MFIとMAに基づく定量的反転戦略

作成日:

2023-12-27 14:42:16

最終変更日:

2023-12-27 14:42:16

コピー:

7

クリック数:

817

1

フォロー

1664

フォロワー

概要

この戦略は,MFI指数を使用して過買過売の領域を特定し,MAフィルターと組み合わせて価格逆転方向を判断するショートライン取引戦略である.これは,株式,外貨,商品,および暗号通貨などの市場で有効である.

戦略原則

戦略は,MFI指標を用いて市場の超買超売現象を判断する.MFIが20未満の超売り領域に入ると,下部地域を表し,価値が過小評価され,その時点で看落する.MFIが80以上の超買領域に入ると,上部地域を表し,資産が過大評価され,その時点で下落する.

偽反転をフィルターするために,戦略はまた,価格の傾向の方向を判断するMA指標を導入した. MFIが反転すると同時に,価格がMA平均線上または下を下回った場合にのみ,取引シグナルが生成される.

取引の論理は以下の通りです.

- MFIは20を下回って超売り区に入ると同時に,閉店価格がMA平均線に上がり,買い信号を生成する

- MFIは80以上を突破して超買区に入ると同時に,閉盘価格がMA平均線を下回り,売り込みシグナルを生む.

このように,ダブル指標フィルターによって,反転の機会を効果的に識別することができ,入場信号はより信頼性が高くなります.

戦略的優位性

- 双指数確認を使用し,偽突破を回避し,信号信頼性が高い

- 超買超売の区間反転は,古典的で効果的な取引技術です.

- トレンドフィルターと組み合わせて,信号をより正確で信頼性のあるものにします.

- 複数の市場に対応し,柔軟性があります.

戦略リスク

- 市場が長期にわたって上昇したり下落したりして,ストップダウンの原因になる可能性があります.

- システム上のリスクに注目し,極端な状況から誤った転換点を回避する

- 取引の頻度が高くなり,取引コストの管理に注意が必要

どう対処するか?

- 戦略に余裕を与えるため,適正にストップ・ロスの幅を緩める.

- ポジションを拡大する際には,より大きなレベルのグラフに注目し,システムリスクの判断をしてください.

- パラメータを最適化して 無意味な取引を減らす

戦略最適化の方向性

- 取引品種の特性にマッチするMAパラメータを最適化

- 市場情勢に合わせて,超買超売のパラメータを最適化する

- ポジション管理の強化により,収益をコントロールできる

要約する

この戦略は,古典的な分析方法と近代的な量化技術を統合し,厳格な二重指標のフィルタリングによって,様々な品種で強い適応性を示し,一般的なショートライン戦略として推奨されます.

ストラテジーソースコード

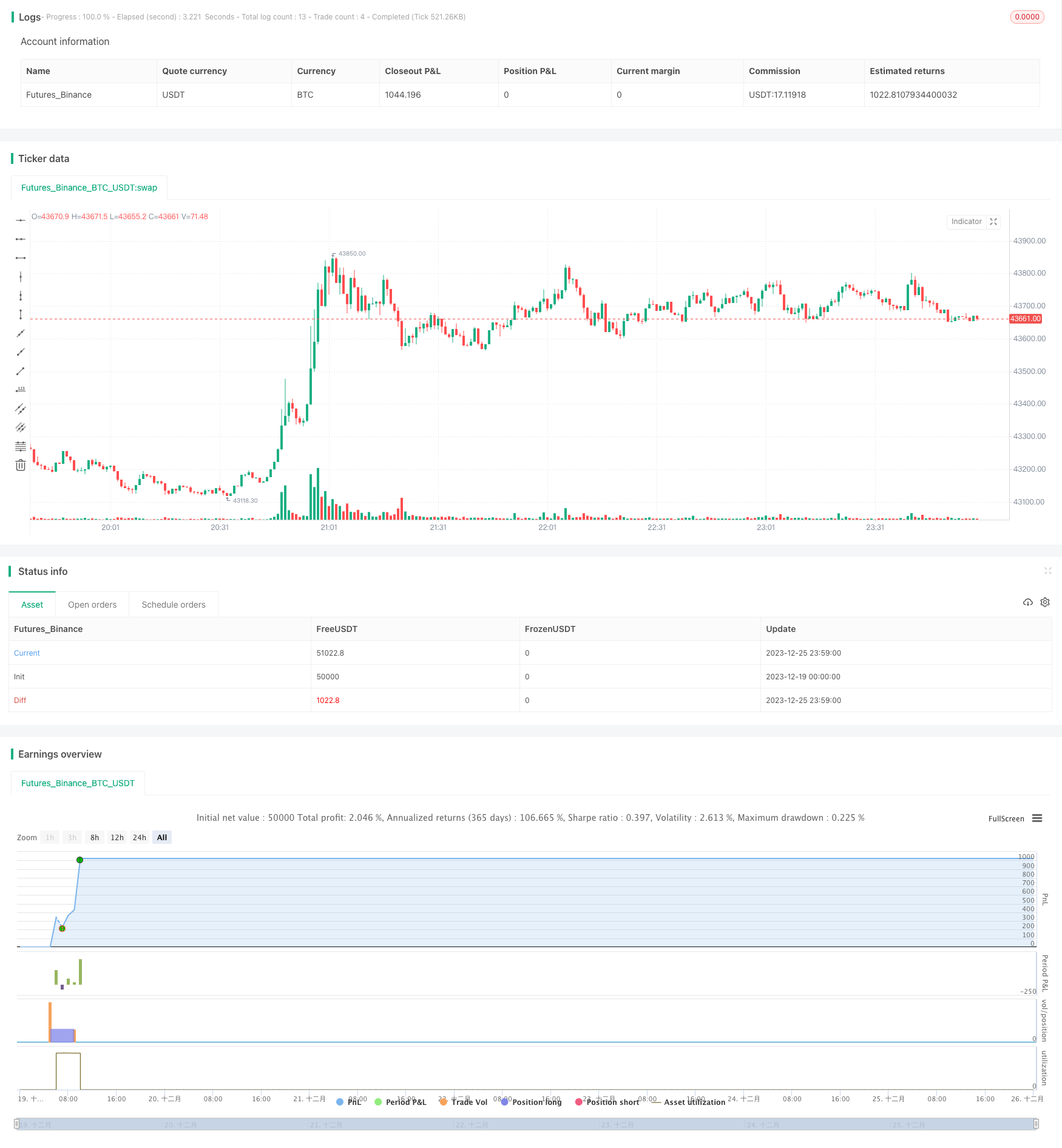

/*backtest

start: 2023-12-19 00:00:00

end: 2023-12-26 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © vikris

//@version=4

strategy("[VJ]Thor for MFI", overlay=true, calc_on_every_tick = false,pyramiding=0)

// ********** Strategy inputs - Start **********

// Used for intraday handling

// Session value should be from market start to the time you want to square-off

// your intraday strategy

// Important: The end time should be at least 2 minutes before the intraday

// square-off time set by your broker

var i_marketSession = input(title="Market session", type=input.session,

defval="0915-1455", confirm=true)

// Make inputs that set the take profit % (optional)

longProfitPerc = input(title="Long Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

shortProfitPerc = input(title="Short Take Profit (%)",

type=input.float, minval=0.0, step=0.1, defval=1) * 0.01

// Set stop loss level with input options (optional)

longLossPerc = input(title="Long Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=0.5) * 0.01

shortLossPerc = input(title="Short Stop Loss (%)",

type=input.float, minval=0.0, step=0.1, defval=0.5) * 0.01

i_MFI = input(3, title="MFI Length")

OB=input(100, title="Overbought Level")

OS=input(0, title="Oversold Level")

barsizeThreshold=input(.5, step=.05, minval=.1, maxval=1, title="Bar Body Size, 1=No Wicks")

i_MAFilter = input(true, title="Use MA Trend Filter")

i_MALen = input(80, title="MA Length")

// ********** Strategy inputs - End **********

// ********** Supporting functions - Start **********

// A function to check whether the bar or period is in intraday session

barInSession(sess) => time(timeframe.period, sess) != 0

// Figure out take profit price

longExitPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortExitPrice = strategy.position_avg_price * (1 - shortProfitPerc)

// Determine stop loss price

longStopPrice = strategy.position_avg_price * (1 - longLossPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortLossPerc)

// ********** Supporting functions - End **********

// ********** Strategy - Start **********

// See if intraday session is active

bool intradaySession = true

// Trade only if intraday session is active

//=================Strategy logic goes in here===========================

MFI=mfi(close,i_MFI)

barsize=high-low

barbodysize=close>open?(open-close)*-1:(open-close)

shortwicksbar=barbodysize>barsize*barsizeThreshold

SMA=sma(close, i_MALen)

MAFilter=close > SMA

BUY = MFI[1] == OB and close > open and shortwicksbar and (i_MAFilter ? MAFilter : true)

SELL = MFI[1] == OS and close < open and shortwicksbar and (i_MAFilter ? not MAFilter : true)

//Final Long/Short Condition

longCondition = BUY

shortCondition = SELL

//Long Strategy - buy condition and exits with Take profit and SL

if (longCondition and intradaySession)

stop_level = longStopPrice

profit_level = longExitPrice

strategy.entry("Buy", strategy.long)

strategy.exit("TP/SL", "Buy", stop=stop_level, limit=profit_level)

//Short Strategy - sell condition and exits with Take profit and SL

if (shortCondition and intradaySession)

stop_level = shortStopPrice

profit_level = shortExitPrice

strategy.entry("Sell", strategy.short)

strategy.exit("TP/SL", "Sell", stop=stop_level, limit=profit_level)

// Square-off position (when session is over and position is open)

squareOff = (not intradaySession) and (strategy.position_size != 0)

strategy.close_all(when = squareOff, comment = "Square-off")

// ********** Strategy - End **********