概述

MACD趋势跟踪策略是一种基于MACD指标的量化交易策略。该策略通过识别MACD指标金叉和死叉信号,来判断市场趋势,实现追踪股价趋势。

策略原理

MACD趋势跟踪策略的核心逻辑是:

- 计算MACD线和信号线。

- 当MACD线从下向上突破0时,记录此时的最高点,等待死叉信号。

- 当MACD线从上向下跌破0时,记录此时的最低点,等待金叉信号。

- 当发生金叉时,记录当前收盘价作为做多入场点,设置止损点,开仓做多。

- 当发生死叉时,记录当前收盘价作为做空入场点,设置止损点,开仓做空。

- 持有做多头寸时,如果收益率达到预设目标或回撤达到止损点,平仓获利了结。

- 持有做空头寸时,如果收益率达到预设目标或回撤达到止损点,平仓获利了结。

通过这种趋势跟踪机制,该策略能及时捕捉市场趋势转折,实现盈利。

优势分析

MACD趋势跟踪策略具有以下优势:

- 策略信号来源唯一清晰,由MACD指标直接产生,避免信号干扰。

- 利用MACD指标的快慢线金叉死叉特征判断市场趋势方向,判断准确。

- 及时追踪趋势转折,跟踪盈利能力强。

- 风险控制到位,有止损机制。

风险分析

MACD趋势跟踪策略也存在以下风险:

- MACD指标容易产生虚假信号,可能导致超短线操作亏损。

- 止损点设置不当,可能扩大单笔亏损。

- 追踪盈利比例和止损点难以平衡,存在过度追踪导致亏损的风险。

针对上述风险,可以采取以下优化措施:

- 结合其他指标过滤虚假信号。

- 动态调整止损点。

- 优化追踪盈利比例和止损点的参数。

优化方向

MACD趋势跟踪策略可以从以下方面进行优化:

优化MACD指标参数,降低虚假信号率。可以测试不同周期参数的MACD。

增加成交量等其他指标过滤信号。可以设置最小成交量条件。

设置动态追踪止损机制。可以根据波动率实时调整止损点。

优化打开头寸的信号判定逻辑。可以设置更严格的信号触发条件。

结合机器学习模型过滤信号。可以训练模型判断信号的可靠性。

总结

MACD趋势跟踪策略整体而言是一种较为成熟的量化策略。该策略利用MACD指标判断市场趋势方向,配合止损机制控制风险,能够有效跟踪股价趋势。但MACD指标本身也存在一定缺陷,容易产生虚假信号。因此该策略还有进一步优化的空间,主要集中在指标参数、止损机制、信号过滤等方面。

策略源码

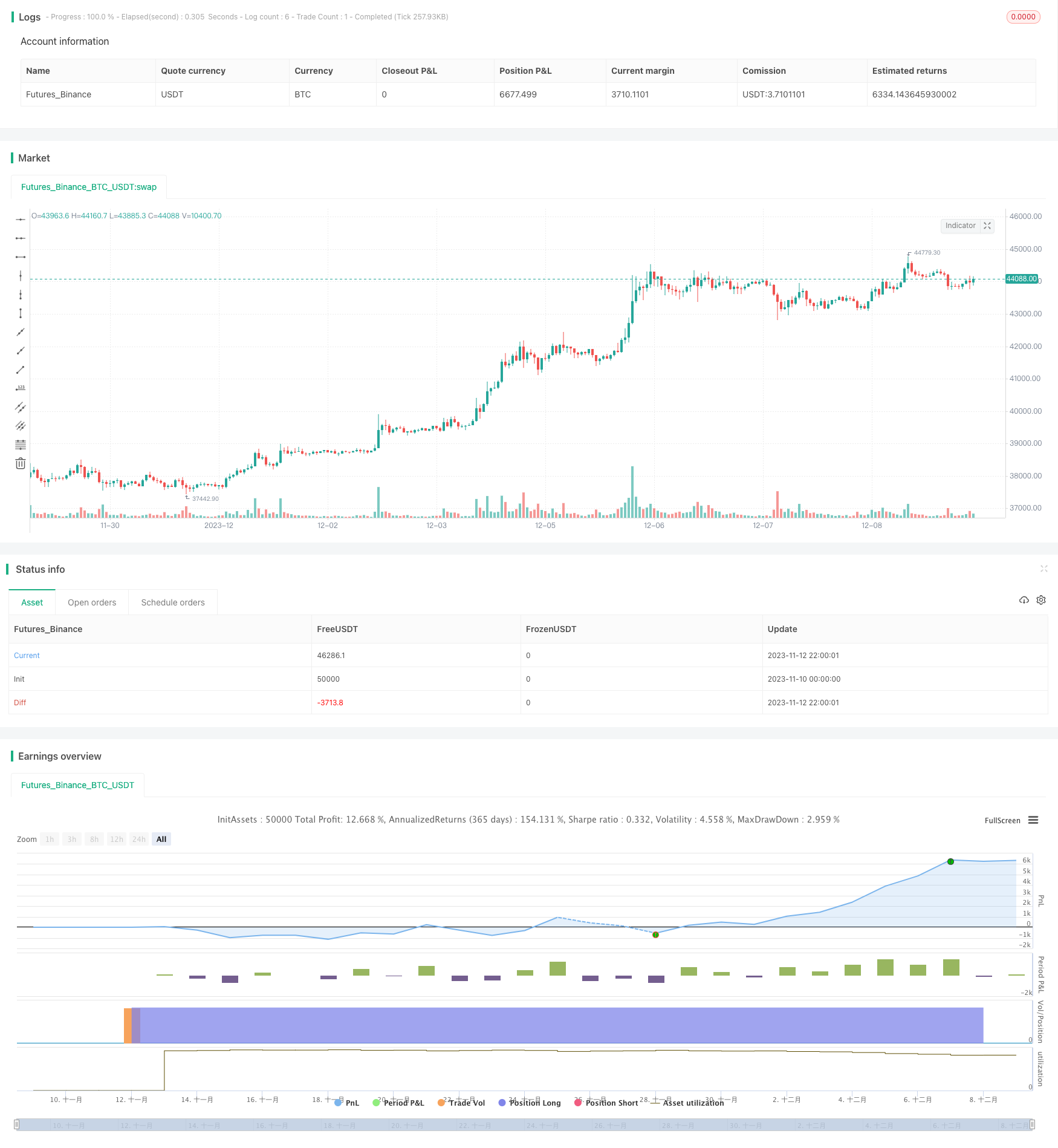

/*backtest

start: 2023-11-10 00:00:00

end: 2023-12-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MACD Cross Strategy", overlay=true)

// Get MACD values

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

var float entryLongPrice = na

var float entryShortPrice = na

var float highestLongProfit = 0

var float highestShortProfit = 0

var float highestMACD = 0

var float lowestMACD = 0

var bool haveOpenedLong = false

var bool haveOpenedShort = false

var float stoploss = 0.04 // To be adjust for different investment

var float minProfit = 0.05 // To be adjust for different investment

if macdLine > 0

lowestMACD := 0

highestMACD := math.max(highestMACD, macdLine)

haveOpenedShort := false

else

highestMACD := 0

lowestMACD := math.min(lowestMACD, macdLine)

haveOpenedLong := false

// Enter long position when MACD line crosses above the signal line

if ta.crossover(macdLine, signalLine) and macdLine < highestMACD and macdLine > 0 and haveOpenedLong == false

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry = "Long", stop=close*(1 - stoploss))

entryLongPrice := close

haveOpenedLong := true

if ta.crossunder(macdLine, signalLine) and macdLine > lowestMACD and macdLine < 0 and haveOpenedShort == false

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", from_entry = "Short", stop=close*(1 + stoploss))

entryShortPrice := close

haveOpenedShort := true

// log.info("entryLongPrice:{0}", entryLongPrice)

if strategy.position_size > 0

profit = close - entryLongPrice

log.info("profit:{0}", profit)

if profit > 0

highestLongProfit := math.max(highestLongProfit, profit)

if profit / entryLongPrice > minProfit and highestLongProfit * 0.8 > profit

strategy.close("Long")

highestLongProfit := 0

if strategy.position_size < 0

profit = entryShortPrice - close

if profit > 0

highestShortProfit := math.max(highestShortProfit, profit)

log.info("highestShortProfit={0}, profit={1}", highestShortProfit, profit)

if profit / entryShortPrice > minProfit and highestShortProfit * 0.8 > profit

strategy.close("Short")

highestShortProfit := 0