Strategi pembalikan RSI multi-faktor

Ringkasan

Strategi ini menggunakan indikator RSI untuk mengidentifikasi fenomena overbought dan oversold, yang dikombinasikan dengan berbagai faktor tambahan seperti MACD, Stochastic indicator dan lain-lain. Strategi ini bertujuan untuk menangkap peluang pembalikan jangka pendek dan merupakan strategi pembalikan.

Prinsip Strategi

Strategi ini terutama menggunakan indikator RSI untuk menentukan apakah pasar berada dalam keadaan overbought atau oversold. Ketika indikator RSI melebihi batas overbought yang ditetapkan, menunjukkan bahwa pasar mungkin berada dalam keadaan overbought, maka strategi memilih untuk melakukan shorting.

Selain itu, strategi ini juga memperkenalkan beberapa faktor tambahan seperti MACD, Stochastic, dan lain-lain. Faktor-faktor ini berfungsi untuk memfilter beberapa sinyal perdagangan positif palsu yang mungkin muncul. Strategi hanya akan melakukan tindakan perdagangan nyata ketika indikator RSI memberi sinyal dan faktor tambahan juga mendukung sinyal tersebut.

Analisis Keunggulan

Keuntungan terbesar dari strategi ini adalah efisiensi penangkapan yang tinggi, dan peningkatan kualitas sinyal melalui verifikasi multi-faktor. Secara khusus, ini terutama tercermin dalam beberapa aspek berikut:

- Indikator RSI sendiri memiliki kemampuan yang kuat untuk mengidentifikasi rezim pasar, sehingga dapat secara efektif mengidentifikasi fenomena overbought dan oversold.

- Dengan bantuan berbagai alat bantu untuk melakukan verifikasi multi faktor, kualitas sinyal meningkat, dan sejumlah besar hasil positif palsu disaring.

- Strategi tidak sensitif terhadap parameter dan mudah dioptimalkan.

Risiko dan Solusi

Strategi ini juga memiliki beberapa risiko, yang terkonsentrasi pada dua hal:

- Risiko kegagalan pembalikan. Sinyal pembalikan itu sendiri bergantung pada peluang arbitrage statistik, tanpa mengecualikan probabilitas kegagalan pembalikan individu. Risiko dapat dikendalikan dengan menurunkan posisi, atau mengatur stop loss.

- Risiko kerugian dalam situasi bermaju. Strategi secara keseluruhan masih dipimpin oleh manipulasi pasar yang berbalik, dalam situasi bermaju pasti akan terjadi kerugian tertentu. Ini mengharuskan kita untuk menilai tren besar dengan akurat, dan jika perlu dengan intervensi buatan untuk melewati situasi perdagangan yang tidak menguntungkan.

Arah optimasi

Strategi ini perlu dioptimalkan dari beberapa aspek berikut:

- Uji varietas untuk mencari kombinasi parameter optimal. Strategi ini tidak sensitif terhadap parameter, tetapi tetap disarankan untuk mencari parameter optimal untuk varietas yang berbeda.

- Menambahkan mekanisme penarikan diri yang adaptif. Anda dapat menguji cara untuk menambahkan stop loss dinamis, penarikan waktu, dan lain-lain, sehingga strategi lebih sesuai dengan perubahan pasar.

- Masukkan algoritma pembelajaran mesin. Anda dapat mencoba mempelajarinya dengan model untuk menilai probabilitas keberhasilan pembalikan, sehingga meningkatkan kemenangan strategi.

Meringkaskan

Strategi ini secara keseluruhan adalah strategi pembalikan garis pendek. Menggunakan indikator RSI untuk menilai kemampuan overbought dan oversold, sementara menggunakan berbagai alat bantu untuk melakukan verifikasi multi-faktor, sehingga meningkatkan kualitas sinyal. Strategi ini menangkap efisiensi tinggi dan stabilitas yang lebih baik.

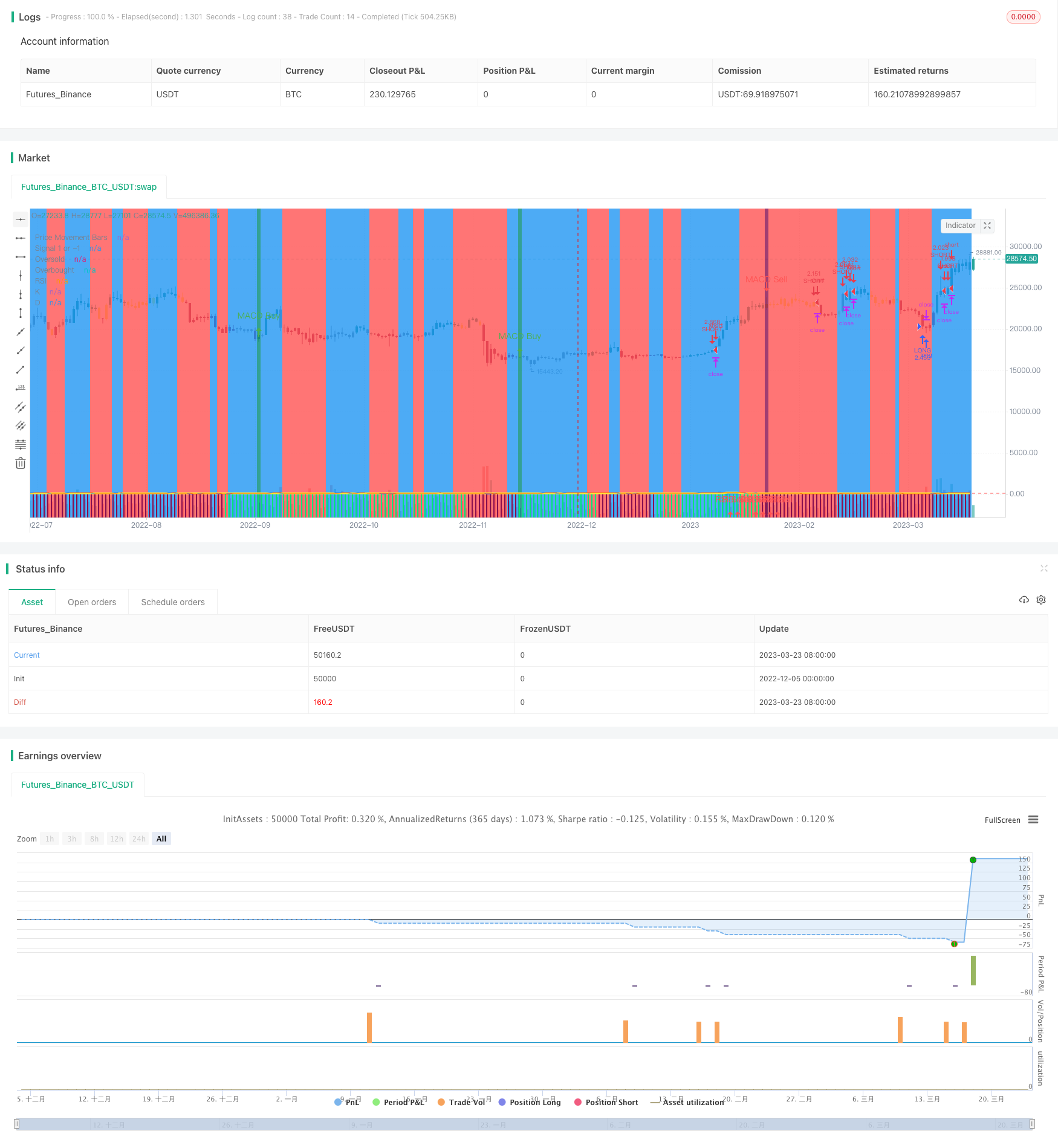

/*backtest

start: 2022-12-05 00:00:00

end: 2023-03-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

strategy(shorttitle='Ain1',title='All in One Strategy', overlay=true, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type=strategy.commission.percent, commission_value=0.18, calc_on_every_tick=true)

kcolor = #0094FF

dcolor = #FF6A00

// ----------------- Strategy Inputs -------------------------------------------------------------

//Backtest dates with auto finish date of today

start = input(defval = timestamp("01 April 2021 00:00 -0500"), title = "Start Time", type = input.time)

finish = input(defval = timestamp("31 December 2021 00:00 -0600"), title = "Start Time", type = input.time)

window() => true

// Strategy Selection - Long, Short, or Both

strat = input(title="Strategy", defval="Long/Short", options=["Long Only", "Long/Short", "Short Only"])

strat_val = strat == "Long Only" ? 1 : strat == "Long/Short" ? 0 : -1

// Risk Management Inputs

sl= input(10.0, "Stop Loss %", minval = 0, maxval = 100, step = 0.01)

stoploss = sl/100

tp = input(20.0, "Target Profit %", minval = 0, maxval = 100, step = 0.01)

TargetProfit = tp/100

// RSI and Stochastic Inputs

length = input(14, "RSI Length", minval=1)

ob_min = input(52, "Overbought Lookback Minimum Value", minval=0, maxval=200)

ob_lb = input(25, "Overbought Lookback Bars", minval=0, maxval=100)

os_min = input(50, "Oversold Lookback Minimum Value", minval=0, maxval=200)

os_lb = input(35, "Oversold Lookback Bars", minval=0, maxval=100)

source = input(title="Source", type=input.source, defval=close)

RSI = rsi(source, length)

// Define f_print function to show key recommendations for RSI

// f_print(_text) =>

// // Create label on the first bar.

// var _label = label(na),

// label.delete(_label),

// _label := label.new(

// time + (time-time[1]),

// ohlc4,

// _text,

// xloc.bar_time,

// yloc.price,

// color(na),

// label.style_none,

// color.gray,

// size.large,

// text.align_left

// )

// Display highest and lowest RSI values

AvgHigh(src,cnt,val) =>

total = 0.0

count = 0

for i = 0 to cnt

if src[i] > val

count := count + 1

total := total + src[i]

round(total / count)

RSI_high = AvgHigh(RSI, ob_lb, ob_min)

AvgLow(src,cnt,val) =>

total = 0.0

count = 0

for i = 5 to cnt by 5

if src[i] < val

count := count + 1

total := total + src[i]

round(total / count)

RSI_low = AvgLow(RSI, os_lb, os_min)

// f_print("Recommended RSI Settings:" + "\nOverbought = " + tostring(RSI_high) + "\nOversold = " + tostring(RSI_low))

overbought= input(62, "Overbought")

oversold= input(35, "Oversold")

// Price Movement Inputs

look_back = input(9,"Look Back Bars")

high_source = input(high,"High Source")

low_source= input(low,"Low Source")

HTF = input("","Curernt or Higher time frame only", type=input.resolution)

// EMA and SMA Background Inputs

smoothK = input(3, "K", minval=1)

smoothD = input(3, "D", minval=1)

k_mode = input("SMA", "K Mode", options=["SMA", "EMA", "WMA"])

// MACD Inputs

fastLength = input(5, minval=1, title="EMA Fast Length")

slowLength = input(10, minval=1, title="EMA Slow Length")

// Selections to show or hide the overlays

showZones = input(true, title="Show Bullish/Bearish Zones")

showStoch = input(true, title="Show Stochastic Overlays")

showRSIBS = input(true, title="Show RSI Buy Sell Zones")

showMACD = input(true, title="Show MACD")

color_bars=input(true, "Color Bars")

useXRSI = input(false, "Use RSI crossing back, select only one")

useMACD = input(false, "Use MACD Only, select only one")

useCRSI = input(false, "Use Tweaked Connors RSI, select only one")

// ------------------ Background Colors based on EMA Indicators -----------------------------------

// Uses standard lengths of 9 and 21, if you want control delete the constant definition and uncomment the inputs

haClose(gap) => (open[gap] + high[gap] + low[gap] + close[gap]) / 4

rsi_ema = rsi(haClose(0), length)

v2 = ema(rsi_ema, length)

v3 = 2 * v2 - ema(v2, length)

emaA = ema(rsi_ema, fastLength)

emaFast = 2 * emaA - ema(emaA, fastLength)

emaB = ema(rsi_ema, slowLength)

emaSlow = 2 * emaB - ema(emaB, slowLength)

// bullish signal rule:

bullishRule =emaFast > emaSlow

// bearish signal rule:

bearishRule =emaFast < emaSlow

// current trading State

ruleState = 0

ruleState := bullishRule ? 1 : bearishRule ? -1 : nz(ruleState[1])

bgcolor(showZones ? ( ruleState==1 ? color.blue : ruleState==-1 ? color.red : color.gray ) : na , title=" Bullish/Bearish Zones", transp=95)

// ------------------ Stochastic Indicator Overlay -----------------------------------------------

// Calculation

// Use highest highs and lowest lows

h_high = highest(high_source ,look_back)

l_low = lowest(low_source ,look_back)

stoch = stoch(RSI, RSI, RSI, length)

k =

k_mode=="EMA" ? ema(stoch, smoothK) :

k_mode=="WMA" ? wma(stoch, smoothK) :

sma(stoch, smoothK)

d = sma(k, smoothD)

k_c = change(k)

d_c = change(d)

kd = k - d

// Plot

signalColor = k>oversold and d<overbought and k>d and k_c>0 and d_c>0 ? kcolor :

k<overbought and d>oversold and k<d and k_c<0 and d_c<0 ? dcolor : na

kp = plot(showStoch ? k : na, "K", transp=80, color=kcolor)

dp = plot(showStoch ? d : na, "D", transp=80, color=dcolor)

fill(kp, dp, color = signalColor, title="K-D", transp=88)

signalUp = showStoch ? not na(signalColor) and kd>0 : na

signalDown = showStoch ? not na(signalColor) and kd<0 : na

plot(signalUp ? kd : na, "Signal Up", color=kcolor, transp=90, style=plot.style_columns)

plot(signalDown ? (kd+100) : na , "Signal Down", color=dcolor, transp=90, style=plot.style_columns, histbase=100)

// -------------- Add Price Movement to Strategy for better visualization -------------------------

// Calculations

h1 = vwma(high, length)

l1 = vwma(low, length)

hp = h_high[1]

lp = l_low[1]

// Plot

var plot_color=#353535

var sig = 0

if (h1 >hp)

sig:=1

plot_color:=color.lime

else if (l1 <lp)

sig:=-1

plot_color:=color.maroon

plot(1,title = "Price Movement Bars", style=plot.style_columns,color=plot_color)

plot(sig,title="Signal 1 or -1",display=display.none)

// --------------------------------------- RSI Plot ----------------------------------------------

// Plot Oversold and Overbought Lines

over = hline(oversold, title="Oversold", color=color.green)

under = hline(overbought, title="Overbought", color=color.red)

fill(over, under, color=#9915FF, transp=90, title="Band Background")

// Show RSI and EMA crosses with arrows and RSI Color (tweaked Connors RSI)

// Improves strategy setting ease by showing where EMA 5 crosses EMA 10 from above to confirm overbought conditions or trend reversals

// This shows where you should enter shorts or exit longs

// Tweaked Connors RSI Calculation

connor_ob = 80

connor_os = 20

ma3 = sma(close,3)

ma20 = sma(close, 20)

ma50 = sma(close, 50)

erection = ((((close[1]-close[2])/close[2]) + ((close[0]-close[1])/close[1]))/2)*100

// Buy Sell Zones using tweaked Connors RSI (RSI values of 80 and 20 for Crypto as well as ma3, ma20, and ma50 are the tweaks)

RSI_SELL = ma20 > ma50 and open > ma3 and RSI >= connor_ob and erection <=4 and window()

RSI_BUY = ma20 < ma50 and ma3 > close and RSI <= connor_os and window()

// Color Definition

col = useCRSI ? (close > ma20 and close < ma3 and RSI <= connor_os ? color.lime : close < ma20 and close > ma3 and RSI <= connor_ob ? color.red : color.yellow ) : color.yellow

// Plot colored RSI Line

plot(RSI, title="RSI", linewidth=3, color=col)

// Shape Plots

plotshape(showRSIBS ? RSI_BUY: na, title = "RSI Buy", style = shape.arrowup, text = "RSI Buy", location = location.bottom, color=color.green, textcolor=color.green, size=size.small)

plotshape(showRSIBS ? RSI_SELL: na, title = "RSI Sell", style = shape.arrowup, text = "RSI Sell", location = location.bottom, color=color.red, textcolor=color.red, size=size.small)

// MACD as another complement to RSI strategy

[macdLine, signalLine, _] = macd(close, fastLength, slowLength, length)

bartrendcolor = macdLine > signalLine and k > 50 and RSI > 50 ? color.teal : macdLine < signalLine and k < 50 and RSI < 50 ? color.maroon : macdLine < signalLine ? color.yellow : color.gray

barcolor(color = color_bars ? bartrendcolor : na)

MACDBuy = crossover(macdLine, signalLine) and macdLine<0 and RSI<RSI_low and window()

MACDSell = crossunder(macdLine, signalLine) and macdLine>0 and RSI>RSI_high and window()

plotshape(showMACD ? MACDBuy: na, title = "MACD Buy", style = shape.arrowup, text = "MACD Buy", color=color.green, textcolor=color.green, size=size.small)

plotshape(showMACD ? MACDSell: na, title = "MACD Sell", style = shape.arrowdown, text = "MACD Sell", color=color.red, textcolor=color.red, size=size.small)

bgcolor(showMACD ? (MACDBuy ? color.teal : MACDSell ? color.maroon : na) : na, title ="MACD Signals", transp=50)

// -------------------------------- Entry and Exit Logic ------------------------------------

// Entry Logic

XRSI_OB = crossunder(RSI, overbought) and window()

RSI_OB = crossover(RSI, overbought) and window()

XRSI_OS = crossover(RSI, oversold) and window()

RSI_OS = crossunder(RSI, oversold) and window()

// Strategy Entry and Exit with built in Risk Management

GoLong = strat_val > -1 ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

GoShort = strat_val < 1 ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

convert_percent_to_points(percent) =>

strategy.position_size != 0 ? round(percent * strategy.position_avg_price / syminfo.mintick) : float(na)

setup_percent(percent) =>

convert_percent_to_points(percent)

if (GoLong)

strategy.entry("LONG", strategy.long)

strategy.exit(id="Exit Long", from_entry = "LONG", loss=setup_percent(stoploss), profit=setup_percent(TargetProfit))

CloseLong = strategy.position_size > 0 ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

if(CloseLong)

strategy.close("LONG")

if (GoShort)

strategy.entry("SHORT", strategy.short)

strategy.exit(id="Exit Short", from_entry = "SHORT", loss=setup_percent(stoploss), profit=setup_percent(TargetProfit))

CloseShort = strat_val < 1 and strategy.position_size < 0 ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

if(CloseShort)

strategy.close("SHORT")