マルチファクターRSI反転戦略

作成日:

2023-12-06 11:57:29

最終変更日:

2023-12-06 11:57:29

コピー:

0

クリック数:

645

1

フォロー

1619

フォロワー

概要

この戦略は,RSI指標を用いて超買い超売り現象を識別し,MACD,ストキャスティック指標などの多種多様な補助因子と組み合わせて介入する.この戦略は,短期的な逆転の機会を捕捉することを目的として,逆転戦略に属している.

戦略原則

この戦略は,市場が超買または超売り状態にあるかどうかを判断するために,主にRSI指標を使用します. RSI指標が設定された超買ラインを超えると,市場が超買状態にある可能性があることを示すとき,戦略は空白を選択します. RSI指標が設定された超売りラインを下回ると,市場が超売り状態にある可能性があることを示すとき,戦略は,そのとき多額の選択を行います.

さらに,戦略はMACD,Stochasticなどの複数の補助因子を導入している.これらの補助因子の役割は,発生する可能性のある偽陽性取引信号をフィルターするものである.RSI指標が信号を発し,補助因子がその信号をサポートしている場合にのみ,戦略は本当の取引行動を起こす.この複数の要因の組み合わせは,戦略信号の信頼性を高め,その結果,戦略の安定性を高めることができる.

優位分析

この戦略の最大の利点は,捕捉効率が高く,マルチファクトル検証が信号品質を向上させるという点にある.具体的には,主に以下の側面に表れている.

- RSI指数は,市場体制を識別する能力が強く,過剰買い過剰販売を効果的に識別することができる.

- 複数の補助ツールによる多要素検証により,信号の質が向上し,多くの偽陽性結果がフィルターされました.

- 戦略はパラメータに敏感で,簡単に最適化できます.

リスクと解決策

この戦略にはリスクもありますが,主に2つの側面に重点を置いています.

- 逆転失敗のリスク。逆転信号自体は,個々の逆転失敗の確率を排除しない統計的ブレイジングの機会に依存している。ポジションを下げるか,またはストップ損失を設定することによってリスクを制御することができます。

- 多頭情勢下での損失リスク。戦略全体では逆市操縦が主であり,多頭情勢下では必然的に一定損失が発生する。これは,大きな傾向を正確に判断し,必要に応じて人工介入によって不利な市場環境を跳び越す必要がある。

最適化の方向

この戦略は,次の側面から改善する必要がある.

- 異なる品種をテストし,最適なパラメータの組み合わせを探します. 策略はパラメータに敏感ではありませんが,異なる品種に対して最適なパラメータを探すことを推奨します.

- 適応退出メカニズムの追加. 動的ストップ,時間退出などの方法を追加して,戦略を市場の変化に適応させる方法をテストすることができます.

- 機械学習アルゴリズムを導入する. 戦略の勝利率を向上させるため,逆転の成功率を判断するモデル学習を試みることができる.

要約する

この戦略は,全体として,ショートライン反転戦略である. RSI指標を使用して,超買い超売りを判断する能力を利用し,同時に,複数の補助ツールを使用して,複数の要因を検証し,その結果,信号の質を向上させる. この戦略は,捕捉効率が高く,安定性が優れている.

ストラテジーソースコード

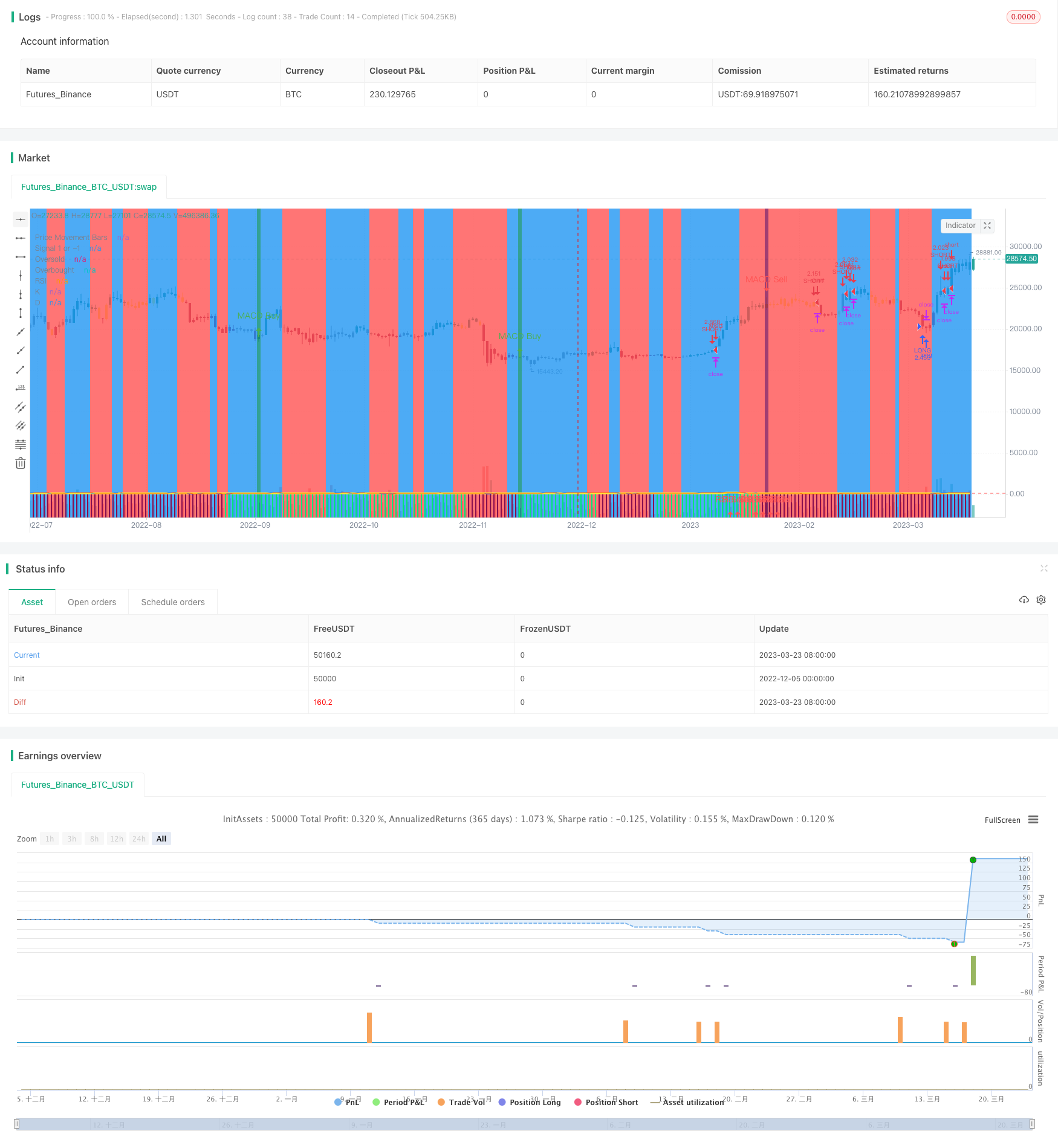

/*backtest

start: 2022-12-05 00:00:00

end: 2023-03-24 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=4

strategy(shorttitle='Ain1',title='All in One Strategy', overlay=true, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type=strategy.commission.percent, commission_value=0.18, calc_on_every_tick=true)

kcolor = #0094FF

dcolor = #FF6A00

// ----------------- Strategy Inputs -------------------------------------------------------------

//Backtest dates with auto finish date of today

start = input(defval = timestamp("01 April 2021 00:00 -0500"), title = "Start Time", type = input.time)

finish = input(defval = timestamp("31 December 2021 00:00 -0600"), title = "Start Time", type = input.time)

window() => true

// Strategy Selection - Long, Short, or Both

strat = input(title="Strategy", defval="Long/Short", options=["Long Only", "Long/Short", "Short Only"])

strat_val = strat == "Long Only" ? 1 : strat == "Long/Short" ? 0 : -1

// Risk Management Inputs

sl= input(10.0, "Stop Loss %", minval = 0, maxval = 100, step = 0.01)

stoploss = sl/100

tp = input(20.0, "Target Profit %", minval = 0, maxval = 100, step = 0.01)

TargetProfit = tp/100

// RSI and Stochastic Inputs

length = input(14, "RSI Length", minval=1)

ob_min = input(52, "Overbought Lookback Minimum Value", minval=0, maxval=200)

ob_lb = input(25, "Overbought Lookback Bars", minval=0, maxval=100)

os_min = input(50, "Oversold Lookback Minimum Value", minval=0, maxval=200)

os_lb = input(35, "Oversold Lookback Bars", minval=0, maxval=100)

source = input(title="Source", type=input.source, defval=close)

RSI = rsi(source, length)

// Define f_print function to show key recommendations for RSI

// f_print(_text) =>

// // Create label on the first bar.

// var _label = label(na),

// label.delete(_label),

// _label := label.new(

// time + (time-time[1]),

// ohlc4,

// _text,

// xloc.bar_time,

// yloc.price,

// color(na),

// label.style_none,

// color.gray,

// size.large,

// text.align_left

// )

// Display highest and lowest RSI values

AvgHigh(src,cnt,val) =>

total = 0.0

count = 0

for i = 0 to cnt

if src[i] > val

count := count + 1

total := total + src[i]

round(total / count)

RSI_high = AvgHigh(RSI, ob_lb, ob_min)

AvgLow(src,cnt,val) =>

total = 0.0

count = 0

for i = 5 to cnt by 5

if src[i] < val

count := count + 1

total := total + src[i]

round(total / count)

RSI_low = AvgLow(RSI, os_lb, os_min)

// f_print("Recommended RSI Settings:" + "\nOverbought = " + tostring(RSI_high) + "\nOversold = " + tostring(RSI_low))

overbought= input(62, "Overbought")

oversold= input(35, "Oversold")

// Price Movement Inputs

look_back = input(9,"Look Back Bars")

high_source = input(high,"High Source")

low_source= input(low,"Low Source")

HTF = input("","Curernt or Higher time frame only", type=input.resolution)

// EMA and SMA Background Inputs

smoothK = input(3, "K", minval=1)

smoothD = input(3, "D", minval=1)

k_mode = input("SMA", "K Mode", options=["SMA", "EMA", "WMA"])

// MACD Inputs

fastLength = input(5, minval=1, title="EMA Fast Length")

slowLength = input(10, minval=1, title="EMA Slow Length")

// Selections to show or hide the overlays

showZones = input(true, title="Show Bullish/Bearish Zones")

showStoch = input(true, title="Show Stochastic Overlays")

showRSIBS = input(true, title="Show RSI Buy Sell Zones")

showMACD = input(true, title="Show MACD")

color_bars=input(true, "Color Bars")

useXRSI = input(false, "Use RSI crossing back, select only one")

useMACD = input(false, "Use MACD Only, select only one")

useCRSI = input(false, "Use Tweaked Connors RSI, select only one")

// ------------------ Background Colors based on EMA Indicators -----------------------------------

// Uses standard lengths of 9 and 21, if you want control delete the constant definition and uncomment the inputs

haClose(gap) => (open[gap] + high[gap] + low[gap] + close[gap]) / 4

rsi_ema = rsi(haClose(0), length)

v2 = ema(rsi_ema, length)

v3 = 2 * v2 - ema(v2, length)

emaA = ema(rsi_ema, fastLength)

emaFast = 2 * emaA - ema(emaA, fastLength)

emaB = ema(rsi_ema, slowLength)

emaSlow = 2 * emaB - ema(emaB, slowLength)

// bullish signal rule:

bullishRule =emaFast > emaSlow

// bearish signal rule:

bearishRule =emaFast < emaSlow

// current trading State

ruleState = 0

ruleState := bullishRule ? 1 : bearishRule ? -1 : nz(ruleState[1])

bgcolor(showZones ? ( ruleState==1 ? color.blue : ruleState==-1 ? color.red : color.gray ) : na , title=" Bullish/Bearish Zones", transp=95)

// ------------------ Stochastic Indicator Overlay -----------------------------------------------

// Calculation

// Use highest highs and lowest lows

h_high = highest(high_source ,look_back)

l_low = lowest(low_source ,look_back)

stoch = stoch(RSI, RSI, RSI, length)

k =

k_mode=="EMA" ? ema(stoch, smoothK) :

k_mode=="WMA" ? wma(stoch, smoothK) :

sma(stoch, smoothK)

d = sma(k, smoothD)

k_c = change(k)

d_c = change(d)

kd = k - d

// Plot

signalColor = k>oversold and d<overbought and k>d and k_c>0 and d_c>0 ? kcolor :

k<overbought and d>oversold and k<d and k_c<0 and d_c<0 ? dcolor : na

kp = plot(showStoch ? k : na, "K", transp=80, color=kcolor)

dp = plot(showStoch ? d : na, "D", transp=80, color=dcolor)

fill(kp, dp, color = signalColor, title="K-D", transp=88)

signalUp = showStoch ? not na(signalColor) and kd>0 : na

signalDown = showStoch ? not na(signalColor) and kd<0 : na

plot(signalUp ? kd : na, "Signal Up", color=kcolor, transp=90, style=plot.style_columns)

plot(signalDown ? (kd+100) : na , "Signal Down", color=dcolor, transp=90, style=plot.style_columns, histbase=100)

// -------------- Add Price Movement to Strategy for better visualization -------------------------

// Calculations

h1 = vwma(high, length)

l1 = vwma(low, length)

hp = h_high[1]

lp = l_low[1]

// Plot

var plot_color=#353535

var sig = 0

if (h1 >hp)

sig:=1

plot_color:=color.lime

else if (l1 <lp)

sig:=-1

plot_color:=color.maroon

plot(1,title = "Price Movement Bars", style=plot.style_columns,color=plot_color)

plot(sig,title="Signal 1 or -1",display=display.none)

// --------------------------------------- RSI Plot ----------------------------------------------

// Plot Oversold and Overbought Lines

over = hline(oversold, title="Oversold", color=color.green)

under = hline(overbought, title="Overbought", color=color.red)

fill(over, under, color=#9915FF, transp=90, title="Band Background")

// Show RSI and EMA crosses with arrows and RSI Color (tweaked Connors RSI)

// Improves strategy setting ease by showing where EMA 5 crosses EMA 10 from above to confirm overbought conditions or trend reversals

// This shows where you should enter shorts or exit longs

// Tweaked Connors RSI Calculation

connor_ob = 80

connor_os = 20

ma3 = sma(close,3)

ma20 = sma(close, 20)

ma50 = sma(close, 50)

erection = ((((close[1]-close[2])/close[2]) + ((close[0]-close[1])/close[1]))/2)*100

// Buy Sell Zones using tweaked Connors RSI (RSI values of 80 and 20 for Crypto as well as ma3, ma20, and ma50 are the tweaks)

RSI_SELL = ma20 > ma50 and open > ma3 and RSI >= connor_ob and erection <=4 and window()

RSI_BUY = ma20 < ma50 and ma3 > close and RSI <= connor_os and window()

// Color Definition

col = useCRSI ? (close > ma20 and close < ma3 and RSI <= connor_os ? color.lime : close < ma20 and close > ma3 and RSI <= connor_ob ? color.red : color.yellow ) : color.yellow

// Plot colored RSI Line

plot(RSI, title="RSI", linewidth=3, color=col)

// Shape Plots

plotshape(showRSIBS ? RSI_BUY: na, title = "RSI Buy", style = shape.arrowup, text = "RSI Buy", location = location.bottom, color=color.green, textcolor=color.green, size=size.small)

plotshape(showRSIBS ? RSI_SELL: na, title = "RSI Sell", style = shape.arrowup, text = "RSI Sell", location = location.bottom, color=color.red, textcolor=color.red, size=size.small)

// MACD as another complement to RSI strategy

[macdLine, signalLine, _] = macd(close, fastLength, slowLength, length)

bartrendcolor = macdLine > signalLine and k > 50 and RSI > 50 ? color.teal : macdLine < signalLine and k < 50 and RSI < 50 ? color.maroon : macdLine < signalLine ? color.yellow : color.gray

barcolor(color = color_bars ? bartrendcolor : na)

MACDBuy = crossover(macdLine, signalLine) and macdLine<0 and RSI<RSI_low and window()

MACDSell = crossunder(macdLine, signalLine) and macdLine>0 and RSI>RSI_high and window()

plotshape(showMACD ? MACDBuy: na, title = "MACD Buy", style = shape.arrowup, text = "MACD Buy", color=color.green, textcolor=color.green, size=size.small)

plotshape(showMACD ? MACDSell: na, title = "MACD Sell", style = shape.arrowdown, text = "MACD Sell", color=color.red, textcolor=color.red, size=size.small)

bgcolor(showMACD ? (MACDBuy ? color.teal : MACDSell ? color.maroon : na) : na, title ="MACD Signals", transp=50)

// -------------------------------- Entry and Exit Logic ------------------------------------

// Entry Logic

XRSI_OB = crossunder(RSI, overbought) and window()

RSI_OB = crossover(RSI, overbought) and window()

XRSI_OS = crossover(RSI, oversold) and window()

RSI_OS = crossunder(RSI, oversold) and window()

// Strategy Entry and Exit with built in Risk Management

GoLong = strat_val > -1 ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

GoShort = strat_val < 1 ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

convert_percent_to_points(percent) =>

strategy.position_size != 0 ? round(percent * strategy.position_avg_price / syminfo.mintick) : float(na)

setup_percent(percent) =>

convert_percent_to_points(percent)

if (GoLong)

strategy.entry("LONG", strategy.long)

strategy.exit(id="Exit Long", from_entry = "LONG", loss=setup_percent(stoploss), profit=setup_percent(TargetProfit))

CloseLong = strategy.position_size > 0 ? (useXRSI ? XRSI_OB : useMACD ? MACDSell : useCRSI ? RSI_SELL : RSI_OB) : false

if(CloseLong)

strategy.close("LONG")

if (GoShort)

strategy.entry("SHORT", strategy.short)

strategy.exit(id="Exit Short", from_entry = "SHORT", loss=setup_percent(stoploss), profit=setup_percent(TargetProfit))

CloseShort = strat_val < 1 and strategy.position_size < 0 ? (useXRSI ? XRSI_OS : useMACD ? MACDBuy : useCRSI ? RSI_BUY : RSI_OS) : false

if(CloseShort)

strategy.close("SHORT")