Multifaktorielle RSI-Umkehrstrategie

Überblick

Diese Strategie verwendet den RSI-Indikator, um Überkauf-Überverkauf zu erkennen, in Kombination mit verschiedenen Hilfsfaktoren wie MACD, Stochastic Indicators und anderen. Die Strategie zielt darauf ab, kurzfristige Umkehrmöglichkeiten zu erfassen und gehört zu den Umkehrstrategien.

Strategieprinzip

Diese Strategie nutzt hauptsächlich die RSI-Anzeige, um zu bestimmen, ob der Markt überkauft oder überverkauft ist. Wenn der RSI-Anzeige über die festgelegte Überkauflinie liegt, deutet dies darauf hin, dass der Markt möglicherweise überkauft ist, und die Strategie wählt einen Short; Wenn der RSI-Anzeige unter der festgelegten Überverkauflinie liegt, deutet dies darauf hin, dass der Markt möglicherweise überverkauft ist, und die Strategie wählt einen Plus.

Die Strategie enthält außerdem mehrere zusätzliche Faktoren wie MACD, Stochastic und andere. Diese Faktoren filtern mögliche falsch-positive Handelssignale aus. Die Strategie wird nur dann wirklich handeln, wenn der RSI-Indikator ein Signal sendet und die zusätzlichen Faktoren das Signal unterstützen.

Analyse der Stärken

Der größte Vorteil dieser Strategie liegt in der hohen Erfassungseffizienz und der Verbesserung der Signalqualität durch Multi-Factor-Verifizierung. Dies zeigt sich insbesondere in folgenden Aspekten:

- Der RSI ist in der Lage, Marktregimes zu erkennen und kann Überkauf und Überverkauf erkennen.

- Mit Hilfe verschiedener Hilfsmittel wurde die Multi-Faktor-Verifizierung durchgeführt, die Signalqualität verbessert und eine große Anzahl von Falschpositiven gefiltert.

- Die Strategie ist nicht parametersensibel und leicht zu optimieren.

Risiken und Lösungen

Die Strategie birgt auch Risiken, die sich auf zwei Bereiche konzentrieren:

- Das Risiko eines Rückschlages. Das Rückschlagsignal selbst hängt von den statistischen Arbitragechancen ab, ohne die Wahrscheinlichkeit eines einzelnen Rückschlages auszuschließen. Das Risiko kann durch die Verringerung der Position oder die Einrichtung eines Stop-Loss-Systems kontrolliert werden.

- Das Risiko von Verlusten bei mehrköpfigen Verhaltensweisen. Die Strategie als Ganzes ist immer noch auf Rückspielung ausgerichtet, und unter mehrköpfigen Verhaltensweisen wird es unweigerlich zu Verlusten kommen. Dies erfordert, dass wir die großen Trends genau beurteilen und, wenn nötig, durch künstliche Intervention die ungünstigen Umstände überspringen.

Optimierungsrichtung

Diese Strategie muss in folgenden Bereichen weiter optimiert werden:

- Verschiedene Sorten testen, um die optimale Kombination von Parametern zu finden. Die Strategie ist nicht empfindlich, aber es wird empfohlen, die optimale Parameter für verschiedene Sorten zu finden.

- Erhöhung der Anpassungsfähigkeit des Ausstiegs. Es kann getestet werden, wie man dynamische Stopps und Zeit-Exits hinzufügt, um die Strategie besser an Veränderungen des Marktes anzupassen.

- Einführung von Algorithmen für maschinelles Lernen. Es kann versucht werden, die Wahrscheinlichkeit des Erfolgs der Umkehrung durch Modelllernen zu bestimmen, um die Strategie-Siegerate zu erhöhen.

Zusammenfassen

Diese Strategie ist insgesamt eine Kurzlinie-Umkehrstrategie. Die Fähigkeit des RSI-Indikators, Überkaufe und Überverkäufe zu beurteilen, wird mit Hilfe verschiedener Hilfswerkzeuge durch Multi-Faktor-Verifizierung beurteilt, wodurch die Qualität der Signale verbessert wird. Die Strategie ist effizient und stabil.

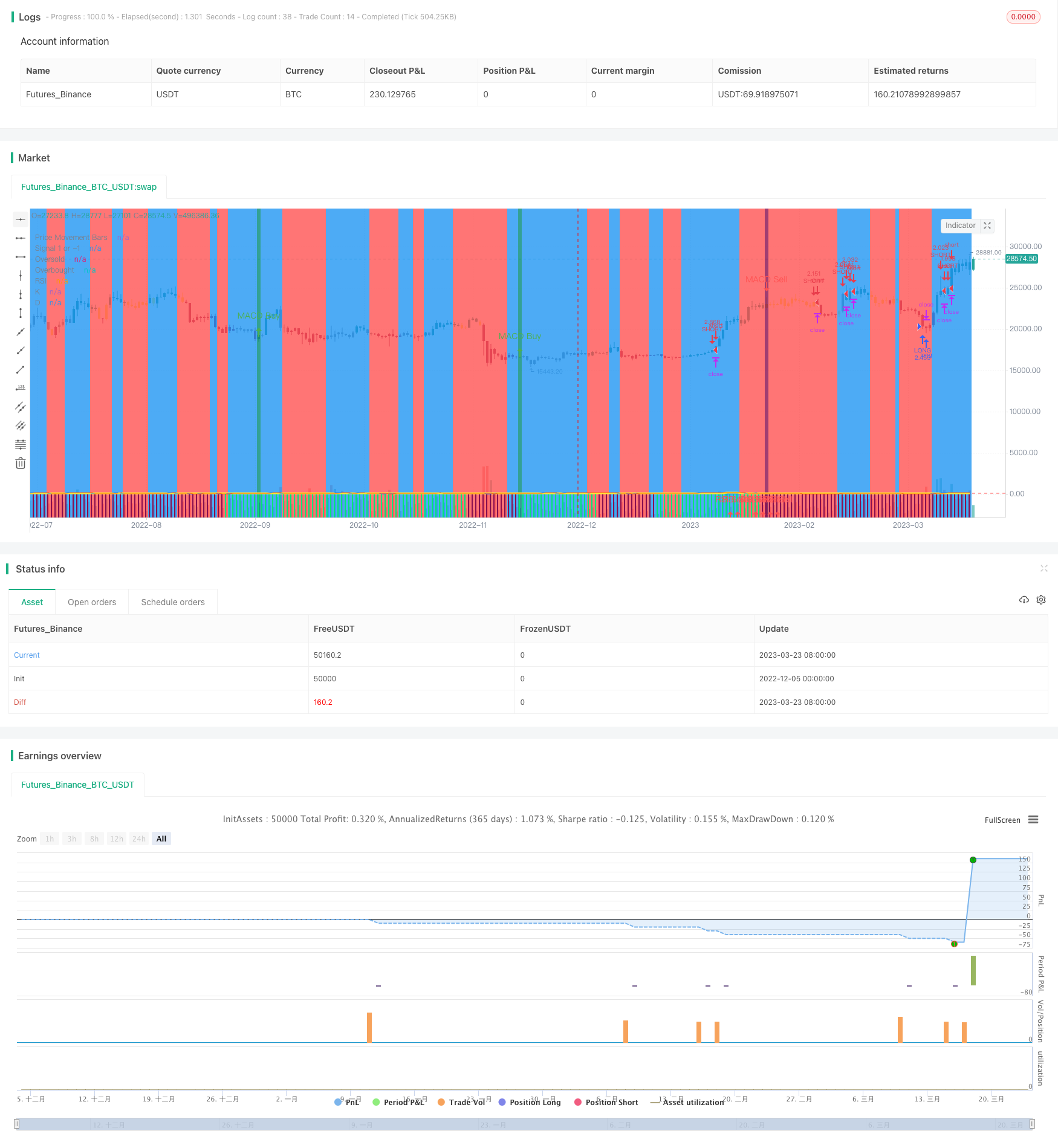

/*backtest

start: 2022-12-05 00:00:00

end: 2023-03-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

strategy(shorttitle='Ain1',title='All in One Strategy', overlay=true, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type=strategy.commission.percent, commission_value=0.18, calc_on_every_tick=true)

kcolor = #0094FF

dcolor = #FF6A00

// ----------------- Strategy Inputs -------------------------------------------------------------

//Backtest dates with auto finish date of today

start = input(defval = timestamp("01 April 2021 00:00 -0500"), title = "Start Time", type = input.time)

finish = input(defval = timestamp("31 December 2021 00:00 -0600"), title = "Start Time", type = input.time)

window() => true

// Strategy Selection - Long, Short, or Both

strat = input(title="Strategy", defval="Long/Short", options=["Long Only", "Long/Short", "Short Only"])

strat_val = strat == "Long Only" ? 1 : strat == "Long/Short" ? 0 : -1

// Risk Management Inputs

sl= input(10.0, "Stop Loss %", minval = 0, maxval = 100, step = 0.01)

stoploss = sl/100

tp = input(20.0, "Target Profit %", minval = 0, maxval = 100, step = 0.01)

TargetProfit = tp/100

// RSI and Stochastic Inputs

length = input(14, "RSI Length", minval=1)

ob_min = input(52, "Overbought Lookback Minimum Value", minval=0, maxval=200)

ob_lb = input(25, "Overbought Lookback Bars", minval=0, maxval=100)

os_min = input(50, "Oversold Lookback Minimum Value", minval=0, maxval=200)

os_lb = input(35, "Oversold Lookback Bars", minval=0, maxval=100)

source = input(title="Source", type=input.source, defval=close)

RSI = rsi(source, length)

// Define f_print function to show key recommendations for RSI

// f_print(_text) =>

// // Create label on the first bar.

// var _label = label(na),

// label.delete(_label),

// _label := label.new(

// time + (time-time[1]),

// ohlc4,

// _text,

// xloc.bar_time,

// yloc.price,

// color(na),

// label.style_none,

// color.gray,

// size.large,

// text.align_left

// )

// Display highest and lowest RSI values

AvgHigh(src,cnt,val) =>

total = 0.0

count = 0

for i = 0 to cnt

if src[i] > val

count := count + 1

total := total + src[i]

round(total / count)

RSI_high = AvgHigh(RSI, ob_lb, ob_min)

AvgLow(src,cnt,val) =>

total = 0.0

count = 0

for i = 5 to cnt by 5

if src[i] < val

count := count + 1

total := total + src[i]

round(total / count)

RSI_low = AvgLow(RSI, os_lb, os_min)

// f_print("Recommended RSI Settings:" + "\nOverbought = " + tostring(RSI_high) + "\nOversold = " + tostring(RSI_low))

overbought= input(62, "Overbought")

oversold= input(35, "Oversold")

// Price Movement Inputs

look_back = input(9,"Look Back Bars")

high_source = input(high,"High Source")

low_source= input(low,"Low Source")

HTF = input("","Curernt or Higher time frame only", type=input.resolution)

// EMA and SMA Background Inputs

smoothK = input(3, "K", minval=1)

smoothD = input(3, "D", minval=1)

k_mode = input("SMA", "K Mode", options=["SMA", "EMA", "WMA"])

// MACD Inputs

fastLength = input(5, minval=1, title="EMA Fast Length")

slowLength = input(10, minval=1, title="EMA Slow Length")

// Selections to show or hide the overlays

showZones = input(true, title="Show Bullish/Bearish Zones")

showStoch = input(true, title="Show Stochastic Overlays")

showRSIBS = input(true, title="Show RSI Buy Sell Zones")

showMACD = input(true, title="Show MACD")

color_bars=input(true, "Color Bars")

useXRSI = input(false, "Use RSI crossing back, select only one")

useMACD = input(false, "Use MACD Only, select only one")

useCRSI = input(false, "Use Tweaked Connors RSI, select only one")

// ------------------ Background Colors based on EMA Indicators -----------------------------------

// Uses standard lengths of 9 and 21, if you want control delete the constant definition and uncomment the inputs

haClose(gap) => (open[gap] + high[gap] + low[gap] + close[gap]) / 4

rsi_ema = rsi(haClose(0), length)

v2 = ema(rsi_ema, length)

v3 = 2 * v2 - ema(v2, length)

emaA = ema(rsi_ema, fastLength)

emaFast = 2 * emaA - ema(emaA, fastLength)

emaB = ema(rsi_ema, slowLength)

emaSlow = 2 * emaB - ema(emaB, slowLength)

// bullish signal rule:

bullishRule =emaFast > emaSlow

// bearish signal rule:

bearishRule =emaFast < emaSlow

// current trading State

ruleState = 0

ruleState := bullishRule ? 1 : bearishRule ? -1 : nz(ruleState[1])

bgcolor(showZones ? ( ruleState==1 ? color.blue : ruleState==-1 ? color.red : color.gray ) : na , title=" Bullish/Bearish Zones", transp=95)

// ------------------ Stochastic Indicator Overlay -----------------------------------------------

// Calculation

// Use highest highs and lowest lows

h_high = highest(high_source ,look_back)

l_low = lowest(low_source ,look_back)

stoch = stoch(RSI, RSI, RSI, length)

k =

k_mode=="EMA" ? ema(stoch, smoothK) :

k_mode=="WMA" ? wma(stoch, smoothK) :

sma(stoch, smoothK)

d = sma(k, smoothD)

k_c = change(k)

d_c = change(d)

kd = k - d

// Plot

signalColor = k>oversold and d<overbought and k>d and k_c>0 and d_c>0 ? kcolor :

k<overbought and d>oversold and k<d and k_c<0 and d_c<0 ? dcolor : na

kp = plot(showStoch ? k : na, "K", transp=80, color=kcolor)

dp = plot(showStoch ? d : na, "D", transp=80, color=dcolor)

fill(kp, dp, color = signalColor, title="K-D", transp=88)

signalUp = showStoch ? not na(signalColor) and kd>0 : na

signalDown = showStoch ? not na(signalColor) and kd<0 : na

plot(signalUp ? kd : na, "Signal Up", color=kcolor, transp=90, style=plot.style_columns)

plot(signalDown ? (kd+100) : na , "Signal Down", color=dcolor, transp=90, style=plot.style_columns, histbase=100)

// -------------- Add Price Movement to Strategy for better visualization -------------------------

// Calculations

h1 = vwma(high, length)

l1 = vwma(low, length)

hp = h_high[1]

lp = l_low[1]

// Plot

var plot_color=#353535

var sig = 0

if (h1 >hp)

sig:=1

plot_color:=color.lime

else if (l1 <lp)

sig:=-1

plot_color:=color.maroon

plot(1,title = "Price Movement Bars", style=plot.style_columns,color=plot_color)

plot(sig,title="Signal 1 or -1",display=display.none)

// --------------------------------------- RSI Plot ----------------------------------------------

// Plot Oversold and Overbought Lines

over = hline(oversold, title="Oversold", color=color.green)

under = hline(overbought, title="Overbought", color=color.red)

fill(over, under, color=#9915FF, transp=90, title="Band Background")

// Show RSI and EMA crosses with arrows and RSI Color (tweaked Connors RSI)

// Improves strategy setting ease by showing where EMA 5 crosses EMA 10 from above to confirm overbought conditions or trend reversals

// This shows where you should enter shorts or exit longs

// Tweaked Connors RSI Calculation

connor_ob = 80

connor_os = 20

ma3 = sma(close,3)

ma20 = sma(close, 20)

ma50 = sma(close, 50)

erection = ((((close[1]-close[2])/close[2]) + ((close[0]-close[1])/close[1]))/2)*100

// Buy Sell Zones using tweaked Connors RSI (RSI values of 80 and 20 for Crypto as well as ma3, ma20, and ma50 are the tweaks)

RSI_SELL = ma20 > ma50 and open > ma3 and RSI >= connor_ob and erection <=4 and window()

RSI_BUY = ma20 < ma50 and ma3 > close and RSI <= connor_os and window()

// Color Definition

col = useCRSI ? (close > ma20 and close < ma3 and RSI <= connor_os ? color.lime : close < ma20 and close > ma3 and RSI <= connor_ob ? color.red : color.yellow ) : color.yellow

// Plot colored RSI Line

plot(RSI, title="RSI", linewidth=3, color=col)

// Shape Plots

plotshape(showRSIBS ? RSI_BUY: na, title = "RSI Buy", style = shape.arrowup, text = "RSI Buy", location = location.bottom, color=color.green, textcolor=color.green, size=size.small)

plotshape(showRSIBS ? RSI_SELL: na, title = "RSI Sell", style = shape.arrowup, text = "RSI Sell", location = location.bottom, color=color.red, textcolor=color.red, size=size.small)

// MACD as another complement to RSI strategy

[macdLine, signalLine, _] = macd(close, fastLength, slowLength, length)

bartrendcolor = macdLine > signalLine and k > 50 and RSI > 50 ? color.teal : macdLine < signalLine and k < 50 and RSI < 50 ? color.maroon : macdLine < signalLine ? color.yellow : color.gray

barcolor(color = color_bars ? bartrendcolor : na)

MACDBuy = crossover(macdLine, signalLine) and macdLine<0 and RSI<RSI_low and window()

MACDSell = crossunder(macdLine, signalLine) and macdLine>0 and RSI>RSI_high and window()

plotshape(showMACD ? MACDBuy: na, title = "MACD Buy", style = shape.arrowup, text = "MACD Buy", color=color.green, textcolor=color.green, size=size.small)

plotshape(showMACD ? MACDSell: na, title = "MACD Sell", style = shape.arrowdown, text = "MACD Sell", color=color.red, textcolor=color.red, size=size.small)

bgcolor(showMACD ? (MACDBuy ? color.teal : MACDSell ? color.maroon : na) : na, title ="MACD Signals", transp=50)

// -------------------------------- Entry and Exit Logic ------------------------------------

// Entry Logic

XRSI_OB = crossunder(RSI, overbought) and window()

RSI_OB = crossover(RSI, overbought) and window()

XRSI_OS = crossover(RSI, oversold) and window()

RSI_OS = crossunder(RSI, oversold) and window()

// Strategy Entry and Exit with built in Risk Management

GoLong = strat_val > -1 ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

GoShort = strat_val < 1 ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

convert_percent_to_points(percent) =>

strategy.position_size != 0 ? round(percent * strategy.position_avg_price / syminfo.mintick) : float(na)

setup_percent(percent) =>

convert_percent_to_points(percent)

if (GoLong)

strategy.entry("LONG", strategy.long)

strategy.exit(id="Exit Long", from_entry = "LONG", loss=setup_percent(stoploss), profit=setup_percent(TargetProfit))

CloseLong = strategy.position_size > 0 ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

if(CloseLong)

strategy.close("LONG")

if (GoShort)

strategy.entry("SHORT", strategy.short)

strategy.exit(id="Exit Short", from_entry = "SHORT", loss=setup_percent(stoploss), profit=setup_percent(TargetProfit))

CloseShort = strat_val < 1 and strategy.position_size < 0 ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

if(CloseShort)

strategy.close("SHORT")