Strategi trailing stop loss Supertrend berdasarkan Heikin Ashi

Tinjauan Strategi

Strategi ini merupakan strategi tracking trend stop loss yang menggabungkan Heikin Ashi filter dan super trend indicator. Strategi ini menggunakan Heikin Ashi filter untuk memfilter kebisingan pasar, super trend indicator untuk menentukan arah trend, dan menggunakan super trend sebagai stop loss line yang dinamis untuk melakukan tracking trend dan pengendalian risiko yang efisien.

Prinsip Strategi

- Perhitungan garis Heikin Ashi: termasuk harga buka, harga tutup, harga tertinggi, harga terendah.

- Perhitungan indikator supertrend: perhitungan atas dan bawah rel berdasarkan ATR dan harga.

- Kombinasi garis Heikin Ashi dan supertrend menentukan arah tren.

- Sebuah tren bullish terjadi ketika harga penutupan Heikin Ashi lebih dekat ke arah atas dari tren super; tren bearish terjadi ketika harga penutupan Heikin Ashi lebih dekat ke arah bawah dari tren super.

- Dalam tren bullish, dengan tren supertrail sebagai jalur penghentian; dalam tren bearish, dengan tren supertrail sebagai jalur penghentian.

Keunggulan Strategis

- Dengan menggunakan filter Heikin Ashi untuk melakukan penembusan palsu, sinyal tren dapat diidentifikasi dengan lebih handal.

- Supertrend berfungsi sebagai stop loss yang dinamis untuk mengunci keuntungan tren secara maksimal dan menghindari penarikan yang terlalu besar.

- Kombinasi dengan periode waktu yang berbeda untuk menilai polygon, mengkonfirmasi sinyal tinggi rendah lebih dapat diandalkan.

- Fungsi penjadwalan posisi terdepan untuk menghindari dampak dari perilaku tidak rasional pada waktu tertentu.

Risiko Strategis

- Hal ini dikarenakan adanya risiko stop loss yang lebih rendah jika trend berbalik.

- Setelan parameter supertrend yang tidak tepat dapat menyebabkan stop loss terlalu lebar atau terlalu sempit. Kombinasi parameter yang berbeda dapat diuji.

- Tidak mempertimbangkan masalah pengelolaan dana. Kontrol posisi harus diatur.

- Tidak mempertimbangkan biaya transaksi.

Arah optimasi strategi

- Optimalkan kombinasi parameter supertrend untuk mencari parameter optimal.

- Menambahkan fungsi kontrol posisi.

- Menambahkan pertimbangan biaya, seperti biaya prosesor, slider, dll.

- Stop loss dapat disesuaikan secara fleksibel dengan kekuatan dan kelemahan tren.

- Pertimbangkan untuk memfilter sinyal masuk digabungkan dengan indikator lainnya.

Meringkaskan

Strategi ini mengintegrasikan keunggulan dari dua indikator Heikin Ashi dan Supertrend, dapat menangkap arah tren, sekaligus menggunakan supertrend untuk mengotomatiskan tracking stop loss, sehingga dapat mengunci keuntungan tren. Risiko strategi terutama berasal dari pembalikan tren dan parameter optimasi, yang keduanya dapat ditingkatkan dengan pengoptimalan lebih lanjut. Secara keseluruhan, strategi ini menggunakan integrasi indikator untuk meningkatkan stabilitas sistem perdagangan dan ruang untuk keuntungan.

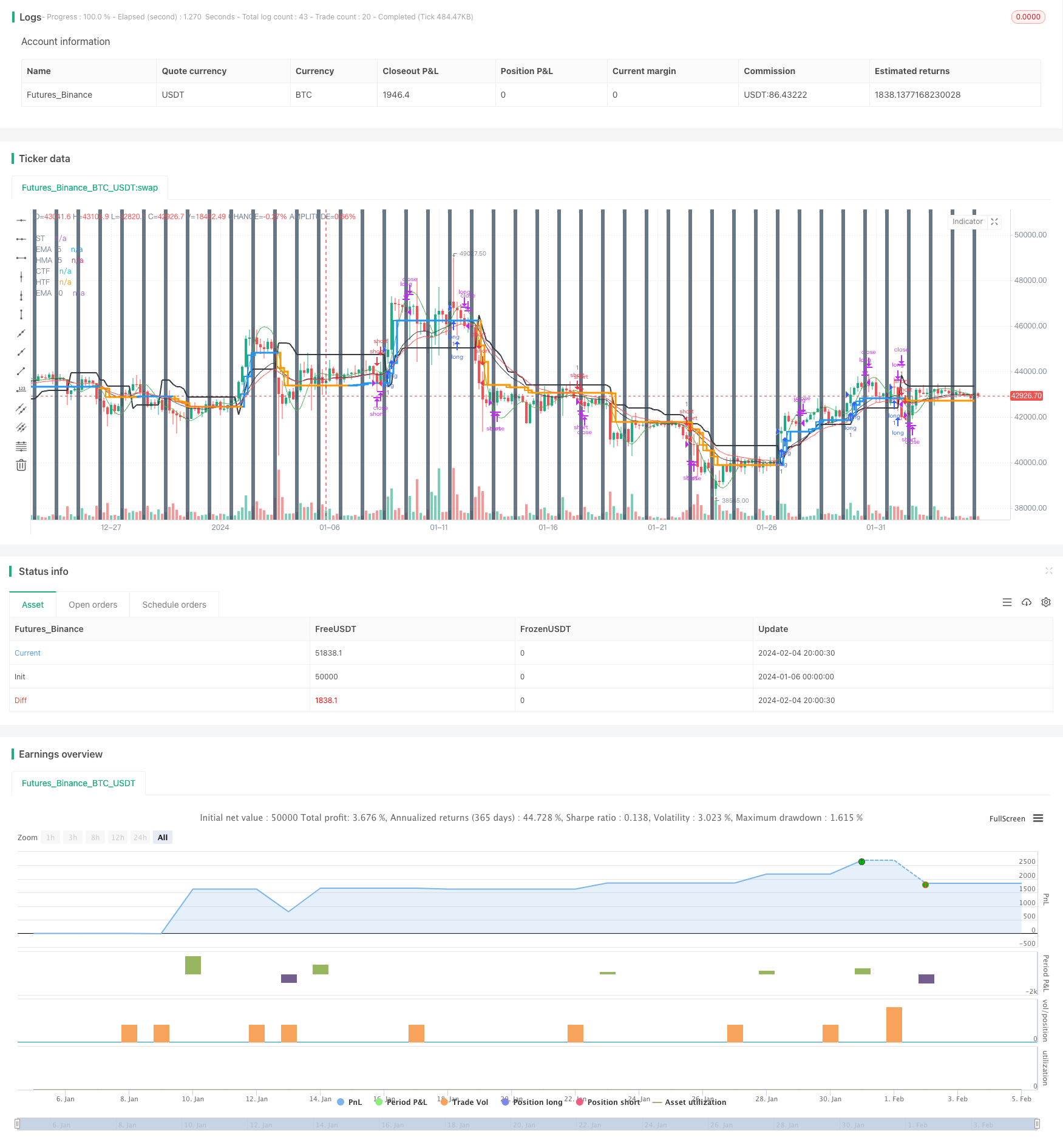

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ringashish

//@version=4

strategy("sa-strategy with HTF-TSL", overlay=true)

Pd = input(title="ATR Period", type=input.integer, defval=4)

Factor = input(title="ATR Multiplier", type=input.float, step=0.1, defval=2)

ST= supertrend(Factor, Pd)

heikinashi_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

heikinashi_low = security(heikinashi(syminfo.tickerid), timeframe.period, low)

heikinashi_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

heikinashi_high = security(heikinashi(syminfo.tickerid), timeframe.period, high)

heikinashi_close30 = security(heikinashi(syminfo.tickerid), "30", close)

//res1 = input("30", type=input.resolution, title="higher Timeframe")

//CCI TSL

res = input("240",type=input.resolution,title = "Higher Time Frame")

CCI = input(20)

ATR = input(5)

Multiplier=input(1,title='ATR Multiplier')

original=input(false,title='original coloring')

thisCCI = cci(close, CCI)

lastCCI = nz(thisCCI[1])

calcx()=>

bufferDn= high + Multiplier * sma(tr,ATR)

bufferUp= low - Multiplier * sma(tr,ATR)

if (thisCCI >= 0 and lastCCI < 0)

bufferUp := bufferDn[1]

if (thisCCI <= 0 and lastCCI > 0)

bufferDn := bufferUp[1]

if (thisCCI >= 0)

if (bufferUp < bufferUp[1])

bufferUp := bufferUp[1]

else

if (thisCCI <= 0)

if (bufferDn > bufferDn[1])

bufferDn := bufferDn[1]

x = 0.0

x := thisCCI >= 0 ?bufferUp:thisCCI <= 0 ?bufferDn:x[1]

x

tempx = calcx()

calcswap() =>

swap = 0.0

swap := tempx>tempx[1]?1:tempx<tempx[1]?-1:swap[1]

swap

tempswap = calcswap()

swap2=tempswap==1?color.blue:color.orange

swap3=thisCCI >=0 ?color.blue:color.orange

swap4=original?swap3:swap2

//display current timeframe's Trend

plot(tempx,"CTF",color=swap4,transp=0,linewidth=2, style = plot.style_stepline)

htfx = security(syminfo.tickerid,res,tempx[1],lookahead = barmerge.lookahead_on)

htfswap4 = security(syminfo.tickerid,res,swap4[1],lookahead = barmerge.lookahead_on)

plot(htfx,"HTF",color=htfswap4,transp=0,linewidth=3,style = plot.style_stepline)

//supertrend

Supertrend(Factor, Pd) =>

Up=hl2-(Factor*atr(Pd))

Dn=hl2+(Factor*atr(Pd))

TrendUp = 0.0

TrendUp := heikinashi_close[1]>TrendUp[1] ? max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := heikinashi_close[1]<TrendDown[1]? min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := heikinashi_close > TrendDown[1] ? 1: heikinashi_close< TrendUp[1]? -1: nz(Trend[1],1)

Tsl = Trend==1? TrendUp: TrendDown

S_Buy = Trend == 1 ? 1 : 0

S_Sell = Trend != 1 ? 1 : 0

[Trend, Tsl]

[Trend,Tsl] = Supertrend(Factor, Pd)

// Security

//ST1_Trend_MTF = security(syminfo.tickerid, res1, Tsl,barmerge.lookahead_on)

//plot(ST1_Trend_MTF, "higher ST")

crossdn = crossunder(heikinashi_close,Tsl) or crossunder(heikinashi_close[1],Tsl) or crossunder(heikinashi_close[2],Tsl) or heikinashi_close < Tsl

crossup = crossover(heikinashi_close,Tsl) or crossover(heikinashi_close[1],Tsl) or crossover(heikinashi_close[2],Tsl) or heikinashi_close > Tsl

plot(Tsl,"ST",color = color.black,linewidth =2)

plot(ema(heikinashi_close,20),"EMA 20",color=color.red)

plot(hma(heikinashi_close,15),"HMA 15",color=color.green)

plot(ema(heikinashi_close,15),"EMA 15",color=color.black)

closedown = (heikinashi_close < hma(heikinashi_close,15) and heikinashi_high > hma(heikinashi_close,15)) or(heikinashi_close < ema(heikinashi_close,20) and heikinashi_high > ema(heikinashi_close,20))

closeup = (heikinashi_close > hma(heikinashi_close,15) and heikinashi_low < hma(heikinashi_close,15)) or (heikinashi_close > ema(heikinashi_close,20) and heikinashi_low < ema(heikinashi_close,20))

buy = heikinashi_open == heikinashi_low and closeup and crossup and close > htfx

//buy = heikinashi_open == heikinashi_low and heikinashi_close > ema(close,20) and heikinashi_low < ema(close,20) and crossup

buyexit = cross(close,tempx) //heikinashi_open == heikinashi_high //and heikinashi_close < ema(close,15) and heikinashi_high > ema(close,15)

//if heikinashi_close30[1] < ST1_Trend_MTF

//sell = heikinashi_open == heikinashi_high and heikinashi_close < ema(close,20) and heikinashi_high > ema(close,20) and rsi(close,14)<60 and crossdn

sell = heikinashi_open == heikinashi_high and closedown and rsi(close,14)<55 and crossdn and close < htfx

sellexit = cross(close,tempx) //heikinashi_open == heikinashi_low //and heikinashi_close > ema(close,15) and heikinashi_low < ema(close,15)

rg = 0

rg := buy ? 1 : buyexit ? 2 : nz(rg[1])

longLogic = rg != rg[1] and rg == 1

longExit = rg != rg[1] and rg == 2

//plotshape(longExit,"exit buy",style = shape.arrowup,location = location.belowbar,color = color.red, text ="buy exit", textcolor = color.red)

//plotshape(longLogic,"BUY",style = shape.arrowup,location = location.belowbar,color = color.green, text ="buy", textcolor= color.green)

nm = 0

nm := sell ? 1 : sellexit ? 2 : nz(nm[1])

shortLogic = nm != nm[1] and nm == 1

shortExit = nm != nm[1] and nm == 2

//plotshape(shortExit,"exit sell",style = shape.arrowup,location = location.belowbar,color = color.red, text ="sell exit", textcolor = color.red)

//plotshape(shortLogic,"SELL",style = shape.arrowup,location = location.belowbar,color = color.green, text ="sell", textcolor= color.green)

//Exit at particular time

ExitHour = input(title="Exit Hour Of Day", type=input.integer, defval=15, step = 5, maxval = 24, minval = 0)

ExitMint = input(title="Exit Minute Of Day", type=input.integer, defval=15, step = 5, maxval = 24, minval = 0)

bgc = input(title="Highlight Background Color?", type=input.bool, defval=true)

mRound(num,rem) => (floor(num/rem)*rem)

exitTime = (hour(time) >= ExitHour and (minute == mRound(ExitMint, timeframe.multiplier))) ? 1 : 0

exitTime := exitTime == 0 ? (hour(time) >= ExitHour and (minute + timeframe.multiplier >= ExitMint)) ? 1 : 0 : exitTime

MarketClose = exitTime and not exitTime[1]

alertcondition(exitTime and not exitTime[1], title="Intraday Session Close Time", message="Close All Positions")

bgcolor(exitTime and not exitTime[1] and bgc ? #445566 : na, transp =40)

longCondition = longLogic

if (longCondition)

strategy.entry("long", strategy.long)

shortCondition = shortLogic

if (shortCondition)

strategy.entry("short", strategy.short)

strategy.close("short", when =cross(close,tempx) or MarketClose)

strategy.close( "long", when =cross(close,tempx) or MarketClose )