")

method = input(title="METHOD", options=["MFI", "RSI"], defval="RSI")

length = input(5, minval=2,maxval = 14, title = "Strategy Period")

// Essential Functions

// Function Sum

f_sum(_src , _length) =>

_output = 0.00

_length_adjusted = _length < 1 ? 1 : _length

for i = 0 to _length_adjusted-1

_output := _output + _src[i]

f_sma(_src, _length)=>

_length_adjusted = _length < 1 ? 1 : _length

float _sum = 0

for _i = 0 to (_length_adjusted - 1)

_sum := _sum + _src[_i]

_return = _sum / _length_adjusted

// Unlocked Exponential Moving Average Function

f_ema(_src, _length)=>

_length_adjusted = _length < 1 ? 1 : _length

_multiplier = 2 / (_length_adjusted + 1)

_return = 0.00

_return := na(_return[1]) ? _src : ((_src - _return[1]) * _multiplier) + _return[1]

// Function Standard Deviation

f_stdev(_src,_length) =>

float _output = na

_length_adjusted = _length < 2 ? 2 : _length

_avg = f_ema(_src , _length_adjusted)

evar = (_src - _avg) * (_src - _avg)

evar2 = ((f_sum(evar,_length_adjusted))/_length_adjusted)

_output := sqrt(evar2)

// Linear Regression Channels :

f_pearson_corr(_src1, _src2, _length) =>

_length_adjusted = _length < 2 ? 2 : _length

_ema1 = f_ema(_src1, _length_adjusted)

_ema2 = f_ema(_src2, _length_adjusted)

isum = 0.0

for i = 0 to _length_adjusted - 1

isum := isum + (_src1[i] - _ema1) * (_src2[i] - _ema2)

isumsq1 = 0.0

for i = 0 to _length_adjusted - 1

isumsq1 := isumsq1 + pow(_src1[i] - _ema1, 2)

isumsq2 = 0.0

for i = 0 to _length_adjusted - 1

isumsq2 := isumsq2 + pow(_src2[i] - _ema2, 2)

pcc = isum/(sqrt(isumsq1*isumsq2))

pcc

// Dow Theory Cycles

dow_coeff = f_pearson_corr(src,volume,length)

dow_bull_factor = (1 + dow_coeff)

dow_bear_factor = (1 - dow_coeff)

// MONEY FLOW INDEX =====> FOR BULL OR BEAR MARKET (CLOSE)

upper_s = f_sum(volume * (change(src) <= 0 ? 0 : src), length)

lower_s = f_sum(volume * (change(src) >= 0 ? 0 : src), length)

_market_index = rsi(upper_s, lower_s)

// RSI (Close)

// Function RMA

f_rma(_src, _length) =>

_length_adjusted = _length < 1 ? 1 : _length

alpha = _length_adjusted

sum = 0.0

sum := (_src + (alpha - 1) * nz(sum[1])) / alpha

// Function Relative Strength Index (RSI)

f_rsi(_src, _length) =>

_output = 0.00

_length_adjusted = _length < 0 ? 0 : _length

u = _length_adjusted < 1 ? max(_src - _src[_length_adjusted], 0) : max(_src - _src[1] , 0) // upward change

d = _length_adjusted < 1 ? max(_src[_length_adjusted] - _src, 0) : max(_src[1] - _src , 0) // downward change

rs = f_rma(u, _length) / f_rma(d, _length)

res = 100 - 100 / (1 + rs)

res

_rsi = f_rsi(src, length)

// Switchable Method Codes

_method = 0.00

if (method=="MFI")

_method:= _market_index

if (method=="RSI")

_method:= _rsi

// Conditions

_bull_gross = (_method )

_bear_gross = (100 - _method )

_price_stagnant = ((_bull_gross * _bear_gross ) / 100)

_price_bull = (_bull_gross - _price_stagnant)

_price_bear = (_bear_gross - _price_stagnant)

_coeff_price = (_price_stagnant + _price_bull + _price_bear) / 100

_bull = _price_bull / _coeff_price

_bear = _price_bear / _coeff_price

_stagnant = _price_stagnant / _coeff_price

// Market Types with Dow Factor

_temp_bull_gross = _bull * dow_bull_factor

_temp_bear_gross = _bear * dow_bear_factor

// Addition : Odds with Stagnant Market

_coeff_normal = (_temp_bull_gross + _temp_bear_gross) / 100

// ********* OUR RSI / MFI VALUE ***********

_value = _temp_bull_gross / _coeff_normal

// Temporary Pure Odds

_temp_stagnant = ((_temp_bull_gross * _temp_bear_gross) / 100)

_temp_bull = _temp_bull_gross - _temp_stagnant

_temp_bear = _temp_bear_gross - _temp_stagnant

// Now we ll do venn scheme (Probability Cluster)

// Pure Bull + Pure Bear + Pure Stagnant = 100

// Markets will get their share in the Probability Cluster

_coeff = (_temp_stagnant + _temp_bull + _temp_bear) / 100

_odd_bull = _temp_bull / _coeff

_odd_bear = _temp_bear / _coeff

_odd_stagnant = _temp_stagnant / _coeff

_positive_condition = crossover (_value,50)

_negative_condition = crossunder(_value,50)

_stationary_condition = ((_odd_stagnant > _odd_bull ) and (_odd_stagnant > _odd_bear))

// Strategy

closePosition = _stationary_condition

if (_positive_condition)

strategy.entry("Long", strategy.long, comment="Long")

strategy.close(id = "Long", when = closePosition )

if (_negative_condition)

strategy.entry("Short", strategy.short, comment="Short")

strategy.close(id = "Short", when = closePosition )

// Plot Data

// Plotage

oversold = input(25 , type = input.integer , title = "Oversold")

overbought = input(75 , type = input.integer , title = "Overbought")

zero = 0

hundred = 100

limit = 50

// Plot Data

stagline = hline(limit , color=color.new(color.white,0) , linewidth=1, editable=false)

zeroline = hline(zero , color=color.new(color.silver,100), linewidth=0, editable=false)

hundredline = hline(hundred , color=color.new(color.silver,100), linewidth=0, editable=false)

oversoldline = hline(oversold , color=color.new(color.silver,100), linewidth=0, editable=false)

overboughtline = hline(overbought , color=color.new(color.silver,100), linewidth=0, editable=false)

// Filling Borders

fill(zeroline , oversoldline , color=color.maroon , transp=88 , title = "Oversold Area")

fill(oversoldline , stagline , color=color.red , transp=80 , title = "Bear Market")

fill(stagline , overboughtline , color=color.green , transp=80 , title = "Bull Market")

fill(overboughtline , hundredline , color=color.teal , transp=88 , title = "Overbought Market")

// Plot DOW Factor Methods

plot(_value, color = #F4C430 , linewidth = 2 , title = "DOW F-RSI" , transp = 0)

// Plot border lines

plot(oversold ,style = plot.style_line,color = color.new(color.maroon,30),linewidth = 1)

plot(overbought,style = plot.style_line,color = color.new(color.teal,30) ,linewidth = 1)

plot(zero ,style = plot.style_line , color = color.new(color.silver,30) , linewidth = 1 ,editable = false)

plot(hundred ,style = plot.style_line , color = color.new(color.silver,30) , linewidth = 1 ,editable = false)

// Switchable Barcolor ( On / Off)

_lights = 0.00

if (lights=="ON")

_lights:= 1.00

if (lights=="OFF")

_lights:= -1.00

bcolor_on = _lights == 1.00

bcolor_off = _lights == -1.00

barcolor((_positive_condition and bcolor_on) ? color.green : (_negative_condition and bcolor_on) ? color.red :

(_stationary_condition and bcolor_on) ? color.yellow : na)

// Alerts

alertcondition(_positive_condition , title='Strong Buy !', message='Strong Buy Signal ')

alertcondition(crossover(_value,overbought) , title='Gradual Buy', message='Gradual Buy Signal')

alertcondition(crossover(_value,oversold) , title='Gradual Buy', message='Gradual Buy Signal')

alertcondition(crossunder(_value,overbought) , title='Gradual Sell', message='Gradual Sell Signal')

alertcondition(crossunder(_value,oversold) , title='Gradual Sell', message='Gradual Sell Signal')

alertcondition(_negative_condition , title='Strong Sell !', message='Strong Sell Signal ')