Stratégies de suivi de tendance basées sur plusieurs indicateurs

Aperçu

Cette stratégie identifie les tendances en combinant plusieurs indicateurs et définit des arrêts de suivi des tendances pour bloquer les bénéfices. Les principaux indicateurs utilisés pour déterminer le moment d’entrée sont les bandes de Brin, RSI, ADX, ATR et bandes de Brin.

Principe de stratégie

Les principaux indicateurs de jugement de la stratégie sont les bandes de Brin, le RSI et l’ADX. Lorsqu’un prix est proche de la bande de Brin et que le RSI est inférieur à 30, il est jugé comme étant survendu et plus; lorsqu’un prix est proche de la bande de Brin et que le RSI est supérieur à 70, il est jugé comme étant survendu et plus court.

Après l’ouverture d’une position, la stratégie utilise l’indicateur ATR et le train de bullings pour effectuer un arrêt de perte. En particulier, l’ATR est utilisé pour l’amplitude maximale de la perte, qui est arrêtée lorsque le prix atteint le point de perte maximale; le train de bullings est utilisé pour définir le point de perte de suivi, qui est mis à jour en temps réel pour suivre le prix de perte en fonction de l’activité du prix.

Analyse des avantages

Cette stratégie, combinant plusieurs indicateurs de jugement, permet d’identifier efficacement les tendances; et utilise le mécanisme de stop-loss pour verrouiller les bénéfices et réduire le risque de pertes, est une stratégie relativement robuste. Les avantages spécifiques sont les suivants:

- Les bandes de Brin permettent de détecter les situations de survente et de reprise.

- La combinaison avec l’indicateur RSI peut augmenter la précision du jugement

- L’indicateur ADX détermine les tendances et assure la bonne direction des transactions

- ATR et Brinband suivent le stop loss pour maximiser le profit

Analyse des risques

Cette stratégie comporte aussi des risques:

- Les paramètres sont trop faciles à optimiser

- Les signaux de survente sont moins efficaces lorsque les bandes de Brin sont plus larges.

- Un mauvais suivi des pertes peut entraîner une augmentation des pertes

Pour contrer ces risques, nous pouvons prendre les mesures suivantes:

- Optimisation des paramètres multicomposés pour éviter une suroptimisation

- Adaptation des paramètres des bandes de Bryn en fonction des fluctuations du marché

- Tester les paramètres de distance de rupture pour s’assurer qu’ils supportent les fluctuations normales

Direction d’optimisation

Cette stratégie peut également être optimisée dans les directions suivantes:

- Augmentation du contrôle des positions et ajustement de la taille des positions en fonction du multiplicateur de stop loss

- Ajout d’un module de gestion de l’argent et contrôle strict du seuil de perte unique

- Tester d’autres indicateurs de résistance, tels que le DMI, l’Envelop, etc.

- Augmenter la probabilité et l’efficacité des modèles d’apprentissage automatique pour détecter les tendances

Résumer

Cette stratégie est globalement une stratégie de suivi de tendance relativement solide. En déterminant la direction de la tendance à l’aide de plusieurs indicateurs et en utilisant des mesures de stop-loss pour contrôler les risques, on obtient un meilleur taux de rendement des gains. Nous avons également proposé plusieurs directions qui peuvent être optimisées et qui peuvent être mieux optimisées.

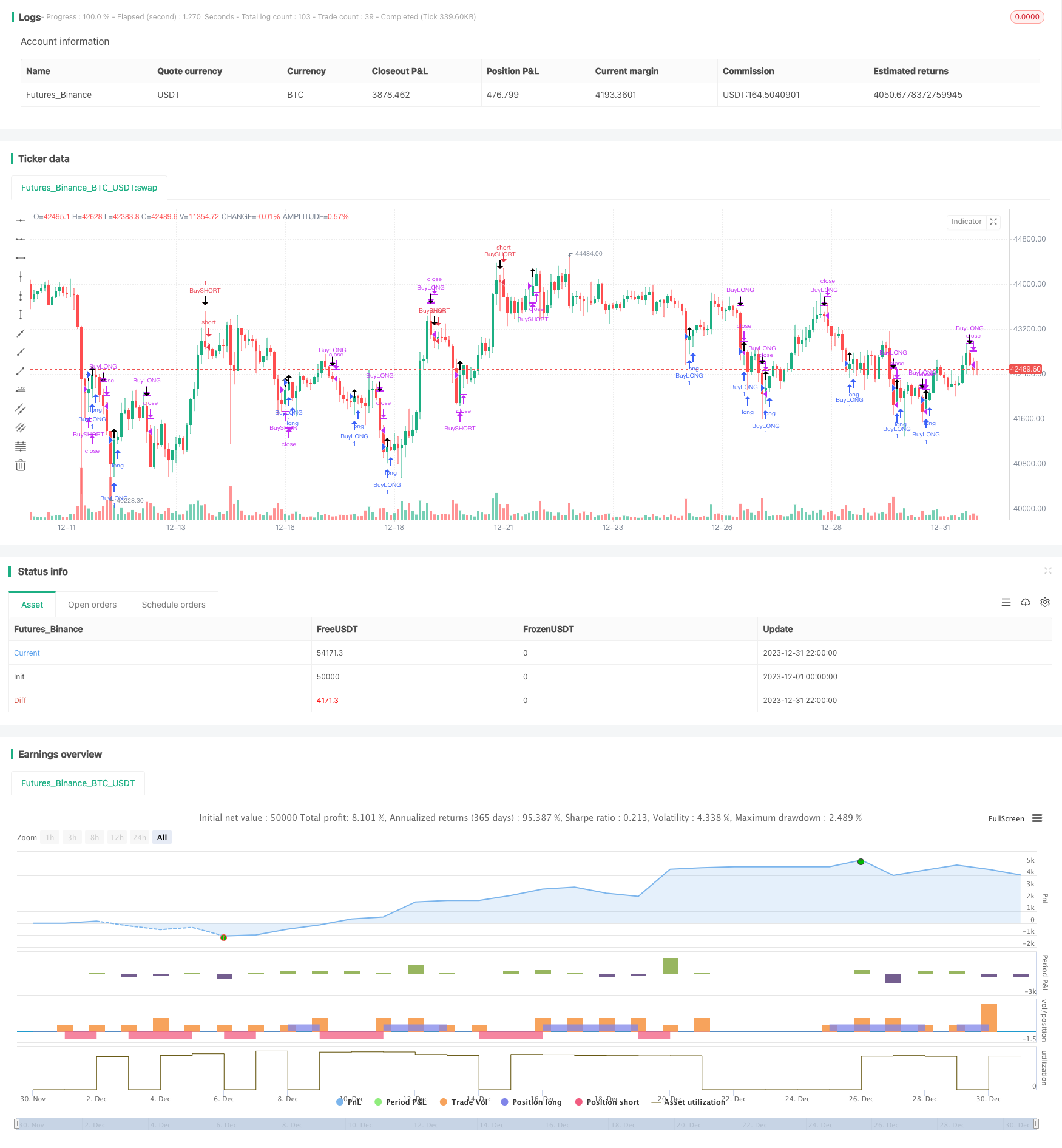

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

// THIS SCRIPT IS MEANT TO ACCOMPANY COMMAND EXECUTION BOTS

// THE INCLUDED STRATEGY IS NOT MEANT FOR LIVE TRADING

// THIS STRATEGY IS PURELY AN EXAMLE TO START EXPERIMENTATING WITH YOUR OWN IDEAS

/////////////////////////////////////////////////////////////////////////////////

// comment out the next line to use this script as an alert script

strategy(title="Dragon Bot - Default Script", overlay=true)

// remove the // in the next line to use this script as an alert script

// study(title="Dragon Bot - Default Script", overlay=true)

// Dragon-Bot default script version 2.0

// This can also be used with bot that reacts to tradingview alerts.

// Use the script as "strategy" for backtesting

// Comment out line 8 and de-comment line 10 to be able to set tradingview alerts.

// You should also comment out (place // before it) the lines 360, 364, 368 and 372 (strategy.entry and strategy.close) to be able to set the alerts.

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

// In this first part of the script we setup variables and make sure the script keeps all information it used in the past. //

/////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

longs = 0

longs := nz(longs[1])

shorts = 0

shorts := nz(shorts[1])

buyprice = 0.0

buyprice := buyprice[1]

sellprice = 0.0

sellprice := sellprice[1]

scaler = 0.0

scaler := scaler[1]

sellprofit = input(1.0, minval=0.0, step=0.1, title="main strat profit")

sellproffinal = sellprofit/100

enable_shorts = input(1, minval=0, maxval=1, title="Shorts on/off")

enable_flipping = input(0, minval=0, maxval=1, title="Flipping on/off -> Go directly from long -> short or short -> long without closing ")

enable_stoploss = input(0, minval=0, maxval=1, title="Stoploss on/off")

sellstoploss = input(30.0, minval=0.0, step=1.0, title="Stoploss %")

sellstoplossfinal = sellstoploss/100

enable_trailing = input(1, minval=0, maxval=1, title="Trailing on/off")

enable_trailing_ATR = input(1, minval=0, maxval=1, title="Trailing use ATR on/off")

ATR_Multi = input(1.0, minval=0.0, step=0.1, title="Multiplier for ATR")

selltrailing = input(10.0, minval=0.0, step=1.0, title="Trailing %")

selltrailingfinal = selltrailing/100

Backtestdate = input(0, minval=0, maxval=1, title="backtest date on/off")

// Component Code by pbergden - Start backtest dates

// The following code snippet is taken from an example by pbergen

// All rights to this snippet remain with pbergden

testStartYear = input(2018, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2019, "Backtest Stop Year")

testStopMonth = input(1, "Backtest Stop Month")

testStopDay = input(1, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

// A switch to control background coloring of the test period

testPeriodBackground = input(title="Color Background?", type=bool, defval=true)

testPeriodBackgroundColor = testPeriodBackground and (time >= testPeriodStart) and (time <= testPeriodStop) ? #00FF00 : na

bgcolor(testPeriodBackgroundColor, transp=97)

testPeriod() => true

/////////////////////////////////////////////////////////////////////////////////////////////////////

// In this second part of the script we setup indicators that we can use for our actual algorithm. //

/////////////////////////////////////////////////////////////////////////////////////////////////////

//ATR

lengthtr = input(20, minval=1, title="ATR Length")

ATRsell = input(0, minval=0, title="1 for added ATR when selling")

ATR=rma(tr(true), lengthtr)

Trail_ATR=rma(tr(true), 10) * ATR_Multi

atr = 0.0

if ATRsell == 1

atr := ATR

//OC2

lengthoc2 = input(20, minval=1, title="OC2 Length")

OC2sell = input(0, minval=0, title="1 for added OC2 when selling")

OC2mult = input(1, minval=1, title="OC2 multiplayer")

OC= abs(open[1]-close)

OC2=rma(OC, lengthoc2)

oc2 = 0.0

if OC2sell == 1

oc2 := OC2*OC2mult

//ADX

lenadx = input(10, minval=1, title="DI Length")

lensig = input(10, title="ADX Smoothing", minval=1, maxval=50)

up = change(high)

down = -change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = rma(tr, lenadx)

plus = fixnan(100 * rma(plusDM, lenadx) / trur)

minus = fixnan(100 * rma(minusDM, lenadx) / trur)

sum = plus + minus

sigadx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), lensig)

//StochRSI

smoothKRSI = input(3, minval=1)

smoothDRSI = input(3, minval=1)

lengthRSI = input(14, minval=1)

lengthStochRSI = input(14, minval=1)

srcRSI = input(close, title="RSI Source")

buyRSI = input(30, minval=1, title="RSI Buy Value")

sellRSI = input(70, minval=1, title="RSI Sell Value")

rsi1 = rsi(srcRSI, lengthRSI)

krsi = sma(stoch(rsi1, rsi1, rsi1, lengthStochRSI), smoothKRSI)

drsi = sma(krsi, smoothDRSI)

// Bollinger bands

lengthbb = input(20, minval=1)

srcbb = input(close, title="Sourcebb")

multbb = input(2.0, minval=0.001, maxval=50)

bb_buy_value = input(0.5, step=0.1, title="BB Buy Value")

bb_sell_value = input(0.5, step=0.1, title="BB Sell Value")

basisbb = sma(srcbb, lengthbb)

devbb = multbb * stdev(srcbb, lengthbb)

upperbb = basisbb + devbb

lowerbb = basisbb - devbb

bbr = (srcbb - lowerbb)/(upperbb - lowerbb)

bbbuy = basisbb - (devbb*bb_buy_value)

bbsell = basisbb + (devbb*bb_sell_value)

//ema very short

shorter = ema(close, 2)

shorterlong = ema(close, 5)

//ema short

short = ema(close, 10)

long = ema(close, 30)

//ema long

shortday = ema(close, 110)

longday = ema(close, 360)

//ema even longer

shortlongerday = ema(close, 240)

longlongerday = ema(close, 720)

//declaring extra timeframe value

profit = request.security(syminfo.tickerid, timeframe.period, close)

////////////////////////////////////////////////////////////////////////

// In the 3rd part of the script we define all the entries and exits //

///////// This third part is basically the acual algorithm ////////////

///////////////////////////////////////////////////////////////////////

//Declaring function with the long entries

OPENLONG_funct() =>

// You can add more buy entries to the script

longentry1 = false

longentry2 = false

longentry3 = false

longentry4 = false

longentry5 = false

makelong_funct = false

if close<bbbuy and krsi<buyRSI // You could for instance add "and shortday > longday"

longentry1 := close>close[1]

// longentry2 := ...

// if another thing we want to buy on happens

// longentry3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more entries, add them in the following list too

makelong_funct := longentry1 or longentry2 or longentry3 or longentry4 or longentry5

//Declaring function wit the short entries

OPENSHORT_funct() =>

// You can add more buy entries to the script

shortentry1 = false

shortentry2 = false

shortentry3 = false

shortentry4 = false

shortentry5 = false

makeshort_funct = false

if close>bbsell and krsi>sellRSI // You could for instance add "and shortday < longday"

shortentry1 := close<close[1]

// shortentry2 := ...

// if another thing we want to buy on happens

// shortentry3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more entries, add them in the following list too

makeshort_funct := shortentry1 or shortentry2 or shortentry3 or shortentry4 or shortentry5

//Declaring function with the long exits

CLOSELONG_funct() =>

// You can add more buy entries to the script

longexit1 = false

longexit2 = false

longexit3 = false

longexit4 = false

longexit5 = false

closelong_funct = false

if close>bbsell and krsi>sellRSI

longexit1 := close<close[1]

// longexit2 := ...

// if another thing we want to close on on happens you can add them here...

// longexit3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more exits, add them in the following list too

closelong_funct := longexit1 or longexit2 or longexit3 or longexit4 or longexit5

//Declaring function wit the short exits

CLOSESHORT_funct() =>

// You can add more buy entries to the script

shortexit1 = false

shortexit2 = false

shortexit3 = false

shortexit4 = false

shortexit5 = false

closeshort_funct = false

if close<bbsell and krsi<sellRSI

shortexit1 := close>close[1]

// shortexit2 := ...

// if another thing we want to close on on happens you can add them here...

// shortexit3 := ...

//All the buy entries go above, this last variable is what the function puts out

// if you add more exits, add them in the following list too

closeshort_funct := shortexit1 or shortexit2 or shortexit3 or shortexit4 or shortexit5

/////////////////////////////////////////////////////////////////////////////////////

////////////// End of "entries" and "exits" definition code /////////////////////////

/////////////////////////////////////////////////////////////////////////////////////

/// In the fourth part we do the actual work, as defined in the part before this ////

////////////////////// This part does not need to be changed ////////////////////////

/////////////////////////////////////////////////////////////////////////////////////

//OPEN LONG LOGIC

makelong = false

//buy with backtesting on specific dates

if Backtestdate > 0 and testPeriod()

if (longs < 1 and shorts < 1) or (short > 0 and enable_flipping > 0 and enable_shorts > 0)

makelong := OPENLONG_funct()

//buy without backtesting on specific dates

if Backtestdate < 1

if (longs < 1 and shorts < 1) or (short > 0 and enable_flipping > 0 and enable_shorts > 0)

makelong := OPENLONG_funct()

if makelong

buyprice := close

scaler := close

longs := 1

shorts := 0

//OPEN SHORT LOGIC

makeshort = false

//buy with backtesting on specific dates

if Backtestdate > 0 and testPeriod()

if (shorts < 1 and longs < 1 and enable_shorts > 0) or (longs > 0 and enable_flipping > 0 and enable_shorts > 0)

makeshort := OPENSHORT_funct()

//buy without backtesting on specific dates

if Backtestdate < 1

if (shorts < 1 and longs < 1 and enable_shorts > 0) or (longs > 0 and enable_flipping > 0 and enable_shorts > 0)

makeshort := OPENSHORT_funct()

if makeshort

buyprice := close

scaler := close

shorts := 1

longs := 0

//Calculating values for traling stop

if longs > 0 and enable_flipping < 1

if close > scaler+Trail_ATR and enable_trailing_ATR > 0

scaler := close

if close > scaler * (1.0 + selltrailingfinal) and enable_trailing_ATR < 1

scaler := close

if shorts > 0 and enable_flipping < 1

if close < scaler-Trail_ATR and enable_trailing_ATR > 0

scaler := close

if close < scaler * (1.0 - selltrailingfinal) and enable_trailing_ATR < 1

scaler := close

long_exit = false

long_security1 = false

long_security2 = false

long_security3 = false

//CLOSE LONG LOGIC

if longs > 0 and enable_flipping < 1

if ( (buyprice + (buyprice*sellproffinal) + atr + oc2) < close) and ( (buyprice + (buyprice*sellproffinal) ) < profit)

long_exit := CLOSELONG_funct()

//security

if enable_stoploss > 0

long_security1 := close < ( buyprice * (1.0 - sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

long_security2 := close < ( scaler * (1.0 - selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

long_security2 := close < ( scaler - Trail_ATR)

//CLOSE LONG LOGIC

if longs > 0 and enable_flipping > 0

//security

if enable_stoploss > 0

long_security1 := close < ( buyprice * (1.0 - sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

long_security2 := close < ( scaler * (1.0 - selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

long_security2 := close < ( scaler - Trail_ATR)

closelong = long_exit or long_security1 or long_security2 or long_security3

short_exit = false

short_security1 = false

short_security2 = false

short_security3 = false

if closelong

longs := 0

//CLOSE SHORT LOGIC

if shorts > 0 and enable_flipping < 1

if ( (buyprice - (buyprice*(sellproffinal) - atr - oc2) > close) and ( (buyprice - (buyprice*sellproffinal) ) > profit) )

short_exit := CLOSESHORT_funct()

//security

if enable_stoploss > 0

short_security1 := close > ( buyprice * (1.0 + sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

short_security2 := close > ( scaler * (1.0 + selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

short_security2 := close > ( scaler + Trail_ATR)

if shorts > 0 and enable_flipping > 0

//security

if enable_stoploss > 0

short_security1 := close > ( buyprice * (1.0 + sellstoplossfinal) )

if enable_trailing > 0 and enable_trailing_ATR < 1

short_security2 := close > ( scaler * (1.0 + selltrailingfinal) )

if enable_trailing > 0 and enable_trailing_ATR > 0

short_security2 := close > ( scaler + Trail_ATR)

closeshort = short_exit or short_security1 or short_security2 or short_security3

if closeshort

shorts := 0

///////////////////////////////////////////////////////////////////////////////////////

///////////// The last section takes care of the alerts //////////////////////////////

//////////////////////////////////////////////////////////////////////////////////////

plotshape(makelong, style=shape.arrowup)

alertcondition(makelong, title="openlong", message="openlong")

strategy.entry("BuyLONG", strategy.long, oca_name="DBCross", when= makelong, comment="Open Long")

plotshape(makeshort, style=shape.arrowdown)

alertcondition(makeshort, title="openshort", message="openshort")

strategy.entry("BuySHORT", strategy.short, oca_name="DBCross", when= makeshort, comment="Open Short")

plotshape(closelong, style=shape.arrowdown)

alertcondition(closelong, title="closelong", message="closelong")

strategy.close("BuyLONG", when=closelong)

plotshape(closeshort, style=shape.arrowup)

alertcondition(closeshort, title="closeshort", message="closeshort")

strategy.close("BuySHORT", when=closeshort)