マルチ期間MACDインジケーター取引戦略

作成日:

2024-01-30 17:44:36

最終変更日:

2024-01-30 17:44:36

コピー:

3

クリック数:

659

1

フォロー

1664

フォロワー

概要

この戦略は,クラシックMACD指標をベースに,傾向判断指標,ストップ・ロース,ストップ・ストップなどの複数の補助判断を組み合わせて,比較的完全なトレンドフォロー取引戦略を形成している.これは仮想通貨だけでなく,外貨と株式取引にも適用できる.

戦略原則

MACDの判断

- FASTLENGTH期EMAとSLOWLENGTH期EMAの差値がMACD柱を形成する

- MACDLENGTH期EMA平らなMACD柱がMACD線を形成する

- MACD柱は0軸を突破し,買付シグナルを形成

傾向を判断する

- ADX:平均トレンド指数で,トレンドがあるかどうかを判断する

- MA: 移動平均で,価格がMA上下を動いている

- SAR:パラパラ線 SAR,SARは価格の上下を移動する判断傾向

損失を抑える方法

- ATR パーセンテージ・ストロー:ATR ファクターによるパーセンテージ・ストロー設定

- SARストップ:パラパララインがエントリー後にストップする

止まる方法

- ATR固定ストップ距離:ATR因子による固定ストップ距離の設定

- パーセンテージ ストップ: パーセンテージ ストップ 距離を設定します

時間の無駄

- 指定された項目の後にストップを設定できます.

優位分析

補助的な判断の種類

- 傾向と抵抗の判断を組み合わせることで,偽信号を減らすことができます.

- ATR/SARの損失をなくし,より全面的なリスク管理

柔軟な設定

- トレンドフィルターを使用するかどうかを選択できます.

- 選択可能なATRまたはSAR停止

- 選択可能なATRまたは標準停止

- パラメータは柔軟に設定できます.

返信分析を提供する

- 歴史は正の方向から逆の方向へ

- テキスト・ヒント

調整を最適化する

- ポリシーの内蔵された多くの可設定パラメータ

- 異なる変数の組み合わせを簡単にテストできます.

リスク分析

パラメータを間違えれば損失が増加する

- ATR,SAR パラメータが正しく設定されず,早めに停止する可能性があります.

- 停止比が大きすぎるため,早めに停止する可能性があります.

トレンド判断の失敗リスク

- トレンド指数のパラメータが正しくない場合,判断が間違えます.

- 突発的な出来事によるトレンド判断の失敗

時間を無駄にするリスク

- 固定時間ストップを設定すると,損失のリスクがあります.

最適化の方向

- ATR,SARパラメータを調整して,止損を滑らかにする.

- 異なるMA周期をテストし,トレンド判断を最適化する

- 試行錯誤を調整して利回りを最適化する

- 波動率指数の最適化パラメータと組み合わせた

要約する

この戦略は,トレンド判断,ストップスロープ,リコール識別などの複数の角度を考慮して,比較的包括的な仮想通貨取引戦略を形成する.それは,MACD指標の優位性を組み合わせて,トレンドフィルタリングを増加させ,誤取引を回避する;ATR/SARの停止を増加させ,リスクをよりよく制御する;リコール識別は,追加の参照を提供する.複数の設定可能なパラメータを簡単にテストして最適化することができる.全体的に,この戦略は,仮想通貨戦略の研究の良い例として使用できます.

ストラテジーソースコード

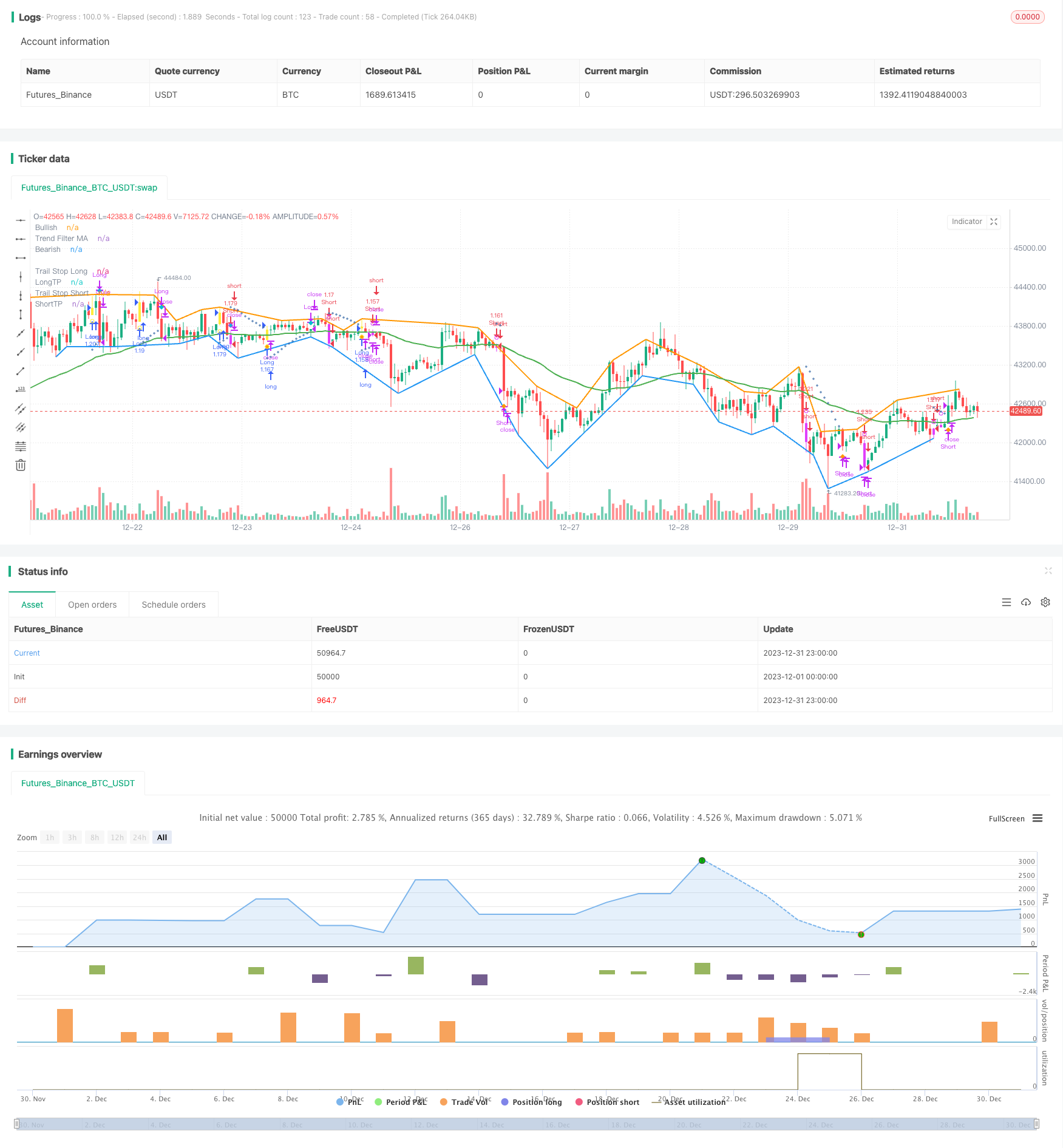

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © systemalphatrader

//@version=4

strategy(title="MACD+ Strategy [SystemAlpha]", shorttitle="MACD+ Strategy [SA]", overlay=true, initial_capital=10000, currency='USD',

default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.04)

// == MAIN INPUT ==

// TREND FILTER

// Make input option to configure trend filter

trendFilter = input(title="Trend Filter", defval='MA', options=['ADX', 'MA', 'SAR', 'All', 'None'])

// Translate input into trend filters

useADXFilter = (trendFilter == 'ADX') or (trendFilter == 'All')

useSARFilter = (trendFilter == 'SAR') or (trendFilter == 'All')

useMAFilter = (trendFilter == 'MA') or (trendFilter == 'All')

// TRAIL STOP

// Make input option to configure trail stop

trailStop = input(title="Trailing Stop Loss", defval='SAR', options=['ATR', 'SAR', 'None'])

// Translate input

useATRStop = (trailStop == 'ATR')

useSARStop = (trailStop == 'SAR')

// TAKE PROFIT TARGET

// Make input option to configure trail stop

TPtarget = input(title="Take Profit Type", defval='ATR', options=['ATR', 'Percent', 'None'])

// Translate input

useATRTP = (TPtarget == 'ATR')

usePercentTP = (TPtarget == 'Percent')

// ALERTS and BAR COLOR

// Make input option to configure alerts

alerts = input(title="Select Alerts to Display", defval='None', options=['Buy/Sell', 'Exit', 'Both', 'None'])

// Translate input

showsignals = (alerts == 'Buy/Sell') or (alerts == 'Both')

showexitsignals = (alerts == 'Exit') or (alerts == 'Both')

showBarColor = input(true, title="Show Bar Color")

// == /MAIN INPUT ==

/////////////////////////////////////

//*STRATEGY LOGIC *//

/////////////////////////////////////

// == MACD ==

fastLength = input(12, title="Fast Length")

slowlength = input(26, title="Slow Length")

MACDLength = input(9, title="MACD Length")

MACD = ema(close, fastLength) - ema(close, slowlength)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

// Calc breakouts

break_up = crossover(delta, 0)

break_down = crossunder(delta,0)

// == /MACD ==

// == DIVERGENCE ==

method = input(title="Divergence Method", defval='Hist', options=['Hist', 'MACD'])

divtype = input(title="Divergence Type", defval='None', options=['Regular', 'Hidden', 'Both', 'None'])

uReg = divtype == 'Regular' or divtype == 'Both'

uHid = divtype == 'Hidden' or divtype == 'Both'

showlabel = input(true, title="Show Divergence Label")

v_show_last = input(500, "Plotting Lookback Bars Length")

high_src = high

low_src = low

// || Functions:

f_top_fractal(_src) =>

_src[4] < _src[2] and _src[3] < _src[2] and _src[2] > _src[1] and

_src[2] > _src[0]

f_bot_fractal(_src) =>

_src[4] > _src[2] and _src[3] > _src[2] and _src[2] < _src[1] and

_src[2] < _src[0]

f_fractalize(_src) =>

f_bot_fractal__1 = f_bot_fractal(_src)

f_top_fractal(_src) ? 1 : f_bot_fractal__1 ? -1 : 0

// === End of Functions

// || Method selection

oscilator_high = float(na)

oscilator_low = float(na)

if method == 'MACD'

oscilator_high := MACD

oscilator_low := MACD

if method == 'Hist'

oscilator_high := delta

oscilator_low := delta

//

fractal_top = f_fractalize(oscilator_high) > 0 ? oscilator_high[2] : na

fractal_bot = f_fractalize(oscilator_low) < 0 ? oscilator_low[2] : na

high_prev = valuewhen(fractal_top, oscilator_high[2], 0)[2]

high_price = valuewhen(fractal_top, high[2], 0)[2]

low_prev = valuewhen(fractal_bot, oscilator_low[2], 0)[2]

low_price = valuewhen(fractal_bot, low[2], 0)[2]

regular_bearish_div = fractal_top and high[2] > high_price and oscilator_high[2] < high_prev

hidden_bearish_div = fractal_top and high[2] < high_price and oscilator_high[2] > high_prev

regular_bullish_div = fractal_bot and low[2] < low_price and oscilator_low[2] > low_prev

hidden_bullish_div = fractal_bot and low[2] > low_price and oscilator_low[2] < low_prev

// Plotting

plot(title='Bullish', series=fractal_top ? high[2] : na, color = regular_bearish_div and uReg or hidden_bearish_div and uHid ? color.red : na, linewidth = 2, transp=50, offset=-2, show_last = v_show_last)

plot(title='Bearish', series=fractal_bot ? low[2] : na, color = regular_bullish_div and uReg or hidden_bullish_div and uHid ? color.green : na, linewidth = 2, transp=50, offset=-2, show_last = v_show_last)

plotshape(title='Regular Bearish', series=not showlabel or not uReg ? na : regular_bearish_div ? high[2] : na, text='R', style=shape.labeldown, location=location.absolute, color=color.red, textcolor=color.white, transp=50, offset=-2, show_last = v_show_last)

plotshape(title='Hidden Bearish', series=not showlabel or not uHid ? na : hidden_bearish_div ? high[2] : na, text='H', style=shape.labeldown, location=location.absolute, color=color.red, textcolor=color.white, transp=80, offset=-2, show_last = v_show_last)

plotshape(title='Regular Bullish', series=not showlabel or not uReg ? na : regular_bullish_div ? low[2] : na, text='R', style=shape.labelup, location=location.absolute, color=color.green, textcolor=color.white, transp=50, offset=-2, show_last = v_show_last)

plotshape(title='Hidden Bullish', series=not showlabel or not uHid ? na : hidden_bullish_div ? low[2] : na, text='H', style=shape.labelup, location=location.absolute, color=color.green, textcolor=color.white, transp=80, offset=-2, show_last = v_show_last)

// == /DIVERGENCE ==

// == ENTRY ==

// == ADX FILTERING ==

// Look at ADX when it is above a user-defined key level (23 default) and this is to identify when it is trending.

// It then looks at the DMI levels. If D+ is above D- and the ADX is sloping upwards and above the key level, it triggers a buy condition. Opposite for short.

adxlen = 13 //input(13, title="TF ADX Smoothing")

dilen = 13 //input(13, title="TF DI Period")

keyLevel = 23 //input(23, title="TF Keylevel for ADX")

// == USE BUILT-IN DMI FUNCTION TO DETERMINE ADX AND BULL/BEAR STRENGTH

[diplus, diminus, adx] = dmi(dilen, adxlen)

//Buy and Sell Filter

ADXBuyCheck = useADXFilter? diplus > diminus : true

ADXSellCheck = useADXFilter? diplus < diminus : true

// == /ADX FILTERING ==

// == MOVING AVERAGE FILTERING ==

// MA FILTER: Use a user-defined moving average to filter long/short if desried.

maType = input(defval="EMA", options=["EMA", "SMA"], title = "TF MA Type")

maLength = input(defval = 50, title = "TF MA Period", minval = 1)

// Declare function to be able to swap out EMA/SMA

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length)

maFilter = ma(maType, close, maLength)

// Check to see if the useMaFilter check box is checked, this then inputs this conditional "maFilterCheck" variable into the strategy entry

maFilterCheck = if useMAFilter == true

maFilter

else

close

// == /MOVING AVERAGE FILTERING ==

// == PARABOLIC SAR AS AN ENTRY and EXIT OPTION ==

// SAR FILTER: The Parabolic SAR (Stop and Reverse) is a time and price technical analysis tool primarily used to identify points of potential stops and reverses.

// Go long when is located below price (BULLISH) and go short when is located above price (BEARISH).

sarStart = 0.04 //input(0.04, "SAR Start")

sarIncrement = 0.02 //input(0.02, "SAR Increment")

sarMaximum = 0.5 //input(0.5, "SAR Max Value")

htclose = close

sarOut = useSARFilter or useSARStop ? sar(sarStart, sarIncrement, sarMaximum) : na

Trend = sarOut < htclose ? 1 : -1

//Buy and Sell Filter

sarBuyCheck = useSARFilter? Trend == 1: true

sarSellCheck = useSARFilter? Trend == -1: true

// Trigger stop based on High/Low

trigResistance = high

trigSupport = low

// Determine if price is above resistance or below support

sarResistanceHit = close >= sarOut and useSARStop == true

sarSupportHit = close <= sarOut and useSARStop == true

// == /PARABOLIC SAR AS AN ENTRY and EXIT OPTION ==

// == EXITS ==

// == ATR TRAILING STOPS ==

// The ATR % stop method can be used by any type of trader because the width of the stop is determined by the percentage of average true range (ATR).

// ATR is a measure of volatility over a specified period of time.

// Exit with ATR support/resistance is hit.

atrLookback = 14 //input(defval=14,title="ATR Lookback Period",type=input.integer)

multiplier = input(defval=2,title="ATR Trailing Stop Multiplier",type=input.float, step=0.1, minval=0.5, maxval=5)

// Calculate the trailing ATR

atrValue = atr(atrLookback)

atrMultiplied = atrValue * multiplier

// Plot the price plus or minus the ATR

atrLow = low - atrMultiplied

atrHigh = high + atrMultiplied

// Calculate both the low and high trailing ATRs every time. The low one never goes down, and the high one never goes up

// Set them to something to start with

trailAtrLow = atrLow

trailAtrHigh = atrHigh

// If the ATR Low has gone up AND it has gone above the trail, the low trailing ATR should also go up. If the ATR Low has gone up or down, but not below the trail, the ATR trail stays where it is

trailAtrLow := na(trailAtrLow[1]) ? trailAtrLow : atrLow >= trailAtrLow[1] ? atrLow : trailAtrLow[1]

// Same for the High

trailAtrHigh := na(trailAtrHigh[1]) ? trailAtrHigh : atrHigh <= trailAtrHigh[1] ? atrHigh : trailAtrHigh[1]

// Determine if price is above resistance or below support

atrResistanceHit = trigResistance >= trailAtrHigh and useATRStop == true

atrSupportHit = trigSupport <= trailAtrLow and useATRStop == true

// If price is above resistance or below support, reset the trailing ATR

trailAtrLow := atrSupportHit ? atrLow : trailAtrLow

trailAtrHigh := atrResistanceHit ? atrHigh : trailAtrHigh

// == /ATR TRAILING STOPS ==

// == INITIAL TP==

// ATR

tpmultiplier = input(defval=3,title="ATR Take Profit Multiplier",type=input.float, step=0.1, minval=0.5, maxval=5)

ema = ema(close, atrLookback)

atr = rma(tr(true), atrLookback)

longATRTP = ema + (atr * tpmultiplier)

shortATRTP = ema - (atr * tpmultiplier)

// Determine if price is above resistance or below support

longATRTPHit = high >= longATRTP and useATRTP == true

shortATRTPHit = low <= shortATRTP and useATRTP == true

// STANDARD TAKE PROFIT %

// User Options to Change Inputs (%)

takePer = input(10, title='Take Profit %', type=input.float, step=0.1, minval=0.5, maxval=100) / 100

//fixed TP prices

longPercentTP = ema * (1 + takePer)

shortPercentTP = ema * (1 - takePer)

// Determine if price is above resistance or below support

longPercentTPHit = high >= longPercentTP and usePercentTP == true

shortPercentTPHit = low <= shortPercentTP and usePercentTP == true

// Set Stop and TP Values

buyStop = trailStop == 'ATR'? trailAtrLow : trailStop == 'SAR'? sarOut : na

sellStop = trailStop == 'ATR'? trailAtrHigh : trailStop == 'SAR'? sarOut : na

longTP = TPtarget == 'ATR'? longATRTP : TPtarget == 'Percent'? longPercentTP : na

shortTP = TPtarget == 'ATR'? shortATRTP : TPtarget == 'Percent'? shortPercentTP : na

// == /EXITS ==

// == PLOTTING ==

buySignal = break_up and ADXBuyCheck and close >= maFilterCheck and sarBuyCheck

shortSignal = break_down and ADXSellCheck and close <= maFilterCheck and sarSellCheck

sellSignal = atrSupportHit or sarSupportHit or longPercentTPHit or longATRTPHit

coverSignal = atrResistanceHit or sarResistanceHit or shortPercentTPHit or shortATRTPHit

//Set BarSince counter

barsSinceLong = 0

barsSinceShort = 0

barsSinceLong := nz(barsSinceLong[1])

barsSinceShort := nz(barsSinceShort[1])

//Plot Sell and Cover Signal

plotshape(not showexitsignals and sellSignal and barsSinceLong == 1? sellSignal : na, title="Sell Long", location=location.abovebar, style=shape.diamond, size=size.auto, color=color.aqua, transp=0, show_last = v_show_last, editable = false)

plotshape(not showexitsignals and coverSignal and barsSinceShort == 1 ? coverSignal : na, title="Cover Short", location=location.belowbar, style=shape.diamond, size=size.auto, color=color.orange, transp=0, show_last = v_show_last, editable = false)

plotshape(showexitsignals and sellSignal and barsSinceLong == 1? sellSignal : na, title="Close Long Text", location=location.abovebar, style=shape.diamond, size=size.auto, color=color.aqua, transp=0, show_last = v_show_last, textcolor=color.aqua, text = "Close\nLong", editable = false)

plotshape(showexitsignals and coverSignal and barsSinceShort == 1 ? coverSignal : na, title="Cover Short Text", location=location.belowbar, style=shape.diamond, size=size.auto, color=color.orange, transp=0, show_last = v_show_last, textcolor=color.orange, text = "Cover\nShort", editable = false)

// Reset BarSince counter

if buySignal

barsSinceLong := 1

barsSinceShort := 0

if shortSignal

barsSinceShort := 1

barsSinceLong := 0

if sellSignal

barsSinceLong := 0

if coverSignal

barsSinceShort := 0

// Show bar color

barcolor(showBarColor? (buySignal or shortSignal ? (shortSignal ? color.fuchsia : color.yellow) : na) : na)

// Plot Buy Alerts

plotshape(buySignal ? buySignal : na, title="Breakout Up", location=location.belowbar, style=shape.circle, size=size.auto, color=color.yellow, transp=0, editable = false)

plotshape(showsignals and buySignal, title= "Long", color=color.green, style=shape.labelup, location=location.belowbar, size=size.auto, show_last = v_show_last, text = "BUY", textcolor=color.white, editable = false)

// Plot Sell Alerts

plotshape(shortSignal ? shortSignal : na, title="Breakout Down", location=location.abovebar, style=shape.circle, size=size.auto, color=color.fuchsia, transp=0, editable = false)

plotshape(showsignals and shortSignal, title= "Short", color=color.red, style=shape.labeldown, location=location.abovebar, size=size.auto, show_last = v_show_last, text = "SELL", textcolor=color.white, editable = false)

// Plot MA Trend Filter

plot(useMAFilter? maFilter : na, title = "Trend Filter MA", color = color.green, linewidth = 2, style = plot.style_line, transp = 20, editable = true)

// Plot Initial Stop

plot(trailStop != 'None' and barsSinceLong >= 1? buyStop : na, color=#3A6CA8, title="Trail Stop Long", style = plot.style_cross, linewidth = 1, transp = 20, editable = true)

plot(trailStop != 'None' and barsSinceShort >= 1? sellStop : na, color=#3A6CA8, title="Trail Stop Short", style = plot.style_cross, linewidth = 1, transp = 20, editable = true)

// Plot Initial Target Profit

plot(TPtarget != 'None' and buySignal? longTP : na, color=color.green, title="LongTP", style = plot.style_linebr, linewidth = 1, editable = false)

plot(TPtarget != 'None' and shortSignal? shortTP : na, color=color.green, title="ShortTP", style = plot.style_linebr, linewidth = 1, editable = false)

// == /PLOTTING ==

// == ALERTS ==

// Buy and Sell Signal

alertcondition(buySignal, title='MACD Long', message='MACD {{exchange}}:{{ticker}} TF: {{interval}}. LONG (TRADE). ENTRY: {{close}}, Target Profit: {{plot("LongTP")}}, STOP LOSS: {{plot("Trail Stop Long")}}')

alertcondition(shortSignal, title='MACD Short', message='MACD {{exchange}}:{{ticker}} TF: {{interval}}. SHORT (TRADE). ENTRY: {{close}}, Target Profit: {{plot("ShortTP")}}, STOP LOSS: {{plot("Trail Stop Short")}}')

alertcondition(sellSignal, title='MACD Close Long', message='MACD {{exchange}}:{{ticker}} Close Long, Price = {{close}}')

alertcondition(coverSignal, title='MACD Cover Short', message='MACD {{exchange}}:{{ticker}} Cover Short, Price = {{close}}')

alertcondition(sellSignal or coverSignal, title="MACD Close Orders", message="{{ticker}} Close Orders")

// Initial SL and TP Hit

stophit = low <= buyStop or high >= sellStop

tphit = low <= shortTP or high >= longTP

alertcondition(stophit, title='MACD SL Hit', message='MACD {{exchange}}:{{ticker}} Stop Loss Hit, Price = {{close}}')

alertcondition(tphit, title='MACD TP Hit', message='MACD {{exchange}}:{{ticker}} Target Profit Hit, Price = {{close}}')

//Divergence Alerts

alertcondition(regular_bullish_div, title='MACD Bullish Divergence', message='MACD Regular Bullish Divergence')

alertcondition(regular_bearish_div, title='MACD Bearish Divergence', message='MACD Regular Bearish Divergence')

alertcondition(hidden_bullish_div, title='MACD Hidden Bullish Divergence', message='MACD Hidden Bullish Divergence')

alertcondition(hidden_bearish_div, title='MACD Hidden Bearish Divergence', message='MACD Hidden Bearish Divergence')

// == /ALERTS ==

//////////////////////////

//* STRATEGY COMPONENT *//

//////////////////////////

// === BACKTEST RANGE ===

From_Year = input(defval = 2017, title = "BACKTEST: From Year")

From_Month = input(defval = 1, title = "BACKTEST: From Month", minval = 1, maxval = 12)

From_Day = input(defval = 1, title = "BACKTEST: From Day", minval = 1, maxval = 31)

To_Year = input(defval = 9999, title = "BACKTEST: To Year")

To_Month = input(defval = 1, title = "BACKTEST: To Month", minval = 1, maxval = 12)

To_Day = input(defval = 1, title = "BACKTEST: To Day", minval = 1, maxval = 31)

Start = timestamp(From_Year, From_Month, From_Day, 00, 00) // backtest start window

Finish = timestamp(To_Year, To_Month, To_Day, 23, 59) // backtest finish window

testPeriod() => true

// === /BACKTEST RANGE ===

// === STRATEGY ===

// Make input option to configure trade direction

tradeDirection = input(title="Trade Direction", defval="Both", options=["Long", "Short", "Both"])

// Translate input into trading conditions

longOK = (tradeDirection == "Long") or (tradeDirection == "Both")

shortOK = (tradeDirection == "Short") or (tradeDirection == "Both")

// == STRATEGY ENTRIES/EXITS ==

timedExit = input(title = "Use Timed Exit", type = input.bool, defval = true)

exitmethod = input(title="Timed Exit Method", defval='3', options=['1', '2', '3'])

bse = input(10, "Bar Since Entry") // Bars to exit after entry

barsSinceEntry = 0

barsSinceEntry := nz(barsSinceEntry[1]) + 1

longCondition = longOK and buySignal and testPeriod()

shortcondition = shortOK and shortSignal and testPeriod()

if strategy.position_size == 0

barsSinceEntry := 0

// === STRATEGY - LONG POSITION EXECUTION ===

if longCondition

strategy.entry("Long", strategy.long)

barsSinceEntry := 0

// === STRATEGY - SHORT POSITION EXECUTION ===

if shortcondition

strategy.entry("Short", strategy.short)

barsSinceEntry := 0

// == STRATEGY EXITS ==

if sellSignal

strategy.close("Long")

barsSinceEntry := 0

if coverSignal

strategy.close("Short")

barsSinceEntry := 0

// Enable Timed Exit

// Exit after specified number of bars.

if timedExit and exitmethod == '1' and barsSinceEntry > bse

strategy.close_all()

barsSinceEntry := 0

// Exit after specified number of bars, ONLY if position is currently profitable.

if timedExit and exitmethod == '2' and strategy.openprofit > 0 and barsSinceEntry > bse

strategy.close_all()

barsSinceEntry := 0

// Exit after specified number of bars, ONLY if position is currently losing.

if timedExit and exitmethod == '3' and strategy.openprofit < 0 and barsSinceEntry > bse

strategy.close_all()

barsSinceEntry := 0

// === /STRATEGY ===

//EOF