ボリンジャーバンドとVWAPに基づく強気ブレイクアウト戦略

作成日:

2024-02-06 14:36:26

最終変更日:

2024-02-06 14:36:26

コピー:

1

クリック数:

918

1

フォロー

1628

フォロワー

概要

この戦略はブリン帯の指標を用いてVWAPを追跡し,VWAPが上向きにブリン帯の中軌道を突破すると多頭突破と判断し,多頭戦略をとる.VWAPが下向きにブリン帯下軌道を突破すると空頭確認と平仓退場と判断する.また,戦略は,入場信号の補助判断条件として主要な支柱位置Pivot Pointを導入し,偽突破をフィルターすることができる.

戦略原則

- VWAP値の計算について

- VWAPのブリン帯を計算し,上線,中線,下線を含む.

- VWAPがブリン帯の中間軌道を上方突破するかどうかを判断し,もしそうで,価格が主要サポートのピボットポイントより高いなら,多頭戦略で入場する.

- ストップダストは5%に設定されています.

- VWAPが下向きにブリンを突破すると,空頭が確認され,平仓が離場する.止損が誘発された場合も離場する.

優位分析

- VWAPは,ブリンバンドと組み合わせた強力なトレンド追跡能力を持ち,トレンドを正確に判断できる.

- Pivot Point を追加すると,多くの偽突破をフィルターし,不必要な損失を防ぐことができます.

- 利益の一部を固定し,リスクをコントロールする部分的な脱出戦略を採用する.

- この戦略は,牛市で優れ,高い安定性を示した.

リスク分析

- 震災時には,偽突破が起こり,損失を招く可能性があります.

- Pivot Pointは,偽突破を完全に回避することはできません.より多くの指標のフィルタリング信号を組み合わせる必要があります.

- 取引の頻度や取引コストが増加した.

- 熊市ではうまくいかないので,リスク管理をよくする必要がある.

最適化の方向

- MACD,KDJなどの他の指標と組み合わせて,入出場信号のフィルタリングを補助することができる.

- ブリン帯の長さと標準差を最適化することで最適なパラメータの組み合わせを探せます.

- ブリン帯のパラメータを動的に最適化するために機械学習アルゴリズムを導入することができる.

- 異なるストップレベルをテストして,最適のストップポイントを見つけることができます.

- 市場変動に応じて目標利益の調整を行うための自己適応脱出メカニズムが組み込まれます.

要約する

この戦略は,全体として安定した突破システムである。標準化された操作方法,パラメータ最適化スペースが広く,量化取引に適している。同時に,リスク管理に注意し,異常な行動による損失を防げる必要がある。全体として,深入な研究と継続的な最適化の価値のある突破型の戦略である。

ストラテジーソースコード

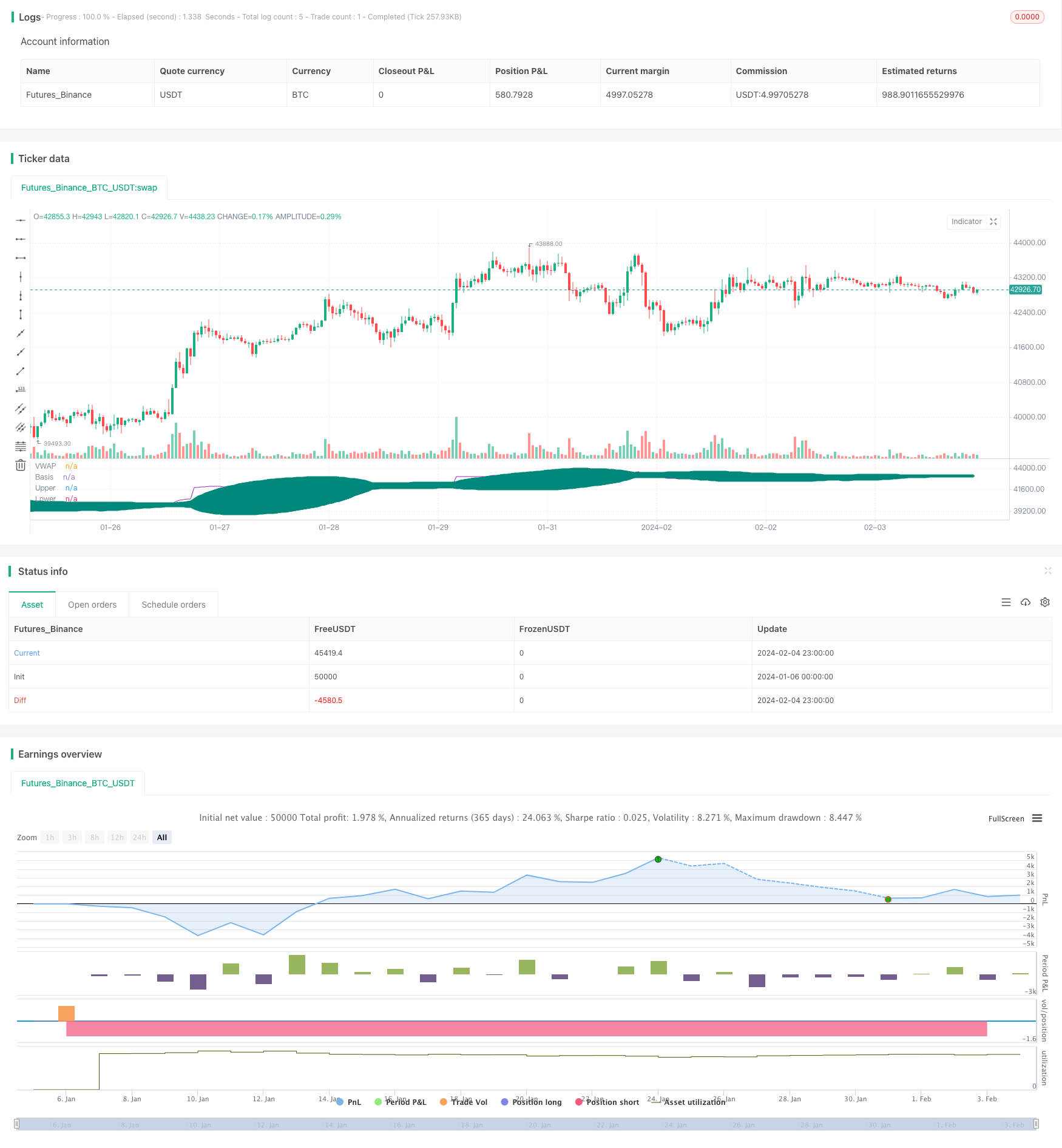

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ediks123

//@version=4

strategy("BBofVWAP with entry at Pivot Point", overlay=false, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=20, initial_capital=10000, currency=currency.USD) //default_qty_value=10, default_qty_type=strategy.fixed,

// Function outputs 1 when it's the first bar of the D/W/M/Y

is_newbar(res) =>

ch = 0

if(res == 'Y')

t = year(time('D'))

ch := change(t) != 0 ? 1 : 0

else

t = time(res)

ch := change(t) != 0 ? 1 : 0

ch

//variables BEGIN

//smaLength=input(200,title="Slow MA Length")

bbLength=input(50,title="BB Length")

//bbsrc = input(close, title="BB Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

pp_period = input(title = "Pivot Period", type=input.string, defval="Week", options = ['Day', 'Week'])

pp_res = pp_period == 'Day' ? 'D' : pp_period == 'Week' ? 'W' : pp_period == 'Month' ? 'M' : 'Y'

riskCapital = input(title="Risk % of capital", defval=10, minval=1)

stopLoss=input(5,title="Stop Loss",minval=1)

//sma200=sma(close,smaLength)

//plot(sma200, title="SMA 200", color=color.orange)

myVwap=vwap(hlc3)

//bollinger calculation

basis = sma(myVwap, bbLength)

dev = mult * stdev(myVwap, bbLength)

upperBand = basis + dev

lowerBand = basis - dev

//plot bb

plot(basis, "Basis", color=color.teal, style=plot.style_circles , offset = offset)

p1 = plot(upperBand, "Upper", color=color.teal, offset = offset)

p2 = plot(lowerBand, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=color.teal, transp=95)

plot(myVwap, title="VWAP", color=color.purple)

//pivot points

// Calc High

high_cur = 0.0

high_cur := is_newbar(pp_res) ? high : max(high_cur[1], high)

phigh = 0.0

phigh := is_newbar(pp_res) ? high_cur[1] : phigh[1]

// Calc Low

low_cur = 0.0

low_cur := is_newbar(pp_res) ? low : min(low_cur[1], low)

plow = 0.0

plow := is_newbar(pp_res) ? low_cur[1] : plow[1]

// Calc Close

pclose = 0.0

pclose := is_newbar(pp_res) ? close[1] : pclose[1]

vPP = (phigh + plow + pclose) / 3

//pivot points

//Entry--

//Echeck how many units can be purchased based on risk manage ment and stop loss

qty1 = (strategy.equity * riskCapital / 100 ) / (close*stopLoss/100)

//check if cash is sufficient to buy qty1 , if capital not available use the available capital only

qty1:= (qty1 * close >= strategy.equity ) ? (strategy.equity / close) : qty1

strategy.entry(id="BB_VWAP_PP",long=true, qty=qty1, when= crossover(myVwap,basis) and close>=vPP )

bgcolor(strategy.position_size>=1?color.blue:na, transp=75)

barcolor(strategy.position_size>=1?color.green:na)

stopLossVal= strategy.position_size>=1 ? close * (1 - (stopLoss*0.01) ) : 0.00

//partial exit

//strategy.close(id="BBofVwap", qty=strategy.position_size/3, when=crossunder(myVwap,upperBand) and strategy.position_size>=1 ) //and close>strategy.position_avg_price)

//exit on lowerband or stoploss

strategy.close(id="BB_VWAP_PP", comment="P" , qty=strategy.position_size/3, when= crossunder(myVwap,upperBand) and strategy.position_size>=1 and close>strategy.position_avg_price) //

strategy.close(id="BB_VWAP_PP", comment="Exit All", when=crossunder(myVwap,lowerBand) and strategy.position_size>=1 )

//strategy.close(id="BBofVwapWithFibPivot", comment="Exit All", when=crossunder(close,vPP) and strategy.position_size>=1 )

strategy.close(id="BB_VWAP_PP", comment="Stop Loss Exit", when=crossunder(close,stopLossVal) and strategy.position_size>=1 )