二重移動平均トレーリングストップロス戦略

概要

この戦略は,高速平均線と遅い平均線の交差を基に,多空を決定する.高速平均線上での遅い平均線を横切るときに多空を決定し,高速平均線下での遅い平均線を横切るときに平仓する.より高い利益を追求するために,この戦略は,追跡ストップ・ロスの仕組みを採用する.多空をすると,直接取引価格の下のストップ・ロスを設定するのではなく,取引価格の下のストップ・ロスの設定を行う.この追跡ストップ・ロスは,価格が上昇するにつれて上を移動し,価格の下落が損失の止まりを触発する価格の下まで移動する.

戦略原則

この戦略は,速いSMA ((SMA) と遅いSMAを使用して,何と平穏なポジションをするかを決定する. 速いSMA上で遅いSMAを穿越すると,トレンドが上昇すると判断し,その時点で多めにします. 速いSMAの下では遅いSMAを穿越すると,トレンドが逆転すると判断し,平穏なポジションを準備します.

より高い利益を追求するために,この戦略は,追跡ストップ・メカニズムを導入した.多額の取引をすると,固定価格でストップ・オーダーを設定するのではなく,追跡ストップ・価格を設定し,価格上昇とともに上方へと追跡し,価格が一定比率上昇したたびに,追跡ストップ・価格は一定幅の向上調整を行う.価格が逆転し,追跡ストップ・価格に触れたとき,ストップ・オーダーをトリガーし,ポジションを平準化する.

具体的には,ストップ・プライスを追跡する計算式は次のとおりです.

ストップ・トラッキング価格 = 価格 × (1 - ストップ・トラッキングパーセント)

その中,ストップ・トラッキングのパーセントは,戦略パラメータ Deviation % によって設定されます.戦略は,ポジション開設後,Kラインの終了時に新しいトラッキング・ストップ・価格を計算します.新しいトラッキング・ストップ・価格は,上記のKラインのトラッキング・ストップ・価格より低い値にはなりません.

価格が下がり,追跡ストップ・ローに触れたとき,平仓シグナルが誘発され,ポジションは市場価格単位の平仓を使用する.

戦略的優位性

- 双均線を用いてトレンドの方向を判断し,反測効果がよりよい.

- ストップ・ロスを採用することで,より高い利益を追求できます.

- カスタマイズ可能な平均線周期と止損追跡幅

- ストップ・ローンは上昇傾向にあるとき,上昇を続け,利益のほとんどを確保します.

- トレンドが逆転したときに,より大きな損失を回避するために,迅速に止まります.

リスクと解決策

- 均線交差のタイミングを誤って選択すると,仮想信号が発生する可能性がある.異なるパラメータをテストして,最適な均線組み合わせを見つけることができる.

- 追跡ストップが激進すぎると,ストップが早めに破られることがあります. 追跡ストップのパーセンテージパラメータを適切に調整できます.

- 価格が空飛ぶ隙間が発生すると,ストップ・ローを直接打ち破ることもあります.他の指標の組み合わせでトレンドを判断し,波動的な状況で取引を避けるようにお勧めします.

最適化の方向

- 異なる均線周期パラメータをテストして,最適なパラメータの組み合わせを見つけることができます.

- 異なるストップトラッキングパーセンテージをテストして,最適なストップレベルを見つけることができます.

- 他の指標の判断に加えられ,震災時の取引を一時停止し,突発的な出来事の影響を受けないようにする.

要約する

この戦略は,均線指標を総合的に利用してトレンドの方向性を判断し,また,ストップ・ロース・メカニズムを追跡して利益をロックし,トレーニングデータでよく表れている.パラメータの組み合わせを最適化して,リスクを制御することで,安定した収益を期待できる.しかし,いかなる戦略も完全に損失を回避することは不可能である.適切なポジション管理を調整し,異なる品種をテストし,リスクを分散することを推奨する.

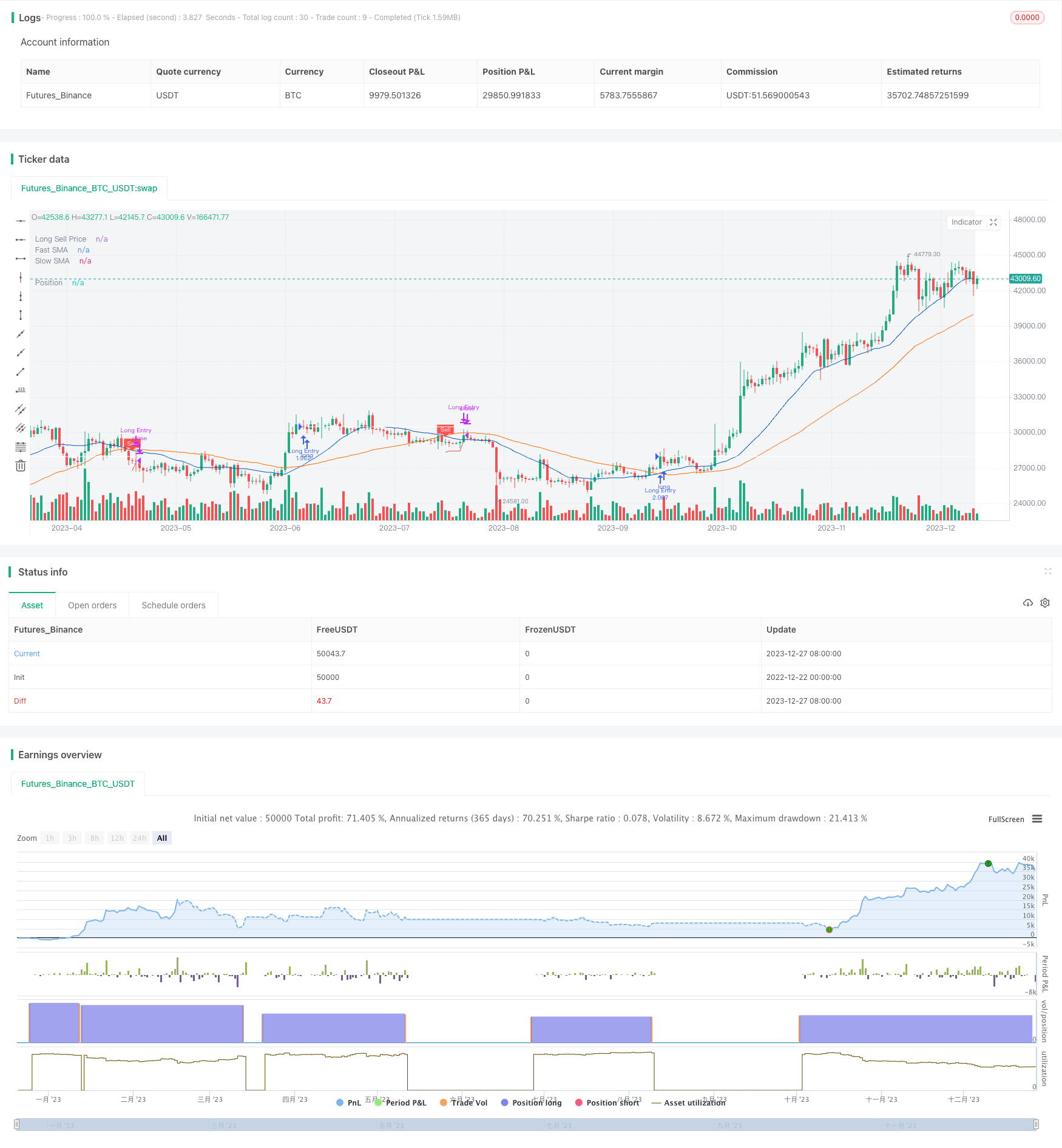

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// -----------------------------------------------------------------------------

// Copyright 2022 Iason Nikolas | jason5480

// Trailing Buy script may be freely distributed under the MIT license.

//

// Permission is hereby granted, free of charge,

// to any person obtaining a copy of this software and associated documentation files (the "Software"),

// to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge,

// publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so,

// subject to the following conditions:

//

// The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

//

// THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND,

// EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

// FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM,

// DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

// OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

//

// -----------------------------------------------------------------------------

//

// Authors: @jason5480

// Revision: v1.0.1

// Date: 24-Feb-2022

//

// Description

// =============================================================================

// This strategy will go long if fast MA crosses over slow MA.

// If the 'Enable Trailing` is checked then the strategy instead of exiting from the position

// directly it will follow the price upwards (percentagewise) with small steps

// If the price drops by this percentage then the exit order will be executed

//

// The strategy has the following parameters:

//

// Fast SMA Length - How many candles back to calculte the fast SMA.

// Slow SMA Length - How many candles back to calculte the slow SMA.

// Enable Trailing - Enable or disable the trailing

// Deviation % - The step to follow the price when the open position condition is met.

// Source Exit Control - The source price to compare with the exit price to trigger the exit order when trailing.

//

// -----------------------------------------------------------------------------

// Disclaimer:

// 1. I am not licensed financial advisors or broker dealer. I do not tell you

// when or what to buy or sell. I developed this software which enables you

// execute manual or automated using TradingView. The

// software allows you to set the criteria you want for entering and exiting

// trades.

// 2. Do not trade with money you cannot afford to lose.

// 3. I do not guarantee consistent profits or that anyone can make money with no

// effort. And I am not selling the holy grail.

// 4. Every system can have winning and losing streaks.

// 5. Money management plays a large role in the results of your trading. For

// example: lot size, account size, broker leverage, and broker margin call

// rules all have an effect on results. Also, your Take Profit and Stop Loss

// settings for individual pair trades and for overall account equity have a

// major impact on results. If you are new to trading and do not understand

// these items, then I recommend you seek education materials to further your

// knowledge.

//

// YOU NEED TO FIND AND USE THE TRADING SYSTEM THAT WORKS BEST FOR YOU AND YOUR

// TRADING TOLERANCE.

//

// I HAVE PROVIDED NOTHING MORE THAN A TOOL WITH OPTIONS FOR YOU TO TRADE WITH THIS PROGRAM ON TRADINGVIEW.

//

// I accept suggestions to improve the script.

// If you encounter any problems I will be happy to share with me.

// -----------------------------------------------------------------------------

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// SETUP ============================================================================================================

strategy(title = 'Trailing Sell',

shorttitle = 'TS',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 100000)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// FILTERS ==========================================================================================================

// INPUT ============================================================================================================

usefromDate = input.bool(defval = true, title = 'From', inline = "From Date", group = "Filters")

fromDate = input(defval = timestamp('01 Jan 2021 00:00 UTC'), title = '', inline = "From Date", group = 'Filters')

usetoDate = input.bool(defval = false, title = 'To ', inline = "To Date", group = "Filters")

toDate = input(defval = timestamp('31 Dec 2121 23:59 UTC'), title = '', inline = "To Date", group = 'Filters')

// LOGIC ============================================================================================================

isWithinPeriod() => true // create function "within window of time"

// PLOT =============================================================================================================

bgcolor(color = isWithinPeriod() ? color.new(color.gray, 90) : na, title = 'Period')

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// STRATEGY =========================================================================================================

// INPUT ============================================================================================================

fastMALen = input.int(defval = 21, title = 'Fast/Slow SMA Length', inline = 'MA Length', group = 'Strategy')

slowMALen = input.int(defval = 49, title = '', tooltip = 'How many candles back to calculte the fast/slow SMA.', inline = 'MA Length', group = 'Strategy')

// LOGIC ============================================================================================================

fastMA = ta.sma(close, fastMALen)

slowMA = ta.sma(close, slowMALen)

bool openLongPosition = isWithinPeriod() and ta.crossover(fastMA, slowMA)

bool closeLongPosition = ta.crossunder(fastMA, slowMA)

// PLOT =============================================================================================================

var fastColor = color.new(#0056BD, 0)

plot(series = fastMA, title = 'Fast SMA', color = fastColor, linewidth = 1, style = plot.style_line)

var slowColor = color.new(#FF6A00, 0)

plot(series = slowMA, title = 'Slow SMA', color = slowColor, linewidth = 1, style = plot.style_line)

plotshape(series = closeLongPosition and strategy.position_size > 0 ? fastMA : na, title = 'Sell', text = 'Sell', style = shape.labeldown, location = location.absolute, color = color.new(color.red, 0), textcolor = color.new(color.white, 0), size = size.tiny)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// EXIT ============================================================================================================

// INPUT ============================================================================================================

enableTrailing = input.bool(defval = true, title = 'Enable Trailing', tooltip = 'Enable or disable the trailing for exit position.', group = 'Exit')

devExitPerc = input.float(defval = 3.0, title = 'Deviation %', minval = 0.01, maxval = 100, step = 0.05, tooltip = 'The step to follow the price when the open position condition is met.', group = 'Exit') / 100

ctrLongExitSrc = input.source(defval = low, title = 'Source Exit Control', tooltip = 'The source price to compare with the exit price to trigger the exit order when trailing.', group = 'Exit')

// LOGIC ============================================================================================================

var bool exitLongPosition = false

int barsSinceOpenLong = nz(ta.barssince(openLongPosition), 999999)

int barsSinceCloseLong = nz(ta.barssince(closeLongPosition), 999999)

int barsSinceExitLong = nz(ta.barssince(exitLongPosition), 999999)

bool closeLongIsActive = barsSinceOpenLong >= barsSinceCloseLong

bool exitLongIsPending = barsSinceExitLong >= barsSinceCloseLong

bool tryExitLongPosition = isWithinPeriod() and closeLongIsActive and exitLongIsPending

float longExitPrice = na

longExitPrice := if closeLongPosition and strategy.position_size > 0

close * (1 - devExitPerc)

else if tryExitLongPosition

math.max(high * (1 - devExitPerc), nz(longExitPrice[1], 999999))

else

na

exitLongPosition := enableTrailing ? isWithinPeriod() and ta.crossunder(closeLongPosition ? close : ctrLongExitSrc, longExitPrice) : closeLongPosition

// PLOT =============================================================================================================

var sellPriceColor = color.new(#e25141, 0)

plot(series = enableTrailing ? longExitPrice : na, title = 'Long Sell Price', color = sellPriceColor, linewidth = 1, style = plot.style_linebr)

//

// ▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒▒

// POSITION ORDERS ==================================================================================================

// LOGIC ============================================================================================================

// getting into LONG position

strategy.entry(id = 'Long Entry', direction = strategy.long, when = openLongPosition, alert_message = 'Long(' + syminfo.ticker + '): Started')

// submit close order on trend reversal

strategy.close(id = 'Long Entry', when = exitLongPosition, comment = 'Close Long', alert_message = 'Long(' + syminfo.ticker + '): Closed at market price')

// PLOT =============================================================================================================

var posColor = color.new(color.white, 0)

plot(series = strategy.position_avg_price, title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr)

// ==================================================================================================================