概述

该策略基于RafaelZioni的SuperB指标,通过动量指标识别趋势,实现对上升趋势和下降趋势的自动跟踪,属于趋势追踪型策略。

策略原理

该策略使用RafaelZioni的SuperB指标识别价格趋势。SuperB指标基于价格波动范围、成交量和开盘价与收盘价之间的价差计算得到的SpreadVol指标。SpreadVol指标反映价格的动量特征。该策略使用SpreadVol指标的移动平均线和标准差确定阈值,当SpreadVol高于上轨时为上升趋势,低于下轨时为下降趋势。

该策略通过追踪最高价最低价实时判断趋势转折。在上升趋势中,最高价一直创新高,判断为持续上升;当价格跌破最高价一定比例时,转为下降趋势。在下降趋势中,判断方法类似。这样可以对趋势转折点进行及时判断。

优势

该策略结合动量指标判断趋势方向,再通过最高价最低价实时跟踪,可以快速识别新的趋势方向,实现对上升和下降趋势的自动跟踪,避免漏买点和超买点的风险。

RafaelZioni的SuperB指标反映价格变动的力度和速度,可以准确判断真正的趋势,有效过滤假突破。判断规则简单清晰,容易理解和验证。

只做多头仓位,降低操作频繁带来的交易成本和滑点损失。

风险

该策略对突破前的盘整区域容易产生多次误交易。可以通过优化参数,降低对盘整区域的敏感度。

在趋势震荡时,止损线容易被触发。可以适当放宽止损范围,以便持仓时间更长。

多空转换时,需要及时切换仓位。如果切换不够及时,可能带来较大亏损。

优化建议

优化SuperB指标的参数,寻找更好的参数组合,提高指标的稳定性。

优化最高价最低价跟踪的比例因子,降低对盘整区域的反应灵敏度。

增加持仓时间标准,避免趋势震荡期间被止损。

总结

该策略利用RafaelZioni的SuperB指标判断价格趋势方向,并通过追踪最高价和最低价实时判断趋势转折,实现对上升和下降趋势的自动跟踪,避免漏买超买的风险,属于趋势追踪型的动量策略。该策略结合动量指标判断真趋势,判断规则简单清晰,可根据优化建议进一步改进和优化,值得研究和应用。

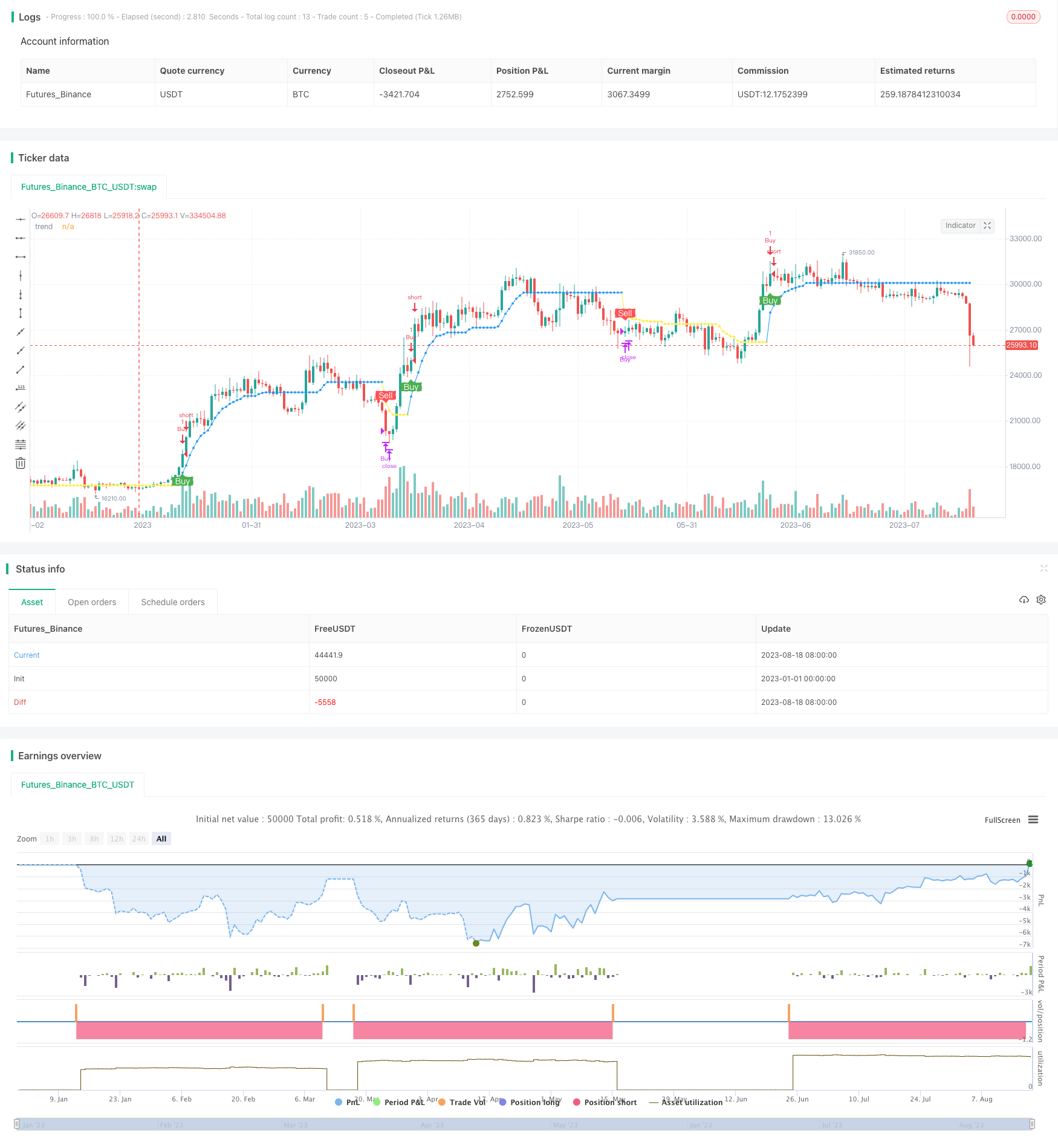

/*backtest

start: 2023-01-01 00:00:00

end: 2023-08-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(shorttitle='SuperB', title='SuperB By RafaelZioni', overlay=true)

long_only = input(title="Only Long?", defval=true)

hilow = ((high - low)*100)

openclose = ((close - open)*100)

vol = (volume / hilow)

spreadvol = (openclose * vol)

VPT = spreadvol + cum(spreadvol)

window_len = 28

v_len = 14

price_spread = stdev(high-low, window_len)

vp = spreadvol + cum(spreadvol)

smooth = sma(vp, v_len)

v_spread = stdev(vp - smooth, window_len)

shadow = (vp - smooth) / v_spread * price_spread

out = shadow > 0 ? high + shadow : low + shadow

//

len = input(10)

vpt=ema(out,len)

// INPUTS //

st_mult = input(1, title = ' Multiplier', minval = 0, maxval = 100, step = 0.01)

st_period = input(10, title = ' Period', minval = 1)

// CALCULATIONS //

up= vpt - (st_mult * atr(st_period))

dn = vpt + (st_mult * atr(st_period))

c5=close

//

factor = input(title="Factor", defval=0.05, minval=0.01, maxval=5, step=0.01, type=input.float)

hb = 0.00 ,hb := nz(hb[1])

hl = 0.000, hl := nz(hl[1])

lb = 0.00 ,lb := nz(lb[1])

l1 = 0.000,l1 := nz(l1[1])

c = 0

c := nz(c[1]) + 1

trend = 0,trend := nz(trend[1]),n = dn,x =up

if barstate.isfirst

c := 0

lb := n

hb := x

l1 := c5

hl := c5

hl

if c == 1

if x >= hb[1]

hb := x

hl := c5

trend := 1

trend

else

lb := n

l1 := c5

trend := -1

trend

if c > 1

if trend[1] > 0

hl := max(hl[1], c5)

if x >= hb[1]

hb := x

hb

else

if n < hb[1] - hb[1] * factor

lb := n

l1 := c5

trend := -1

trend

else

l1 := min(l1[1], c5 )

if n <= lb[1]

lb := n

lb

else

if x > lb[1] + lb[1] * factor

hb := x

hl := c5

trend := 1

trend

v = trend == 1 ? hb : trend == -1 ? lb : na

plot(v, color=trend == 1 ? color.blue : color.yellow, style=plot.style_circles, linewidth=1, title="trend", transp=0, join=true)

//

long = trend == 1 and trend[1] == -1

short = trend == -1 and trend[1] == 1

//

last_long = 0.0

last_short = 0.0

last_long := long ? time : nz(last_long[1])

last_short := short ? time : nz(last_short[1])

buy = crossover(last_long, last_short)

sell = crossover(last_short, last_long)

/////////////// Positions //////////////

if long

strategy.entry("Buy", long=true)

if long_only == false

strategy.close("Sell")

if short

if long_only == false

strategy.entry("Sell", long=false)

strategy.close("Buy")

/////////////// Plotting ///////////////

plotshape(buy, title="buy", text="Buy", color=color.green, style=shape.labelup, location=location.belowbar, size=size.small, textcolor=color.white, transp=0) //plot for buy icon

plotshape(sell, title="sell", text="Sell", color=color.red, style=shape.labeldown, location=location.abovebar, size=size.small, textcolor=color.white, transp=0)

/////////////// Alerts ///////////////

alertcondition(buy, title='buy', message='Buy')

alertcondition(sell, title='sell', message='Sell')