概述

阳光超级趋势策略是一种基于ATR和SuperTrend指标的趋势跟踪策略。它可以准确预测趋势反转,非常适合作为时序指标使用。该策略可以增强投资者的耐心和定力,帮助它们在合适的时机进入和退出市场。

策略原理

该策略使用SuperTrend指标判断当前趋势方向。当SuperTrend指标发生方向变化时,我们认为可能发生了趋势反转。此外,策略还使用K线实体的方向进行辅助判断。当潜在反转信号出现而K线实体的方向与此前一致时,过滤掉无效信号。

具体来说,策略根据以下逻辑生成交易信号: 1. 使用SuperTrend指标判断主要趋势方向 2. 当SuperTrend指标方向发生变化时,产生潜在反转信号 3. 如果此时K线实体方向与之前一致,过滤掉该反转信号 4. 如果K线实体方向发生变化,确认反转信号,产生交易信号

优势分析

- 基于SuperTrend指标,能够准确判断趋势反转点

- 结合K线实体方向过滤无效信号,提高信号质量

- 适合作为时序指标,指导投资者选择合理入场和退出时间

- 可广泛应用于任何时间周期和不同品种,适应性强

风险及解决方法

- SuperTrend指标容易产生多余信号,需辅助过滤

解决方法:本策略采用K线实体方向进行辅助判断,有效过滤无效信号 - SuperTrend参数设置易过优化或过度优化

解决方法:采用默认参数,避免人为调参过度优化 - 无法处理超快行情的反转

解决方法:适当调整ATR周期参数,应对更快速行情

优化方向

- 尝试不同的ATR周期参数组合

- 增加Volume或波动率指标进行辅助过滤信号

- 结合其它指标系统进行组合,提高策略性能

- 开发止损机制,控制单笔损失

总结

阳光超级趋势策略是一种基于SuperTrend指标判断趋势反转的高效策略。它结合K线实体方向进行辅助判断,能有效过滤无效信号,提高信号质量。该策略操作简单,适应性强,可广泛应用于多个品种和时间周期。通过合理参数优化和止损机制增加,可以进一步提升策略表现。

策略源码

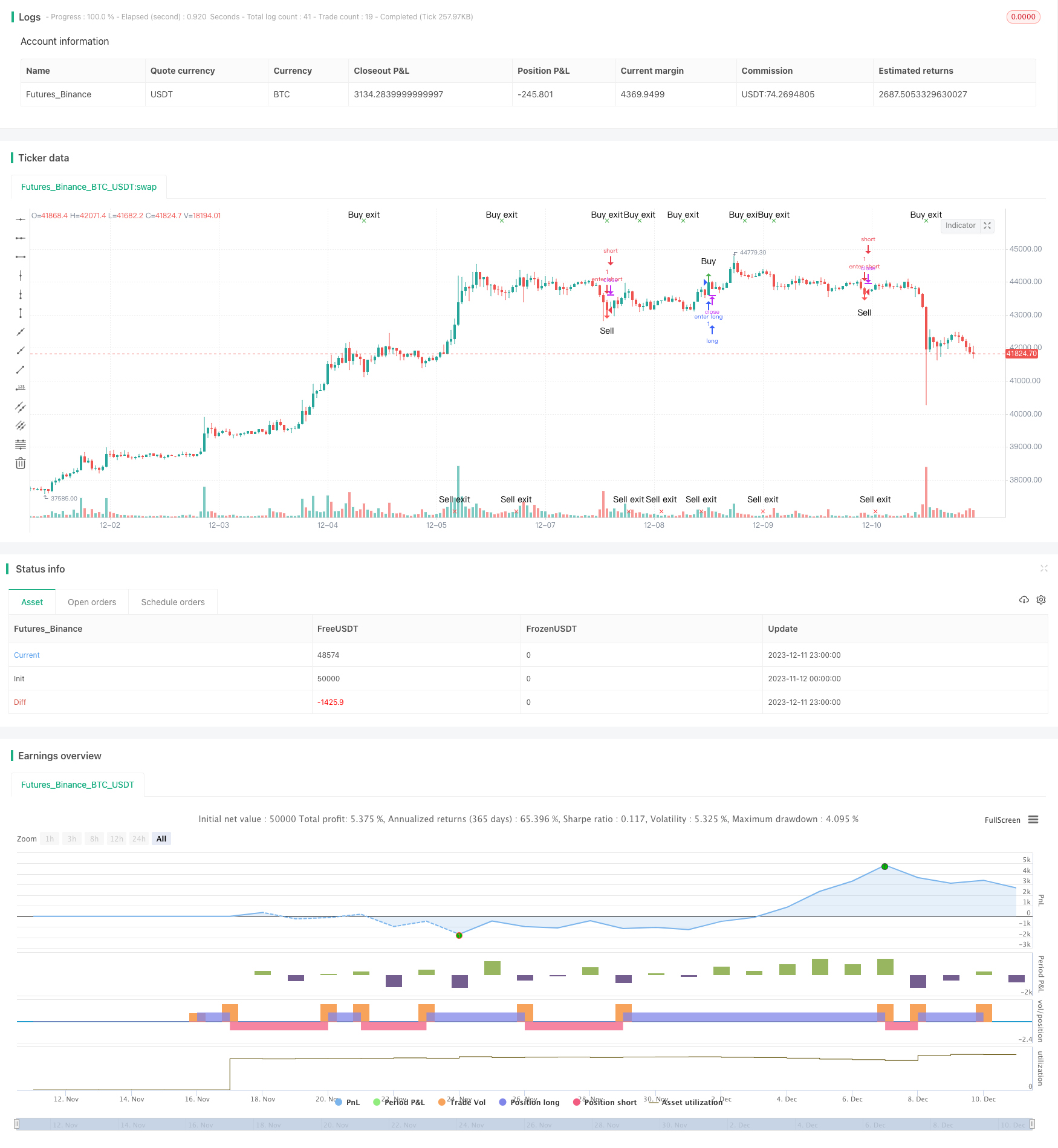

/*backtest

start: 2023-11-12 00:00:00

end: 2023-12-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Sunny Supertrend Strategy", overlay=true, default_qty_type=strategy.percent_of_equity)

atrPeriod = input(10, "ATR Length")

factor = input.float(3.0, "Factor", step = 0.01)

[_, direction] = ta.supertrend(factor, atrPeriod)

shor= close > open and close[1] > open[1] and close[2] > open[2]

lon = open > close and open[1] > close[1] and open[2] > close[2]

tt= ta.change(direction) < 0

ss= ta.change(direction) > 0

long= tt

longexit = lon or ss

short= ss

shortexit = shor or tt

longPosMem = false

longexitPosMem = false

shortPosMem = false

shortexitPosMem = false

longPosMem := long ? true : short ? false : longPosMem[1]

longexitPosMem := longexit ? true : shortexit ? false : longexitPosMem[1]

shortPosMem := short ? true : long ? false : shortPosMem[1]

shortexitPosMem := shortexit ? true : longexit ? false : shortexitPosMem[1]

longy = long and not(longPosMem[1])

longexity = longexit and not(longexitPosMem[1])

shorty = short and not(shortPosMem[1])

shortexity = shortexit and not(shortexitPosMem[1])

//Use this to customize the look of the arrows to suit your needs.

plotshape(longy, location=location.abovebar, color=color.green, style=shape.arrowup, text="Buy")

plotshape(longexity, location=location.top, color=color.green, style=shape.xcross, text="Buy exit")

plotshape(shorty, location=location.belowbar, color=color.red, style=shape.arrowdown, text="Sell")

plotshape(shortexity, location=location.bottom, color=color.red, style=shape.xcross, text="Sell exit")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

// STEP 1:

// Make input options that configure backtest date range

startDate = input.int(title="Start Date", defval=1, minval=1, maxval=31)

startMonth = input.int(title="Start Month",

defval=1, minval=1, maxval=12)

startYear = input.int(title="Start Year",

defval=2021, minval=1800, maxval=2100)

endDate = input.int(title="End Date",

defval=1, minval=1, maxval=31)

endMonth = input.int(title="End Month",

defval=2, minval=1, maxval=12)

endYear = input.int(title="End Year",

defval=2021, minval=1800, maxval=2100)

// STEP 2:

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

// STEP 3:

// Submit entry orders, but only when bar is inside date range

if (inDateRange and longy)

strategy.entry("enter long",strategy.long,when= longy)

strategy.close("long",when=longexity)

if (inDateRange and shorty)

strategy.entry("enter short",strategy.short,when = shorty)

strategy.close("short", when=shortexity)