Stratégie de trading d'inversion de cassure de canal

Aperçu

Une stratégie de trading inversée de rupture de canal est une stratégie de trading inversée qui suit les points d’arrêt et de perte mobiles des canaux de prix. Elle calcule les canaux de prix en utilisant la méthode des moyennes mobiles pondérées et établit des positions en surplus ou en blanc lorsque les prix franchissent les canaux.

Principe de stratégie

La stratégie utilise d’abord l’indicateur Wilder Average True Range (ATR) pour calculer la volatilité des prix. Ensuite, elle calcule la constante d’intervalle moyenne (ARC) en fonction de la valeur ATR. L’ARC est la moitié de la largeur du canal de prix.

Plus précisément, on calcule d’abord l’ATR de la ligne N à la racine K la plus proche. On obtient ARC en multipliant ATR par un coefficient. ARC est le coefficient qui permet de contrôler la largeur du canal. ARC est le coefficient qui permet d’obtenir une hausse du canal au plus haut point de clôture de la ligne N à la racine K.

Avantages stratégiques

- Les canaux d’adaptation permettent de suivre les fluctuations du marché en utilisant la volatilité des prix.

- Le trading inversé, adapté au marché inversé

- Stop loss mobile, qui permet de verrouiller les bénéfices et de contrôler les risques

Risque stratégique

- Les transactions inversées sont faciles à manipuler et nécessitent des paramètres adaptés.

- Les positions sont facilement fermées dans des marchés très volatils.

- Les paramètres incorrects entraînent des transactions trop fréquentes

La solution est simple:

- Optimisation des cycles ATR et du coefficient ARC pour une largeur de passage raisonnable

- Le filtrage de l’indicateur de tendance en temps réel

- Augmentation des cycles ATR et réduction de la fréquence des transactions

Orientation de l’optimisation de la stratégie

- Optimisation des cycles ATR et du coefficient ARC

- Augmentation des conditions d’ouverture, par exemple en combinant avec l’indicateur MACD

- Augmentation des stratégies de réduction des pertes

Résumer

La stratégie de négociation de retournement de rupture de canal utilise le canal pour suivre les variations de prix, inverser les positions en cas d’intensification de la volatilité et définir un stop-loss mobile adaptatif. Cette stratégie s’applique aux marchés de liquidation dominés par les retournements et permet d’obtenir un bon retour sur investissement en déterminant avec précision le point de retournement.

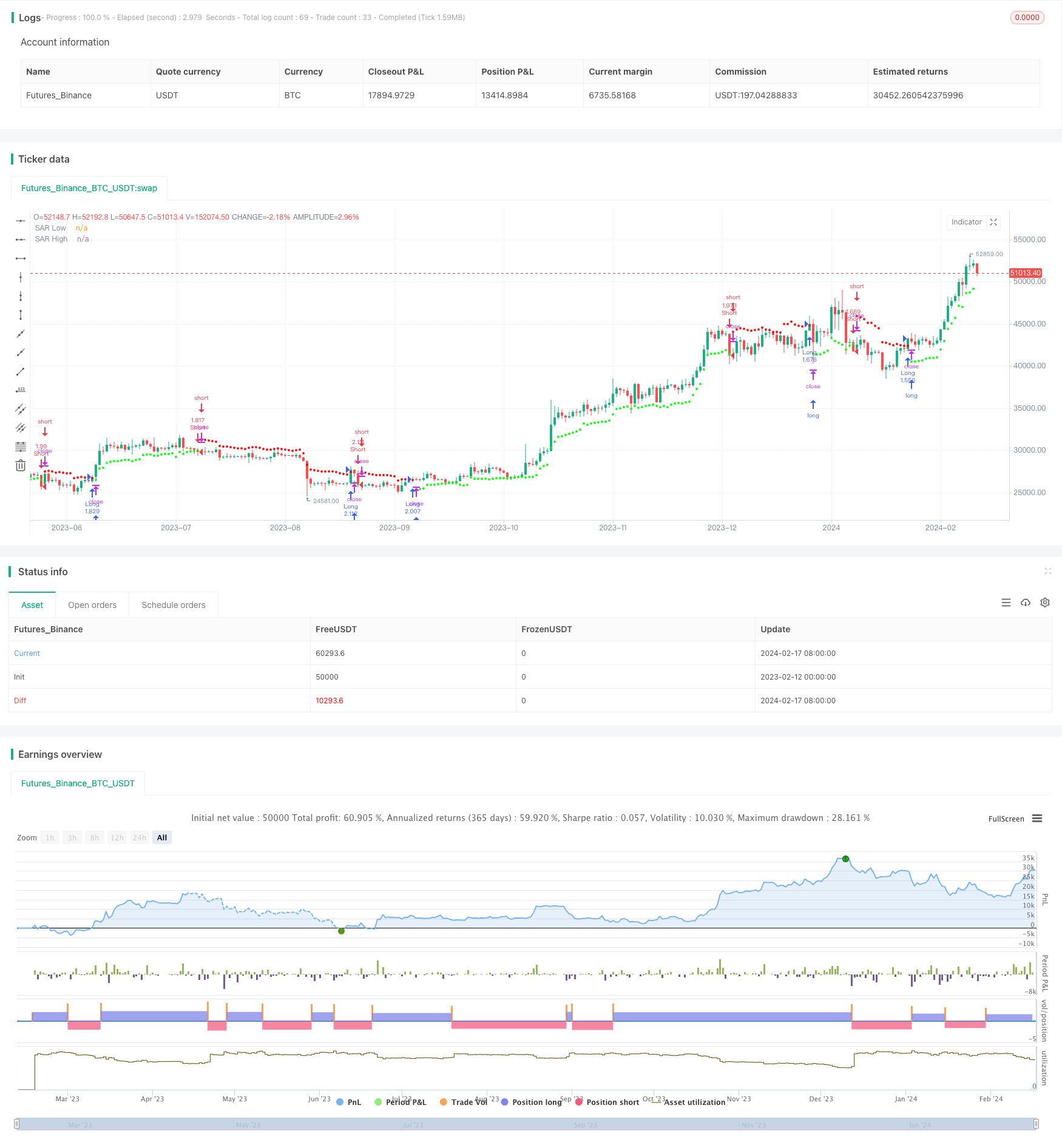

/*backtest

start: 2023-02-12 00:00:00

end: 2024-02-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//@author=LucF

// Volatility System [LucF]

// v1.0, 2019.04.14

// The Volatility System was created by Welles Wilder.

// It first appeared in his seminal masterpiece "New Concepts in Technical Trading Systems" (1978).

// He describes it on pp.23-26, in the chapter discussing the first presentation ever of the "Volatility Index",

// which later became known as ATR.

// Performance of the strategy usually increases with the time frame.

// Tuning of ATR length and, especially, the ARC factor, is key.

// This code runs as a strategy, which cannot generate alerts.

// If you want to use the alerts it must be converted to an indicator.

// To do so:

// 1. Swap the following 2 lines by commenting the first and uncommenting the second.

// 2. Comment out the last 4 lines containing the strategy() calls.

// 3. Save.

strategy(title="Volatility System by Wilder [LucF]", shorttitle="Volatility System [Strat]", overlay=true, precision=8, pyramiding=0, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1)

// study("Volatility System by Wilder [LucF]", shorttitle="Volatility System", precision=8, overlay=true)

// -------------- Colors

MyGreenRaw = color(#00FF00,0), MyGreenMedium = color(#00FF00,50), MyGreenDark = color(#00FF00,75), MyGreenDarkDark = color(#00FF00,92)

MyRedRaw = color(#FF0000,0), MyRedMedium = color(#FF0000,30), MyRedDark = color(#FF0000,75), MyRedDarkDark = color(#FF0000,90)

// -------------- Inputs

LongsOnly = input(false,"Longs only")

ShortsOnly = input(false,"Shorts only")

AtrLength = input(9, "ATR length", minval=2)

ArcFactor = input(1.8, "ARC factor", minval=0, type=float,step=0.1)

ShowSAR = input(false, "Show all SARs (Stop & Reverse)")

HideSAR = input(false, "Hide all SARs")

ShowTriggers = input(false, "Show Entry/Exit triggers")

ShowTradedBackground = input(false, "Show Traded Background")

FromYear = input(defval = 2000, title = "From Year", minval = 1900)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 1900)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

// -------------- Date range filtering

FromDate = timestamp(FromYear, FromMonth, FromDay, 00, 00)

ToDate = timestamp(ToYear, ToMonth, ToDay, 23, 59)

TradeDateIsAllowed() => true

// -------------- Calculate Stop & Reverse (SAR) points using Average Range Constant (ARC)

Arc = atr(AtrLength)*ArcFactor

SarLo = highest(close, AtrLength)-Arc

SarHi = lowest(close, AtrLength)+Arc

// -------------- Entries/Exits

InLong = false

InShort = false

EnterLong = TradeDateIsAllowed() and not InLong[1] and crossover(close, SarHi[1])

EnterShort = TradeDateIsAllowed() and not InShort[1] and crossunder(close, SarLo[1])

InLong := (InLong[1] and not EnterShort[1]) or (EnterLong[1] and not ShortsOnly)

InShort := (InShort[1] and not EnterLong[1]) or (EnterShort[1] and not LongsOnly)

// -------------- Plots

// SAR points

plot( not HideSAR and ((InShort or EnterLong) or ShowSAR)? SarHi:na, color=MyRedMedium, style=circles, linewidth=2, title="SAR High")

plot( not HideSAR and ((InLong or EnterShort) or ShowSAR)? SarLo:na, color=MyGreenMedium, style=circles, linewidth=2, title="SAR Low")

// Entry/Exit markers

plotshape( ShowTriggers and not ShortsOnly and EnterLong, style=shape.triangleup, location=location.belowbar, color=MyGreenRaw, size=size.small, text="")

plotshape( ShowTriggers and not LongsOnly and EnterShort, style=shape.triangledown, location=location.abovebar, color=MyRedRaw, size=size.small, text="")

// Exits when printing only longs or shorts

plotshape( ShowTriggers and ShortsOnly and InShort[1] and EnterLong, style=shape.triangleup, location=location.belowbar, color=MyRedMedium, transp=70, size=size.small, text="")

plotshape( ShowTriggers and LongsOnly and InLong[1] and EnterShort, style=shape.triangledown, location=location.abovebar, color=MyGreenMedium, transp=70, size=size.small, text="")

// Background

bgcolor( color=ShowTradedBackground? InLong and not ShortsOnly?MyGreenDarkDark: InShort and not LongsOnly? MyRedDarkDark:na:na)

// ---------- Alerts

alertcondition( EnterLong or EnterShort, title="1. Reverse", message="Reverse")

alertcondition( EnterLong, title="2. Long", message="Long")

alertcondition( EnterShort, title="3. Short", message="Short")

// ---------- Strategy reversals

strategy.entry("Long", strategy.long, when=EnterLong and not ShortsOnly)

strategy.entry("Short", strategy.short, when=EnterShort and not LongsOnly)

strategy.close("Short", when=EnterLong and ShortsOnly)

strategy.close("Long", when=EnterShort and LongsOnly)