Stratégie de trading Ichimoku Cloud Nine

Aperçu

La stratégie Ichimoku Cloud Nine est une stratégie de trading basée sur l’indicateur Ichimoku Cloud et combinée avec le classement Williams. La stratégie utilise plusieurs signaux de trading fournis par l’indicateur Ichimoku Cloud pour générer des signaux de trading.

Principe de stratégie

La stratégie est basée principalement sur les signaux d’Ichimoku suivants:

- Le Cloud Breakout: produit un signal lorsque la clôture du prix dépasse le bord supérieur ou inférieur du Cloud

- TK croisement: produit un signal lorsque la ligne de virage (Tenkan) et la ligne de référence (Kijun) se croisent

- Revirement du nuage: un signal est généré lorsque la ligne Senkou Span A et la ligne Senkou Span B se croisent

- Cross-borders: signaux générés lorsque le prix passe d’un côté du nuage à l’autre

En outre, la stratégie se calme dans les cas suivants:

- La clôture de la bourse se termine par une clôture dans les nuages

- TK équilibre à la croisée arrière

- Williams est partiellement à zéro lors de la percée.

Cette stratégie intègre plusieurs signaux de négociation de l’Ichimoku Cloud Graph afin d’améliorer la fiabilité des signaux de négociation tout en utilisant la modélisation pour régler les stop-loss et contrôler les risques.

Avantages stratégiques

Par rapport à la stratégie d’un seul signal, cette stratégie utilise de manière synthétique plusieurs signaux de la carte de nuage Ichimoku, ce qui permet de filtrer certains signaux erronés et d’améliorer l’exactitude du signal. De plus, les paramètres de la stratégie peuvent être configurés de manière flexible pour s’adapter à différentes variétés et optimisations de paramètres.

En outre, l’introduction d’une rupture de la catégorie Williams dans la stratégie permet de contrôler plus activement les risques, de verrouiller les bénéfices et d’éviter des pertes massives.

Risque stratégique

Les principaux risques de cette stratégie sont les suivants:

- L’indicateur Cloud Graph est en retard et ne reflète pas les changements de prix en temps opportun.

- Les signaux multiples peuvent être trop conservateurs et manquer certaines opportunités

- Les pertes dues à la rupture de type

Pour les problèmes de latence, il est possible d’ajuster les paramètres de manière appropriée, ou d’éteindre une partie du signal de filtrage. Pour le risque d’arrêt de tri, il est possible d’ajuster la période de tri, ou seulement une partie de l’arrêt.

Orientation de l’optimisation de la stratégie

Cette stratégie peut être optimisée principalement dans les domaines suivants:

- Ajustez les paramètres Ichimoku pour s’adapter aux différentes périodes et variétés

- Ajuster ou désactiver le filtre partiel, en préservant le signal central

- Ajuster les paramètres de la modélisation, en utilisant une modélisation à plus long terme, ou en utilisant seulement un stop-loss partiel

- Ajouter des filtres pour d’autres indicateurs, tels que les indicateurs de puissance

Résumer

La stratégie Ichimoku Cloud Nine améliore la précision et le taux de victoire des signaux en intégrant plusieurs signaux de trading Ichimoku Cloud Chart, tout en tirant parti des avantages de l’indicateur Cloud Chart. La stratégie utilise également la segmentation comme moyen de contrôle des pertes pour contrôler les risques. La stratégie peut être optimisée par des paramètres et des signaux et s’applique à la négociation d’algorithmes multivariés.

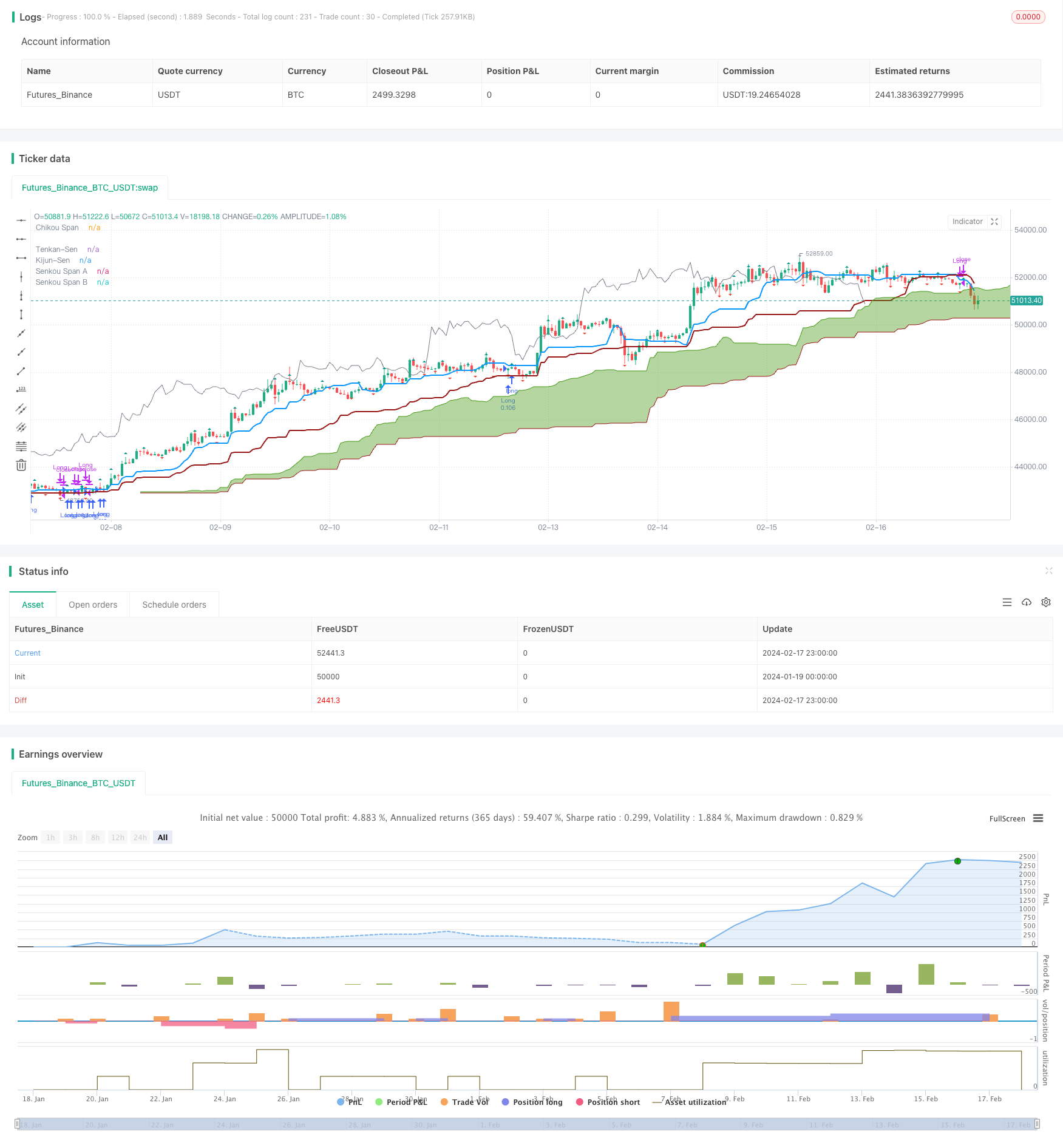

/*backtest

start: 2024-01-19 00:00:00

end: 2024-02-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ichimoku Cloud Nine", shorttitle="Ichimoku Cloud Nine", overlay=true, calc_on_every_tick = true, calc_on_order_fills = false, initial_capital = 5000, currency = "USD", default_qty_type = "percent_of_equity", default_qty_value = 10, pyramiding = 3, process_orders_on_close = true)

color green = #459915

color red = #991515

// --------

// Fractals

// --------

// Define "n" as the number of periods and keep a minimum value of 2 for error handling.

close_on_fractal = input.bool(false, title="Use William Fractals for SL?", group = "Fractals")

n = input.int(title="Periods", defval=2, minval=2, group = "Fractals")

fractal_close_percentage = input.int(100, minval=1, maxval=100, title="Position % to close on fractal breach", group = "Fractals")

selected_fractals_timeframe = input.timeframe('Current', "Timeframe", options=["Current", "1D", "12H", "8H", "4H", "1H"], group = "Fractals", tooltip = "Timeframe to use to look for fractals. Example: if 12H is selected, it will close positions when the last 12H fractal is breached.")

string fractals_timeframe = switch selected_fractals_timeframe

"1D" => "1D"

"12H" => "720"

"8H" => "480"

"4H" => "240"

"1H" => "60"

// Default used when the three first cases do not match.

=> ""

prev_high = request.security(syminfo.tickerid, fractals_timeframe, high)

prev_low = request.security(syminfo.tickerid, fractals_timeframe, low)

period_high=prev_high

period_low=prev_low

// UpFractal

bool upflagDownFrontier = true

bool upflagUpFrontier0 = true

bool upflagUpFrontier1 = true

bool upflagUpFrontier2 = true

bool upflagUpFrontier3 = true

bool upflagUpFrontier4 = true

for i = 1 to n

upflagDownFrontier := upflagDownFrontier and (period_high[n-i] < period_high[n])

upflagUpFrontier0 := upflagUpFrontier0 and (period_high[n+i] < period_high[n])

upflagUpFrontier1 := upflagUpFrontier1 and (period_high[n+1] <= period_high[n] and period_high[n+i + 1] < period_high[n])

upflagUpFrontier2 := upflagUpFrontier2 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+i + 2] < period_high[n])

upflagUpFrontier3 := upflagUpFrontier3 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+3] <= period_high[n] and period_high[n+i + 3] < period_high[n])

upflagUpFrontier4 := upflagUpFrontier4 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+3] <= period_high[n] and period_high[n+4] <= period_high[n] and period_high[n+i + 4] < period_high[n])

flagUpFrontier = upflagUpFrontier0 or upflagUpFrontier1 or upflagUpFrontier2 or upflagUpFrontier3 or upflagUpFrontier4

upFractal = (upflagDownFrontier and flagUpFrontier)

var float upFractalPrice = 0

if (upFractal)

upFractalPrice := period_high[n]

// downFractal

bool downflagDownFrontier = true

bool downflagUpFrontier0 = true

bool downflagUpFrontier1 = true

bool downflagUpFrontier2 = true

bool downflagUpFrontier3 = true

bool downflagUpFrontier4 = true

for i = 1 to n

downflagDownFrontier := downflagDownFrontier and (period_low[n-i] > period_low[n])

downflagUpFrontier0 := downflagUpFrontier0 and (period_low[n+i] > period_low[n])

downflagUpFrontier1 := downflagUpFrontier1 and (period_low[n+1] >= period_low[n] and period_low[n+i + 1] > period_low[n])

downflagUpFrontier2 := downflagUpFrontier2 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+i + 2] > period_low[n])

downflagUpFrontier3 := downflagUpFrontier3 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+3] >= period_low[n] and period_low[n+i + 3] > period_low[n])

downflagUpFrontier4 := downflagUpFrontier4 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+3] >= period_low[n] and period_low[n+4] >= period_low[n] and period_low[n+i + 4] > period_low[n])

flagDownFrontier = downflagUpFrontier0 or downflagUpFrontier1 or downflagUpFrontier2 or downflagUpFrontier3 or downflagUpFrontier4

downFractal = (downflagDownFrontier and flagDownFrontier)

var float downFractalPrice = 0

if (downFractal)

downFractalPrice := period_low[n]

plotshape(downFractal, style=shape.triangledown, location=location.belowbar, offset=-n, color=#F44336, size = size.auto)

plotshape(upFractal, style=shape.triangleup, location=location.abovebar, offset=-n, color=#009688, size = size.auto)

// --------

// Ichimoku

// --------

previous_close = close[1]

conversionPeriods = input.int(20, minval=1, title="Conversion Line Periods", group = "Cloud Settings"),

basePeriods = input.int(60, minval=1, title="Base Line Periods", group = "Cloud Settings")

laggingSpan2Periods = input.int(120, minval=1, title="Lagging Span 2 Periods", group = "Cloud Settings"),

displacement = input.int(30, minval=1, title="Displacement", group = "Cloud Settings")

long_entry = input.bool(true, title="Longs", group = "Entries", tooltip = "Will look for longs")

short_entry = input.bool(true, title="Shorts", group = "Entries", tooltip = "Will look for shorts")

wait_for_twist = input.bool(true, title="Wait for kumo twist?", group = "Entries", tooltip = "Will wait for the Kumo to turn green (longs) or red (shorts)")

ignore_lagging_span = input.bool(true, title="Ignore Lagging Span Signal?", group = "Entries", tooltip = "Will not wait for lagging span to be above/below price and cloud")

bounce_entry = input.bool(true, title="Kijun Bounce", group = "Entries", tooltip = "Will enter position on a Kijun bounce")

e2e_entry = input.bool(true, title="Enable", group = "Edge 2 Edge", tooltip = "Will look for edge-to-edge trades")

e2e_entry_tk_confluence = input.bool(true, title="Require TK Confluence?", group = "Edge 2 Edge", tooltip = "Require confluent TK cross in order to enter an e2e trade")

min_cloud_thickness = input.float(10, minval=1, title="Minimun Cloud Thickness (%)", group = "Edge 2 Edge", tooltip = "Minimum cloud thickness for entering e2e trades")

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

tenkan = donchian(conversionPeriods)

kijun = donchian(basePeriods)

spanA = math.avg(tenkan, kijun)

spanB = donchian(laggingSpan2Periods)

plot(tenkan, color=#0496ff, title="Tenkan-Sen", linewidth = 2)

plot(kijun, color=red, title="Kijun-Sen", linewidth = 2)

plot(close, offset = -displacement, color=color.gray, title="Chikou Span")

p1 = plot(spanA, offset = displacement, color=green, title="Senkou Span A")

p2 = plot(spanB, offset = displacement, color=red, title="Senkou Span B")

fill(p1, p2, color = spanA > spanB ? color.new(green, 50) : color.new(red, 50))

cloud_high = math.max(spanA[displacement], spanB[displacement])

cloud_low = math.min(spanA[displacement], spanB[displacement])

lagging_span_above_price_and_cloud = (close > close[displacement] and close > cloud_high[displacement]) or ignore_lagging_span

lagging_span_below_price_and_cloud = (close < close[displacement] and close < cloud_low[displacement]) or ignore_lagging_span

step1=cloud_high-cloud_low

step2=(cloud_high+cloud_low)/2

cloud_thickness = (step1/step2)*100

// --------

// Trades

// --------

// LONGS

// kumo breakout

if (long_entry and ta.crossover(close, cloud_high) and tenkan > kijun and close > kijun and lagging_span_above_price_and_cloud and (not wait_for_twist or spanA > spanB))

comment = "Long - Kumo Breakout"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// tk cross above cloud

if (long_entry and close > cloud_high and ta.crossover(tenkan, kijun) and lagging_span_above_price_and_cloud and (not wait_for_twist or spanA > spanB))

comment = "Long - TK Cross"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// kumo twist

if (long_entry and close > cloud_high and tenkan > kijun and ta.crossover(spanA, spanB) and lagging_span_above_price_and_cloud)

comment = "Long - Kumo Twist"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// close inside cloud

if (ta.crossunder(close, cloud_high))

comment = "Close Long - Close inside cloud"

strategy.close("Long", comment = comment)

alert(comment, alert.freq_once_per_bar)

// bearish tk cross

if (ta.crossunder(tenkan, kijun))

comment = "Close Long - TK Cross"

strategy.close("Long", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossunder(low, downFractalPrice))

comment = "Close Long - Fractal"

strategy.close("Long", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// SHORTS

// kumo breakout

if (short_entry and ta.crossunder(close, cloud_low) and tenkan < kijun and close < kijun and lagging_span_below_price_and_cloud and (not wait_for_twist or spanA < spanB))

comment = "Short - Kumo Breakout"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// tk cross below cloud

if (short_entry and close < cloud_low and ta.crossunder(tenkan, kijun) and lagging_span_below_price_and_cloud and (not wait_for_twist or spanA < spanB))

comment = "Short - TK Cross"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// kumo twist

if (short_entry and close < cloud_low and tenkan < kijun and lagging_span_below_price_and_cloud and ta.crossunder(spanA, spanB))

comment = "Short - Kumo Twist"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// close inside cloud

if (ta.crossover(close, cloud_low))

comment = "Close Short - Close inside cloud"

strategy.close("Short", comment = comment)

alert(comment, alert.freq_once_per_bar)

// bullish tk cross

if (ta.crossover(tenkan, kijun))

comment = "Close Short - TK Cross"

strategy.close("Short", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossover(high, upFractalPrice))

comment = "Close Short - Fractal"

strategy.close("Short", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// BULL EDGE TO EDGE

if (e2e_entry and e2e_entry_tk_confluence and ta.crossover(close, cloud_low) and tenkan > kijun and open > kijun and cloud_thickness > min_cloud_thickness)

comment = "Long e2e"

strategy.entry("Long e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (e2e_entry and not e2e_entry_tk_confluence and ta.crossover(close, cloud_low) and open > kijun and cloud_thickness > min_cloud_thickness)

comment = "Long e2e"

strategy.entry("Long e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.cross(high, cloud_high))

comment = "Close Long e2e - Target Hit"

strategy.close("Long e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.crossunder(close, cloud_low))

comment = "Close Long e2e - Close below cloud"

strategy.close("Long e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossunder(low, downFractalPrice))

comment = "Close Long e2e - Fractal"

strategy.close("Long e2e", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// BEAR EDGE TO EDGE

if (e2e_entry and e2e_entry_tk_confluence and ta.crossunder(close, cloud_high) and tenkan < kijun and open < kijun and cloud_thickness > min_cloud_thickness)

comment = "Short e2e"

strategy.entry("Short e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (e2e_entry and not e2e_entry_tk_confluence and ta.crossunder(close, cloud_high) and open < kijun and cloud_thickness > min_cloud_thickness)

comment = "Short e2e"

strategy.entry("Short e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.cross(low, cloud_low))

comment = "Close Short e2e - Target Hit"

strategy.close("Short e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.crossover(close, cloud_high))

comment = "Close Short e2e - Close below cloud"

strategy.close("Short e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossover(high, upFractalPrice))

comment = "Close Short e2e - Fractal"

strategy.close("Short e2e", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// Kijun Bounce

if (bounce_entry and long_entry and open > cloud_high and open > kijun and ta.crossunder(low, kijun) and close > kijun and tenkan > kijun and kijun > cloud_high and lagging_span_above_price_and_cloud)

comment = "Long - Kijun Bounce"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (bounce_entry and short_entry and open < cloud_low and open < kijun and ta.crossover(high, kijun) and close < kijun and tenkan < kijun and kijun < cloud_low and lagging_span_below_price_and_cloud)

comment = "Short - Kijun Bounce"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)