Stratégie de trading du système de croisement des moyennes mobiles

Aperçu

Cette stratégie est basée sur un système de trading basé sur le croisement des moyennes mobiles. En calculant les moyennes mobiles de différentes périodes, et en définissant le croisement entre les moyennes comme un signal d’achat et de vente. En combinaison avec l’indicateur RSI, le filtrage des signaux de trading réduit la fréquence des transactions et augmente les taux de profit.

Principe de stratégie

Calculer la moyenne rapide, la moyenne moyenne et la moyenne lente. La moyenne rapide et la moyenne lente constituent un canal de transaction.

Faire plus lorsque le prix est au-dessus de la moyenne rapide; faire moins lorsque le prix est en dessous de la moyenne rapide.

Détermination de la direction du canal: ligne moyenne rapide > ligne moyenne rapide à plusieurs têtes; ligne moyenne rapide < ligne moyenne moyenne vide. Ne négociez que si la direction du canal est la même.

La moyenne lente sert de filtre de tendance: on ne fait plus que lorsque le prix est au-dessus de la moyenne lente, et vice versa.

RSI: RSI est supérieur à la ligne de vente et RSI est inférieur à la ligne de vente et RSI est supérieur à la ligne de vente.

Réglage d’arrêt de perte: arrêt de perte ATR, arrêt ATR.

Analyse des avantages

Plusieurs combinaisons homogènes et une flexibilité pour s’adapter aux changements du marché.

L’indicateur RSI évite les fausses ruptures et améliore la qualité du signal.

ATR: arrêt dynamique des pertes et des arrêts pour réduire le risque de rupture de position.

La LME + RSI est doublement filtrée pour éviter les transactions inutiles.

Analyse des risques

Il est possible que le signal de croisement soit en retard.

Le double filtrage peut vous faire rater certaines opportunités de transactions.

L’arrêt de l’ATR peut entraîner des pertes au-delà de la portée normale.

Une mauvaise configuration des paramètres peut entraîner des transactions trop fréquentes ou trop rares.

Les mesures de gestion des risques correspondantes:

Réduire la probabilité de retard en raccourcissant de manière appropriée le cycle de la moyenne.

Ajustez les paramètres de filtrage de manière appropriée pour maintenir une fréquence de transaction modérée.

Ajuster le coefficient ATR pour s’assurer que le stop loss est dans la plage acceptable.

Optimiser les paramètres afin de trouver la meilleure combinaison de paramètres.

Direction d’optimisation

Tester l’efficacité combinée de différents types de ligne uniforme.

Optimisation des paramètres de périodes moyennes différentes.

Test de l’optimisation des paramètres RSI

Optimisation du coefficient d’arrêt ATR.

Optimiser les paramètres de filtration pour trouver l’intensité de filtration optimale.

Résumer

Cette stratégie utilise les trois indicateurs de la moyenne, du RSI et de l’ATR pour configurer un système de trading adapté aux différents marchés grâce à l’optimisation des paramètres. Comparé aux indicateurs techniques uniques, il peut réduire efficacement les faux signaux et améliorer la probabilité de gagner. Cependant, aucune stratégie d’indicateur technique ne peut éviter complètement les risques du marché et nécessite la mise en place d’un système de gestion des risques strict comme garantie.

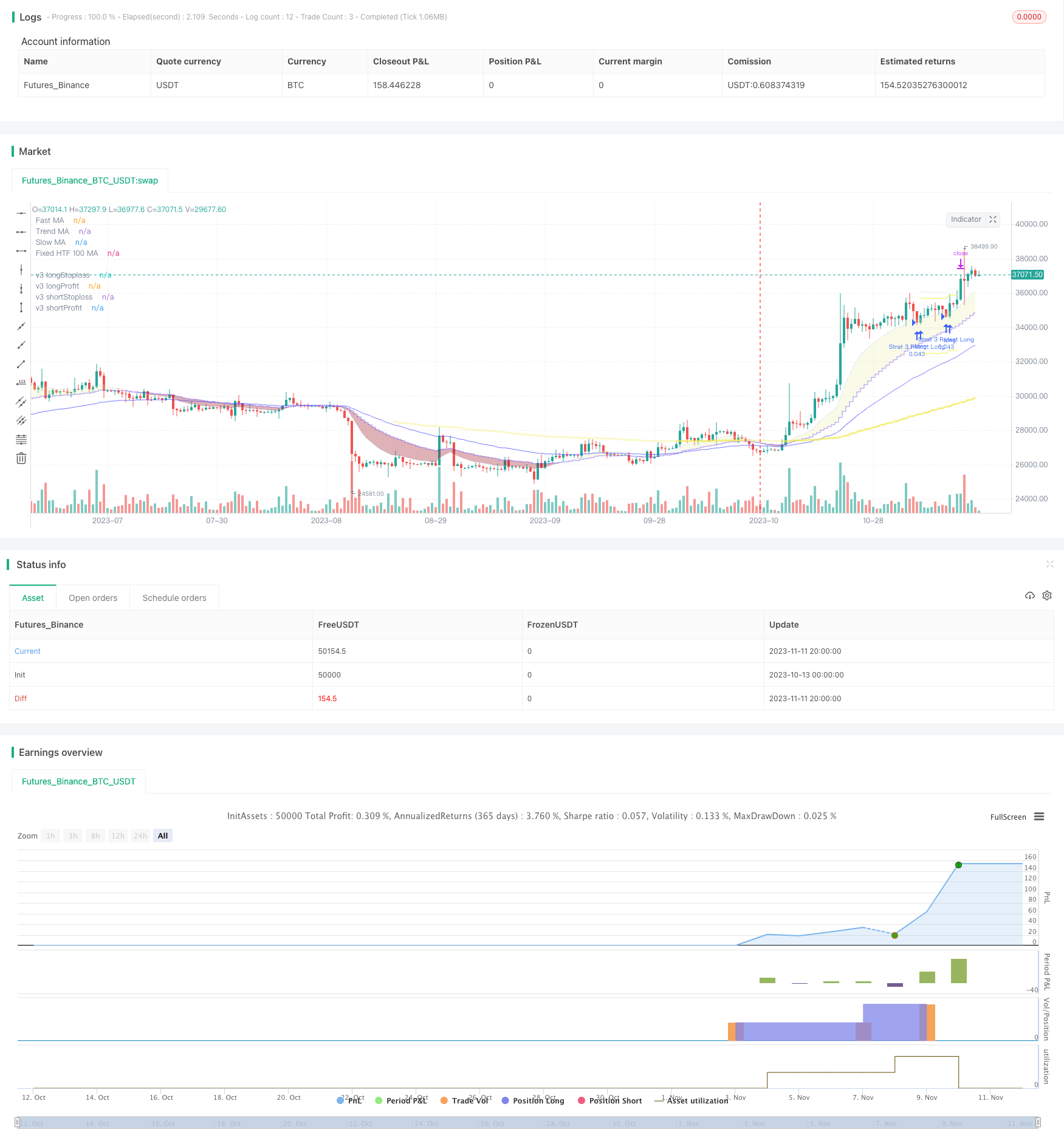

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 12h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// *** USE AT YOUR OWN RISK ***

// FIRST: This is MASSIVELY derived from other people's work...

// I honestly hadn't found a mixed indicator MA strategy tool that does what this now does. If it is out there, apologies!!

// This tool can help backtest various MA trends; can factor in RSI levels (or not); and can factor in a fixed HTF MA (or not).

// You can apply a 'retest entry' or a 'breakout entry', and you can apply various risk mgt for SL/TP orders based on:

// 1) No SL/TP or 2) a fixed %, or 3) dynamic ATR multipliers.

// For those of us who love indicators & analysis, and make no money... and LOVE every day of it :)

// Thank you, tack, salute!

strategy('Negroni MA & RSI Strategy', shorttitle='Negroni MA & RSI Strategy', overlay=true, pyramiding=3, default_qty_type=strategy.percent_of_equity, default_qty_value=3, initial_capital=100000)

// === Inputs ===

//

// Retest or Breakout Strategy

s1 = input(true, title='Retest Entry strategy', group="Trade entry strategy", tooltip = "RETEST entry strat: price crosses UNDER FastMA INTO the 'MA trend zone'. CONFLUENCE checks: 1) Fast MA > Trend MA > SlowMA; AND 2) Price (close) is above fixed HTF MA; AND 3) RSI is above your chosen level. [and vice versa for shorts]. You can effectively 'disable' confluence checks (see info tooltips when selecting your options).")

s2 = input(false, title='Breakout Entry strategy', group="Trade entry strategy", tooltip = "BREAKOUT entry strat: price crosses OVER FastMA OUT the 'MA trend zone'. CONFLUENCE checks: 1) Fast MA > Trend MA > SlowMA; AND 2) Price (close) is above fixed HTF MA; AND 3) RSI is above your chosen level. [and vice versa for shorts]. You can effectively 'disable' confluence checks (see info tooltips when selecting your options).")

// Stop-loss and Take-profit Inputs

v1 = input(false, title='Strat 1) No SL/TP', group="Risk Mgt strategy", tooltip = "Long trades are closed when the LOW crosses back UNDER the fastMA again, and shorts are closed when the HIGH crosses back OVER the fastMA again. (You can select more than 1 strategy.)")

v2 = input(false, title='Strat 2) Static % SL/TP', group="Risk Mgt strategy", tooltip = "Your SL/TP will be a fixed % away from avg. position price... WARNING: You should change this for various asset classes; FX vol is not the same as crypto altcoin vol! (You can select more than 1 strategy.)")

v3 = input(true, title='Strat 3) Dynamic ATR SL/TP', group="Risk Mgt strategy", tooltip = "Your SL/TP is a multiple of your selected ATR range (default is 50, see 'info' when you select ATR range). ATR accounts for the change in vol of different asset classes somewhat, HOWEVER... you should probably still not have the same multiplier trading S&P500 as you would trading crypto altcoins! (You can select more than 1 strategy.)")

v2stoploss_input = input.float(2.5, title='2) Fixed Stop Loss %', minval=0.01, tooltip = "e.g. Avg. long BTCUSDT position price is $23000, and SL is 2.5%. The SL price is: 23000 x (1-0.025) = $22425") / 100

v2takeprofit_input = input.float(3.0, title='2) Fixed Take Profit %', minval=0.01, tooltip = "e.g. Avg. long BTCUSDT position price is $23000, and TP is 3.0%. The TP price is: 23000 x (1+0.030) = $23690") / 100

atrLength=input.int(defval=50, title= '3) ATR Length', minval=1, tooltip = "Standard ATR length is usually 14, however... your SL/TP will move POST entry, and can tighten or widen your initial SL/TP... for better AND usually for worse! Find a trade (strat 3) on the chart, look at the SL/TP lines, now change the number to 5, you'll see.")

v3stoploss_input = input.float(defval=2.0, title= '3) ATR SL Multiplier', minval=1, tooltip = "e.g. Avg. long BTCUSDT position price is $23000, and ATR SL mutliplier is 2.0. Lets say ATR is 200 on this day, then SL price is: 23000 - (2 x ATR) = $22600")

v3takeprofit_input = input.float(defval=2.5, title= '3) ATR TP Multiplier', minval=1, tooltip = "e.g. Avg. long BTCUSDT position price is $23000, and ATR TP mutliplier is 2.5. Lets say ATR is 200 on this day, then TP price is: 23000 + (2.5 x ATR) = $23500")

longv2stoploss_level = strategy.position_avg_price * (1 - v2stoploss_input)

longv2takeprofit_level = strategy.position_avg_price * (1 + v2takeprofit_input)

shortv2stoploss_level = strategy.position_avg_price * (1 + v2stoploss_input)

shortv2takeprofit_level = strategy.position_avg_price * (1 - v2takeprofit_input)

longv3stoploss_level = strategy.position_avg_price - (v3stoploss_input*(ta.atr(atrLength)))

longv3takeprofit_level = strategy.position_avg_price + (v3takeprofit_input*(ta.atr(atrLength)))

shortv3stoploss_level = strategy.position_avg_price + (v3stoploss_input*(ta.atr(atrLength)))

shortv3takeprofit_level = strategy.position_avg_price - (v3takeprofit_input*(ta.atr(atrLength)))

// Plots both long and short SL and TP lines (I wasn't good enough to make this only plot the SL/TP conditional on the entry :( )

plot(v2 and v2stoploss_input and longv2stoploss_level ? longv2stoploss_level : na, title = 'Strat 2) long SL', color=color.new(#e7f6e9, 40), style=plot.style_linebr, linewidth=2, title='v2 longStoploss')

plot(v2 and v2takeprofit_input ? longv2takeprofit_level : na, title = 'Strat 2) long TP', color=color.new(#e7f6e9, 40), style=plot.style_linebr, linewidth=2, title='v2 longProfit')

plot(v2 and v2stoploss_input and shortv2stoploss_level ? shortv2stoploss_level : na, title = 'Strat 2) short SL', color=color.new(#ebf951, 40), style=plot.style_linebr, linewidth=2, title='v2 shortStoploss')

plot(v2 and v2takeprofit_input ? shortv2takeprofit_level : na, title = 'Strat 2) short TP', color=color.new(#ebf951, 40), style=plot.style_linebr, linewidth=2, title='v2 shortProfit')

plot(v3 and v3stoploss_input and longv3stoploss_level ? longv3stoploss_level : na, title = 'Strat 3) long SL', color=color.new(#e7f6e9, 40), style=plot.style_linebr, linewidth=2, title='v3 longStoploss')

plot(v3 and v3takeprofit_input ? longv3takeprofit_level : na, title = 'Strat 3) long TP', color=color.new(#e7f6e9, 40), style=plot.style_linebr, linewidth=2, title='v3 longProfit')

plot(v3 and v3stoploss_input and shortv3stoploss_level ? shortv3stoploss_level : na, title = 'Strat 3) short SL', color=color.new(#ebf951, 40), style=plot.style_linebr, linewidth=2, title='v3 shortStoploss')

plot(v3 and v3takeprofit_input ? shortv3takeprofit_level : na, title = 'Strat 3) short TP', color=color.new(#ebf951, 40), style=plot.style_linebr, linewidth=2, title='v3 shortProfit')

// RSI

rsiLength = input.int(defval=14, title = 'RSI length', minval = 1, group="RSI options")

rsiBuyLevel = input.int(defval=55, title = 'RSI Buy signal', minval = 1, group="RSI options", tooltip = "RSI oversold levels are usually 20-30, some like using 50 as support. If you don't care for RSI levels, then set buy signal at 1... i.e always buys!")

rsiSellLevel = input.int(defval=45, title = 'RSI Sell signal', minval = 1, group="RSI options", tooltip = "RSI overbought levels are usually 70-80, some like using 50 as resistance. If you don't care for RSI levels, then set sell signal at 99... i.e always sells!")

src = close

up = ta.rma(math.max(ta.change(src), 0), rsiLength)

down = ta.rma(-math.min(ta.change(src), 0), rsiLength)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

///// Moving average types and variables ////////

// Fast MA

fastMAtype = input.string(title='Fast MA Type', defval='EMA', options=['EMA', 'SMA', 'VWMA', 'HMA'], group="Fast MA options", tooltip = "The 'Fast MA' and 'Trend MA' will form the MA zone from which your entries will trigger.")

maFastSource = input(defval=close, title='Fast MA Source', group="Fast MA options")

maFastLength = input.int(defval=13, title='Fast MA Period', minval=1, group="Fast MA options")

fastMA = fastMAtype == 'EMA' ? ta.ema(maFastSource, maFastLength) : fastMAtype == 'SMA' ? ta.sma(maFastSource, maFastLength) : fastMAtype == 'VWMA' ? ta.vwma(maFastSource, maFastLength) : ta.hma(maFastSource, maFastLength)

// Trend MA

trendMAtype = input.string(title='Trend MA Type', defval='EMA', options=['EMA', 'SMA', 'VWMA', 'HMA'], group="Trend MA options", tooltip = "The 'Fast MA' and 'Trend MA' will form the MA zone from which your entries will trigger.")

maTrendSource = input(defval=close, title='Trend MA Source', group="Trend MA options")

maTrendLength = input.int(defval=32, title='Trend MA Period', minval=1, group="Trend MA options")

trendMA = trendMAtype == 'EMA' ? ta.ema(maTrendSource, maTrendLength) : trendMAtype == 'SMA' ? ta.sma(maTrendSource, maTrendLength) : trendMAtype == 'VWMA' ? ta.vwma(maTrendSource, maTrendLength) : ta.hma(maTrendSource, maTrendLength)

// Slow MA

slowMAtype = input.string(title='Slow MA Type', defval='EMA', options=['EMA', 'SMA', 'VWMA', 'HMA'], group="Slow MA options", tooltip = "The 'Slow MA' acts as confluence i.e. Only triggers 'longs' above this, and only triggers 'shorts' below it. If you don't care for 'Slow MA' confluence, just change the options to match the 'Trend MA' options you've chosen.")

maSlowSource = input(defval=close, title='Slow MA Source', group="Slow MA options")

maSlowLength = input.int(defval=64, title='Slow MA Period', minval=1, group="Slow MA options")

slowMA = slowMAtype == 'EMA' ? ta.ema(maSlowSource, maSlowLength) : slowMAtype == 'SMA' ? ta.sma(maSlowSource, maSlowLength) : slowMAtype == 'VWMA' ? ta.vwma(maSlowSource, maSlowLength) : ta.hma(maSlowSource, maSlowLength)

// Plot MAs and colour-fills inbetween the fastMA & trendMA to make pretty clouds...

// (if you aren't making art whilst trading, then why even bother!)

fastMAline = plot(fastMA, title='Fast MA', color=color.new(#b9cbef, 60))

trendMAline = plot(trendMA, title='Trend MA', color=color.new(#4b21f3, 50), style=plot.style_stepline)

slowMAline = plot(slowMA, title='Slow MA', color=color.new(#3b3eff, 30))

fill(fastMAline, trendMAline, color=fastMA > trendMA ? color.rgb(232, 234, 163, 70) : color.rgb(155, 17, 30, 60), title='MA Trend Zone', editable = true)

// Fixed 100 MA (e.g. if you are on the 4H, then this will show the 1D 100MA)

fixedMA1type = input.string(title='Fixed MA Type', defval='EMA', options=['EMA', 'SMA', 'VWMA', 'HMA'], group="Fixed HTF MA 1 options", tooltip = "This is the fixed HTF MA used as confluence i.e. Only triggers 'longs' above this, and only triggers 'shorts' below it. If you don't care for HTF confluence, just change the timeframe/options to match the 'Slow MA' options you've chosen.")

ema1FixSource = input(defval=close, title='Fixed EMA Source', group="Fixed HTF MA 1 options")

ema1FixLength = input.int(defval=100, title='Fixed EMA Period', minval=1, group="Fixed HTF MA 1 options")

ema1Res = input.timeframe(title="Fixed EMA Timeframe", defval="D", group="Fixed HTF MA 1 options")

ema1col = input.bool(title="Fixed HTF EMA bull/bear colouring", defval=true, group="Fixed HTF MA 1 options", tooltip = "Meh... this can give the fixed HTF MA line a bull/bear colour. Nothing to see here really.")

ema1smooth = input.bool(title="Smoothed?", defval=false, group="Fixed HTF MA 1 options", tooltip = "Just smoothes the above.")

fixedMA1 = fixedMA1type == 'EMA' ? ta.ema(ema1FixSource, ema1FixLength) : fixedMA1type == 'SMA' ? ta.sma(ema1FixSource, ema1FixLength) : fixedMA1type == 'VWMA' ? ta.vwma(ema1FixSource, ema1FixLength) : ta.hma(ema1FixSource, ema1FixLength)

ema1Step = request.security(syminfo.tickerid, ema1Res, fixedMA1[barstate.isrealtime ? 1 : 0])

ema1Smooth = request.security(syminfo.tickerid, ema1Res, fixedMA1[barstate.isrealtime ? 1 : 0], gaps=barmerge.gaps_on)

plot(ema1smooth ? ema1Smooth : ema1Step, color=ema1col ? (close > ema1Step ? color.rgb(240, 232, 73, 30) : color.rgb(240, 232, 73, 70)) : color.rgb(240, 222, 23, 20), linewidth=3, title="Fixed HTF 100 MA")

// Fixed 200 MA (e.g. if you are on the 4H, then this will show the 1D 200MA)

fixedMA2type = input.string(title='Fixed MA Type', defval='EMA', options=['EMA', 'SMA', 'VWMA', 'HMA'], group="Fixed HTF MA 2 options", tooltip = "This is purely a cosmetic additional feature, for those of us who need more indicators!")

ema2FixSource = input(defval=close, title='Fixed EMA Source', group="Fixed HTF MA 2 options")

ema2FixLength = input.int(defval=200, title='Fixed EMA Period', minval=1, group="Fixed HTF MA 2 options")

ema2Res = input.timeframe(title="Fixed EMA Timeframe", defval="D", group="Fixed HTF MA 2 options")

ema2col = input.bool(title="Fixed HTF EMA bull/bear colouring", defval=true, group="Fixed HTF MA 2 options", tooltip = "Meh... this can give the fixed HTF MA line a bull/bear colour. Nothing to see here really.")

ema2smooth = input.bool(title="Smoothed?", defval=false, group="Fixed HTF MA 2 options", tooltip = "Just smoothes the above.")

fixedMA2 = fixedMA2type == 'EMA' ? ta.ema(ema2FixSource, ema2FixLength) : fixedMA2type == 'SMA' ? ta.sma(ema2FixSource, ema2FixLength) : fixedMA2type == 'VWMA' ? ta.vwma(ema2FixSource, ema2FixLength) : ta.hma(ema2FixSource, ema2FixLength)

ema2Step = request.security(syminfo.tickerid, ema2Res, fixedMA2[barstate.isrealtime ? 1 : 0])

ema2Smooth = request.security(syminfo.tickerid, ema2Res, fixedMA2[barstate.isrealtime ? 1 : 0], gaps=barmerge.gaps_on)

plot(ema2smooth ? ema2Smooth : ema2Step, color=ema2col ? (close > ema2Step ? color.rgb(155, 17, 30, 20) : color.rgb(155, 17, 30, 60)) : color.rgb(155, 17, 30, 20), linewidth=3, title="Fixed HTF 200 MA")

////////////////////////////////////////////////

// ========== TRADE ENTRY PARAMETERS ============

// v1 Retest Strategy Parameters

BBLongTrigger1 = ta.crossunder(close, fastMA)

BBShortTrigger1 = ta.crossover(close, fastMA)

BBcloseLongTrigger1 = ta.crossunder(low, fastMA)

BBcloseShortTrigger1 = ta.crossover(high, fastMA)

MABuyGuard1 = fastMA > trendMA and trendMA > slowMA

MASellGuard1 = fastMA < trendMA and trendMA < slowMA

longFixedMAGuard1 = close > ema1Step

shortFixedMAGuard1 = close < ema1Step

rsiBuyGuard1 = rsi > rsiBuyLevel

rsiSellGuard1 = rsi < rsiSellLevel

// v1 Breakout Strategy Parameters

brBBLongTrigger1 = ta.crossover(close, fastMA)

brBBShortTrigger1 = ta.crossunder(close, fastMA)

// v2 Retest Strategy Parameters

BBLongTrigger2 = ta.crossunder(close, fastMA)

BBShortTrigger2 = ta.crossover(close, fastMA)

BBcloseLongTrigger2 = ta.crossunder(low, fastMA)

BBcloseShortTrigger2 = ta.crossover(high, fastMA)

MABuyGuard2 = trendMA > slowMA and trendMA > slowMA

MASellGuard2 = trendMA < slowMA and trendMA < slowMA

longFixedMAGuard2 = close > ema1Step

shortFixedMAGuard2 = close < ema1Step

rsiBuyGuard2 = rsi > rsiBuyLevel

rsiSellGuard2 = rsi < rsiSellLevel

// v2 Breakout Strategy Parameters

brBBLongTrigger2 = ta.crossover(close, fastMA)

brBBShortTrigger2 = ta.crossunder(close, fastMA)

// v3 Retest Strategy Parameters

BBLongTrigger3 = ta.crossunder(close, fastMA)

BBShortTrigger3 = ta.crossover(close, fastMA)

BBcloseLongTrigger3 = ta.crossunder(low, fastMA)

BBcloseShortTrigger3 = ta.crossover(high, fastMA)

MABuyGuard3 = trendMA > slowMA and trendMA > slowMA

MASellGuard3 = trendMA < slowMA and trendMA < slowMA

longFixedMAGuard3 = close > ema1Step

shortFixedMAGuard3 = close < ema1Step

rsiBuyGuard3 = rsi > rsiBuyLevel

rsiSellGuard3 = rsi < rsiSellLevel

// v3 Breakout Strategy Parameters

brBBLongTrigger3 = ta.crossover(close, fastMA)

brBBShortTrigger3 = ta.crossunder(close, fastMA)

////////////////////////////////////////////////

// ====== TRADE ENTRY TRIGGERS ======

// v1 Retest Signals

Long_1 = BBLongTrigger1 and MABuyGuard1 and rsiBuyGuard1 and longFixedMAGuard1

closeLong_1 = BBcloseLongTrigger1

Short_1 = BBShortTrigger1 and MASellGuard1 and rsiSellGuard1 and shortFixedMAGuard1

closeShort_1 = BBcloseShortTrigger1

if s1 == true and v1 == true

strategy.entry("Strat 1 'Retest' Long", strategy.long, when = Long_1, alert_message = "Strat 1 'Retest' - Buy Signal!")

strategy.close("Strat 1 'Retest' Long", when = closeLong_1, alert_message = "Strat 1 'Retest' - Close Signal!")

strategy.entry("Strat 1 'Retest' Short", strategy.short, when = Short_1, alert_message = "Strat 1 'Retest' - Short Signal!")

strategy.close("Strat 1 'Retest' Short", when = closeShort_1, alert_message = "Strat 1 'Retest' - Close Signal!")

// v1 Breakout Signals

brLong_1 = brBBLongTrigger1 and MABuyGuard1 and rsiBuyGuard1 and longFixedMAGuard1

brcloseLong_1 = BBcloseLongTrigger1

brShort_1 = brBBShortTrigger1 and MASellGuard1 and rsiSellGuard1 and shortFixedMAGuard1

brcloseShort_1 = BBcloseShortTrigger1

if s2 == true and v1 == true

strategy.entry("Strat 1 'Breakout' Long", strategy.long, when = brLong_1, alert_message = "Strat 1 'Breakout' - Buy Signal!")

strategy.close("Strat 1 'Breakout' Long", when = closeLong_1, alert_message = "Strat 1 'Breakout' - Close Signal!")

strategy.entry("Strat 1 'Breakout' Short", strategy.short, when = brShort_1, alert_message = "Strat 1 'Breakout' - Short Signal!")

strategy.close("Strat 1 'Breakout' Short", when = closeShort_1, alert_message = "Strat 1 'Breakout' - Close Signal!")

// v2 Retest Signals

Long_2 = BBLongTrigger2 and MABuyGuard2 and rsiBuyGuard2 and longFixedMAGuard2

Short_2 = BBShortTrigger2 and MASellGuard2 and rsiSellGuard2 and shortFixedMAGuard2

if s1 == true and v2 == true

strategy.entry("Strat 2 Retest Long", strategy.long, when = Long_2, alert_message = "Strat 2 Retest - Buy Signal!")

strategy.exit("SL/TP Strat 2 Retest long", "Strat 2 Retest Long", stop = longv2stoploss_level, limit = longv2takeprofit_level)

strategy.entry("Strat 2 Retest Short", strategy.short, when = Short_2, alert_message = "Strat 2 Retest - Short Signal!")

strategy.exit("SL/TP Strat 2 Retest short", "Strat 2 Retest Short", stop = shortv2stoploss_level, limit = shortv2takeprofit_level)

// v2 Breakout Signals

brLong_2 = brBBLongTrigger2 and MABuyGuard2 and rsiBuyGuard2 and longFixedMAGuard2

brShort_2 = brBBShortTrigger2 and MASellGuard2 and rsiSellGuard2 and shortFixedMAGuard2

if s2 == true and v2 == true

strategy.entry("Strat 2 Breakout Long", strategy.long, when = brLong_2, alert_message = "Strat 2 Breakout - Buy Signal!")

strategy.exit("SL/TP Strat 2 Breakout long", "Strat 2 Breakout Long", stop = longv2stoploss_level, limit = longv2takeprofit_level)

strategy.entry("Strat 2 Breakout Short", strategy.short, when = brShort_2, alert_message = "Strat 2 Breakout - Short Signal!")

strategy.exit("SL/TP Strat 2 Breakout short", "Strat 2 Breakout Short", stop = shortv2stoploss_level, limit = shortv2takeprofit_level)

// v3 Retest Signals

Long_3 = BBLongTrigger3 and MABuyGuard3 and rsiBuyGuard3 and longFixedMAGuard3

Short_3 = BBShortTrigger3 and MASellGuard3 and rsiSellGuard3 and shortFixedMAGuard3

if s1 == true and v3 == true

strategy.entry("Strat 3 Retest Long", strategy.long, when = Long_3, alert_message = "Strat 3 Retest - Buy Signal!")

strategy.exit("SL/TP Strat 3 Retest long", "Strat 3 Retest Long", stop = longv3stoploss_level, limit = longv3takeprofit_level)

strategy.entry("Strat 3 Retest Short", strategy.short, when = Short_3, alert_message = "Strat 3 Retest - Short Signal!")

strategy.exit("SL/TP Strat 3 Retest short", "Strat 3 Retest Short", stop = shortv3stoploss_level, limit = shortv3takeprofit_level)

// v3 Breakout Signals

brLong_3 = brBBLongTrigger3 and MABuyGuard3 and rsiBuyGuard3 and longFixedMAGuard3

brShort_3 = brBBShortTrigger3 and MASellGuard3 and rsiSellGuard3 and shortFixedMAGuard3

if s2 == true and v3 == true

strategy.entry("Strat 3 Breakout Long", strategy.long, when = brLong_3, alert_message = "Strat 3 Breakout - Buy Signal!")

strategy.exit("SL/TP Strat 3 Breakout long", "Strat 3 Breakout Long", stop = longv3stoploss_level, limit = longv3takeprofit_level)

strategy.entry("Strat 3 Breakout Short", strategy.short, when = brShort_3, alert_message = "Strat 3 Breakout - Short Signal!")

strategy.exit("SL/TP Strat 3 Breakout short", "Strat 3 Breakout Short", stop = shortv3stoploss_level, limit = shortv3takeprofit_level)

////////////////////////////////////////////////