概述

该策略主要基于相对强弱指数(RSI)指标判断过买过卖情况,以200日简单移动平均线(200 Day Simple Moving Average, SMA)作为主要的价格趋势滤波器,在确定趋势方向的基础上,利用RSI指标寻找较佳的入场和出场时机,实现盈利。相比单一使用RSI指标,该策略增加了趋势判断,可以更加准确地把握市场走势,在牛市中追涨杀跌,在熊市中反其道而行之,从而获取更高的策略收益。

策略原理

该策略主要由RSI指标和200日SMA滤波器两部分组成。

RSI指标部分主要判断价格是否进入超买超卖区域。其计算公式为:

RSI = 100 - 100 / (1 + RSI上涨天数的平均涨幅 / RSI下跌天数的平均跌幅)

根据经验参数,当RSI < 30时为超卖,>70时为超买。

200日SMA滤波器主要判断大盘趋势方向。当价格高于200日SMA时为牛市,否则为熊市。

根据以上两者综合判断,策略有如下入场和出场逻辑:

多头入场:RSI < 45 且 收盘价 > 200日SMA

多头出场:RSI > 75 且 收盘价 > 200日SMA

空头入场:RSI > 65 且 收盘价 < 200日SMA

空头出场:RSI < 25 且 收盘价 < 200日SMA

这样,就利用RSI指标的精确判断在大趋势中寻找较优入场和出场点,进而获取较高策略收益。

策略优势分析

该策略最大的优势在于利用RSI指标和200日SMA滤波器的配合,使得策略更加稳定和精确:

- 200日SMA有效判断大盘趋势,避免了单一RSI指标的误判

- RSI指标可以在大盘趋势中寻找较佳入场出场点

- 策略操作简单,容易实施

此外,该策略还具有如下优势:

- 适用于各种品种,包括股票指数、数字货币和贵金属

- 资金利用效率高

- 可谨慎加入止损,有效控制单笔损失

策略风险分析

该策略也存在一些风险:

- 大盘发生突发性调整时,可能产生较大亏损

- RSI指标和200日SMA指标存在一定程度的滞后

- 交易频繁,交易成本较高

为控制这些风险,可采取如下措施:

- 适当调整仓位管理,防范突发事件的冲击

- 优化RSI和SMA的参数,降低滞后概率

- 适当调整交易频率,降低交易成本

策略优化方向

该策略可从以下几个方面进行优化:

- 动态调整RSI参数,根据市场波动程度选择合适的参数

- 测试其他均线指标如EMA是否能带来更好效果

- 增加自动止损机制

- 增加仓位管理模块,根据资金规模动态调整仓位

- 优化入场出场逻辑,测试能否带来更好收益

总结

该策略整体运行效果良好,具有判断准确、操作简单、适用范围广等优点。加入止损和仓位管理后,可谨慎实盘运行。后续可从参数优化、止损优化、仓位管理等方面进行策略增强,使策略效果更加出色。

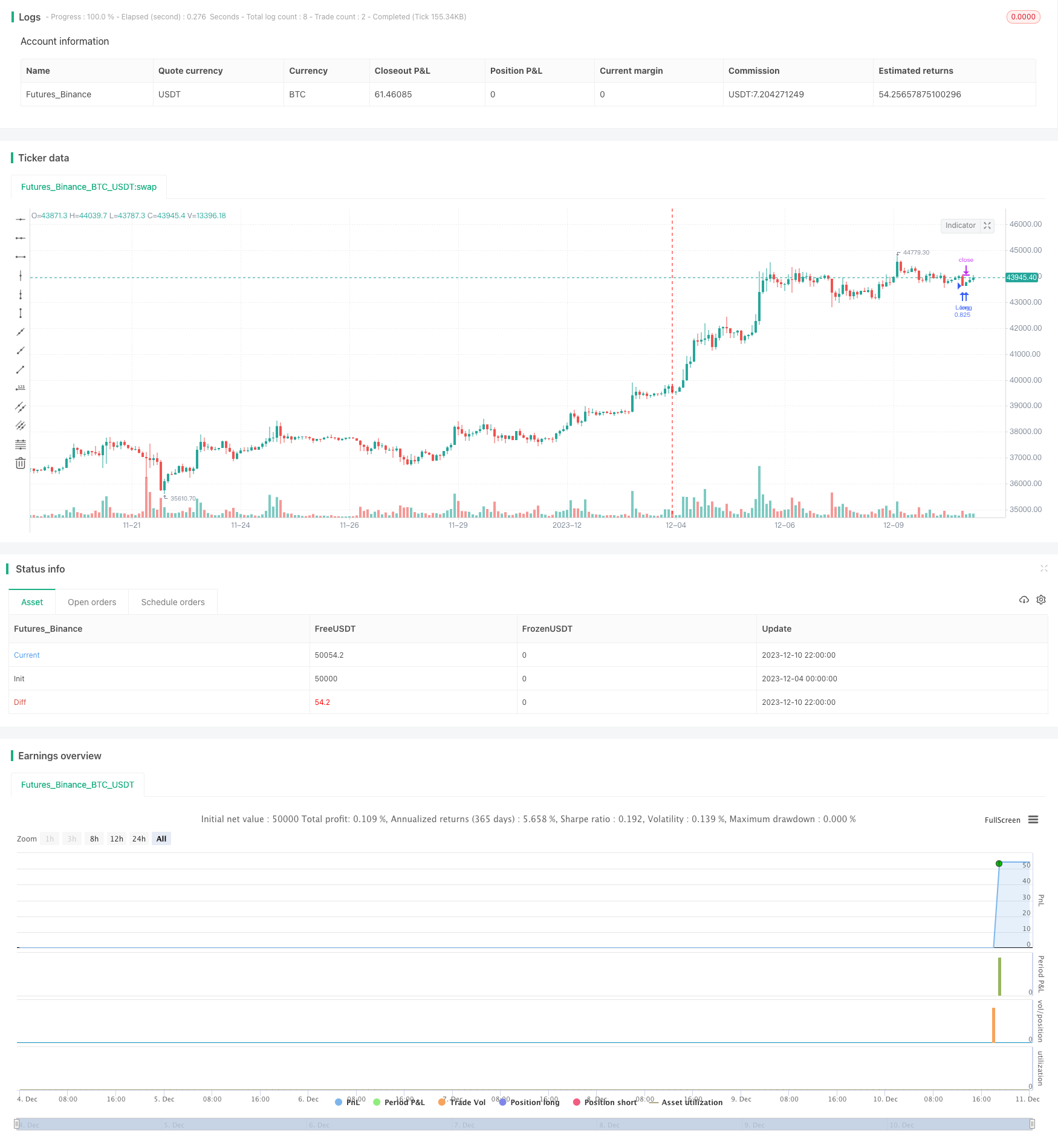

/*backtest

start: 2023-12-04 00:00:00

end: 2023-12-11 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © LuxAlgo

//@version=5

strategy('Relative Strength Index Extremes with 200-Day Moving Average Filte', overlay=true, pyramiding=1, initial_capital=10000, default_qty_type=strategy.cash, default_qty_value=36000, calc_on_order_fills=false, slippage=0, commission_type=strategy.commission.percent, commission_value=0.01)

// Rsi

rsi_lenght = input.int(14, title='RSI lenght', minval=0)

rsi_up = ta.rma(math.max(ta.change(close), 0), rsi_lenght)

rsi_down = ta.rma(-math.min(ta.change(close), 0), rsi_lenght)

rsi_value = rsi_down == 0 ? 100 : rsi_up == 0 ? 0 : 100 - 100 / (1 + rsi_up / rsi_down)

//Sma

Length1 = input.int(200, title=' SMA Lenght', minval=1)

SMA1 = ta.sma(close, Length1)

//Strategy Logic

Long = rsi_value < 45 and close > SMA1

Long_exit = rsi_value > 75 and close > SMA1

Short = rsi_value > 65 and close < SMA1

Short_exit = rsi_value < 25 and close < SMA1

if Long

strategy.entry('Long', strategy.long)

if Short

strategy.entry('Short', strategy.short)

strategy.close_all(Long_exit or Short_exit)

pera(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

stoploss = input.float(title=' stop loss', defval=5, minval=0.5)

los = pera(stoploss)

strategy.exit('SL', loss=los)

//by wielkieef