Handelsstrategie für Kanalausbruchsumkehr

Überblick

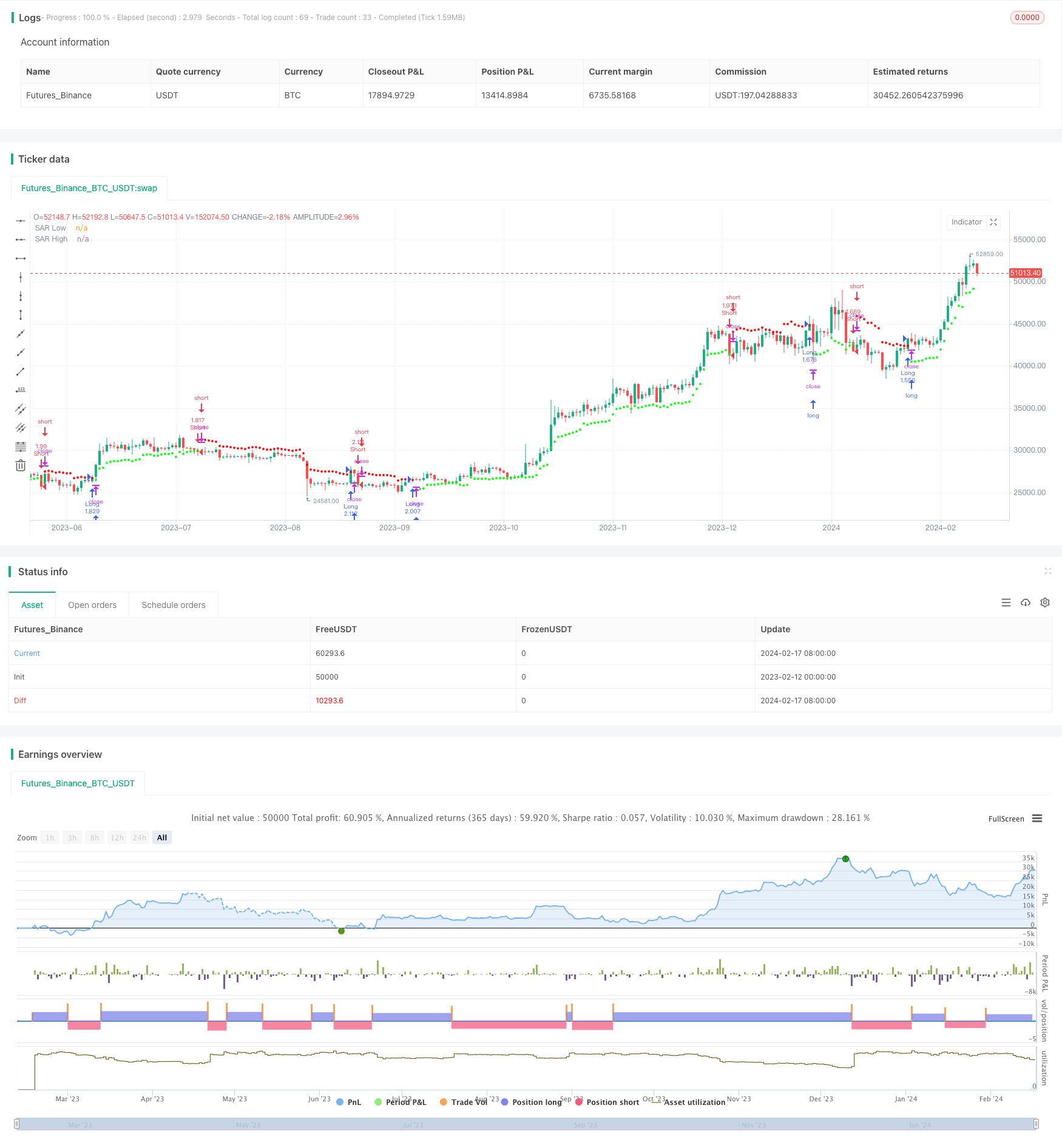

Eine Channel-Breakout-Umkehr-Handelsstrategie ist eine Umkehr-Handelsstrategie, bei der die beweglichen Stopp-Loss-Punkte eines Preiskanals verfolgt werden. Sie berechnet den Preiskanal anhand einer gewichteten Moving-Average-Methode und errichtet Über- oder Leerpositionen, wenn der Preis den Kanal durchbricht.

Strategieprinzip

Die Strategie berechnet zunächst die Preisschwankungen anhand des Wilders Average True Range (ATR) Indikators. Danach wird die Average Range Constant (ARC) anhand des ATR-Wertes berechnet. ARC ist die halbe Breite des Preiskanals.

Konkret berechnet man zunächst den ATR der letzten N-K-Linie. Dann wird mit einem Faktor multipliziert, um ATR zu erhalten. ARC wird mit dem Faktor multipliziert, um die Breite des Kanals zu kontrollieren. ARC plus der höchste Punkt des Abschlusses in der N-K-Linie erhält den Aufschwung des Kanals, also einen hohen SAR.

Strategische Vorteile

- Die Berechnung von Preisschwankungen als Anpassungskanal zur Verfolgung von Marktveränderungen

- Umkehrhandel, geeignet für Trendwende

- Mobile Stop Loss, um Gewinne zu sichern und Risiken zu kontrollieren

Strategisches Risiko

- Umkehrgeschäfte sind leicht zu manipulieren und erfordern entsprechende Parameter.

- In stark schwankenden Märkten ist es leicht, Positionen zu schließen.

- Die falschen Parameter führen zu zu häufigem Handel.

Die Lösung:

- Optimierung der ATR-Zyklen und der ARC-Koeffizienten, um die Durchgangsbreite zu optimieren

- Ein Trend-Filter in Kombination mit einem Trend-Filter

- Erhöhung der ATR-Zyklen und Verringerung der Transaktionsfrequenz

Richtung der Strategieoptimierung

- Optimierung der ATR-Zyklen und des ARC-Faktors

- Erhöhung der Aufnahmebedingungen, beispielsweise in Verbindung mit dem MACD-Index

- Erhöhung der Stop-Loss-Strategie

Zusammenfassen

Die Strategie verwendet die Kanal-Breakout-Umkehr-Handelsstrategie, um Preisänderungen zu verfolgen, Positionen umzukehren, wenn sich die Volatilität verstärkt, und um die Stop-Loss-Anpassung zu ändern. Diese Strategie ist für den umgekehrten Umrechnungsmarkt geeignet und bietet eine gute Investitionsrendite, wenn der Umkehrpunkt genau beurteilt wird.

/*backtest

start: 2023-02-12 00:00:00

end: 2024-02-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//@author=LucF

// Volatility System [LucF]

// v1.0, 2019.04.14

// The Volatility System was created by Welles Wilder.

// It first appeared in his seminal masterpiece "New Concepts in Technical Trading Systems" (1978).

// He describes it on pp.23-26, in the chapter discussing the first presentation ever of the "Volatility Index",

// which later became known as ATR.

// Performance of the strategy usually increases with the time frame.

// Tuning of ATR length and, especially, the ARC factor, is key.

// This code runs as a strategy, which cannot generate alerts.

// If you want to use the alerts it must be converted to an indicator.

// To do so:

// 1. Swap the following 2 lines by commenting the first and uncommenting the second.

// 2. Comment out the last 4 lines containing the strategy() calls.

// 3. Save.

strategy(title="Volatility System by Wilder [LucF]", shorttitle="Volatility System [Strat]", overlay=true, precision=8, pyramiding=0, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1)

// study("Volatility System by Wilder [LucF]", shorttitle="Volatility System", precision=8, overlay=true)

// -------------- Colors

MyGreenRaw = color(#00FF00,0), MyGreenMedium = color(#00FF00,50), MyGreenDark = color(#00FF00,75), MyGreenDarkDark = color(#00FF00,92)

MyRedRaw = color(#FF0000,0), MyRedMedium = color(#FF0000,30), MyRedDark = color(#FF0000,75), MyRedDarkDark = color(#FF0000,90)

// -------------- Inputs

LongsOnly = input(false,"Longs only")

ShortsOnly = input(false,"Shorts only")

AtrLength = input(9, "ATR length", minval=2)

ArcFactor = input(1.8, "ARC factor", minval=0, type=float,step=0.1)

ShowSAR = input(false, "Show all SARs (Stop & Reverse)")

HideSAR = input(false, "Hide all SARs")

ShowTriggers = input(false, "Show Entry/Exit triggers")

ShowTradedBackground = input(false, "Show Traded Background")

FromYear = input(defval = 2000, title = "From Year", minval = 1900)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 1900)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

// -------------- Date range filtering

FromDate = timestamp(FromYear, FromMonth, FromDay, 00, 00)

ToDate = timestamp(ToYear, ToMonth, ToDay, 23, 59)

TradeDateIsAllowed() => true

// -------------- Calculate Stop & Reverse (SAR) points using Average Range Constant (ARC)

Arc = atr(AtrLength)*ArcFactor

SarLo = highest(close, AtrLength)-Arc

SarHi = lowest(close, AtrLength)+Arc

// -------------- Entries/Exits

InLong = false

InShort = false

EnterLong = TradeDateIsAllowed() and not InLong[1] and crossover(close, SarHi[1])

EnterShort = TradeDateIsAllowed() and not InShort[1] and crossunder(close, SarLo[1])

InLong := (InLong[1] and not EnterShort[1]) or (EnterLong[1] and not ShortsOnly)

InShort := (InShort[1] and not EnterLong[1]) or (EnterShort[1] and not LongsOnly)

// -------------- Plots

// SAR points

plot( not HideSAR and ((InShort or EnterLong) or ShowSAR)? SarHi:na, color=MyRedMedium, style=circles, linewidth=2, title="SAR High")

plot( not HideSAR and ((InLong or EnterShort) or ShowSAR)? SarLo:na, color=MyGreenMedium, style=circles, linewidth=2, title="SAR Low")

// Entry/Exit markers

plotshape( ShowTriggers and not ShortsOnly and EnterLong, style=shape.triangleup, location=location.belowbar, color=MyGreenRaw, size=size.small, text="")

plotshape( ShowTriggers and not LongsOnly and EnterShort, style=shape.triangledown, location=location.abovebar, color=MyRedRaw, size=size.small, text="")

// Exits when printing only longs or shorts

plotshape( ShowTriggers and ShortsOnly and InShort[1] and EnterLong, style=shape.triangleup, location=location.belowbar, color=MyRedMedium, transp=70, size=size.small, text="")

plotshape( ShowTriggers and LongsOnly and InLong[1] and EnterShort, style=shape.triangledown, location=location.abovebar, color=MyGreenMedium, transp=70, size=size.small, text="")

// Background

bgcolor( color=ShowTradedBackground? InLong and not ShortsOnly?MyGreenDarkDark: InShort and not LongsOnly? MyRedDarkDark:na:na)

// ---------- Alerts

alertcondition( EnterLong or EnterShort, title="1. Reverse", message="Reverse")

alertcondition( EnterLong, title="2. Long", message="Long")

alertcondition( EnterShort, title="3. Short", message="Short")

// ---------- Strategy reversals

strategy.entry("Long", strategy.long, when=EnterLong and not ShortsOnly)

strategy.entry("Short", strategy.short, when=EnterShort and not LongsOnly)

strategy.close("Short", when=EnterLong and ShortsOnly)

strategy.close("Long", when=EnterShort and LongsOnly)