Strategi Kuantitatif Gabungan Triple Moving Average dan MACD

Ringkasan

Strategi ini menggunakan kombinasi indikator Triple Moving Average dan MACD untuk mengembangkan strategi perdagangan kuantitatif yang lebih stabil dan dapat diandalkan. Strategi ini dirancang untuk menangkap tren yang mungkin muncul di masa depan, terutama untuk posisi medium dan panjang.

Prinsip Strategi

Strategi ini didasarkan pada kombinasi antara triple moving average dan MACD.

Pertama, strategi ini menggunakan tiga rata-rata bergerak ponential dengan panjang 3, 7 dan 2. Tiga rata-rata bergerak ini membangun sistem rata-rata bergerak cepat dan lambat untuk menentukan arah tren masa depan.

Kedua, strategi ini juga menggunakan indikator MACD dengan parameter 3 dan 7. Ketika MACD melintasi garis sinyal di jalur utama sebagai sinyal ganda, dan melintasi jalur bawah sebagai sinyal kosong.

Dengan menggunakan indikator ganda dalam kombinasi, Anda dapat menghindari beberapa kesalahan sinyal yang disebabkan oleh indikator tunggal, sehingga meningkatkan stabilitas strategi.

Keunggulan Strategis

- Filter ganda untuk meningkatkan kualitas sinyal

- Parameter telah dioptimalkan melalui beberapa kali pengujian, stabil dan dapat diandalkan

- Sistem Triple Moving Average yang efektif memfilter kebisingan pasar untuk mengevaluasi tren masa depan

- Pengaturan parameter indikator MACD lebih cepat, dapat menangkap peluang jangka pendek dengan cepat

Risiko Strategis

- Ada beberapa risiko penarikan dan kerugian berkelanjutan

- Strategi ini menghasilkan lebih banyak perdagangan yang salah ketika tidak ada tren yang jelas di pasar.

- Indikator MACD mudah menghasilkan sinyal yang salah dan perlu digunakan dalam kombinasi dengan indikator garis rata-rata

Solusi:

- Menggunakan strategi stop loss yang tepat untuk mengendalikan penarikan maksimum

- Kurangi frekuensi transaksi saat keadaan pasar tidak menunjukkan tren

- Optimalkan parameter MACD dan gunakan dengan kombinasi indikator lainnya

Arah optimasi strategi

- Uji dan optimalkan parameter moving average dan MACD untuk menemukan kombinasi terbaik

- Menambahkan indikator tambahan seperti KDJ, VRSI dan lain-lain untuk menghindari sinyal yang salah

- Menggunakan model pembelajaran mesin untuk mengevaluasi keadaan pasar dan melakukan penyesuaian secara dinamis

- Setel Stop Loss Optimal dengan Strategi Stop Loss

Meringkaskan

Strategi ini memungkinkan untuk menangkap tren yang stabil melalui kombinasi antara moving average dan MACD. Keunggulan strategi ini adalah bahwa penggunaan kombinasi indikator dapat secara efektif mengurangi sinyal yang salah, sehingga mendapatkan efek strategi yang lebih baik. Selanjutnya, strategi ini disempurnakan lebih lanjut dengan cara pengoptimalan parameter, pengenalan strategi stop loss, dan penyesuaian dinamis, sehingga menjadi alat yang efektif untuk mencari peluang garis tengah.

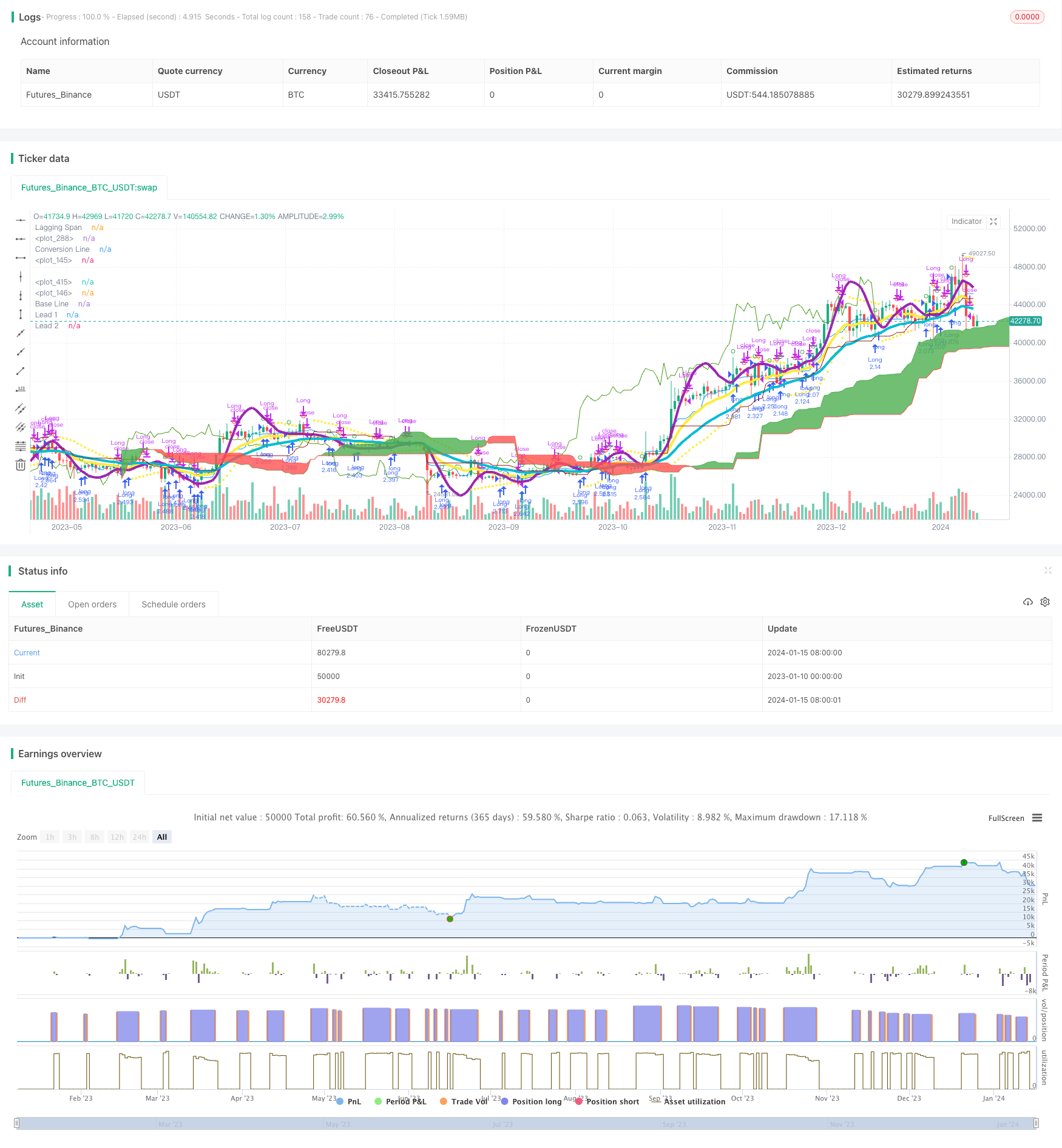

/*backtest

start: 2023-01-10 00:00:00

end: 2024-01-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Matt's MACD Algo v1", shorttitle="Matt's MACD Algo v1", overlay=true, pyramiding = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=7000, calc_on_order_fills = true, commission_type=strategy.commission.percent, commission_value=0, currency = currency.USD)

//study("MFI Fresh", shorttitle="MFI Fresh", overlay=true)

//Risk Management Settings

//trategy.risk.max_drawdown(20, strategy.percent_of_equity)

//strategy.risk.max_intraday_loss(10, strategy.percent_of_equity)

//strategy.risk.max_cons_loss_days(3)

/////////////////

ts = input(title="Trailing Stop in cents", defval=50)/100

//Time Inputs

FromMonth = input(defval = 6, title = "From Month", minval = 1)

FromDay = input(defval = 1, title = "From Day", minval = 1)

FromYear = input(defval = 2017, title = "From Year", minval = 1)

ToMonth = input(defval = 1, title = "To Month", minval = 1)

ToDay = input(defval = 1, title = "To Day", minval = 1)

ToYear = input(defval = 9999, title = "To Year", minval = 1)

//Time Variable

testPeriod() =>

(time > timestamp(FromYear, FromMonth, FromDay, 09, 30)) and (time < timestamp(ToYear, ToMonth, ToDay, 09, 29))

//MA On and MA Colors On? Inputs

switch1=input(false, title="Enable Bar Color?")

switch2=input(true, title="Enable Moving Averages?")

switch3=input(false, title="Enable Background Color?")

switch4=input(false, title="Enable Bolinger Bands?")

switch5=input(false, title="Enable Keltner Channel?")

////////////////////////////////Williams %R

R_length = input(14, minval=1)

R_overBought = input(title="%R Overbought", defval=80)

R_overSold = input(title="%R Oversold", defval=20)

R_upper = highest(R_length)

R_lower = lowest(R_length)

R_out = 100 * (close - R_upper) / (R_upper - R_lower)

WilliamsR_longEntry = crossover(R_out, R_overSold)

WilliamsR_shortEntry = crossunder(R_out, R_overBought)

//plot(R_out)

//R_band1 = hline(R_overSold)

//R_band0 = hline(R_overBought)

//fill(R_band1, R_band0)

////////////////////////////////RSI Variables

rsi_source = close

RSI_Length = input(title="RSI Length", defval=3)

RSI_overBought = input(title="RSI Overbought", defval=80)

RSI_overSold = input(title="RSI Oversold", defval=20)

up = rma(max(change(rsi_source), 0), RSI_Length)

down = rma(-min(change(rsi_source), 0), RSI_Length)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

RSI_longEntry = rsi > 50

//crossover(rsi, RSI_overSold)

RSI_shortEntry = rsi < 50

//crossunder(rsi, RSI_overBought)

//plot(rsi, color=purple)

//band1 = hline(RSI_overBought)

//band0 = hline(RSI_overSold)

//fill(band1, band0, color=purple, transp=90)

//////////////////////Commodity Channel Index

cci_length = input(20, minval=1)

cci_src = input(close, title="Source")

cci_ma = sma(cci_src, cci_length)

cci = (cci_src - cci_ma) / (0.015 * dev(cci_src, cci_length))

cci_longEntry = crossover(cci, -100)

cci_shortEntry = crossunder(cci, 100)

//plot(cci, color=olive)

//cci_band1 = hline(100, color=gray, linestyle=dashed)

//cci_band0 = hline(-100, color=gray, linestyle=dashed)

//fill(cci_band1, cci_band0, color=olive)

//MFI Inputs

MFI_length = input(title="MFI Length", defval=3)

MFI_overBought = input(title="MFI Overbought", defval=80)

MFI_overSold = input(title="MFI Oversold", defval=20)

//MFI Variables

rawMoneyFlow = hlc3 * volume

positiveMoneyFlow = 0.0

positiveMoneyFlow := hlc3 > hlc3[1] ? positiveMoneyFlow + rawMoneyFlow : positiveMoneyFlow

negativeMoneyFlow = 0.0

negativeMoneyFlow := hlc3 < hlc3[1] ? negativeMoneyFlow + rawMoneyFlow : negativeMoneyFlow

moneyFlowRatio = sma(positiveMoneyFlow, MFI_length) / sma(negativeMoneyFlow, MFI_length)

moneyFlowIndex = 100 - 100 / (1 + moneyFlowRatio)

MFI_longEntry = (crossover(moneyFlowIndex, MFI_overSold))

MFI_shortEntry = (crossunder(moneyFlowIndex, MFI_overBought))

///// MFI Plot for STUDY

//plot(moneyFlowIndex, color=#459915)

//MFI_OB=hline(MFI_overBought, title="Overbought", color=#c0c0c0)

//MFI_OS=hline(MFI_overSold, title="Oversold", color=#c0c0c0)

//fill(MFI_overBought, MFI_overSold, color=#9915ff, transp=90)

////VERY SLOW SMA

veryslowLength=input(50,minval=1, title="Very slow SMA")

veryslowSMA = sma(close, veryslowLength)

//MACD Inputs

source = input(close, title="MACD source")

fastLength = input(title="MACD Fast Length", defval=12)

fastLength2 = input(title="MACD Fast Length #2", defval=3)

slowLength = input(title="MACD Slow Length", defval=26)

slowLength2 = input(title="MACD Slow Length #2", defval=7)

MACD_fastsignalSmoothing = input(title="Signal Smoothing", defval=7)

MACD_slowsignalSmoothing = input(title="Signal Smoothing", defval=12)

MACD_fastsignalSmoothing2 = input(title="Signal Smoothing #2", defval=5)

MACD_slowsignalSmoothing2 = input(title="Signal Smoothing #2", defval=9)

MACD_percentthreshold = input(title="MACD % Threshold", defval=-0.0030, step=0.0001)

//MACD variables

fastEMA = ema(source, fastLength)

fastEMA2 = ema(source, fastLength2)

slowEMA = ema(source, slowLength)

slowEMA2 = ema(source, slowLength2)

MACD_Line = fastEMA - slowEMA

MACD_Line2 = fastEMA2 - slowEMA2

MACD_fastsignalLine = ema(MACD_Line, MACD_fastsignalSmoothing)

MACD_slowsignalLine = ema(MACD_Line, MACD_slowsignalSmoothing)

MACD_fastsignalLine2 = ema(MACD_Line2, MACD_fastsignalSmoothing2)

MACD_slowsignalLine2 = ema(MACD_Line2, MACD_slowsignalSmoothing2)

fasthist = MACD_Line - MACD_slowsignalLine

MACD_Histogram2 = MACD_Line2 - MACD_fastsignalLine2

minimum = close * MACD_percentthreshold

SMA = sma(MACD_Line, 10)

// MACD and veryslowSMA Plot for STRATEGY

Fast=plot(switch2?fastEMA:na,color=yellow, linewidth=4)

Slow=plot(switch2?slowEMA:na,color=aqua, linewidth=4)

//VerySlow=plot(switch2?veryslowSMA:na,color=purple,linewidth=4)

//fill(Fast,VerySlow,color=gray)

/////// MACD Plots for STUDY

//plot(fasthist, color=fasthist>0 and fasthist[0]>fasthist[1]?#00ff00:fasthist<=0 and fasthist[0]<fasthist[1]?#f72e2e:fasthist>0 and fasthist[0]<fasthist[1]?#008000:fasthist<0 and fasthist[0]>fasthist[1]?#7f0000:white, style=histogram)

//plot(slowhist, color=slowhist>0 and slowhist[0]>slowhist[1]?#00ff00:slowhist<=0 and slowhist[0]<slowhist[1]?#f72e2e:slowhist>0 and slowhist[0]<slowhist[1]?#008000:slowhist<0 and slowhist[0]>slowhist[1]?#7f0000:white, style=histogram)

//plot(MACD_Line, color=yellow, title="MACD Line")

//plot(MACD_fastsignalSmoothing, color=green, title="Fast Signal Line")

//plot(MACD_slowsignalSmoothing, color=red, title="Slow Signal Line")

//plot(MACD_Line2, color=aqua, title="MACD Line 2")

//plot(MACD_fastsignalSmoothing2, color=orange, title="Fast Signal Line 2")

//plot(MACD_slowsignalSmoothing2, color=white, title="Slow Signal Line 2")

//plot(minimum, color=white, title="% Threshold")

//plot(fasthist, color=fasthist>0 and fasthist[0]>fasthist[1]?#00ff00:fasthist<=0 and fasthist[0]<fasthist[1]?#f72e2e:fasthist>0 and fasthist[0]<fasthist[1]?#008000:fasthist<0 and fasthist[0]>fasthist[1]?#7f0000:white, style=histogram)

//plot(MACD_Histogram2, color=MACD_Histogram2>0?blue:MACD_Histogram2<0?orange:white, style=histogram)

//plot(SMA, color=white, title="SMA")

//MACD Entry Conditions

MACD_longEntry2 = (crossover(MACD_Histogram2, 0))

MACD_shortEntry2 = (crossunder(MACD_Histogram2, 0))

MACD_longEntry = (crossover(fasthist, 0))

MACD_shortEntry = (crossunder(fasthist, 0))

// Colors

//MAtrendcolor = change(veryslowSMA) > 0 ? green : red

//trendcolor = fastEMA > slowEMA and change(veryslowSMA) > 0 and close > slowEMA ? green : fastEMA < slowEMA and change(veryslowSMA) < 0 and close < slowEMA ? red : yellow

//bartrendcolor = close > fastEMA and close > slowEMA and close > veryslowSMA and change(slowEMA) > 0 ? green : close < fastEMA and close < slowEMA and close < veryslowSMA and change(slowEMA) < 0 ? red : yellow

//backgroundcolor = slowEMA > veryslowSMA and MACD_longEntry and MACD_Line > 0 and fastEMA > slowEMA and close[slowLength] > veryslowSMA ? green : slowEMA < veryslowSMA and MACD_shortEntry and MACD_Line < 0 and fastEMA < slowEMA and close[slowLength] < veryslowSMA ? red : na

//barcolor(switch1?bartrendcolor:na)

// Conditional Bar Colors

//backgroundcolor = (MACD_longEntry ? green : MACD_shortEntry ? red : na)

//bgcolor(switch3?backgroundcolor:na,transp=80)

////BOLLINGER BAND Conditions

bb_source = close

bb_length = input(20, minval=1)

bb_mult = input(1.86, minval=0.001, maxval=50)

bb_basis = ema(bb_source, bb_length)

bb_dev = bb_mult * stdev(bb_source, bb_length)

bb_upper = bb_basis + bb_dev

bb_lower = bb_basis - bb_dev

bb_longEntry = crossover(bb_source, bb_lower)

bb_shortEntry = crossunder(bb_source, bb_upper)

plot(switch4?bb_basis:na, color=red, linewidth=4)

p1=plot(switch4?bb_upper:na)

p2=plot(switch4?bb_lower:na)

fill(p1,p2, color=aqua, transp=95)

////KELTNER CHANNEL Inputs/Variables/Plots

KC_useTrueRange = input(true)

KC_length = input(20, minval=1)

KC_mult = input(3.0)

KC_source = input(close, title="Source")

KC_ma = ema(KC_source, KC_length)

KC_range = KC_useTrueRange ? tr : high - low

KC_rangema = ema(KC_range, KC_length)

KC_upper = KC_ma + KC_rangema * KC_mult

KC_lower = KC_ma - KC_rangema * KC_mult

KC_longEntry = crossover(KC_source, KC_lower)

KC_shortEntry = crossunder(KC_source, KC_upper)

plot(switch5?KC_ma:na, color=red, title="Basis")

KC_u = plot(switch5?KC_upper:na, color=red, title="Upper")

KC_l = plot(switch5?KC_lower:na, color=red, title="Lower")

fill(KC_u, KC_l, color=red)

///////////////////ADX

//len = input(title="ADX Length", type=integer, defval=14)

//th = input(title="ADX threshold", type=integer, defval=20)

//TrueRange = max(max(high-low, abs(high-nz(close[1]))), abs(low-nz(close[1])))

//DirectionalMovementPlus = high-nz(high[1]) > nz(low[1])-low ? max(high-nz(high[1]), 0): 0

//DirectionalMovementMinus = nz(low[1])-low > high-nz(high[1]) ? max(nz(low[1])-low, 0): 0

//SmoothedTrueRange = nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1])/len) + TrueRange

//SmoothedDirectionalMovementPlus = nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1])/len) + DirectionalMovementPlus

//SmoothedDirectionalMovementMinus = nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1])/len) + DirectionalMovementMinus

//DIPlus = sma(SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100, len)

//DIMinus = sma(SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100, len)

//DX = abs(DIPlus-DIMinus) / (DIPlus+DIMinus)*100

//ADX = sma(DX, len)

///

//ADX_longEntry = crossover(DIPlus, DIMinus) //or (DIPlus > DIMinus and DIPlus > th and ADX > th)

//ADX_shortEntry = crossover(DIMinus, DIPlus) //or (DIMinus > DIPlus and DIMinus > th and ADX > th)

//DI_long = if DIPlus > DIMinus and ADX > 20 and DIPlus > 20

//plot(DIPlus, color=green, title="DI+")

//plot(DIMinus, color=red, title="DI-")

//plot(ADX, color=black, title="ADX")

//hline(th, color=black, linestyle=dashed)

//////////////////////////////////Playing with RES

r1 = input("5", "Resolution")

r2 = input("15", "Resolution")

r3 = input("30", "Resolution")

r4 = input("60", "Resolution")

o1 = request.security(heikinashi(syminfo.tickerid), r1, MACD_Line[1])

c1 = request.security(heikinashi(syminfo.tickerid), r1, MACD_slowsignalLine[1])

o2 = request.security(heikinashi(syminfo.tickerid), r2, MACD_Line[1])

c2 = request.security(heikinashi(syminfo.tickerid), r2, MACD_slowsignalLine[1])

o3 = request.security(heikinashi(syminfo.tickerid), r3, MACD_Line[1])

c3 = request.security(heikinashi(syminfo.tickerid), r3, MACD_slowsignalLine[1])

o4 = request.security(heikinashi(syminfo.tickerid), r4, MACD_Line[1])

c4 = request.security(heikinashi(syminfo.tickerid), r4, MACD_slowsignalLine[1])

res_long = (o4 > c4 and o3 > c3 and o2 > c2 and o1 > c1)

res_short = (o4 < c4 and o3 < c3 and o2 < c2 and o1 < c1)

///////////////////// Parabolic SAR (stop and reverse)

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

psar = sar(start, increment, maximum)

plot(psar, style=circles, color=yellow)

psar_longEntry = close > psar

psar_longExit = crossunder(close, psar)

psar_shortEntry = close < psar//crossunder(close, psar)

psar_shortExit = crossover(close, psar)

mix = (moneyFlowIndex + rsi)/2

RSI_MFI = ema(mix, input(3))

//color = RSI_MFI > 80 ? red :RSI_MFI < 20 ? green : silver

vrsi = RSI_MFI

rsiBuySell = vrsi[1] < 95 and crossover(vrsi, 95) or vrsi[1] < 90 and crossover(vrsi, 90) or vrsi[1] < 85 and crossover(vrsi, 85) or vrsi[1] < 80 and crossover(vrsi, 80) or vrsi[1] < 75 and crossover(vrsi, 75) or vrsi[1] < 70 and crossover(vrsi, 70) or vrsi[1] < 65 and crossover(vrsi, 65) or vrsi[1] < 60 and crossover(vrsi, 60) or vrsi[1] < 55 and crossover(vrsi, 55) or vrsi[1] < 50 and crossover(vrsi, 50) or vrsi[1] < 45 and crossover(vrsi, 45) or vrsi[1] < 40 and crossover(vrsi, 40) or vrsi[1] < 35 and crossover(vrsi, 35) or vrsi[1] < 30 and crossover(vrsi, 30) or vrsi[1] < 25 and crossover(vrsi, 25) or vrsi[1] < 20 and crossover(vrsi, 20) or vrsi[1] < 15 and crossover(vrsi, 15) or vrsi[1] < 10 and crossover(vrsi, 10) or vrsi[1] < 5 and crossover(vrsi, 5) ? 1 : vrsi[1] > 95 and crossunder(vrsi, 95) or vrsi[1] > 90 and crossunder(vrsi, 90) or vrsi[1] > 85 and crossunder(vrsi, 85) or vrsi[1] > 80 and crossunder(vrsi, 80) or vrsi[1] > 75 and crossunder(vrsi, 75) or vrsi[1] > 70 and crossunder(vrsi, 70) or vrsi[1] > 65 and crossunder(vrsi, 65) or vrsi[1] > 60 and crossunder(vrsi, 60) or vrsi[1] > 55 and crossunder(vrsi, 55) or vrsi[1] > 50 and crossunder(vrsi, 50) or vrsi[1] > 45 and crossunder(vrsi, 45) or vrsi[1] > 40 and crossunder(vrsi, 40) or vrsi[1] > 35 and crossunder(vrsi, 35) or vrsi[1] > 30 and crossunder(vrsi, 30) or vrsi[1] > 25 and crossunder(vrsi, 25) or vrsi[1] > 20 and crossunder(vrsi, 20) or vrsi[1] > 15 and crossunder(vrsi, 15) or vrsi[1] > 10 and crossunder(vrsi, 10) or vrsi[1] > 5 and crossunder(vrsi, 5) ?-1:na

//////////////////////////////////Entry Conditions

//

MA1 = ema(hlc3, input(3))

MA2 = wma(MA1, input(7))

MA3 = ema(MA2, input(2))

MA4 = wma(MA3, input(1))

buy = close > MA4 or hlc3[1] < MA4 and hlc3 > MA4 and rsiBuySell == 1

sell = close < MA4 or hlc3[1] > MA4 and hlc3 < MA4 and rsiBuySell == -1

p=14

CO=close-open

HL=high-low

value1 = (CO + 2*CO[1] + 2*CO[2] + CO[3])/6

value2 = (HL + 2*HL[1] + 2*HL[2] + HL[3])/6

num=sum(value1,p)

denom=sum(value2,p)

RVI=denom!=0?num/denom:0

RVIsig=(RVI+ 2*RVI[1] + 2*RVI[2] + RVI[3])/6

//plot(RVI,color=white,style=line,linewidth=1)

//plot(RVIsig,color=orange,style=line,linewidth=1)

Tenkan_periods = input(9, minval=1, title="Conversion Line Periods"),

Kijun_periods = input(26, minval=1, title="Base Line Periods")

Senkou_Span_B_Length = input(50, minval=1, title="Lagging Span 2 Periods"),

Chikou_Span_Length = input(25, minval=1, title="Displacement")

donchian(len) => avg(lowest(len), highest(len))

Tenkan_sen = donchian(Tenkan_periods)

Kijun_sen = donchian(Kijun_periods)

Senkou_Span_A = avg(Tenkan_sen, Kijun_sen)

Senkou_Span_B = donchian(Senkou_Span_B_Length)

plot(Tenkan_sen, color=#0496ff, title="Conversion Line")

plot(Kijun_sen, color=#991515, title="Base Line")

plot(close, offset = -Chikou_Span_Length, color=#459915, title="Lagging Span")

p3 = plot(Senkou_Span_A, offset = Chikou_Span_Length, color=green,

title="Lead 1")

p4 = plot(Senkou_Span_B, offset = Chikou_Span_Length, color=red,

title="Lead 2")

fill(p3, p4, color = Senkou_Span_A > Senkou_Span_B ? green : red, transp=50)

Ichimoku_longEntry = Senkou_Span_B < Senkou_Span_A

Ichimoku_shortEntry = Senkou_Span_A < Senkou_Span_B

len9 = input(9, minval=1, title="Length")

srce = input(hlc3, title="Source")

ema9 = ema(srce, len9)

sma50 = sma(ema9, 80)

sma30 = vwma(sma50, 26)

ema930 = ema(sma30, 9)

//plot(ema930, color=blue, title="MA", linewidth=5, transp=0)

SMA100 = sma(input(ohlc4), input(10))

Lookback = SMA100[input(7)]

sma300 = SMA100 + (SMA100 - Lookback)

//if Ichimoku_longEntry

longEntry = (MACD_longEntry2) //or Stoch_longEntry// or buy //or cci_longEntry or bb_longEntry or psar_shortExit //or //// // KC_longEntry// or WilliamsR_longEntry// // // or RSI_longEntry// // or or MFI_longEntry// or crossover(close,psar) //(o4 < c4 and o3 < c3 and o2 < c2 and o1 < c1)

//if Ichimoku_shortEntry

shortEntry = (MACD_shortEntry2) //or Stoch_shortEntry// or sell//or cci_shortEntry or bb_shortEntry or psar_longExit// // //or KC_shortEntry// or WilliamsR_shortEntry// //or cci_shortEntry // // or or MFI_shortEntry// or crossunder(close,psar)// (o4 < c4 and o3 < c3 and o2 < c2 and o1 < c1)

//longExit = shortEntry or psar_longExit // if not (ADX > th and )

//shortExit = longEntry or psar_shortExit // if not (ADX > th and )

////psar for trailing stops or some other measure? we must have a good trailing stop.

///////////////////////////////Strategy Execution

if testPeriod()

strategy.entry("Long", strategy.long, when=longEntry)

strategy.close("Long", when=shortEntry)

//if testPeriod()

// strategy.entry("Long", strategy.long, when=longEntry)

// strategy.exit("Exit Long", "Long", when=shortEntry)

//else

// strategy.cancel("Long")

//if testPeriod()

// strategy.entry("Short", strategy.short, when=shortEntry)

// strategy.exit("Exit Short", "Short", when=longEntry)

//else

// strategy.cancel("Long")

//Other Plots and Alerts

plotshape(MACD_longEntry2, title= "3,7 Long Open", color=green, style=shape.circle)

plotshape(MACD_shortEntry2, title= "3,7 Short Open", color=red, style=shape.circle)

//plotshape(Stoch_longEntry, title= "Stoch Long Open", color=aqua, style=shape.circle)

//plotshape(Stoch_shortEntry, title= "Stoch Short Open", color=orange, style=shape.circle)

//plotshape(buy, title= "RES Long Open", color=green, location=location.belowbar, style=shape.circle)

///plotshape(sell, title= "RES Short Open", color=red, location=location.belowbar, style=shape.circle)

//plotshape(MACD_longEntry, title= "12,26 Long Open", color=green, style=shape.arrowup, size=size.normal, location=location.belowbar)

//plotshape(MACD_shortEntry, title= "12,26 Short Open", color=red, style=shape.arrowdown, size=size.normal, location=location.abovebar)

//plotshape(MACD_longEntry, title= "12,26 Long Open", color=green, style=shape.diamond, size=size.tiny, location=location.belowbar)

//plotshape(MACD_shortEntry, title= "12,26 Short Open", color=red, style=shape.diamond, size=size.tiny, location=location.abovebar)

//plotchar(longCondition, location=bottom char="L", color=green)

//plotchar(shortCondition, char="S", color=red)

//alertcondition(longCondition, title="MFI+MACD Long", message="(MFI crossOver 30) or MACD+")

//alertcondition(shortCondition, title="MFI+MACD Short", message="(MFI crossUnder 70) or MACD-")

plot(sma300, color=purple, linewidth=4)